Home > Analyses > Consumer Defensive > Bunge Global S.A.

Bunge Global S.A. feeds millions daily by transforming raw agricultural commodities into essential food products worldwide. As a powerhouse in agribusiness, it excels in oilseed processing, milling, and bioenergy, serving industries from animal feed to food manufacturers. Bunge’s blend of innovation and scale secures its position amid evolving global food demands. The key question: Does Bunge’s current financial strength support its ambitious growth and justify its market valuation?

Table of contents

Business Model & Company Overview

Bunge Global S.A., founded in 1818 and headquartered in Chesterfield, Missouri, stands as a dominant player in the agricultural farm products sector. It operates an integrated ecosystem spanning agribusiness, refined oils, milling, and bioenergy. This cohesive platform processes oilseeds and grains into essential ingredients for food manufacturers, livestock producers, and biofuel companies, reinforcing its role in global food supply chains.

Its revenue engine balances commodity trading, processing, and value-added product sales across the Americas, Europe, and Asia. Bunge’s diversified streams include bulk agricultural commodities, specialty oils, bakery mixes, and sugar-derived bioenergy. This mix supports stable cash flow while leveraging global agricultural trends. The company’s deep supply chain expertise and broad geographic reach create a robust economic moat, shaping the future of global agribusiness.

Financial Performance & Fundamental Metrics

I will analyze Bunge Global S.A.’s income statement, key financial ratios, and dividend payout policy to assess its underlying financial health and shareholder returns.

Income Statement

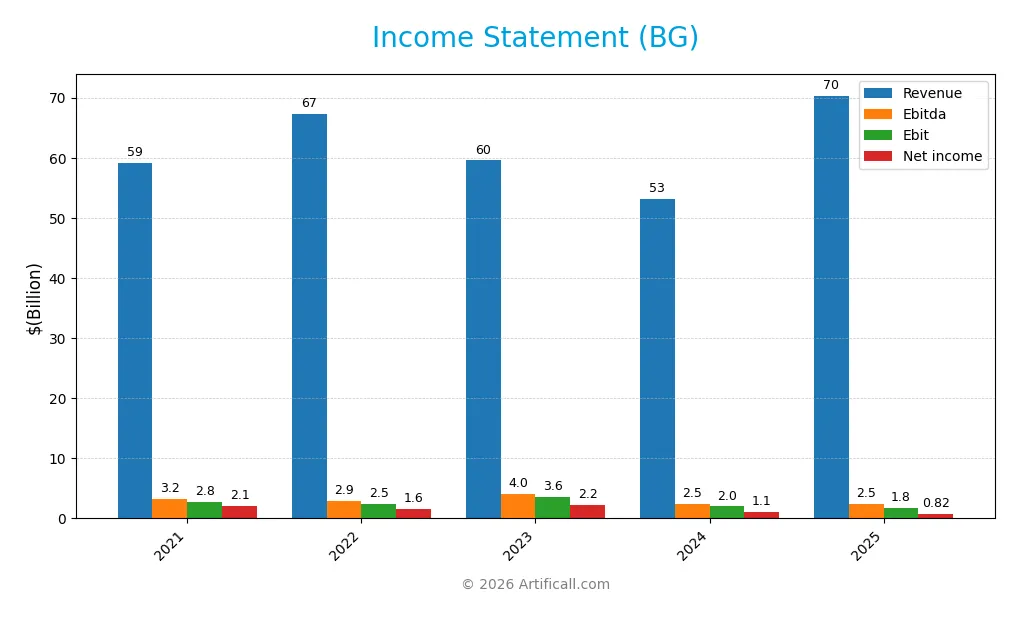

The following table summarizes Bunge Global S.A.’s key income statement metrics for the fiscal years 2021 through 2025, reported in USD.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 59.2B | 67.2B | 59.5B | 53.1B | 70.3B |

| Cost of Revenue | 55.8B | 63.6B | 54.7B | 49.7B | 66.9B |

| Operating Expenses | 1.2B | 1.4B | 1.7B | 1.8B | 2.1B |

| Gross Profit | 3.4B | 3.7B | 4.8B | 3.4B | 3.4B |

| EBITDA | 3.2B | 2.9B | 4.0B | 2.5B | 2.5B |

| EBIT | 2.8B | 2.5B | 3.6B | 2.0B | 1.8B |

| Interest Expense | 243M | 403M | 516M | 471M | 628M |

| Net Income | 2.1B | 1.6B | 2.2B | 1.1B | 816M |

| EPS | 14.49 | 10.74 | 15.07 | 8.09 | 4.91 |

| Filing Date | 2022-02-24 | 2023-02-24 | 2024-02-22 | 2025-02-20 | 2026-02-04 |

Income Statement Evolution

From 2021 to 2025, Bunge Global’s revenue grew 18.9%, reaching $70.3B in 2025, a favorable trend. However, net income declined 60.7% over the same period, compressing net margins from a higher base to 1.16% in 2025. Gross profit remained stable near $3.4B, while EBIT margins softened to 2.51%, signaling margin pressure despite revenue gains.

Is the Income Statement Favorable?

In 2025, revenue surged 32.4% year-over-year, but EBIT declined 11.7%, and net margin fell 45.8%, reflecting cost and profitability challenges. Interest expense was well controlled at 0.89% of revenue, a favorable sign. Overall, fundamentals appear unfavorable due to margin contraction and significant earnings decline despite top-line growth.

Financial Ratios

The following table presents key financial ratios for Bunge Global S.A. (BG) over the last five fiscal years, reflecting profitability, liquidity, leverage, and valuation metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 3.5% | 2.4% | 3.8% | 2.1% | 1.2% |

| ROE | 27.1% | 17.5% | 20.7% | 11.5% | 4.7% |

| ROIC | 11.2% | 11.2% | 12.8% | 6.5% | 2.7% |

| P/E | 6.3 | 9.2 | 6.7 | 9.5 | 18.1 |

| P/B | 1.72 | 1.61 | 1.38 | 1.10 | 0.85 |

| Current Ratio | 1.77 | 1.75 | 2.13 | 2.15 | 1.61 |

| Quick Ratio | 0.86 | 0.87 | 1.20 | 1.27 | 0.74 |

| D/E | 0.89 | 0.61 | 0.53 | 0.72 | 0.98 |

| Debt-to-Assets | 29% | 23% | 23% | 29% | 38% |

| Interest Coverage | 8.8 | 5.7 | 6.1 | 3.4 | 2.1 |

| Asset Turnover | 2.48 | 2.74 | 2.35 | 2.13 | 1.58 |

| Fixed Asset Turnover | 13.4 | 14.5 | 10.9 | 8.6 | 5.3 |

| Dividend Yield | 2.45% | 2.35% | 2.55% | 3.48% | 3.10% |

Evolution of Financial Ratios

Bunge Global’s Return on Equity (ROE) declined sharply from 27.1% in 2021 to 4.7% in 2025, illustrating a significant slowdown in profitability. The Current Ratio fell from over 2.1 in 2023 to 1.61 in 2025, indicating reduced liquidity. Debt-to-Equity ratio increased towards 0.98 by 2025, signaling higher leverage and financial risk.

Are the Financial Ratios Favorable?

Profitability ratios like ROE (4.7%) and net margin (1.16%) are unfavorable, reflecting weak earnings relative to equity and sales. Liquidity shows mixed signals: Current Ratio (1.61) is favorable, but Quick Ratio (0.74) is not. Leverage metrics such as Debt-to-Equity (0.98) and interest coverage are neutral. Efficiency ratios including Asset Turnover (1.58) and Fixed Asset Turnover (5.26) are favorable. Overall, the financial ratios lean slightly favorable with 42.86% positive metrics.

Shareholder Return Policy

Bunge Global S.A. maintains a consistent dividend payout, with a 2025 payout ratio of 56% and a 3.1% annual yield. Dividends are supported by earnings, but free cash flow coverage is negative, indicating potential reliance on operating cash or debt.

The company also conducts share buybacks, aligning with its payout strategy. While dividends and repurchases provide shareholder returns, free cash flow constraints pose risks to sustainability. This distribution approach requires close monitoring to ensure long-term value is preserved.

Score analysis

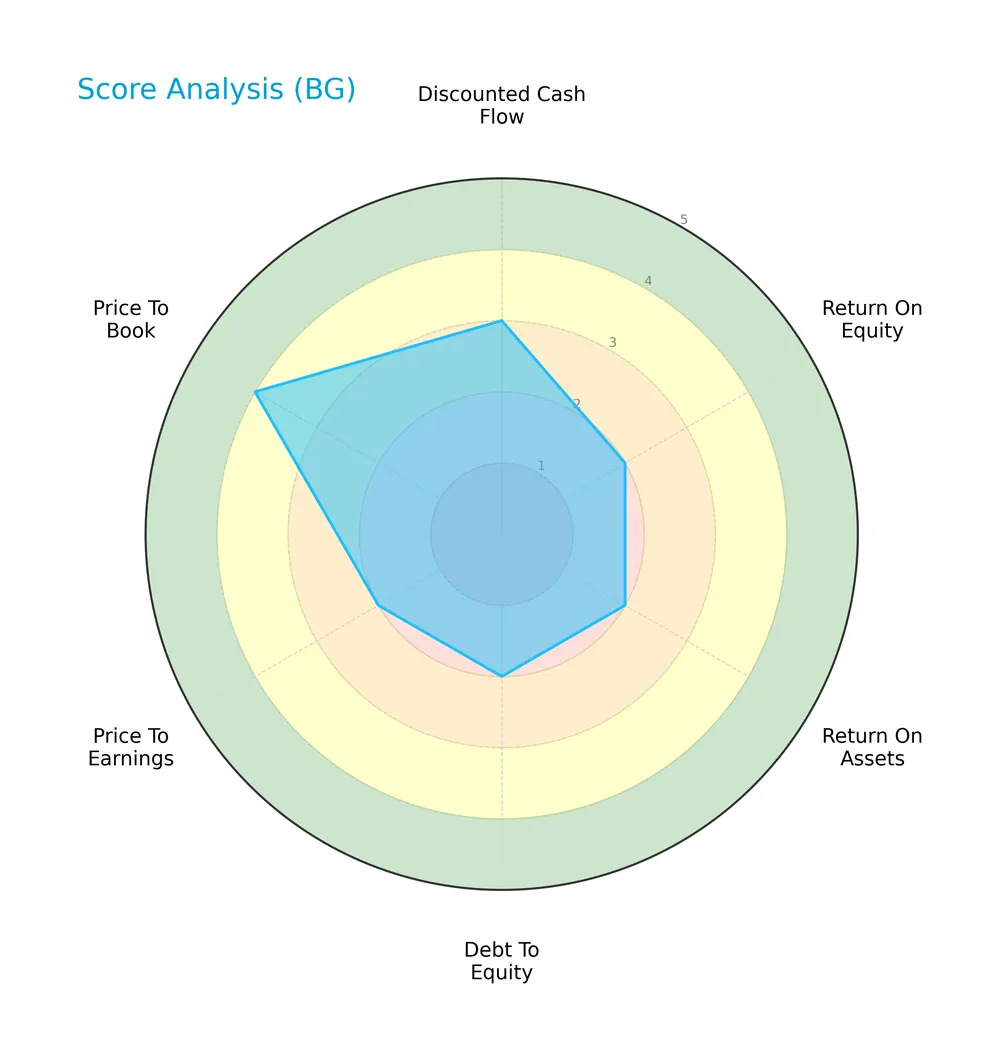

Below is a radar chart illustrating Bunge Global S.A.’s key financial scores across valuation and profitability metrics:

Bunge Global shows moderate scores in discounted cash flow, ROE, ROA, debt-to-equity, and P/E ratios. The price-to-book score stands out as favorable, indicating relative valuation strength versus peers.

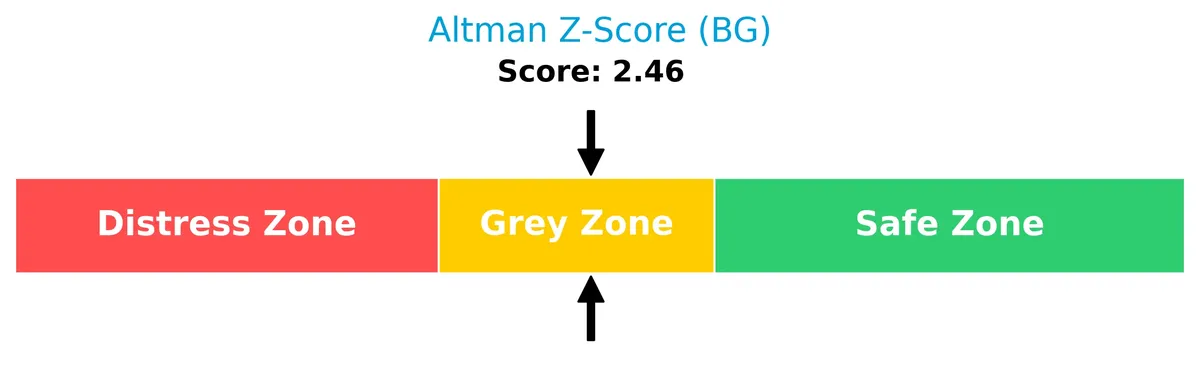

Analysis of the company’s bankruptcy risk

The Altman Z-Score places Bunge Global in the grey zone, signaling a moderate risk of bankruptcy and financial distress:

Is the company in good financial health?

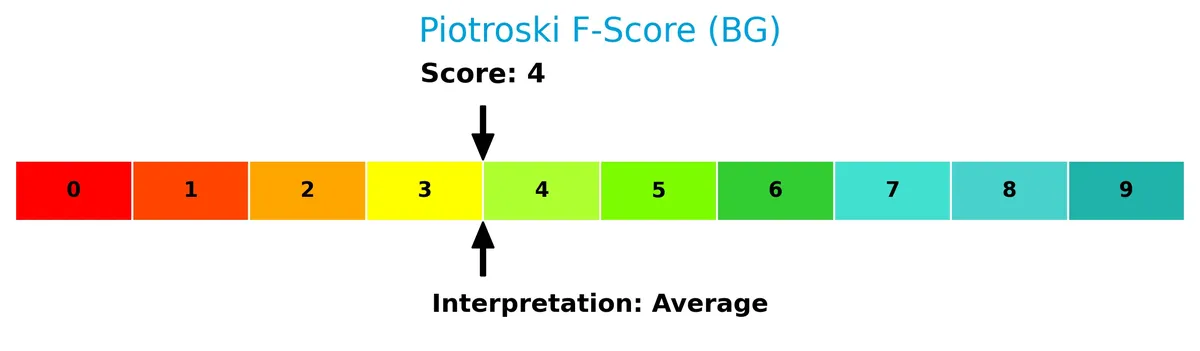

The Piotroski Score diagram below reflects Bunge Global’s average financial health status based on nine fundamental criteria:

With a Piotroski Score of 4, the company shows modest financial strength, suggesting neither strong nor weak fundamentals according to this metric.

Competitive Landscape & Sector Positioning

This sector analysis examines Bunge Global S.A.’s strategic positioning within the agricultural farm products industry. I will assess the company’s revenue segments, key products, top competitors, and competitive advantages. The goal is to determine whether Bunge holds a sustainable edge over its peers.

Strategic Positioning

Bunge Global S.A. maintains a diversified product portfolio, with agribusiness dominating at $28B in 2024, complemented by edible oils, milling, and sugar/bioenergy segments. Geographically, it spreads revenue across Europe ($25B), the U.S. ($14B), Asia Pacific ($6B), Brazil, Canada, and Argentina, reflecting broad global exposure.

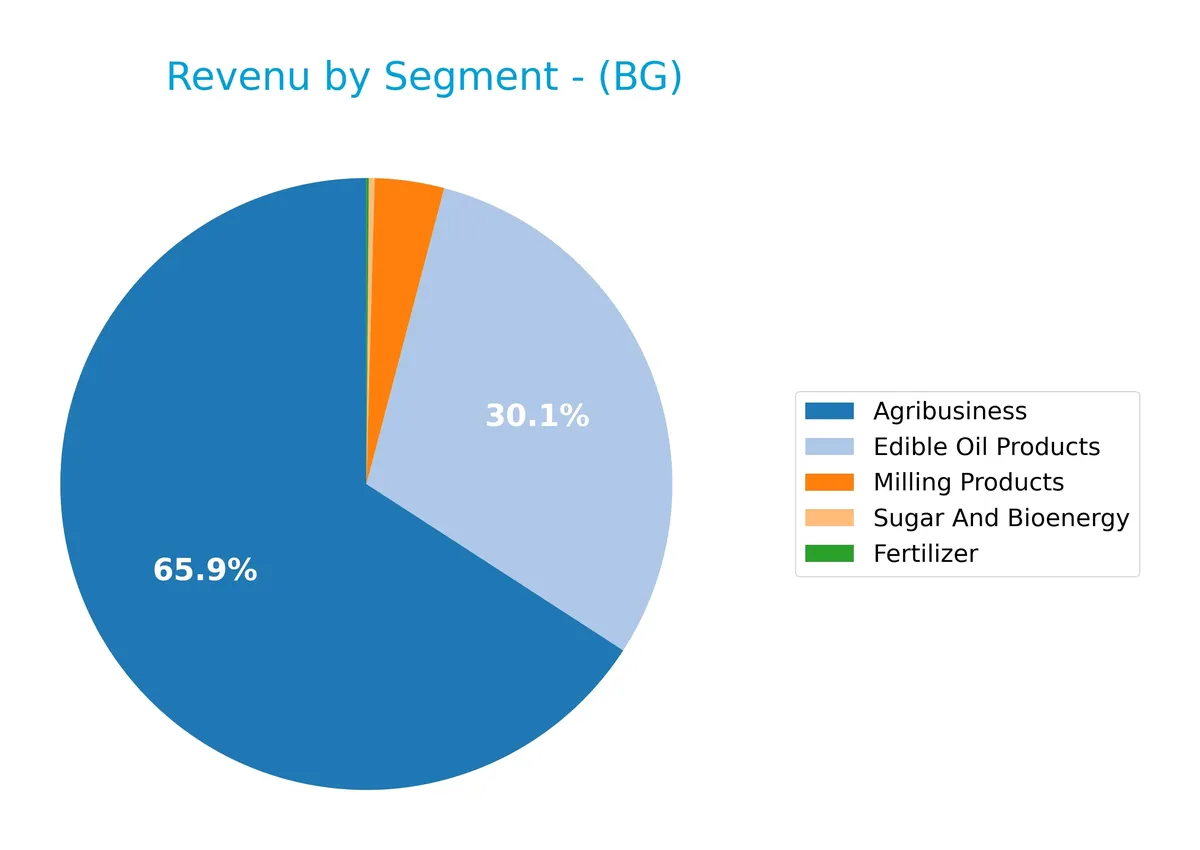

Revenue by Segment

This pie chart illustrates Bunge Global S.A.’s revenue distribution by segment for the fiscal year 2024, highlighting the contribution of each business unit in USD.

Agribusiness leads with $28B in revenue, followed by Edible Oil Products at $12.8B. Smaller segments like Milling Products ($1.6B), Fertilizer ($54M), and Sugar and Bioenergy ($130M) contribute modestly. The recent year shows a slight revenue contraction in core segments, signaling potential concentration risk and a need for diversification strategy.

Key Products & Brands

Bunge Global S.A. operates through a diverse range of agribusiness and food products segments:

| Product | Description |

|---|---|

| Agribusiness | Purchases, stores, transports, processes, and sells oilseeds (soybeans, rapeseed, canola, sunflower) and grains (wheat, corn). Offers oils and protein meals for animal feed, industrial, and biofuel uses. |

| Refined and Specialty Oils | Sells packaged and bulk cooking oils, shortenings, margarines, mayonnaise, and related products for food manufacturers, retailers, and foodservice operators. |

| Milling | Provides wheat flours, bakery mixes, corn milling products (dry-milled meals, masa, flours), soy-fortified blends, whole grains, and non-GMO products. |

| Sugar and Bioenergy | Produces sugar, ethanol, and generates electricity from burning sugarcane bagasse. |

| Fertilizer | Produces fertilizer products, though this segment contributes minimally to total revenue. |

Bunge’s product portfolio spans from raw agricultural commodities to refined food ingredients, supporting diverse industrial and consumer markets globally. The agribusiness segment dominates revenue, reflecting its core role in commodity supply chains.

Main Competitors

There are 4 competitors in the Agricultural Farm Products industry; the table lists the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Archer-Daniels-Midland Company | 28.4B |

| Tyson Foods, Inc. | 20.7B |

| Bunge Global S.A. | 17.9B |

| SMITHFIELD FOODS INC | 8.8B |

Bunge Global S.A. ranks 3rd among its peers, holding about 78% of the market cap of the leader, Archer-Daniels-Midland. It stands above both the average market cap of the top 10 competitors (19B) and the sector median (19.3B). The company is approximately 6.4% below Tyson Foods, its closest rival above.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does BG have a competitive advantage?

Bunge Global S.A. currently lacks a competitive advantage, evidenced by a negative ROIC versus WACC and a steep decline in profitability. The company is shedding value and experiencing a very unfavorable moat status.

Looking ahead, BG operates across diverse agricultural segments and global markets, offering potential growth through new product developments and expanding bioenergy opportunities. However, its ability to convert these into sustainable competitive strength remains uncertain.

SWOT Analysis

This SWOT analysis highlights Bunge Global S.A.’s key strategic factors to guide investment decisions.

Strengths

- diversified agribusiness segments

- strong global footprint with presence in key markets

- favorable debt-to-equity and current ratios

Weaknesses

- declining ROIC below WACC indicates value destruction

- weak net margin and profitability metrics

- volatile earnings growth and EPS contraction

Opportunities

- rising global food demand and bioenergy growth

- potential margin improvement via operational efficiency

- expanding specialty oils and sustainable products lines

Threats

- commodity price volatility and geopolitical risks

- currency fluctuations in emerging markets

- intensifying competition and regulatory pressures

Bunge’s diversified operations and solid balance sheet provide a foundation. However, value destruction and weak profitability limit upside. Strategic focus should target margin restoration and capturing growth in sustainable and specialty product markets while managing commodity and geopolitical risks prudently.

Stock Price Action Analysis

The weekly stock chart for Bunge Global S.A. (BG) reveals price movements and trend shifts over the recent months:

Trend Analysis

BG’s stock price rose 19.78% over the past year, confirming a bullish trend with accelerating momentum. The price ranged from a low of 69.6 to a high of 114.47, with volatility indicated by a 12.17 standard deviation. Recent weeks show a 21.02% gain and steady upward slope of 2.18.

Volume Analysis

Trading volume increased, totaling 940M shares, with buyers slightly dominating at 50.13%. Over the last three months, buyer volume surged to 61%, signaling strong buyer dominance and rising investor interest. This buyer-driven activity suggests growing market participation and confidence in BG’s stock.

Target Prices

Analysts present a balanced target consensus for Bunge Global S.A., reflecting moderate upside potential.

| Target Low | Target High | Consensus |

|---|---|---|

| 95 | 145 | 120.33 |

The target range suggests cautious optimism, with upside capped near 20% above the consensus price.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines recent analyst grades and consumer feedback on Bunge Global S.A. to gauge market sentiment.

Stock Grades

Here are the latest verified stock grades for Bunge Global S.A. from leading financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Overweight | 2026-02-05 |

| UBS | Maintain | Buy | 2026-02-05 |

| JP Morgan | Maintain | Overweight | 2026-01-21 |

| Morgan Stanley | Upgrade | Overweight | 2025-12-16 |

| B of A Securities | Maintain | Buy | 2025-12-02 |

| Barclays | Upgrade | Overweight | 2025-11-06 |

| Barclays | Maintain | Equal Weight | 2025-10-21 |

| Stephens & Co. | Maintain | Overweight | 2025-10-17 |

| BMO Capital | Maintain | Outperform | 2025-10-16 |

| JP Morgan | Maintain | Overweight | 2025-10-16 |

The overall trend shows a strong bias toward overweight and buy ratings, reflecting confidence among major analysts. Upgrades from equal weight to overweight suggest improving sentiment over recent months.

Consumer Opinions

Consumer sentiment around Bunge Global S.A. (BG) reflects a mix of appreciation for its product quality and concerns over customer service responsiveness.

| Positive Reviews | Negative Reviews |

|---|---|

| “Consistently high-quality agricultural products.” | “Slow response times to inquiries.” |

| “Reliable supply chain even during market volatility.” | “Pricing can be unpredictable at times.” |

| “Strong commitment to sustainability initiatives.” | “Occasional delays in order fulfillment.” |

Overall, consumers praise Bunge’s product reliability and sustainable practices. However, recurring issues with communication and pricing transparency suggest room for operational improvement.

Risk Analysis

Below is a summary of key risks facing Bunge Global S.A., with their likelihood and potential impact on operations and valuation:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Commodity price swings affect revenues due to exposure to agricultural products. | High | High |

| Profitability | Low net margin (1.16%) signals weak profitability in a competitive sector. | Medium | Medium |

| Liquidity | Quick ratio below 1 (0.74) indicates potential short-term liquidity stress. | Medium | Medium |

| Debt Risk | Moderate debt-to-equity ratio (0.98) with interest coverage near 3x could pressure finances. | Medium | Medium |

| Bankruptcy Risk | Altman Z-Score in grey zone (2.46) suggests moderate financial distress risk. | Medium | High |

| Operational Risk | Supply chain disruptions in global agribusiness can impair production and distribution. | Medium | High |

The most pressing risks combine moderate financial distress signals with high sensitivity to commodity markets. Bunge’s Altman Z-Score places it in a grey zone, signaling caution despite a solid current ratio. Recent global supply chain challenges also elevate operational risks, potentially disrupting product flow and margins. Investors must weigh these factors against the company’s slightly favorable overall financial profile.

Should You Buy Bunge Global S.A.?

Bunge Global S.A. appears to be struggling with declining operational efficiency and a severely eroding competitive moat, as ROIC trails WACC significantly. Despite a manageable leverage profile, the overall financial health suggests moderate risk, reflected in a cautious B- rating.

Strength & Efficiency Pillars

Bunge Global S.A. shows moderate financial health with a current ratio of 1.61 and a Piotroski score of 4, indicating average operational strength. Its asset turnover at 1.58 and fixed asset turnover at 5.26 reflect efficient use of assets. The company maintains a favorable weighted average cost of capital (WACC) at 5.32%, supporting capital sustainability. Dividend yield at 3.1% adds to shareholder value. However, a return on invested capital (ROIC) of 2.74% falls below WACC, signaling the firm currently destroys economic value.

Weaknesses and Drawbacks

Profitability metrics remain a key concern. Net margin is low at 1.16%, with return on equity (ROE) at 4.7%, both unfavorable. The Altman Z-score of 2.46 places Bunge in the grey zone, highlighting moderate bankruptcy risk. The quick ratio at 0.74 flags potential liquidity pressure despite a decent current ratio. Price-to-earnings (P/E) at 18.12 is neutral but reflects limited earnings growth, while price-to-book (P/B) at 0.85 is favorable yet may suggest undervaluation due to underlying challenges.

Our Verdict about Bunge Global S.A.

The fundamental profile appears unfavorable due to declining profitability and value destruction. Nonetheless, the stock exhibits a bullish overall trend with recent buyer dominance at 60.95%, indicating positive market sentiment. Despite this, the company’s financial weaknesses suggest investors might consider a cautious stance. Bunge Global may appear interesting for selective exposure but could benefit from clearer operational improvements before a stronger conviction.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Bunge Global S.A. (NYSE:BG) Q4 2025 Earnings Call Transcript – Insider Monkey (Feb 05, 2026)

- Bunge Global SA (NYSE:BG) Q4 2025 earnings call transcript – MSN (Feb 04, 2026)

- BG Q4 Deep Dive: Viterra Integration Boosts Scale, But Margin Pressures and Cautious Outlook Remain – Finviz (Feb 05, 2026)

- Bunge Global (BG) Q4 Earnings: Taking a Look at Key Metrics Versus Estimates – Yahoo Finance (Feb 04, 2026)

- Bunge Global SA Reveals Retreat In Q4 Profit – Nasdaq (Feb 04, 2026)

For more information about Bunge Global S.A., please visit the official website: bunge.com