Home > Analyses > Technology > Cadence Design Systems, Inc.

Cadence Design Systems powers the invisible backbone of modern electronics, enabling chips that drive everything from 5G networks to autonomous vehicles. As a pioneer in electronic design automation, Cadence excels with its suite of software and hardware tools that accelerate integrated circuit innovation. Its market influence and cutting-edge solutions define industry standards. Yet, in 2026, the key question remains: do Cadence’s robust fundamentals still support its premium valuation and future growth prospects?

Table of contents

Business Model & Company Overview

Cadence Design Systems, Inc., founded in 1987 and headquartered in San Jose, California, commands a leading position in software and hardware for integrated circuit design. Its ecosystem blends design, verification, and analysis tools into a unified platform that serves critical sectors like 5G, aerospace, and automotive. The company’s 12.8K employees drive innovation across a comprehensive suite, from logic synthesis to electromagnetic analysis, creating seamless chip development workflows.

The company’s revenue engine balances software sales, hardware platforms, and recurring services, including maintenance and education. Cadence’s footprint spans the Americas, Europe, and Asia, supporting global customers with scalable solutions. This diversified approach builds a robust economic moat, anchoring its role as a cornerstone in semiconductor design’s evolving landscape.

Financial Performance & Fundamental Metrics

I will analyze Cadence Design Systems, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its fundamental strength and growth prospects.

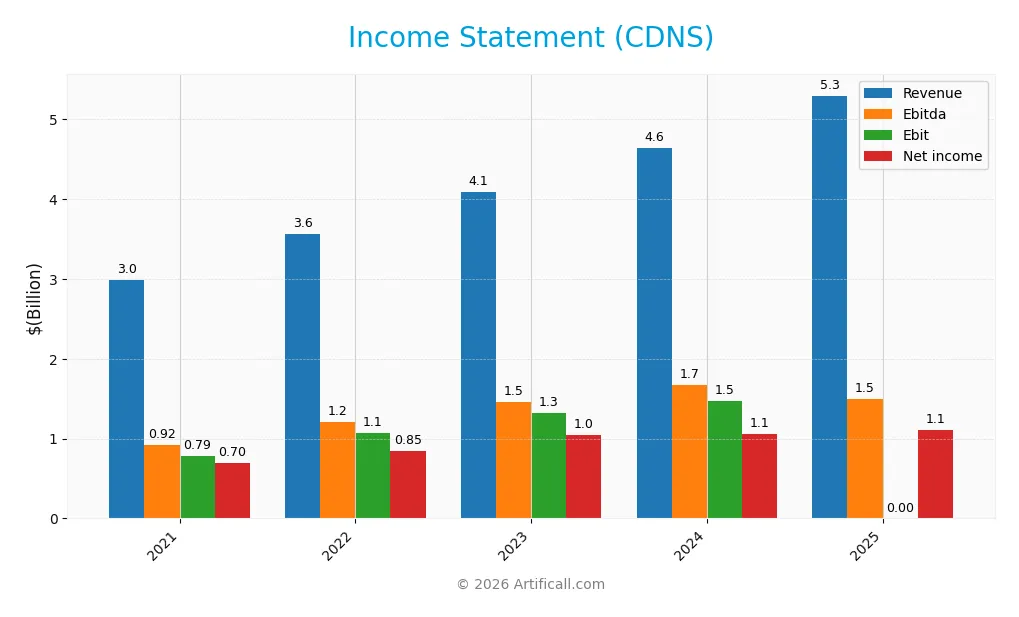

Income Statement

The table below summarizes Cadence Design Systems, Inc.’s key income statement figures from 2021 to 2025, showing revenue growth alongside profitability metrics.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 2.99B | 3.56B | 4.09B | 4.64B | 5.30B |

| Cost of Revenue | 307M | 372M | 435M | 648M | 204M |

| Operating Expenses | 1.90B | 2.12B | 2.40B | 2.64B | 3.60B |

| Gross Profit | 2.68B | 3.19B | 3.65B | 3.99B | 5.09B |

| EBITDA | 916M | 1.20B | 1.46B | 1.67B | 1.49B |

| EBIT | 785M | 1.07B | 1.32B | 1.47B | 0* |

| Interest Expense | 17M | 23M | 36M | 76M | 117M |

| Net Income | 696M | 849M | 1.04B | 1.06B | 1.11B |

| EPS | 2.54 | 3.13 | 3.86 | 3.89 | 4.09 |

| Filing Date | 2022-02-22 | 2023-02-13 | 2024-02-12 | 2025-02-21 | 2026-02-17 |

*Note: EBIT for 2025 reported as zero in source data; operating income was 1.49B.

Income Statement Evolution

Cadence Design Systems, Inc. showed steady revenue growth from 2021 to 2025, increasing by 77.25%. Net income also rose by 59.33% over the period. Gross margin remained strong and favorable at 96.16%. However, the net margin declined by 10.11%, indicating some margin pressure despite higher sales.

Is the Income Statement Favorable?

In 2025, revenue grew 14.12% year-over-year to $5.3B, supported by a 27.53% rise in gross profit. Operating expenses grew in line with revenue, negatively impacting EBIT, which declined 100%. Net margin decreased to 20.94%, yet EPS increased 5.45%. Overall, fundamentals appear favorable, with solid growth offset by margin challenges and zero EBIT margin as a red flag.

Financial Ratios

The table below summarizes key financial ratios for Cadence Design Systems, Inc. over the past five fiscal years, providing insights into profitability, valuation, liquidity, leverage, and efficiency:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 23% | 24% | 25% | 23% | 21% |

| ROE | 25% | 31% | 31% | 23% | N/A |

| ROIC | 21% | 22% | 23% | 13% | N/A |

| P/E | 73.2 | 51.3 | 70.5 | 77.2 | 76.5 |

| P/B | 18.6 | 15.9 | 21.6 | 17.4 | 0 |

| Current Ratio | 1.77 | 1.27 | 1.24 | 2.93 | 0 |

| Quick Ratio | 1.65 | 1.17 | 1.13 | 2.74 | 0 |

| D/E | 0.17 | 0.32 | 0.22 | 0.55 | 0 |

| Debt-to-Assets | 10% | 17% | 13% | 29% | 0 |

| Interest Coverage | 45.9 | 46.8 | 34.6 | 17.8 | -12.8 |

| Asset Turnover | 0.68 | 0.69 | 0.72 | 0.52 | 0 |

| Fixed Asset Turnover | 6.85 | 6.57 | 7.38 | 7.68 | 0 |

| Dividend Yield | 0 | 0 | 0 | 0 | 0 |

Evolution of Financial Ratios

Return on Equity (ROE) shows a decline to zero in 2025 after steady levels around 25-31% from 2021 to 2024. The Current Ratio demonstrates notable volatility, peaking near 2.9 in 2024 but dropping to zero in 2025. Debt-to-Equity Ratio improves to zero in 2025 from moderate levels below 0.6 in prior years. Profitability margins slightly declined but remained stable.

Are the Financial Ratios Favorable?

In 2025, net margin at 20.94% is favorable, but ROE and ROIC at zero are clearly unfavorable, signaling potential operational or reporting issues. Liquidity ratios (Current and Quick) are unfavorable, while leverage ratios including Debt-to-Equity and Debt-to-Assets are favorable, indicating low debt risk. High price-to-earnings ratio (76.48) and negative interest coverage ratio raise caution. Overall, most ratios tilt toward an unfavorable assessment.

Shareholder Return Policy

Cadence Design Systems, Inc. does not pay dividends, reflecting a strategic focus on reinvestment and growth rather than immediate shareholder payouts. The company’s free cash flow supports potential share buybacks, though no explicit buyback programs have been disclosed.

This approach aligns with sustaining long-term shareholder value through reinvestment in innovation and expansion. However, absence of dividends requires investors to trust management’s capital allocation to generate future returns.

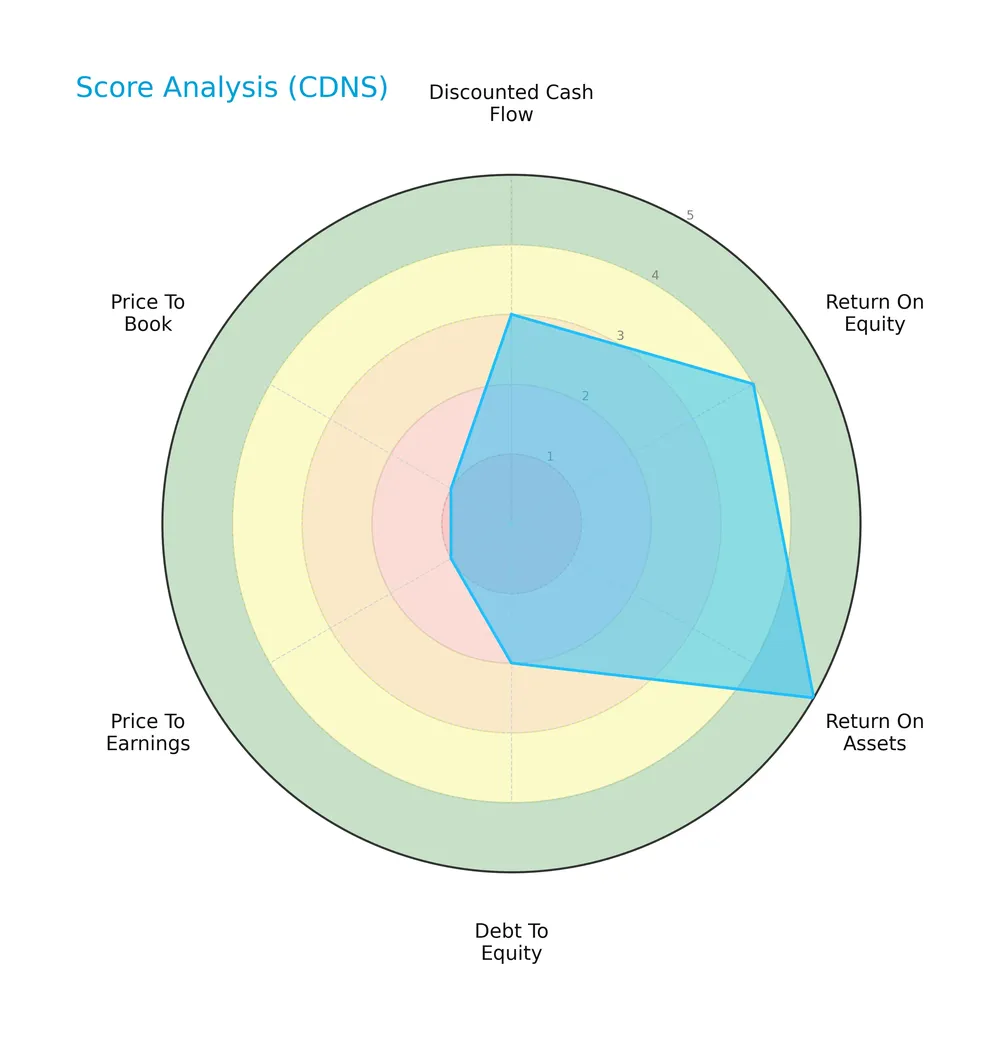

Score analysis

The following radar chart shows Cadence Design Systems’ key financial scores across valuation, profitability, and leverage metrics:

The company demonstrates very favorable return on assets and favorable return on equity scores. However, valuation metrics like price-to-earnings and price-to-book scores are very unfavorable. Debt-to-equity remains an unfavorable point, while discounted cash flow stands moderate.

Analysis of the company’s bankruptcy risk

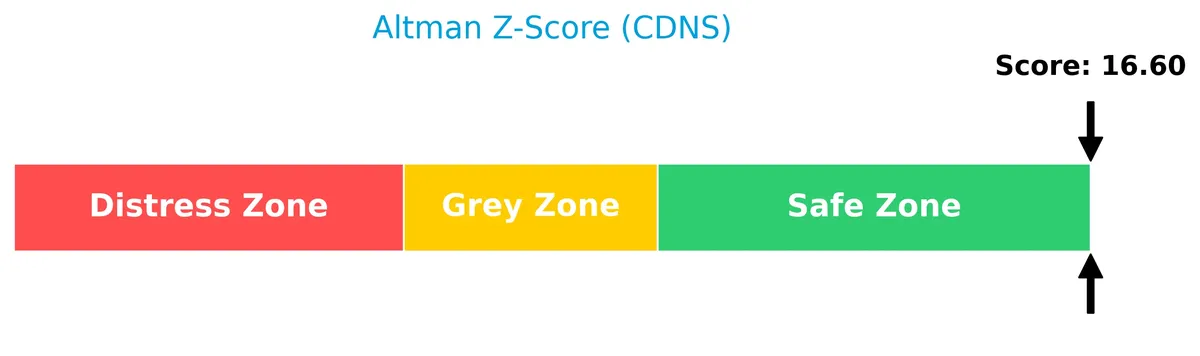

Cadence Design Systems’ Altman Z-Score places it well within the safe zone, indicating a very low risk of bankruptcy:

Is the company in good financial health?

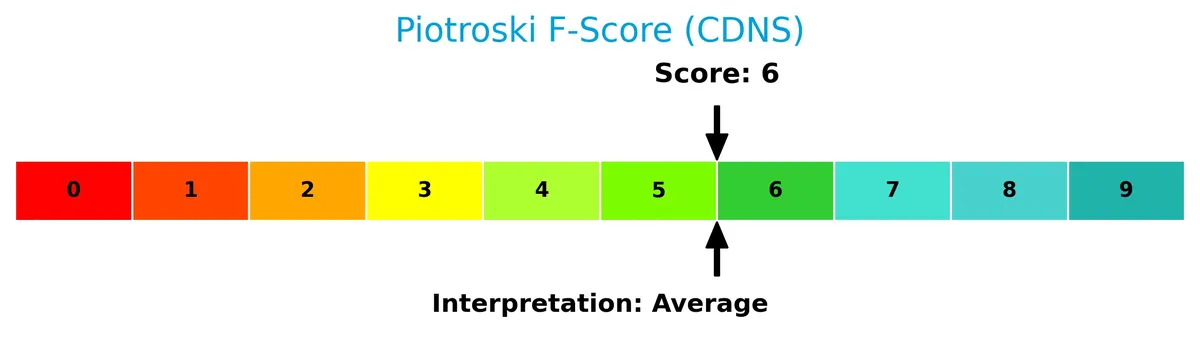

The Piotroski Score diagram reflects an average financial health level for Cadence Design Systems:

A score of 6 suggests the company maintains reasonable profitability and efficiency but leaves room for improvement to reach strong financial health status.

Competitive Landscape & Sector Positioning

This sector analysis explores Cadence Design Systems’ strategic positioning, revenue streams, and key products. I will assess its main competitors and evaluate competitive advantages. My goal is to determine whether Cadence holds a sustainable edge over its rivals.

Strategic Positioning

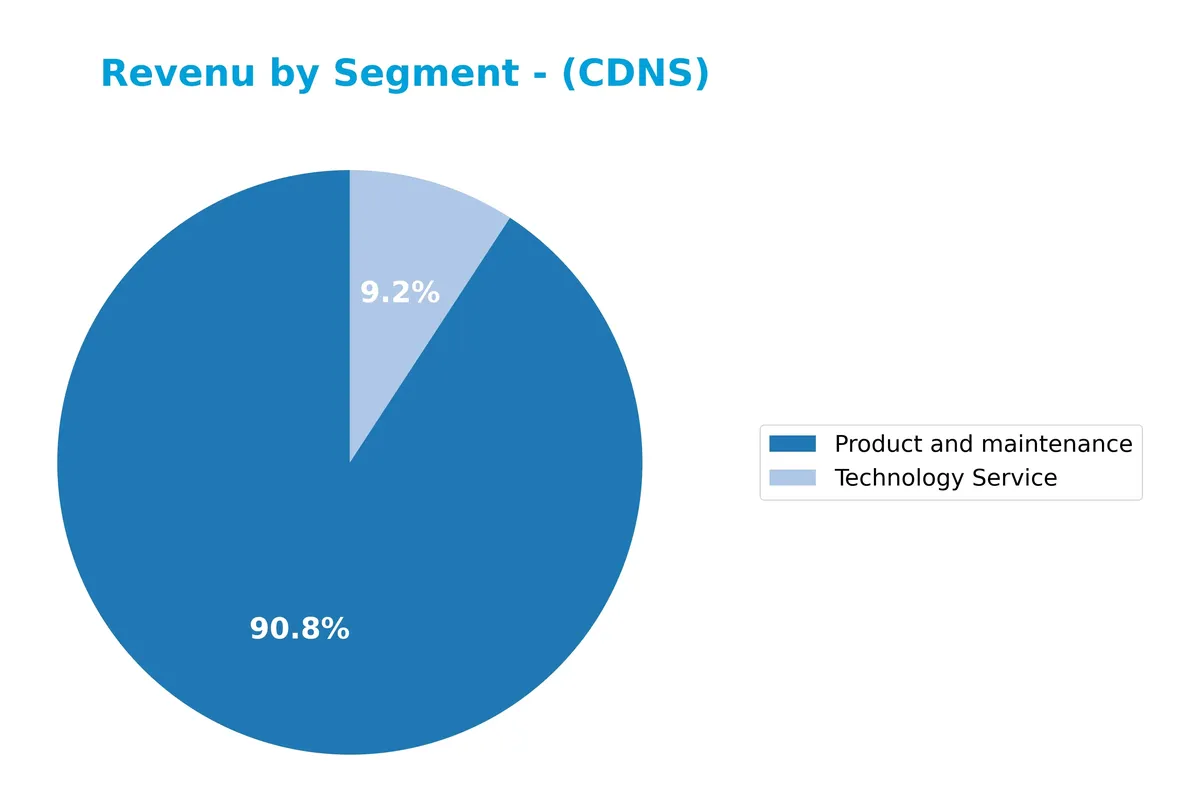

Cadence Design Systems concentrates on software, hardware, and services for IC design verification and analysis, with 2024 revenues heavily weighted toward product and maintenance at $4.2B. Geographically, it diversifies across Americas ($2.25B), Asia ($1.43B), EMEA ($700M), and Japan ($260M), serving multiple high-tech markets without reliance on a single region.

Revenue by Segment

This pie chart illustrates Cadence Design Systems’ revenue breakdown by segment for fiscal year 2024, highlighting contributions from Product and Maintenance and Technology Service.

Product and Maintenance dominates revenue, reaching 4.2B in 2024, up from 3.8B in 2023. Technology Service, though smaller, expanded sharply to 428M, nearly doubling since 2021. This growth signals increased diversification but also rising reliance on core product sales, underscoring a need to monitor emerging segment risks despite solid overall expansion.

Key Products & Brands

Cadence Design Systems’ key offerings span software platforms, hardware, IP products, and related services:

| Product | Description |

|---|---|

| JasperGold | Formal verification platform ensuring design correctness through exhaustive mathematical analysis. |

| Xcelium | Parallel logic simulation platform accelerating functional verification through multi-threaded processing. |

| Palladium | Enterprise emulation platform enabling early hardware/software integration and system validation. |

| Protium | Prototyping platform designed for rapid chip verification and design iteration. |

| Genus | Digital IC design tool specializing in logic synthesis to optimize performance and power. |

| Joules | RTL power solution that reduces power consumption early in the chip design cycle. |

| Modus | Software solution that shortens system-on-chip design-for-test time, improving manufacturing readiness. |

| Physical Implementation Tools | Tools for place and route, optimization, and lithography preparation to ensure manufacturable layouts. |

| Custom IC Design & Simulation | Products creating detailed analog, mixed-signal, and RF circuit representations down to transistor level. |

| System Design & Analysis | Tools for PCB and IC package development, including electromagnetic and thermal effect analysis. |

| Intellectual Property (IP) | Pre-verified, customizable functional blocks and verification IP supporting standard industry protocols. |

| Technology Services | Methodology consulting, education, hosted design solutions, technical support, and maintenance services. |

Cadence’s portfolio focuses on comprehensive electronic design automation. Its platforms and tools boost chip design speed and accuracy. The IP and services complement software and hardware offerings, addressing diverse markets from 5G to aerospace.

Main Competitors

Cadence Design Systems, Inc. faces competition from 33 firms in its sector, with the table below showing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Salesforce, Inc. | 242B |

| Shopify Inc. | 210B |

| AppLovin Corporation | 209B |

| Intuit Inc. | 175B |

| Uber Technologies, Inc. | 172B |

| ServiceNow, Inc. | 153B |

| Cadence Design Systems, Inc. | 84B |

| Snowflake Inc. | 73B |

| Autodesk, Inc. | 61B |

| Workday, Inc. | 55B |

Cadence ranks 7th among 33 competitors with a market cap at 32% of the leader Salesforce. It sits below the average top-10 market cap of 144B but above the sector median of 19B. The company holds a strong lead over the next competitor, Snowflake, with a 98% market cap gap.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does CDNS have a competitive advantage?

Cadence Design Systems, Inc. demonstrates competitive strength through its extensive software and hardware solutions for integrated circuit design. Its favorable gross margin of 96% and strong net margin of 21% highlight operational efficiency in a competitive technology sector.

Looking ahead, Cadence’s broad product portfolio spans emerging markets like 5G, automotive, and aerospace, supporting growth opportunities. Continuous innovation in chip verification platforms and system design tools positions it to capture expanding demand globally.

SWOT Analysis

This analysis highlights Cadence Design Systems’ key internal and external factors affecting its competitive position.

Strengths

- strong revenue growth (77% over 5 years)

- high gross margin (96%)

- diversified global presence with growing Americas segment

Weaknesses

- declining EBIT and net margin growth

- unfavorable ROIC and WACC data

- weak liquidity ratios and high P/E ratio

Opportunities

- expanding 5G and automotive markets

- increasing demand for advanced IC design tools

- growth in hyperscale computing and AI-driven design

Threats

- intense competition in EDA software

- rapid technological change risk

- geopolitical tensions affecting global supply chains

Cadence’s robust revenue and margin base underpin its market strength, but rising costs and weak returns signal caution. Strategic focus on innovation and market expansion is essential to counter competitive and macro risks.

Stock Price Action Analysis

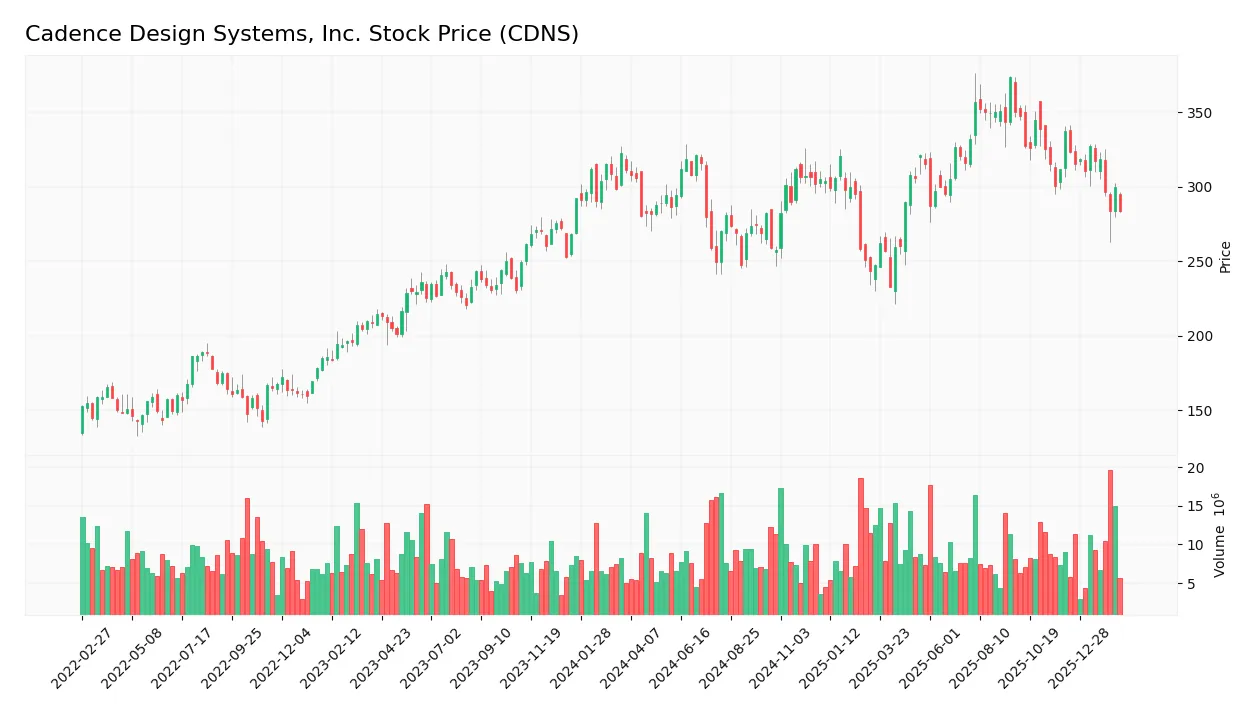

The weekly stock chart for Cadence Design Systems, Inc. (CDNS) over the past 12 months reveals key price movements and trend patterns:

Trend Analysis

Over the past 12 months, CDNS’s stock price declined by 8.94%, indicating a bearish trend. The trend shows deceleration after peaking at 373.35 and bottoming at 232.88. Volatility remains elevated with a 29.16 standard deviation, reflecting significant price swings.

Volume Analysis

Trading volume has increased over the last three months, with sellers slightly dominating at 59.68%. This seller-driven activity suggests cautious investor sentiment and heightened market participation amid price declines.

Target Prices

Analysts present a bullish consensus for Cadence Design Systems, Inc. with a strong upside potential.

| Target Low | Target High | Consensus |

|---|---|---|

| 275 | 418 | 382.17 |

The target range reflects confidence in CDNS’s growth prospects, with a consensus price substantially above current levels.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines Cadence Design Systems, Inc.’s analyst ratings and consumer feedback to provide a comprehensive sentiment overview.

Stock Grades

Here is a summary of recent verified stock grades from leading financial institutions for Cadence Design Systems, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Rosenblatt | Maintain | Neutral | 2026-02-17 |

| Needham | Maintain | Buy | 2025-12-22 |

| JP Morgan | Maintain | Overweight | 2025-10-28 |

| Wells Fargo | Maintain | Overweight | 2025-10-28 |

| Rosenblatt | Maintain | Neutral | 2025-10-28 |

| Oppenheimer | Maintain | Underperform | 2025-10-28 |

| Baird | Maintain | Outperform | 2025-10-28 |

| Needham | Maintain | Buy | 2025-10-28 |

| Rosenblatt | Maintain | Neutral | 2025-10-22 |

| Keybanc | Maintain | Overweight | 2025-07-29 |

The consensus reflects a predominantly positive stance with multiple Buy and Overweight ratings maintained over recent months. Neutral and Underperform grades indicate some caution among analysts, suggesting mixed views on near-term momentum.

Consumer Opinions

Consumers consistently praise Cadence Design Systems for its robust software solutions and innovation leadership.

| Positive Reviews | Negative Reviews |

|---|---|

| Intuitive interface accelerates design work | Steep learning curve for new users |

| Reliable customer support enhances experience | High subscription costs limit accessibility |

| Frequent updates improve functionality | Occasional software bugs disrupt workflow |

Overall, users appreciate Cadence’s powerful tools and responsive support. However, complexity and pricing remain consistent pain points, suggesting room for improved onboarding and cost management.

Risk Analysis

The table below outlines key risks facing Cadence Design Systems, Inc., highlighting their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Valuation Risk | Elevated P/E ratio of 76.48 indicates potential overvaluation relative to sector benchmarks. | High | High |

| Liquidity Risk | Unfavorable current and quick ratios suggest weak short-term liquidity position. | Medium | Medium |

| Profitability Risk | Zero reported ROE and ROIC raise concerns about efficient capital use and profit generation. | Medium | High |

| Debt Risk | Favorable debt-to-equity and debt-to-assets ratios reduce leverage concerns. | Low | Low |

| Market Volatility | Beta near 1.0 implies stock price moves closely with the market, exposing it to downturns. | High | Medium |

| Dividend Risk | Absence of dividends may deter income-focused investors and affect stock appeal. | Medium | Low |

Valuation risk stands out as the most pressing due to a P/E ratio well above technology sector norms. Liquidity and profitability metrics signal operational caution. Despite a strong Altman Z-Score placing Cadence in the safe zone, investors must monitor these financial weaknesses amid evolving market conditions.

Should You Buy Cadence Design Systems, Inc.?

Cadence Design Systems appears to be a profitable company with strong operational efficiency and a manageable leverage profile, despite a declining ROIC trend. Its overall rating of B suggests a very favorable investment profile tempered by moderate valuation concerns.

Strength & Efficiency Pillars

Cadence Design Systems, Inc. maintains a robust net margin of 20.94%, reflecting efficient core operations. Its gross margin impressively stands at 96.16%, underscoring strong pricing power and operational control. Revenue growth over the last year reached 14.12%, with overall period growth of 77.25%, signaling solid top-line momentum. Although ROE and ROIC data are unavailable or unfavorable, the Altman Z-Score of 16.60 places the company firmly in the safe zone, confirming financial stability amidst operational efficiency.

Weaknesses and Drawbacks

Despite operational strengths, valuation metrics raise concerns. The price-to-earnings ratio at 76.48 signals a significant premium, suggesting overvaluation risk. Current and quick ratios are unfavorable, indicating potential liquidity constraints. Interest coverage is negative, hinting at challenges servicing debt from operating earnings. Market sentiment has turned bearish with a recent price decline of 16.02% and seller dominance of 59.68%, adding near-term pressure. These factors collectively caution against complacency in valuation and liquidity risk management.

Our Final Verdict about Cadence Design Systems, Inc.

Cadence’s financial health is secure with a high Altman Z-Score, mitigating bankruptcy concerns. However, the elevated P/E and liquidity red flags, combined with recent bearish price action and seller dominance, suggest a cautious stance. Despite long-term operational strength, current market dynamics might warrant a wait-and-see approach for a more attractive entry point. The profile could appeal to investors prioritizing growth but may appear too stretched for conservative capital at present.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Cadence Design Systems pops as Q4 results, full-year guidance tops estimates (CDNS:NASDAQ) – Seeking Alpha (Feb 17, 2026)

- Cadence Design Systems Inc (CDNS) Q4 2025 Earnings Call Highligh – GuruFocus (Feb 18, 2026)

- Cadence Design Systems Q4 Earnings Call Highlights – Yahoo Finance (Feb 18, 2026)

- Cadence Design Systems’s (NASDAQ:CDNS) Q4 CY2025 Sales Top Estimates – The Globe and Mail (Feb 18, 2026)

- AI for investors – MLQ.ai (Feb 17, 2026)

For more information about Cadence Design Systems, Inc., please visit the official website: cadence.com