Imagine a world where the technology that powers our daily lives—from smartphones to autonomous vehicles—relies on meticulous design and verification processes. Cadence Design Systems, Inc. stands at the forefront of this innovation, revolutionizing the semiconductor industry with cutting-edge software solutions for integrated circuit design. With a reputation for excellence and a diverse product suite, Cadence is essential for companies developing complex electronic systems. As we delve into the investment potential of Cadence, it’s crucial to assess whether its impressive growth trajectory and robust fundamentals continue to justify its market valuation.

Table of contents

Company Description

Cadence Design Systems, Inc. is a prominent player in the software application industry, specializing in electronic design automation (EDA) tools that empower innovation in integrated circuit (IC) design. Founded in 1987 and headquartered in San Jose, California, the company has established a robust presence globally, catering to diverse markets such as 5G communications, aerospace, automotive, and healthcare. Cadence offers a comprehensive suite of software and hardware solutions, including verification platforms like JasperGold and Palladium, along with custom IC design tools. With over 12,800 employees, Cadence stands out for its commitment to advancing technology and shaping industry standards through innovative methodologies and strategic partnerships.

Fundamental Analysis

In this section, I will analyze Cadence Design Systems, Inc. by examining its income statement, key financial ratios, and payout policy to assess its financial health and investment potential.

Income Statement

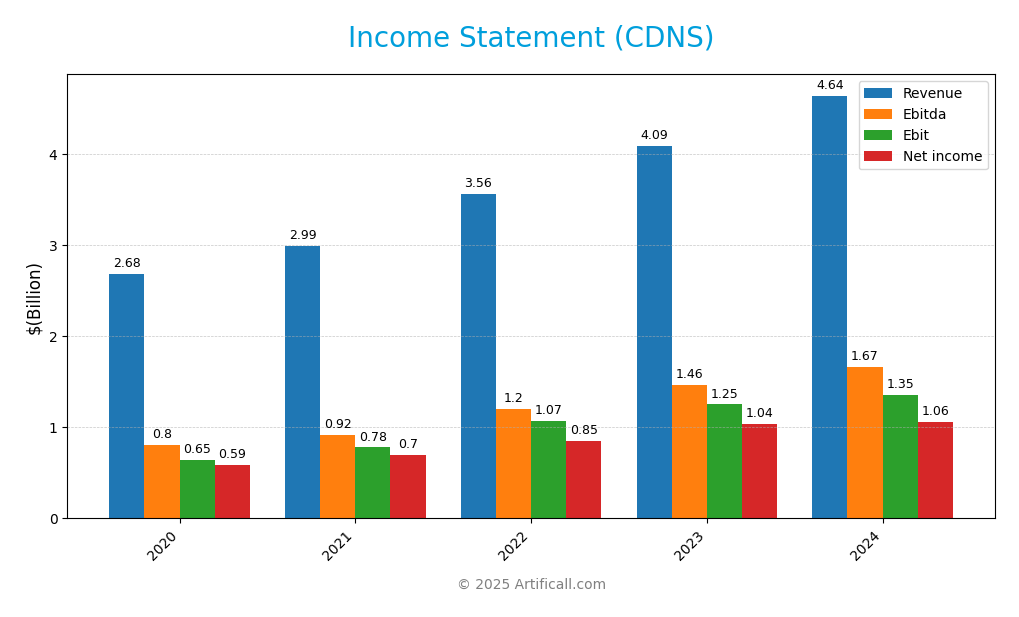

The following table outlines the income statement of Cadence Design Systems, Inc. (CDNS) over the past few years, highlighting key financial metrics and performance trends.

| Metric | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 2.68B | 2.99B | 3.56B | 4.09B | 4.64B |

| Cost of Revenue | 305M | 307M | 372M | 435M | 648M |

| Operating Expenses | 1.73B | 1.90B | 2.12B | 2.40B | 2.64B |

| Gross Profit | 2.38B | 2.68B | 3.19B | 3.65B | 3.99B |

| EBITDA | 804M | 916M | 1.20B | 1.46B | 1.67B |

| EBIT | 646M | 779M | 1.07B | 1.25B | 1.35B |

| Interest Expense | 21M | 17M | 23M | 36M | 76M |

| Net Income | 591M | 696M | 849M | 1.04B | 1.06B |

| EPS | 2.16 | 2.54 | 3.13 | 3.86 | 3.89 |

| Filing Date | N/A | 2022-02-22 | 2023-02-13 | 2024-02-12 | 2025-02-21 |

Over the five-year period, Cadence Design Systems has shown a robust upward trend in both Revenue and Net Income. Revenue has increased from $2.68 billion in 2020 to $4.64 billion in 2024, reflecting a compound annual growth rate (CAGR) of approximately 21%. Similarly, Net Income grew from $591 million to $1.06 billion, indicating strong operational efficiency and profitability. The gross profit margin has slightly declined from 89.6% in 2020 to 86.0% in 2024, suggesting rising costs, particularly in revenue generation. In 2024, while revenue growth continued, the increase in operating expenses and interest expense indicates a cautionary note for investors regarding potential future profitability pressures.

Financial Ratios

The following table presents the key financial ratios for Cadence Design Systems, Inc. (CDNS) across the last available years:

| Ratio | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 22.0% | 23.3% | 23.8% | 25.5% | 22.7% |

| ROE | 23.7% | 25.4% | 30.9% | 30.6% | 22.6% |

| ROIC | 20.5% | 22.8% | 28.3% | 30.7% | 17.8% |

| P/E | 63.2 | 73.2 | 51.3 | 70.5 | 77.2 |

| P/B | 15.0 | 18.6 | 15.9 | 21.6 | 17.4 |

| Current Ratio | 1.86 | 1.77 | 1.27 | 1.24 | 2.93 |

| Quick Ratio | 1.76 | 1.65 | 1.17 | 1.13 | 2.74 |

| D/E | 0.18 | 0.17 | 0.32 | 0.22 | 0.55 |

| Debt-to-Assets | 11.7% | 10.4% | 17.3% | 13.5% | 28.8% |

| Interest Coverage | 31.1 | 45.9 | 46.8 | 34.6 | 17.8 |

| Asset Turnover | 0.68 | 0.68 | 0.69 | 0.72 | 0.52 |

| Fixed Asset Turnover | 6.0 | 6.9 | 6.6 | 7.4 | 7.7 |

| Dividend Yield | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% |

Interpretation of Financial Ratios

In 2024, Cadence Design Systems shows a mix of strengths and weaknesses. The net margin at 22.7% and ROE at 22.6% indicate solid profitability, but the decline in ROIC and interest coverage suggests increased leverage and potential risks in covering debt obligations. The high P/E ratio of 77.2 may signal overvaluation, warranting caution for potential investors.

Evolution of Financial Ratios

Over the past five years, CDNS has generally improved its liquidity, as evidenced by the significant increase in current and quick ratios. However, the sharp rise in debt metrics like D/E and Debt-to-Assets raises concerns about financial stability and risk exposure, indicating a need for careful monitoring going forward.

Distribution Policy

Cadence Design Systems, Inc. does not currently pay dividends, reflecting its focus on reinvestment to fuel growth and innovation. With a payout ratio of 0, the company prioritizes research and development, positioning itself for future opportunities. Additionally, Cadence engages in share buybacks, which can enhance shareholder value. This strategy aligns with long-term value creation, as it allows for capital allocation towards initiatives that could yield sustainable growth.

Sector Analysis

Cadence Design Systems, Inc. operates in the software application industry, providing advanced tools for integrated circuit design and verification, competing with firms like Synopsys and Mentor Graphics. Its competitive advantages include a robust product portfolio and strong market presence.

Strategic Positioning

Cadence Design Systems, Inc. (CDNS) commands a significant market share in the application software sector, particularly in functional verification and digital integrated circuit design. With a market capitalization of approximately $88.5 billion, it faces competitive pressure from other industry leaders, yet maintains a strong foothold thanks to its innovative offerings such as JasperGold and Xcelium. The rapid pace of technological disruption in areas like 5G communications and AI design necessitates constant adaptation and investment in R&D, which Cadence appears to embrace. This proactive approach enables the company to stay ahead in a dynamic market landscape.

Key Products

Cadence Design Systems, Inc. offers a range of innovative products that support various aspects of integrated circuit design and verification. Below is a table summarizing some of their key offerings:

| Product | Description |

|---|---|

| JasperGold | A formal verification platform that helps ensure design correctness through advanced mathematical methods. |

| Xcelium | A parallel logic simulation platform designed for faster verification of digital designs. |

| Palladium | An enterprise emulation platform that allows for real-time testing and validation of hardware designs. |

| Protium | A prototyping platform that accelerates chip verification by enabling early software development. |

| Genus | A logic synthesis tool that optimizes designs for performance, power, and area. |

| Joules | An RTL power solution that helps manage power consumption in integrated circuits. |

| Modus | A design-for-test solution aimed at reducing time and complexity in systems-on-chip verification. |

| Custom IC Design Tools | Tools for creating schematic and physical representations of circuits for various design types. |

| Verification IP | Pre-verified blocks that facilitate integration and testing of designs with standard protocols. |

| Methodology Services | Consulting and support services that help clients implement best practices in design and verification. |

These products play a critical role in the semiconductor industry, catering to diverse markets, including 5G communications, automotive, and aerospace, among others.

Main Competitors

Currently, I was unable to identify any reliable competitors for Cadence Design Systems, Inc. (CDNS).

Consequently, I can provide an estimation of the company’s competitive position. Cadence Design Systems, Inc. holds a significant market share in the software application sector, specifically within the electronic design automation (EDA) space, where it is known for its comprehensive suite of design and verification tools. The company’s ability to cater to various high-demand industries, such as 5G communications, automotive, and aerospace, further solidifies its competitive position and sector dominance.

Competitive Advantages

Cadence Design Systems, Inc. (CDNS) boasts a strong competitive advantage through its comprehensive suite of software and hardware solutions tailored for integrated circuit design. The company is well-positioned in high-growth markets such as 5G communications, automotive, and healthcare, which enhances its future outlook. As the demand for advanced semiconductor technologies continues to rise, Cadence is expected to introduce innovative products that cater to evolving industry needs. Their commitment to research and development will likely unlock new opportunities, ensuring they remain a leader in functional verification and digital IC design solutions.

SWOT Analysis

This analysis evaluates the strengths, weaknesses, opportunities, and threats for Cadence Design Systems, Inc. (CDNS) to inform strategic decision-making.

Strengths

- Strong market position

- Diverse product offerings

- Established customer base

Weaknesses

- High reliance on specific markets

- Limited dividend payout

- Competitive industry landscape

Opportunities

- Growth in 5G and automotive sectors

- Expansion into new markets

- Increasing demand for design solutions

Threats

- Rapid technological changes

- Intense competition

- Economic downturns

Overall, Cadence Design Systems demonstrates robust strengths and significant opportunities that can drive growth. However, the company must address its weaknesses and remain vigilant against external threats to maintain its competitive edge and financial health.

Stock Analysis

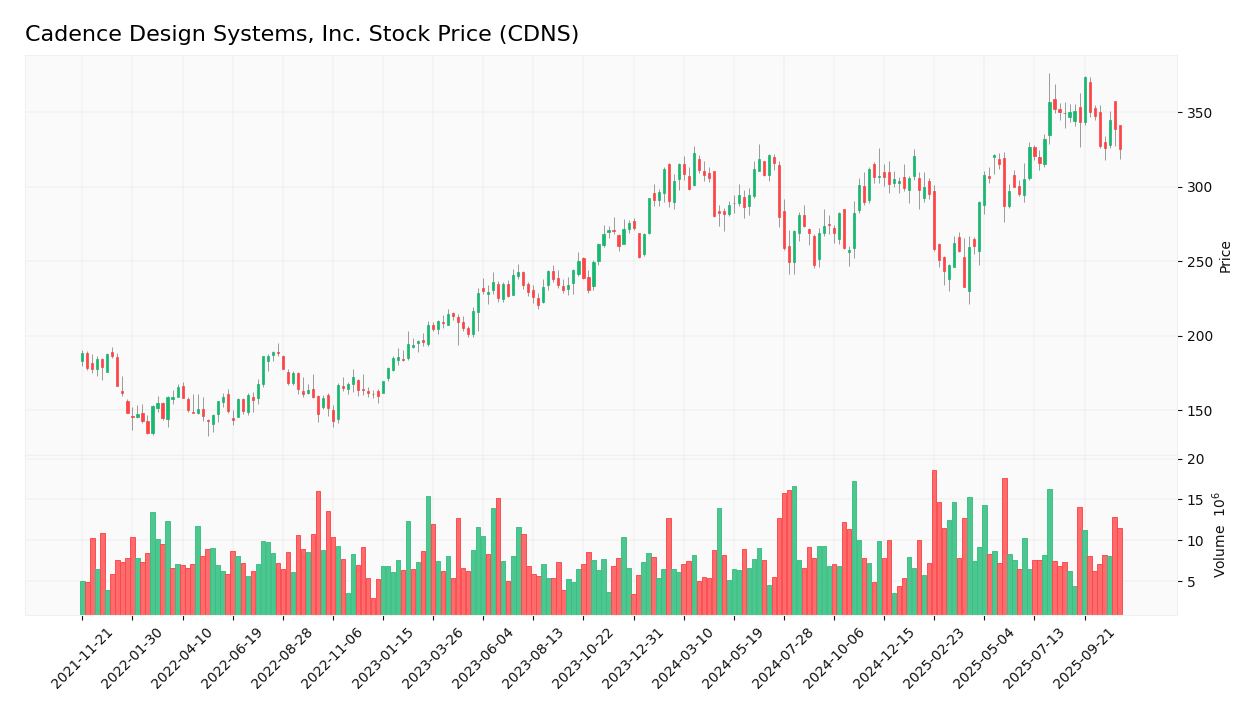

Over the past year, Cadence Design Systems, Inc. (CDNS) has experienced notable price movements, culminating in a significant bullish trend, despite some recent fluctuations.

Trend Analysis

Analyzing the stock’s performance over the last two years, I observe a percentage change of +19.71%. This indicates a bullish trend, although there has been a deceleration in the trend’s acceleration. The stock reached a notable high of $373.35 and a low of $232.88 during this period. The standard deviation of 29.38 suggests a level of volatility that warrants attention for risk management.

Volume Analysis

In examining trading volumes over the past three months, it appears that seller-driven activity is predominant, with an average volume of 8.84M shares. While the overall volume trend is bullish, the recent average volume of 8.78M shows a slight decrease. The buyer volume proportion is at 35.42%, reflecting cautious investor sentiment as sellers have been more active in the market. As indicated by an acceleration in volume trend slope of 309K, market participation remains dynamic but skewed toward selling.

Analyst Opinions

Recent analyst recommendations for Cadence Design Systems, Inc. (CDNS) reflect a cautious outlook. On November 7, 2025, analysts assigned a “Neutral” rating, indicating a balanced view on the stock’s potential. The recommendation was supported by a strong buy on ROA and a buy on ROE, suggesting strong operational efficiency. However, concerns were raised with a sell on debt equity and a strong sell on price-to-earnings and price-to-book ratios. Overall, the consensus leans towards a neutral stance, with caution advised for potential investors.

Stock Grades

No verified stock grades were available from recognized analysts for Cadence Design Systems, Inc. (CDNS). As such, I recommend investors exercise caution and consider other market indicators or analyses to gauge the stock’s performance and potential.

Target Prices

No verified target price data is available from recognized analysts for Cadence Design Systems, Inc. (CDNS). General market sentiment appears cautiously optimistic, reflecting a stable outlook for the company.

Consumer Opinions

Consumer sentiment about Cadence Design Systems, Inc. reflects a blend of enthusiasm and criticism, highlighting both the strengths of their products and areas needing improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| “The software is intuitive and user-friendly.” | “Customer support can be slow to respond.” |

| “Innovative solutions that significantly boost productivity.” | “High pricing compared to competitors.” |

| “Excellent integration with existing systems.” | “Documentation lacks depth and clarity.” |

Overall, consumer feedback indicates that while Cadence Design Systems excels in innovation and usability, there are concerns regarding customer support responsiveness and pricing competitiveness.

Risk Analysis

In assessing the investment potential of Cadence Design Systems, Inc. (CDNS), it is crucial to evaluate the various risks that may impact its performance. Below is a summary of key risks to consider:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in the semiconductor market may affect demand for design solutions. | High | High |

| Technological Risk | Rapid advancements may render current technologies obsolete. | Medium | High |

| Regulatory Risk | Changes in regulations affecting software development could impact operations. | Medium | Medium |

| Competitive Risk | Increasing competition from emerging tech companies could undermine market share. | High | High |

| Operational Risk | Supply chain disruptions may hinder production and delivery of services. | Medium | Medium |

The most pressing risks for CDNS include market and competitive risks, as the semiconductor sector remains volatile and competitive dynamics continuously evolve.

Should You Buy Cadence Design Systems, Inc.?

Cadence Design Systems, Inc. offers a strong portfolio of solutions for electronic design automation, showcasing a solid net profit margin of 22.74%, a return on invested capital (ROIC) of 17.76%, and a weighted average cost of capital (WACC) of 10.00%. However, the stock is currently facing heightened seller volumes and a recent negative price trend, which raises caution.

Given the recent performance metrics, Cadence Design Systems appears favorable for long-term investors due to its positive net margin exceeding zero and ROIC surpassing WACC. Nevertheless, the long-term trend is negative, and recent seller volumes indicate a cautious approach is warranted. It may be more prudent to wait for a bullish reversal or a return of buyer volumes before making a decision to add this stock to your portfolio.

Specific risks related to Cadence Design Systems include intense competition within the electronic design automation space, potential supply chain disruptions, and ongoing valuation concerns in a fluctuating market.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Freemont Management S.A. Buys 30,100 Shares of Cadence Design Systems, Inc. $CDNS – MarketBeat (Nov 09, 2025)

- Could The Market Be Wrong About Cadence Design Systems, Inc. (NASDAQ:CDNS) Given Its Attractive Financial Prospects? – Yahoo Finance (Nov 06, 2025)

- Flossbach Von Storch SE Takes Position in Cadence Design Systems, Inc. $CDNS – MarketBeat (Nov 09, 2025)

- Cadence Design Systems: Expensive But Worth It – Margins And AI Growth Justify Price – Seeking Alpha (Nov 04, 2025)

- DJE Kapital AG Buys New Shares in Cadence Design Systems, Inc. $CDNS – MarketBeat (Nov 09, 2025)

For more information about Cadence Design Systems, Inc., please visit the official website: cadence.com