Home > Analyses > Technology > Block, Inc.

Block, Inc. revolutionizes the way businesses and consumers handle payments, seamlessly integrating hardware and software to transform everyday transactions. As a trailblazer in the software infrastructure space, Block’s flagship products—ranging from versatile point-of-sale systems to the popular Cash App—underscore its commitment to innovation and market influence. With a global footprint and a reputation for quality, the key question remains: does Block’s current financial strength and growth trajectory justify its market valuation in 2026?

Table of contents

Business Model & Company Overview

Block, Inc., founded in 2009 and headquartered in Oakland, California, has established itself as a leader in the software infrastructure sector. It develops an integrated ecosystem of payment tools and analytics designed to empower sellers with seamless card payment acceptance and next-day settlements. Its diverse hardware lineup, including magstripe and chip readers, Square Stand, and Square Terminal, complements its extensive suite of software products such as Square Point of Sale and Cash App, forming a cohesive platform that serves multiple markets.

The company’s revenue engine balances hardware sales with recurring software and service fees, driving consistent value creation. Block maintains a strategic presence across major global markets including the United States, Canada, Japan, Australia, and several European countries. By combining innovative payment technology with comprehensive business management solutions, Block has built a formidable economic moat, positioning itself as a key architect of the future financial ecosystem.

Financial Performance & Fundamental Metrics

In this section, I analyze Block, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its financial health and investment potential.

Income Statement

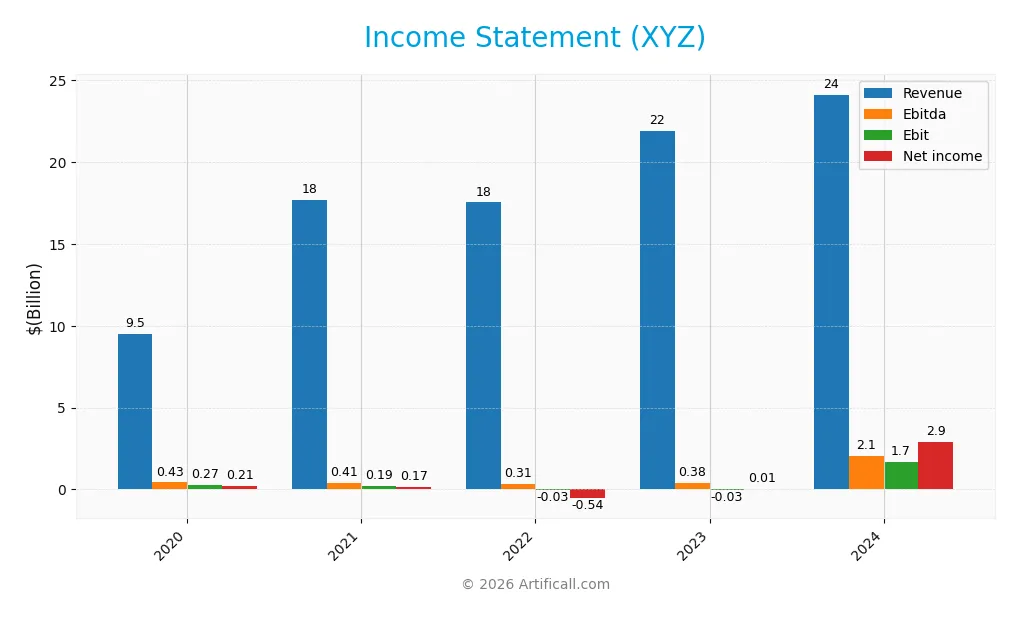

The table below summarizes Block, Inc.’s key income statement figures for fiscal years 2020 through 2024, reflecting revenue, expenses, and profitability metrics.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 9.5B | 17.7B | 17.5B | 21.9B | 24.1B |

| Cost of Revenue | 6.8B | 13.4B | 11.5B | 14.6B | 15.2B |

| Operating Expenses | 2.5B | 3.8B | 6.6B | 6.7B | 8.0B |

| Gross Profit | 2.7B | 4.3B | 6.0B | 7.3B | 8.9B |

| EBITDA | 427M | 408M | 313M | 379M | 2.1B |

| EBIT | 273M | 191M | -27M | -29M | 1.7B |

| Interest Expense | 57M | 33M | 36M | 0 | 9M |

| Net Income | 213M | 166M | -541M | 10M | 2.9B |

| EPS | 0.48 | 0.36 | -0.93 | 0.016 | 4.7 |

| Filing Date | 2021-02-23 | 2022-02-24 | 2023-02-23 | 2024-02-22 | 2025-02-24 |

Income Statement Evolution

From 2020 to 2024, Block, Inc. demonstrated robust growth with revenue increasing by 154% to $24.1B and net income surging over 1259% to $2.9B. Gross margin improved to 36.85%, reflecting better cost management, while EBIT margin remained neutral at 6.99%. The net margin advanced significantly, reaching 12.01%, indicating enhanced profitability despite operating expenses growing in line with revenue.

Is the Income Statement Favorable?

The 2024 income statement shows strong fundamentals, with revenue growing 10.1% year-over-year and gross profit up 21.3%. EBIT expanded dramatically by 5887%, driving a substantial rise in net margin and EPS growth exceeding 28,000%. Interest expense remains low at 0.04% of revenue, which is favorable. Overall, 85.7% of income statement metrics are positive, signaling a generally favorable financial position for investors.

Financial Ratios

The table below presents key financial ratios for Block, Inc. (ticker: XYZ) over the fiscal years 2020 to 2024, offering insight into profitability, liquidity, leverage, and market valuation:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 2.24% | 0.94% | -3.08% | 0.04% | 12.01% |

| ROE | 7.95% | 5.08% | -3.14% | 0.05% | 13.62% |

| ROIC | 2.66% | 5.06% | -2.55% | 1.84% | 3.03% |

| P/E | 453x | 445x | -67x | 4819x | 18x |

| P/B | 36.0x | 22.6x | 2.11x | 2.52x | 2.47x |

| Current Ratio | 1.88 | 1.94 | 1.85 | 2.01 | 2.33 |

| Quick Ratio | 1.87 | 1.92 | 1.84 | 1.99 | 2.31 |

| D/E | 1.30 | 1.69 | 0.37 | 0.32 | 0.37 |

| Debt-to-Assets | 35.4% | 39.6% | 20.2% | 18.4% | 21.5% |

| Interest Coverage | 3.0x | 13.8x | -17.2x | 0.0 | 95.9x |

| Asset Turnover | 0.96 | 1.27 | 0.56 | 0.66 | 0.66 |

| Fixed Asset Turnover | 13.8x | 24.1x | 25.0x | 40.5x | 45.1x |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

From 2020 to 2024, Block, Inc.’s Return on Equity (ROE) showed volatility, rising from 7.95% in 2020 to a peak, then stabilizing at 13.62% in 2024. The Current Ratio improved steadily, reaching 2.33 in 2024, indicating better short-term liquidity. The Debt-to-Equity ratio declined from 1.69 in 2021 to 0.37 in 2024, reflecting a significant reduction in leverage and enhanced financial stability. Profitability margins, notably net margin, improved markedly from negative or near zero levels to 12.01% in 2024.

Are the Financial Ratios Fovorable?

In 2024, Block, Inc.’s ratios present a mixed but slightly favorable picture. Profitability shows strength with a favorable net margin of 12.01%, while ROE and price multiples like P/E and P/B are neutral, suggesting moderate returns relative to valuation. Liquidity ratios, including current and quick ratios above 2, are favorable, indicating strong short-term financial health. Leverage ratios, such as debt-to-equity at 0.37 and debt-to-assets at 21.53%, are favorable, signalling controlled debt levels. However, return on invested capital (3.03%) and weighted average cost of capital (14.32%) are unfavorable, pointing to some concerns in capital efficiency and cost.

Shareholder Return Policy

Block, Inc. does not pay dividends, reflecting a strategy focused on reinvestment and growth rather than immediate shareholder payouts. Despite positive net profit margins in recent years, the company shows no dividend yield or payout ratio, indicating prioritization of capital allocation towards operations or acquisitions.

The absence of dividends is complemented by no disclosed share buyback programs. This lack of direct shareholder distributions suggests a long-term value creation approach, relying on business expansion and profitability improvements rather than cash returns to investors at this stage.

Score analysis

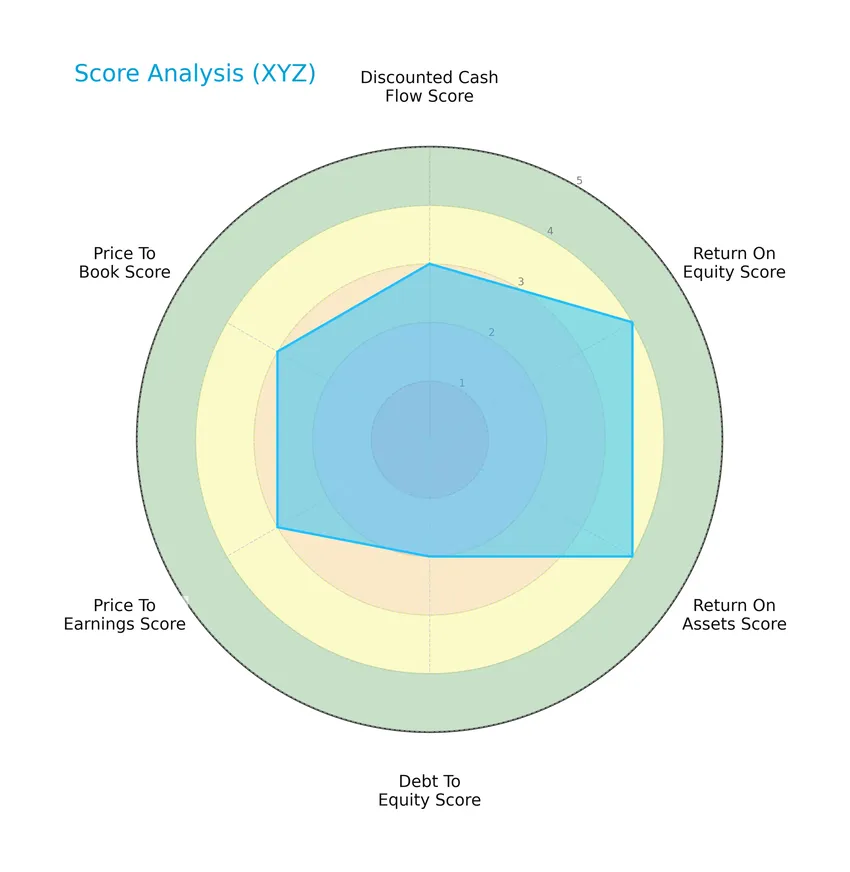

The following radar chart presents a detailed overview of Block, Inc.’s key financial scores across multiple valuation and performance metrics:

Block, Inc. shows a moderate discounted cash flow score of 3 and moderate price-to-earnings and price-to-book scores of 3 each. Its return on equity and return on assets scores are favorable at 4, while the debt-to-equity score is moderate at 2, reflecting balanced financial leverage.

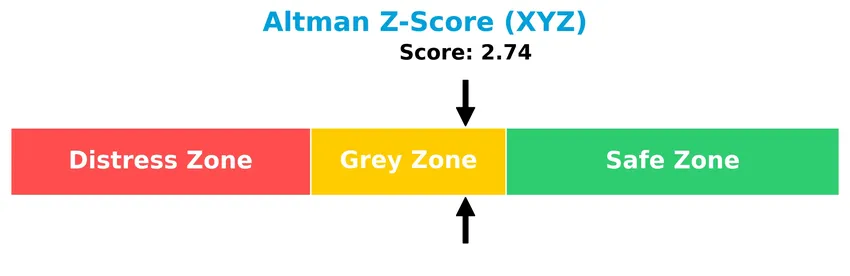

Analysis of the company’s bankruptcy risk

Block, Inc.’s Altman Z-Score places it in the grey zone, indicating a moderate risk of bankruptcy and some financial uncertainty:

Is the company in good financial health?

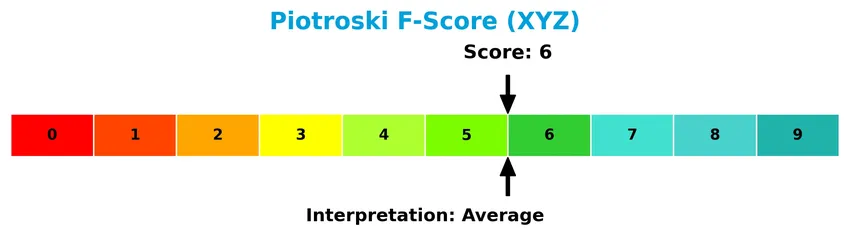

The Piotroski Score diagram illustrates Block, Inc.’s financial health based on nine profitability and efficiency criteria:

With a Piotroski Score of 6, Block, Inc. is considered to have average financial strength, suggesting a stable but not exceptional financial condition.

Competitive Landscape & Sector Positioning

This sector analysis will examine Block, Inc.’s strategic positioning, revenue segments, key products, and main competitors. I will assess whether Block, Inc. holds a competitive advantage over its peers in the software infrastructure industry.

Strategic Positioning

Block, Inc. maintains a diversified product portfolio across software, cryptocurrency assets, hardware, and transaction services, with dominant revenue from software and cryptocurrency. Geographically, it is heavily concentrated in the United States, generating over 90% of its $24.4B 2024 revenue domestically, with limited but growing international exposure.

Revenue by Segment

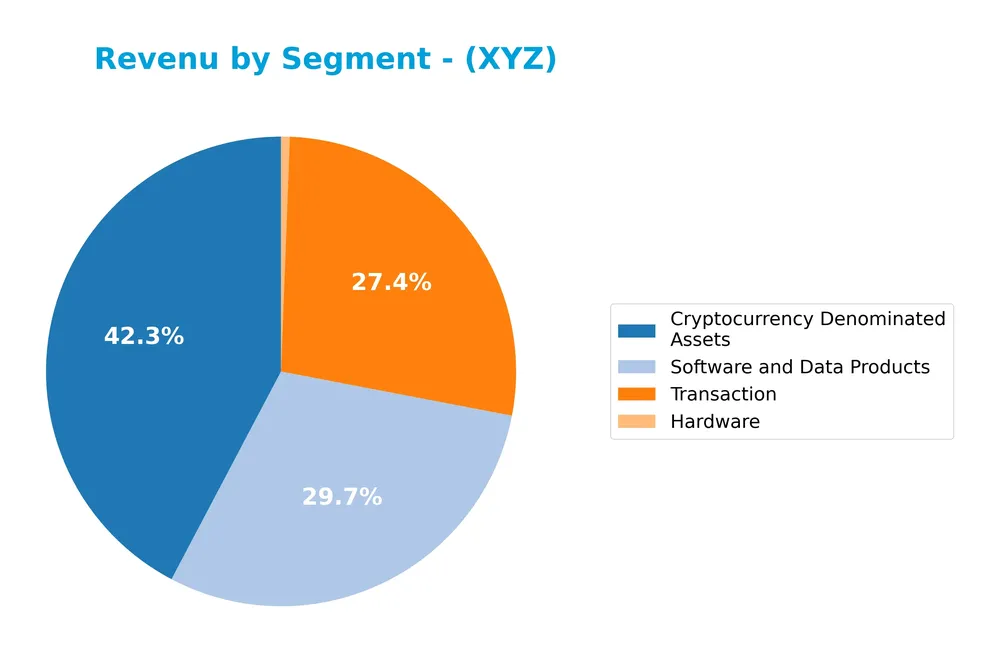

The pie chart illustrates Block, Inc.’s revenue distribution across its main product segments for the fiscal year 2024.

In 2024, Cryptocurrency Denominated Assets and Software and Data Products were the primary revenue drivers, generating 10.2B and 7.2B USD respectively. Transaction revenues also showed strength with 6.6B USD, while Hardware remained a minor contributor at 143M USD. The latest year highlights continued growth in software and crypto assets, suggesting an expanding focus on digital products and services with moderate diversification risk.

Key Products & Brands

The following table highlights Block, Inc.’s main products and services, reflecting its diversified revenue streams:

| Product | Description |

|---|---|

| Software and Data Products | Includes Square Point of Sale, Square Appointments, Square for Retail, Square for Restaurants, Square Online platforms, and developer APIs and SDKs. |

| Cryptocurrency Denominated Assets | Revenue from Cash App, which enables sending, spending, and storing money, including cryptocurrency transactions. |

| Hardware | Payment devices such as Magstripe reader, Contactless and chip reader, Square Stand, Square Register, and Square Terminal. |

| Transaction | Fees and revenue generated from payment processing services enabling card acceptance, reporting, analytics, and next-day settlement. |

Block, Inc. offers a comprehensive suite of payment hardware, software solutions, and cryptocurrency services, supporting sellers and consumers across multiple countries.

Main Competitors

There are 32 competitors in total, with the table below listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Microsoft Corporation | 3.52T |

| Oracle Corporation | 553B |

| Palantir Technologies Inc. | 383B |

| Adobe Inc. | 140B |

| Palo Alto Networks, Inc. | 120B |

| CrowdStrike Holdings, Inc. | 113B |

| Synopsys, Inc. | 92B |

| Cloudflare, Inc. | 69B |

| Fortinet, Inc. | 59B |

| Block, Inc. | 39.6B |

Block, Inc. ranks 10th among its 32 competitors, holding a market cap just 1.16% of the leader, Microsoft Corporation. The company sits below the average market cap of the top 10 competitors (508B) but remains above the sector median (18.8B). Notably, Block has a significant 46% market cap gap to the next competitor above it, indicating a clear separation in scale from larger peers.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does Block have a competitive advantage?

Block, Inc. currently does not present a strong competitive advantage as its return on invested capital (ROIC) is below its weighted average cost of capital (WACC), indicating value destruction despite a growing ROIC trend. The company’s overall moat status is slightly unfavorable, reflecting ongoing challenges in generating excess returns above its capital costs.

Looking ahead, Block’s diverse product portfolio—including payment hardware, point-of-sale software, and financial services platforms like Cash App—positions it to expand across multiple geographies and markets. Continued innovation in software development kits and API integrations could offer new growth opportunities and enhance its competitive positioning over time.

SWOT Analysis

This SWOT analysis highlights Block, Inc.’s key internal and external factors to inform strategic investment decisions.

Strengths

- Strong revenue growth of 10% in past year

- Diverse product ecosystem including hardware and software

- Favorable net margin of 12%

Weaknesses

- ROIC below WACC indicating value destruction

- High beta of 2.665 implying elevated stock volatility

- No dividend yield limiting income investors

Opportunities

- Expanding international revenue outside US

- Growing fintech and digital payment market

- Increasing adoption of developer platform APIs

Threats

- Intense competition in payment processing

- Regulatory risks in multiple countries

- Economic downturn impacting merchant sales

Overall, Block, Inc. demonstrates robust growth and a solid product suite but faces challenges from profitability efficiency and market volatility. Strategic focus on improving capital returns and expanding global footprint can mitigate risks and leverage growth opportunities.

Stock Price Action Analysis

The weekly stock chart below illustrates price fluctuations of Block, Inc. (ticker: XYZ) over the last 100 weeks:

Trend Analysis

Over the past 12 months, the stock price declined by 15.7%, indicating a bearish trend with accelerating downward momentum. The price ranged between a high of 98.25 and a low of 46.53, with notable volatility reflected by a standard deviation of 10.4.

Volume Analysis

In the last three months, trading volume shows a slight buyer dominance at 54.34%, though overall volume is decreasing. This suggests moderate investor participation with cautious buying interest prevailing amid reduced market activity.

Target Prices

The target price consensus for Block, Inc. indicates moderate upside potential according to current analyst estimates.

| Target High | Target Low | Consensus |

|---|---|---|

| 100 | 65 | 84.73 |

Analysts expect the stock to trade between 65 and 100, with a consensus target price around 85, reflecting cautious optimism in the near term.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the latest grades and consumer feedback regarding Block, Inc. (ticker: XYZ).

Stock Grades

Here are the latest verified stock grades for Block, Inc. from reputable grading companies:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Underweight | 2026-01-14 |

| Keefe, Bruyette & Woods | Maintain | Outperform | 2026-01-02 |

| Needham | Maintain | Buy | 2025-11-24 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-21 |

| B of A Securities | Maintain | Buy | 2025-11-21 |

| RBC Capital | Maintain | Outperform | 2025-11-20 |

| BTIG | Maintain | Buy | 2025-11-20 |

| Mizuho | Maintain | Outperform | 2025-11-20 |

| Stephens & Co. | Maintain | Overweight | 2025-11-20 |

| BTIG | Maintain | Buy | 2025-11-14 |

The grades show a predominance of buy and outperform ratings, with a few hold and underweight assessments, reflecting a generally positive but cautious analyst sentiment towards Block, Inc.

Consumer Opinions

Consumers express a mix of enthusiasm and concern regarding Block, Inc.’s products and services, reflecting a diverse user experience.

| Positive Reviews | Negative Reviews |

|---|---|

| “Innovative payment solutions that simplify transactions.” | “Customer support response times can be slow.” |

| “User-friendly app interface with seamless integration.” | “Occasional glitches during high-traffic periods.” |

| “Strong commitment to security and data protection.” | “Fees are higher compared to some competitors.” |

Overall, consumers appreciate Block, Inc.’s innovation and security features but frequently mention issues with customer service responsiveness and occasional technical glitches as areas needing improvement.

Risk Analysis

Below is a summary table highlighting key risk categories, their descriptions, probabilities, and potential impacts for Block, Inc.:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | High beta (2.665) indicates significant stock price fluctuations. | High | High |

| Financial Health | Altman Z-Score in grey zone (2.74) suggests moderate bankruptcy risk. | Moderate | High |

| Profitability | ROIC (3.03%) below WACC (14.32%) signals possible value destruction. | Moderate | Moderate |

| Competition | Intense competition in payment processing and software infrastructure. | High | Moderate |

| Dividend Policy | No dividend yield may deter income-focused investors. | High | Low |

| Regulatory Risk | Operating in multiple countries exposes the company to varying regulations. | Moderate | Moderate |

The most pressing risks for Block, Inc. are its high market volatility and moderate financial distress risk indicated by the Altman Z-Score. While profitability challenges persist with ROIC below WACC, the company maintains favorable liquidity and debt ratios, which somewhat mitigate financial risk. Investors should watch these factors closely amid a competitive and regulated environment.

Should You Buy Block, Inc.?

Block, Inc. appears to be improving its operational efficiency with growing profitability, despite a slightly unfavorable moat indicating value erosion. The company maintains a manageable leverage profile and earns a very favorable B+ rating, suggesting a moderate investment appeal overall.

Strength & Efficiency Pillars

Block, Inc. exhibits solid profitability metrics, with a net margin of 12.01% and a return on equity (ROE) of 13.62%, supported by a favorable gross margin of 36.85%. Its financial health is underscored by a strong current ratio of 2.33 and a low debt-to-equity ratio of 0.37, indicating sound liquidity and moderate leverage. Although the Altman Z-Score at 2.74 places the company in the grey zone for bankruptcy risk, its Piotroski score of 6 signals average financial strength. However, the return on invested capital (ROIC) of 3.03% falls below the weighted average cost of capital (WACC) of 14.32%, indicating that Block, Inc. is currently not a value creator.

Weaknesses and Drawbacks

The company faces valuation and profitability challenges that warrant caution. Its price-to-earnings (P/E) ratio of 18.1 and price-to-book (P/B) ratio of 2.47 reflect a moderate valuation, which may limit upside potential relative to peers. Despite favorable leverage ratios, the ROIC being significantly lower than WACC suggests value destruction, raising concerns about capital efficiency. Market pressure is evident in the overall bearish stock trend with a price decline of 15.7% over the longer term, although recent buyer dominance at 54.34% suggests some stabilization. Additionally, the absence of dividend yield may deter income-focused investors.

Our Verdict about Block, Inc.

Block, Inc. presents a fundamentally mixed profile with moderate profitability and financial stability but lacks value creation as ROIC trails WACC. Despite the overall bearish stock trend, recent market behavior shows slight buyer dominance, which might indicate emerging interest. Therefore, despite some long-term strengths, recent market pressure suggests a wait-and-see approach for a better entry point, as the investment case may appear cautiously favorable but still requires close monitoring.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Strs Ohio Sells 66,296 Shares of Block, Inc. $XYZ – MarketBeat (Jan 25, 2026)

- Did Block’s US$200 Billion Data‑Driven Lending Push Just Shift Its (SQ) Investment Narrative? – simplywall.st (Jan 25, 2026)

- Assessing Block (XYZ) Valuation After Fresh Buy Ratings On Bitcoin And BNPL Growth – Yahoo Finance (Jan 09, 2026)

- Envestnet Portfolio Solutions Inc. Takes $5.86 Million Position in Block, Inc. $XYZ – MarketBeat (Jan 25, 2026)

- Block Inc (XYZ) Shares Up 4.01% on Jan 21 – GuruFocus (Jan 21, 2026)

For more information about Block, Inc., please visit the official website: block.xyz