Home > Analyses > Consumer Cyclical > Best Buy Co., Inc.

Best Buy Co., Inc. transforms how millions access cutting-edge technology, blending in-store expertise with a robust online presence to meet evolving consumer needs. As a dominant player in specialty retail, Best Buy offers a broad range of electronics and appliances, backed by trusted services like Geek Squad. Renowned for innovation and market influence, the company stands at a crossroads—can its strong fundamentals and adaptability continue to justify its valuation amid shifting retail dynamics?

Table of contents

Business Model & Company Overview

Best Buy Co., Inc., founded in 1966 and headquartered in Richfield, Minnesota, stands as a leader in specialty retail across the United States and Canada. Its comprehensive ecosystem delivers a vast array of technology products—from computing and mobile devices to consumer electronics and appliances—integrated with services like consultation, repair, and technical support. This blend positions Best Buy as a one-stop destination for tech consumers, supported by 1,144 stores and multiple online platforms.

The company’s revenue engine balances product sales with recurring services, including warranties, memberships, and installation, creating consistent cash flow streams. Best Buy’s strategic footprint spans key North American markets, leveraging its strong presence in both physical and digital retail. Its competitive advantage lies in combining extensive product variety with value-added services, securing a durable economic moat that shapes the future of consumer technology retail.

Financial Performance & Fundamental Metrics

In this section, I analyze Best Buy Co., Inc.’s income statement, key financial ratios, and dividend payout policy to assess its overall financial health and investment potential.

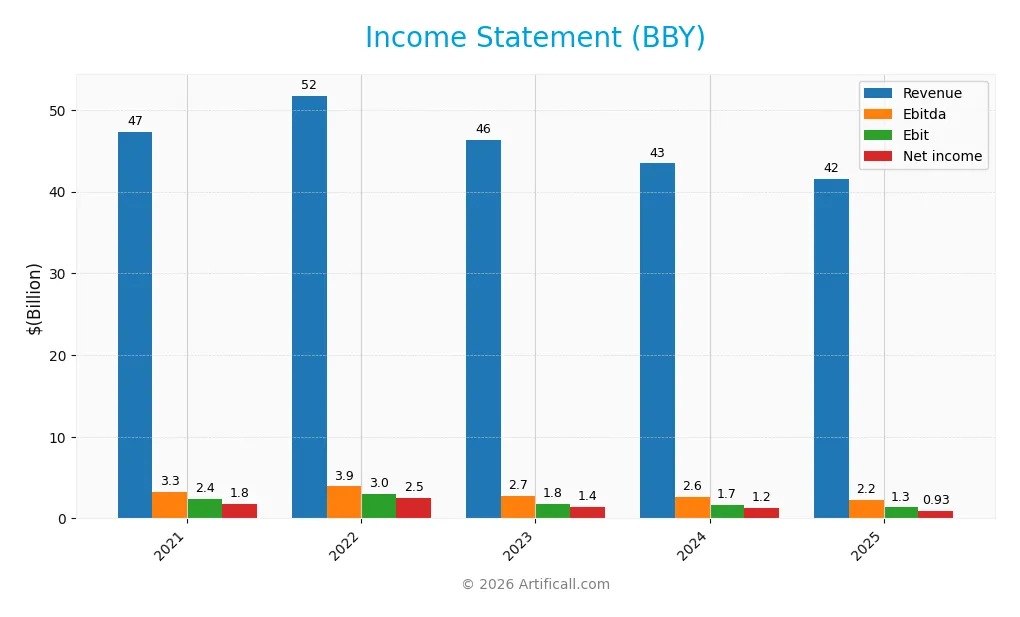

Income Statement

The table below summarizes Best Buy Co., Inc.’s key income statement figures for the fiscal years 2021 through 2025, showing revenue, expenses, profitability, and earnings per share (EPS).

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 47.3B | 51.8B | 46.3B | 43.5B | 41.5B |

| Cost of Revenue | 36.7B | 40.1B | 36.4B | 33.8B | 32.1B |

| Operating Expenses | 8.2B | 8.6B | 8.1B | 8.0B | 7.6B |

| Gross Profit | 10.6B | 11.6B | 9.9B | 9.6B | 9.4B |

| EBITDA | 3.3B | 3.9B | 2.7B | 2.6B | 2.2B |

| EBIT | 2.4B | 3.0B | 1.8B | 1.7B | 1.3B |

| Interest Expense | 52M | 25M | 35M | 52M | 51M |

| Net Income | 1.8B | 2.5B | 1.4B | 1.2B | 927M |

| EPS | 6.93 | 9.94 | 6.31 | 5.7 | 4.31 |

| Filing Date | 2021-03-19 | 2022-03-18 | 2023-03-17 | 2024-03-15 | 2025-03-19 |

Income Statement Evolution

Best Buy’s revenue declined by 4.43% from 2024 to 2025, continuing a downward trend of 12.13% over five years. Net income also fell sharply by 21.84% in the latest year and nearly halved over the period, reflecting a 41.32% drop in net margins. Gross margin remained relatively stable at 22.6%, while EBIT and net margins showed neutral status despite declines in absolute values.

Is the Income Statement Favorable?

The 2025 income statement reveals weakened fundamentals with a 2.23% net margin marked as neutral but accompanied by unfavorable trends in revenue, EBIT, and net income growth. Operating expenses declined proportionally with revenue, considered favorable, yet this was insufficient to offset earnings pressure. Interest expense is low at 0.12%, a positive aspect, but overall, the income statement evaluation is unfavorable, signaling caution for investors.

Financial Ratios

The following table presents key financial ratios for Best Buy Co., Inc. (BBY) over the last five fiscal years, providing a snapshot of profitability, liquidity, leverage, efficiency, and shareholder returns:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 3.8% | 4.7% | 3.1% | 2.9% | 2.2% |

| ROE | 39.2% | 81.3% | 50.8% | 40.6% | 33.0% |

| ROIC | 19.3% | 32.4% | 19.0% | 15.7% | 16.6% |

| P/E | 15.7 | 9.8 | 13.5 | 13.3 | 19.9 |

| P/B | 6.2 | 8.0 | 6.9 | 5.4 | 6.6 |

| Current Ratio | 1.19 | 0.99 | 0.98 | 1.00 | 1.03 |

| Quick Ratio | 0.66 | 0.43 | 0.41 | 0.37 | 0.39 |

| D/E | 0.87 | 1.30 | 1.42 | 1.30 | 1.44 |

| Debt-to-Assets | 21% | 22% | 25% | 27% | 27% |

| Interest Coverage | 46.0 | 120.0 | 51.3 | 30.3 | 33.7 |

| Asset Turnover | 2.48 | 2.96 | 2.93 | 2.90 | 2.81 |

| Fixed Asset Turnover | 9.7 | 10.6 | 9.1 | 8.7 | 8.4 |

| Dividend Yield | 2.0% | 2.9% | 4.1% | 4.9% | 4.4% |

Evolution of Financial Ratios

Best Buy’s Return on Equity (ROE) showed a strong upward trend, reaching 33.01% in 2025, indicating improved profitability over the period. The Current Ratio remained relatively stable around 1.0, signaling consistent liquidity. However, the Debt-to-Equity Ratio increased to 1.44 by 2025, suggesting a higher reliance on debt financing compared to earlier years.

Are the Financial Ratios Fovorable?

In 2025, Best Buy’s profitability ratios present a mixed picture: ROE and Return on Invested Capital (16.61%) are favorable, but the net margin at 2.23% is unfavorable. Liquidity ratios show neutrality for the Current Ratio (1.03) but unfavorable for the Quick Ratio (0.39). Leverage appears elevated with an unfavorable Debt-to-Equity of 1.44, yet Debt-to-Assets and interest coverage ratios are favorable. Overall, half the evaluated ratios are favorable, making the financial profile slightly favorable.

Shareholder Return Policy

Best Buy Co., Inc. maintains a dividend payout ratio near 87% in 2025, with a stable dividend per share around $3.75 and a yield above 4%. The dividend payments are supported by free cash flow, though the high payout ratio may pose sustainability risks if earnings decline. The company also engages in share buybacks, complementing its shareholder returns strategy.

This combined approach of dividends and buybacks aims to deliver shareholder value, but the elevated payout ratio suggests caution regarding long-term sustainability. The policy appears balanced for current income investors but may require adjustment should free cash flow or net income face pressure in future periods.

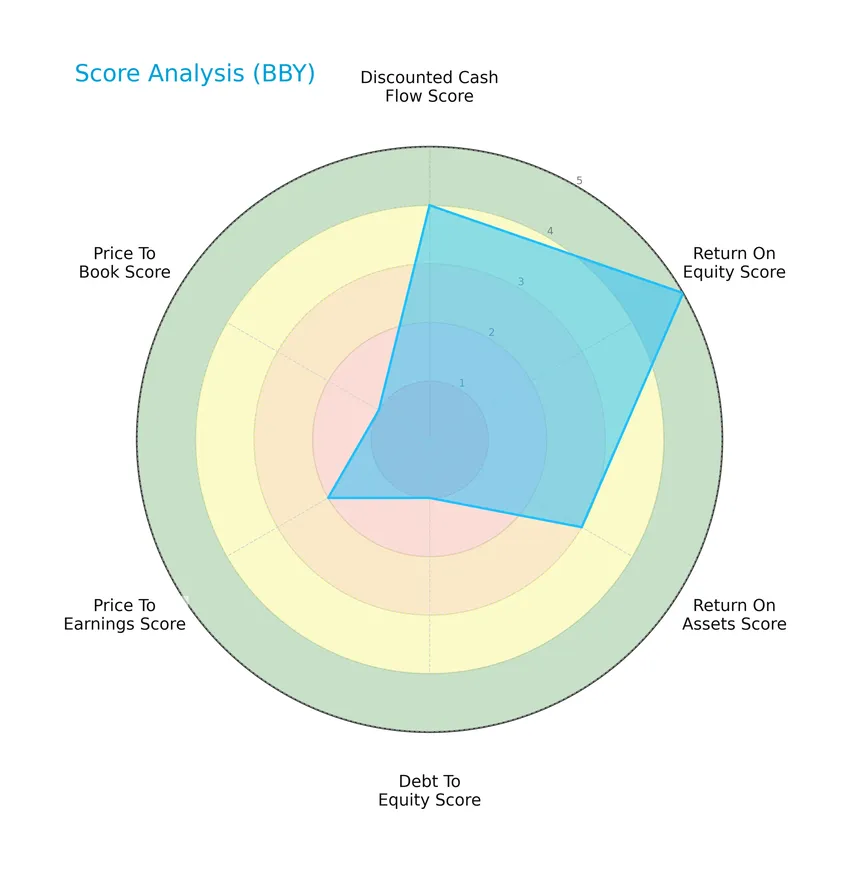

Score analysis

The following radar chart presents an overview of Best Buy Co., Inc.’s key financial scores across several valuation and performance metrics:

Best Buy exhibits a very favorable return on equity score of 5 and a favorable discounted cash flow score of 4, indicating solid profitability and valuation. However, the company’s debt to equity and price to book scores are very unfavorable at 1, reflecting higher leverage and lower market valuation relative to book value. Return on assets and price to earnings scores are moderate, suggesting mixed operational efficiency and earnings valuation.

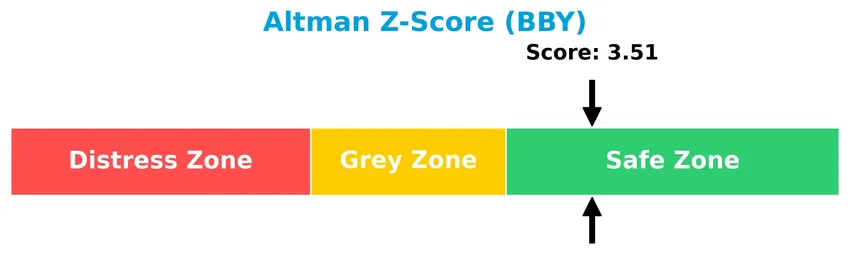

Analysis of the company’s bankruptcy risk

Best Buy’s Altman Z-Score places it in the safe zone, indicating low bankruptcy risk and strong financial stability:

Is the company in good financial health?

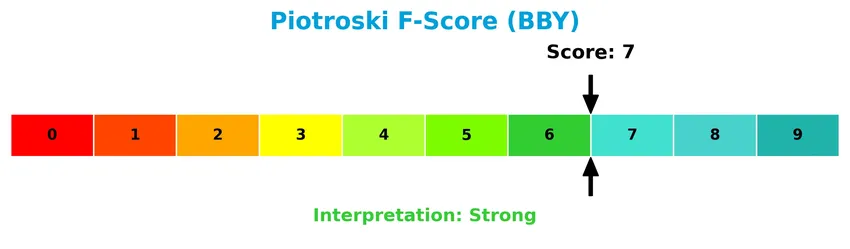

The Piotroski diagram below illustrates Best Buy Co., Inc.’s financial strength based on comprehensive criteria:

With a Piotroski Score of 7 categorized as strong, the company demonstrates solid financial health, supported by profitability, liquidity, and operational efficiency, which investors may find reassuring.

Competitive Landscape & Sector Positioning

This sector analysis will examine Best Buy Co., Inc.’s strategic positioning, revenue by segment, key products, main competitors, and competitive advantages. I will assess whether Best Buy holds a competitive advantage over its rivals in the specialty retail industry.

Strategic Positioning

Best Buy Co., Inc. maintains a diversified product portfolio spanning computing, mobile phones, consumer electronics, appliances, entertainment, and services. Geographically, it is heavily concentrated in the U.S. with $38.2B domestic revenue versus $3.3B internationally in FY 2025, reflecting a primarily domestic market focus.

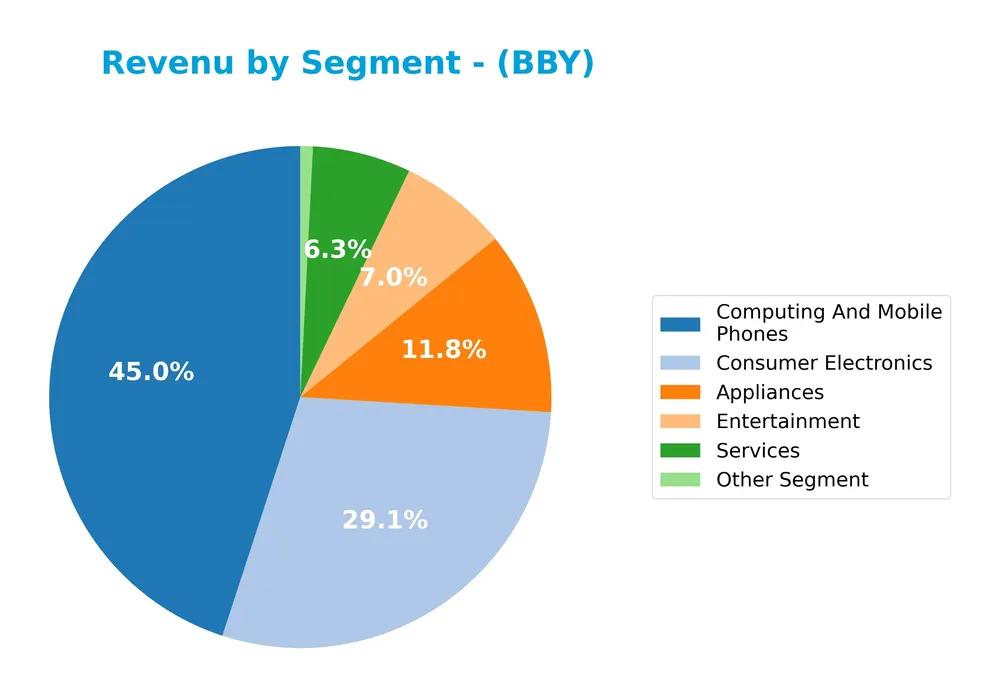

Revenue by Segment

This pie chart displays Best Buy Co., Inc.’s revenue distribution by segment for the fiscal year 2025, highlighting the contributions of various product categories.

In 2025, Computing and Mobile Phones led with $18.7B, followed by Consumer Electronics at $12.1B and Appliances at $4.9B. Services and Entertainment contributed smaller portions at $2.6B and $2.9B respectively. Recently, there is a slight decline in Appliances and Consumer Electronics compared to prior years, while Computing and Mobile Phones remain stable, indicating a concentrated but steady core business with some shifts in product demand.

Key Products & Brands

The table below presents Best Buy Co., Inc.’s key products and brands with their descriptions:

| Product | Description |

|---|---|

| Computing and Mobile Phones | Includes desktops, notebooks, peripherals, mobile phones with related carrier commissions, networking products, tablets, e-readers, and smartwatches. |

| Consumer Electronics | Covers digital imaging, health and fitness devices, home theater equipment, portable audio including headphones and speakers, and smart home products. |

| Appliances | Comprises dishwashers, laundry machines, ovens, refrigerators, blenders, coffee makers, and vacuum cleaners. |

| Entertainment | Encompasses drones, peripherals, movies, music, toys, gaming hardware and software, virtual reality, and other software products. |

| Services | Includes consultation, delivery, design, health-related services, installation, memberships, repair, set-up, technical support, and warranty-related services. |

| Other Segment | Consists of baby products, food and beverage, luggage, outdoor living, and sporting goods. |

| Brands and Retail Channels | Products are offered through stores and websites under brands such as Best Buy, Geek Squad, Magnolia, Pacific Kitchen, Home, Yardbird, and Best Buy Mobile. |

Best Buy’s diverse portfolio spans technology products, appliances, entertainment, and services, marketed through well-known retail brands and online platforms.

Main Competitors

There are 10 competitors in total, with the table below listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Amazon.com, Inc. | 2.42T |

| Alibaba Group Holding Limited | 340B |

| PDD Holdings Inc. | 159B |

| MercadoLibre, Inc. | 102B |

| eBay Inc. | 39.4B |

| Ulta Beauty, Inc. | 27.8B |

| Tractor Supply Company | 26.9B |

| Williams-Sonoma, Inc. | 23.0B |

| Genuine Parts Company | 17.2B |

| Best Buy Co., Inc. | 14.5B |

Best Buy Co., Inc. ranks 10th among its main competitors, with a market cap representing 0.58% of the leader, Amazon.com, Inc. It is positioned below both the average market cap of the top 10 competitors (317B) and the sector median (33.6B). The company’s market cap is 22.44% lower than its next closest competitor, Genuine Parts Company, indicating a notable gap.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does BBY have a competitive advantage?

Best Buy Co., Inc. presents a slight competitive advantage, as it is creating value with a ROIC exceeding its WACC by 7.7%, indicating efficient capital use despite a declining profitability trend. The company operates a diversified retail portfolio across the U.S. and Canada, with 1,144 stores and a broad product and service range in technology and appliances.

Looking ahead, Best Buy’s future outlook includes opportunities through its various brands such as Geek Squad and Best Buy Health, as well as digital platforms like bestbuy.com, which may support growth in service offerings and new market segments. However, recent unfavorable revenue and profit growth trends suggest cautious monitoring of these developments is warranted.

SWOT Analysis

This SWOT analysis highlights Best Buy Co., Inc.’s core strengths, weaknesses, opportunities, and threats to guide investor decision-making.

Strengths

- Strong brand presence in North America

- Diverse product and service offerings

- High return on equity (33%) and solid ROIC (16.6%)

Weaknesses

- Declining revenue and net income over recent years

- Weak liquidity ratios and high debt-to-equity ratio

- Negative growth in earnings per share and net margin

Opportunities

- Expansion in health tech and smart home markets

- Growing e-commerce and digital service segments

- Potential for international market growth

Threats

- Intense competition from online and big-box retailers

- Rapid technology changes impacting inventory relevance

- Macroeconomic uncertainties affecting consumer spending

Best Buy demonstrates solid operational efficiency and brand strength but faces significant challenges from declining financial performance and competitive pressure. The company’s strategy should focus on leveraging its service capabilities and digital channels while strengthening financial health and controlling debt risk.

Stock Price Action Analysis

The weekly stock chart for Best Buy Co., Inc. (BBY) over the past 12 months illustrates price fluctuations and trend dynamics clearly:

Trend Analysis

Over the past 12 months, BBY’s stock price declined by 13.95%, indicating a bearish trend. The trend shows deceleration with a volatility measured by a 9.7 standard deviation. The highest price was 102.26 and the lowest reached 60.43, confirming significant downside movement without acceleration.

Volume Analysis

Trading volume over the last three months is increasing, with sellers dominating 73.13% of the activity. Buyer volume is significantly lower at 26.87%, reflecting a seller-driven market. This pattern suggests cautious or negative investor sentiment with growing market participation favoring selling pressure.

Target Prices

The consensus target prices for Best Buy Co., Inc. indicate a moderately optimistic outlook from analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 96 | 73 | 81.71 |

Analysts expect Best Buy’s stock to trade within a range of $73 to $96, with an average target around $81.71, reflecting cautious confidence in its growth potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines recent analyst ratings and consumer feedback regarding Best Buy Co., Inc. (BBY) performance and reputation.

Stock Grades

Here is the latest collection of stock grades for Best Buy Co., Inc. from recognized financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Truist Securities | Maintain | Hold | 2026-01-16 |

| Morgan Stanley | Maintain | Equal Weight | 2026-01-15 |

| Barclays | Maintain | Equal Weight | 2026-01-08 |

| Evercore ISI Group | Maintain | In Line | 2025-12-09 |

| Barclays | Maintain | Equal Weight | 2025-11-26 |

| Guggenheim | Maintain | Buy | 2025-11-26 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-26 |

| UBS | Maintain | Buy | 2025-11-26 |

| Evercore ISI Group | Maintain | In Line | 2025-11-26 |

| Telsey Advisory Group | Maintain | Outperform | 2025-11-26 |

The overall trend in grades for Best Buy shows a predominant consensus around “Hold” and “Equal Weight,” with several firms maintaining “Buy” and “Outperform” ratings, indicating a balanced outlook without significant recent changes in analyst sentiment.

Consumer Opinions

Consumers generally express mixed sentiments about Best Buy Co., Inc., reflecting both appreciation for its service and concerns over some aspects of the shopping experience.

| Positive Reviews | Negative Reviews |

|---|---|

| Friendly and knowledgeable staff who assist well. | Long wait times for in-store pickups and customer service. |

| Wide product selection with competitive pricing. | Occasional issues with online order accuracy. |

| Convenient store locations and flexible return policies. | Limited stock availability of popular items during sales. |

Overall, consumers praise Best Buy for its helpful staff and product variety but often highlight delays and inventory challenges as key drawbacks. This suggests the company should focus on improving operational efficiency to enhance customer satisfaction.

Risk Analysis

The risks associated with Best Buy Co., Inc. are summarized in the table below for clear understanding and evaluation:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Exposure to fluctuations in consumer demand and economic cycles impacting retail sales. | High | High |

| Competitive Risk | Intense competition from e-commerce giants and specialty retailers affecting market share. | High | High |

| Financial Risk | Elevated debt-to-equity ratio of 1.44 poses refinancing and interest burden challenges. | Medium | Medium |

| Operational Risk | Supply chain disruptions could impact inventory availability and sales performance. | Medium | Medium |

| Technological Risk | Rapid tech innovation requiring continuous adaptation to new consumer electronics trends. | High | Medium |

| Regulatory Risk | Changes in trade policies or regulations affecting import costs and operational compliance. | Low | Medium |

Market and competitive risks are the most likely and impactful for Best Buy. Despite solid profitability metrics such as a 33% ROE and 16.6% ROIC, the company faces pressures from evolving consumer preferences and strong online competitors. Additionally, the unfavorable debt-to-equity ratio suggests caution in financial leverage. Overall, Best Buy remains in a safe financial zone but vigilance on market trends and debt management is prudent.

Should You Buy Best Buy Co., Inc.?

Best Buy appears to be generating robust value creation with a slightly favorable competitive moat despite a declining ROIC trend. While its leverage profile could be seen as substantial, the overall rating suggests a very favorable B profile supported by a safe-zone Altman Z-Score and strong Piotroski Score.

Strength & Efficiency Pillars

Best Buy Co., Inc. demonstrates solid profitability and financial health, with a return on equity (ROE) of 33.01% and a return on invested capital (ROIC) of 16.61%, both favorable metrics. Crucially, its ROIC of 16.61% comfortably exceeds the weighted average cost of capital (WACC) at 8.93%, confirming that the company is a clear value creator. The Altman Z-Score of 3.51 places Best Buy well within the safe zone, signaling low bankruptcy risk, while a Piotroski Score of 7 indicates strong financial strength. These factors collectively underscore the company’s operational efficiency and prudent capital management.

Weaknesses and Drawbacks

Despite these strengths, Best Buy faces notable valuation and liquidity challenges. Its price-to-book (P/B) ratio stands at an elevated 6.58, flagged as very unfavorable, suggesting the stock trades at a premium relative to its book value, which may limit upside. The debt-to-equity ratio is high at 1.44, indicating significant leverage that could increase financial risk if market conditions tighten. The quick ratio of 0.39 reflects constrained short-term liquidity, potentially stressing the company’s ability to cover immediate obligations. Moreover, recent market activity has been seller dominant, with only 26.87% buyer volume from November 2025 to January 2026, creating near-term headwinds.

Our Verdict about Best Buy Co., Inc.

Best Buy’s long-term fundamental profile appears favorable due to strong profitability and value creation metrics. However, the recent bearish price trend coupled with seller-dominant trading suggests caution. Despite the company’s operational strengths, the current market pressure may imply that investors adopt a wait-and-see approach for a more attractive entry point. This balanced view suggests Best Buy could present opportunities, yet risks remain in the near term.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Best Buy Co., Inc. $BBY Shares Sold by Wealth Enhancement Advisory Services LLC – MarketBeat (Jan 23, 2026)

- Best Buy Reports Q3 FY26 Results – Best Buy (Nov 25, 2025)

- Truist Cuts Best Buy (BBY) Target to $73, Keeps Hold Rating After Spending Data Review – Yahoo Finance (Jan 22, 2026)

- Best Buy: Setup Has Gotten Cleaner Vs. A Few Months Ago (NYSE:BBY) – Seeking Alpha (Jan 09, 2026)

- Top 3 Companies Owned by Best Buy (BBY) – Investopedia (Dec 04, 2025)

For more information about Best Buy Co., Inc., please visit the official website: investors.bestbuy.com/investor-relations/overview/default.aspx