Home > Analyses > Industrials > Builders FirstSource, Inc.

Builders FirstSource, Inc. transforms raw materials into the backbone of America’s homes and commercial buildings. It commands the construction sector with a vast portfolio of lumber, engineered wood, and custom building components. Renowned for blending innovation with quality, the company supports professional builders from foundation to finish. As the housing market evolves, I explore whether Builders FirstSource’s core strengths still justify its premium valuation and growth outlook.

Table of contents

Business Model & Company Overview

Builders FirstSource, Inc., founded in 1998 and headquartered in Irving, Texas, commands a dominant position in the U.S. construction industry. It delivers a comprehensive ecosystem of building materials, components, and services, integrating lumber, engineered wood products, and custom solutions into one cohesive offering. This approach caters to professional homebuilders, remodelers, and contractors, reinforcing its critical role in residential construction.

The company’s revenue engine balances product sales with value-added services, including turnkey framing and professional installation. Its diverse portfolio spans lumber, roofing, siding, and interior finishes, serving markets across the Americas. Builders FirstSource’s robust supply chain and broad geographic footprint build a strong economic moat, shaping the future of construction materials distribution.

Financial Performance & Fundamental Metrics

I will analyze Builders FirstSource, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its current financial health and shareholder returns.

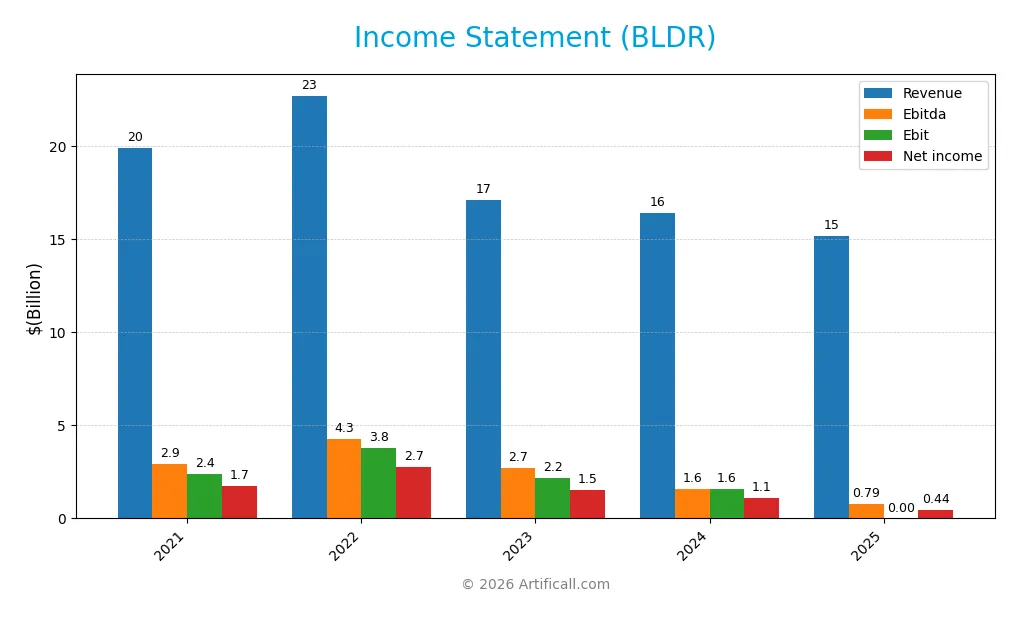

Income Statement

The table below summarizes Builders FirstSource, Inc.’s key income statement metrics for fiscal years 2021 through 2025, showing revenue and profitability trends.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 19.9B | 22.7B | 17.1B | 16.4B | 15.2B |

| Cost of Revenue | 14.0B | 15.0B | 11.1B | 11.0B | 10.6B |

| Operating Expenses | 3.5B | 4.0B | 3.8B | 3.8B | 3.8B |

| Gross Profit | 5.9B | 7.7B | 6.0B | 5.4B | 4.6B |

| EBITDA | 2.9B | 4.3B | 2.7B | 1.6B | 0.8B |

| EBIT | 2.4B | 3.8B | 2.2B | 1.6B | 0.0B |

| Interest Expense | 129M | 171M | 192M | 208M | 274M |

| Net Income | 1.7B | 2.7B | 1.5B | 1.1B | 0.4B |

| EPS | 8.55 | 16.98 | 12.06 | 9.13 | 3.91 |

| Filing Date | 2022-03-01 | 2023-02-28 | 2024-02-22 | 2025-02-20 | 2026-02-17 |

Income Statement Evolution

Builders FirstSource’s revenue declined 7.4% from 2024 to 2025 and 23.6% over five years. Gross profit fell 14.3% last year, reflecting margin compression. Operating expenses tracked revenue declines, but EBIT margin dropped sharply to zero. Net income also contracted steeply, with margins shrinking significantly during the period.

Is the Income Statement Favorable?

In 2025, Builders FirstSource reported a gross margin of 30.4%, a favorable metric in isolation. However, EBIT margin collapsed to zero, signaling operational strain. Interest expense remains manageable at 1.8% of revenue, but net margin at 2.9% and EPS fell over 50%, indicating weak profitability fundamentals. Overall, the income statement trends appear unfavorable.

Financial Ratios

The table below summarizes Builders FirstSource, Inc.’s key financial ratios from 2021 to 2025, providing insight into profitability, leverage, liquidity, and valuation:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 8.67% | 12.10% | 9.01% | 6.57% | 2.86% |

| ROE | 35.93% | 55.40% | 32.55% | 25.09% | 0.01% |

| ROIC | 21.06% | 32.76% | 19.34% | 13.90% | 0.01% |

| P/E | 10.03 | 3.82 | 13.85 | 15.65 | 26.34 |

| P/B | 3.60 | 2.12 | 4.51 | 3.93 | 0.00 |

| Current Ratio | 1.86 | 1.90 | 1.77 | 1.77 | 1.86 |

| Quick Ratio | 1.10 | 1.12 | 1.11 | 1.09 | 1.16 |

| D/E | 0.71 | 0.70 | 0.78 | 1.01 | 0.15 |

| Debt-to-Assets | 31.75% | 32.93% | 35.37% | 40.94% | 5.99% |

| Interest Coverage | 18.54 | 22.05 | 11.33 | 7.68 | 2.87 |

| Asset Turnover | 1.86 | 2.14 | 1.63 | 1.55 | 0.00 |

| Fixed Asset Turnover | 10.79 | 11.07 | 7.41 | 6.42 | 0.01 |

| Dividend Yield | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

Evolution of Financial Ratios

Builders FirstSource’s Return on Equity (ROE) sharply declined from 55.4% in 2022 to near zero in 2025, signaling a collapse in profitability. The Current Ratio remained stable around 1.8, indicating consistent liquidity. Debt-to-Equity fell significantly from above 1 in 2024 to 0.15 in 2025, reflecting a marked reduction in leverage.

Are the Financial Ratios Favorable?

In 2025, profitability metrics like net margin (2.86%) and ROE (0.01%) are unfavorable, showing weak returns. Liquidity ratios, including current (1.86) and quick ratio (1.16), are favorable, signaling solid short-term financial health. Low debt-to-equity (0.15) and debt-to-assets (5.99%) ratios indicate conservative leverage. However, asset turnover and interest coverage ratios are poor, contributing to an overall unfavorable financial ratio profile.

Shareholder Return Policy

Builders FirstSource, Inc. (BLDR) does not pay dividends, reflecting a focus on reinvestment and growth rather than immediate shareholder payouts. The company does not report share buybacks, indicating a strategy centered on capital allocation toward operations and expansion.

This approach aligns with sustainable long-term value creation by prioritizing free cash flow coverage of capital expenditures and maintaining solid liquidity ratios. However, investors should monitor if the absence of direct returns continues to support shareholder value amid evolving market conditions.

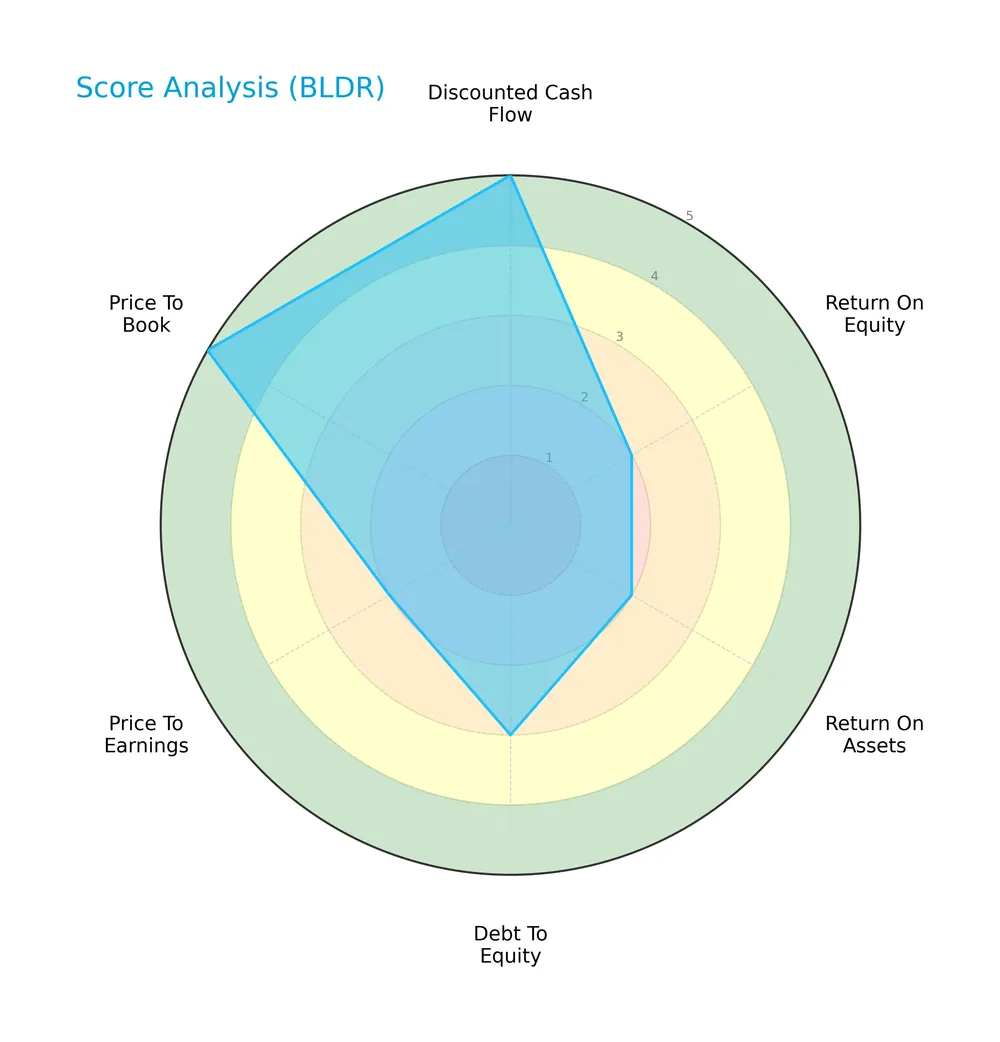

Score analysis

The following radar chart illustrates Builders FirstSource, Inc.’s key financial scores across multiple valuation and performance metrics:

The company scores very favorably in discounted cash flow (5) and price to book (5), indicating attractive valuation metrics. However, return on equity (2), return on assets (2), and price to earnings (2) scores are unfavorable, reflecting weaker profitability. Debt to equity is moderate (3), suggesting balanced leverage.

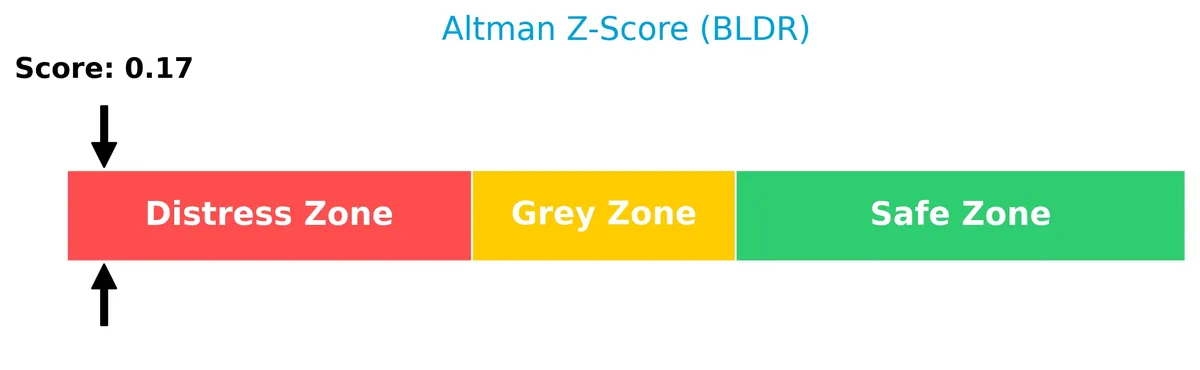

Analysis of the company’s bankruptcy risk

Builders FirstSource, Inc. currently falls deep within the distress zone based on its Altman Z-Score, signaling a high bankruptcy risk:

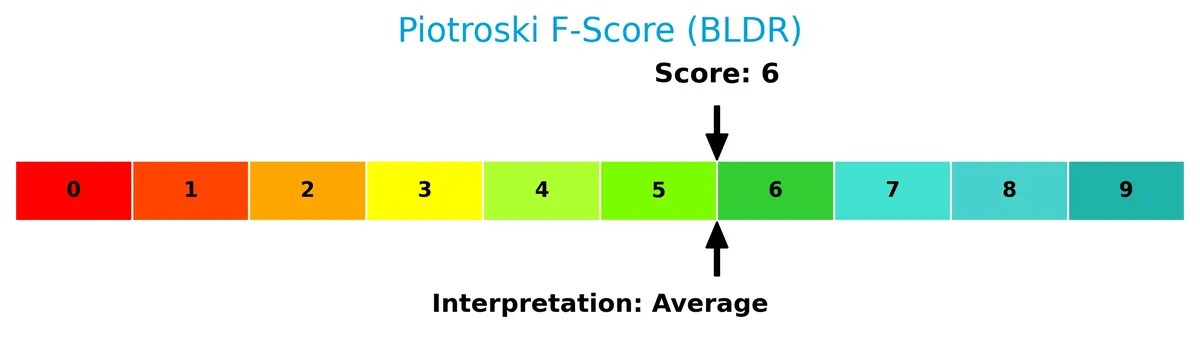

Is the company in good financial health?

The Piotroski Score chart below provides insight into the company’s average financial strength and operational efficiency:

With a Piotroski Score of 6, Builders FirstSource, Inc. demonstrates average financial health. This suggests some strengths but also room for improvement in profitability and balance sheet quality.

Competitive Landscape & Sector Positioning

This section analyzes Builders FirstSource, Inc.’s strategic positioning within the construction sector. It reviews revenue by segment, key products, main competitors, and competitive advantages. I will assess whether Builders FirstSource holds a sustainable edge over its rivals.

Strategic Positioning

Builders FirstSource, Inc. maintains a diversified product portfolio across lumber, manufactured products, specialty building goods, and millwork, with revenues in the low-to-mid billions. Its geographic exposure spans the US Northeast, South, Southeast, and West regions, reflecting broad domestic market coverage.

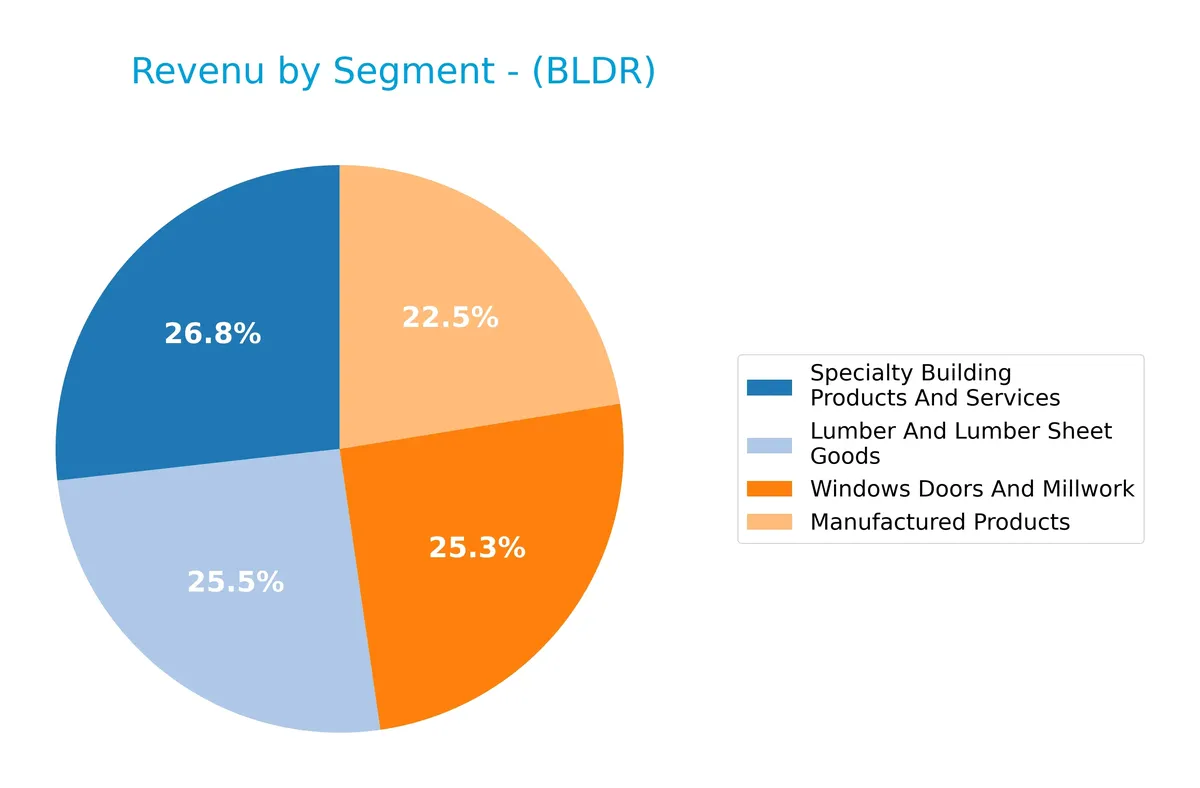

Revenue by Segment

The pie chart displays Builders FirstSource’s revenue distribution across four key segments for fiscal year 2025, illustrating the company’s business composition and segment contributions.

In 2025, Specialty Building Products and Services leads with $4.1B, closely followed by Lumber and Lumber Sheet Goods at $3.9B. Windows Doors and Millwork and Manufactured Products contribute similarly, around $3.8B and $3.4B respectively. Compared to prior years, revenue has slightly contracted across most segments, signaling a cautious market environment and highlighting the need to monitor segment concentration risks.

Key Products & Brands

Builders FirstSource’s main product lines and brands across its construction materials and services include:

| Product | Description |

|---|---|

| Lumber And Lumber Sheet Goods | Dimensional lumber, plywood, oriented strand board, used for on-site house framing. |

| Manufactured Products | Wood and steel trusses, wall panels, stairs, engineered wood products. |

| Specialty Building Products And Services | Gypsum, roofing, insulation, siding, metal and concrete products, plus cabinets and hardware. |

| Windows Doors And Millwork | Interior and exterior door units, windows, trims, and custom products under the Synboard brand. |

Builders FirstSource offers a broad and diversified product portfolio critical to residential construction. Its mix spans raw materials, manufactured components, and specialty products supporting various building phases.

Main Competitors

There are 6 competitors in total; the table below lists the top 6 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Trane Technologies plc | 88.3B |

| Johnson Controls International plc | 80.0B |

| Carrier Global Corporation | 45.1B |

| Lennox International Inc. | 17.5B |

| Masco Corporation | 13.4B |

| Builders FirstSource, Inc. | 11.6B |

Builders FirstSource ranks 6th among its competitors. Its market cap is 14.36% of the top player’s size. The company sits below both the average market cap of the top 10 (42.6B) and the median sector market cap (31.3B). It trails the next competitor above by 5.65%, indicating a modest gap to close.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does BLDR have a competitive advantage?

Builders FirstSource currently lacks a competitive advantage. Its ROIC falls well below WACC, indicating value destruction and declining profitability over recent years.

Future prospects include expanding its product range and services across multiple U.S. regions, potentially leveraging growth in construction demand despite recent revenue declines.

SWOT Analysis

This analysis highlights Builders FirstSource’s core competitive factors and risks to guide strategic decisions.

Strengths

- large market cap at 12.7B

- diversified product range

- favorable balance sheet ratios

Weaknesses

- declining revenue and profitability

- negative ROIC vs WACC

- weak earnings growth

Opportunities

- expansion in growing US housing markets

- integration of turnkey services

- rising demand for sustainable building materials

Threats

- housing market volatility

- rising interest rates pressure

- intense competition from large suppliers

Builders FirstSource faces value destruction amid shrinking margins but benefits from strong scale and solid liquidity. The company must leverage growth opportunities while managing cyclical housing risks carefully.

Stock Price Action Analysis

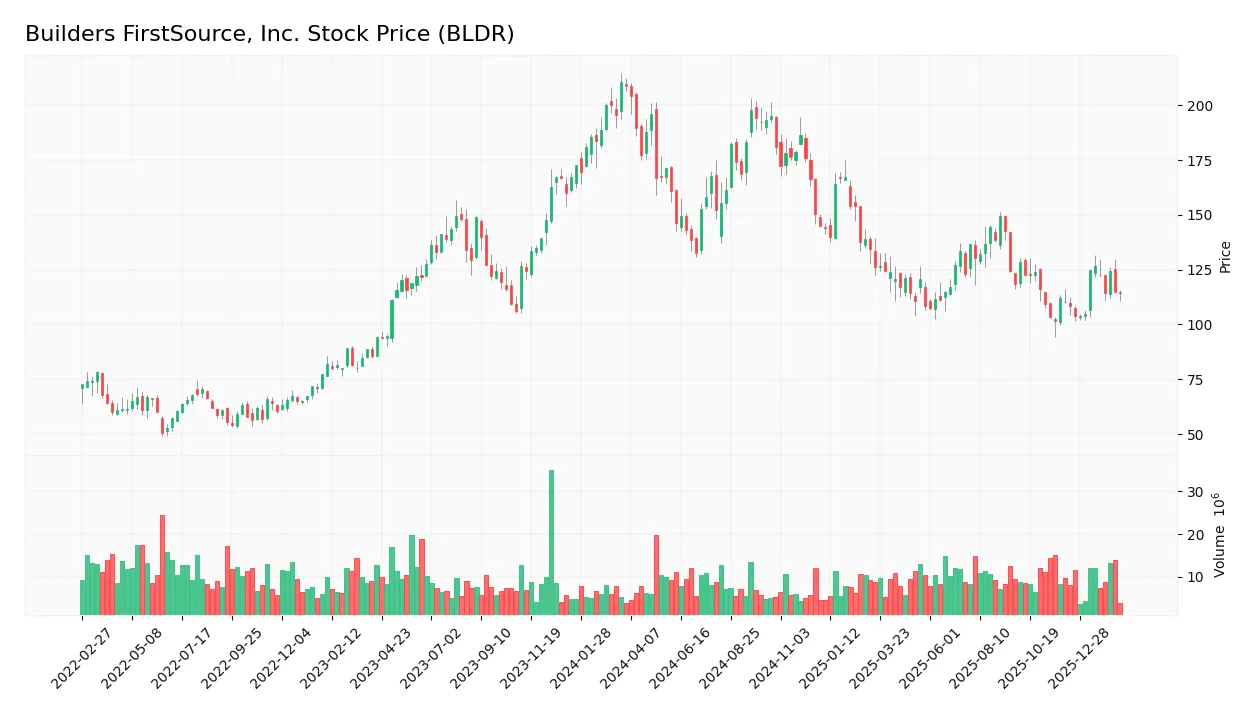

The weekly stock chart illustrates Builders FirstSource, Inc.’s price movements, highlighting significant volatility and key support and resistance levels:

Trend Analysis

Over the past 12 months, BLDR’s stock price declined sharply by 45.03%, confirming a bearish trend with accelerating downward momentum. The price ranged between a high of 208.55 and a low of 101.62, with volatility reflected in a 28.43 standard deviation. A recent short-term rebound of 4.2% shows a nascent recovery phase.

Volume Analysis

In the last three months, trading volume in BLDR has increased but remains slightly seller-driven, with sellers accounting for 58.17% of activity. This rising volume alongside seller dominance suggests cautious investor sentiment and persistent selling pressure despite some buying interest.

Target Prices

Analysts project a target consensus that reflects moderate upside potential for Builders FirstSource, Inc.

| Target Low | Target High | Consensus |

|---|---|---|

| 109.41 | 145 | 127.49 |

The target range suggests cautious optimism, with the consensus price indicating a roughly 10-15% upside from current levels.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews analyst ratings and consumer feedback to provide a balanced view of Builders FirstSource, Inc.’s market perception.

Stock Grades

Here is the latest comprehensive overview of Builders FirstSource, Inc. stock grades from leading financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Equal Weight | 2026-02-11 |

| DA Davidson | Maintain | Neutral | 2026-02-02 |

| Stephens & Co. | Downgrade | Equal Weight | 2026-01-20 |

| Barclays | Maintain | Overweight | 2026-01-15 |

| UBS | Maintain | Buy | 2026-01-06 |

| Stifel | Maintain | Hold | 2025-12-16 |

| Jefferies | Downgrade | Hold | 2025-12-15 |

| Barclays | Maintain | Overweight | 2025-12-08 |

| DA Davidson | Maintain | Neutral | 2025-11-03 |

| Benchmark | Maintain | Buy | 2025-10-31 |

The overall trend shows a cautious stance with many firms maintaining neutral or hold ratings while a few continue to rate the stock as overweight or buy. Recent downgrades indicate some reservations about near-term outlooks.

Consumer Opinions

Builders FirstSource, Inc. (BLDR) elicits mixed reactions from its customer base, reflecting its operational strengths and areas for improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| High-quality construction materials with consistent availability. | Delivery delays affecting project timelines. |

| Responsive customer service addressing order issues promptly. | Pricing higher compared to local competitors. |

| Wide product selection meeting diverse building needs. | Occasional inaccuracies in order fulfillment. |

Overall, customers praise Builders FirstSource for product quality and service responsiveness. However, delivery reliability and pricing remain frequent concerns, signaling areas requiring strategic focus to enhance customer satisfaction.

Risk Analysis

Below is a summary table outlining Builders FirstSource, Inc.’s key risk factors and their likelihood and impact on the business:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Altman Z-Score at 0.17 signals high bankruptcy risk (Distress Zone) | High | Severe |

| Profitability | Very low ROE and ROIC (0.01%), net margin at 2.86% unfavorable | High | Moderate |

| Market Volatility | Beta of 1.55 indicates above-average stock price volatility | Moderate | Moderate |

| Leverage & Debt | Low debt-to-equity (0.15) and debt-to-assets (6%) ratios favorable | Low | Low |

| Liquidity | Strong current (1.86) and quick (1.16) ratios support short-term health | Low | Low |

| Dividend Policy | No dividend yield, limiting income appeal for dividend investors | Moderate | Low |

| Operational Efficiency | Asset turnover near zero signals poor asset utilization | Moderate | Moderate |

The most critical risk is financial distress indicated by the Altman Z-Score, highlighting potential solvency threats. Poor profitability metrics and weak asset turnover compound concerns. While liquidity and leverage ratios offer some cushion, investors should remain cautious given the company’s vulnerability amid cyclical construction sector headwinds.

Should You Buy Builders FirstSource, Inc.?

Builders FirstSource, Inc. appears to be shedding value with a very unfavorable moat due to declining profitability. While its leverage profile seems moderate, its overall rating of B+ suggests cautious optimism amid financial distress risks.

Strength & Efficiency Pillars

Builders FirstSource, Inc. shows operational resilience with a robust gross margin of 30.39%. Its interest expense remains low at 1.8%, indicating manageable financing costs. However, profitability metrics flag concerns: net margin is a modest 2.86%, and both ROE and ROIC hover near 0.01%, well below WACC of 3.01%. This signals the company is not a value creator but is instead shedding value, as ROIC fails to cover its cost of capital. Operational efficiency is mixed amid challenging fundamentals.

Weaknesses and Drawbacks

The company is in financial distress, evidenced by a perilously low Altman Z-Score of 0.17, placing it deep in the Distress Zone and indicating a high bankruptcy risk. Profitability collapses, with EBIT margin at 0% and net margin growth declining sharply by 56.41% year-over-year. Leverage is moderate (Debt-to-Equity 0.15), but liquidity ratios are supported (Current Ratio 1.86). Market pressure intensifies as seller dominance reaches 58.17%, exerting near-term downward price pressure. Valuation metrics are stretched with a P/E of 26.34, reflecting a premium despite weak earnings.

Our Final Verdict about Builders FirstSource, Inc.

Despite some operational strengths, the company’s solvency risk, signaled by the Altman Z-Score of 0.17, renders the investment profile highly speculative and too risky for conservative capital. The steep erosion in profitability and ongoing value destruction outweigh pockets of liquidity and market interest. Caution is paramount until financial health stabilizes and profitability metrics improve meaningfully.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Builders FirstSource’s Q4 Earnings & Sales Lag, Margins Down Y/Y – Yahoo Finance (Feb 17, 2026)

- Builders FirstSource Inc (BLDR) Q4 2025 Earnings Call Highlights: Navigating Challenges and Strategic Growth – GuruFocus (Feb 17, 2026)

- Builders FirstSource: Q4 Earnings Snapshot – KVUE (Feb 17, 2026)

- Builders FirstSource, Inc. Q4 Income Retreats – Nasdaq (Feb 17, 2026)

- Builders FirstSource, Inc. $BLDR Shares Sold by Rhumbline Advisers – MarketBeat (Feb 16, 2026)

For more information about Builders FirstSource, Inc., please visit the official website: bldr.com