Home > Analyses > Financial Services > Berkshire Hathaway Inc.

Berkshire Hathaway Inc. quietly powers a vast array of industries that touch everyday life, from insurance and freight rail to energy and consumer goods. Renowned for its diversified portfolio and disciplined management under CEO Gregory Abel, the company stands as a paragon of innovation and market influence. As it continues to expand across sectors, the question remains: do Berkshire Hathaway’s solid fundamentals and strategic vision still justify its premium market valuation and growth prospects for investors today?

Table of contents

Business Model & Company Overview

Berkshire Hathaway Inc., headquartered in Omaha, Nebraska, stands as a dominant player in diversified financial services and industrial sectors. Founded in 1998, it operates a vast ecosystem spanning insurance, freight rail transportation, utilities, manufacturing, and retail. This integrated portfolio reinforces its core mission to deliver broad-based value through numerous subsidiaries that together form a resilient and diversified industrial conglomerate.

The company’s revenue engine combines substantial recurring income from insurance and utilities with manufacturing and retail operations distributed across the Americas, Europe, and Asia. Its balance of hardware-intensive industries and service-driven segments supports consistent cash flow and operational flexibility. Berkshire Hathaway’s wide-reaching presence and diverse assets create a formidable economic moat, positioning it to shape multiple industries’ futures over the long term.

Financial Performance & Fundamental Metrics

This section provides an overview of Berkshire Hathaway Inc.’s income statement, key financial ratios, and dividend payout policy to support informed investment decisions.

Income Statement

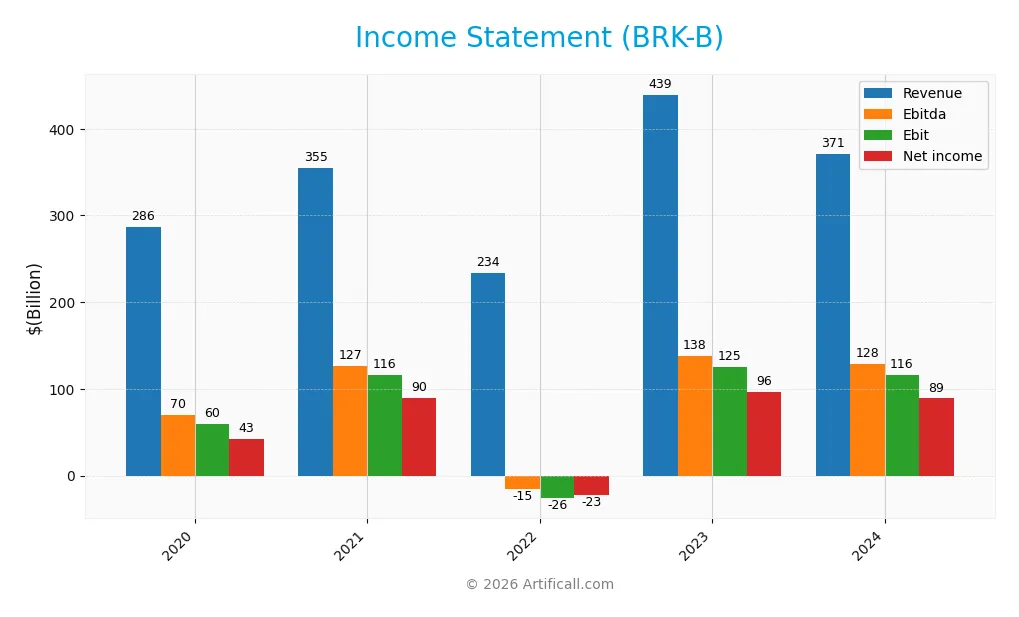

The table below presents Berkshire Hathaway Inc.’s key income statement items for the fiscal years 2020 through 2024, expressed in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 286.3B | 354.7B | 234.1B | 439.3B | 371.4B |

| Cost of Revenue | 150.9B | 169.9B | 187.2B | 230.5B | 284.9B |

| Operating Expenses | 79.8B | 72.9B | 77.4B | 88.7B | 27.1B |

| Gross Profit | 135.5B | 184.8B | 46.9B | 208.8B | 86.6B |

| EBITDA | 70.4B | 126.8B | -15.2B | 137.7B | 128.4B |

| EBIT | 59.8B | 116.0B | -26.1B | 125.2B | 115.6B |

| Interest Expense | 4.1B | 4.2B | 4.4B | 5.0B | 5.2B |

| Net Income | 42.5B | 89.9B | -22.8B | 96.2B | 89.0B |

| EPS | 17.78 | 39.64 | -10.36 | 44.27 | 41.27 |

| Filing Date | 2021-03-01 | 2022-02-28 | 2023-02-27 | 2024-02-26 | 2025-02-24 |

Income Statement Evolution

Between 2020 and 2024, Berkshire Hathaway’s revenue grew by 29.72%, while net income more than doubled, rising 109.3%. However, the latest year saw a 15.46% revenue decline and a 7.66% drop in EBIT. Margins improved overall, with gross margin at 23.31% and net margin at 23.96%, reflecting stronger profitability despite recent top-line pressure.

Is the Income Statement Favorable?

In 2024, Berkshire Hathaway reported $371B in revenue and $89B in net income, with a net margin of 23.96%, indicating solid profitability. Despite a 15.46% revenue decline from 2023, operating expenses decreased proportionally, supporting margin stability. EPS fell 6.78% to $41.27, yet net margin growth was favorable. Overall, the income statement fundamentals appear generally favorable given the strong margins and income resilience.

Financial Ratios

The table below summarizes key financial ratios of Berkshire Hathaway Inc. (BRK-B) over the past five fiscal years, providing insight into profitability, valuation, liquidity, leverage, and efficiency:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 15% | 25% | -10% | 22% | 24% |

| ROE | 9.6% | 17.8% | -4.8% | 17.1% | 13.7% |

| ROIC | 5.2% | 9.9% | -2.4% | 9.5% | 4.4% |

| P/E | 13.0 | 7.5 | -29.9 | 8.1 | 11.0 |

| P/B | 1.25 | 1.34 | 1.44 | 1.38 | 1.51 |

| Current Ratio | 4.28 | 4.74 | 3.83 | 4.14 | 5.94 |

| Quick Ratio | 3.89 | 4.31 | 3.40 | 3.77 | 5.61 |

| D/E | 0.28 | 0.24 | 0.27 | 0.24 | 0.22 |

| Debt-to-Assets | 14% | 12% | 13% | 12% | 12% |

| Interest Coverage | 13.6 | 26.8 | -7.0 | 24.0 | 11.4 |

| Asset Turnover | 0.33 | 0.37 | 0.25 | 0.41 | 0.32 |

| Fixed Asset Turnover | 1.49 | 1.81 | 1.16 | 1.98 | 1.62 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

From 2020 to 2024, Berkshire Hathaway’s Return on Equity (ROE) showed fluctuations, peaking near 17.7% in 2021-2023 before declining to 13.7% in 2024, indicating a slowdown in profitability growth. The Current Ratio steadily improved, reaching 5.94 in 2024, reflecting stronger liquidity. The Debt-to-Equity Ratio decreased from about 0.28 in 2020 to 0.22 in 2024, signaling reduced leverage and greater financial stability.

Are the Financial Ratios Fovorable?

In 2024, profitability ratios like net margin (23.96%) and price-to-earnings (10.98) were favorable, while ROE was neutral and return on invested capital (4.37%) unfavorable, showing mixed efficiency. Liquidity ratios showed divergence: a high current ratio (5.94) was unfavorable, but quick ratio (5.61) was favorable. Leverage ratios including debt-to-equity (0.22) and interest coverage (22.23) were favorable. Asset turnover was unfavorable, and dividend yield was zero, contributing to a slightly favorable overall evaluation.

Shareholder Return Policy

Berkshire Hathaway Inc. (BRK-B) does not pay dividends, reflecting a consistent dividend payout ratio of 0 and zero dividend yield over recent years. The company appears to prioritize reinvestment and capital allocation strategies over direct shareholder distributions, with no share buyback programs reported.

This retention of earnings aligns with a long-term value creation approach, relying on internal cash flow and operational performance. The absence of dividends and buybacks suggests a focus on growth and capital preservation, supporting sustainable shareholder value without risking unsustainable payouts or excessive repurchases.

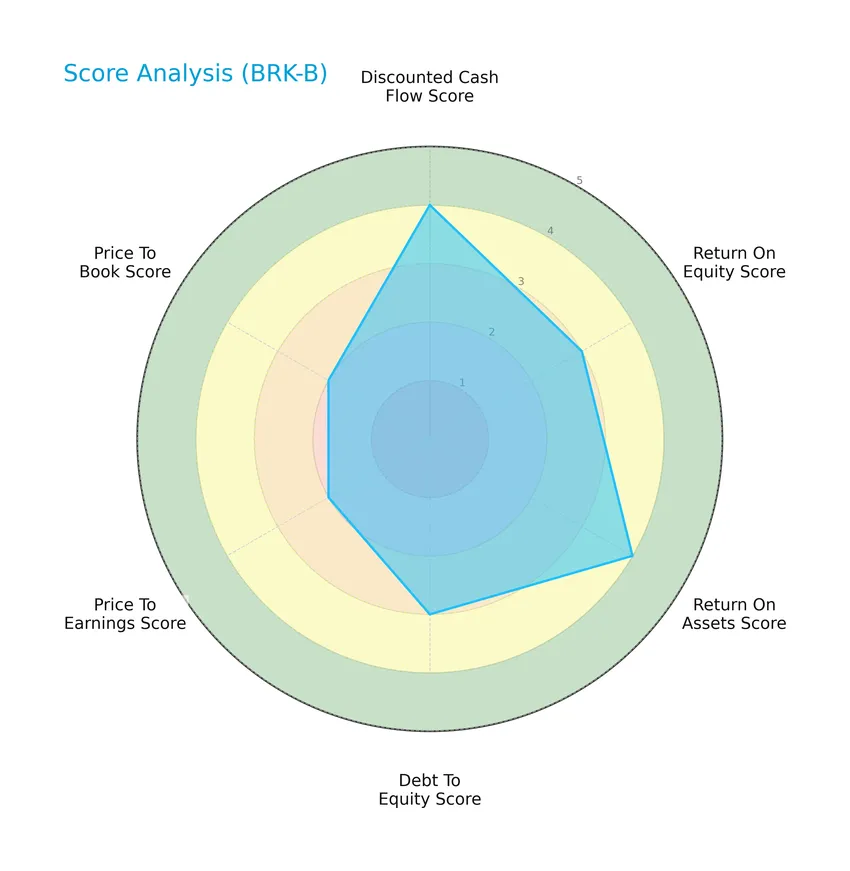

Score analysis

The following radar chart illustrates the company’s key financial scores, providing a snapshot of its valuation and performance metrics:

Berkshire Hathaway Inc. shows a favorable discounted cash flow and return on assets scores at 4, while return on equity and debt to equity scores are moderate at 3. Valuation metrics such as price to earnings and price to book scores are moderate, both at 2, indicating balanced market expectations.

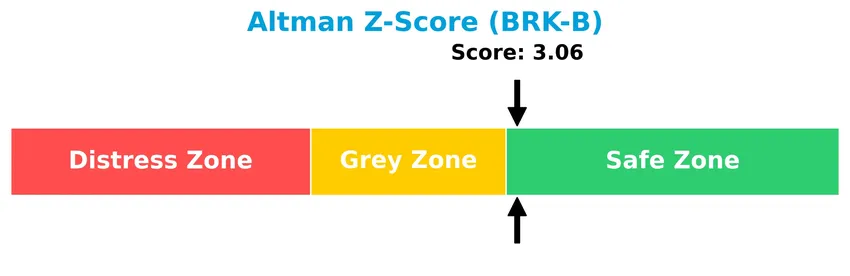

Analysis of the company’s bankruptcy risk

The Altman Z-Score places Berkshire Hathaway Inc. comfortably in the safe zone, indicating a low risk of bankruptcy and financial distress:

Is the company in good financial health?

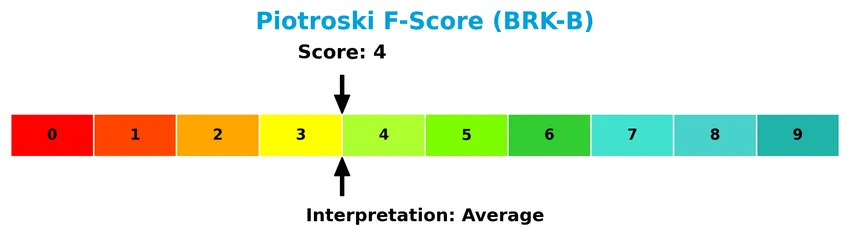

The Piotroski Score diagram below illustrates Berkshire Hathaway Inc.’s financial health indicators:

With a Piotroski Score of 4, the company exhibits average financial strength, suggesting moderate performance in profitability, leverage, liquidity, and operational efficiency metrics.

Competitive Landscape & Sector Positioning

This sector analysis will examine Berkshire Hathaway Inc.’s strategic positioning, revenue streams, key products, and main competitors within the financial services sector. I will assess whether the company holds a competitive advantage relative to its peers in insurance, transportation, utilities, manufacturing, and retail segments.

Strategic Positioning

Berkshire Hathaway Inc. maintains a highly diversified portfolio across insurance, energy, freight rail, manufacturing, retail, and service sectors, with 2024 revenues spanning from $10.5B in insurance to $77B in manufacturing. Its global presence and broad industry exposure underpin a multi-industry strategic position.

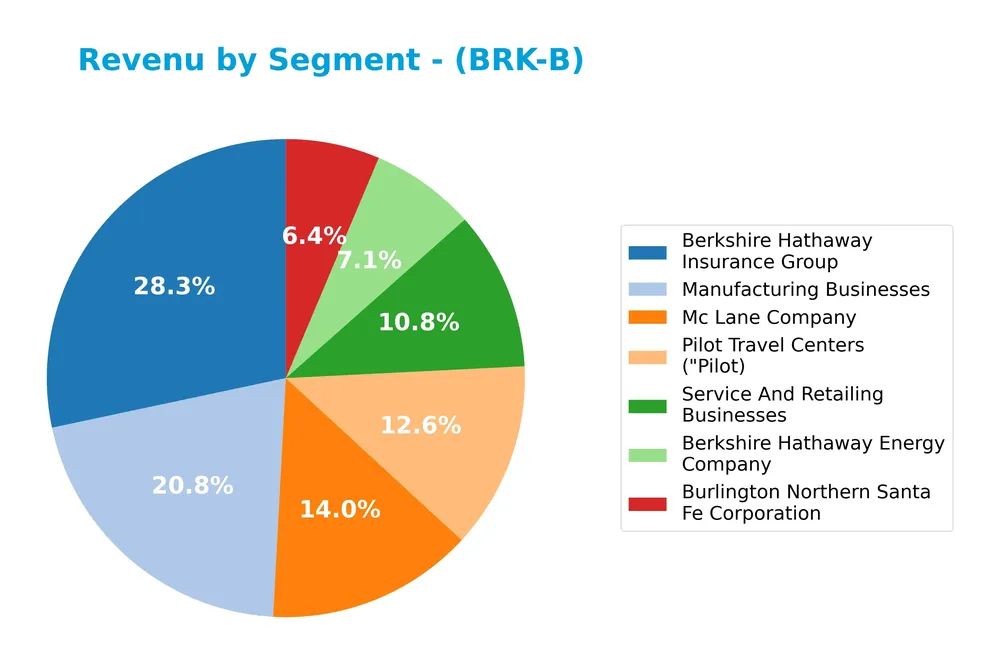

Revenue by Segment

This pie chart illustrates Berkshire Hathaway Inc.’s revenue distribution by business segments for the fiscal year 2024.

In 2024, Berkshire Hathaway Insurance Group remains the dominant revenue driver with $105B, showing continued growth from prior years. Manufacturing Businesses also contribute significantly with $77B, while Mc Lane Company and Pilot Travel Centers bring in $52B and $47B respectively. Energy and rail segments are stable around $26B and $24B. The revenue mix indicates a well-diversified portfolio with insurance as the core, though exposure to cyclical manufacturing and retail sectors suggests moderate concentration risk.

Key Products & Brands

The table below outlines Berkshire Hathaway Inc.’s key business segments and their primary activities:

| Product | Description |

|---|---|

| Berkshire Hathaway Insurance Group | Provides property, casualty, life, accident, and health insurance and reinsurance services worldwide. |

| Burlington Northern Santa Fe Corporation | Operates freight rail transportation systems across North America. |

| Berkshire Hathaway Energy Company | Generates, transmits, stores, and distributes electricity from diverse sources including natural gas, coal, wind, solar, and nuclear. Also manages natural gas distribution and infrastructure. |

| Manufacturing Businesses | Produces boxed chocolates, specialty chemicals, metal cutting tools, aerospace components, flooring, insulation, roofing, paints, bricks, and related products. |

| Mc Lane Company | Engages in grocery and foodservice distribution services. |

| Pilot Travel Centers (“Pilot”) | Operates travel centers providing fuel, food, and related services to motorists. |

| Service And Retailing Businesses | Provides logistics, professional aviation training, quick service restaurant franchising, automobile retailing, and various consumer products including apparel, jewelry, and household goods. |

Berkshire Hathaway’s diverse portfolio spans insurance, rail transportation, energy, manufacturing, distribution, retail, and service sectors, reflecting its broad industrial and consumer market presence.

Main Competitors

There are 5 competitors in the Financial Services sector for Berkshire Hathaway Inc., with the table below listing the top 5 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Berkshire Hathaway Inc. | 1.07T |

| American International Group, Inc. | 45.5B |

| The Hartford Financial Services Group, Inc. | 38.2B |

| Arch Capital Group Ltd. | 34.9B |

| Principal Financial Group, Inc. | 20.1B |

Berkshire Hathaway Inc. holds the 1st position among its competitors with a market cap nearly equal to the sector leader (relative scale 0.96). It is significantly above both the average market cap of the top 10 competitors (242B) and the median sector market cap (38.2B). The company has a substantial gap below to its closest competitor, confirming a dominant market presence.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does BRK-B have a competitive advantage?

Berkshire Hathaway Inc. does not currently present a competitive advantage, as its ROIC is below its WACC by 2.3%, indicating value destruction and a declining profitability trend. The company’s global moat status is rated very unfavorable due to decreasing returns on invested capital.

Looking ahead, Berkshire Hathaway’s diversified operations across insurance, freight rail, utilities, manufacturing, and retail sectors offer opportunities to explore new markets and product lines. However, the company’s recent income statement shows mixed signals with favorable net margin growth but declining revenue and gross profit in the past year.

SWOT Analysis

This analysis highlights Berkshire Hathaway Inc.’s key internal and external factors to guide investment decisions.

Strengths

- Diversified business portfolio

- Strong market cap of 1.03T USD

- Favorable net margin at 23.96%

Weaknesses

- Recent 1-year revenue decline of 15.46%

- Declining ROIC trend

- No dividend yield

Opportunities

- Expansion in renewable energy infrastructure

- Growth in insurance and freight rail sectors

- Potential in emerging markets

Threats

- Economic downturn impacting financial services

- Increased competition in insurance and utilities

- Regulatory changes in energy and finance sectors

Overall, Berkshire Hathaway’s diversification and strong profitability provide a solid foundation, but recent growth challenges and declining capital efficiency require strategic focus. Investors should watch how the company leverages opportunities in renewables and emerging markets while managing regulatory and economic risks.

Stock Price Action Analysis

The following weekly chart illustrates Berkshire Hathaway Inc. (BRK-B) stock price movements over the past 100 weeks:

Trend Analysis

Over the past 12 months, BRK-B stock price increased by 17.65%, indicating a bullish trend with deceleration. The price ranged between a low of 400.87 and a high of 539.8, with a high volatility reflected by a 36.46 standard deviation.

Volume Analysis

In the last three months, trading volume has increased overall, but recent activity shows slight seller dominance with buyers comprising 41.84%. This suggests cautious investor sentiment and somewhat elevated selling pressure despite rising market participation.

Target Prices

The consensus target price for Berkshire Hathaway Inc. (BRK-B) reflects a moderately bullish outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 481 | 450 | 465.5 |

Analysts expect the stock to trade between 450 and 481, with a consensus target near 465.5, indicating a positive but cautious growth expectation.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews the latest analyst ratings and consumer feedback regarding Berkshire Hathaway Inc. (BRK-B).

Stock Grades

The following table presents the recent stock grades for Berkshire Hathaway Inc. from a recognized grading company:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Buy | 2025-11-03 |

| UBS | Maintain | Buy | 2025-10-15 |

| UBS | Maintain | Buy | 2025-08-04 |

| UBS | Maintain | Buy | 2025-07-23 |

| UBS | Maintain | Buy | 2025-06-03 |

| UBS | Maintain | Buy | 2025-04-25 |

| UBS | Maintain | Buy | 2025-02-24 |

| UBS | Maintain | Buy | 2025-01-24 |

| UBS | Maintain | Buy | 2024-11-04 |

| UBS | Maintain | Buy | 2024-02-28 |

UBS has consistently maintained a “Buy” rating on Berkshire Hathaway Inc. over multiple updates in 2024 and 2025. However, the broader consensus from other analysts leans toward a “Hold” rating, indicating a mix of moderate confidence in the stock’s near-term outlook.

Consumer Opinions

Investor sentiment towards Berkshire Hathaway Inc. reflects a blend of admiration for its stability and concerns about its size and complexity.

| Positive Reviews | Negative Reviews |

|---|---|

| “Berkshire Hathaway offers a diversified portfolio that reduces risk effectively.” | “The company’s massive size limits its growth potential.” |

| “Warren Buffett’s leadership inspires confidence and trust in long-term value.” | “Some holdings feel outdated and may not keep up with tech-driven markets.” |

| “Consistent dividends and strong cash flow make it a reliable income source.” | “Complex structure makes it difficult for new investors to understand.” |

Overall, consumers praise Berkshire Hathaway’s stability and leadership but frequently note concerns about its growth limitations and complexity for newcomers.

Risk Analysis

The table below summarizes key risks facing Berkshire Hathaway Inc., highlighting their likelihood and potential impact on investors:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Stock price fluctuations due to economic cycles and sector-specific changes. | Medium | Medium |

| Regulatory Risks | Changes in insurance and energy regulations affecting operations and profitability. | Medium | High |

| Operational Risks | Challenges across diverse business segments, including railroads, utilities, and manufacturing. | Medium | Medium |

| Financial Risks | Moderate ROIC and current ratio concerns may pressure cash flow and capital allocation. | Medium | Medium |

| No Dividend Policy | Lack of dividends could deter income-focused investors, impacting stock demand. | High | Low |

| Environmental Risks | Exposure to fossil fuels and coal assets amid growing environmental regulations and transition. | Medium | High |

The most significant risks for Berkshire Hathaway stem from regulatory changes and environmental transition pressures, particularly given its exposure to fossil fuels and diversified insurance business. While the company remains financially stable with a safe Altman Z-score of 3.06, cautious monitoring of operational and financial efficiency is advisable.

Should You Buy Berkshire Hathaway Inc.?

Berkshire Hathaway Inc. appears to be characterized by moderate profitability and a very unfavorable competitive moat, suggesting value erosion and declining operational efficiency. Despite a manageable leverage profile and a B+ overall rating, the company’s financial health could be seen as cautious, supported by a safe Altman Z-score but only an average Piotroski score.

Strength & Efficiency Pillars

Berkshire Hathaway Inc. exhibits solid profitability with a net margin of 23.96% and a moderate return on equity at 13.7%. The Altman Z-Score of 3.06 places the company securely in the safe zone, underscoring strong financial health and low bankruptcy risk. Its debt-to-equity ratio of 0.22 and interest coverage of 22.23 further confirm prudent leverage management. While the ROIC at 4.37% trails the WACC of 6.68%, indicating the company is currently not a value creator, operational efficiency remains stable with a quick ratio of 5.61 signaling strong liquidity.

Weaknesses and Drawbacks

Despite favorable valuation metrics, Berkshire faces several challenges. The price-to-book ratio of 1.51 and P/E of 10.98 suggest a relatively moderate valuation but not a significant margin of safety. The current ratio at 5.94 is unusually high and may indicate inefficient use of current assets. Asset turnover at 0.32 is low, hinting at suboptimal asset utilization. Additionally, recent revenue growth declined by 15.46%, and gross profit dropped sharply by 58.54%, raising concerns about near-term operational pressures. The recent period shows seller dominance at 58.16%, reflecting short-term market headwinds.

Our Verdict about Berkshire Hathaway Inc.

Berkshire Hathaway’s long-term fundamental profile appears favorable due to strong profitability and financial health, though it is not currently generating value above its cost of capital. Despite a bullish overall stock trend, recent seller dominance and declining short-term performance suggest a cautious stance. Investors might consider waiting for a clearer technical recovery before increasing exposure, as the company may appear attractive for long-term portfolios but faces near-term uncertainties.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Berkshire Stock Is Getting Cheaper. When Will the Company Resume Buybacks? – Barron’s (Jan 20, 2026)

- Berkshire Hathaway: The End Of An Era (NYSE:BRK.A) – Seeking Alpha (Jan 22, 2026)

- Before Retiring, Warren Buffett Invested Another $6.4 Billion in 6 Different Stocks. Here’s the Best of the Bunch. – Yahoo Finance (Jan 23, 2026)

- Kraft Heinz’s stock drops as Berkshire Hathaway may sell its $7 billion stake – MarketWatch (Jan 21, 2026)

- What to Expect From Berkshire Hathaway’s Q4 2025 Earnings Report – Yahoo Finance (Jan 22, 2026)

For more information about Berkshire Hathaway Inc., please visit the official website: berkshirehathaway.com