Home > Analyses > Consumer Defensive > British American Tobacco p.l.c.

British American Tobacco p.l.c. shapes global nicotine consumption through its vast portfolio of iconic brands like Dunhill, Camel, and Vuse. It dominates the tobacco industry with a stronghold in combustible cigarettes and a growing presence in modern nicotine products such as vapour and heated tobacco. Renowned for innovation and quality, BAT influences millions daily. The key question: does its evolving product mix and robust market footprint justify its premium valuation in 2026?

Table of contents

Business Model & Company Overview

British American Tobacco p.l.c., founded in 1902 and headquartered in London, stands as a dominant player in the global tobacco industry. It offers a broad ecosystem of tobacco and nicotine products, including vapour, heated, and traditional oral options. Its portfolio features renowned brands like Vuse, Dunhill, and Camel, uniting combustible cigarettes with modern nicotine delivery systems to serve diverse consumer preferences worldwide.

The company’s revenue engine balances sales across combustible cigarettes and innovative nicotine alternatives, distributed through extensive retail networks spanning the Americas, Europe, Asia-Pacific, and beyond. This strategic global footprint supports recurring demand and solid cash flows. British American Tobacco’s competitive advantage lies in its scale and brand equity, securing a robust economic moat that shapes the future trajectory of the tobacco sector.

Financial Performance & Fundamental Metrics

I analyze British American Tobacco’s income statement, key financial ratios, and dividend payout policy to assess its core profitability and shareholder value creation.

Income Statement

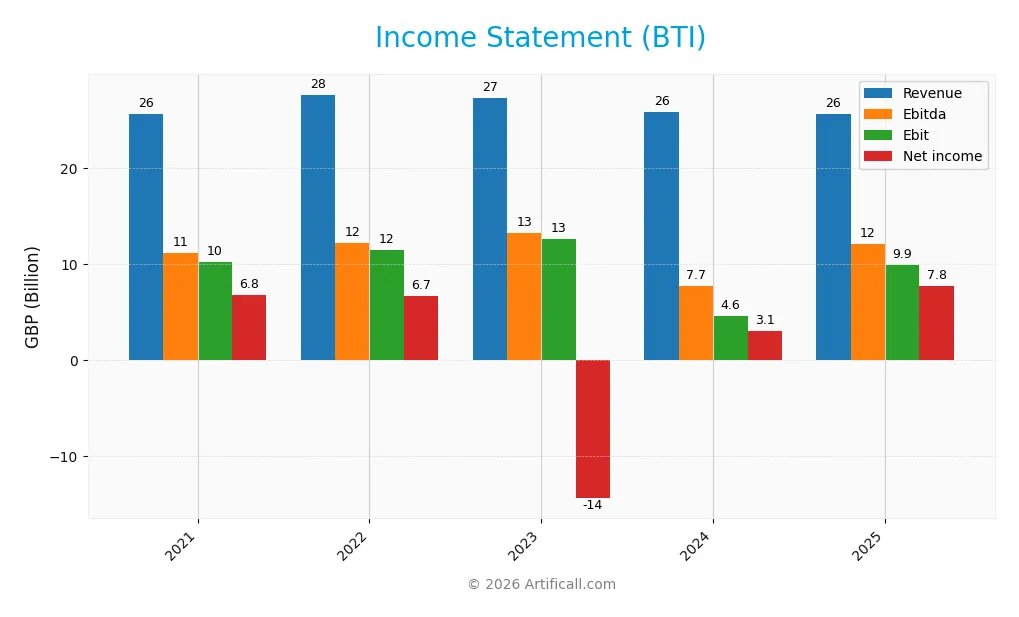

Below is the income statement summary for British American Tobacco p.l.c. over the past five fiscal years, reported in GBP.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 25.7B | 27.7B | 27.3B | 25.9B | 25.6B |

| Cost of Revenue | 4.6B | 4.8B | 4.9B | 4.4B | 4.2B |

| Operating Expenses | 10.9B | 12.3B | 38.1B | 18.6B | 11.4B |

| Gross Profit | 21.1B | 22.9B | 22.4B | 21.4B | 21.4B |

| EBITDA | 11.2B | 12.2B | 13.3B | 7.7B | 12.1B |

| EBIT | 10.2B | 11.5B | 12.6B | 4.6B | 9.9B |

| Interest Expense | 1.5B | 1.7B | 1.9B | 1.1B | 1.8B |

| Net Income | 6.8B | 6.7B | -14.4B | 3.1B | 7.8B |

| EPS | 2.97 | 2.93 | -6.49 | 1.37 | 3.51 |

| Filing Date | 2022-03-08 | 2023-03-02 | 2024-02-09 | 2025-02-14 | 2026-02-13 |

Income Statement Evolution

From 2021 to 2025, British American Tobacco’s revenue slightly declined by 0.29%, reflecting a stable but mature market position. Net income grew 14.16%, driven by improving net margins which rose 14.49% over the period. Despite a marginal revenue dip, profitability strengthened, with gross margins remaining high and stable around 83.5%.

Is the Income Statement Favorable?

In 2025, fundamentals appear favorable. Net income reached £7.7B, up sharply from £3.1B in 2024, reflecting a 155.6% net margin increase to 30.32%. EBIT more than doubled, signaling operational efficiency gains. Interest expense remains neutral at 7.1% of revenue, supporting a robust bottom line despite slight revenue contraction.

Financial Ratios

The table below summarizes key financial ratios for British American Tobacco p.l.c. over the last five fiscal years, providing a snapshot of profitability, liquidity, leverage, and valuation metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 26% | 24% | -53% | 12% | 30% |

| ROE | 10% | 9% | -27% | 6% | 16% |

| ROIC | 6% | 6% | -12% | 2% | 8% |

| P/E | 9.2 | 11.2 | -3.6 | 20.9 | 11.8 |

| P/B | 0.93 | 0.99 | 0.99 | 1.29 | 1.92 |

| Current Ratio | 0.85 | 0.86 | 0.91 | 0.76 | 0.87 |

| Quick Ratio | 0.50 | 0.55 | 0.59 | 0.52 | 0.57 |

| D/E | 0.59 | 0.57 | 0.76 | 0.74 | 0.73 |

| Debt-to-Assets | 29% | 28% | 33% | 31% | 32% |

| Interest Coverage | 6.9 | 6.3 | -8.3 | 2.5 | 5.5 |

| Asset Turnover | 0.19 | 0.18 | 0.23 | 0.22 | 0.23 |

| Fixed Asset Turnover | 5.2 | 5.7 | 6.0 | 5.9 | 5.7 |

| Dividend Yield | 7.9% | 6.6% | 9.8% | 8.1% | 5.6% |

Evolution of Financial Ratios

Over the period, Return on Equity (ROE) improved significantly from negative in 2023 to 16.2% in 2025, reflecting a recovery in profitability. The Current Ratio remained below 1.0, indicating persistent liquidity constraints. The Debt-to-Equity Ratio showed slight fluctuations but stayed around 0.7, signaling stable leverage levels.

Are the Financial Ratios Fovorable?

In 2025, profitability ratios like net margin (30.3%) and ROE (16.2%) are favorable, supported by an interest coverage ratio of 5.46. Liquidity ratios, including the current ratio (0.87) and quick ratio (0.57), remain unfavorable, posing short-term risk. Asset turnover is low at 0.23, while fixed asset turnover is strong at 5.71. Overall, the ratio profile is slightly favorable with balanced strengths and weaknesses.

Shareholder Return Policy

British American Tobacco maintains a dividend payout ratio near 66%, with a steady dividend per share around 2.34 GBP and a yield of approximately 5.57%. The dividend is well covered by free cash flow, and the company also engages in share buybacks.

This balanced approach, combining dividends with buybacks, aligns with sustainable long-term shareholder value. Coverage ratios suggest distributions remain prudent without compromising capital expenditure or financial stability.

Score analysis

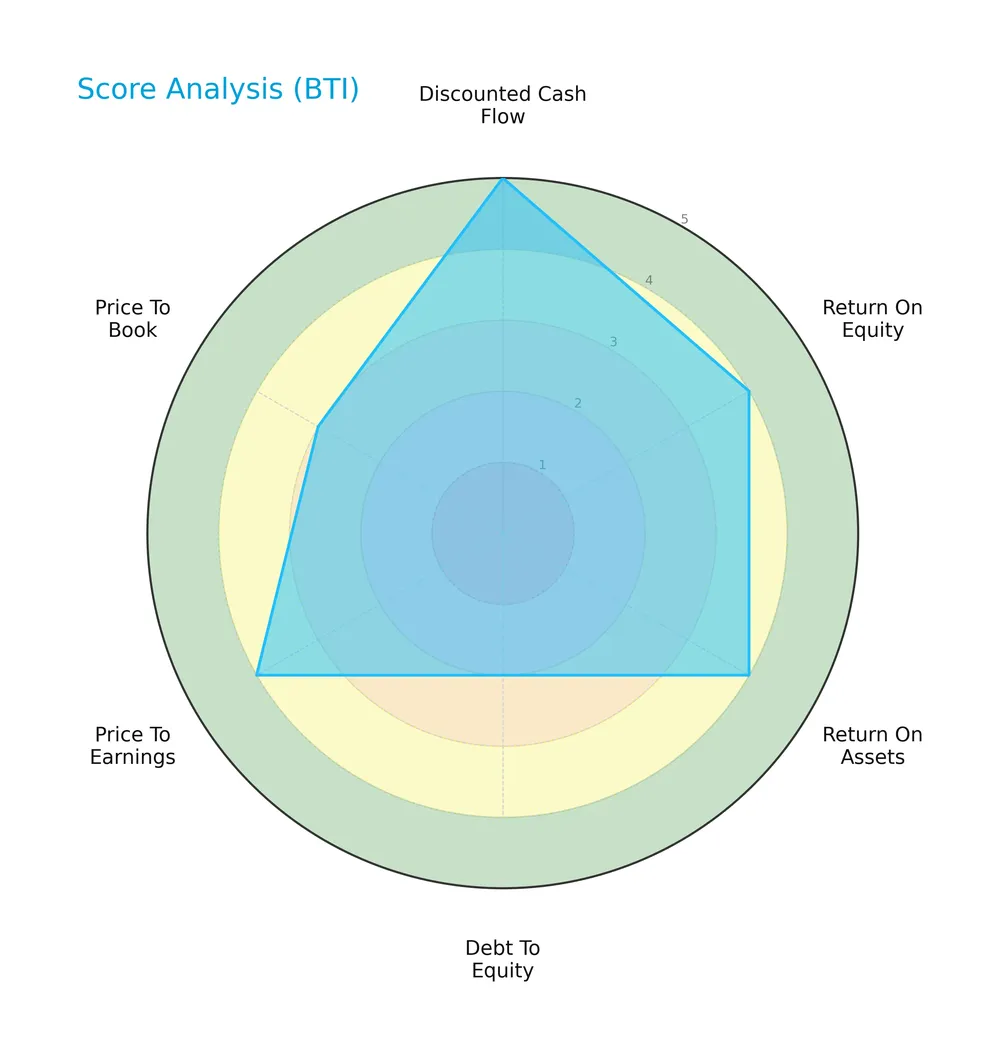

The radar chart below summarizes key financial scores for British American Tobacco p.l.c.:

The company scores very favorably on discounted cash flow (5) and solidly on return on equity (4) and return on assets (4). However, its debt-to-equity score is unfavorable (2), while price-to-earnings (4) and price-to-book (3) reflect moderate valuation metrics.

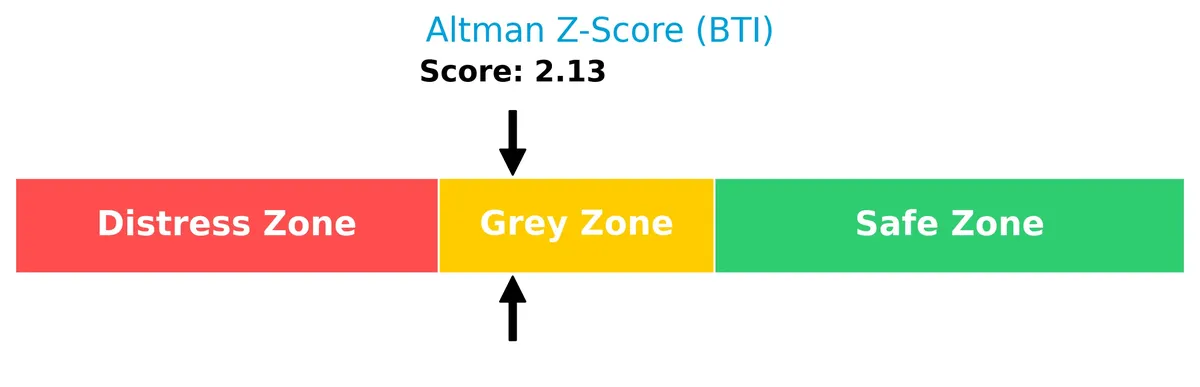

Analysis of the company’s bankruptcy risk

British American Tobacco’s Altman Z-Score places it in the grey zone, indicating a moderate risk of bankruptcy:

Is the company in good financial health?

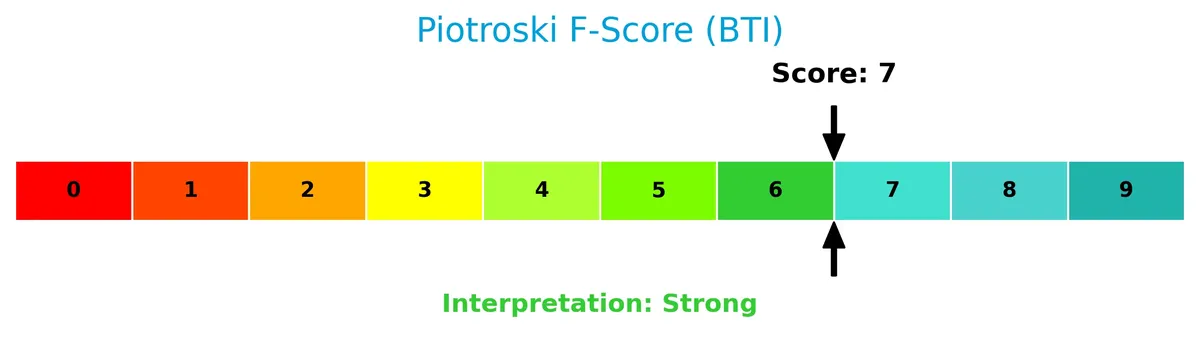

The Piotroski Score diagram highlights the company’s strong financial health:

With a Piotroski Score of 7, British American Tobacco demonstrates strong profitability, liquidity, and operational efficiency, signaling robust financial fundamentals.

Competitive Landscape & Sector Positioning

British American Tobacco p.l.c. operates across multiple regions, offering diverse tobacco and nicotine products. I will assess whether the company holds a competitive advantage over its main rivals.

Strategic Positioning

British American Tobacco concentrates on combustible cigarettes, generating over £20B annually, while maintaining smaller segments in traditional oral and “others.” Its geographic exposure is broad, with revenues consistently above £20B from foreign markets, reflecting a diversified international footprint in tobacco and nicotine products.

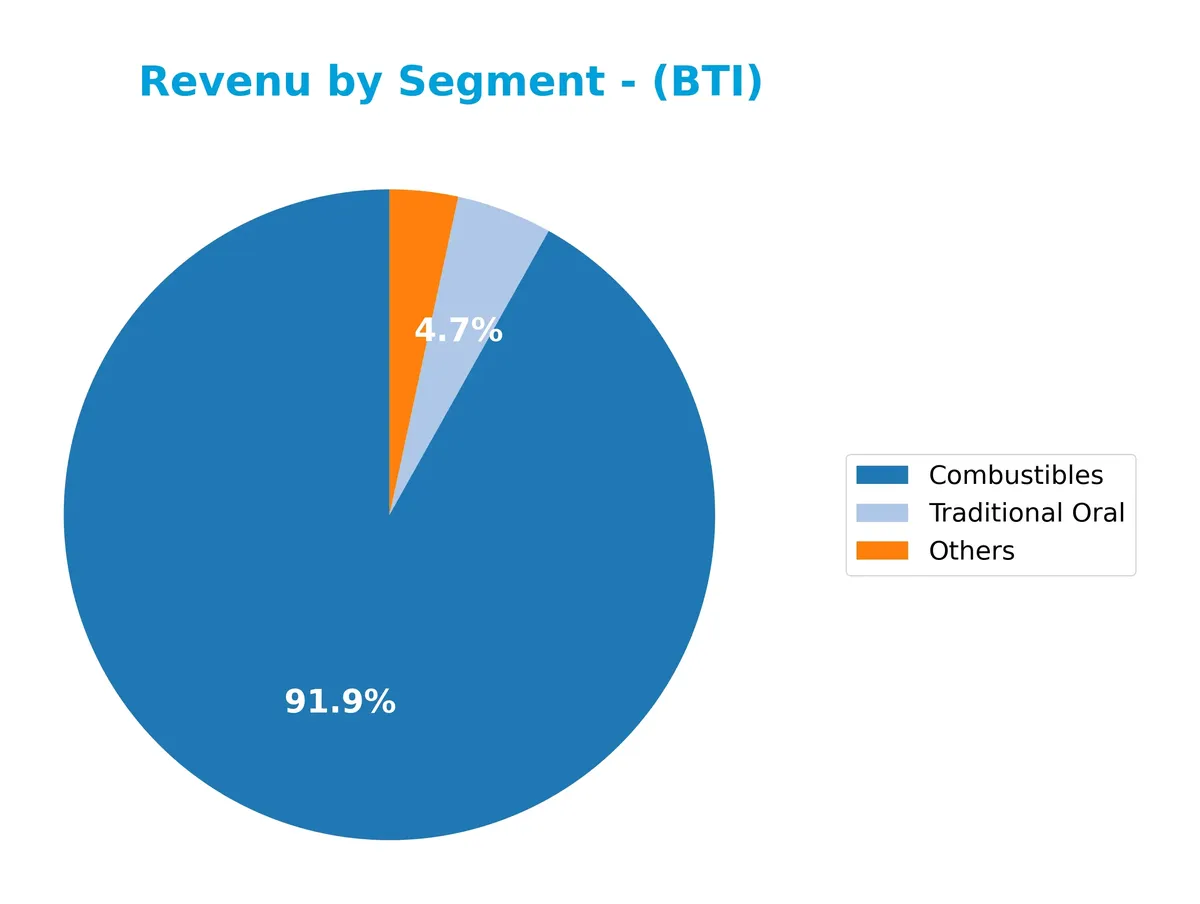

Revenue by Segment

This pie chart displays British American Tobacco’s revenue breakdown by product segment for the fiscal year 2025, highlighting the composition and scale of each business line.

In 2025, combustibles dominate with £20.2B, though down from £23.0B in 2022, signaling slight contraction in the core business. Traditional oral products contributed £1.0B, showing modest decline versus prior years. The Others segment grew to £745M, reflecting a gradual diversification. Overall, combustibles remain the primary revenue driver, but the recent slowdown suggests a cautious outlook amid shifting consumer preferences and regulatory pressures.

Key Products & Brands

British American Tobacco offers a diverse range of tobacco and nicotine products, including traditional and modern categories:

| Product | Description |

|---|---|

| Combustible Cigarettes | Traditional cigarettes remain a core revenue driver, generating £20.2B in FY 2025. |

| Traditional Oral Products | Includes snus and moist snuff, contributing £1.04B in FY 2025. |

| Vapour Products | Modern nicotine alternatives such as Vuse, part of the company’s new product portfolio. |

| Heated Tobacco Products (glo) | Tobacco heated rather than burned, representing a strategic growth area. |

| Other Products | Includes various nicotine products and smaller segments, totaling £745M in FY 2025 revenue. |

| Key Brands | Vuse, glo, Velo, Grizzly, Kodiak, Dunhill, Kent, Lucky Strike, Pall Mall, Rothmans, Newport, Natural American Spirit, Camel. |

British American Tobacco balances legacy combustible products with expanding modern nicotine formats. Combustibles dominate revenue but the firm invests in vapour and heated products to capture shifting consumer preferences. Traditional oral products provide a steady niche contribution.

Main Competitors

British American Tobacco p.l.c. faces 3 main competitors in the Tobacco industry. Below is a table of the top 3 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Philip Morris International Inc. | 250B |

| British American Tobacco p.l.c. | 124B |

| Altria Group, Inc. | 96B |

British American Tobacco ranks 2nd among its competitors, holding 51.2% of the market cap of the leader, Philip Morris International. It sits below the average market cap of the top 10 competitors (156.6B) but above the median market cap for the sector (124.2B). The company maintains a significant 95.3% gap to the next competitor above, highlighting a substantial scale difference with the sector leader.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does BTI have a competitive advantage?

British American Tobacco p.l.c. presents a very favorable competitive advantage supported by a growing ROIC, which exceeds its WACC by 3.57%, indicating consistent value creation. The company maintains robust profitability with an 83.5% gross margin and a 38.8% EBIT margin, outperforming many peers in the tobacco sector.

Looking ahead, BTI’s portfolio includes vapour, heated, and modern oral nicotine products alongside traditional tobacco brands, positioning it well for evolving consumer preferences. Expansion in emerging markets and innovation in reduced-risk products offer significant growth opportunities despite recent slight revenue declines.

SWOT Analysis

This SWOT analysis highlights British American Tobacco’s core strategic factors shaping its competitive position and growth potential.

Strengths

- strong global brand portfolio

- high gross margin (83.5%)

- growing ROIC above WACC indicating value creation

Weaknesses

- declining revenue growth (-0.99% last year)

- weak liquidity ratios (current ratio 0.87)

- low asset turnover (0.23)

Opportunities

- expansion in modern nicotine products

- favorable earnings growth and margin improvement

- potential in emerging markets

Threats

- regulatory pressures on tobacco products

- shifting consumer preferences to alternatives

- currency and geopolitical risks in diverse markets

British American Tobacco combines a durable competitive advantage with operational efficiency. However, revenue stagnation and liquidity concerns require cautious capital allocation. The company’s strategy must prioritize innovation and regulatory navigation to sustain growth.

Stock Price Action Analysis

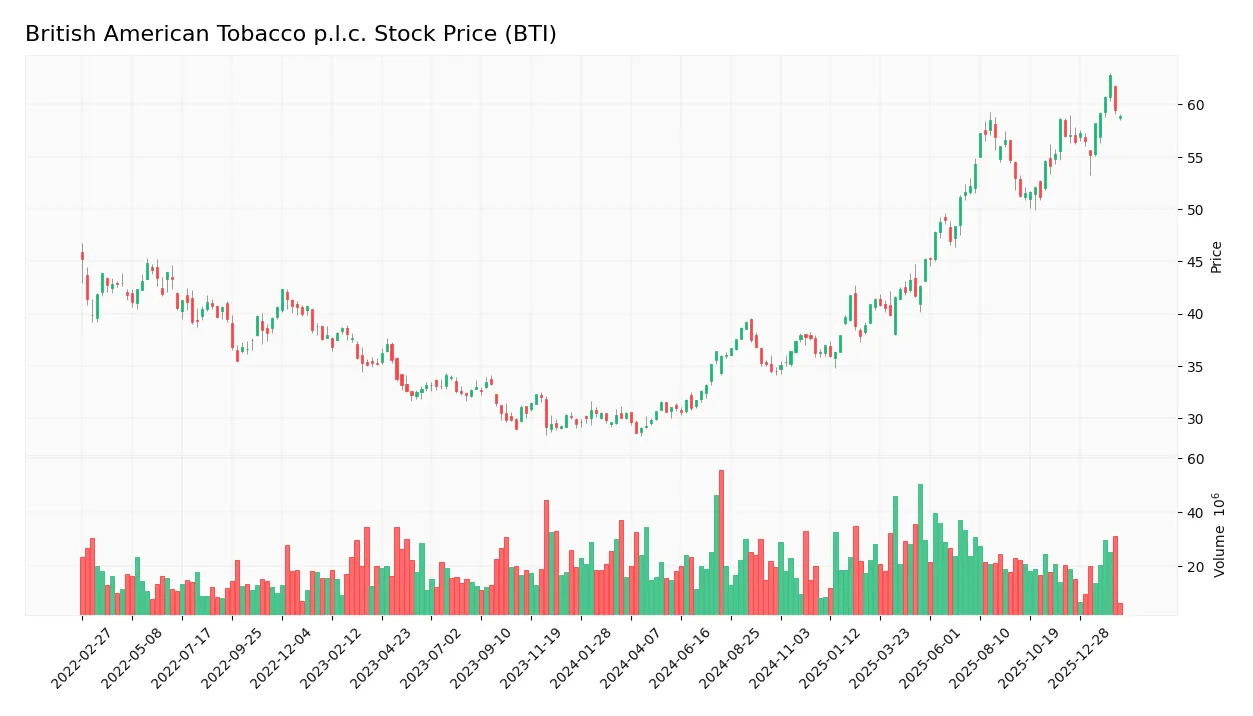

The weekly chart below illustrates British American Tobacco p.l.c.’s stock price movements over the past 100 weeks:

Trend Analysis

Over the past 100 weeks, BTI’s stock price rose sharply by 93.15%, confirming a strong bullish trend with accelerating momentum. The price ranged from a low of 28.62 to a high of 62.8, reflecting significant upward volatility (9.81 std deviation). Recent weeks show a mild 3.33% gain, maintaining a bullish slope of 0.4.

Volume Analysis

In the last three months, trading volume shows a decreasing trend despite buyer dominance at 52.79%. Total volume declined, with buyer activity appearing neutral rather than aggressive. This suggests cautious investor participation, with neither strong accumulation nor heavy selling pressure prevailing.

Target Prices

Analysts converge on a firm target consensus for British American Tobacco p.l.c. at $40.

| Target Low | Target High | Consensus |

|---|---|---|

| 40 | 40 | 40 |

This unanimity suggests stable expectations among analysts, reflecting confidence in the stock’s valuation at $40.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines analyst ratings and consumer feedback related to British American Tobacco p.l.c. (BTI).

Stock Grades

Here is the latest grading summary from leading financial analysts for British American Tobacco p.l.c.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Argus Research | Upgrade | Buy | 2025-09-08 |

| UBS | Upgrade | Buy | 2025-01-27 |

| Argus Research | Downgrade | Hold | 2023-09-01 |

| Argus Research | Downgrade | Hold | 2023-08-31 |

| JP Morgan | Upgrade | Overweight | 2022-03-24 |

| JP Morgan | Upgrade | Overweight | 2022-03-23 |

| JP Morgan | Downgrade | Neutral | 2021-04-09 |

| JP Morgan | Downgrade | Neutral | 2021-04-08 |

| Jefferies | Upgrade | Buy | 2021-03-26 |

| Jefferies | Upgrade | Buy | 2021-03-25 |

The consensus among analysts shifted from neutral and hold ratings in early 2020s to a stronger buy stance by 2025, reflecting renewed confidence. Recent upgrades by Argus and UBS highlight a positive trend in sentiment towards BTI.

Consumer Opinions

British American Tobacco p.l.c. sparks diverse consumer sentiment, reflecting its complex market position and product range.

| Positive Reviews | Negative Reviews |

|---|---|

| High-quality tobacco products with rich flavor. | Concerns over health risks associated with smoking. |

| Consistent product availability worldwide. | Premium pricing deters some customers. |

| Innovative vaping alternatives gaining traction. | Customer service can be slow in certain regions. |

Overall, consumers appreciate BTI’s product quality and innovation in alternatives. However, health concerns and pricing remain persistent drawbacks in public perception.

Risk Analysis

Below is a summary of key risks facing British American Tobacco p.l.c., highlighting their probability and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Liquidity Risk | Current ratio at 0.87 signals potential short-term liquidity issues. | Medium | Medium |

| Regulatory Risk | Tobacco industry faces ongoing tightening regulations globally. | High | High |

| Market Risk | Low beta (0.059) suggests limited stock volatility but market shifts remain a threat. | Low | Medium |

| Leverage Risk | Debt-to-equity score unfavorable; moderate debt levels may pressure finances if interest rates rise. | Medium | Medium |

| Operational Risk | Asset turnover low at 0.23, indicating potential inefficiencies in asset use. | Medium | Low |

| Reputational Risk | Shifts in consumer preferences toward alternatives could impact brand strength. | Medium | High |

The most pressing risks are regulatory tightening and liquidity constraints. Regulatory changes in key markets remain the largest threat to BTI’s stable cash flows. Despite a solid dividend yield (5.57%) and favorable profitability metrics, the below-par current and quick ratios highlight caution on short-term financial flexibility. The grey zone Altman Z-score at 2.13 confirms moderate financial distress potential, requiring close monitoring.

Should You Buy British American Tobacco p.l.c.?

British American Tobacco appears to be generating strong value creation with a durable competitive moat supported by growing ROIC well above WACC. Despite a manageable leverage profile appearing as a relative weakness, its overall rating is very favorable, suggesting operational efficiency.

Strength & Efficiency Pillars

British American Tobacco p.l.c. posts robust profitability with a net margin of 30.32% and a return on equity of 16.2%, signaling efficient capital use. The company generates value as its ROIC of 8.02% comfortably exceeds the WACC of 4.45%, confirming it as a value creator. Margins remain strong, supported by an 83.5% gross margin and a solid EBIT margin of 38.76%. These figures underscore a sustainable competitive advantage and growing operational efficiency.

Weaknesses and Drawbacks

The Altman Z-Score of 2.13 places the company in the grey zone, indicating moderate bankruptcy risk and warranting caution. Liquidity ratios are weak, with a current ratio of 0.87 and quick ratio of 0.57, signaling potential short-term solvency pressures. While valuation metrics appear reasonable—P/E at 11.84 and P/B at 1.92—the modest debt-to-equity level (0.73) and declining revenue growth (-0.99% last year) raise concerns about near-term financial flexibility and market challenges.

Our Final Verdict about British American Tobacco p.l.c.

Despite its strong profitability and value creation profile, the company’s grey-zone solvency score tempers enthusiasm. The moderate risk highlighted by the Altman Z-Score suggests the investment is somewhat speculative. While the long-term fundamentals remain solid, investors might prefer to monitor liquidity and revenue trends before committing significant capital. This profile may appear suitable for those with a tolerance for moderate financial risk.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Results centre – British American Tobacco (Feb 13, 2026)

- British American Tobacco: Shifting My Conviction Lower (Downgrade) (NYSE:BTI) – Seeking Alpha (Feb 17, 2026)

- Todd Asset Management LLC Cuts Position in British American Tobacco p.l.c. $BTI – MarketBeat (Feb 16, 2026)

- British American Tobacco (BTI) 2025 results: cash hit by Canada deal – Stock Titan (Feb 12, 2026)

- British American Tobacco p.l.c. $BTI Shares Sold by GF Fund Management CO. LTD. – MarketBeat (Feb 16, 2026)

For more information about British American Tobacco p.l.c., please visit the official website: bat.com