Home > Analyses > Technology > BigBear.ai Holdings, Inc.

BigBear.ai Holdings, Inc. transforms complex data into actionable intelligence that empowers organizations to make real-time decisions. As a pioneer in artificial intelligence and machine learning, BigBear.ai leads the information technology services sector with cutting-edge solutions in cybersecurity, cloud engineering, and advanced analytics. Renowned for its innovative approach and deep expertise, the company shapes how industries manage risk and optimize operations. The key question now is whether BigBear.ai’s robust fundamentals can sustain its growth momentum and justify its current market valuation.

Table of contents

Business Model & Company Overview

BigBear.ai Holdings, Inc., founded in 2021 and headquartered in Columbia, Maryland, stands as a significant player in the Information Technology Services sector. The company integrates artificial intelligence and machine learning into a unified ecosystem, offering advanced decision support through its Cyber & Engineering and Analytics segments. These segments collectively deliver consulting and technology solutions that span cloud engineering, cybersecurity, and big data analytics, enabling clients to harness data-driven insights for operational excellence.

The company’s revenue engine balances high-end consulting services with cutting-edge technological solutions, creating value through its dual focus on enterprise IT and predictive analytics. BigBear.ai’s strategic footprint extends across key global markets, including the Americas, Europe, and Asia, supporting diverse industries. Its robust competitive advantage lies in blending sophisticated AI with actionable intelligence, positioning it as a formidable force shaping the future of data-driven decision-making.

Financial Performance & Fundamental Metrics

I will analyze BigBear.ai Holdings, Inc.’s income statement, key financial ratios, and dividend payout policy to provide a clear view of its fundamental strength.

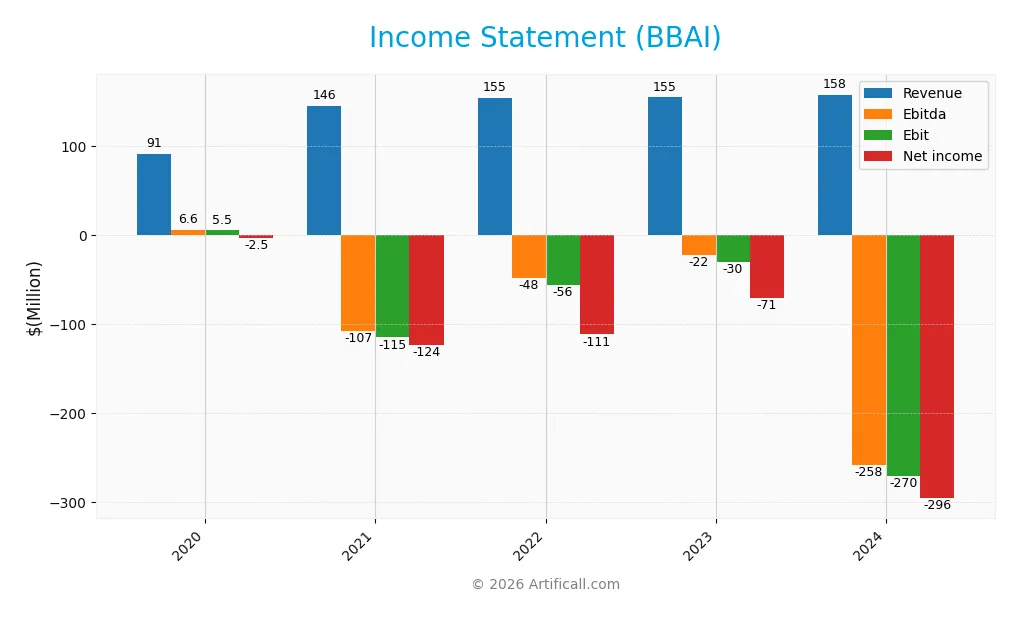

Income Statement

The table below summarizes BigBear.ai Holdings, Inc.’s key income statement figures for fiscal years 2020 through 2024, reflecting revenue, expenses, profitability, and earnings per share.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 91.3M | 145.6M | 155.0M | 155.2M | 158.2M |

| Cost of Revenue | 69.6M | 111.5M | 112.0M | 114.6M | 113.0M |

| Operating Expenses | 26.2M | 112.5M | 153.5M | 79.6M | 178.6M |

| Gross Profit | 21.7M | 34.1M | 43.0M | 40.6M | 45.2M |

| EBITDA | 6.6M | -107.4M | -48.2M | -22.3M | -258.3M |

| EBIT | 5.5M | -114.7M | -55.9M | -30.2M | -270.2M |

| Interest Expense | – | 7.8M | 14.4M | 14.2M | 25.6M |

| Net Income | -2.5M | -123.6M | -111.4M | -70.7M | -295.5M |

| EPS | -0.0003 | -1.15 | -0.95 | -0.40 | -1.27 |

| Filing Date | 2021-03-31 | 2022-03-31 | 2023-03-31 | 2024-03-15 | 2025-03-25 |

Income Statement Evolution

Between 2020 and 2024, BigBear.ai Holdings, Inc. saw a revenue increase of 73.3%, reaching $158M in 2024. However, net income sharply declined by over 11,000%, resulting in a net loss of $296M in 2024. Gross margin improved to 28.6%, signaling better cost control at the revenue level, but operating and net margins worsened significantly, reflecting rising expenses and losses.

Is the Income Statement Favorable?

In 2024, fundamentals remain generally unfavorable despite revenue growth and a higher gross margin. The company reported a negative EBIT margin of -171% and a net margin of -187%, driven by high interest expenses amounting to 16.2% of revenue and significant operating losses. Net income deteriorated sharply year-over-year with EPS falling to -$1.27, indicating ongoing challenges in profitability and cost management.

Financial Ratios

The following table presents key financial ratios for BigBear.ai Holdings, Inc. over the fiscal years 2020 to 2024, offering insight into profitability, liquidity, leverage, and market valuation:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | -2.8% | -84.9% | -71.8% | -45.5% | -186.8% |

| ROE | -2.5 | -1.0 | 2.9 | 1.0 | 79.6 |

| ROIC | 69.2% | -24.7% | -68.1% | -29.3% | -93.4% |

| P/E | -405 | -4.9 | -0.8 | -4.5 | -3.5 |

| P/B | 10.3 | 4.9 | -2.3 | -4.7 | -280 |

| Current Ratio | 2.8 | 2.9 | 1.5 | 0.9 | 0.5 |

| Quick Ratio | 2.8 | 1.5 | 1.5 | 0.9 | 0.5 |

| D/E | 1.1 | 1.6 | -5.3 | -3.0 | -39.4 |

| Debt-to-Assets | 0.5 | 0.5 | 1.0 | 1.0 | 0.4 |

| Interest Coverage | 0.0 | -10.1 | -7.7 | -2.7 | -5.2 |

| Asset Turnover | 0.42 | 0.38 | 0.79 | 0.78 | 0.46 |

| Fixed Asset Turnover | 106 | 135 | 26 | 31 | 15 |

| Dividend Yield | 0.9% | 0.0% | 0.0% | 0.0% | 0.0% |

Evolution of Financial Ratios

From 2020 to 2024, BigBear.ai Holdings, Inc. showed a volatile trajectory in key ratios. Return on Equity (ROE) improved markedly, reaching an unusually high 79.58% in 2024, despite negative profitability margins throughout the period. The Current Ratio declined sharply from 2.85 in 2020 to 0.46 in 2024, indicating reduced short-term liquidity. Debt-to-Equity ratio remained negative in recent years, reflecting complex capital structure and equity deficits.

Are the Financial Ratios Favorable?

In 2024, BigBear.ai’s profitability ratios were mostly unfavorable with net margin at -186.78% and ROIC at -93.42%, despite a favorable ROE and price-to-earnings ratio. Liquidity ratios such as Current and Quick Ratios stood at 0.46, marked unfavorable. Leverage measured by Debt-to-Equity showed a favorable negative value, while Debt-to-Assets was neutral at 42.59%. Efficiency ratios like asset turnover were unfavorable, but fixed asset turnover was strong at 14.61. Overall, 57.14% of ratios were unfavorable, leading to a global unfavorable assessment.

Shareholder Return Policy

BigBear.ai Holdings, Inc. does not pay dividends, reflecting its ongoing negative net income and focus on reinvestment during its growth phase. The absence of dividend payouts aligns with its strategy to prioritize operational development over immediate shareholder distributions.

The company does not currently engage in share buybacks either, which is consistent with its financial position. This approach may support long-term value creation by preserving capital for growth initiatives, though it also requires careful monitoring to ensure sustainable shareholder returns in the future.

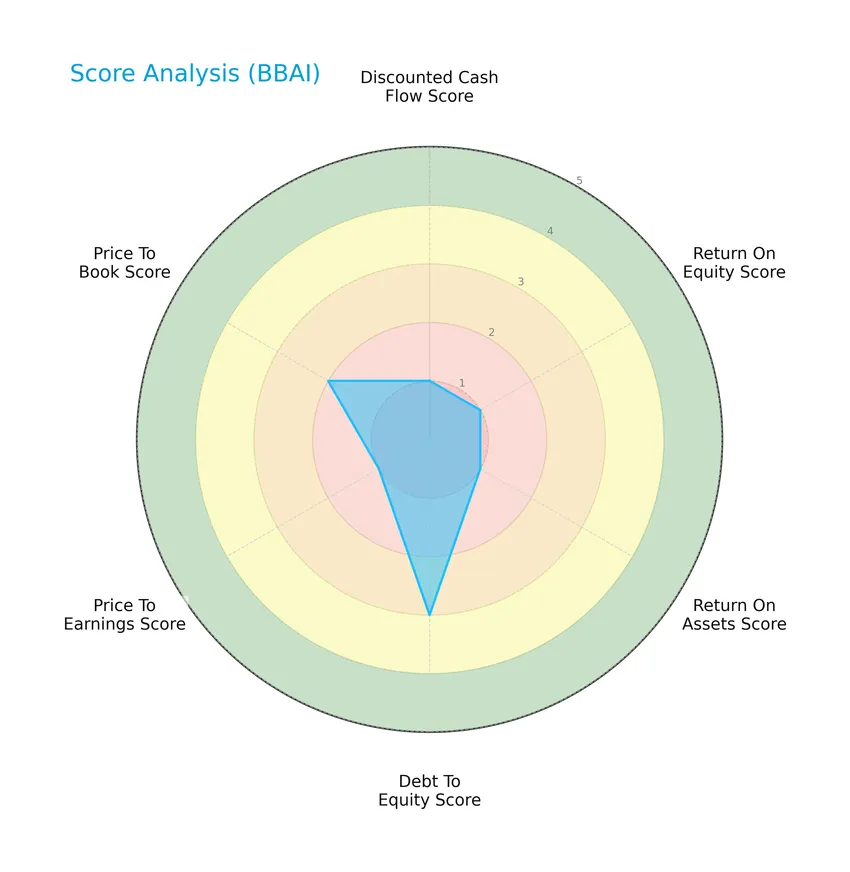

Score analysis

The following radar chart presents key financial scores to evaluate BigBear.ai Holdings, Inc.’s valuation and profitability metrics:

BigBear.ai Holdings, Inc. shows very unfavorable scores in discounted cash flow, return on equity, return on assets, and price-to-earnings ratios. The debt-to-equity and price-to-book scores are moderate, indicating some balance in leverage and valuation despite weak profitability metrics.

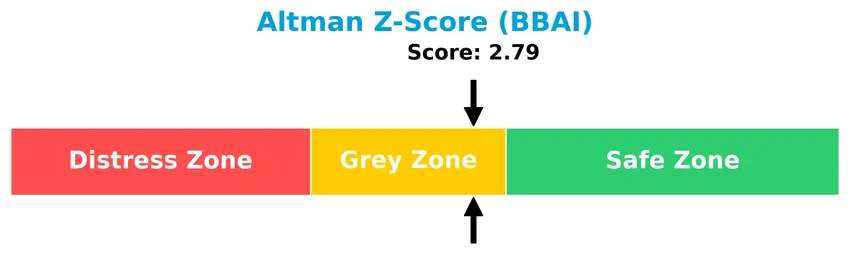

Analysis of the company’s bankruptcy risk

The Altman Z-Score of 2.79 places the company in the grey zone, suggesting a moderate risk of bankruptcy that investors should monitor closely:

Is the company in good financial health?

The Piotroski Score diagram below highlights the company’s financial health based on its recent financial statements:

With a Piotroski Score of 3, BigBear.ai Holdings, Inc. is categorized as very weak in financial health, reflecting challenges in profitability, leverage, and operational efficiency.

Competitive Landscape & Sector Positioning

This sector analysis will explore BigBear.ai Holdings, Inc.’s strategic positioning, revenue segments, key products, main competitors, and competitive advantages. I will also conduct a SWOT analysis to assess the company’s strengths, weaknesses, opportunities, and threats. The goal is to determine whether BigBear.ai holds a competitive advantage over its peers in the technology services sector.

Strategic Positioning

BigBear.ai Holdings, Inc. operates through two distinct segments: Cyber & Engineering and Analytics, reflecting a diversified product portfolio focused on AI-driven decision support. Headquartered in the US, the company targets technology services with a balanced approach between cybersecurity, cloud engineering, and advanced analytics.

Revenue by Segment

This pie chart illustrates BigBear.ai Holdings, Inc.’s revenue distribution by segment for the fiscal year 2024, highlighting key business areas and their financial contributions.

The overall trend shows a concentration of revenue in the “Reportable Segment” with $158M in 2024, indicating a shift from previous years where “Analytics” and “Cyber and Engineering” were distinct contributors. Analytics grew from $71M in 2021 to $84M in 2022, but its latest value is not reported. The absence of segmented data in 2024 suggests possible consolidation or reporting changes, warranting caution due to potential concentration risk.

Key Products & Brands

The following table outlines BigBear.ai Holdings, Inc.’s key products and brand segments with their core descriptions:

| Product | Description |

|---|---|

| Cyber & Engineering | Provides high-end technology and management consulting in cloud engineering, enterprise IT, cybersecurity, network operations, wireless, systems engineering, and strategic program planning. |

| Analytics | Offers big data computing and analytical solutions, including predictive and prescriptive analytics, enabling real-time decision-making by aggregating and interpreting data. |

BigBear.ai operates through two main segments: Cyber & Engineering focuses on IT and cybersecurity consulting, while Analytics delivers advanced data solutions for strategic insights and decision support.

Main Competitors

BigBear.ai Holdings, Inc. faces competition from 16 companies, with the table below showing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| International Business Machines Corporation | 272B |

| Accenture plc | 162B |

| Cognizant Technology Solutions Corporation | 40B |

| Fiserv, Inc. | 36B |

| Fidelity National Information Services, Inc. | 34B |

| Wipro Limited | 30B |

| Leidos Holdings, Inc. | 23B |

| Gartner, Inc. | 18B |

| CDW Corporation | 17B |

| Jack Henry & Associates, Inc. | 13B |

BigBear.ai Holdings, Inc. ranks 15th among 16 competitors in the Information Technology Services industry. Its market cap is roughly 0.79% of the leader’s (IBM). The company is positioned below both the average market cap of the top 10 competitors (approximately 64.6B) and the sector median (about 17.8B). It maintains a 22.29% market cap gap with its closest competitor above.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does BBAI have a competitive advantage?

BigBear.ai Holdings, Inc. does not present a competitive advantage as it shows a very unfavorable economic moat, with a declining ROIC and value destruction relative to its cost of capital. Its profitability metrics remain unfavorable, including a negative EBIT margin of -171% and a net margin of -187%.

Looking ahead, BigBear.ai operates in the artificial intelligence and analytics sector, offering services in cybersecurity, cloud engineering, and predictive analytics. Future opportunities may arise from expanding these segments and leveraging AI for decision support, but current financial indicators suggest ongoing challenges in value creation.

SWOT Analysis

This SWOT analysis highlights BigBear.ai Holdings, Inc.’s key internal and external factors to inform investment decisions.

Strengths

- strong expertise in AI and machine learning

- diverse service segments in Cyber & Engineering and Analytics

- fixed asset turnover is favorable

Weaknesses

- negative net and EBIT margins

- poor liquidity ratios (current and quick ratio below 1)

- very weak Piotroski score indicating financial distress

Opportunities

- growing demand for AI-driven analytics and cybersecurity

- expansion potential in cloud engineering and IT consulting

- opportunity to improve profitability through operational efficiencies

Threats

- high beta indicating stock volatility

- intense competition in technology and AI sectors

- financial instability risk due to negative cash flow and high interest expenses

Overall, BigBear.ai demonstrates strong technological capabilities but faces significant financial and operational challenges. The company’s strategy should focus on improving profitability and liquidity while leveraging market growth in AI and cybersecurity to mitigate risks.

Stock Price Action Analysis

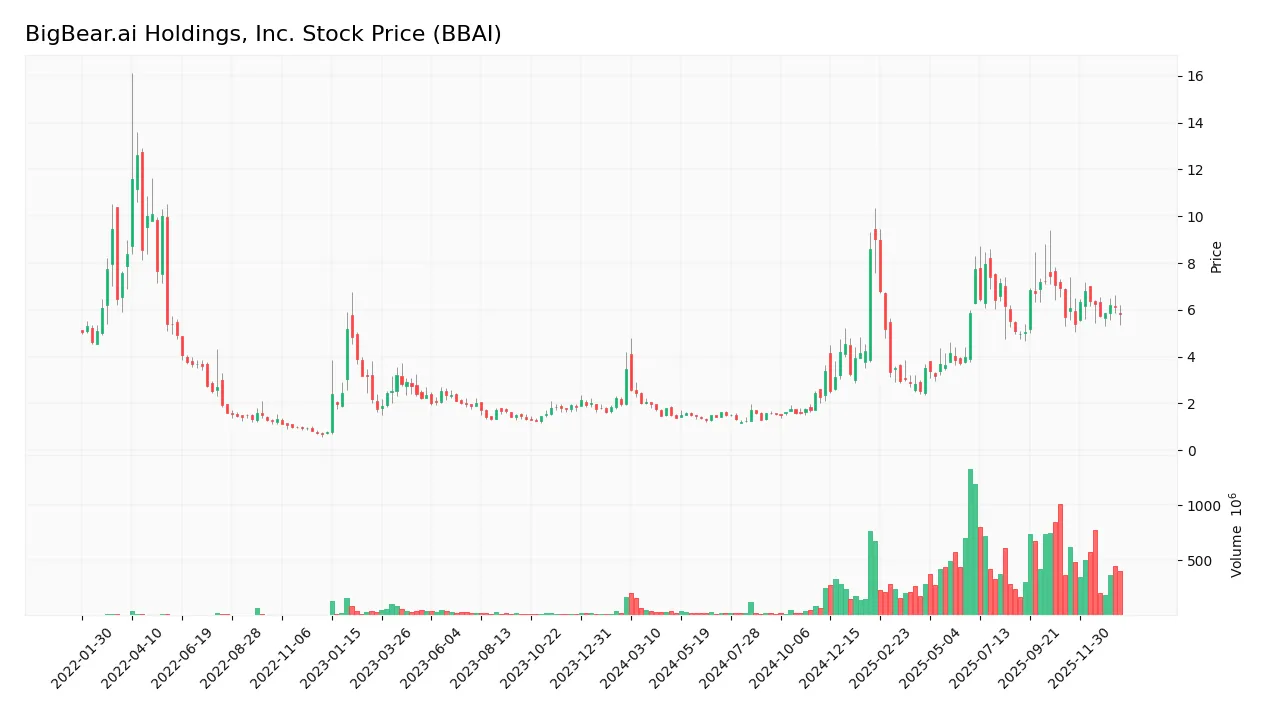

The following weekly stock chart for BigBear.ai Holdings, Inc. (BBAI) illustrates price movements and volatility over the past 12 months:

Trend Analysis

Over the past 12 months, BBAI’s stock price increased by 68.21%, indicating a bullish trend. The price peaked at 9.02 and bottomed at 1.21, with a standard deviation of 2.19 showing moderate volatility. Although the trend remains bullish, there is a noted deceleration in momentum.

Volume Analysis

In the last three months, trading volume has been seller-driven, with buyers accounting for 38.41% of activity. Volume is increasing overall, signaling growing market participation but with dominant selling pressure, suggesting cautious or bearish investor sentiment during this period.

Target Prices

The consensus target price for BigBear.ai Holdings, Inc. (BBAI) reflects a unified analyst outlook.

| Target High | Target Low | Consensus |

|---|---|---|

| 6 | 6 | 6 |

Analysts expect the stock to stabilize around the $6 mark, indicating a clear and consistent valuation forecast.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews the latest analyst ratings and consumer feedback regarding BigBear.ai Holdings, Inc. (BBAI).

Stock Grades

Here is the latest overview of BigBear.ai Holdings, Inc. grades from recognized financial analysts and their recent updates:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Cantor Fitzgerald | Downgrade | Neutral | 2026-01-07 |

| HC Wainwright & Co. | Maintain | Buy | 2025-11-11 |

| HC Wainwright & Co. | Maintain | Buy | 2025-08-12 |

| HC Wainwright & Co. | Maintain | Buy | 2025-07-01 |

| HC Wainwright & Co. | Maintain | Buy | 2025-03-07 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-03-07 |

| HC Wainwright & Co. | Maintain | Buy | 2024-12-30 |

| HC Wainwright & Co. | Maintain | Buy | 2024-11-06 |

| HC Wainwright & Co. | Maintain | Buy | 2024-10-15 |

| Cantor Fitzgerald | Maintain | Overweight | 2024-08-21 |

The trend shows a consistent buy rating from HC Wainwright & Co. throughout 2024 and 2025, while Cantor Fitzgerald downgraded its rating to neutral in early 2026 after previously maintaining an overweight stance. Overall, the consensus currently leans toward a hold position with no strong buy or sell signals.

Consumer Opinions

Consumers have shared a variety of insights about BigBear.ai Holdings, Inc., reflecting both enthusiasm and areas for improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| Advanced AI analytics provide valuable insights. | Customer support response times can be slow. |

| Innovative solutions help optimize decision-making. | Some users find the platform complex to use. |

| Strong data security and privacy measures. | Pricing may be high for smaller businesses. |

Overall, BigBear.ai is praised for its cutting-edge AI capabilities and robust security, though users often mention a learning curve and customer service delays as key areas needing attention.

Risk Analysis

The following table summarizes the key risks associated with BigBear.ai Holdings, Inc., highlighting their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Performance | Negative net margin (-186.78%) and unfavorable returns on invested capital indicate weak profitability. | High | High |

| Liquidity Risk | Current and quick ratios at 0.46 reveal limited short-term liquidity to cover obligations. | High | Medium |

| Market Volatility | High beta (3.214) suggests significant stock price fluctuations relative to the market. | High | High |

| Credit Risk | Moderate debt to assets ratio (42.59%) but unfavorable interest coverage (-10.53) signals risk in debt servicing. | Medium | Medium |

| Bankruptcy Risk | Altman Z-Score of 2.79 places the company in the grey zone, indicating moderate bankruptcy risk. | Medium | High |

| Operational Efficiency | Low asset turnover (0.46) suggests inefficient use of assets to generate sales. | Medium | Medium |

| Dividend Risk | No dividend yield, which may deter income-focused investors. | High | Low |

The most critical risks are the poor profitability combined with high market volatility and moderate bankruptcy risk. The company’s weak liquidity and unfavorable interest coverage further compound financial vulnerability. Investors should exercise caution and closely monitor these factors before considering BBAI for their portfolio.

Should You Buy BigBear.ai Holdings, Inc.?

BigBear.ai Holdings, Inc. appears to be facing significant challenges with declining profitability and a very unfavorable competitive moat characterized by value destruction. Despite a manageable leverage profile, its overall financial health could be seen as weak, reflected in a cautious C- rating.

Strength & Efficiency Pillars

BigBear.ai Holdings, Inc. presents a nuanced efficiency profile. While the company posts an impressive return on equity of 7957.65%, this figure contrasts sharply with a negative return on invested capital of -93.42%, highlighting operational challenges. The Altman Z-Score at 2.79 places the company in the grey zone for bankruptcy risk, signaling moderate financial stability. Despite these mixed signals, BigBear.ai’s fixed asset turnover of 14.61 and a debt-to-equity ratio of -39.42 suggest some effective asset utilization and conservative leverage management.

Weaknesses and Drawbacks

The firm faces considerable headwinds. Negative net margins at -186.78% and an EBIT margin of -170.73% underscore profitability struggles, compounded by an unfavorable current and quick ratio of 0.46, indicating liquidity concerns. The interest coverage ratio stands at -10.53, reflecting difficulties in covering debt expenses. Additionally, recent trends show seller dominance with only 38.41% buyer volume, creating short-term market pressure. Valuation metrics such as a negative P/E of -3.52 and a P/B of -279.9, although technically favorable due to negative earnings, complicate traditional valuation assessments.

Our Verdict about BigBear.ai Holdings, Inc.

The long-term fundamental profile of BigBear.ai appears unfavorable due to persistent profitability and liquidity weaknesses despite some asset efficiency. While the overall stock trend remains bullish with a 68.21% price increase, recent seller dominance suggests caution. Consequently, despite underlying operational challenges, the profile may appear attractive for selective exposure but suggests a wait-and-see approach for a more favorable entry point.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- BigBear.ai Holdings, Inc. (BBAI) Registers a Bigger Fall Than the Market: Important Facts to Note – Yahoo Finance (Jan 20, 2026)

- Can BigBear.ai’s CargoSeer Acquisition Strengthen Its AI Moat? – TradingView — Track All Markets (Jan 22, 2026)

- BigBear.ai vs. Palantir: Which Defense AI Stock Is the Smarter Investment? – Zacks Investment Research (Jan 21, 2026)

- A Look At BigBear.ai (BBAI) Valuation After Recent Share Price Pullback – Yahoo Finance (Jan 22, 2026)

- BigBear.ai (NYSE:BBAI) Stock Price Down 1.8% – What’s Next? – MarketBeat (Jan 23, 2026)

For more information about BigBear.ai Holdings, Inc., please visit the official website: bigbear.ai