Home > Analyses > Financial Services > BlackRock, Inc.

BlackRock, Inc. quietly shapes the financial future of millions by managing trillions in assets across global markets, influencing how institutions and individuals grow wealth. As the world’s largest asset manager, BlackRock leads with cutting-edge investment strategies, from ETFs to alternative assets, backed by a reputation for innovation and rigorous risk management. Yet, as market dynamics evolve rapidly, the key question remains: does BlackRock’s current valuation fully reflect its growth potential and resilient fundamentals in 2026?

Table of contents

Business Model & Company Overview

BlackRock, Inc., founded in 1988 and headquartered in New York City, stands as a dominant force in the asset management industry. It operates a comprehensive ecosystem of investment products and services, catering to institutional, intermediary, and individual investors worldwide. Its core mission revolves around managing a broad spectrum of portfolios, from equity and fixed income to alternative investments, creating a cohesive platform that addresses diverse client needs across multiple asset classes.

The company’s revenue engine balances recurring management fees from mutual funds, ETFs, and hedge funds with advisory and global risk management services. With a strategic presence spanning the Americas, Europe, and Asia, BlackRock leverages its global reach to tap into various markets and asset classes. Its strong economic moat lies in its scale, diversified product suite, and sophisticated investment strategies, shaping the future of global asset management.

Financial Performance & Fundamental Metrics

This section provides an overview of BlackRock, Inc.’s income statement, key financial ratios, and dividend payout policy to aid investment decisions.

Income Statement

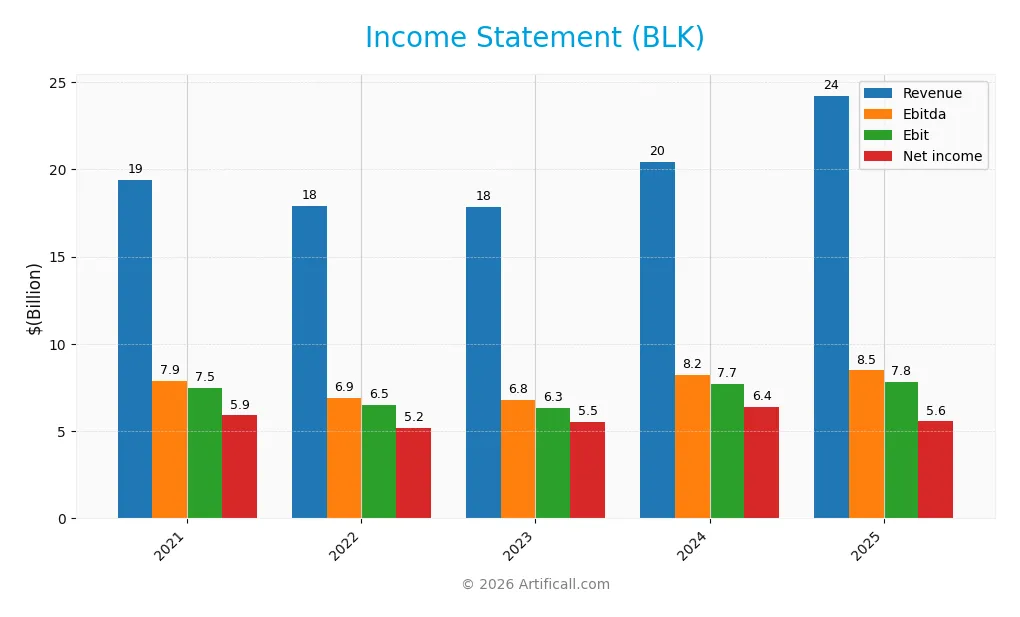

The table below presents BlackRock, Inc.’s key income statement figures for the fiscal years 2021 through 2025, reflecting revenue, expenses, profitability, and earnings per share.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 19.4B | 17.9B | 17.9B | 20.4B | 24.2B |

| Cost of Revenue | 9.6B | 9.2B | 9.3B | 10.3B | 10.8B |

| Operating Expenses | 2.4B | 2.3B | 2.3B | 2.5B | 6.4B |

| Gross Profit | 9.8B | 8.7B | 8.6B | 10.1B | 13.4B |

| EBITDA | 7.9B | 6.9B | 6.8B | 8.2B | 8.5B |

| EBIT | 7.5B | 6.5B | 6.3B | 7.7B | 7.8B |

| Interest Expense | 205M | 212M | 292M | 538M | 706M |

| Net Income | 5.9B | 5.2B | 5.5B | 6.4B | 5.6B |

| EPS | 38.76 | 34.31 | 36.85 | 42.45 | 35.84 |

| Filing Date | 2022-02-25 | 2023-02-24 | 2024-02-23 | 2025-02-25 | 2026-01-15 |

Income Statement Evolution

BlackRock’s revenue grew 25% from 2021 to 2025, accelerating to 18.7% between 2024 and 2025, while net income declined nearly 6% over the entire period. Gross margin improved to 55.5%, reflecting solid cost control, but net margin fell by almost 25%. Operating expenses grew in tandem with revenue, limiting EBIT margin growth, which remained stable near 32%.

Is the Income Statement Favorable?

In 2025, BlackRock posted $24.2B revenue and $5.55B net income, with a net margin of 22.9%, indicating generally favorable fundamentals. Despite strong revenue and gross profit growth, net income and EPS declined, impacted by rising expenses and margin compression. Interest expense remains low at 2.9%, supporting earnings quality, but the recent decline in profitability ratios suggests mixed near-term operational challenges.

Financial Ratios

The following table presents key financial ratios for BlackRock, Inc. across the fiscal years 2021 to 2025, offering insight into profitability, valuation, liquidity, leverage, and efficiency:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 30.46% | 28.97% | 30.81% | 31.21% | 22.93% |

| ROE | 15.66% | 13.72% | 13.98% | 13.41% | 0 |

| ROIC | 3.74% | 4.36% | 4.08% | 4.64% | 0 |

| P/E | 23.62 | 20.65 | 22.03 | 24.15 | 29.90 |

| P/B | 3.70 | 2.83 | 3.08 | 3.24 | 0 |

| Current Ratio | 14.45 | 14.08 | 15.63 | 2.19 | 0 |

| Quick Ratio | 14.45 | 14.08 | 15.63 | 2.19 | 0 |

| D/E | 0.25 | 0.22 | 0.25 | 0.30 | 0 |

| Debt-to-Assets | 6.10% | 7.22% | 7.87% | 10.26% | 0 |

| Interest Coverage | 36.34 | 30.12 | 21.49 | 14.08 | 9.98 |

| Asset Turnover | 0.13 | 0.15 | 0.14 | 0.15 | 0 |

| Fixed Asset Turnover | 8.13 | 7.02 | 7.05 | 7.78 | 0 |

| Dividend Yield | 1.83% | 2.80% | 2.50% | 2.02% | 1.95% |

Evolution of Financial Ratios

From 2021 to 2025, BlackRock’s Return on Equity (ROE) data is unavailable for 2025, but showed moderate stability around 13–16% prior. The Current Ratio, a liquidity measure, declined sharply to 0 in 2025 after consistent levels above 2 in earlier years, suggesting data gaps or a change in reporting. Debt-to-Equity Ratio remained low and stable, indicating controlled leverage and conservative debt management. Profitability margins exhibited some volatility, with net profit margin dropping to 22.9% in 2025 from over 30% in prior years.

Are the Financial Ratios Favorable?

In 2025, BlackRock’s profitability appears favorable with a net margin of 22.9%, but the absence of ROE and ROIC figures marks an unfavorable signal. Liquidity ratios, including Current and Quick Ratios, are recorded as zero, flagged as unfavorable, thus raising caution on short-term financial health. Leverage metrics such as Debt-to-Equity and Debt-to-Assets ratios are favorable, reflecting low financial risk. The Price-to-Earnings ratio is elevated at 29.9, considered unfavorable, while dividend yield is neutral at 1.95%. Overall, the ratio evaluation suggests a slightly unfavorable financial position for the year.

Shareholder Return Policy

BlackRock, Inc. maintains a consistent dividend payout ratio around 50-58%, with dividend per share increasing from $16.73 in 2021 to $20.84 in 2025, yielding approximately 1.95-2.8% annually. The company also supports shareholder returns through share buybacks, balanced by solid free cash flow coverage.

This policy reflects a disciplined approach to distributing earnings while preserving capital for growth and risk management. The dividend and buyback strategy appears aligned with sustainable long-term value creation, avoiding excessive distributions or repurchases that could impair financial stability.

Score analysis

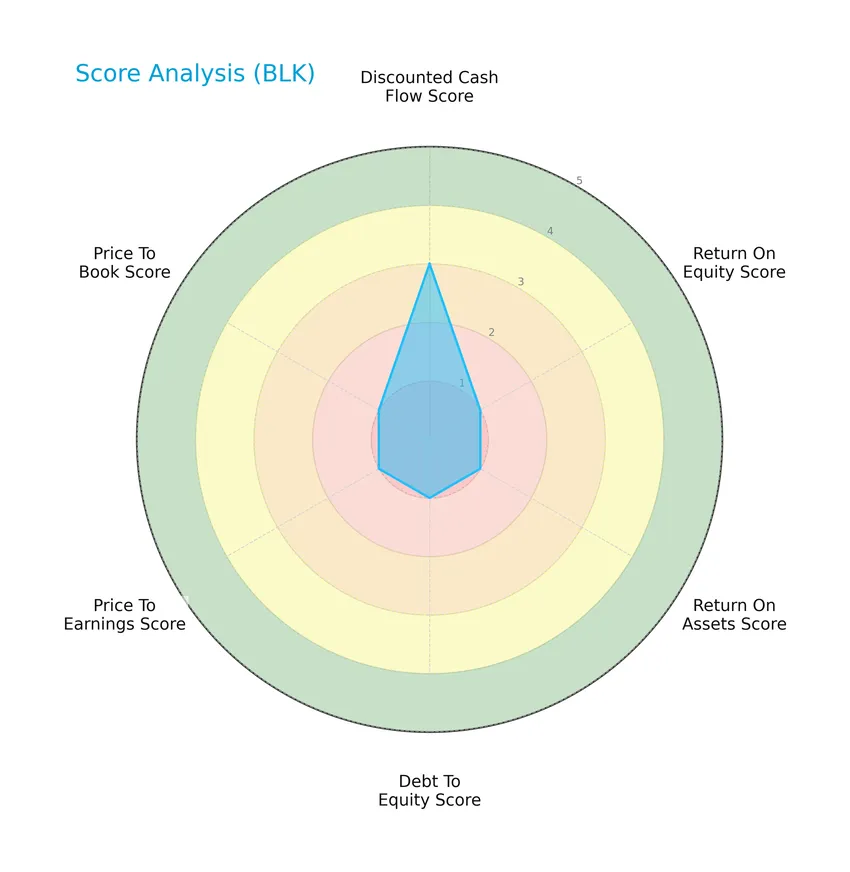

The following radar chart illustrates BlackRock, Inc.’s key financial metric scores across several valuation and profitability dimensions:

BlackRock’s discounted cash flow score stands at a moderate level of 3, while all other scores—including return on equity, return on assets, debt to equity, price to earnings, and price to book—register very unfavorable values of 1, indicating broad challenges in profitability, leverage, and valuation metrics.

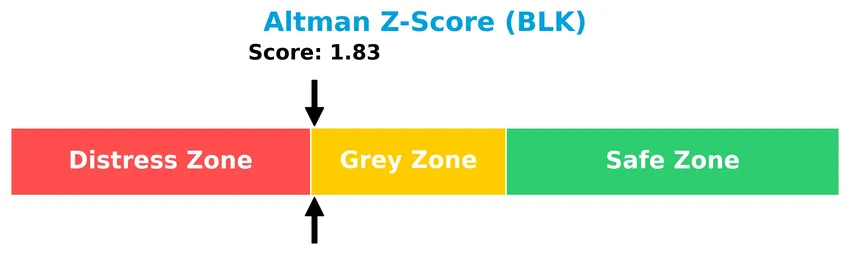

Analysis of the company’s bankruptcy risk

BlackRock’s Altman Z-Score places the company in the grey zone, suggesting a moderate risk of financial distress and bankruptcy:

Is the company in good financial health?

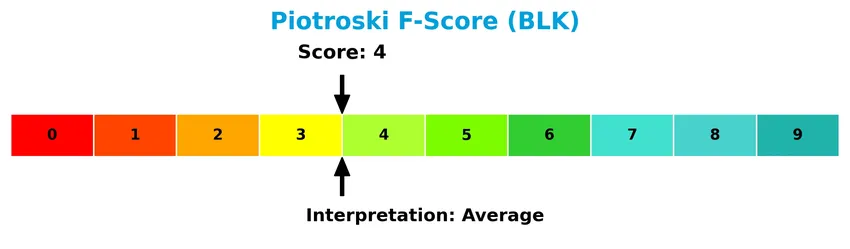

The Piotroski F-Score diagram below provides insight into BlackRock’s financial strength based on nine fundamental criteria:

With a Piotroski Score of 4, BlackRock is positioned in the average category, reflecting a moderate financial health status that neither strongly favors nor substantially weakens its investment appeal.

Competitive Landscape & Sector Positioning

This sector analysis will examine BlackRock, Inc.’s strategic positioning, revenue by segment, key products, main competitors, and competitive advantages. I will assess whether BlackRock holds a competitive advantage relative to its peers in the asset management industry.

Strategic Positioning

BlackRock, Inc. maintains a diversified product portfolio centered on investment advice, distribution, technology, and performance services, with 2024 revenues heavily weighted toward investment advice at $16.1B. Geographically, it spans Americas ($13.4B), Europe ($6.1B), and Asia Pacific ($859M), demonstrating broad global exposure in asset management.

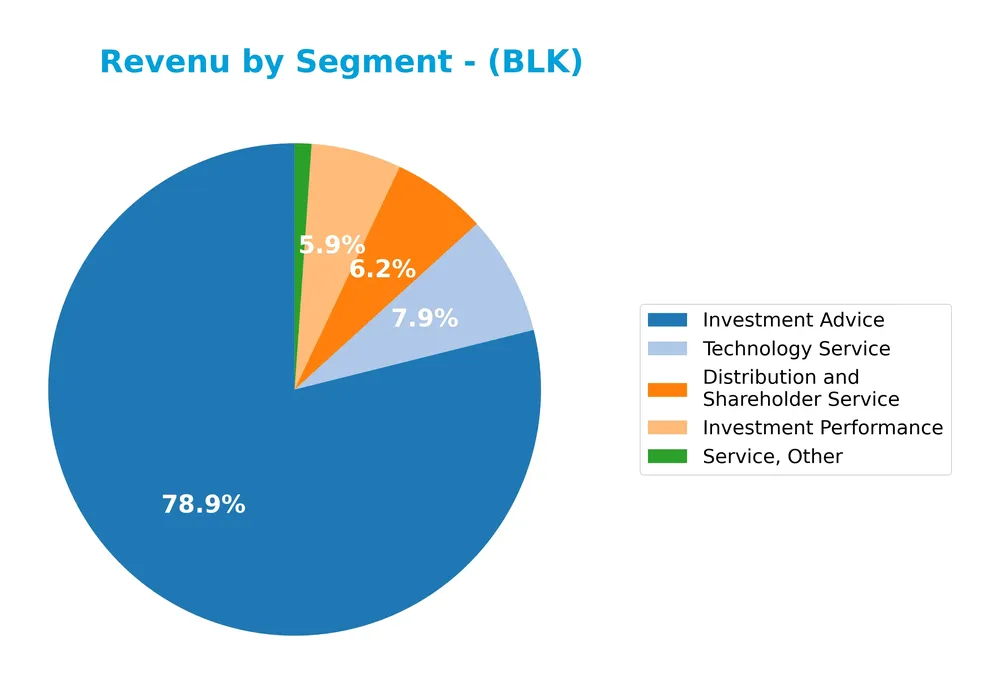

Revenue by Segment

The pie chart illustrates BlackRock, Inc.’s revenue distribution by segment for the fiscal year 2024, highlighting the key business areas contributing to the company’s total income.

In 2024, Investment Advice remains the dominant revenue driver at 16.1B, showing a notable increase from 14.4B in 2023. Distribution and Shareholder Service and Technology Service contribute significantly as well, with 1.27B and 1.6B respectively. Investment Performance also grew sharply to 1.21B, nearly doubling from the prior year. This diversification reduces concentration risk while signaling robust growth in advisory and technology services.

Key Products & Brands

The table below summarizes BlackRock, Inc.’s main product lines and services with their descriptions:

| Product | Description |

|---|---|

| Investment Advice | Services offering portfolio management and advisory to institutional, intermediary, and individual clients. |

| Distribution and Shareholder Service | Support services related to distribution and shareholder management. |

| Investment Performance | Revenue derived from performance fees linked to investment returns. |

| Technology Service | Technology solutions supporting asset management and investment processes. |

| Service, Other | Miscellaneous services not classified under other categories. |

BlackRock’s key products focus on comprehensive investment advice, distribution support, performance-based fees, and technology services, reflecting its broad asset management capabilities.

Main Competitors

There are 11 competitors in the Asset Management industry; below are the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Blackstone Inc. | 191B |

| BlackRock, Inc. | 168B |

| KKR & Co. Inc. | 115B |

| The Bank of New York Mellon Corporation | 82B |

| Ares Management Corporation | 55B |

| Ameriprise Financial, Inc. | 46B |

| State Street Corporation | 36B |

| Northern Trust Corporation | 26B |

| T. Rowe Price Group, Inc. | 23B |

| Franklin Resources, Inc. | 12B |

BlackRock, Inc. holds the 2nd position among its competitors with a market cap at 92% of the top leader, Blackstone Inc. It ranks above both the average market cap of the top 10 (75B) and the sector median (46B). The company maintains a solid 8.7% market cap lead over the next closest competitor.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does BLK have a competitive advantage?

BlackRock, Inc. presents a competitive advantage supported by favorable income statement metrics such as a 55.52% gross margin and 32.25% EBIT margin, alongside strong revenue growth of 18.67% in the past year. However, the company faces challenges with declining net margin and EPS growth, as well as a downward trend in ROIC.

Looking ahead, BlackRock’s expansion in real estate investments in Poland and Germany, coupled with its diversified product offerings across global equity, fixed income, and alternative markets, suggests potential growth opportunities in emerging markets and new asset classes.

SWOT Analysis

This SWOT analysis highlights BlackRock, Inc.’s key internal strengths and weaknesses alongside the external opportunities and threats that impact its strategic positioning.

Strengths

- Leading global asset manager with $175B market cap

- Strong gross margin at 55.5%

- Diverse product offering across equities, fixed income, alternatives

Weaknesses

- Declining net income and EPS growth over recent years

- Average Piotroski score of 4 indicating moderate financial strength

- High beta of 1.48 implying stock volatility

Opportunities

- Expansion into growing markets like Asia Pacific and Europe

- Increasing demand for ESG and alternative investments

- Leveraging advanced risk management and advisory services

Threats

- Rising competition from fintech and passive investment platforms

- Regulatory changes affecting asset management fees

- Market volatility impacting assets under management and fee income

BlackRock’s robust market position and diversified offerings provide a solid foundation, but profitability and financial health trends warrant caution. Strategic focus on emerging markets and innovation will be crucial to counter competitive and regulatory challenges.

Stock Price Action Analysis

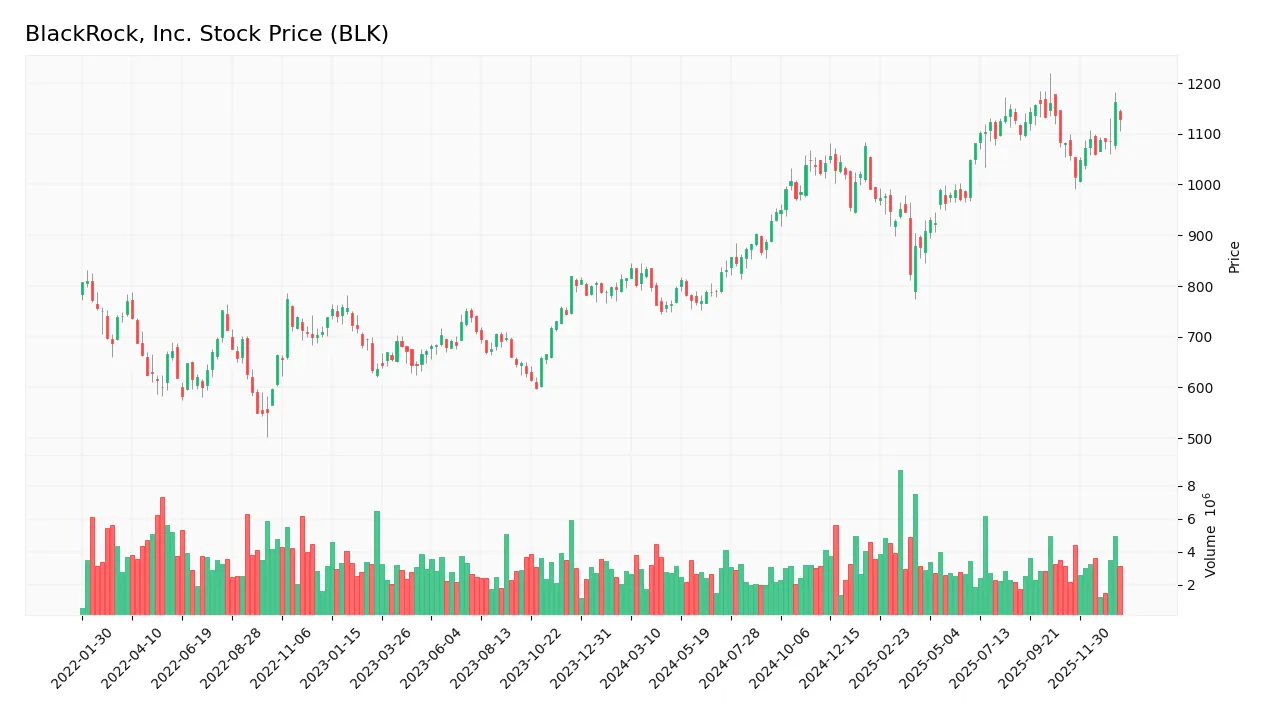

The following weekly stock chart for BlackRock, Inc. illustrates price movements and volatility over the past 100 weeks:

Trend Analysis

Over the past 12 months, BlackRock’s stock price increased by 38.67%, signaling a bullish trend with accelerating momentum. The price ranged between a low of 749.98 and a high of 1163.17, supported by a notable volatility level with a standard deviation of 121.14. Recent data from November 2025 to January 2026 shows a 4.41% gain, maintaining bullishness but with reduced volatility.

Volume Analysis

Over the last three months, trading volume has increased overall, with a total volume of 376.7M shares. Buyers dominated with 61.46% of total volume historically, but recent buyer dominance is neutral at 50.72%, reflecting balanced buying and selling activity. This volume pattern suggests steady market participation without decisive investor sentiment shifts.

Target Prices

The consensus target prices for BlackRock, Inc. indicate a generally positive outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 1514 | 1200 | 1333.7 |

Analysts expect BlackRock’s stock price to range between 1200 and 1514, with a consensus target near 1334, suggesting moderate upside potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback related to BlackRock, Inc. (BLK).

Stock Grades

Here is the latest overview of BlackRock, Inc. stock grades from established financial institutions and analysts:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keefe, Bruyette & Woods | Maintain | Outperform | 2026-01-16 |

| UBS | Maintain | Neutral | 2026-01-16 |

| Barclays | Maintain | Overweight | 2026-01-16 |

| TD Cowen | Downgrade | Hold | 2026-01-14 |

| UBS | Maintain | Neutral | 2026-01-12 |

| Keefe, Bruyette & Woods | Maintain | Outperform | 2026-01-08 |

| Barclays | Maintain | Overweight | 2026-01-08 |

| Keefe, Bruyette & Woods | Maintain | Outperform | 2025-12-17 |

| Morgan Stanley | Maintain | Overweight | 2025-12-17 |

| Barclays | Maintain | Overweight | 2025-12-12 |

The consensus among these reputable firms generally favors a positive outlook with multiple “Outperform” and “Overweight” ratings, although a recent downgrade to “Hold” by TD Cowen introduces some caution. Overall, the consensus remains mostly bullish with a majority supporting a “Buy” stance.

Consumer Opinions

Consumers of BlackRock, Inc. (BLK) express a mix of satisfaction and concerns, reflecting diverse experiences with the asset management giant.

| Positive Reviews | Negative Reviews |

|---|---|

| “Strong portfolio management with consistent returns.” | “High fees compared to some competitors.” |

| “Excellent customer service and easy-to-use platform.” | “Occasional delays in transaction processing.” |

| “Transparent communication about investment strategies.” | “Limited options for smaller investors.” |

| “Robust risk management and diversified investment funds.” | “Complex product offerings can be confusing.” |

Overall, BlackRock is praised for its strong portfolio management and customer service, but some investors are concerned about fees and product complexity. These insights suggest a solid reputation with room for improvement in accessibility and cost.

Risk Analysis

Below is a summary table highlighting the main risks associated with investing in BlackRock, Inc. (BLK) as of 2026:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | BLK’s beta of 1.484 indicates above-average sensitivity to market fluctuations, increasing share price risk. | High | High |

| Financial Health | The Altman Z-Score of 1.83 places the company in the “grey zone,” suggesting moderate bankruptcy risk. | Moderate | High |

| Profitability | Despite a favorable net margin (22.93%), unfavorable ROE and ROIC signal challenges in generating shareholder returns. | Moderate | Medium |

| Valuation | A high P/E ratio of 29.9 is unfavorable, indicating potential overvaluation and lower margin of safety. | Moderate | Medium |

| Liquidity | Unfavorable current and quick ratios point to liquidity concerns which could impact short-term financial flexibility. | Low | Medium |

| Debt Levels | Favorable debt-to-assets ratio and interest coverage (11.06) mitigate default risk, though some leverage concerns remain. | Low | Low |

The most critical risks for BlackRock investors stem from its elevated market sensitivity and moderate financial distress signals. Its placement in the Altman Z-Score grey zone and high beta reveal vulnerability to economic downturns and market swings. Additionally, weak returns on equity and asset utilization suggest operational efficiency challenges, while valuation metrics warn of possible overpricing. Investors should carefully weigh these factors before increasing exposure.

Should You Buy BlackRock, Inc.?

BlackRock, Inc. appears to be characterized by moderate profitability with improving operational efficiency, while its competitive moat seems to be eroding given declining returns on invested capital. Despite a manageable leverage profile, its overall rating could be seen as cautious (C-), suggesting a need for prudent risk assessment.

Strength & Efficiency Pillars

BlackRock, Inc. exhibits solid profitability with a gross margin of 55.52%, an EBIT margin of 32.25%, and a net margin of 22.93%, reflecting strong operational efficiency. The interest coverage ratio stands robust at 11.06, highlighting manageable debt servicing capabilities. Despite unavailable ROIC and WACC data, the Altman Z-Score at 1.83 places the company in the grey zone, indicating moderate financial stability. The Piotroski score of 4 suggests average financial health, pointing to room for improvement in value creation and operational resilience.

Weaknesses and Drawbacks

Valuation metrics present concerns: a P/E ratio of 29.9 signals a premium valuation, which could limit upside potential amid market fluctuations. The absence of a current ratio and quick ratio data, combined with a slightly unfavorable overall leverage profile, raises questions about short-term liquidity. Furthermore, the recent period shows a neutral buyer dominance at 50.72%, indicating balanced but cautious market sentiment. Declines in net margin growth (-24.71%) and EPS growth (-7.33%) over the long term further underscore operational challenges.

Our Verdict about BlackRock, Inc.

BlackRock’s long-term fundamental profile appears moderately favorable due to strong margins and manageable debt costs, yet tempered by liquidity uncertainties and stretched valuation multiples. The bullish overall stock trend, supported by increasing volume and 38.67% price appreciation, contrasts with neutral recent buyer behavior, suggesting cautious investor positioning. Despite underlying strengths, the current market dynamics might suggest a wait-and-see approach for a more attractive entry point.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- “Winner Winner, Chicken Dinner,” Says Jim Cramer About BlackRock (BLK) – Yahoo Finance (Jan 20, 2026)

- BlackRock’s Rick Rieder odds for Fed chair post surges – report (BLK:NYSE) – Seeking Alpha (Jan 23, 2026)

- Envestnet Portfolio Solutions Inc. Lowers Stake in BlackRock $BLK – MarketBeat (Jan 23, 2026)

- BlackRock (NYSE:BLK) Has Announced That It Will Be Increasing Its Dividend To $5.73 – simplywall.st (Jan 19, 2026)

- BlackRock: Q4 Earnings Snapshot – king5.com (Jan 15, 2026)

For more information about BlackRock, Inc., please visit the official website: blackrock.com