Home > Analyses > Financial Services > Blackstone Inc.

Blackstone Inc. transforms capital into growth across global markets, shaping industries and daily lives through strategic investments. As a titan in alternative asset management, Blackstone commands leadership in private equity, real estate, credit, and hedge funds, renowned for its innovative deal-making and market influence. Its diverse portfolio spans early-stage ventures to large buyouts, reflecting a sophisticated capital allocation approach. The key question remains: do Blackstone’s fundamentals justify its premium valuation amid evolving market dynamics?

Table of contents

Business Model & Company Overview

Blackstone Inc., founded in 1985 and headquartered in New York City, commands a dominant position in alternative asset management. It orchestrates a comprehensive ecosystem spanning real estate, private equity, hedge funds, credit, and multi-asset strategies. This integrated approach targets diverse sectors such as healthcare, energy, and enterprise technology, reflecting a core mission to unlock value across complex investment landscapes.

The company’s revenue engine balances recurring management fees with performance-driven gains from its broad asset base. It leverages a strategic global footprint across North America, Europe, and Asia, focusing on opportunistic real estate and varied private equity deals, including growth and distressed assets. Blackstone’s economic moat lies in its unparalleled scale and expertise, shaping the future of alternative investments worldwide.

Financial Performance & Fundamental Metrics

I analyze Blackstone Inc.’s income statement, key financial ratios, and dividend payout policy to assess its operational efficiency and shareholder returns.

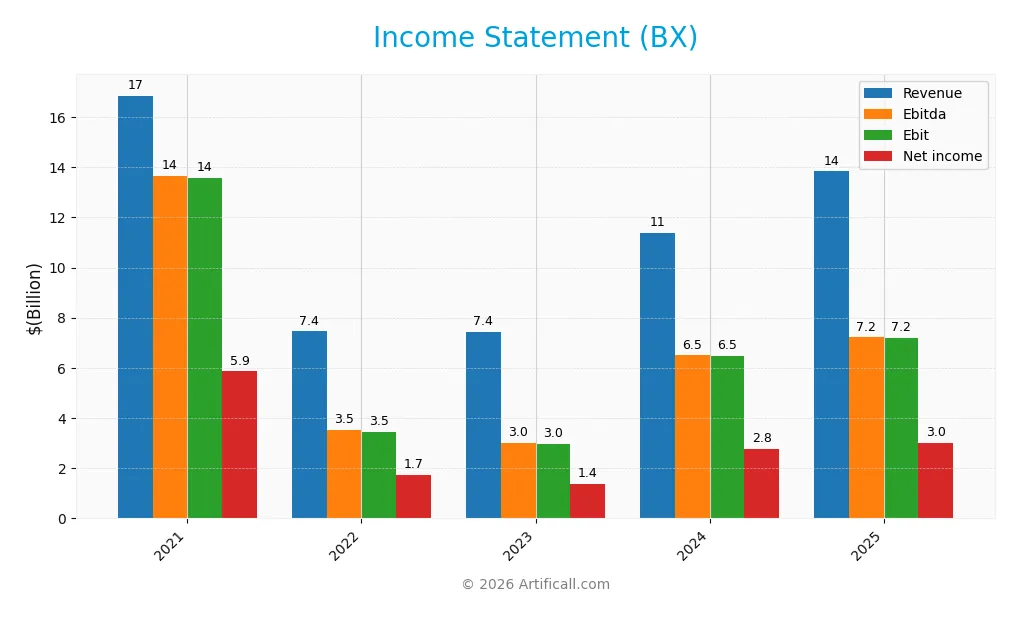

Income Statement

This table summarizes Blackstone Inc.’s key income statement figures over the past five fiscal years, presented in USD.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 16.9B | 7.4B | 7.4B | 11.4B | 13.8B |

| Cost of Revenue | 198M | 317M | 432M | 444M | 1.9B |

| Operating Expenses | 3.1B | 3.7B | 4.0B | 4.5B | 4.7B |

| Gross Profit | 16.7B | 7.1B | 7.0B | 10.9B | 11.9B |

| EBITDA | 13.6B | 3.5B | 3.0B | 6.5B | 7.2B |

| EBIT | 13.6B | 3.5B | 3.0B | 6.5B | 7.2B |

| Interest Expense | 198M | 317M | 432M | 444M | 508M |

| Net Income | 5.9B | 1.7B | 1.4B | 2.8B | 3.0B |

| EPS | 8.14 | 2.36 | 1.84 | 3.62 | 3.88 |

| Filing Date | 2022-02-25 | 2023-02-24 | 2024-01-25 | 2025-02-28 | 2026-01-29 |

Income Statement Evolution

Blackstone’s revenue grew 21.6% from 2024 to 2025, reversing earlier declines since 2021. Gross profit rose 8.9%, reflecting stable gross margins near 86%. Operating expenses increased proportionally with revenue, maintaining operating efficiency. However, net income growth lags, and net margins slightly declined over one year, signaling margin pressure despite top-line gains.

Is the Income Statement Favorable?

The 2025 income statement shows solid fundamentals with a 21.8% net margin and a strong 51.9% EBIT margin, both favorable against industry benchmarks. Interest expenses remain low at 3.7% of revenue, supporting profitability. Despite a 10.6% one-year dip in net margin, overall growth metrics and margin stability render the income statement generally favorable but warrant monitoring for margin sustainability.

Financial Ratios

The table below presents key financial ratios for Blackstone Inc. from 2021 to 2025, offering a snapshot of profitability, liquidity, leverage, and valuation metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 34.8% | 23.5% | 18.7% | 24.4% | 21.8% |

| ROE | 62.2% | 22.8% | 20.4% | 33.8% | 34.8% |

| ROIC | 30.7% | 7.2% | 6.4% | 12.5% | 17.2% |

| P/E | 15.9 | 31.4 | 69.6 | 47.6 | 39.9 |

| P/B | 9.9 | 7.2 | 14.2 | 16.1 | 13.9 |

| Current Ratio | 8.0 | 7.2 | 3.4 | 0.0 | 0.9 |

| Quick Ratio | 8.0 | 7.2 | 3.4 | 0.0 | 0.9 |

| D/E | 0.9 | 1.7 | 1.8 | 1.5 | 1.4 |

| Debt-to-Assets | 21.2% | 31.4% | 30.5% | 28.3% | 26.1% |

| Interest Coverage | 68.4 | 10.9 | 6.8 | 14.6 | 14.1 |

| Asset Turnover | 0.41 | 0.18 | 0.18 | 0.26 | 0.29 |

| Fixed Asset Turnover | 16.3 | 5.7 | 5.4 | 8.5 | 18.3 |

| Dividend Yield | 4.9% | 11.9% | 4.4% | 3.3% | 3.0% |

Evolution of Financial Ratios

Over 2021–2025, Blackstone’s Return on Equity (ROE) showed a declining trend from 62.16% to 34.84%, indicating moderated profitability. The Current Ratio sharply dropped from a strong 8.01 in 2021 to 0.85 in 2025, highlighting a decline in short-term liquidity. Debt-to-Equity Ratio increased from 0.92 to 1.44, reflecting higher leverage.

Are the Financial Ratios Fovorable?

In 2025, Blackstone’s profitability is robust with a 21.83% net margin and 34.84% ROE, both favorable. Liquidity ratios signal caution; the Current Ratio at 0.85 is unfavorable, while the Quick Ratio is neutral. Leverage is elevated with a Debt-to-Equity of 1.44, viewed unfavorably. Market valuation multiples like P/E (39.87) and P/B (13.89) are high, indicating overvaluation risks. Overall, the ratio profile is slightly favorable but warrants careful monitoring.

Shareholder Return Policy

Blackstone Inc. maintains a dividend payout ratio above 100%, with dividends per share declining from 8.80 in 2022 to 4.69 in 2025. The annual dividend yield stands near 3%, supported by share buyback programs. However, the high payout ratio suggests potential distribution risks.

Free cash flow coverage of dividends remains below 100%, indicating reliance on earnings or financing to sustain payments. While buybacks complement shareholder returns, the elevated payout ratio and coverage shortfall warrant caution. This policy may challenge long-term value sustainability if cash flows do not strengthen.

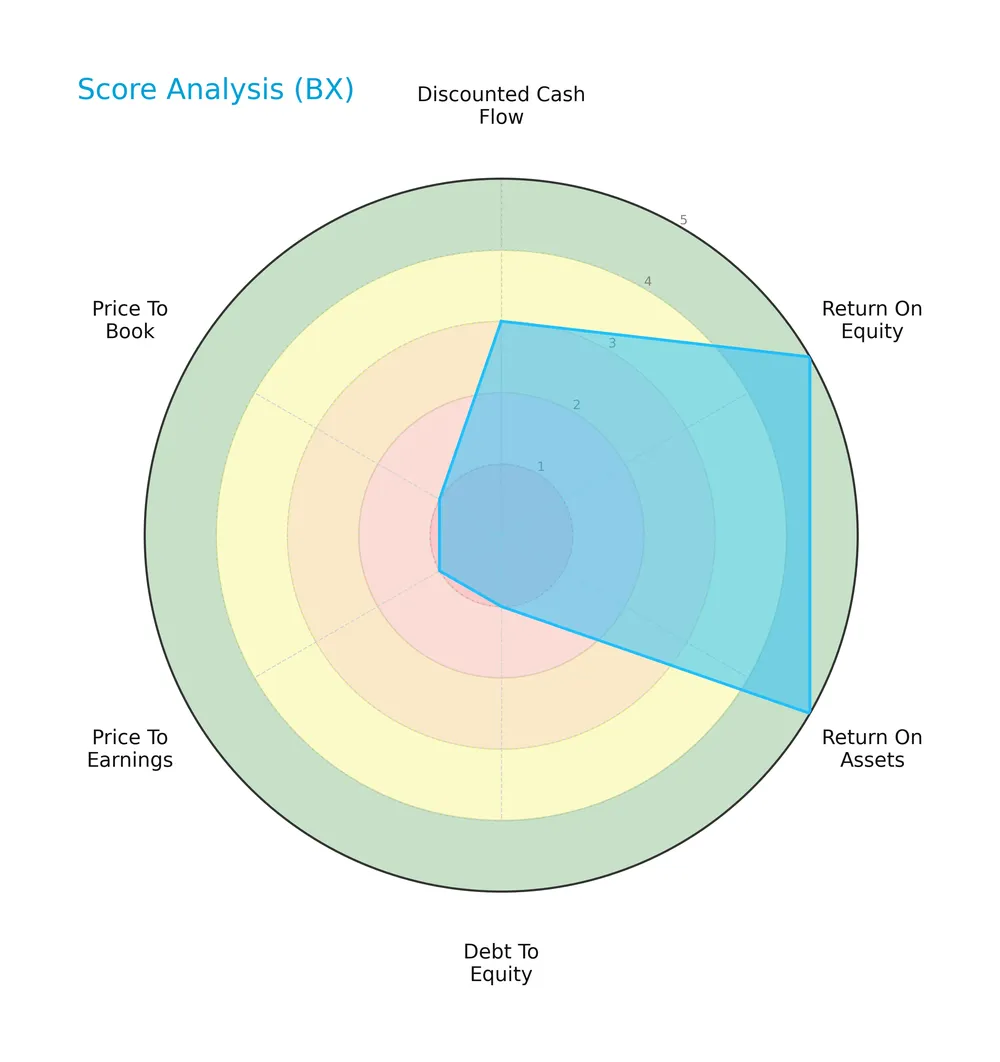

Score analysis

The following radar chart illustrates Blackstone Inc.’s key financial scores across valuation and profitability metrics:

Blackstone shows very favorable returns on equity and assets with scores of 5 each. However, its debt-to-equity, price-to-earnings, and price-to-book scores are very unfavorable at 1. The overall score is moderate at 3, reflecting mixed strengths and risks.

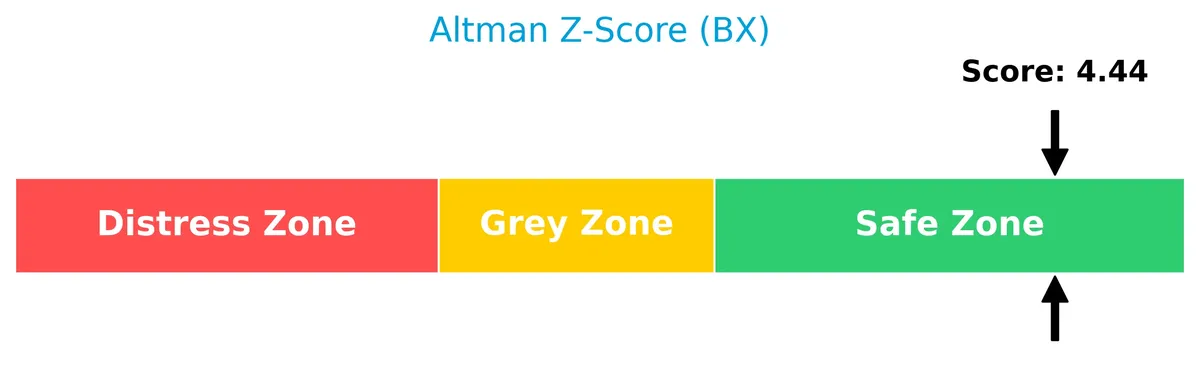

Analysis of the company’s bankruptcy risk

Blackstone’s Altman Z-Score places it well within the safe zone, indicating a low risk of bankruptcy:

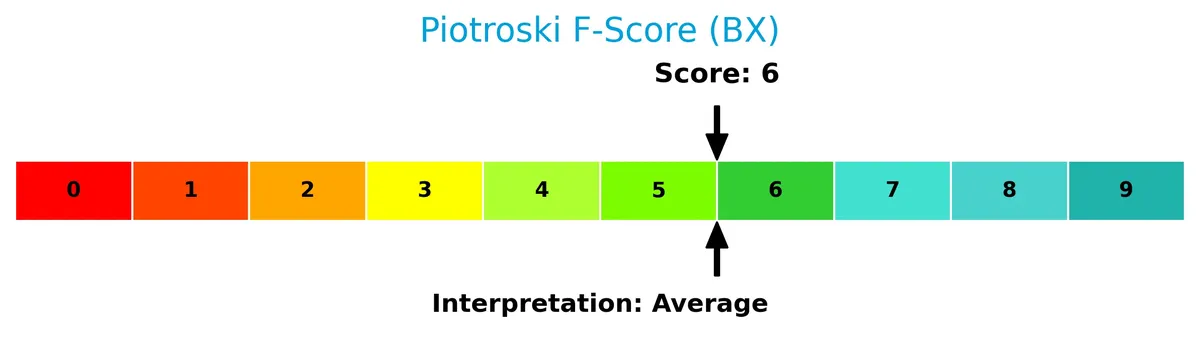

Is the company in good financial health?

The Piotroski diagram below reflects Blackstone’s financial health based on key profitability and efficiency criteria:

With a Piotroski Score of 6, Blackstone demonstrates average financial strength. This moderate score suggests reasonable operational performance but signals room for improvement in financial fundamentals.

Competitive Landscape & Sector Positioning

This analysis explores Blackstone Inc.’s strategic positioning, revenue segments, key products, competitors, and competitive advantages. I will assess whether Blackstone holds a sustainable edge over its rivals.

Strategic Positioning

Blackstone Inc. maintains a diversified product portfolio across private equity, real estate, hedge funds, and credit. Its geographic exposure spans North America, Europe, and Asia, reflecting a global reach with a focus on opportunistic and income-oriented real estate investments and varied private equity strategies.

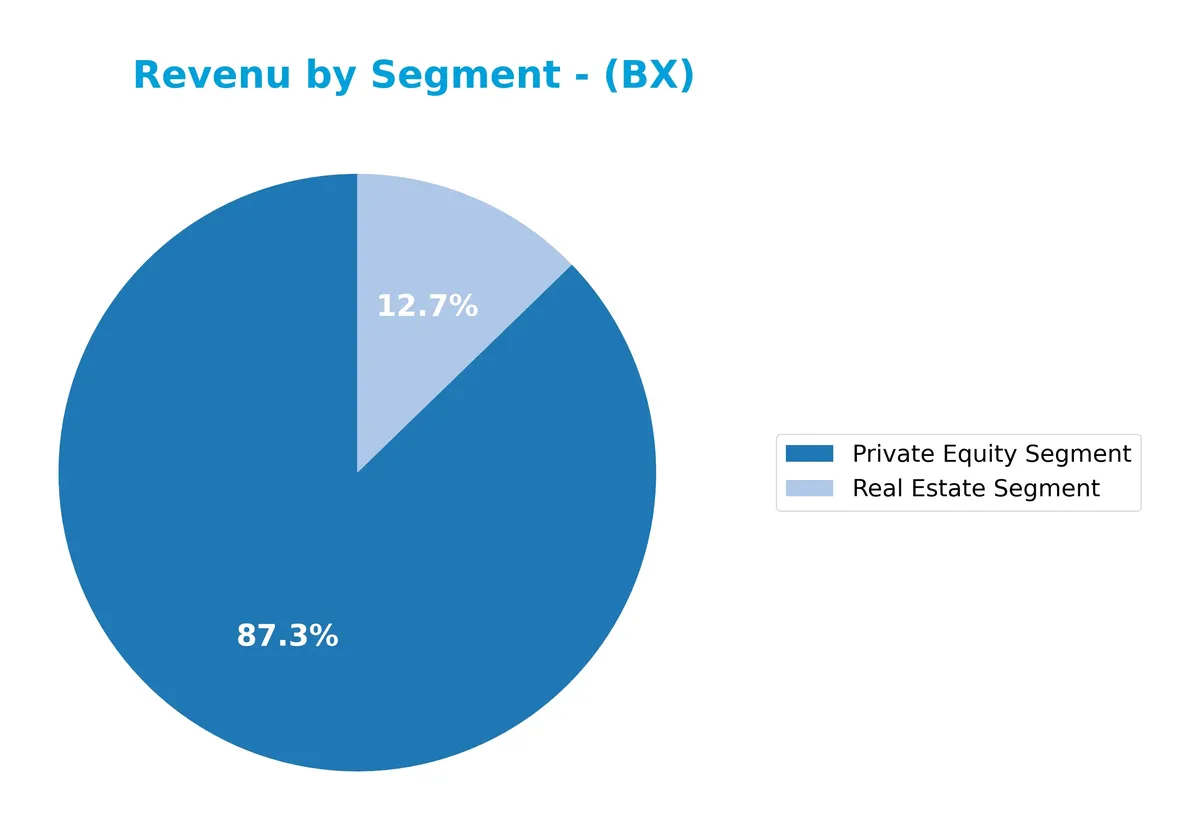

Revenue by Segment

This pie chart breaks down Blackstone Inc.’s revenue by segment for fiscal year 2024, highlighting the distribution between Private Equity and Real Estate segments.

In 2024, Private Equity leads with $1.39B, representing the core revenue driver. Real Estate follows with $203M but shows a slowdown compared to previous years. The absence of Hedge Fund Solutions this year signals a possible strategic shift or concentration risk. Historically, Private Equity has been the growth engine, and this trend continues, emphasizing Blackstone’s focus on its strongest moat.

Key Products & Brands

Blackstone Inc. operates multiple asset management segments generating diverse revenue streams:

| Product | Description |

|---|---|

| Private Equity Segment | Invests globally in buyouts, growth equity, special situations, and development projects across various industries. |

| Real Estate Segment | Focuses on opportunistic, core+, and stabilized commercial real estate investments in North America, Europe, Asia. |

| Hedge Fund Solutions | Manages commingled and customized hedge fund strategies. |

| Credit Segment | Provides loans and securities across the capital structure to non-investment grade companies. |

| Investment Advice | Offers advisory services related to investment strategies and portfolio management. |

| Investment Performance | Income generated from performance fees on managed assets. |

| Financial Advisory Segment | Provides financial advisory services including M&A and restructuring. |

Blackstone’s revenue comes primarily from private equity and real estate, supported by hedge funds, credit, and advisory services. This diversified product mix reflects its broad alternative asset management expertise.

Main Competitors

There are 11 competitors in the Financial Services sector; the table below lists the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Blackstone Inc. | 191B |

| BlackRock, Inc. | 168B |

| KKR & Co. Inc. | 115B |

| The Bank of New York Mellon Corporation | 82B |

| Ares Management Corporation | 55B |

| Ameriprise Financial, Inc. | 46B |

| State Street Corporation | 36B |

| Northern Trust Corporation | 26B |

| T. Rowe Price Group, Inc. | 23B |

| Franklin Resources, Inc. | 12B |

Blackstone Inc. ranks 1st among its peers with a market cap 0.81 times that of the sector’s largest player. It sits above both the average market cap of the top 10 (75B) and the median for the sector (46B). The company leads the pack, with its closest competitor trailing by 8.44%, underscoring a strong market position.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does Blackstone Inc. have a competitive advantage?

Blackstone Inc. demonstrates a competitive advantage by creating value, with a ROIC exceeding its WACC by 6.35%. Despite this, its profitability shows a declining trend, signaling caution in sustained performance.

Looking ahead, Blackstone’s diverse asset management across real estate, private equity, and credit, combined with expansion into Asia and Latin America, opens opportunities for growth in emerging markets and alternative energy sectors.

SWOT Analysis

This analysis highlights Blackstone Inc.’s key internal and external factors shaping its strategic outlook.

Strengths

- strong ROE at 34.8%

- high EBIT margin of 51.9%

- diversified asset management platform

Weaknesses

- declining ROIC trend

- high debt-to-equity ratio 1.44

- overvalued valuation multiples (PE 39.9, PB 13.9)

Opportunities

- expansion in Asia and Latin America

- growing demand for alternative assets

- innovation in multi-asset strategies

Threats

- market volatility impacting asset values

- regulatory changes in financial sector

- interest rate fluctuations increasing funding costs

Blackstone’s robust profitability and diversification underpin its competitive moat, though rising leverage and stretched valuations warrant caution. Strategic growth in emerging markets offers upside, but risk management remains critical amid financial sector uncertainties.

Stock Price Action Analysis

The following weekly chart illustrates Blackstone Inc. (BX) stock price movements over the past 12 months, highlighting key highs and lows:

Trend Analysis

Over the past 12 months, BX’s price increased 3.04%, indicating a bullish trend with deceleration. The stock reached a high of 199.05 and a low of 117.62. Volatility remains elevated at a 20.28 standard deviation, reflecting wide price swings during this period.

Volume Analysis

Trading volume has been increasing, with buyers accounting for 52.95% of total activity, signaling a buyer-driven market overall. However, in the recent three months, seller volume slightly exceeded buyers at 51.24%, suggesting neutral buyer behavior and balanced market participation.

Target Prices

Analysts set a solid target consensus for Blackstone Inc., reflecting cautious optimism.

| Target Low | Target High | Consensus |

|---|---|---|

| 158 | 215 | 178.17 |

The target range suggests analysts expect steady growth, with upside potential near 215. The consensus of 178 indicates moderate confidence in the stock’s appreciation.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines analyst ratings and consumer feedback to provide a balanced view of Blackstone Inc.’s market perception.

Stock Grades

Here is the latest consolidated view of Blackstone Inc.’s stock ratings from recognized analysts:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Neutral | 2026-02-02 |

| TD Cowen | Maintain | Buy | 2026-01-30 |

| Barclays | Maintain | Equal Weight | 2026-01-30 |

| Citizens | Maintain | Market Outperform | 2026-01-30 |

| JP Morgan | Maintain | Neutral | 2026-01-30 |

| TD Cowen | Maintain | Buy | 2026-01-14 |

| UBS | Maintain | Neutral | 2026-01-13 |

| Barclays | Maintain | Equal Weight | 2026-01-09 |

| Barclays | Maintain | Equal Weight | 2025-12-12 |

| JP Morgan | Maintain | Neutral | 2025-10-24 |

The consensus leans toward a Buy rating, reflecting moderate optimism with several Hold/Neutral opinions. No recent upgrades or downgrades suggest stability in analyst sentiment.

Consumer Opinions

Consumer sentiment around Blackstone Inc. reflects a blend of respect for its market leadership and concern over its fee structures.

| Positive Reviews | Negative Reviews |

|---|---|

| Strong track record in alternative investments | High management fees reduce net returns |

| Transparent communication with investors | Complexity of investment products |

| Robust risk management during downturns | Limited accessibility for smaller investors |

| Consistent returns outperforming benchmarks | Perceived lack of innovation in product offerings |

Overall, consumers appreciate Blackstone’s consistent performance and risk controls. However, the high fees and product complexity remain notable drawbacks for retail investors seeking simplicity and lower costs.

Risk Analysis

Below is a summary table of key risks affecting Blackstone Inc., highlighting their likelihood and potential impact on the company:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | High beta (1.76) signals sensitivity to market swings. | High | High |

| Leverage Risk | Debt-to-equity ratio of 1.44 indicates elevated financial leverage. | Medium | High |

| Liquidity Risk | Current ratio at 0.85 suggests potential short-term liquidity issues. | Medium | Medium |

| Valuation Risk | High P/E (39.9) and P/B (13.9) ratios imply overvaluation risk. | Medium | Medium |

| Interest Rates | Rising rates could increase debt servicing costs despite strong coverage (14.1x). | Medium | Medium |

| Economic Downturn | Exposure to real estate and private equity sectors may suffer in recession. | Medium | High |

Leverage and market volatility pose the greatest risks. Blackstone’s debt level exceeds typical asset management peers, increasing vulnerability in tightening credit markets. The stock’s high beta and rich valuation amplify downside in a market correction. However, strong interest coverage and a solid Altman Z-score (4.44, safe zone) mitigate bankruptcy risk. I remain cautious on liquidity given the sub-1 current ratio, a red flag in this sector.

Should You Buy Blackstone Inc.?

Blackstone appears to be creating value with a slightly favorable moat despite a declining ROIC trend. Profitability remains robust, supported by strong returns on equity and assets. However, its leverage profile shows substantial risks, reflected in a very unfavorable debt rating. The overall B rating suggests a very favorable profile tempered by moderate financial strength and liquidity concerns.

Strength & Efficiency Pillars

Blackstone Inc. exhibits robust profitability with a net margin of 21.83% and an impressive return on equity of 34.84%. Its return on invested capital stands at 17.2%, comfortably above its 10.85% WACC, confirming the company as a clear value creator. Financial health is solid, supported by a safe-zone Altman Z-score of 4.44 and an average Piotroski score of 6, reflecting moderate operational strength and low bankruptcy risk. These metrics underline Blackstone’s efficiency and capital discipline in a competitive sector.

Weaknesses and Drawbacks

Valuation metrics signal caution: a high P/E ratio of 39.87 and an elevated P/B ratio of 13.89 suggest the stock trades at a significant premium. Leverage is a concern with a debt-to-equity ratio of 1.44 and a low current ratio of 0.85, indicating potential liquidity stress. The recent price decline of 9.74% amid nearly balanced buyer-seller activity hints at short-term market pressure. These factors could weigh on near-term performance despite underlying strength.

Our Verdict about Blackstone Inc.

Blackstone’s long-term fundamentals appear favorable due to strong profitability and value creation. However, the recent seller dominance and price weakness suggest a cautious stance. Despite its solid efficiency pillars, the stock might appear overvalued and faces liquidity challenges. Therefore, investors could consider a wait-and-see approach to identify a more attractive entry point amid market volatility.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Four Days Left Until Blackstone Inc. (NYSE:BX) Trades Ex-Dividend – Yahoo Finance (Feb 04, 2026)

- Border to Coast Pensions Partnership Ltd Decreases Stake in Blackstone Inc. $BX – MarketBeat (Feb 05, 2026)

- Blackstone (BX) Attracts Attention in Options Market – GuruFocus (Feb 05, 2026)

- 5 Revealing Analyst Questions From Blackstone’s Q4 Earnings Call – Finviz (Feb 05, 2026)

- Blackstone (BX) reports strong Q4 earnings, Citizens maintains market outperform rating – MSN (Feb 03, 2026)

For more information about Blackstone Inc., please visit the official website: blackstone.com