Home > Analyses > Consumer Defensive > BJ’s Wholesale Club Holdings, Inc.

BJ’s Wholesale Club Holdings, Inc. transforms how millions of Americans access everyday essentials by blending warehouse-style savings with digital convenience. As a prominent player in the discount retail sector, BJ’s operates hundreds of clubs and gas stations across the East Coast, offering a wide range of perishable goods and general merchandise. Renowned for innovation in omni-channel retail and customer loyalty, BJ’s stands at a pivotal point—does its current market valuation reflect its growth and resilience in a competitive landscape?

Table of contents

Business Model & Company Overview

BJ’s Wholesale Club Holdings, Inc., founded in 1984 and headquartered in Westborough, Massachusetts, is a leading player in the discount stores sector. Operating an integrated network of 229 warehouse clubs and 160 gas stations along the U.S. east coast, BJ’s offers a comprehensive ecosystem of perishable goods, general merchandise, gasoline, and ancillary services, supported by a robust digital presence including multiple e-commerce platforms and a mobile app.

The company’s revenue engine blends membership fees with product sales across physical and online channels, creating a balanced stream from both recurring and transactional sources. While primarily focused on the U.S. market, BJ’s innovative approach to combining warehouse retail with digital convenience defines its competitive edge. This strategic positioning fortifies its economic moat, shaping the future landscape of wholesale retail in a highly competitive industry.

Financial Performance & Fundamental Metrics

This section provides a focused analysis of BJ’s Wholesale Club Holdings, Inc., covering its income statement, key financial ratios, and dividend payout policy.

Income Statement

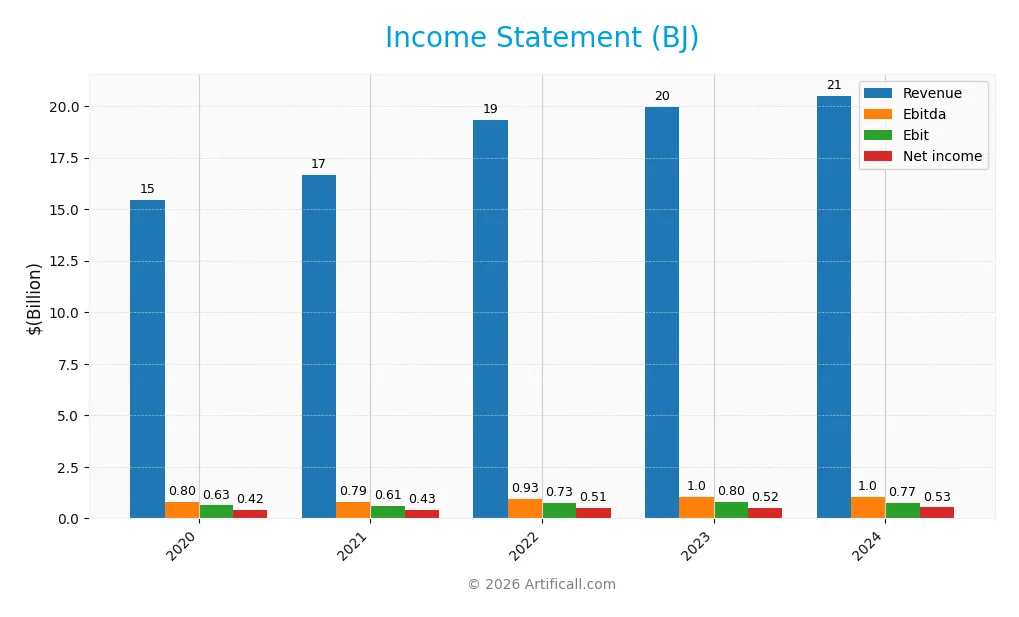

The table below presents BJ’s Wholesale Club Holdings, Inc. annual income statement figures for the fiscal years 2020 through 2024, reported in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 15.4B | 16.7B | 19.3B | 19.9B | 20.5B |

| Cost of Revenue | 12.5B | 13.6B | 15.9B | 16.3B | 16.7B |

| Operating Expenses | 2.3B | 2.5B | 2.7B | 2.8B | 3.0B |

| Gross Profit | 3.0B | 3.1B | 3.4B | 3.6B | 3.8B |

| EBITDA | 796M | 789M | 933M | 1.0B | 1.0B |

| EBIT | 629M | 608M | 732M | 798M | 770M |

| Interest Expense | 84M | 59M | 47M | 63M | 50M |

| Net Income | 421M | 427M | 513M | 524M | 534M |

| EPS | 3.09 | 3.15 | 3.83 | 3.94 | 4.04 |

| Filing Date | 2021-03-19 | 2022-03-17 | 2023-03-16 | 2024-03-18 | 2025-03-14 |

Income Statement Evolution

From 2020 to 2024, BJ’s Wholesale Club Holdings, Inc. experienced a favorable revenue growth of 32.87%, with net income also rising by 26.93%. However, the net margin declined by 4.47% over this period, indicating some pressure on profitability. In the latest year, revenue growth slowed to 2.67%, and EBIT decreased by 3.49%, reflecting challenges in maintaining operating efficiency. Margins overall remained mostly stable, with gross margin steady at 18.36% and EBIT margin neutral at 3.76%.

Is the Income Statement Favorable?

The 2024 income statement shows generally neutral fundamentals. While revenue and gross profit grew modestly, operating expenses rose at the same rate as revenue, contributing to a decline in EBIT and net margin. Interest expense remains favorably low at 0.25% of revenue, supporting financial costs. Earnings per share increased by 3.09%, a positive indicator. Overall, the balance of favorable, unfavorable, and neutral factors results in a neutral assessment of the company’s income statement for the year.

Financial Ratios

The following table presents key financial ratios for BJ’s Wholesale Club Holdings, Inc. over the last five fiscal years for a comprehensive performance overview:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 2.73% | 2.56% | 2.66% | 2.62% | 2.61% |

| ROE | 132% | 66% | 49% | 36% | 29% |

| ROIC | 13% | 12.9% | 12.5% | 12.2% | 11.7% |

| P/E | 13.7 | 19.5 | 18.9 | 16.3 | 24.5 |

| P/B | 18.1 | 12.8 | 9.3 | 5.9 | 7.1 |

| Current Ratio | 0.72 | 0.76 | 0.67 | 0.73 | 0.74 |

| Quick Ratio | 0.13 | 0.14 | 0.13 | 0.14 | 0.15 |

| D/E | 10.1 | 4.6 | 3.0 | 2.0 | 1.5 |

| Debt-to-Assets | 60% | 52% | 49% | 45% | 40% |

| Interest Coverage | 7.6 | 10.4 | 15.5 | 12.8 | 15.3 |

| Asset Turnover | 2.85 | 2.94 | 3.04 | 2.99 | 2.90 |

| Fixed Asset Turnover | 5.40 | 5.42 | 5.55 | 5.37 | 5.13 |

| Dividend Yield | 0.0004% | 0.0003% | 0.0003% | 0.0003% | 0.0002% |

Evolution of Financial Ratios

Between 2020 and 2024, BJ’s Wholesale Club Holdings, Inc. saw fluctuations in its financial ratios. Return on Equity (ROE) notably declined from a high of 131.85% in 2020 to 28.93% in 2024, indicating reduced profitability efficiency. The Current Ratio remained below 1, showing persistent liquidity constraints, while the Debt-to-Equity Ratio decreased from 10.15 in 2020 to 1.54 in 2024, signaling some deleveraging over the period. Profitability margins were relatively stable, with net margin around 2.6% in 2024.

Are the Financial Ratios Favorable?

In 2024, BJ’s profitability ratios show mixed signals: ROE at 28.93% and Return on Invested Capital (ROIC) at 11.69% are favorable, yet the net profit margin of 2.61% is unfavorable. Liquidity ratios, including Current Ratio (0.74) and Quick Ratio (0.15), are unfavorable, reflecting tight short-term financial flexibility. Leverage remains elevated with a Debt-to-Equity Ratio of 1.54, also unfavorable. Efficiency ratios like Asset Turnover (2.9) and Interest Coverage (15.26) are favorable, but market valuation ratios such as Price to Book (7.09) are unfavorable. Overall, the ratio profile is neutral with a balanced mix of favorable and unfavorable indicators.

Shareholder Return Policy

BJ’s Wholesale Club Holdings, Inc. pays a very minimal dividend, with a payout ratio near zero and an annual dividend yield effectively negligible. The company’s dividend per share has remained virtually flat, and no significant share buyback program is reported, indicating a restrained distribution approach.

This limited return policy suggests BJ prioritizes reinvesting earnings over shareholder payouts, which may support sustainable long-term value creation given the low dividend coverage and modest free cash flow. The absence of aggressive distributions reduces risks of financial strain while maintaining capital for operational needs.

Score analysis

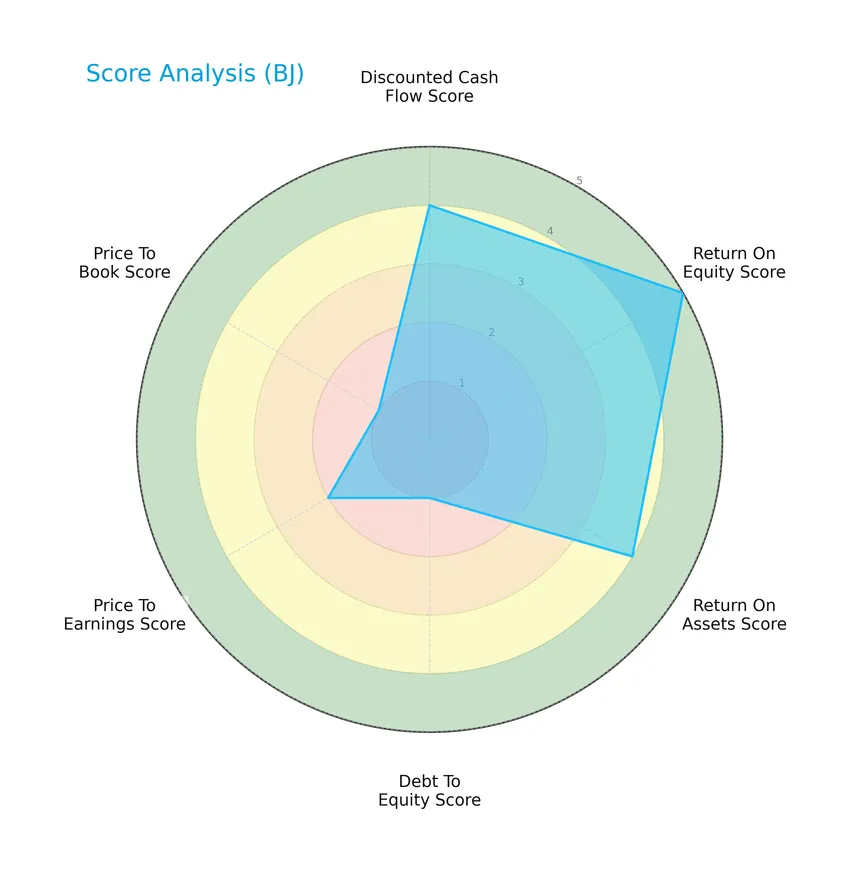

The following radar chart presents an overview of BJ’s Wholesale Club Holdings, Inc.’s key financial scores and valuation metrics:

BJ shows a favorable discounted cash flow score of 4 and strong return on equity at 5, complemented by a solid return on assets score of 4. However, debt-to-equity and price-to-book ratios are very unfavorable, scoring 1 each, while price-to-earnings is moderate at 2.

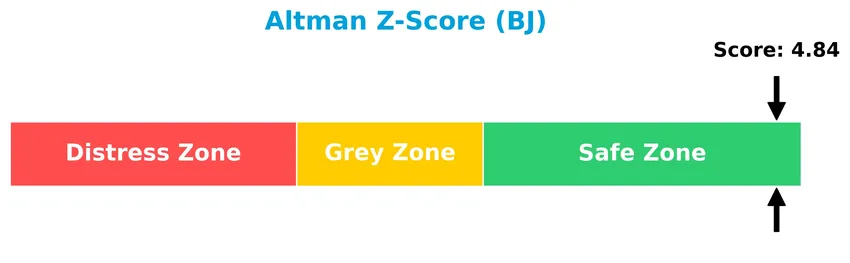

Analysis of the company’s bankruptcy risk

The Altman Z-Score places BJ’s Wholesale Club Holdings, Inc. comfortably in the safe zone, indicating a low risk of bankruptcy:

Is the company in good financial health?

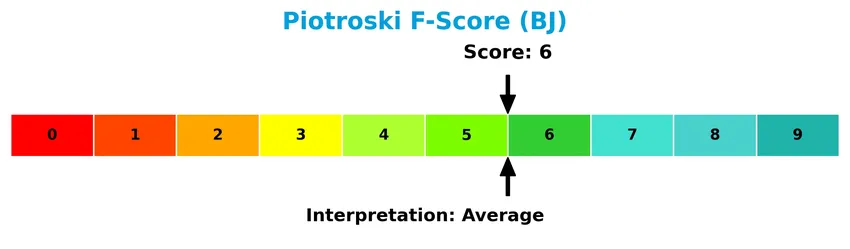

The Piotroski Score diagram offers insight into BJ’s overall financial health and operational efficiency:

With a Piotroski Score of 6, BJ falls into the average category, suggesting moderate financial strength but leaving room for improvement in certain areas of profitability, leverage, liquidity, or efficiency.

Competitive Landscape & Sector Positioning

This sector analysis will explore BJ’s Wholesale Club Holdings, Inc.’s strategic positioning, revenue segments, key products, competitors, and competitive advantages. I will assess whether BJ’s holds a competitive edge over its main industry rivals.

Strategic Positioning

BJ’s Wholesale Club Holdings, Inc. has concentrated its operations primarily on warehouse clubs along the U.S. East Coast, operating 229 clubs and 160 gas locations across 17 states. Its revenue is mainly derived from product sales (~$20B in 2024) with a smaller but growing membership segment (~$456M), reflecting a focused retail portfolio and regional geographic exposure.

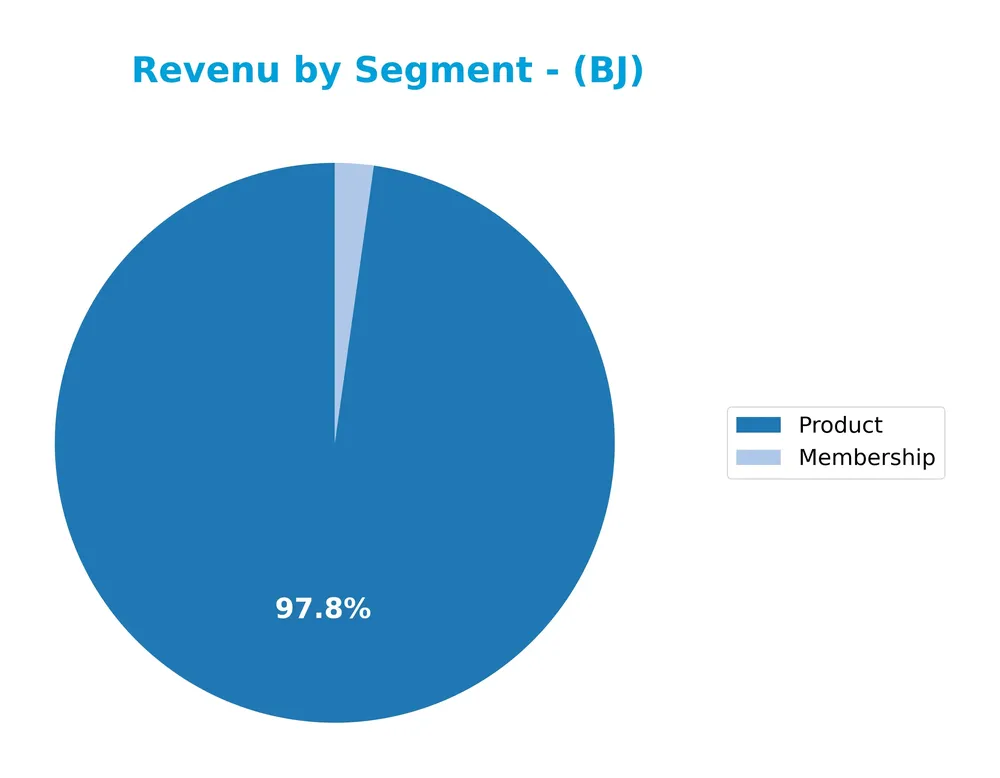

Revenue by Segment

This pie chart illustrates BJ’s Wholesale Club Holdings, Inc.’s revenue distribution by segment for the fiscal year 2024, highlighting the relative contributions of Membership and Product sales.

In 2024, Product sales dominate BJ’s revenue with $20.0B, showing steady growth from $12.7B in 2018, while Membership revenue also increased to $456M from $283M over the same period. The business remains heavily reliant on Product sales, but Membership fees provide a solid recurring revenue base. Recent years demonstrate consistent expansion in both segments, indicating balanced growth without excessive concentration risk.

Key Products & Brands

Below is an overview of BJ’s Wholesale Club Holdings, Inc.’s key products and brands:

| Product | Description |

|---|---|

| Membership | Revenue from membership fees allowing access to BJ’s warehouse clubs and exclusive offers. |

| Product | Sales of perishable goods, general merchandise, gasoline, and ancillary services through physical and online channels. |

BJ’s Wholesale Club generates revenue primarily from membership fees and product sales, including groceries, merchandise, and fuel. These offerings support its warehouse club business model across the US East Coast.

Main Competitors

There are 6 main competitors in the Discount Stores industry, with the table below listing the top 6 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Walmart Inc. | 899B |

| Costco Wholesale Corporation | 379B |

| Target Corporation | 45.7B |

| Dollar General Corporation | 30.1B |

| Dollar Tree, Inc. | 26.8B |

| BJ’s Wholesale Club Holdings, Inc. | 11.9B |

BJ’s Wholesale Club Holdings, Inc. ranks 6th among its competitors with a market cap representing 1.43% of the leader Walmart Inc. The company is positioned below both the average market cap of the top 10 competitors (232B) and the median sector market cap (38B). It has a significant 108.72% gap to the next competitor above, Dollar Tree, indicating a notable difference in scale.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does BJ have a competitive advantage?

BJ’s Wholesale Club Holdings, Inc. demonstrates a slight competitive advantage, creating value by earning an ROIC 6.7% above its WACC. However, this advantage is tempered by a declining ROIC trend and neutral income statement margins, indicating cautious profitability.

Looking ahead, BJ’s operates 229 warehouse clubs and 160 gas locations across 17 states, with diversified sales channels including multiple e-commerce websites and a mobile app. These assets position the company to explore growth opportunities in new markets and through enhanced digital offerings.

SWOT Analysis

This SWOT analysis highlights the key internal and external factors affecting BJ’s Wholesale Club Holdings, Inc. to guide strategic investment decisions.

Strengths

- strong ROE at 28.93%

- favorable ROIC above WACC

- solid asset turnover ratios

Weaknesses

- low current and quick ratios indicating liquidity concerns

- high debt-to-equity ratio at 1.54

- no dividend payout

Opportunities

- expanding e-commerce presence

- potential for margin improvement

- growth in warehouse club demand

Threats

- intense retail competition

- margin pressure from cost increases

- economic downturn impacting consumer spending

Overall, BJ demonstrates solid profitability and operational efficiency but faces liquidity and leverage challenges. The company’s growth prospects hinge on improving margins and leveraging its digital channels, while risks from competitive and macroeconomic pressures require cautious monitoring in the investment strategy.

Stock Price Action Analysis

The weekly stock chart of BJ’s Wholesale Club Holdings, Inc. illustrates price movements and key technical levels over the past 12 months:

Trend Analysis

Over the past year, BJ’s stock price increased by 36.35%, reflecting a bullish trend with clear acceleration. The stock moved from a low of 71.47 to a high of 118.45, supported by a relatively high volatility level with a standard deviation of 12.08. Recent three-month data shows a moderate 6.61% gain with low volatility (2.16), indicating steady upward momentum.

Volume Analysis

Trading volume for BJ has been increasing overall, with total volume near 989M shares. In the recent three-month period, buyer volume slightly dominated at 58%, signaling a buyer-driven market environment. This rising volume trend suggests growing investor interest and positive market participation in the stock.

Target Prices

Analysts present a clear target consensus for BJ’s Wholesale Club Holdings, Inc.

| Target High | Target Low | Consensus |

|---|---|---|

| 135 | 95 | 111.67 |

The target prices suggest moderate upside potential, with analysts expecting the stock to trade around the $111.67 consensus, reflecting balanced optimism.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback regarding BJ’s Wholesale Club Holdings, Inc. (BJ).

Stock Grades

The latest stock grades for BJ’s Wholesale Club Holdings, Inc. from reputable financial institutions are summarized below:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Equal Weight | 2026-01-15 |

| Barclays | Downgrade | Underweight | 2026-01-07 |

| Evercore ISI Group | Maintain | In Line | 2025-11-24 |

| Baird | Maintain | Outperform | 2025-11-24 |

| DA Davidson | Maintain | Buy | 2025-11-24 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-24 |

| BTIG | Maintain | Buy | 2025-11-21 |

| Evercore ISI Group | Maintain | In Line | 2025-11-17 |

| Wells Fargo | Maintain | Overweight | 2025-11-12 |

| JP Morgan | Maintain | Neutral | 2025-11-10 |

Overall, the grades show a mixed but generally neutral to moderately positive stance, with several firms maintaining buy or outperform ratings while Barclays recently downgraded to underweight, indicating some cautious sentiment.

Consumer Opinions

Consumers of BJ’s Wholesale Club Holdings, Inc. generally appreciate the value and product variety but also note areas where the company could improve.

| Positive Reviews | Negative Reviews |

|---|---|

| “Great prices and a wide selection of bulk items.” | “Checkout lines can be very long.” |

| “Friendly staff and clean store environment.” | “Membership fees seem a bit high.” |

| “Convenient locations and good online shopping.” | “Limited fresh produce options.” |

Overall, customers consistently praise BJ’s for its competitive pricing and helpful staff, while common complaints focus on checkout wait times and membership costs.

Risk Analysis

Below is a summary table outlining key risk categories for BJ’s Wholesale Club Holdings, Inc., with their likelihood and potential impact on investors:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Leverage | Elevated debt-to-equity ratio (1.54) increases financial risk. | Medium | High |

| Liquidity | Low current ratio (0.74) and quick ratio (0.15) indicate tight liquidity. | High | Medium |

| Market Valuation | High price-to-book ratio (7.09) may suggest overvaluation risk. | Medium | Medium |

| Profitability | Low net margin (2.61%) could pressure earnings growth. | Medium | Medium |

| Dividend Policy | No dividend yield presents limited income for investors. | Low | Low |

| Operational Risks | Dependence on East Coast US markets may limit growth and increase exposure to regional disruptions. | Medium | Medium |

The most significant risks for BJ are its high financial leverage and weak liquidity, which can strain operations under economic stress. Despite a strong Altman Z-Score placing it in the safe zone, investors should monitor debt levels closely. The company’s favorable return on equity contrasts with its low net margin, signaling efficiency but thin profitability margins.

Should You Buy BJ’s Wholesale Club Holdings, Inc.?

BJ’s Wholesale Club Holdings, Inc. appears to be generating value with a slightly favorable competitive moat despite a declining ROIC trend. While profitability metrics suggest operational efficiency, the company’s leverage profile could be seen as substantial. Overall, the investment rating is a moderate B, indicating balanced prospects tempered by financial risks.

Strength & Efficiency Pillars

BJ’s Wholesale Club Holdings, Inc. exhibits solid profitability and value creation metrics. The return on equity stands at a favorable 28.93%, supported by an 11.69% return on invested capital (ROIC) that comfortably exceeds the weighted average cost of capital (WACC) of 4.96%, confirming the company as a value creator. Its Altman Z-Score of 4.84 places it safely in the “safe zone,” indicating low bankruptcy risk, while a Piotroski score of 6 suggests average but stable financial health. Operational efficiency is further underlined by strong asset turnover ratios.

Weaknesses and Drawbacks

Despite these strengths, BJ faces notable challenges. The company’s valuation appears stretched with a price-to-book ratio of 7.09, flagged as very unfavorable, implying a premium price relative to book value that might deter value-focused investors. Leverage is also a concern; the debt-to-equity ratio is elevated at 1.54, combined with weak liquidity ratios (current ratio 0.74, quick ratio 0.15), signaling potential short-term financial strain. Although the stock trend remains bullish overall, the moderate price-to-earnings ratio of 24.49 and neutral income statement results caution against overoptimism.

Our Verdict about BJ’s Wholesale Club Holdings, Inc.

BJ’s fundamental profile may appear favorable due to its value-creating efficiency and financial safety, but the elevated leverage and valuation risks temper enthusiasm. The bullish overall stock trend paired with recent slight buyer dominance suggests cautious optimism. Therefore, despite long-term strength, recent market conditions might suggest a wait-and-see approach for investors seeking a more attractive entry point.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Teacher Retirement System of Texas Buys 104,783 Shares of BJ’s Wholesale Club Holdings, Inc. $BJ – MarketBeat (Jan 23, 2026)

- BJ’s Wholesale Club: Bulk-Sized Opportunity at an Affordable Valuation. Buy the Stock. – Barron’s (Jan 22, 2026)

- A Look At BJ’s Wholesale Club (BJ) Valuation As Shares Trade Near $96 And Fair Value Seen At $109.26 – simplywall.st (Jan 23, 2026)

- Chattanooga Families Can Save at BJ’s Wholesale Club Starting January 30 – Business Wire (Jan 22, 2026)

- Here’s Why BJ’s Wholesale Club (BJ) is a Strong Growth Stock – Yahoo Finance (Jan 12, 2026)

For more information about BJ’s Wholesale Club Holdings, Inc., please visit the official website: bjs.com