Home > Analyses > Real Estate > BXP, Inc.

BXP, Inc. transforms urban skylines with its premier Class A office properties, shaping how businesses operate in major U.S. cities. As the largest publicly-held developer and owner in this niche, BXP commands a portfolio spanning 51M square feet across Boston, New York, San Francisco, and more. Renowned for its strategic developments and market influence, the company sets standards in office real estate. The key question: Do BXP’s robust fundamentals still support its valuation and future growth?

Table of contents

Business Model & Company Overview

BXP, Inc. stands as the largest publicly-held developer and owner of Class A office properties in the United States. Founded in 1997 and headquartered in Boston, it operates as a fully integrated REIT with a strategic focus on five key markets: Boston, Los Angeles, New York, San Francisco, and Washington, DC. Its portfolio encompasses 51.2M square feet across 196 properties, blending development, management, and ownership into a seamless ecosystem of premium office real estate.

The company generates value through a balanced mix of property development, leasing, and operations that deliver steady rental income and capital appreciation. Its presence spans major U.S. economic hubs, capturing demand across diverse industries and geographies. BXP’s economic moat lies in its dominant market position and deep expertise in Class A office space, shaping the future of urban commercial real estate.

Financial Performance & Fundamental Metrics

I analyze BXP, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its fiscal health and shareholder value creation.

Income Statement

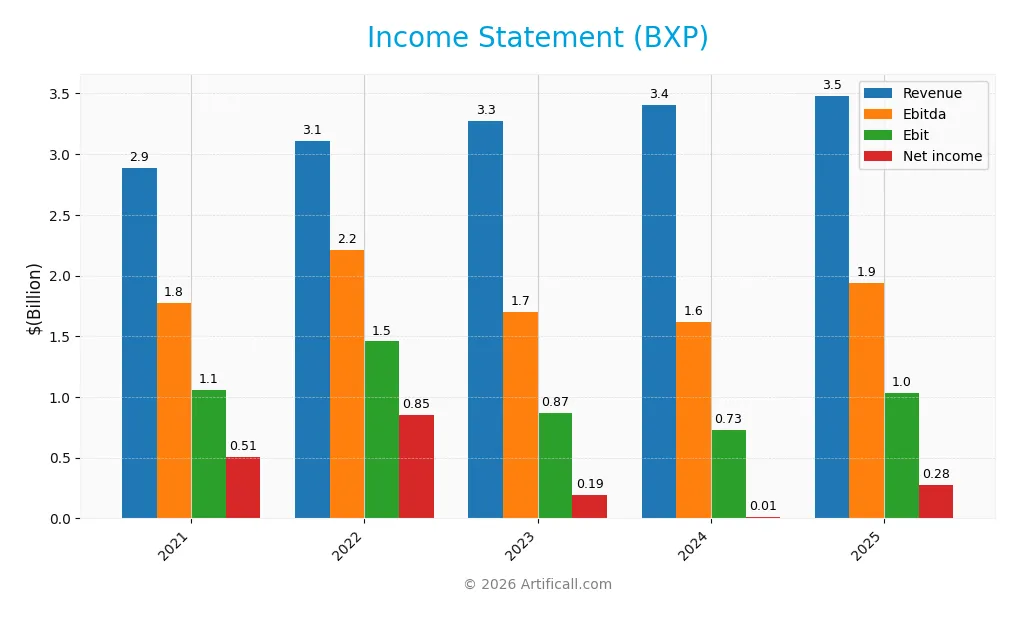

Below is the income statement for BXP, Inc. showing key financial figures over the past five fiscal years.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 2.89B | 3.11B | 3.27B | 3.41B | 3.48B |

| Cost of Revenue | 1.03B | 1.14B | 1.22B | 1.32B | 1.37B |

| Operating Expenses | 881M | 912M | 1.02B | 1.06B | 169M |

| Gross Profit | 1.85B | 1.97B | 2.06B | 2.09B | 2.11B |

| EBITDA | 1.78B | 2.21B | 1.70B | 1.62B | 1.94B |

| EBIT | 1.06B | 1.46B | 871M | 729M | 1.03B |

| Interest Expense | 423M | 437M | 573M | 645M | 648M |

| Net Income | 505M | 849M | 190M | 14M | 277M |

| EPS | 3.18 | 5.42 | 1.21 | 0.09 | 1.75 |

| Filing Date | 2022-02-25 | 2023-02-27 | 2024-02-27 | 2025-02-27 | 2026-01-28 |

Income Statement Evolution

Between 2021 and 2025, BXP’s revenue grew 20.55%, showing steady expansion. Net income, however, declined 45.21% over the same period, reflecting margin pressure. Gross margin remained favorable at 60.56%, stable through the years. EBIT margin improved to 29.63%, signaling better operational efficiency despite rising interest expenses.

Is the Income Statement Favorable?

In 2025, revenue increased modestly by 2.19%, while EBIT surged 41.46%, driving net margin growth of nearly 1,798%. The net margin stood at 7.95%, a favorable level given the 18.6% interest expense ratio. Earnings per share jumped 1,833%, highlighting improved profitability. Overall, fundamentals appear favorable but interest costs pose risks.

Financial Ratios

The following table summarizes key financial ratios for BXP, Inc. over the last five fiscal years:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 17% | 27% | 6% | 0.4% | 8% |

| ROE | 8.6% | 14% | 3.2% | 0.3% | 5.4% |

| ROIC | 4.5% | 4.5% | 4.1% | 4.0% | 7.6% |

| P/E | 36 | 12 | 58 | 820 | 39 |

| P/B | 3.1 | 1.7 | 1.9 | 2.2 | 2.1 |

| Current Ratio | 2.6 | 3.2 | 4.2 | 2.6 | 2.3 |

| Quick Ratio | 2.6 | 3.2 | 4.2 | 2.6 | 2.3 |

| D/E | 2.3 | 2.4 | 2.8 | 3.2 | 3.4 |

| Debt-to-Assets | 60% | 61% | 64% | 66% | 66% |

| Interest Coverage | 2.3 | 2.4 | 1.8 | 1.6 | 3.0 |

| Asset Turnover | 0.13 | 0.13 | 0.13 | 0.13 | 0.13 |

| Fixed Asset Turnover | 0.0 | 7.7 | 0.0 | 4.8 | 0.17 |

| Dividend Yield | 3.8% | 6.5% | 6.2% | 5.9% | 5.4% |

All values are rounded for clarity.

Evolution of Financial Ratios

Return on Equity (ROE) showed a downward trend, declining from 13.8% in 2022 to 5.38% in 2025, indicating weakening profitability. The Current Ratio fell from 4.19 in 2023 to 2.28 in 2025 but remains above 2, signaling solid liquidity. Debt-to-Equity ratio increased steadily, reaching 3.37 in 2025, reflecting higher leverage and financial risk.

Are the Financial Ratios Fovorable?

In 2025, profitability metrics like net margin (7.95%) and ROIC (7.63%) are neutral, but ROE (5.38%) is unfavorable versus sector norms. Liquidity ratios (current and quick at 2.28) are favorable, supporting short-term solvency. Leverage ratios, including debt-to-equity (3.37) and debt-to-assets (66.34%), are unfavorable, highlighting elevated debt risk. Market multiples like P/E (38.78) are also unfavorable, while dividend yield (5.39%) remains neutral. Overall, ratios lean slightly unfavorable.

Shareholder Return Policy

BXP, Inc. maintains a consistent dividend policy, with a payout ratio near 209% in 2025 and a dividend per share around $3.64. The dividend yield has hovered near 5.4%, supported by ongoing share buybacks, though the payout ratio above 100% signals potential sustainability risks.

The dividend distribution relies heavily on capital allocation beyond net income, raising caution about long-term cash flow coverage. While buybacks enhance shareholder returns, the elevated payout ratio warrants close monitoring to ensure sustainable value creation over time.

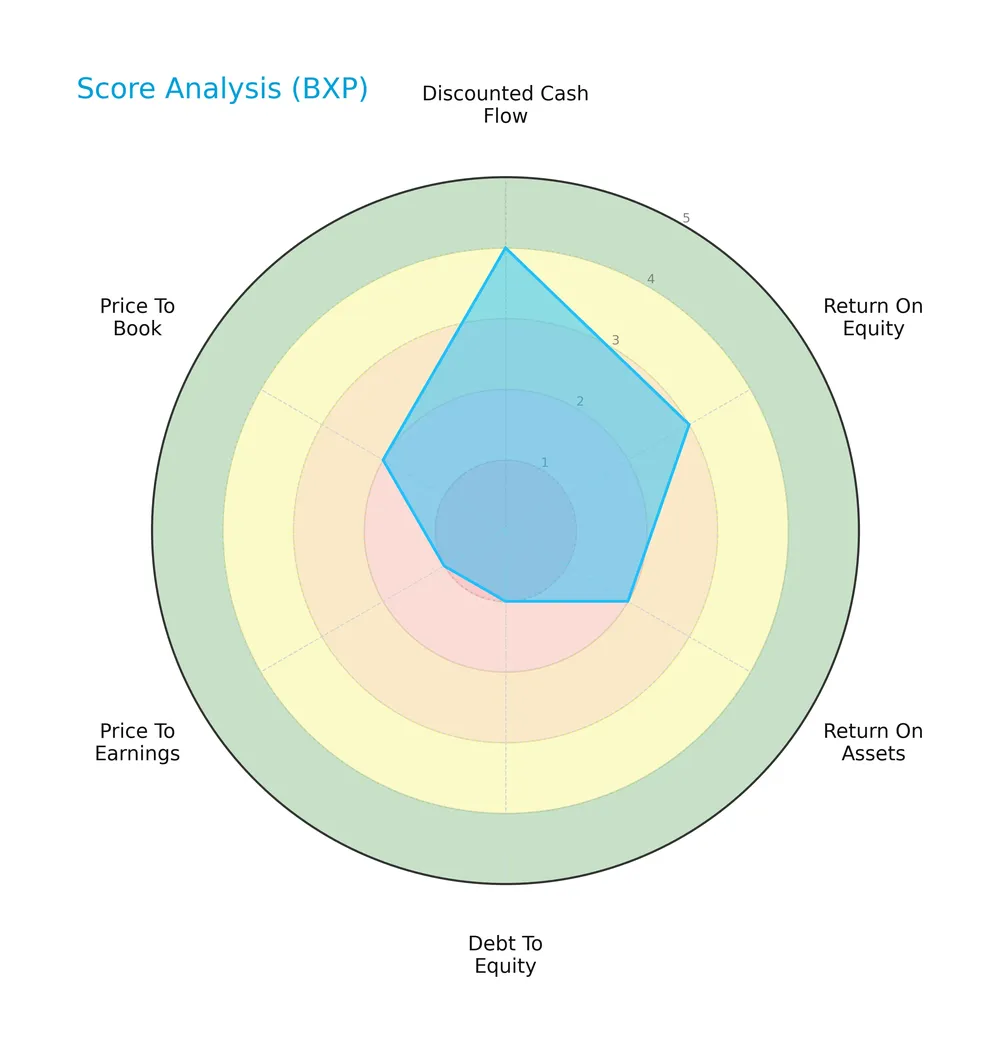

Score analysis

The following radar chart illustrates key financial scores for BXP, Inc., highlighting its valuation, profitability, and leverage metrics:

BXP scores favorably on discounted cash flow at 4, indicating solid intrinsic value. Profitability metrics like ROE and ROA show moderate strength at 3 and 2. However, debt-to-equity and valuation ratios (PE and PB) are weak, signaling financial and market challenges.

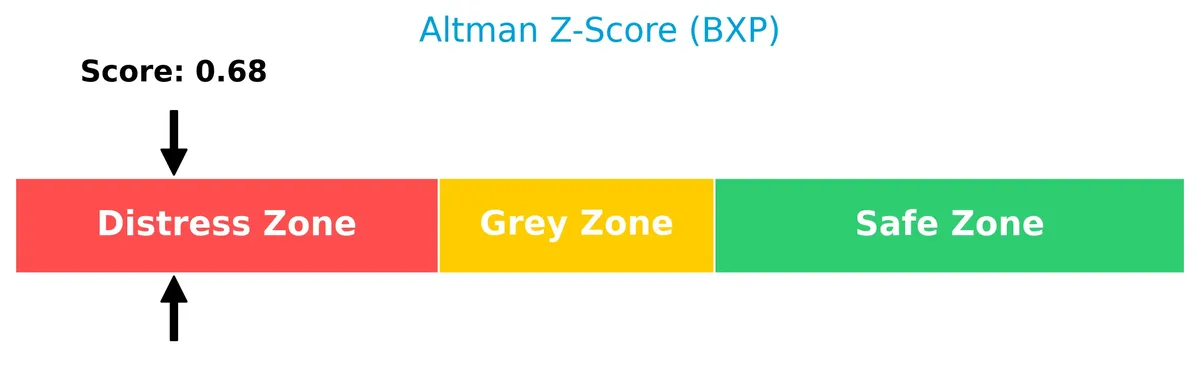

Analysis of the company’s bankruptcy risk

BXP’s Altman Z-Score places it in the distress zone, indicating a high probability of financial distress and bankruptcy risk:

Is the company in good financial health?

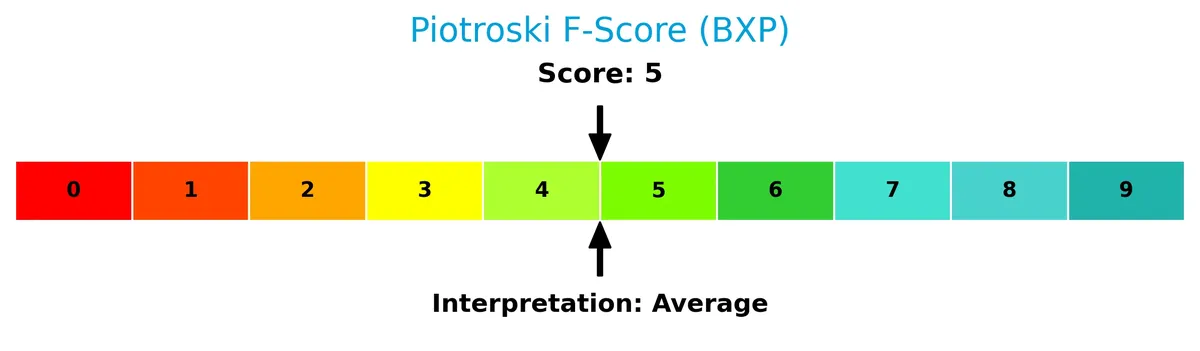

The Piotroski Score diagram below shows BXP’s financial health is average, reflecting mixed signals on profitability, leverage, and efficiency:

With a score of 5, BXP demonstrates moderate financial strength but lacks the robustness typical of strong value investments.

Competitive Landscape & Sector Positioning

This section analyzes BXP, Inc.’s strategic positioning, revenue segments, key products, competitors, and strengths. I will assess whether BXP holds a sustainable competitive advantage.

Strategic Positioning

BXP focuses on Class A office properties concentrated in five major U.S. markets: Boston, New York, Washington DC, San Francisco, and Los Angeles. Its portfolio includes 196 properties totaling 51.2M sq ft, with diversified revenue streams from office, parking, hotel, and management services.

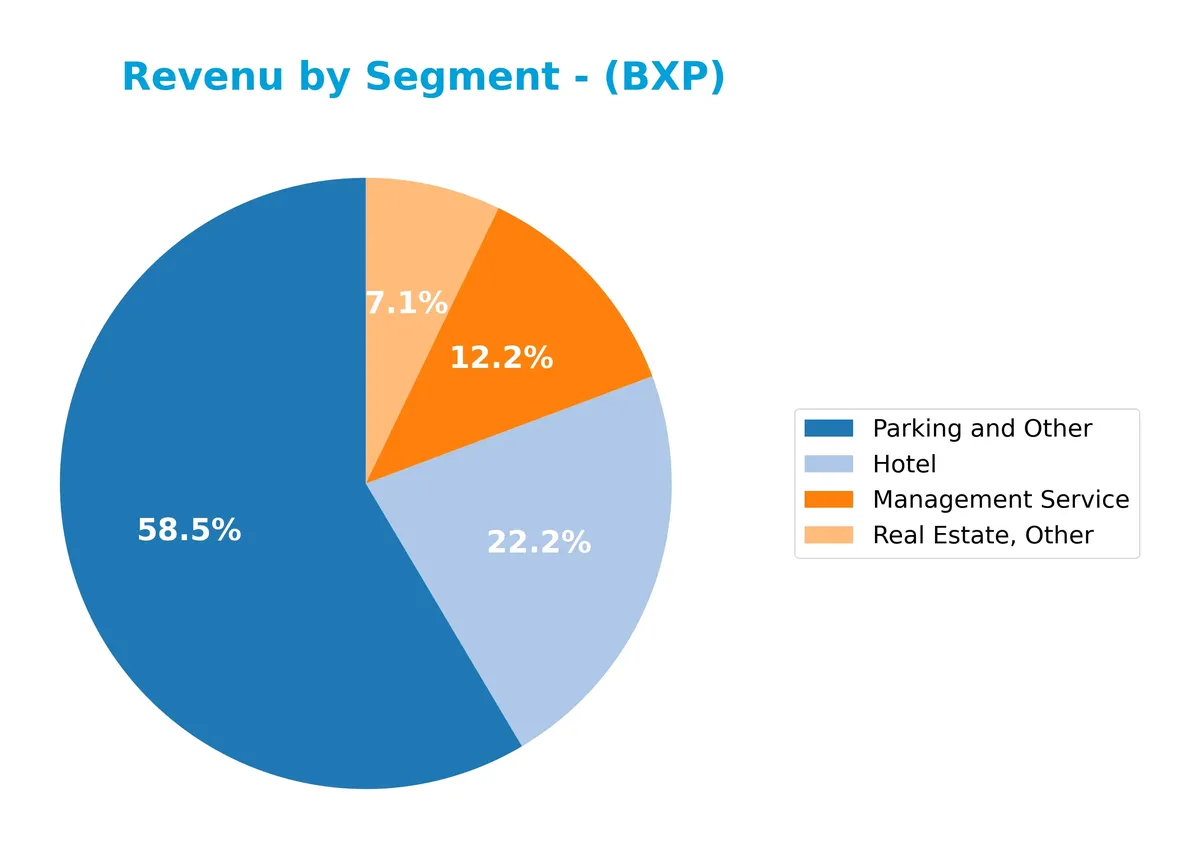

Revenue by Segment

This pie chart breaks down BXP, Inc.’s revenue by segment for fiscal year 2024, illustrating the relative contribution of each business line.

Parking and Other dominates BXP’s revenue at $135M in 2024, reflecting steady growth from $103M in 2019. Hotel revenue rebounded to $51M, nearly doubling since 2021’s low. Management Service declined sharply to $28M, signaling a shift in focus. Real Estate, Other remains the smallest segment at $16M, showing minor fluctuations. The concentration in Parking and Other highlights potential concentration risk despite overall revenue diversification.

Key Products & Brands

The following table summarizes BXP, Inc.’s main revenue-generating products and service lines:

| Product | Description |

|---|---|

| Management Service | Provides property management services for BXP’s portfolio of Class A office properties. |

| Hotel | Operations and revenue from hotel properties within BXP’s real estate portfolio. |

| Parking and Other | Income from parking facilities and ancillary real estate services associated with BXP’s properties. |

| Real Estate, Other | Miscellaneous real estate-related activities outside core office and hotel segments. |

BXP’s revenue streams diversify beyond office leasing to include property management, hotel operations, parking, and other real estate services. This mix supports stability amid cyclical real estate market shifts.

Main Competitors

There are 3 competitors in total; below is the list of the top 3 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Digital Realty Trust, Inc. | 53.3B |

| BXP, Inc. | 10.7B |

| Alexandria Real Estate Equities, Inc. | 8.5B |

BXP, Inc. ranks 2nd among its peers, holding 18.9% of the market cap of the top player, Digital Realty Trust, Inc. The company trades below both the average market cap of the top 10 (24.2B) and the median market cap in the sector (10.7B). It maintains a significant 428.7% gap over its closest competitor above.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does BXP have a competitive advantage?

BXP, Inc. demonstrates a sustainable competitive advantage with a very favorable moat. Its ROIC exceeds WACC by nearly 3%, indicating efficient capital use and consistent value creation.

The company benefits from a large Class A office portfolio in key U.S. markets and continues expanding with six properties under redevelopment. This positions BXP well to capture future growth opportunities in prime urban locations.

SWOT Analysis

This SWOT analysis highlights BXP, Inc.’s key strengths, weaknesses, opportunities, and threats to guide strategic decisions.

Strengths

- Largest publicly-held Class A office REIT

- Strong presence in top U.S. markets

- Growing ROIC creates value

Weaknesses

- High debt-to-equity ratio

- Low interest coverage ratio

- Declining net income over long term

Opportunities

- Urban office space demand recovery

- Redevelopment projects underway

- Potential to optimize capital structure

Threats

- Rising interest rates increase financing costs

- Office space demand volatility

- Economic downturn risks impacting occupancy

BXP’s solid market position and improving profitability underpin a competitive moat. However, structural debt risks and sector headwinds require cautious capital management. Strategic focus should balance growth with financial prudence.

Stock Price Action Analysis

The weekly stock chart illustrates BXP, Inc.’s price movements and key levels over the past 12 months:

Trend Analysis

Over the past 12 months, BXP’s stock price increased by 1.42%, indicating a bullish trend based on the numeric threshold. The trend shows deceleration despite a 6.63 standard deviation reflecting moderate volatility. The highest price reached 89.72, while the lowest was 59.26, with no acceleration in momentum.

Volume Analysis

Trading volume over the last three months is increasing but remains seller-driven, with sellers accounting for 73.4% of activity. This dominance suggests cautious investor sentiment and potential profit-taking. Rising volume amid selling pressure points to active market participation but a bearish tilt in the short term.

Target Prices

Analysts project a moderate upside for BXP, Inc., reflecting cautious optimism.

| Target Low | Target High | Consensus |

|---|---|---|

| 70 | 85 | 77.07 |

The target range from 70 to 85 indicates a balanced outlook, with the consensus price suggesting modest appreciation potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines analyst ratings and consumer feedback to provide a balanced view of BXP, Inc.’s market perception.

Stock Grades

The following table presents recent stock grades from leading financial institutions for BXP, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Neutral | 2026-02-03 |

| Truist Securities | Maintain | Hold | 2026-02-02 |

| Evercore ISI Group | Maintain | In Line | 2026-01-29 |

| Cantor Fitzgerald | Maintain | Overweight | 2026-01-29 |

| Barclays | Maintain | Overweight | 2026-01-23 |

| Scotiabank | Maintain | Sector Perform | 2026-01-14 |

| JP Morgan | Maintain | Overweight | 2026-01-13 |

| Barclays | Upgrade | Overweight | 2026-01-13 |

| UBS | Maintain | Neutral | 2026-01-08 |

| Citigroup | Maintain | Neutral | 2026-01-07 |

The consensus shows a dominant “Buy” sentiment with 24 buy ratings against 17 holds and 1 sell. Most firms maintain stable ratings, indicating steady investor confidence without major directional shifts.

Consumer Opinions

BXP, Inc. has cultivated a solid reputation among consumers, reflecting a mix of enthusiasm and constructive critique.

| Positive Reviews | Negative Reviews |

|---|---|

| Modern facilities and well-maintained properties | Some tenants cite slow maintenance responses |

| Excellent location with easy access to transit | Pricing is perceived as above average |

| Responsive management team | Limited parking availability in some areas |

Overall, consumers praise BXP’s property quality and location but consistently point to pricing concerns and occasional service delays as areas needing improvement. These insights suggest a strong asset base tempered by operational challenges.

Risk Analysis

Below is a summary of key risks facing BXP, Inc., highlighting their likelihood and potential impact on performance:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Leverage | High debt-to-equity ratio at 3.37 increases risk. | High | High |

| Interest Coverage | Low interest coverage of 1.59 limits financial flexibility. | High | High |

| Market Valuation | Unfavorable P/E of 38.78 suggests overvaluation risk. | Medium | Medium |

| Profitability | ROE at 5.38% is weak, limiting growth potential. | Medium | Medium |

| Bankruptcy Risk | Altman Z-Score of 0.68 places company in distress zone. | Medium | High |

| Operational Efficiency | Low asset turnover of 0.13 signals underutilization. | Medium | Medium |

The most pressing risks include heavy leverage and weak interest coverage, which strain financial stability. The Altman Z-Score confirms increased bankruptcy risk, unusual for a REIT of this size. Market valuation remains stretched, posing downside if sentiment shifts. Caution is warranted given the combination of high debt and modest profitability.

Should You Buy BXP, Inc.?

BXP, Inc. appears to be creating value with a durable competitive moat supported by growing ROIC. Despite robust operational efficiency, its leverage profile remains substantial, reflected in a cautious debt rating. Overall, it suggests a C+ profile with moderate financial strength.

Strength & Efficiency Pillars

BXP, Inc. demonstrates clear value creation, with a ROIC of 7.63% exceeding its WACC of 4.71%. This gap signals efficient capital allocation and sustainable profitability growth. The company’s gross margin stands strong at 60.56%, supported by a favorable EBIT margin of 29.63%. Its current and quick ratios both register at a healthy 2.28, reflecting sound short-term liquidity. Despite a moderate Piotroski score of 5, BXP’s growing ROIC trend reinforces its durable competitive advantage.

Weaknesses and Drawbacks

BXP’s financial profile reveals significant leverage concerns, with a debt-to-equity ratio of 3.37 and a debt-to-assets ratio of 66.34%, both unfavorable and imposing risk on financial flexibility. The interest coverage ratio is weak at 1.59, signaling vulnerability to rising borrowing costs. Valuation appears stretched, with a high P/E of 38.78 indicating premium pricing. Recent market activity shows seller dominance at 26.6%, suggesting near-term selling pressure and potential volatility.

Our Verdict about BXP, Inc.

BXP’s long-term fundamentals appear favorable due to its value creation and profitability metrics. However, recent seller dominance and decelerating price trends might suggest a cautious, wait-and-see approach. The profile may appear attractive for investors prioritizing capital efficiency but requires careful risk management given its leverage and current market dynamics.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Principal Financial Group Inc. Sells 16,170 Shares of BXP, Inc. $BXP – MarketBeat (Feb 05, 2026)

- BXP: Valuation Should Re-Rate Upwards When FFO Growth Inflects Positively (NYSE:BXP) – Seeking Alpha (Feb 04, 2026)

- Earnings call transcript: BXP Q4 2025 beats EPS forecast, stock dips – Investing.com (Feb 03, 2026)

- BXP Inc (BXP) Q4 2025 Earnings Call Highlights: Strong Leasing Activity and Strategic Asset … – Yahoo Finance (Jan 28, 2026)

- Here’s Why You Should Retain BXP Stock in Your Portfolio Now – MSN (Feb 02, 2026)

For more information about BXP, Inc., please visit the official website: bxp.com