Home > Analyses > Energy > Cameco Corporation

Cameco Corporation powers the global nuclear energy sector by mining and refining uranium, a critical fuel that keeps millions of homes and industries running cleanly and efficiently. As one of the world’s foremost uranium producers, Cameco’s expertise spans exploration, mining, milling, and fuel fabrication, underpinned by a reputation for innovation and reliability. As energy markets evolve, investors must consider whether Cameco’s strong fundamentals and market position continue to support its compelling growth and valuation prospects.

Table of contents

Business Model & Company Overview

Cameco Corporation, founded in 1987 and headquartered in Saskatoon, Canada, stands as a leading force in the uranium industry. Its core mission integrates uranium exploration, mining, milling, and fuel services into a cohesive ecosystem, serving global nuclear utilities. With a market cap of $54B, Cameco leverages its expertise across the Uranium and Fuel Services segments to maintain a dominant market position.

The company’s revenue engine balances the sale of uranium concentrate with refining, conversion, and fabrication of nuclear fuel bundles, particularly for CANDU reactors. Operating across the Americas, Europe, and Asia, Cameco sustains value through a mix of commodity sales and specialized fuel services. Its competitive advantage lies in a vertically integrated model that underpins its strong economic moat, shaping the future of clean energy supply.

Financial Performance & Fundamental Metrics

In this section, I analyze Cameco Corporation’s income statement, key financial ratios, and dividend payout policy to assess its financial health and investment potential.

Income Statement

The table below summarizes Cameco Corporation’s key income statement figures for fiscal years 2020 through 2024, reported in CAD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 1.80B | 1.47B | 1.87B | 2.59B | 3.14B |

| Cost of Revenue | 1.43B | 1.47B | 1.63B | 1.81B | 2.07B |

| Operating Expenses | 449M | 138M | 218M | 499M | 553M |

| Gross Profit | 370M | 1.93M | 233M | 782M | 1.06B |

| EBITDA | 184M | 147M | 331M | 800M | 789M |

| EBIT | -37M | -43M | 154M | 579M | 475M |

| Interest Expense | 82M | 56M | 56M | 76M | 111M |

| Net Income | -53M | -103M | 89M | 361M | 172M |

| EPS | -0.13 | -0.26 | 0.22 | 0.83 | 0.40 |

| Filing Date | 2021-03-19 | 2022-03-22 | 2023-03-29 | 2024-03-22 | 2025-03-21 |

Income Statement Evolution

From 2020 to 2024, Cameco Corporation’s revenue increased substantially by 74.2%, reaching 3.14B CAD in 2024. Net income showed even stronger growth of 423.22% over the period, despite a 60.7% decline in net margin growth in the last year. Gross and EBIT margins remained favorable at 33.91% and 15.15% respectively, supporting improved profitability overall.

Is the Income Statement Favorable?

The 2024 income statement reveals mixed signals; revenue and gross profit grew by 21.18% and 35.97% respectively, reflecting strong top-line momentum. However, EBIT declined 18%, and net margin contracted significantly, leading to a 53% drop in EPS to 0.40 CAD. Interest expenses remain favorable at 3.54% of revenue. Despite short-term margin pressure, the fundamentals are generally favorable, supported by solid revenue growth and positive margin levels.

Financial Ratios

The table below presents key financial ratios for Cameco Corporation (CCJ) over the last five fiscal years, highlighting profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | -2.95% | -6.95% | 4.78% | 13.94% | 5.48% |

| ROE | -1.07% | -2.12% | 1.53% | 5.92% | 2.70% |

| ROIC | -1.08% | -1.90% | 0.19% | 2.27% | 3.79% |

| P/E | -127.3 | -106.9 | 139.3 | 68.5 | 187.0 |

| P/B | 1.36 | 2.26 | 2.13 | 4.06 | 5.05 |

| Current Ratio | 6.40 | 5.18 | 5.92 | 1.55 | 1.62 |

| Quick Ratio | 3.87 | 3.96 | 4.46 | 0.84 | 0.80 |

| D/E | 0.20 | 0.21 | 0.17 | 0.29 | 0.20 |

| Debt-to-Assets | 13.3% | 13.3% | 11.5% | 18.0% | 13.1% |

| Interest Coverage | -0.96 | -2.45 | 0.27 | 3.71 | 4.60 |

| Asset Turnover | 0.24 | 0.20 | 0.22 | 0.26 | 0.32 |

| Fixed Asset Turnover | 0.48 | 0.41 | 0.54 | 0.77 | 0.95 |

| Dividend Yield | 0.37% | 0.29% | 0.42% | 0.21% | 0.22% |

Evolution of Financial Ratios

From 2020 to 2024, Cameco Corporation’s Return on Equity (ROE) showed a fluctuating trend, ending at a low 2.7% in 2024, indicating diminished profitability. The Current Ratio declined from a high 6.4 in 2020 to a more moderate 1.62 in 2024, signaling reduced but stable liquidity. The Debt-to-Equity Ratio remained fairly stable around 0.2, reflecting consistent leverage levels.

Are the Financial Ratios Favorable?

In 2024, profitability ratios such as ROE (2.7%) and Return on Invested Capital (3.79%) are unfavorable, while net margin (5.48%) is neutral. Liquidity is generally favorable with a Current Ratio of 1.62, though Quick Ratio is neutral at 0.8. Leverage ratios like Debt-to-Equity (0.2) and Debt-to-Assets (13.08%) are favorable. Market valuation metrics, including a high Price-to-Earnings ratio of 187 and Price-to-Book of 5.05, are unfavorable, resulting in a slightly unfavorable overall financial ratio profile.

Shareholder Return Policy

Cameco Corporation maintains a dividend payout ratio of around 40.5% in 2024, with a modest dividend yield of 0.22%. The company’s dividend per share has shown steady growth over recent years, supported by free cash flow coverage and a dividend paid and capex coverage ratio above 3. Share buybacks are not explicitly detailed.

The current policy balances dividend payments with capital expenditures, suggesting a sustainable approach to shareholder returns. This distribution policy appears aligned with long-term value creation, given the moderate payout and strong cash flow metrics, though investors should monitor potential risks in changing market conditions.

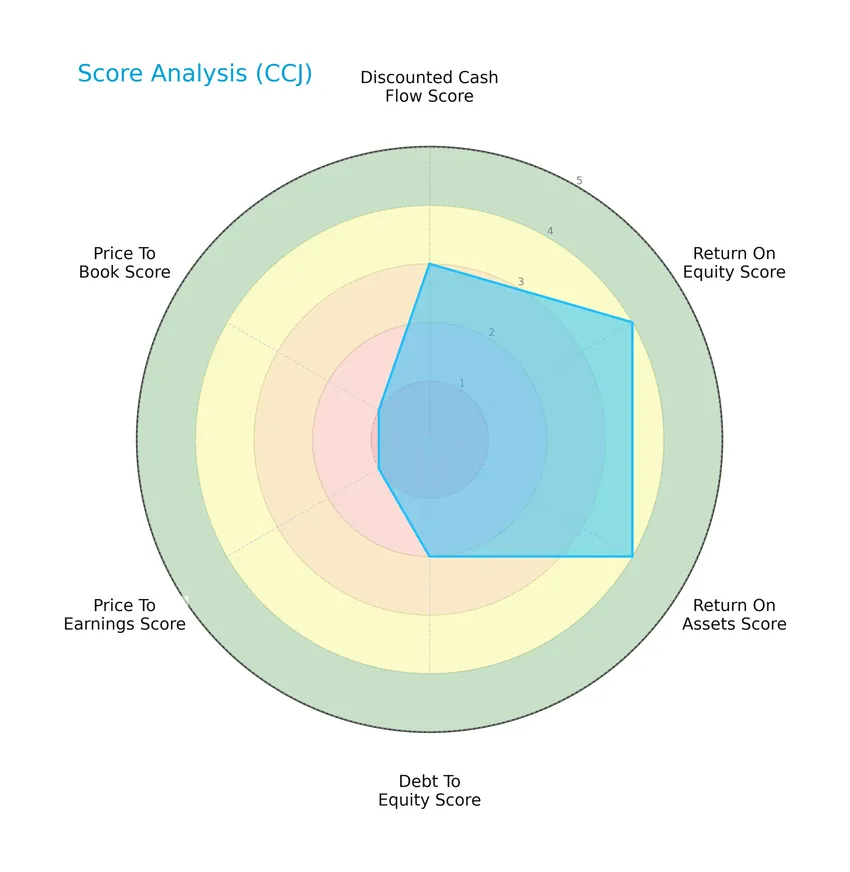

Score analysis

The following radar chart displays a detailed evaluation of Cameco Corporation’s key financial scores:

Cameco shows moderate scores in discounted cash flow (3) and debt-to-equity (2), favorable scores for return on equity (4) and return on assets (4), but very unfavorable valuations reflected by low price-to-earnings (1) and price-to-book (1) scores.

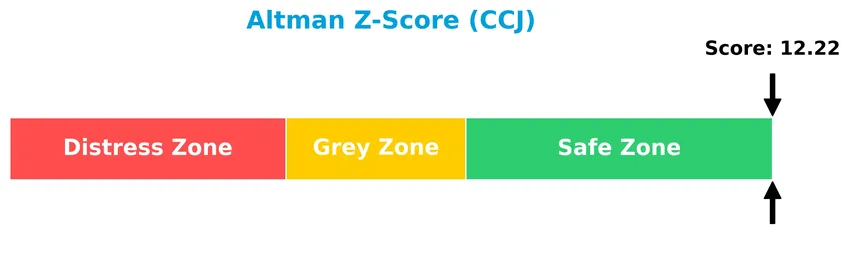

Analysis of the company’s bankruptcy risk

The Altman Z-Score indicates that Cameco Corporation is well within the safe zone, suggesting a very low risk of bankruptcy:

Is the company in good financial health?

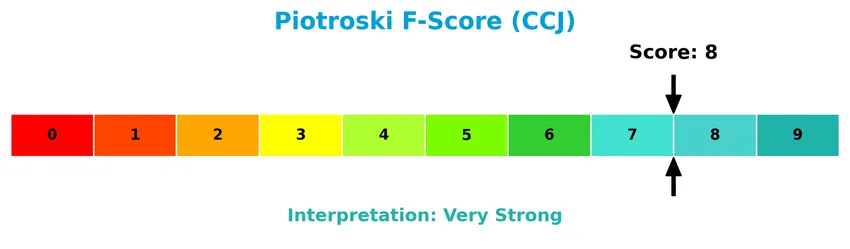

The Piotroski Score diagram summarizes the company’s strong financial health status:

With a Piotroski Score of 8, Cameco demonstrates very strong financial fundamentals, indicating robust profitability, liquidity, and operational efficiency consistent with sound financial health.

Competitive Landscape & Sector Positioning

This sector analysis will examine Cameco Corporation’s strategic positioning, revenue by segment, key products, main competitors, and competitive advantages. I will evaluate whether Cameco holds a competitive advantage over other players in the uranium industry.

Strategic Positioning

Cameco Corporation focuses on uranium production and fuel services, with a product portfolio concentrated in nuclear fuel supply. Geographically, its revenue is primarily from North America, especially the United States and Canada, reflecting a moderately diversified regional exposure within the energy sector.

Key Products & Brands

The following table outlines Cameco Corporation’s primary products and brand activities:

| Product | Description |

|---|---|

| Uranium | Exploration, mining, milling, and trading of uranium concentrate for nuclear utilities worldwide. |

| Fuel Services | Refining, conversion, fabrication of uranium concentrate, and production of fuel bundles for CANDU reactors. |

Cameco Corporation’s business is centered on uranium production and fuel services, serving nuclear utilities across the Americas, Europe, and Asia.

Main Competitors

There are 10 competitors in the Uranium industry, with the table below listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Cameco Corporation | 39.8B |

| NexGen Energy Ltd. | 6.0B |

| Uranium Energy Corp. | 5.6B |

| Centrus Energy Corp. | 4.2B |

| Energy Fuels Inc. | 3.5B |

| Denison Mines Corp. | 2.4B |

| Ur-Energy Inc. | 507M |

| IsoEnergy Ltd. | 499M |

| Uranium Royalty Corp. | 471M |

| enCore Energy Corp. | 464M |

Cameco Corporation ranks first among its 10 main competitors, with a market cap 1.36 times larger than the next closest rival. It stands well above both the average market cap of the top 10 competitors (6.4B) and the sector median (2.9B). The significant gap to the second-ranked company highlights Cameco’s dominant position in the Uranium industry.

Does CCJ have a competitive advantage?

Cameco Corporation currently does not present a strong competitive advantage, as its ROIC is below its WACC, indicating value destruction despite a growing return on invested capital. This suggests the company is improving profitability but still shedding value relative to its cost of capital.

Looking ahead, Cameco’s operations in uranium mining and fuel services across the Americas, Europe, and Asia position it to benefit from ongoing nuclear energy demand. The company’s focus on refining, conversion, and fuel bundle production for CANDU reactors may offer growth opportunities in diverse markets.

Comparisons with competitors

Check out how we compare the company to its competitors:

SWOT Analysis

This SWOT analysis highlights Cameco Corporation’s key internal and external factors to inform strategic investment decisions.

Strengths

- strong revenue growth of 74% over 5 years

- favorable gross margin at 33.91%

- safe Altman Z-score indicating financial stability

Weaknesses

- declining EBIT and net margin growth in last year

- unfavorable ROE and ROIC ratios

- high P/E and P/B ratios signaling overvaluation risk

Opportunities

- growing global demand for nuclear energy

- expansion in fuel services and reactor components

- improving ROIC trend suggesting operational efficiency gains

Threats

- uranium price volatility

- regulatory and environmental risks

- geopolitical tensions impacting supply chains

Cameco shows solid revenue and profitability growth over the medium term but faces short-term margin pressures and valuation concerns. Its strategic focus should leverage nuclear energy demand growth while managing financial efficiency and external risks prudently.

Stock Price Action Analysis

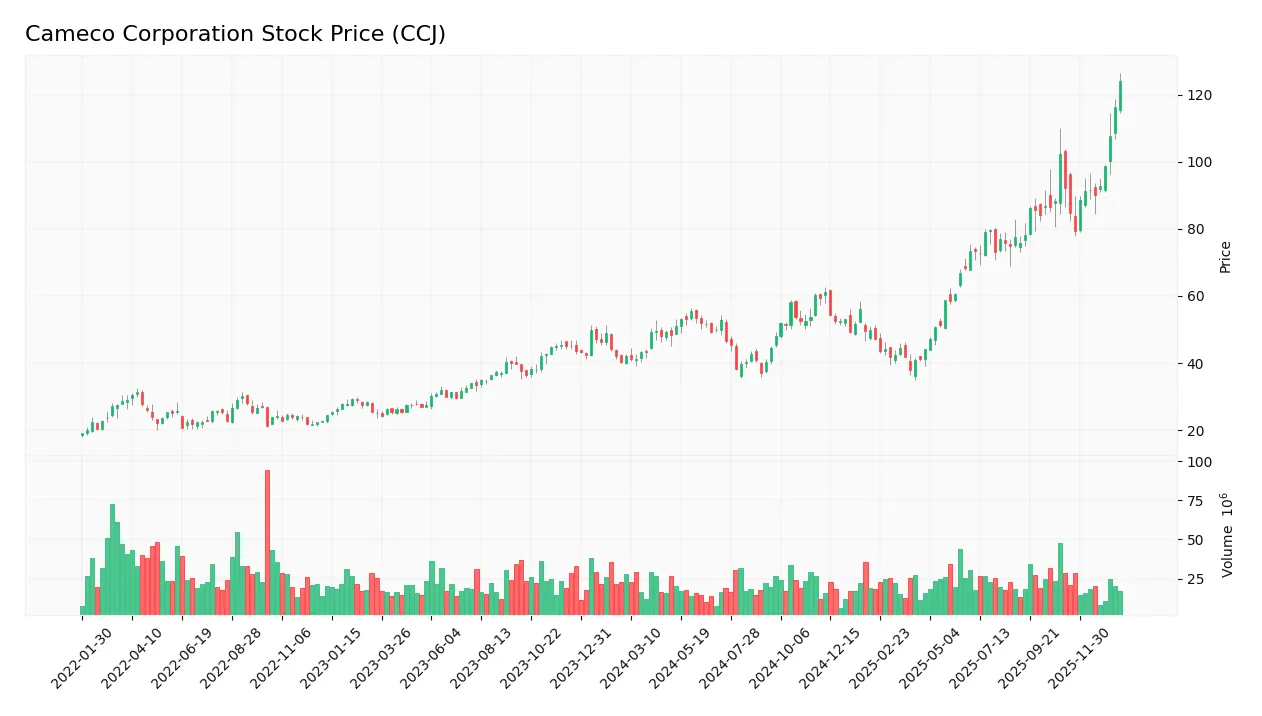

The following weekly stock chart illustrates Cameco Corporation’s price movements over the past two years, highlighting key fluctuations and trend phases:

Trend Analysis

Over the past two years, Cameco Corporation’s stock price increased by 195.54%, indicating a clear bullish trend with acceleration. The price ranged from a low of 36.96 to a high of 124.04, with a volatility measure (std deviation) of 19.5. Recent months show continued upward momentum, rising 34.45% since November 2025.

Volume Analysis

Trading volume over the last three months shows a slightly buyer-dominant pattern, with buyers accounting for 56.82% of activity. Despite this, total volume is decreasing, suggesting waning market participation or cautious investor sentiment amid the recent upward price trend.

Target Prices

The consensus target prices for Cameco Corporation indicate a moderately optimistic outlook from analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 109 | 99.74 | 102.75 |

Analysts expect Cameco’s stock price to trade between approximately 100 and 109, with a consensus near 103, reflecting cautious confidence in its growth potential.

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback concerning Cameco Corporation (CCJ) to gauge market sentiment.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Stock Grades

Here are the latest verified grades for Cameco Corporation from recognized financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| RBC Capital | Maintain | Outperform | 2025-11-13 |

| RBC Capital | Maintain | Outperform | 2025-10-31 |

| Goldman Sachs | Maintain | Buy | 2025-10-29 |

| RBC Capital | Maintain | Outperform | 2025-08-01 |

| RBC Capital | Maintain | Outperform | 2025-06-20 |

| GLJ Research | Maintain | Buy | 2025-06-12 |

| Goldman Sachs | Maintain | Buy | 2025-06-11 |

| GLJ Research | Maintain | Buy | 2025-03-12 |

| RBC Capital | Maintain | Outperform | 2025-03-04 |

| Scotiabank | Maintain | Outperform | 2024-08-19 |

The consensus among grading companies is predominantly positive, with repeated “Outperform” and “Buy” ratings maintained throughout 2025. This indicates a stable favorable outlook from major analysts.

Consumer Opinions

Investors and consumers alike have shared varied insights on Cameco Corporation, reflecting both confidence and concerns in its market approach and product reliability.

| Positive Reviews | Negative Reviews |

|---|---|

| Strong commitment to sustainable energy | Concerns about uranium market volatility |

| Reliable and consistent dividend payouts | Limited diversification outside uranium |

| Transparent communication with shareholders | Environmental impact debates remain active |

Overall, consumer feedback on Cameco highlights its strength in sustainability and shareholder returns, while concerns persist regarding market risks and environmental challenges. This balance is crucial for prospective investors to consider.

Risk Analysis

Below is a summary table outlining key risks associated with investing in Cameco Corporation (CCJ), highlighting potential challenges and their likelihood and impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Valuation | High P/E ratio (187) and P/B ratio (5.05) indicate overvaluation risk with potential price drops | Medium | High |

| Operational Risk | Low asset turnover and fixed asset turnover suggest inefficiencies affecting profitability | Medium | Medium |

| Regulatory Risk | Uranium industry faces stringent regulations and geopolitical tensions impacting supply/demand | Medium | High |

| Financial Health | Moderate debt with favorable coverage but low ROE (2.7%) and ROIC (3.79%) signal weak returns | Low | Medium |

| Dividend Risk | Low dividend yield (0.22%) may disappoint income-focused investors | Low | Low |

The most significant risks lie in Cameco’s high valuation and exposure to regulatory and geopolitical uncertainties. Despite solid liquidity and low bankruptcy risk (Altman Z-score 12.2, safe zone), investors should cautiously weigh valuation against industry volatility and operational inefficiencies.

Should You Buy Cameco Corporation?

Cameco Corporation appears to be in a safe financial zone with a very strong Piotroski score, suggesting robust profitability and operational efficiency. While its competitive moat is slightly unfavorable due to value shedding, improving ROIC and a manageable leverage profile support a moderate B- rating.

Strength & Efficiency Pillars

Cameco Corporation exhibits solid financial health, underpinned by an Altman Z-Score of 12.22, placing it comfortably in the safe zone against bankruptcy risks. The Piotroski Score of 8 further attests to its very strong financial strength. Profitability metrics are mixed: while the net margin stands at a modest 5.48%, the company maintains a favorable gross margin of 33.91% and EBIT margin of 15.15%. Its debt-to-equity ratio is low at 0.2, supporting financial stability. However, the ROIC of 3.79% trails the WACC of 9.55%, indicating that Cameco is currently not a value creator despite improving profitability trends.

Weaknesses and Drawbacks

Cameco’s valuation metrics raise caution, with a price-to-earnings ratio at an elevated 187.01 and a price-to-book ratio of 5.05, both flagged as very unfavorable, suggesting the stock trades at a premium that may not be fully justified by current earnings. The company’s return on equity is low at 2.7%, reflecting limited shareholder value generation. Asset turnover ratios are weak, signaling operational inefficiencies. Additionally, the dividend yield is minimal at 0.22%, which may deter income-focused investors. While the current ratio of 1.62 is favorable, the quick ratio of 0.8 indicates less liquidity cushion in immediate obligations.

Our Verdict about Cameco Corporation

Cameco’s long-term fundamental profile appears moderately favorable given its strong financial health and improving profitability. The overall bullish stock trend and acceleration, supported by a 195.54% price increase over the observed period, reinforce positive momentum. Recent trading shows slight buyer dominance with 56.82% buyer volume, suggesting sustained investor interest. This profile might appear attractive for long-term exposure but is tempered by stretched valuation multiples and operational inefficiencies, warranting a cautious, measured approach.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Cameco (NYSE:CCJ) Stock Price Up 1.6% – What’s Next? – MarketBeat (Jan 23, 2026)

- Cameco (CCJ) Laps the Stock Market: Here’s Why – Yahoo Finance (Jan 23, 2026)

- Bull of the Day: Cameco (CCJ) – The Globe and Mail (Jan 23, 2026)

- Myriad Asset Management US LP Makes New Investment in Cameco Corporation $CCJ – MarketBeat (Jan 23, 2026)

- Cameco Corporation (CCJ): A Bull Case Theory – Yahoo Finance (Jan 19, 2026)

For more information about Cameco Corporation, please visit the official website: cameco.com