Home > Analyses > Industrials > C.H. Robinson Worldwide, Inc.

C.H. Robinson Worldwide, Inc. orchestrates the flow of goods that underpin global commerce and daily life. As a dominant force in integrated freight and logistics, it connects 85,000 carriers with customers worldwide, delivering complex transportation and supply chain solutions. Renowned for innovation and operational excellence, C.H. Robinson shapes how industries move freight efficiently across continents. The key question now: does its robust market position still translate into compelling growth and valuation upside for investors in 2026?

Table of contents

Business Model & Company Overview

C.H. Robinson Worldwide, Inc., founded in 1905 and headquartered in Eden Prairie, Minnesota, commands a dominant position in integrated freight and logistics. It delivers a seamless ecosystem of transportation and supply-chain solutions, spanning truckload, intermodal, ocean, air, and customs brokerage, alongside fresh produce distribution under Robinson Fresh. This comprehensive network serves diverse industries worldwide with precision and scale.

The company’s revenue engine balances freight brokerage with managed logistics services, leveraging contractual ties to 85,000 carriers globally. Its North American Surface Transportation and Global Forwarding segments capitalize on recurring contracts and technology-driven transportation management. With strong footholds across the Americas, Europe, and Asia, C.H. Robinson sustains a formidable economic moat, shaping the future of global logistics.

Financial Performance & Fundamental Metrics

I analyze C.H. Robinson Worldwide, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its operational strength and shareholder value.

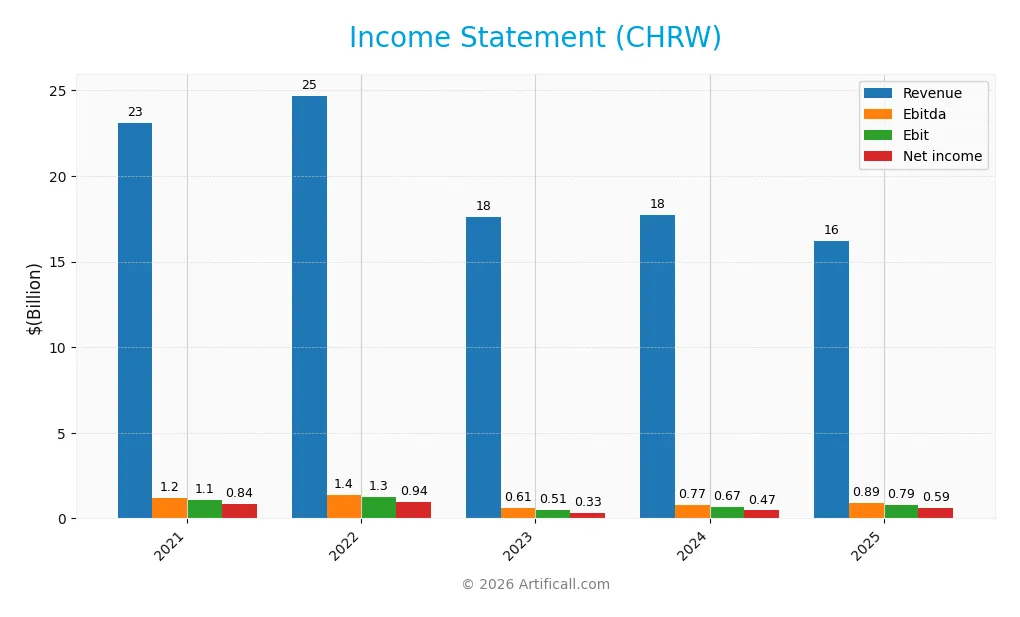

Income Statement

Below is C.H. Robinson Worldwide, Inc.’s income statement summary for fiscal years 2021 through 2025, reflecting revenue trends, profitability, and earnings per share.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 23.10B | 24.70B | 17.60B | 17.72B | 16.23B |

| Cost of Revenue | 21.49B | 22.83B | 16.46B | 16.42B | 14.87B |

| Operating Expenses | 526M | 603M | 624M | 640M | 564M |

| Gross Profit | 1.61B | 1.87B | 1.14B | 1.31B | 1.36B |

| EBITDA | 1.17B | 1.36B | 614M | 766M | 888M |

| EBIT | 1.08B | 1.27B | 515M | 669M | 786M |

| Interest Expense | 60M | 100M | 105M | 90M | 63M |

| Net Income | 844M | 941M | 325M | 466M | 587M |

| EPS | 6.37 | 7.48 | 2.74 | 3.89 | 4.88 |

| Filing Date | 2022-02-23 | 2023-02-17 | 2024-02-16 | 2025-02-14 | 2026-02-13 |

Income Statement Evolution

From 2021 to 2025, C.H. Robinson’s revenue declined nearly 30%, reflecting contraction in core operations. Net income similarly dropped about 30%, signaling margin pressure. Gross margin remained stable near 8.4%, while EBIT margin held around 4.8%, showing consistent cost control despite lower top-line. Recent year saw improved profitability despite revenue dip.

Is the Income Statement Favorable?

In 2025, fundamentals show mixed signals. Revenue declined 8.4%, an unfavorable trend, but gross profit rose modestly 3.9%, suggesting better cost efficiency. EBIT increased 17.4%, and net margin expanded 37.7%, driven by lower operating expenses and interest costs. Earnings per share grew 25%, indicating improved shareholder value despite top-line challenges. Overall, the income statement appears neutral with both risks and strengths.

Financial Ratios

The table below summarizes key financial ratios for C.H. Robinson Worldwide, Inc. over the last five fiscal years:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 3.65% | 3.81% | 1.85% | 2.63% | 3.62% |

| ROE | 41.75% | 69.49% | 22.92% | 27.04% | 31.81% |

| ROIC | 20.92% | 27.16% | 12.00% | 15.36% | 19.58% |

| P/E | 16.89 | 12.24 | 31.50 | 26.58 | 32.93 |

| P/B | 7.05 | 8.51 | 7.22 | 7.19 | 10.47 |

| Current Ratio | 1.44 | 1.08 | 1.40 | 1.28 | 1.53 |

| Quick Ratio | 1.44 | 1.08 | 1.40 | 1.28 | 1.53 |

| D/E | 1.10 | 1.74 | 1.38 | 1.01 | 0.88 |

| Debt-to-Assets | 31.7% | 39.7% | 37.4% | 32.9% | 32.2% |

| Interest Coverage | 18.1 | 12.7 | 4.88 | 7.44 | 12.6 |

| Asset Turnover | 3.29 | 4.15 | 3.37 | 3.35 | 3.21 |

| Fixed Asset Turnover | 53.43 | 46.46 | 35.29 | 38.37 | 41.13 |

| Dividend Yield | 1.94% | 2.48% | 2.85% | 2.38% | 1.56% |

Evolution of Financial Ratios

Return on Equity (ROE) improved significantly, rising from 22.9% in 2023 to 31.8% in 2025, indicating stronger profitability. The Current Ratio increased steadily from 1.40 to 1.53, enhancing liquidity. Debt-to-Equity Ratio showed a decline from 1.38 in 2023 to 0.88 in 2025, reflecting reduced leverage and a more conservative capital structure.

Are the Financial Ratios Favorable?

In 2025, profitability metrics such as ROE (31.8%) and ROIC (19.6%) are favorable, comfortably exceeding the WACC of 7.5%. Liquidity ratios, including a Current and Quick Ratio of 1.53, are also favorable. Leverage ratios like Debt-to-Equity (0.88) and Debt-to-Assets (32.2%) are neutral. Market valuation ratios such as P/E (32.9) and P/B (10.5) appear unfavorable. Overall, 57% of ratios are favorable, suggesting a generally positive financial profile.

Shareholder Return Policy

C.H. Robinson Worldwide, Inc. maintains a consistent dividend policy with a payout ratio near 51% in 2025 and a dividend yield around 1.56%. The company funds dividends and share buybacks comfortably from free cash flow, ensuring coverage above 2.8x for dividends plus capex.

The steady dividend per share growth and share repurchase activity suggest a balanced distribution approach. This policy aligns with sustainable long-term value creation, supported by prudent capital allocation and healthy cash flow coverage ratios.

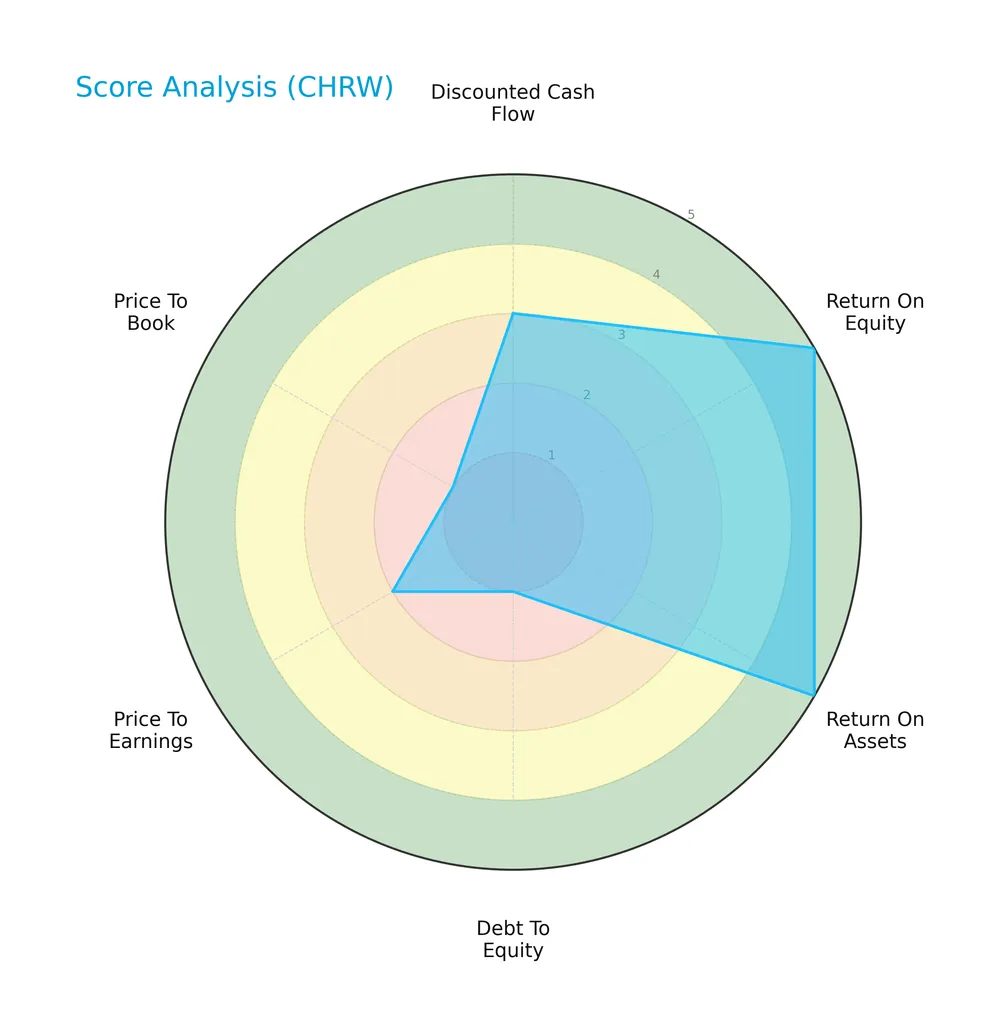

Score analysis

The following radar chart highlights key financial performance and valuation metrics for C.H. Robinson Worldwide, Inc.:

The company scores very favorably on return on equity and assets, reflecting operational efficiency. However, debt-to-equity and valuation metrics show significant weakness, indicating elevated leverage and potentially overvalued stock prices relative to book value.

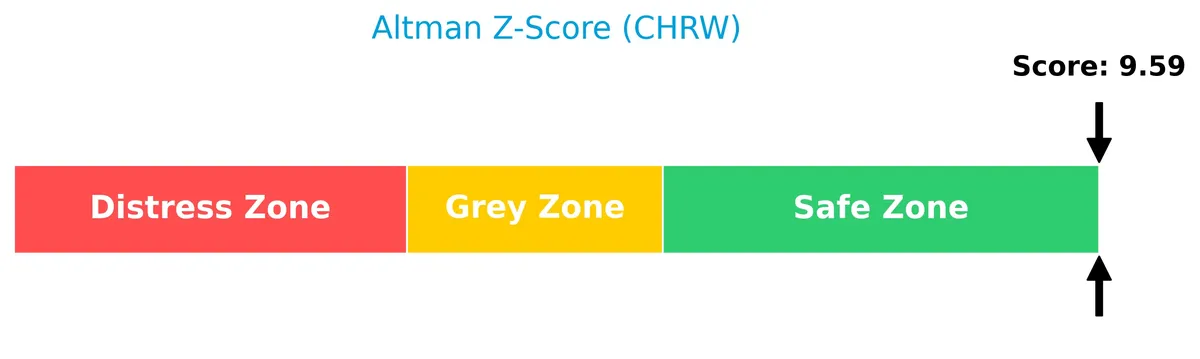

Analysis of the company’s bankruptcy risk

C.H. Robinson’s Altman Z-Score places it comfortably in the safe zone, indicating a very low bankruptcy risk:

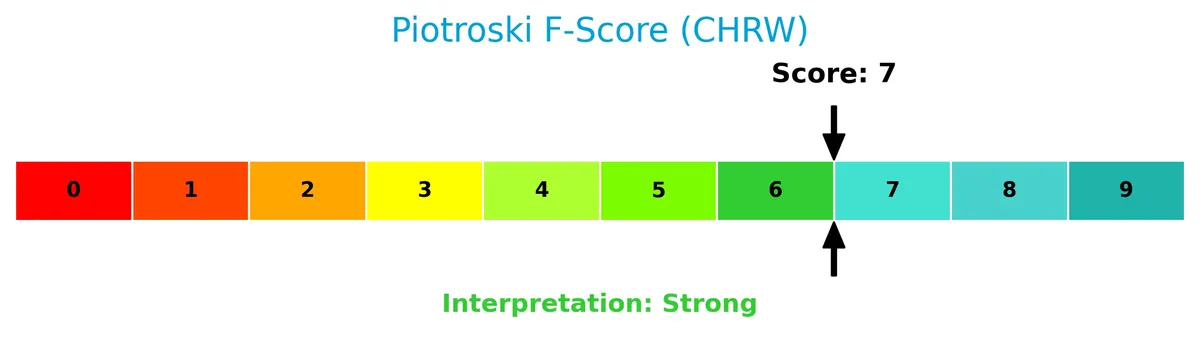

Is the company in good financial health?

The Piotroski diagram illustrates the company’s strong financial health based on nine fundamental criteria:

With a Piotroski score of 7, the company demonstrates solid profitability, liquidity, and operational efficiency, signaling robust financial strength though not at the highest echelon of this scale.

Competitive Landscape & Sector Positioning

This sector analysis explores C.H. Robinson Worldwide, Inc.’s strategic positioning, revenue segments, key products, and main competitors. I will evaluate whether the company maintains a competitive advantage within the integrated freight and logistics industry.

Strategic Positioning

C.H. Robinson Worldwide focuses on integrated freight and logistics with a product portfolio spanning North American Surface Transportation and Global Forwarding. Its revenue is heavily concentrated in U.S. freight transportation, with non-U.S. markets contributing a smaller, yet significant, portion of sales near 1.9B in 2025.

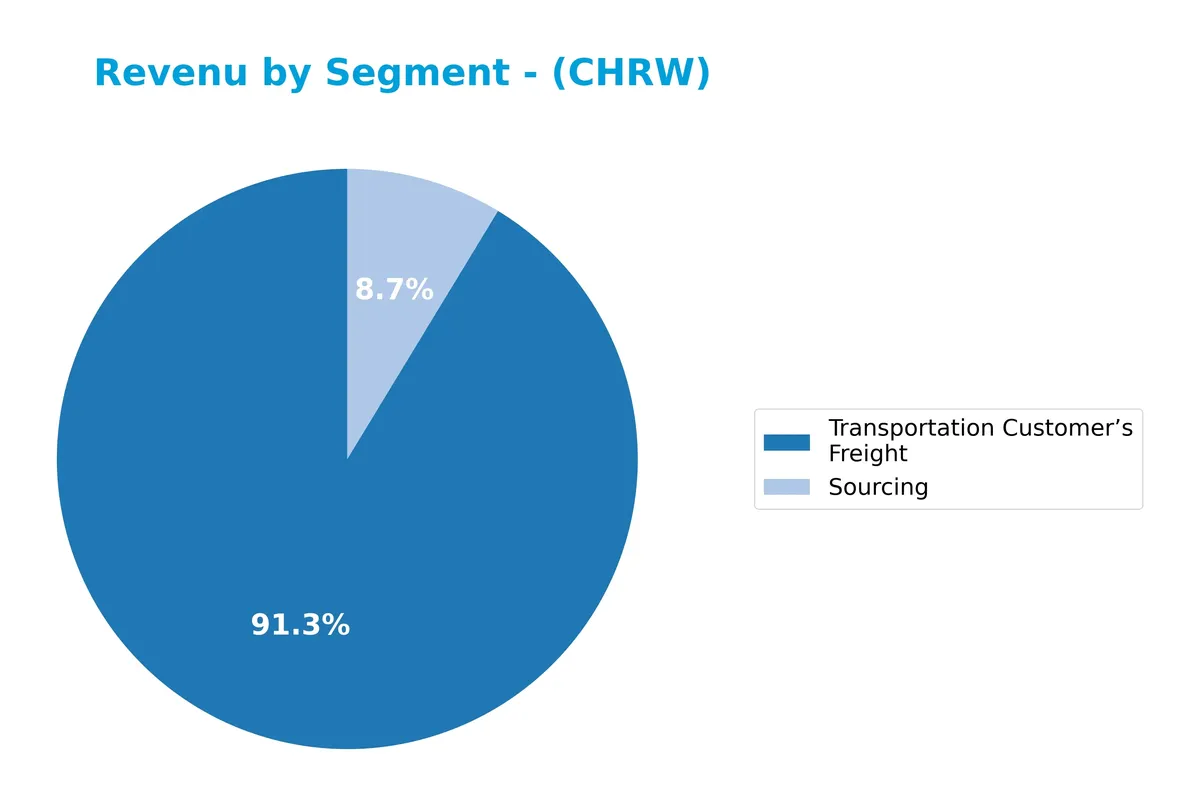

Revenue by Segment

The pie chart displays C.H. Robinson’s revenue distribution by segment for fiscal year 2025, highlighting the relative size of its main business lines.

In 2025, Transportation Customer’s Freight dominates with $14.8B, showing a slight decline from $16.4B in 2024, reflecting potential market softness or pricing pressure. Sourcing contributes $1.4B, stable but minor compared to freight. Historical data reveals growth and contraction in Global Forwarding and other segments, but the latest year underscores concentration risk in freight, signaling dependence on this core business.

Key Products & Brands

C.H. Robinson’s principal offerings cover freight transportation and produce sourcing services:

| Product | Description |

|---|---|

| North American Surface Transportation | Brokerage services for truckload, less-than-truckload, intermodal shipments combining truck and rail transport. |

| Global Forwarding | Non-vessel ocean common carrier and freight forwarding, plus air shipment organization and door-to-door logistics services. |

| Robinson Fresh | Buying, selling, and marketing fresh produce, including fruits, vegetables, and value-added perishables to retailers and foodservice. |

| Managed Transportation Services | Fee-based managed logistics including transportation management systems (TMS), warehousing, and small parcel services. |

C.H. Robinson’s diversified logistics platform spans surface and global freight, complemented by a fresh produce sourcing division. This mix supports broad industry reach and customer needs worldwide.

Main Competitors

There are 5 main competitors in the Integrated Freight & Logistics industry; below is a list of the top 5 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| United Parcel Service, Inc. | 85.7B |

| FedEx Corporation | 69.2B |

| Expeditors International of Washington, Inc. | 20.8B |

| C.H. Robinson Worldwide, Inc. | 19.3B |

| J.B. Hunt Transport Services, Inc. | 18.7B |

C.H. Robinson ranks 4th among its direct competitors with a market cap about 24% of the leader, United Parcel Service. The company sits below both the average market cap of the top 10 peers (43B) and the sector median (20.8B). It maintains a slim 0.13% gap above its closest rival, Expeditors, indicating tight competition in this mid-range segment.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does CHRW have a competitive advantage?

C.H. Robinson Worldwide, Inc. demonstrates a competitive advantage by generating returns on invested capital (ROIC) that exceed its weighted average cost of capital (WACC) by about 12%. However, I note the ROIC trend is declining, signaling some erosion in profitability over recent years.

Looking ahead, CHRW’s extensive network of 85,000 transportation partners and diversified logistics services position it well to capitalize on growth opportunities. Expansion in global forwarding and fresh produce logistics offers potential avenues to strengthen its market presence.

SWOT Analysis

This SWOT analysis highlights key internal and external factors shaping C.H. Robinson Worldwide, Inc.’s strategic position in 2026.

Strengths

- strong ROE at 31.8%

- ROIC well above WACC at 19.6%

- robust asset turnover and interest coverage

Weaknesses

- declining revenue and net income over five years

- high valuation multiples (PE 32.9, PB 10.5)

- heavy reliance on US market (~88% revenue)

Opportunities

- expanding global logistics demand

- technology-driven efficiency gains

- growing managed TMS and value-added services

Threats

- intense competition in freight logistics

- economic cycles impacting shipping volumes

- regulatory and geopolitical risks in global trade

C.H. Robinson demonstrates solid capital efficiency and financial strength but faces revenue erosion and valuation concerns. Strategic focus should emphasize diversification and digital innovation to mitigate cyclical and competitive pressures.

Stock Price Action Analysis

The weekly stock chart for C.H. Robinson Worldwide, Inc. reveals significant price movements and trend shifts over the last 12 months:

Trend Analysis

Over the past 12 months, CHRW’s stock price rose 136.35%, indicating a strong bullish trend with accelerating momentum. The price volatility is notable, with a standard deviation of 28.55. The stock reached a high of 200.59 and a low of 70.22, reflecting robust upward movement and expanding investor interest.

Volume Analysis

Trading volume over the last three months shows increasing activity, with buyers dominating 59.12% of the volume. Buyer volume outpaces sellers, suggesting sustained investor confidence. This rising volume trend implies growing market participation and a slightly buyer-driven sentiment supporting the recent price appreciation.

Target Prices

Analysts present a wide target range, reflecting varied growth expectations for C.H. Robinson Worldwide, Inc.

| Target Low | Target High | Consensus |

|---|---|---|

| 90 | 220 | 185.47 |

The consensus target price of $185.47 implies upside potential from current levels, though the broad range signals divergent views on the company’s near-term prospects.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the latest analyst grades and consumer feedback related to C.H. Robinson Worldwide, Inc. (CHRW).

Stock Grades

The following table presents the latest verified stock grades for C.H. Robinson Worldwide, Inc. from established analysts:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Benchmark | Maintain | Buy | 2026-01-30 |

| Citigroup | Maintain | Neutral | 2026-01-30 |

| Morgan Stanley | Maintain | Underweight | 2026-01-29 |

| Wells Fargo | Maintain | Overweight | 2026-01-29 |

| Truist Securities | Maintain | Buy | 2026-01-29 |

| Stifel | Maintain | Buy | 2026-01-29 |

| Susquehanna | Maintain | Positive | 2026-01-29 |

| Evercore ISI Group | Maintain | Outperform | 2026-01-29 |

| UBS | Maintain | Buy | 2026-01-23 |

| Truist Securities | Maintain | Buy | 2026-01-15 |

The consensus reveals a stable sentiment with most analysts maintaining a Buy rating. However, a few firms hold neutral or underweight views, indicating some caution around the stock.

Consumer Opinions

C.H. Robinson Worldwide, Inc. consistently earns praise for its reliable logistics services, though some users express concerns about pricing and communication.

| Positive Reviews | Negative Reviews |

|---|---|

| “Dependable freight tracking and timely deliveries.” | “Customer service can be slow during peak times.” |

| “Strong network that handles complex shipments well.” | “Rates have increased noticeably over the past year.” |

| “User-friendly platform simplifies logistics management.” | “Occasional delays in updating shipment status.” |

Overall, consumers applaud C.H. Robinson for its robust logistics network and technology. However, recurring complaints about customer service responsiveness and pricing pressure suggest areas for improvement.

Risk Analysis

Below is a summary table outlining key risks for C.H. Robinson Worldwide, Inc., their likelihood, and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Valuation Risk | Elevated P/E (32.9) and P/B (10.5) ratios suggest overvaluation relative to peers. | Medium | High |

| Leverage Risk | Debt-to-equity ratio near 0.88 signals moderate leverage, which could pressure cash flow. | Medium | Medium |

| Profitability Risk | Low net margin of 3.62% highlights thin profit buffer despite strong ROE and ROIC. | High | Medium |

| Market Volatility | Beta of 0.90 shows sensitivity to market swings, though less volatile than S&P 500. | Medium | Medium |

| Operational Risk | Dependency on transportation contracts with ~85,000 carriers exposes to industry shocks. | Medium | High |

| Dividend Risk | Dividend yield at 1.56% is modest, limiting income stability for yield-focused investors. | Low | Low |

The most pressing risks are valuation stretch and operational exposure. The stock trades near its 2026 high of $203, reflecting optimistic growth expectations. However, weak net margins and moderate debt warrant caution amid economic uncertainties in the freight sector. I observe that industry disruptions could impact contract renewals, amplifying operational risk. The Altman Z-score of 9.6 reassures financial stability, but elevated valuation multiples and leverage require close monitoring.

Should You Buy C.H. Robinson Worldwide, Inc.?

C.H. Robinson appears to be a company with robust profitability and a slightly favorable moat, suggesting value creation despite declining returns. While its leverage profile is substantial, the overall rating of B indicates a moderately favorable investment profile with notable risks.

Strength & Efficiency Pillars

C.H. Robinson Worldwide, Inc. exhibits solid profitability with a return on equity (ROE) of 31.81% and a return on invested capital (ROIC) of 19.58%. The weighted average cost of capital (WACC) stands at a favorable 7.51%. Since ROIC exceeds WACC by 12.07 percentage points, the company is a clear value creator. Operational margins are stable, supported by efficient asset turnover ratios of 3.21 and fixed asset turnover at 41.13, underscoring robust operational efficiency.

Weaknesses and Drawbacks

The company is not in financial distress, reflected by a safe Altman Z-Score of 9.59. However, valuation metrics raise concerns. A high price-to-earnings ratio of 32.93 and a price-to-book ratio of 10.47 indicate a premium valuation that may limit upside. Although leverage is moderate, with a debt-to-equity ratio of 0.88, investor caution is warranted. Market sentiment remains positive, with buyer dominance at 59.12%, but premium pricing introduces short-term risk.

Our Final Verdict about C.H. Robinson Worldwide, Inc.

The company’s fundamentals suggest a resilient long-term profile, bolstered by strong profitability and value creation. The bullish overall stock trend and slight recent buyer dominance could support further gains. However, the elevated valuation metrics suggest that investors might prefer a wait-and-see approach for a more attractive entry point. This profile may appear suitable for disciplined investors seeking exposure to operationally efficient logistics.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- ‘The AI Disruptor’: C.H. Robinson Stock (CHRW) Climbs after AI-Fueled Selloff – TipRanks (Feb 13, 2026)

- C.H. Robinson stock tumbles amid freight sector AI disruption fears – Investing.com (Feb 12, 2026)

- C. H. ROBINSON WORLDWIDE, INC. SEC 10-K Report – TradingView (Feb 13, 2026)

- C.H. Robinson Worldwide (NASDAQ:CHRW) Shares Down 10.2% Following Insider Selling – MarketBeat (Feb 12, 2026)

- KHNGY vs. CHRW: Which Stock Is the Better Value Option? – Yahoo Finance UK (Feb 13, 2026)

For more information about C.H. Robinson Worldwide, Inc., please visit the official website: chrobinson.com