Home > Analyses > Technology > Bentley Systems, Incorporated

Bentley Systems, Incorporated transforms how infrastructure projects come to life, powering the design, construction, and operation of vital assets worldwide. As a technology leader in infrastructure engineering software, Bentley delivers cutting-edge solutions like MicroStation and ProjectWise that enable engineers, architects, and planners to collaborate seamlessly and innovate boldly. Renowned for its comprehensive, integrated platforms, the company shapes the future of civil and geotechnical engineering. Yet, as the market evolves, investors must ask: do Bentley’s fundamentals still justify its current valuation and growth outlook?

Table of contents

Business Model & Company Overview

Bentley Systems, Incorporated, founded in 1984 and headquartered in Exton, Pennsylvania, stands as a dominant player in the infrastructure engineering software sector. Its ecosystem integrates open modeling, simulation, and project delivery applications tailored to civil, structural, geotechnical, and geospatial professionals worldwide. Bentley’s portfolio spans MicroStation to AssetWise, reflecting a comprehensive mission to enhance infrastructure design, collaboration, and asset management.

The company’s revenue engine balances recurring software licenses and cloud-based services with specialized engineering applications, serving markets across the Americas, Europe, and Asia-Pacific. This strategic global footprint supports diverse sectors from construction to utilities, reinforcing Bentley’s competitive advantage. Its deep integration into critical infrastructure workflows creates a durable economic moat, positioning it to shape the future of digital infrastructure engineering.

Financial Performance & Fundamental Metrics

In this section, I analyze Bentley Systems, Incorporated’s income statement, key financial ratios, and dividend payout policy to assess its financial health and investment potential.

Income Statement

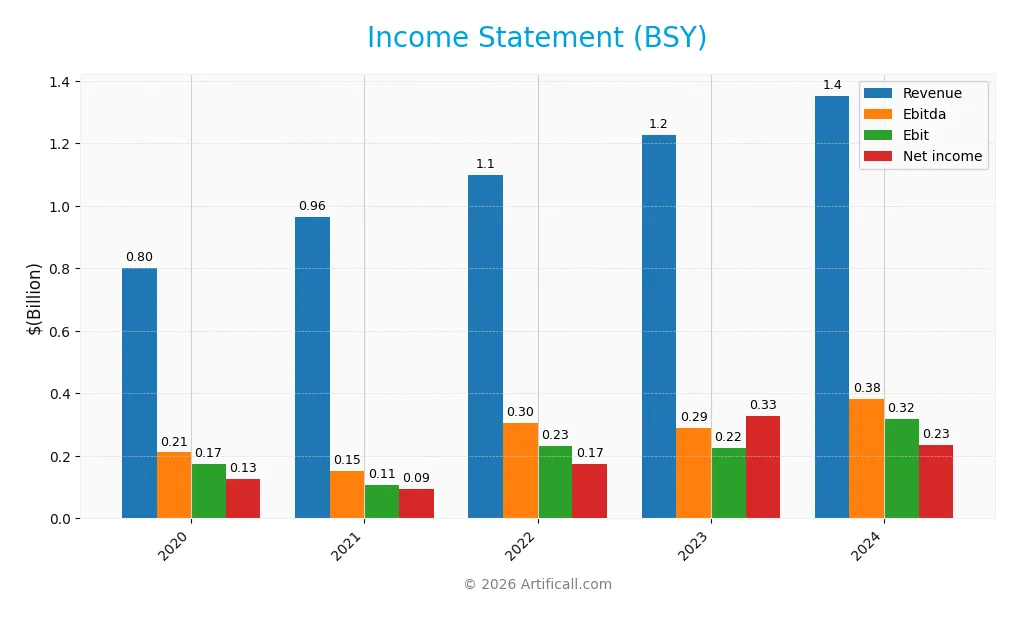

The table below presents Bentley Systems, Incorporated’s key income statement figures for the fiscal years 2020 through 2024, reported in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 802M | 965M | 1.10B | 1.23B | 1.35B |

| Cost of Revenue | 167M | 217M | 237M | 318M | 258M |

| Operating Expenses | 484M | 654M | 653M | 680M | 793M |

| Gross Profit | 634M | 749M | 862M | 910M | 1.10B |

| EBITDA | 211M | 152M | 305M | 288M | 382M |

| EBIT | 175M | 107M | 233M | 225M | 318M |

| Interest Expense | 7.9M | 11.5M | 35.1M | 41.3M | 24.8M |

| Net Income | 127M | 93.2M | 175M | 327M | 235M |

| EPS | 0.44 | 0.30 | 0.57 | 1.07 | 0.75 |

| Filing Date | 2021-03-02 | 2022-03-01 | 2023-02-28 | 2024-02-27 | 2025-02-26 |

Income Statement Evolution

Between 2020 and 2024, Bentley Systems, Incorporated (BSY) experienced consistent revenue growth, rising from $801.5M to $1.35B, a 68.8% increase. Net income grew even more substantially by 85.6% over the period, reaching $242M in 2024. Margins improved overall, with gross margin at 81.0% and EBIT margin at 23.5%, reflecting favorable operational efficiency despite some fluctuations in net margin growth.

Is the Income Statement Favorable?

In 2024, BSY reported a 10.2% revenue increase and a 41.4% surge in EBIT, indicating strong operating leverage. However, net margin declined by 34.8%, and EPS dropped 28.0%, signaling some pressure on profitability at the bottom line. Interest expense remained low at 1.8% of revenue, supporting financial stability. Overall, the fundamentals are generally favorable, with solid top-line expansion and improved operating income, though margin compression warrants attention.

Financial Ratios

The following table presents key financial ratios for Bentley Systems, Incorporated (BSY) over the fiscal years 2020 to 2024, offering insight into profitability, liquidity, valuation, leverage, and efficiency:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 16% | 10% | 16% | 27% | 17% |

| ROE | 37% | 23% | 31% | 37% | 23% |

| ROIC | 17% | 5% | 7% | 9% | 9% |

| P/E | 93 | 159 | 65 | 50 | 63 |

| P/B | 34 | 36 | 20 | 18 | 14 |

| Current Ratio | 0.73 | 1.04 | 0.66 | 0.55 | 0.54 |

| Quick Ratio | 0.73 | 1.04 | 0.66 | 0.55 | 0.54 |

| D/E | 0.86 | 3.64 | 3.18 | 1.78 | 1.37 |

| Debt-to-Assets | 26% | 56% | 58% | 47% | 42% |

| Interest Coverage | 19.0 | 8.2 | 6.0 | 5.6 | 12.2 |

| Asset Turnover | 0.71 | 0.36 | 0.35 | 0.37 | 0.40 |

| Fixed Asset Turnover | 11 | 12 | 15 | 16 | 20 |

| Dividend Yield | 3.6% | 0.23% | 0.30% | 0.36% | 0.49% |

Evolution of Financial Ratios

Bentley Systems’ Return on Equity (ROE) showed variability, peaking near 37% in 2020 and declining to 22.55% in 2024. The Current Ratio steadily decreased from above 1 in 2021 to 0.54 in 2024, indicating reduced short-term liquidity. The Debt-to-Equity Ratio remained elevated, reaching 3.64 in 2021 before improving slightly to 1.37 in 2024, highlighting persistent leverage but some deleveraging. Profitability margins improved overall, with net profit margin rising to 17.35% in 2024 from 9.66% in 2021.

Are the Financial Ratios Favorable?

In 2024, Bentley Systems exhibits favorable profitability with a 22.55% ROE and a net margin of 17.35%, alongside a strong interest coverage ratio of 12.83. However, liquidity ratios such as the Current and Quick Ratios at 0.54 are unfavorable, suggesting short-term financial constraints. Leverage remains a concern with a debt-to-equity ratio of 1.37. Market valuation ratios, including a high P/E of 62.63 and P/B of 14.13, are also unfavorable. The overall assessment is slightly unfavorable with 50% of ratios negative, 28.57% positive, and 21.43% neutral.

Shareholder Return Policy

Bentley Systems, Incorporated maintains a dividend payout ratio around 18–36%, with dividend per share rising from $0.11 in 2021 to $0.23 in 2024, supporting a modest annual yield near 0.5%. The company funds dividends sustainably, as free cash flow coverage ratios exceed 90%, with no explicit share buyback programs reported.

This disciplined distribution approach, coupled with steady dividend growth and strong cash flow coverage, indicates a balanced policy aimed at preserving long-term shareholder value without risking excessive payouts or capital depletion.

Score analysis

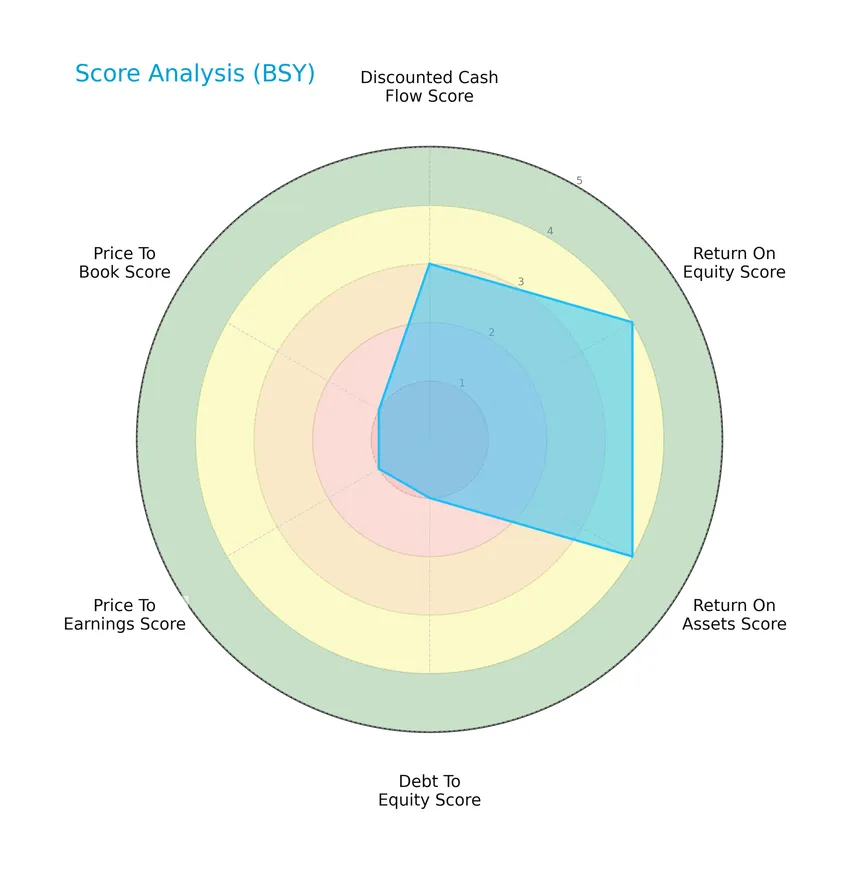

The following radar chart presents Bentley Systems, Incorporated’s key financial scores for a comprehensive performance overview:

The company’s scores reveal moderate discounted cash flow and strong profitability metrics with return on equity and assets rated favorably. However, leverage and valuation indicators such as debt-to-equity, price-to-earnings, and price-to-book ratios are very unfavorable.

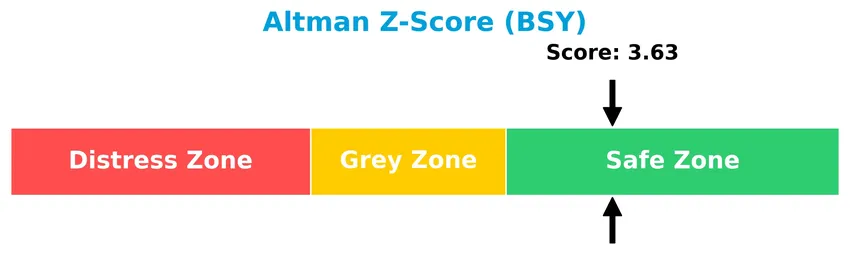

Analysis of the company’s bankruptcy risk

Bentley Systems’ Altman Z-Score places it firmly in the safe zone, indicating a low risk of bankruptcy and financial distress:

Is the company in good financial health?

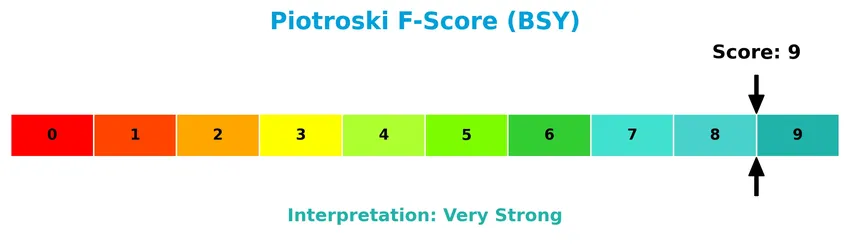

The Piotroski diagram below illustrates Bentley Systems’ financial strength based on various accounting criteria:

With a perfect Piotroski Score of 9, Bentley Systems demonstrates very strong financial health, reflecting robust profitability, efficient asset use, and solid balance sheet conditions.

Competitive Landscape & Sector Positioning

This sector analysis will examine Bentley Systems, Incorporated’s strategic positioning, revenue by segment, key products, main competitors, competitive advantages, and SWOT analysis. I will assess whether Bentley Systems holds a competitive advantage over its peers in the infrastructure engineering software industry.

Strategic Positioning

Bentley Systems, Incorporated maintains a diversified product portfolio focused on infrastructure engineering software, spanning modeling, simulation, project delivery, and asset performance solutions. Geographically, it operates broadly across the Americas, EMEA, and Asia Pacific, with the largest revenue concentration in the United States, Canada, and Latin America.

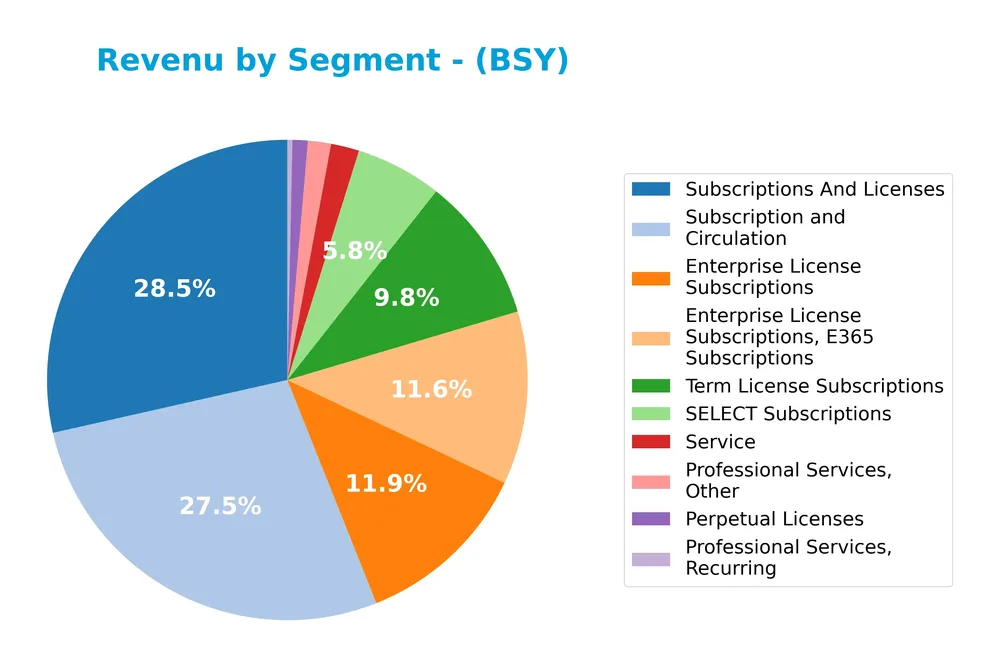

Revenue by Segment

This pie chart illustrates Bentley Systems, Incorporated’s revenue distribution by product segments for the fiscal year 2024.

In 2024, Subscriptions and Licenses remain the dominant revenue driver at approximately 1.27B, with Subscription and Circulation closely following at 1.22B. Enterprise License Subscriptions also contribute significantly, totaling about 530M. Notably, recurring subscription segments like Enterprise License Subscriptions, E365 Subscriptions (518M) and Term License Subscriptions (434M) indicate a strong shift towards recurring revenue models. The Service and Professional Services segments are smaller but stable, reflecting diversification. The overall trend suggests robust growth and increasing concentration in subscription-based offerings.

Key Products & Brands

The following table summarizes Bentley Systems’ key products and brand offerings across its infrastructure engineering software portfolio:

| Product | Description |

|---|---|

| MicroStation | Open modeling application for infrastructure design integration. |

| OpenRoads, OpenRail, OpenPlant | Open simulation applications tailored for roads, railways, and plant infrastructure design. |

| OpenBuildings, OpenBridge | Software solutions focused on building and bridge design integration. |

| OpenSite, OpenFlows | Applications for site development and water infrastructure modeling. |

| STAAD, RAM, SACS, MOSES | Structural analysis and design software for civil and structural engineers. |

| AutoPIPE | Pipe stress analysis and design solution. |

| SITEOPS | Site development and earthwork optimization software. |

| CUBE, DYNAMEQ, EMME, LEGION | Transportation and pedestrian simulation applications. |

| Leapfrog, GeoStudio, PLAXIS | Geoprofessional modeling and simulation software for subsurface conditions. |

| ProjectWise, SYNCHRO | Project delivery systems supporting collaboration and 4D construction modeling. |

| AssetWise | Asset and network performance systems with modules like ALIM, Asset Reliability, and 4D Analytics. |

| ContextCapture, OpenCities | Industry solutions including reality modeling and city planning tools. |

| OpenUtilities, OpenTower | Software for utilities and telecommunications infrastructure management. |

| Power Line, SPIDA, OrbitGT | Solutions focused on power line analysis, asset management, and geospatial visualization. |

| sensemetrics, PlantSight, WaterSight | IoT and digital twin applications for operations and maintenance in industrial and water sectors. |

Bentley Systems offers a comprehensive range of software products and services designed to support infrastructure engineering, project delivery, and asset performance across multiple sectors globally. Their portfolio covers modeling, simulation, collaboration, and operational tools for diverse engineering disciplines.

Main Competitors

There are 33 competitors in the Technology sector, with the table below listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Salesforce, Inc. | 242.5B |

| Shopify Inc. | 209.6B |

| AppLovin Corporation | 209.0B |

| Intuit Inc. | 175.2B |

| Uber Technologies, Inc. | 172.2B |

| ServiceNow, Inc. | 153.0B |

| Cadence Design Systems, Inc. | 84.5B |

| Snowflake Inc. | 73.4B |

| Autodesk, Inc. | 61.2B |

| Workday, Inc. | 54.9B |

Bentley Systems, Incorporated ranks 21st among 33 competitors, with a market cap just 4.68% that of the leader, Salesforce. The company is positioned below both the average market cap of the top 10 competitors (143.6B) and the sector median (18.8B). It maintains a 20.78% market cap gap to the next competitor above, reflecting a moderate distance from its closest rival.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does BSY have a competitive advantage?

Bentley Systems, Incorporated currently does not present a strong competitive advantage as its return on invested capital (ROIC) is below its weighted average cost of capital (WACC), indicating value is being shed. Additionally, the company’s ROIC trend is declining, signaling decreasing profitability and less efficient use of invested capital.

Looking ahead, Bentley Systems operates across diverse geographic markets and offers a broad portfolio of infrastructure engineering software, including open modeling, simulation, and asset performance solutions. These product offerings and market presence may provide opportunities to improve value creation and expand its footprint in infrastructure and geospatial technology sectors.

SWOT Analysis

This SWOT analysis highlights Bentley Systems, Incorporated’s key internal and external factors to guide investment decisions.

Strengths

- strong 80.95% gross margin

- diverse global infrastructure software portfolio

- favorable 22.55% ROE

Weaknesses

- high P/E of 62.63 indicating expensive valuation

- low liquidity ratios (current and quick ratio at 0.54)

- declining ROIC trend

Opportunities

- expanding infrastructure needs worldwide

- growth in Asia Pacific and EMEA markets

- innovation in 4D construction and asset performance software

Threats

- intense competition in software sector

- economic downturn impacting infrastructure spending

- high debt-to-equity ratio at 1.37

Bentley Systems shows robust profitability and strong market presence but faces valuation and liquidity challenges. Strategic focus on leveraging global growth and innovation while managing financial risks is essential.

Stock Price Action Analysis

The following weekly stock chart illustrates Bentley Systems, Incorporated’s price movements over the last 12 months, highlighting key fluctuations and trend patterns:

Trend Analysis

Over the past 12 months, Bentley Systems’ stock price declined by 24.08%, indicating a bearish trend. The price decreased from a high of 58.59 to a low of 38.15 with a deceleration in the downtrend. The standard deviation of 4.71 reflects moderate volatility during this period.

Volume Analysis

In the last three months, trading volume has been increasing but is strongly seller-driven, with buyers accounting for only 22.65%. This seller dominance suggests cautious investor sentiment and heightened selling pressure, reducing market participation from buyers despite rising volume levels.

Target Prices

Analysts present a clear consensus on Bentley Systems, Incorporated’s target price range.

| Target High | Target Low | Consensus |

|---|---|---|

| 55 | 45 | 49.33 |

The target prices suggest moderate upside potential, with analysts expecting the stock to trade around $49.33 on average, reflecting cautious optimism in the near term.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the recent grades and consumer feedback relating to Bentley Systems, Incorporated (BSY).

Stock Grades

The following table summarizes recent grades assigned to Bentley Systems, Incorporated by leading financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Oppenheimer | Maintain | Outperform | 2026-01-20 |

| Piper Sandler | Downgrade | Neutral | 2026-01-13 |

| Barclays | Maintain | Equal Weight | 2026-01-12 |

| RBC Capital | Maintain | Outperform | 2026-01-05 |

| JP Morgan | Maintain | Neutral | 2025-11-06 |

| Rosenblatt | Maintain | Buy | 2025-11-06 |

| Baird | Maintain | Outperform | 2025-11-06 |

| Piper Sandler | Maintain | Overweight | 2025-11-06 |

| Rosenblatt | Upgrade | Buy | 2025-10-17 |

| Oppenheimer | Maintain | Outperform | 2025-08-07 |

Overall, the grades show a predominance of positive ratings with several maintain actions on Outperform and Buy levels, though a recent downgrade to Neutral by Piper Sandler indicates some caution among analysts. The consensus remains a Buy based on 6 buy and 5 hold recommendations, reflecting a balanced but generally favorable view.

Consumer Opinions

Consumers of Bentley Systems, Incorporated (BSY) generally appreciate the company’s innovative software solutions but express some concerns regarding cost and customer support.

| Positive Reviews | Negative Reviews |

|---|---|

| “Bentley’s engineering software is highly reliable and feature-rich, boosting project efficiency.” | “The pricing is quite steep for smaller firms and startups.” |

| “Excellent integration capabilities with other design tools make workflows seamless.” | “Customer support can be slow and unresponsive at times.” |

| “Regular updates improve functionality and keep the software competitive.” | “Steep learning curve for new users without sufficient training resources.” |

Overall, customers praise Bentley Systems for its advanced, reliable software and integration strengths, while recurring complaints focus on high costs and the need for better customer service and user training.

Risk Analysis

Below is a summary table outlining key risk categories for Bentley Systems, Incorporated, with their probability and potential impact on the company’s performance:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Valuation | High P/E (62.63) and P/B (14.13) ratios suggest overvaluation risk amid market corrections. | Medium | High |

| Liquidity Risk | Low current and quick ratios (0.54) indicate potential short-term liquidity constraints. | Medium | Medium |

| Debt Levels | Elevated debt-to-equity ratio (1.37) could pressure financial flexibility and increase costs. | Medium | Medium |

| Competitive Pressure | Rapid technology changes in software infrastructure may erode market share. | Medium | High |

| Economic Cyclicality | Global infrastructure spending fluctuations may impact revenue growth significantly. | Medium | Medium |

| Operational Risk | Dependency on continuous innovation and integration of multiple complex software products. | Low | Medium |

The most critical risks include market overvaluation and competitive pressure, as Bentley’s high valuation multiples expose investors to correction risks, and fast industry evolution demands constant innovation. Despite strong financial health signals like a 3.63 Altman Z-Score and a perfect Piotroski score of 9, debt levels and liquidity remain concerns that warrant cautious monitoring.

Should You Buy Bentley Systems, Incorporated?

Bentley Systems appears to be characterized by improving profitability and operational efficiency, despite a slightly unfavorable competitive moat reflecting declining value creation. The leverage profile could be seen as substantial, yet the overall financial health suggests a B- rating, indicating moderate investment appeal.

Strength & Efficiency Pillars

Bentley Systems, Incorporated exhibits robust profitability with a net margin of 17.35% and a return on equity of 22.55%, underscoring solid operational efficiency. The Altman Z-Score of 3.63 places the company comfortably in the safe zone, indicating strong financial health. The Piotroski Score of 9 further confirms a very strong financial position. While the ROIC stands at 9.3%, slightly above the WACC of 8.96%, this marginal spread suggests that Bentley is a marginal value creator, though the company’s ROIC has been declining, warranting caution on sustained value creation.

Weaknesses and Drawbacks

Significant challenges persist, notably in valuation and leverage metrics. The price-to-earnings ratio of 62.63 and price-to-book ratio of 14.13 reflect a premium valuation that may overextend investor expectations. Financial leverage is elevated, with a debt-to-equity ratio of 1.37 and a current ratio of 0.54, signaling potential liquidity risks. Recent market behavior shows a seller-dominant trend with buyer dominance at only 22.65%, which, combined with a 24.08% overall price decline and a 16.85% drop in the recent period, introduces short-term market pressure risk.

Our Verdict about Bentley Systems, Incorporated

The company presents a favorable long-term fundamental profile supported by strong profitability and financial health scores. However, the bearish stock trend and pronounced seller dominance in recent months suggest that despite these strengths, investors might consider a cautious, wait-and-see approach pending signs of market stabilization. The elevated valuation and liquidity concerns could temper the attractiveness for immediate entry, although Bentley may appear compelling for long-term exposure if these headwinds ease.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Rakuten Investment Management Inc. Invests $4.31 Million in Bentley Systems, Incorporated $BSY – MarketBeat (Jan 23, 2026)

- BMO Capital Initiates Coverage of Bentley Systems (BSY) with Outperform Recommendation – Nasdaq (Jan 22, 2026)

- Is Bentley Systems, Incorporated (BSY) Being Reset for 2026? – Yahoo Finance (Jan 15, 2026)

- Reflecting On Vertical Software Stocks’ Q3 Earnings: Bentley Systems (NASDAQ:BSY) – Finviz (Jan 18, 2026)

- Bentley Systems Retires $678 Million of Convertible Senior Notes – Business Wire (Jan 15, 2026)

For more information about Bentley Systems, Incorporated, please visit the official website: bentley.com