Home > Analyses > Industrials > BWX Technologies, Inc.

BWX Technologies, Inc. powers critical nuclear applications that safeguard national security and advance clean energy innovation. As a key player in aerospace and defense, BWXT supplies precision nuclear components, reactors, and fuel assemblies essential to the U.S. Navy and commercial nuclear power sectors. Renowned for its engineering excellence and cutting-edge solutions, BWXT stands at the intersection of strategic defense and sustainable energy. The question investors face now is whether its robust fundamentals continue to support its premium valuation and growth prospects.

Table of contents

Business Model & Company Overview

BWX Technologies, Inc., founded in 1867 and headquartered in Lynchburg, Virginia, stands as a dominant player in the aerospace and defense industry. Its core mission revolves around manufacturing and supplying nuclear components through a cohesive ecosystem spanning naval reactors, commercial nuclear power equipment, and nuclear services. This integrated approach serves critical government and commercial clients, underpinning its leadership in nuclear technology.

The company’s revenue engine balances precision hardware like nuclear fuel assemblies and steam generators with recurring services such as in-plant maintenance and environmental site restoration. BWXT operates strategically across the Americas, Canada, and international markets, capitalizing on its deep expertise and diversified offerings. Its robust economic moat is anchored in proprietary technology and long-term government contracts, positioning it to shape the future of nuclear power and defense infrastructure.

Financial Performance & Fundamental Metrics

This section provides an overview of BWX Technologies, Inc.’s income statement, key financial ratios, and dividend payout policy to support informed investment decisions.

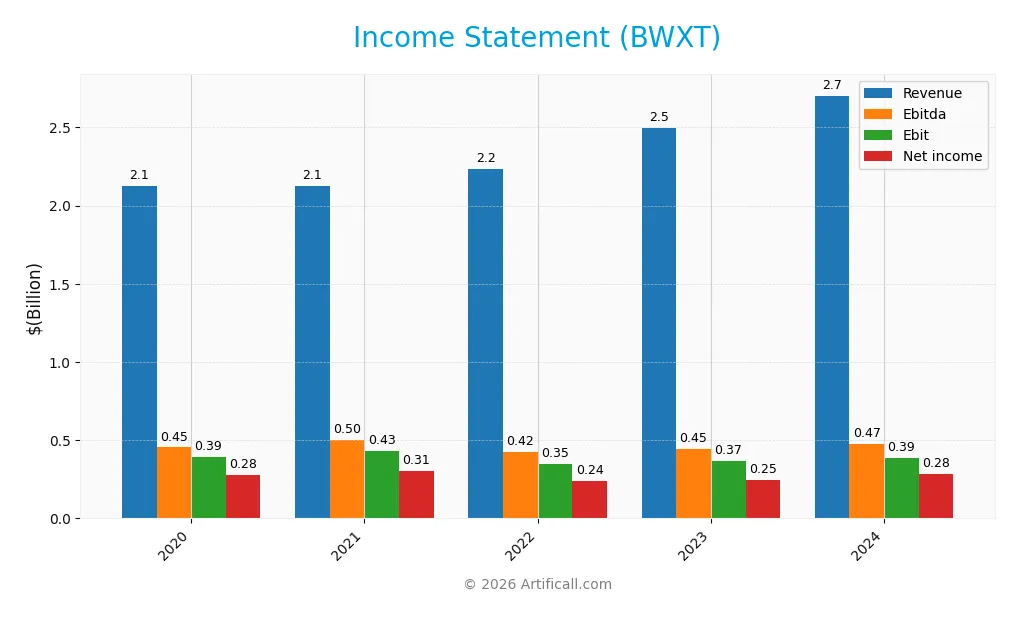

Income Statement

The following table presents BWX Technologies, Inc.’s key income statement figures for the fiscal years 2020 through 2024, reported in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 2.12B | 2.12B | 2.23B | 2.50B | 2.70B |

| Cost of Revenue | 1.55B | 1.57B | 1.68B | 1.88B | 2.05B |

| Operating Expenses | 217M | 204M | 203M | 238M | 275M |

| Gross Profit | 575M | 550M | 552M | 621M | 655M |

| EBITDA | 454M | 501M | 425M | 447M | 474M |

| EBIT | 393M | 431M | 351M | 368M | 388M |

| Interest Expense | 31M | 36M | 36M | 47M | 39M |

| Net Income | 279M | 306M | 238M | 246M | 282M |

| EPS | 2.92 | 3.24 | 2.60 | 2.68 | 3.08 |

| Filing Date | 2021-02-22 | 2022-02-22 | 2023-02-23 | 2024-02-27 | 2025-02-24 |

Income Statement Evolution

Between 2020 and 2024, BWX Technologies, Inc. saw revenue grow by 27.3% overall, with an 8.3% increase in the most recent year. Net income growth was neutral at 1.2% over the period but rose 5.9% year-over-year. Gross and EBIT margins remained favorable, with a slight decline in net margin over the full period, signaling mixed profitability trends.

Is the Income Statement Favorable?

The 2024 income statement shows generally favorable fundamentals: revenue and net income both increased, supported by a gross margin of 24.2% and an EBIT margin of 14.4%. Interest expense remains low at 1.5% of revenue, while EPS grew 14.6% year-over-year. Operating expenses grew in line with revenue, slightly dampening margin expansion, but the overall income statement quality is considered favorable.

Financial Ratios

The following table presents key financial ratios for BWX Technologies, Inc. over the fiscal years 2020 to 2024, reflecting profitability, valuation, liquidity, leverage, efficiency, and dividend metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 13% | 14% | 11% | 10% | 10% |

| ROE | 45% | 48% | 32% | 26% | 26% |

| ROIC | 15% | 13% | 12% | 12% | 13% |

| P/E | 21 | 15 | 22 | 29 | 36 |

| P/B | 9.3 | 7.1 | 7.1 | 7.5 | 9.4 |

| Current Ratio | 1.46 | 1.68 | 2.10 | 2.18 | 1.96 |

| Quick Ratio | 1.45 | 1.68 | 2.09 | 2.11 | 1.88 |

| D/E | 1.54 | 1.87 | 1.72 | 1.30 | 0.98 |

| Debt-to-Assets | 41% | 48% | 49% | 44% | 37% |

| Interest Coverage | 12 | 10 | 10 | 8 | 10 |

| Asset Turnover | 0.93 | 0.85 | 0.85 | 0.91 | 0.94 |

| Fixed Asset Turnover | 2.60 | 2.03 | 1.97 | 2.03 | 2.12 |

| Dividend Yield | 1.27% | 1.76% | 1.53% | 1.21% | 0.87% |

Evolution of Financial Ratios

From 2020 to 2024, BWX Technologies, Inc. saw its Return on Equity (ROE) remain strong, with a slight decrease from 45.1% in 2020 to 26.1% in 2024, indicating a moderation in profitability. The Current Ratio improved from 1.46 to 1.96, reflecting better short-term liquidity. The Debt-to-Equity Ratio declined from 1.54 to 0.98, showing a reduction in financial leverage and a more balanced capital structure.

Are the Financial Ratios Favorable?

In 2024, profitability ratios such as net margin (10.43%) and ROE (26.09%) are favorable, supported by a return on invested capital of 12.79% exceeding the weighted average cost of capital at 7.61%. Liquidity is strong with a current ratio of 1.96 and quick ratio of 1.88, both favorable. Leverage ratios, including debt-to-equity at 0.98 and debt-to-assets at 36.78%, are neutral, while valuation multiples like price-to-earnings (36.18) and price-to-book (9.44) are unfavorable. Overall, BWXT’s financial ratios present a slightly favorable profile.

Shareholder Return Policy

BWX Technologies, Inc. maintains a consistent dividend payout ratio around 31-35%, with a dividend per share steadily increasing from $0.76 in 2020 to $0.96 in 2024. The annual dividend yield ranges between 0.87% and 1.76%, supported by free cash flow coverage above 60%, indicating moderate sustainability.

The company also engages in share buybacks, complementing dividends to return capital to shareholders. This balanced approach, combining dividends and repurchases, appears aligned with sustainable long-term value creation, given stable profitability and cash flow metrics.

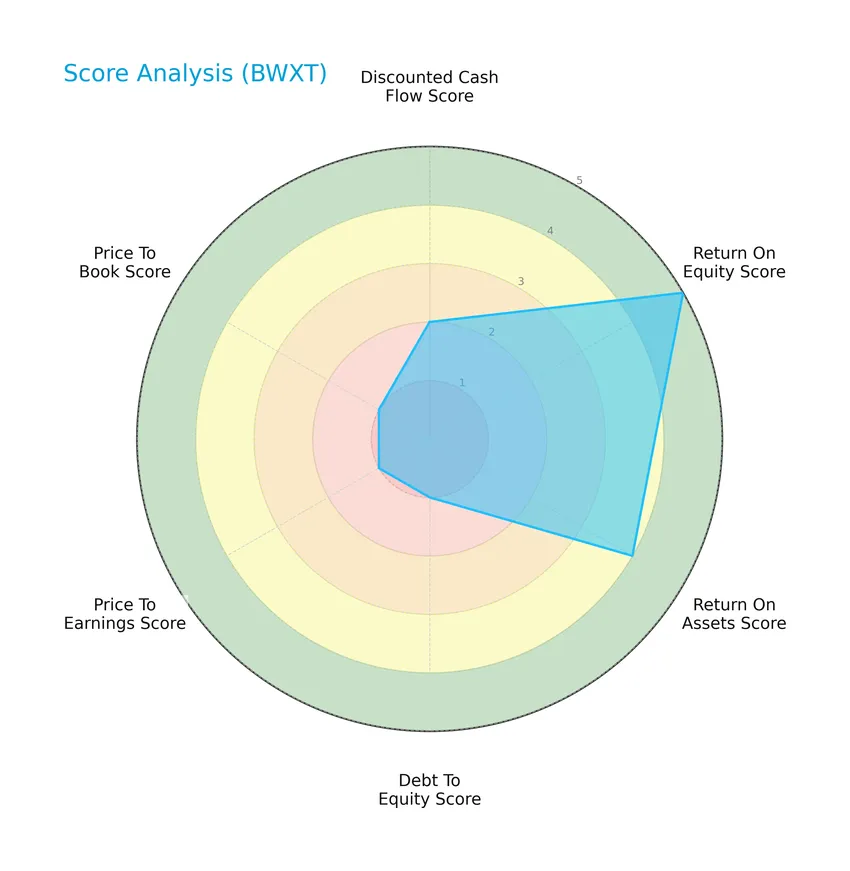

Score analysis

The following radar chart illustrates the company’s key financial scores across valuation, profitability, and leverage metrics:

BWX Technologies, Inc. presents a mixed score profile: strong returns on equity (5) and assets (4) contrast with very unfavorable scores in debt to equity (1), price to earnings (1), and price to book (1), while discounted cash flow is moderate (2).

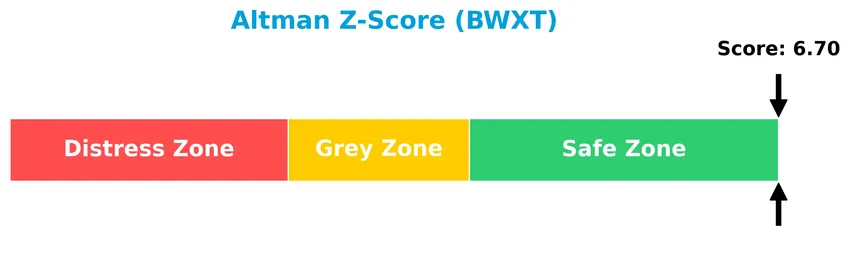

Analysis of the company’s bankruptcy risk

The Altman Z-Score places the company firmly in the safe zone, indicating a low risk of bankruptcy based on its current financial metrics:

Is the company in good financial health?

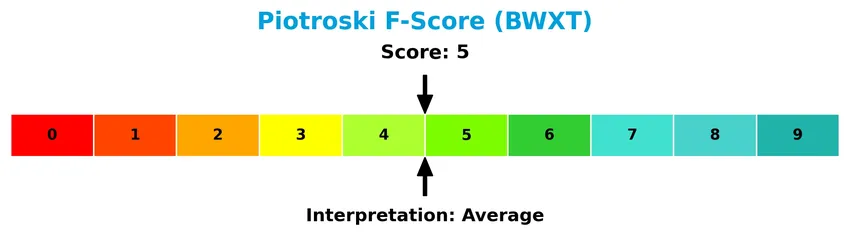

The Piotroski Score diagram provides insights into the company’s financial strength and operational efficiency:

With a Piotroski Score of 5, BWX Technologies, Inc. exhibits average financial health, reflecting moderate profitability, leverage, and liquidity conditions without strong signals of either weakness or exceptional strength.

Competitive Landscape & Sector Positioning

This sector analysis will explore BWX Technologies, Inc.’s strategic positioning, revenue by segment, key products, main competitors, and competitive advantages. I will also conduct a SWOT analysis to provide a comprehensive view. Additionally, I will assess whether BWXT holds a competitive advantage over its industry peers.

Strategic Positioning

BWX Technologies, Inc. operates a concentrated product portfolio focused on nuclear components and services across three main segments, primarily serving the U.S. government and commercial nuclear sectors. Geographically, its revenues are concentrated in the United States (over 2.2B in 2024) and Canada (431M), with limited exposure internationally.

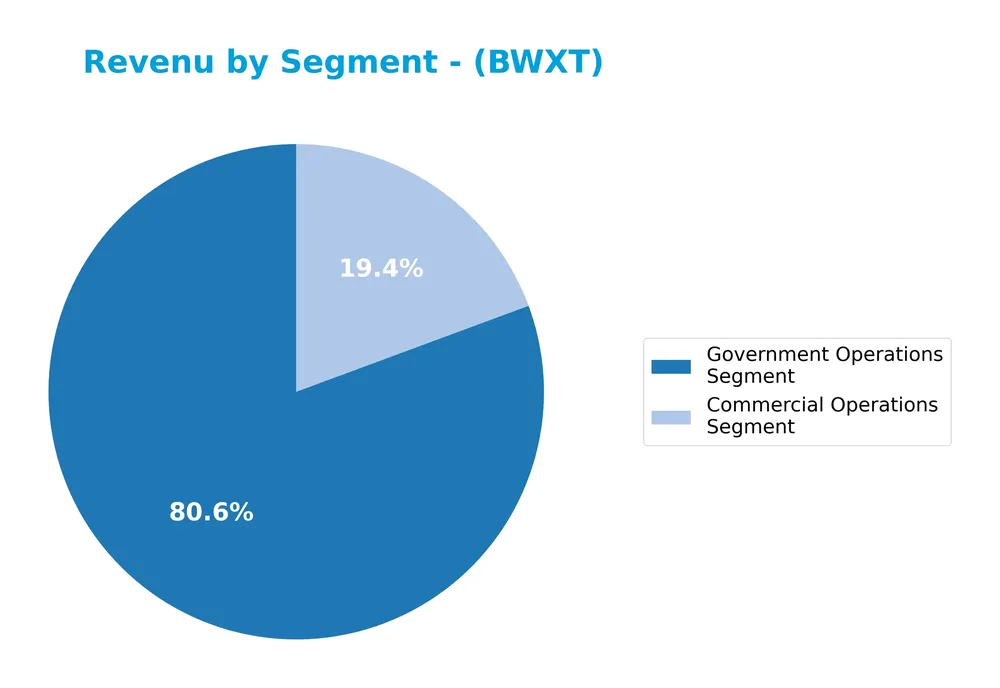

Revenue by Segment

This pie chart presents BWX Technologies, Inc.’s revenue distribution by segment for the fiscal year 2024, highlighting the relative contributions of its main business units.

In 2024, the Government Operations Segment dominated with $2.18B in revenue, showing steady growth from $2.03B in 2023. The Commercial Operations Segment contributed $524M, also increasing from $466M the previous year. This indicates a clear concentration in government contracts driving BWXT’s business, with both segments expanding but government operations remaining the core revenue driver, suggesting a moderate concentration risk.

Key Products & Brands

The table below summarizes BWX Technologies, Inc.’s key products and brands across its business segments:

| Product | Description |

|---|---|

| Nuclear Operations Group | Provides precision naval and critical nuclear components, reactors, nuclear fuel, assemblies, missile launch tubes, and uranium processing for defense and research applications. |

| Nuclear Power Group | Offers commercial nuclear steam generators, fuel, fuel handling systems, pressure vessels, reactor components, heat exchangers, tooling, in-plant services, and medical radioisotopes. |

| Nuclear Services Group | Delivers nuclear materials processing, environmental restoration, technology development for nuclear power sources, and reactor design, engineering, licensing, and manufacturing services. |

BWX Technologies’ products focus on nuclear components and services for defense, commercial power generation, and research sectors, emphasizing precision manufacturing and nuclear fuel solutions.

Main Competitors

There are 12 competitors in the Industrials sector Aerospace & Defense industry; below is the list of the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| GE Aerospace | 338.3B |

| RTX Corporation | 250.7B |

| The Boeing Company | 171.4B |

| Lockheed Martin Corporation | 116.3B |

| General Dynamics Corporation | 92.6B |

| Northrop Grumman Corporation | 83.6B |

| TransDigm Group Incorporated | 76.5B |

| L3Harris Technologies, Inc. | 56.9B |

| Axon Enterprise, Inc. | 44.5B |

| BWX Technologies, Inc. | 17.3B |

BWX Technologies, Inc. ranks 10th among its peers with a market cap approximately 5.61% that of the leader, GE Aerospace. The company’s market capitalization is below both the average market cap of the top 10 competitors (124.8B) and the sector median (80.0B). It holds a significant gap of +134.09% to the next competitor above, Axon Enterprise, indicating a notable scale difference within the group.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does BWXT have a competitive advantage?

BWX Technologies, Inc. presents a slight competitive advantage, evidenced by a ROIC exceeding its WACC by 5.18%, indicating value creation despite a declining ROIC trend. The company maintains favorable income statement metrics, including a 10.43% net margin and 8.31% revenue growth over the past year.

Looking ahead, BWXT’s diverse segments in nuclear operations, power, and services, along with expanding international revenues, position it to leverage opportunities in nuclear fuel, medical radioisotopes, and reactor technology. Its established contracts with the U.S. Department of Energy and growth in Canadian and other markets suggest potential for sustained demand.

SWOT Analysis

This SWOT analysis highlights BWX Technologies, Inc.’s key internal and external factors to guide investors in assessing its strategic position.

Strengths

- Strong market position in nuclear components

- Favorable profitability margins (net margin 10.43%, ROE 26.09%)

- Stable revenue growth (8.31% in last year)

Weaknesses

- High valuation multiples (PE 36.18, PB 9.44)

- Declining ROIC trend despite value creation

- Moderate Piotroski score (5/9) indicating average financial strength

Opportunities

- Expansion in nuclear power and medical radioisotopes

- Growing defense and clean energy demand

- International market growth, especially Canada and other geographies

Threats

- Regulatory and geopolitical risks in nuclear sector

- Increasing operating expenses impacting margins

- Competition and technological disruption in aerospace & defense

Overall, BWXT shows solid financial health and growth potential but faces valuation concerns and margin pressures. Investors should weigh its strong niche position and growth opportunities against operational and external risks when considering a strategic investment.

Stock Price Action Analysis

The weekly stock chart below illustrates BWX Technologies, Inc.’s price movements over the past 12 months, highlighting key fluctuations and trend developments:

Trend Analysis

Over the past 12 months, BWXT’s stock price increased by 102.92%, indicating a bullish trend with clear acceleration. The price ranged from a low of 88.41 to a high of 217.89, reflecting strong upward momentum. The high volatility is confirmed by a standard deviation of 35.65, signaling significant price fluctuations during this period.

Volume Analysis

Trading volumes total 502M shares, with buyers accounting for 62.21%, showing increasing activity overall. However, in the recent 11-week period ending January 25, 2026, seller volume (42M) dominated buyer volume (24M) at 36.08% buyer share. This seller dominance and volume shift suggest cautious investor sentiment and potential short-term profit-taking.

Target Prices

Analysts present a confident target consensus for BWX Technologies, Inc. reflecting positive growth expectations.

| Target High | Target Low | Consensus |

|---|---|---|

| 225 | 180 | 204 |

The target prices suggest that analysts anticipate BWXT’s stock to trade between 180 and 225, with a consensus price of 204, indicating a generally optimistic outlook.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews recent analyst ratings and consumer feedback regarding BWX Technologies, Inc. to inform investor perspectives.

Stock Grades

Here is the latest summary of BWX Technologies, Inc. grades from recognized financial institutions and analysts:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Seaport Global | Downgrade | Neutral | 2026-01-20 |

| B of A Securities | Maintain | Buy | 2025-11-13 |

| BTIG | Maintain | Buy | 2025-11-07 |

| Truist Securities | Maintain | Hold | 2025-11-04 |

| Truist Securities | Maintain | Hold | 2025-10-15 |

| Deutsche Bank | Maintain | Hold | 2025-10-08 |

| B of A Securities | Maintain | Buy | 2025-08-13 |

| Deutsche Bank | Maintain | Hold | 2025-08-06 |

| Maxim Group | Downgrade | Hold | 2025-08-06 |

| Truist Securities | Maintain | Hold | 2025-08-05 |

The grading trend for BWXT shows a mixture of Buy and Hold ratings with a recent notable downgrade to Neutral by Seaport Global. The consensus remains Buy, supported by nine Buy ratings versus six Holds and one Sell, reflecting cautious optimism among analysts.

Consumer Opinions

Consumer sentiment around BWX Technologies, Inc. reflects a mix of appreciation for its product reliability and concerns about customer service responsiveness.

| Positive Reviews | Negative Reviews |

|---|---|

| “BWXT’s products are highly reliable and durable, meeting our expectations consistently.” | “Customer support can be slow to respond during critical issues, causing delays.” |

| “The company’s commitment to innovation is evident in their advanced technology offerings.” | “Pricing is on the higher side compared to competitors, which affects overall value.” |

| “Strong safety standards and quality control make BWXT a trustworthy supplier.” | “Occasional delays in delivery have disrupted our project timelines.” |

Overall, consumers praise BWXT for its product quality and safety, but recurring issues with customer service and pricing highlight areas for potential improvement.

Risk Analysis

Below is a summary table highlighting key risks related to BWX Technologies, Inc., including their likelihood and potential impact on investors:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Valuation | High P/E (36.18) and P/B (9.44) ratios suggest the stock is potentially overvalued | Medium | High |

| Debt Levels | Debt-to-equity ratio near 1.0 indicates moderate leverage with some risk if interest rates rise | Medium | Medium |

| Industry Exposure | Dependence on defense and nuclear sectors may face regulatory or geopolitical challenges | Medium | High |

| Dividend Yield | Low dividend yield at 0.87% may deter income-focused investors | Low | Low |

| Financial Health | Strong Altman Z-Score (6.7) indicates low bankruptcy risk | Low | Low |

The most significant risks stem from BWXT’s relatively rich valuation multiples and its exposure to geopolitical and regulatory factors impacting the aerospace and defense industry. Despite moderate leverage, the company’s robust financial health reduces default risk.

Should You Buy BWX Technologies, Inc.?

BWX Technologies, Inc. appears to be demonstrating robust profitability with strong value creation, supported by a slightly favorable competitive moat despite a declining ROIC trend. While its leverage profile could be seen as substantial, the overall rating suggests a moderate investment profile with a B- classification.

Strength & Efficiency Pillars

BWX Technologies, Inc. exhibits solid profitability with a net margin of 10.43% and a return on equity of 26.09%, underscoring efficient management and operational effectiveness. Its return on invested capital (ROIC) stands at 12.79%, comfortably above the weighted average cost of capital (WACC) at 7.61%, confirming the company as a value creator. Financial stability is reinforced by a robust Altman Z-Score of 6.70, placing BWXT in the safe zone, while a Piotroski Score of 5 suggests average financial health. These factors collectively frame a slightly favorable moat and efficiency profile.

Weaknesses and Drawbacks

Despite operational strengths, BWXT faces valuation headwinds with a high price-to-earnings ratio of 36.18 and a price-to-book ratio of 9.44, indicating a premium valuation that may limit upside potential. The debt-to-equity ratio is neutral at 0.98, but the debt-related score is very unfavorable, signaling leverage concerns. Recent market dynamics reveal seller dominance with only 36.08% buyer volume over the latest period, creating short-term pressure. Additionally, the dividend yield is low at 0.87%, which may not appeal to income-focused investors.

Our Verdict about BWX Technologies, Inc.

BWXT presents a fundamentally favorable long-term profile, driven by strong profitability and value creation. However, the current seller dominance in the recent period tempers the bullish overall trend, suggesting that investors might consider a wait-and-see approach for a more attractive entry point. The balance of premium valuation and debt concerns warrants cautious optimism, making BWXT a company that could merit attention for long-term exposure under disciplined risk management.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- BWX Technologies (NYSE:BWXT) Upgraded by Zacks Research to “Strong-Buy” Rating – MarketBeat (Jan 23, 2026)

- BWX Technologies Inc (BWXT) Shares Gap Down to $207.67 on Jan 20 – GuruFocus (Jan 20, 2026)

- Group against BWXT expansion hopeful request will be denied – wjhl.com (Jan 02, 2026)

- BWX Technologies, Inc. (BWXT): A Bull Case Theory – Yahoo Finance (Dec 18, 2025)

- BWX Technologies, Inc. (NYSE:BWXT) Sees Significant Growth in Short Interest – MarketBeat (Jan 20, 2026)

For more information about BWX Technologies, Inc., please visit the official website: bwxt.com