Home > Analyses > Industrials > Booz Allen Hamilton Holding Corporation

Booz Allen Hamilton Holding Corporation transforms how governments and businesses harness technology and analytics to tackle complex challenges. As a premier consulting services firm, it leads with cutting-edge solutions in artificial intelligence, cyber risk management, and digital engineering, earning a reputation for innovation and reliability. With deep expertise and a broad client base, Booz Allen shapes critical operations worldwide. The key question for investors now is whether its strong fundamentals support continued growth and justify its current market valuation.

Table of contents

Business Model & Company Overview

Booz Allen Hamilton Holding Corporation, founded in 1914 and headquartered in McLean, Virginia, stands as a leader in consulting services. Its core mission integrates management, technology consulting, analytics, engineering, digital solutions, and cyber services into a unified ecosystem that addresses complex challenges for governments, corporations, and nonprofits globally. This comprehensive approach positions Booz Allen as a dominant force shaping strategic and operational transformations across industries.

The company’s revenue engine balances high-value consulting solutions with advanced analytics, AI-driven services, and cyber risk management, creating a robust mix of recurring and project-based income. Booz Allen’s strategic footprint spans the Americas, Europe, and Asia, enabling it to serve diverse markets effectively. Its competitive advantage lies in delivering cutting-edge, mission-critical solutions that build a strong economic moat, securing its role in the future of consulting and technology innovation.

Financial Performance & Fundamental Metrics

This section analyzes Booz Allen Hamilton Holding Corporation’s income statement, key financial ratios, and dividend payout policy to assess its financial health and investment potential.

Income Statement

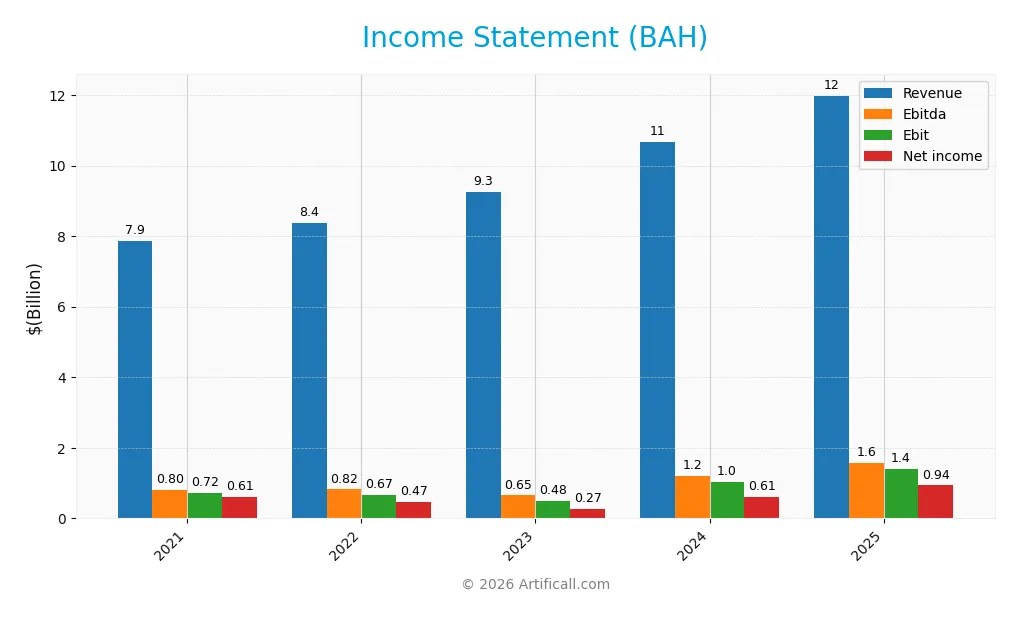

The table below presents Booz Allen Hamilton Holding Corporation’s key income statement figures for fiscal years 2021 through 2025, reflecting revenue, expenses, profitability, and earnings per share.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 7.86B | 8.36B | 9.26B | 10.66B | 11.98B |

| Cost of Revenue | 3.66B | 3.90B | 4.30B | 4.92B | 5.42B |

| Operating Expenses | 3.45B | 3.78B | 4.51B | 4.73B | 5.19B |

| Gross Profit | 4.20B | 4.46B | 4.95B | 5.74B | 6.56B |

| EBITDA | 803M | 820M | 650M | 1.20B | 1.57B |

| EBIT | 719M | 674M | 485M | 1.04B | 1.41B |

| Interest Expense | 61M | 95M | 121M | 188M | 196M |

| Net Income | 609M | 467M | 272M | 606M | 935M |

| EPS | 4.40 | 3.46 | 2.04 | 4.61 | 7.28 |

| Filing Date | 2021-05-21 | 2022-05-20 | 2023-05-26 | 2024-05-24 | 2025-05-23 |

Income Statement Evolution

From 2021 to 2025, Booz Allen Hamilton’s revenue rose by 52.44% to $11.98B, with net income increasing 53.54% to $930M. The gross margin remained robust at 54.77%, reflecting stable cost control, while the net margin showed slight improvement, growing 0.72% overall. EBIT margin also improved, supporting stronger profitability.

Is the Income Statement Favorable?

In 2025, the company reported a favorable income statement with a net margin of 7.8% and an EBIT margin of 11.76%. Revenue grew 12.36% year-over-year, with net income up 37.38%, and EPS surged 57.95%. Interest expense was relatively low at 1.64% of revenue. Overall, fundamentals appear solid with strong margin expansion and earnings growth.

Financial Ratios

The following table summarizes key financial ratios for Booz Allen Hamilton Holding Corporation (BAH) over the fiscal years 2021 to 2025:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 7.7% | 5.6% | 2.9% | 5.7% | 7.8% |

| ROE | 56.8% | 44.6% | 27.4% | 57.9% | 93.2% |

| ROIC | 15.97% | 11.47% | 6.94% | 14.45% | 18.80% |

| P/E | 18.2 | 25.2 | 45.1 | 32.1 | 14.3 |

| P/B | 10.4 | 11.3 | 12.3 | 18.6 | 13.3 |

| Current Ratio | 2.04 | 1.59 | 1.21 | 1.62 | 1.79 |

| Quick Ratio | 2.04 | 1.59 | 1.21 | 1.62 | 1.79 |

| D/E | 2.50 | 2.96 | 3.09 | 3.47 | 4.21 |

| Debt-to-Assets | 49% | 51% | 47% | 55% | 58% |

| Interest Coverage | 12.4 | 7.2 | 3.7 | 5.4 | 7.0 |

| Asset Turnover | 1.43 | 1.39 | 1.41 | 1.62 | 1.64 |

| Fixed Asset Turnover | 17.7 | 19.5 | 24.2 | 29.5 | 33.7 |

| Dividend Yield | 1.63% | 1.77% | 1.93% | 1.31% | 2.01% |

Evolution of Financial Ratios

From 2021 to 2025, Booz Allen Hamilton Holding Corporation’s Return on Equity (ROE) exhibited strong growth, reaching an exceptional 93.22% in 2025, signaling a significant rise in profitability. The Current Ratio improved steadily from 2.04 in 2021 to 1.79 in 2025, reflecting stable liquidity. However, the Debt-to-Equity Ratio increased notably, peaking at 4.21 in 2025, indicating a higher reliance on debt financing.

Are the Financial Ratios Fovorable?

In 2025, profitability ratios such as ROE (93.22%) and Return on Invested Capital (18.8%) are favorable, supported by a solid interest coverage ratio of 7.19. Liquidity is strong with a Current and Quick Ratio of 1.79. Efficiency ratios like asset turnover (1.64) and fixed asset turnover (33.75) are positive. Conversely, leverage ratios including Debt-to-Equity (4.21) and Debt-to-Assets (57.7%) are unfavorable, while market valuation shows a mixed picture with a favorable P/E of 14.29 but an unfavorable Price-to-Book of 13.32. Overall, 71.43% of ratios indicate a favorable financial position.

Shareholder Return Policy

Booz Allen Hamilton Holding Corporation pays dividends with a payout ratio around 29% in 2025, showing a moderate and stable distribution supported by a 2.0% dividend yield. Dividend coverage by free cash flow remains strong, and the company also engages in share buybacks, balancing cash returns to shareholders.

This approach indicates a prudent distribution policy that aligns dividend payments with earnings and cash flow generation, supporting sustainable long-term value creation. The combination of dividends and buybacks suggests a balanced capital allocation without excessive risk of unsustainable payouts or over-leveraging.

Score analysis

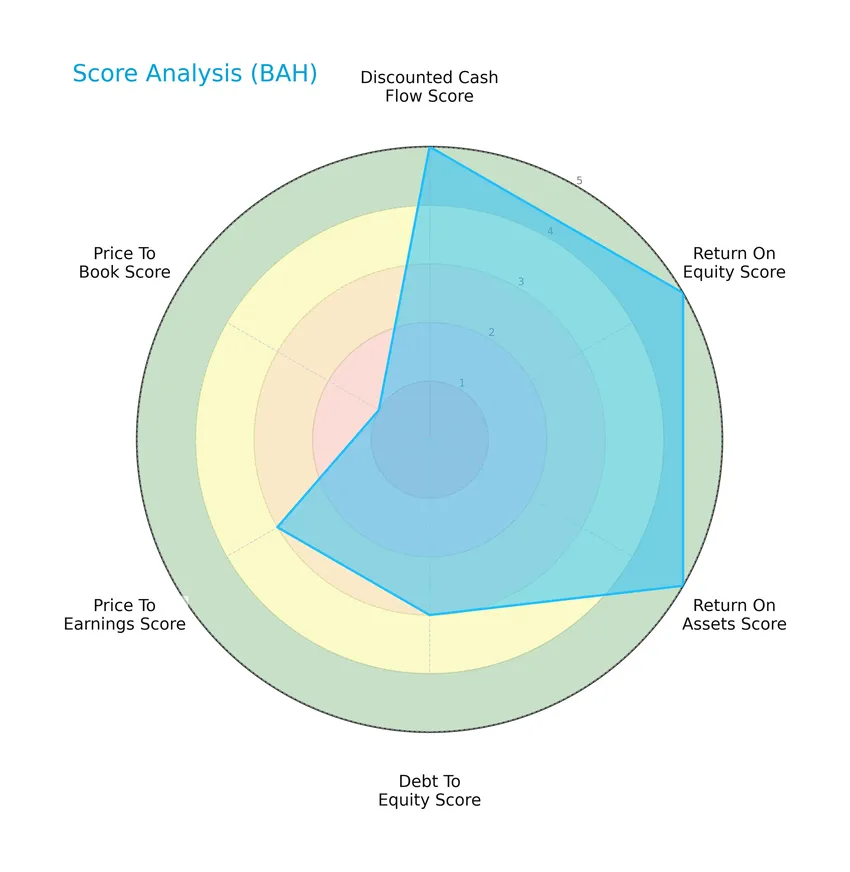

The following radar chart illustrates the company’s key financial scores for a comprehensive overview:

Booz Allen Hamilton Holding Corporation demonstrates very favorable scores in discounted cash flow, return on equity, and return on assets, each rated 5. The debt-to-equity and price-to-earnings scores are moderate at 3, while the price-to-book score is notably low at 1, indicating some valuation concerns.

Analysis of the company’s bankruptcy risk

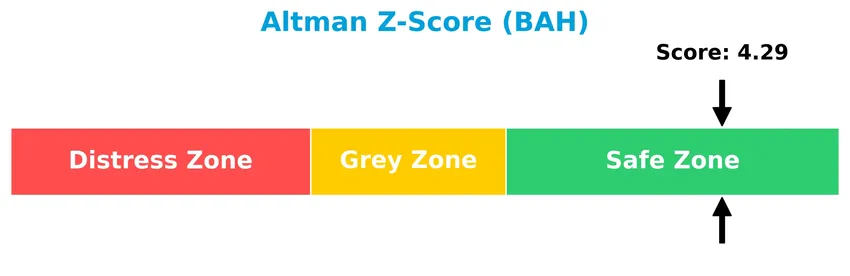

The Altman Z-Score places the company firmly in the safe zone, indicating a low risk of bankruptcy and solid financial stability:

Is the company in good financial health?

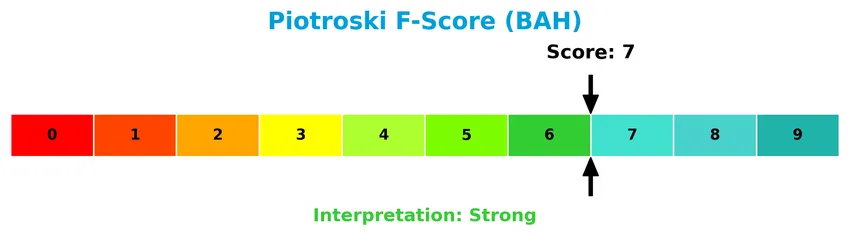

The Piotroski diagram below summarizes the company’s financial strength based on multiple criteria:

With a Piotroski score of 7, Booz Allen Hamilton Holding Corporation is considered financially strong, reflecting solid profitability, efficiency, and liquidity metrics supportive of its overall financial health.

Competitive Landscape & Sector Positioning

This sector analysis will examine Booz Allen Hamilton Holding Corporation’s strategic positioning, revenue breakdown, key products, and main competitors. I will also assess whether Booz Allen Hamilton holds a competitive advantage over its peers in the consulting services industry.

Strategic Positioning

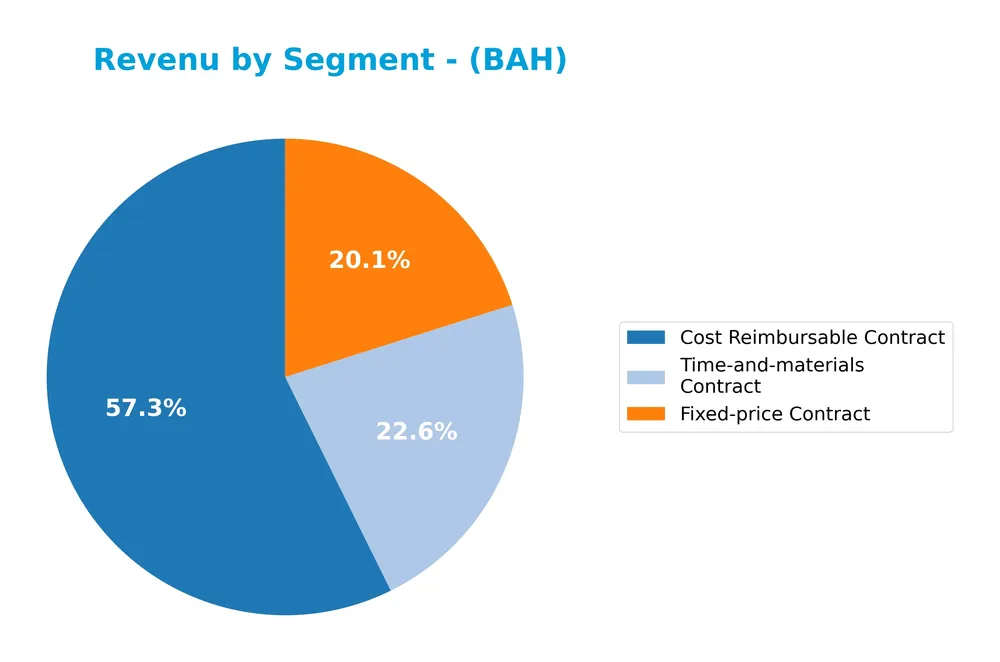

Booz Allen Hamilton concentrates its revenue in the U.S. market, generating over $10B in 2024, with no disclosed international revenue. Its product portfolio is diversified across contract types: cost reimbursable dominates with $6.9B in 2025, complemented by fixed-price ($2.4B) and time-and-materials contracts ($2.7B).

Revenue by Segment

This pie chart illustrates Booz Allen Hamilton’s revenue distribution by contract type for the fiscal year 2025, highlighting the company’s diverse income streams.

In 2025, Booz Allen Hamilton’s revenue is primarily driven by Cost Reimbursable Contracts at 6.9B, followed by Time-and-materials Contracts at 2.7B, and Fixed-price Contracts at 2.4B. The data shows consistent growth across all segments since 2019, with Cost Reimbursable Contracts accelerating notably. This diversification reduces concentration risk while emphasizing the importance of flexible contract types in the firm’s portfolio.

Key Products & Brands

The table below highlights Booz Allen Hamilton Holding Corporation’s main contract types and their associated services:

| Product | Description |

|---|---|

| Cost Reimbursable Contract | Contracts where costs are reimbursed along with an agreed-upon fee, supporting flexible project execution. |

| Fixed-price Contract | Contracts with a set price regardless of incurred costs, emphasizing predictability and risk control. |

| Time-and-materials Contract | Contracts billed based on actual time and materials used, allowing adaptability to changing project needs. |

Booz Allen Hamilton’s revenue is segmented primarily across these three contract types, reflecting its consulting and technology services model focused on government and commercial clients. Each contract type supports different project risk and pricing structures.

Main Competitors

There are 3 competitors in the Consulting Services industry, with the table below listing the top 3 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Verisk Analytics, Inc. | 30.8B |

| Equifax Inc. | 26.5B |

| Booz Allen Hamilton Holding Corporation | 10.5B |

Booz Allen Hamilton Holding Corporation ranks 3rd among its competitors, with a market cap at 40.9% of the leader, Verisk Analytics. It is positioned below both the average market cap of the top 10 (22.6B) and the median market cap in its sector (26.5B). The company maintains a 110.3% gap in market cap below its nearest competitor, Equifax.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does BAH have a competitive advantage?

Booz Allen Hamilton Holding Corporation presents a clear competitive advantage, demonstrated by its very favorable moat status marked by a ROIC surpassing WACC by nearly 14% and a strong upward ROIC trend of 17.7%. The company shows efficient capital use and growing profitability, indicating durable value creation.

Looking ahead, BAH’s future outlook is supported by its expansion in advanced analytics, artificial intelligence, automation, and cyber risk management services. These innovations, combined with its established presence in government consulting, position the firm well to capture new market opportunities and sustain growth.

SWOT Analysis

This SWOT analysis highlights Booz Allen Hamilton Holding Corporation’s key internal strengths and weaknesses alongside external opportunities and threats to guide strategic investment decisions.

Strengths

- Strong revenue growth of 52% over 5 years

- High ROE at 93% indicating efficient capital use

- Durable competitive advantage with growing ROIC

- Favorable income statement margins and improving profitability

Weaknesses

- High debt-to-equity ratio of 4.21

- Unfavorable price-to-book ratio of 13.32

- Geographic revenue dependence primarily on US market

Opportunities

- Expansion into AI, quantum computing, and cyber services

- Increasing government and corporate digital transformation demand

- Potential for international market diversification

Threats

- Intense competition in consulting and technology sectors

- Regulatory and government spending uncertainties

- Economic downturns impacting client budgets

Overall, Booz Allen Hamilton demonstrates robust financial health and competitive positioning supported by strong growth and profitability. However, its high leverage and reliance on the US market require cautious monitoring. Strategic focus on innovation and geographic diversification will be critical to mitigate risks and sustain long-term value creation.

Stock Price Action Analysis

The weekly stock chart below illustrates Booz Allen Hamilton Holding Corporation’s price movements and key levels over the past 12 months:

Trend Analysis

Over the past 12 months, Booz Allen Hamilton’s stock price declined by 31.01%, indicating a bearish trend with accelerating downward momentum. The price fluctuated between a high of 183.5 and a low of 80.78, reflecting significant volatility with a standard deviation of 26.1. However, a recent period between November 2025 and January 2026 shows a 16.9% price increase, suggesting a short-term recovery phase.

Volume Analysis

Trading volumes have been increasing overall, with total volume at 877M shares. Sellers dominated historically with 55.28% of volume, but recent activity since November 2025 reveals a slight buyer dominance of 59.46%. This shift indicates growing investor interest and potentially improving market participation favoring buyers in the near term.

Target Prices

The consensus target prices for Booz Allen Hamilton Holding Corporation (BAH) indicate moderate upside potential.

| Target High | Target Low | Consensus |

|---|---|---|

| 106 | 80 | 94.4 |

Analysts expect the stock to trade between $80 and $106, with a consensus target near $94, suggesting cautious optimism in the near term.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews recent analyst ratings and consumer feedback regarding Booz Allen Hamilton Holding Corporation’s market performance.

Stock Grades

Here is a summary of the latest verified stock grades for Booz Allen Hamilton Holding Corporation from reputable analysts:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Neutral | 2026-01-13 |

| Jefferies | Maintain | Hold | 2025-12-18 |

| Goldman Sachs | Maintain | Sell | 2025-10-27 |

| JP Morgan | Maintain | Underweight | 2025-10-27 |

| UBS | Maintain | Neutral | 2025-10-27 |

| TD Cowen | Downgrade | Hold | 2025-10-17 |

| UBS | Maintain | Neutral | 2025-07-28 |

| Stifel | Maintain | Hold | 2025-07-28 |

| JP Morgan | Maintain | Underweight | 2025-07-28 |

| William Blair | Upgrade | Outperform | 2025-07-22 |

The overall trend shows a predominance of neutral to hold ratings with occasional downgrades and few upgrades, reflecting a cautious analyst outlook with some divergence on performance expectations. The consensus remains a Hold based on 9 buy and 10 hold ratings, balanced by 2 sell opinions.

Consumer Opinions

Consumers have expressed a mix of admiration and constructive criticism regarding Booz Allen Hamilton Holding Corporation, reflecting varied experiences with the company’s services and corporate culture.

| Positive Reviews | Negative Reviews |

|---|---|

| Strong expertise in consulting and government projects | Occasionally slow response times on client inquiries |

| Professional and knowledgeable staff | High billing rates compared to competitors |

| Good work-life balance reported by employees | Some clients find project delivery timelines tight |

| Innovative solutions tailored to client needs | Internal bureaucracy can delay decision-making |

Overall, Booz Allen Hamilton is praised for its consulting expertise and professional team, though clients and employees note challenges with pricing and operational efficiency. These insights suggest opportunities for improvement in responsiveness and project management.

Risk Analysis

Below is a summary table highlighting key risks that investors should consider when evaluating Booz Allen Hamilton Holding Corporation (BAH):

| Category | Description | Probability | Impact |

|---|---|---|---|

| Leverage Risk | High debt-to-equity ratio (4.21) and debt-to-assets (57.7%) increase financial leverage risk. | Medium | High |

| Valuation Risk | Unfavorable price-to-book ratio (13.32) suggests potential overvaluation. | Medium | Medium |

| Market Volatility | Low beta (0.338) implies less sensitivity but potential limited upside in volatile markets. | Low | Medium |

| Operational Risk | Dependency on government contracts exposes the company to changes in public sector budgets. | Medium | High |

| Cybersecurity Risk | As a cyber services provider, evolving cyber threats could impact reputation and revenues. | Medium | High |

The most significant risks are Booz Allen’s elevated financial leverage and dependency on government contracts, which can affect earnings stability. Despite a safe Altman Z-Score (4.29) and strong Piotroski Score (7), caution is warranted due to valuation concerns and sector-specific operational risks.

Should You Buy Booz Allen Hamilton Holding Corporation?

Booz Allen Hamilton appears to be delivering robust profitability supported by a durable competitive moat with growing returns on invested capital. Despite moderate leverage, its overall rating of A suggests a favorable value creation profile and solid operational efficiency.

Strength & Efficiency Pillars

Booz Allen Hamilton Holding Corporation exhibits strong profitability and operational efficiency, underscored by a return on equity of 93.22% and a robust return on invested capital (ROIC) of 18.8%. With a weighted average cost of capital (WACC) at 5%, the company’s ROIC significantly exceeds its WACC, confirming it as a clear value creator. Financial health metrics further support this stability, with an Altman Z-Score of 4.29 placing it firmly in the safe zone and a Piotroski Score of 7 reflecting strong financial strength. Additionally, favorable margins and an improving ROIC trend underline its durable competitive advantage.

Weaknesses and Drawbacks

Despite these strengths, Booz Allen Hamilton faces notable valuation and leverage concerns. The price-to-book ratio stands at an elevated 13.32, signaling a potentially overpriced equity relative to book value, which may deter value-focused investors. The debt-to-equity ratio of 4.21 and a debt-to-assets ratio of 57.7% indicate significant leverage, posing risks in volatile market conditions. While liquidity ratios remain favorable, the high leverage could limit financial flexibility. The overall bearish stock trend with a 31.01% price decline over the long term adds market pressure, although recent periods show slight buyer dominance.

Our Verdict about Booz Allen Hamilton Holding Corporation

The company’s long-term fundamental profile appears favorable given its strong profitability, value creation, and financial health. However, the current bearish stock trend and elevated leverage suggest caution. Despite recent signs of buyer dominance and a moderate price recovery of 16.9%, the valuation and market pressure imply that Booz Allen Hamilton might appear more suitable for investors with a higher risk tolerance or those seeking a strategic entry point in the medium term.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Booz Allen Hamilton Announces Third Quarter Fiscal Year 2026 Results – Business Wire (Jan 23, 2026)

- Defense Giant Booz Allen Hits Record Backlog, Hikes Dividend – Benzinga (Jan 23, 2026)

- Booz Allen Hamilton Holding Corp (BAH) Q3 2026 Earnings Call Highlights: Navigating Challenges … – Yahoo Finance (Jan 23, 2026)

- Booz Allen Hamilton Holding Corporation (NYSE:BAH) Receives Average Recommendation of “Hold” from Analysts – MarketBeat (Jan 23, 2026)

- Booz Allen Teams Up with Andreessen Horowitz, Boosting US Tech Leadership – StocksToTrade (Jan 23, 2026)

For more information about Booz Allen Hamilton Holding Corporation, please visit the official website: boozallen.com