Home > Analyses > Consumer Cyclical > Ball Corporation

Every day, Ball Corporation shapes how millions enjoy their favorite beverages by pioneering sustainable aluminum packaging solutions that combine functionality with environmental responsibility. As a global leader in the packaging and aerospace industries, Ball’s innovative products and advanced technologies have earned it a reputation for quality and market influence. With its diversified portfolio and steady dividend history, the key question remains: does Ball’s current valuation fully reflect its growth potential and resilience in evolving markets?

Table of contents

Business Model & Company Overview

Ball Corporation, founded in 1880 and headquartered in Westminster, Colorado, stands as a leading force in the Packaging & Containers industry. With a workforce of 16K employees, it offers a comprehensive ecosystem of aluminum packaging solutions that serve beverages, personal care, and household products across the Americas, Europe, and beyond. The company also extends its expertise into aerospace technologies, developing spacecraft and defense systems, creating a unique dual-industry presence.

The company’s revenue engine balances its robust aluminum packaging business with advanced aerospace products and services. It operates through regional segments in North and Central America, Europe, Middle East and Africa, and South America, driving growth via diversified markets. This blend of recurring packaging sales and high-tech aerospace contracts underpins Ball’s competitive advantage, reinforcing its position as a key player shaping the future of sustainable packaging and aerospace innovation.

Financial Performance & Fundamental Metrics

I will analyze Ball Corporation’s income statement, key financial ratios, and dividend payout policy to provide a clear view of its fundamental health.

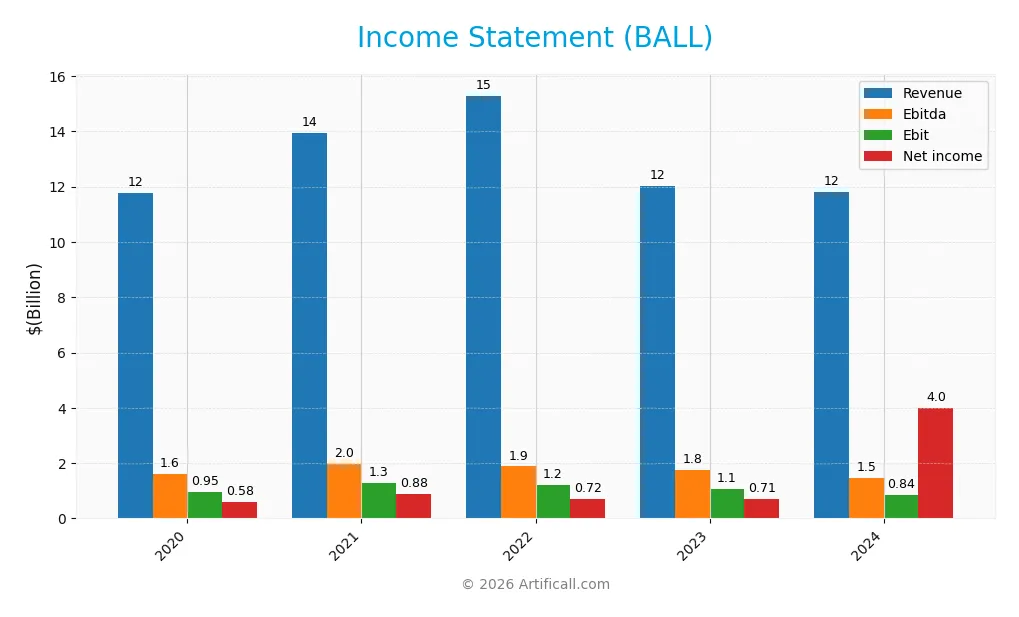

Income Statement

The table below presents Ball Corporation’s key income statement figures for fiscal years 2020 through 2024, reflecting revenue, expenses, profits, and earnings per share.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 11.76B | 13.93B | 15.29B | 12.02B | 11.80B |

| Cost of Revenue | 9.88B | 11.90B | 13.54B | 10.30B | 9.96B |

| Operating Expenses | 575M | 800M | 742M | 540M | 847M |

| Gross Profit | 1.88B | 2.03B | 1.76B | 1.72B | 1.84B |

| EBITDA | 1.62B | 1.98B | 1.88B | 1.76B | 1.46B |

| EBIT | 954M | 1.28B | 1.21B | 1.07B | 839M |

| Interest Expense | 275M | 270M | 313M | 460M | 293M |

| Net Income | 585M | 878M | 719M | 707M | 4.01B |

| EPS | 1.79 | 2.69 | 2.27 | 2.25 | 13.12 |

| Filing Date | 2021-02-17 | 2022-02-16 | 2023-02-21 | 2024-02-20 | 2025-02-20 |

Income Statement Evolution

Between 2020 and 2024, Ball Corporation’s revenue showed minimal growth, increasing by only 0.34%, with a slight decline of 1.84% in the last year. Despite this, net income surged 585%, driven by a significant improvement in net margin, which rose by 583%. Gross margin remained stable near 15.6%, and EBIT margin stayed neutral at 7.1%, indicating consistent operational efficiency over the period.

Is the Income Statement Favorable?

For 2024, Ball reported $11.8B in revenue and $4B in net income, with net margin at a favorable 33.97%, reflecting strong profitability mainly influenced by $3.58B from discontinued operations. While revenue and EBIT declined year-on-year, EPS jumped by 483%, highlighting improved earnings quality. Interest expense was low at 2.48% of revenue, favoring financial costs. Overall, the income statement fundamentals are assessed as favorable.

Financial Ratios

The following table presents key financial ratios for Ball Corporation over the last five fiscal years, reflecting profitability, liquidity, leverage, efficiency, and shareholder returns:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 5.0% | 6.3% | 4.7% | 5.9% | 34.0% |

| ROE | 17.9% | 24.2% | 20.8% | 18.8% | 68.4% |

| ROIC | 8.0% | 7.5% | 5.8% | 6.4% | 5.7% |

| P/E | 52.1 | 35.7 | 22.5 | 25.6 | 4.2 |

| P/B | 9.3 | 8.7 | 4.7 | 4.8 | 2.9 |

| Current Ratio | 1.05 | 0.88 | 0.78 | 0.79 | 1.00 |

| Quick Ratio | 0.75 | 0.58 | 0.47 | 0.54 | 0.69 |

| D/E | 2.47 | 2.25 | 2.72 | 2.27 | 1.03 |

| Debt-to-Assets | 44.4% | 41.4% | 47.2% | 44.4% | 34.1% |

| Interest Coverage | 4.7 | 4.6 | 3.2 | 2.6 | 3.4 |

| Asset Turnover | 0.64 | 0.71 | 0.77 | 0.62 | 0.67 |

| Fixed Asset Turnover | 2.08 | 2.01 | 2.04 | 1.70 | 1.81 |

| Dividend Yield | 0.65% | 0.73% | 1.57% | 1.39% | 1.45% |

Evolution of Financial Ratios

Over the period, Ball Corporation’s Return on Equity (ROE) showed marked improvement, reaching 68.37% in 2024, indicating enhanced profitability. The Current Ratio remained below 1.0, reflecting liquidity constraints with only slight improvement to nearly 1.0 in 2024. The Debt-to-Equity Ratio decreased from above 2.2 in earlier years to about 1.03 in 2024, suggesting a reduction in financial leverage but still at a cautious level.

Are the Financial Ratios Favorable?

In 2024, Ball Corporation exhibits a strong net margin of 33.97% and a high ROE of 68.37%, both rated favorable, while return on invested capital is neutral at 5.73%. Liquidity ratios, including the current ratio at 1.0 and quick ratio at 0.69, are considered unfavorable, indicating potential short-term financial pressure. Leverage is moderate with a debt-to-equity ratio of 1.03, deemed unfavorable, though interest coverage is neutral at 2.86. Market valuation ratios such as price-to-earnings at 4.2 are favorable, while price-to-book at 2.87 is neutral. Overall, the financial ratios paint a slightly favorable picture.

Shareholder Return Policy

Ball Corporation maintains a consistent dividend payout with a ratio around 6.1% in 2024, yielding approximately 1.45%. The dividend per share has remained stable near $0.80, while free cash flow coverage is negative, signaling reliance on operating cash flow and potential risks in sustaining dividends long term. Share buybacks are not explicitly reported, suggesting dividends are the primary distribution method.

Despite moderate profitability and a solid net profit margin of 34%, negative free cash flow per share may pressure future payouts or capital allocation. The current policy balances shareholder returns with operational needs, but the limited free cash flow coverage warrants attention to ensure sustainable long-term shareholder value creation.

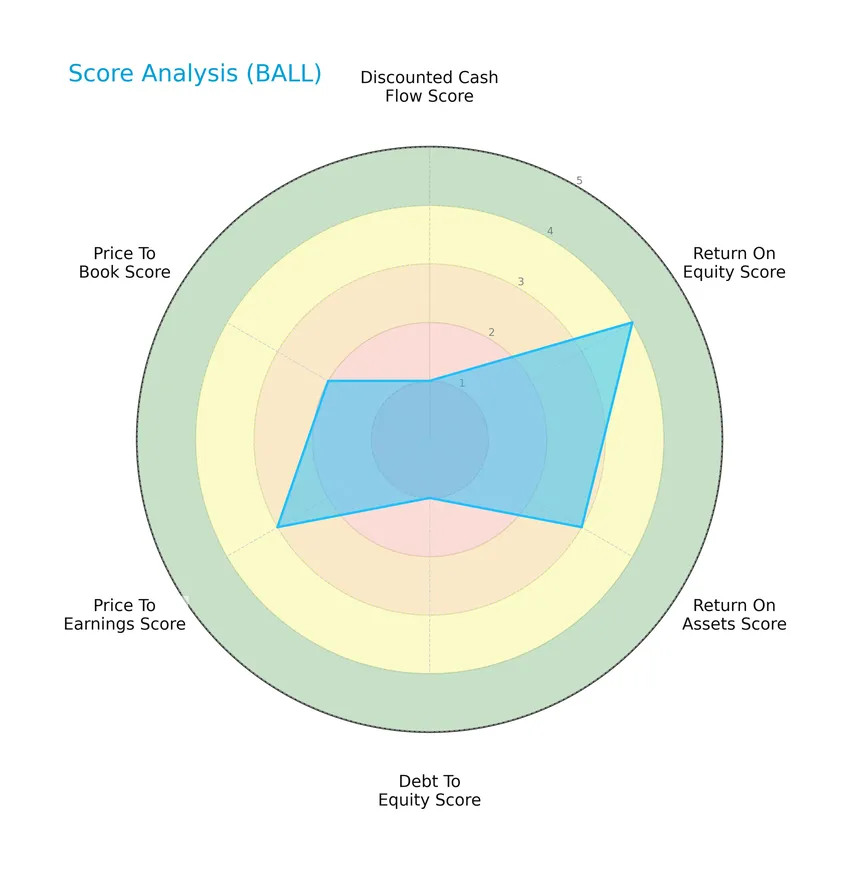

Score analysis

The following radar chart presents a comprehensive view of Ball Corporation’s key financial scores:

Ball Corporation’s scores reveal a mixed financial profile: a very unfavorable discounted cash flow and debt-to-equity ratio contrast with favorable return on equity, moderate return on assets, price-to-earnings, and price-to-book scores, indicating varied strengths and weaknesses.

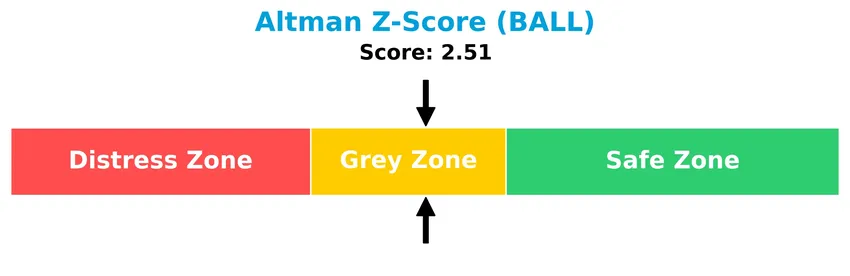

Analysis of the company’s bankruptcy risk

Ball Corporation’s Altman Z-Score places it in the grey zone, indicating a moderate risk of bankruptcy and financial uncertainty:

Is the company in good financial health?

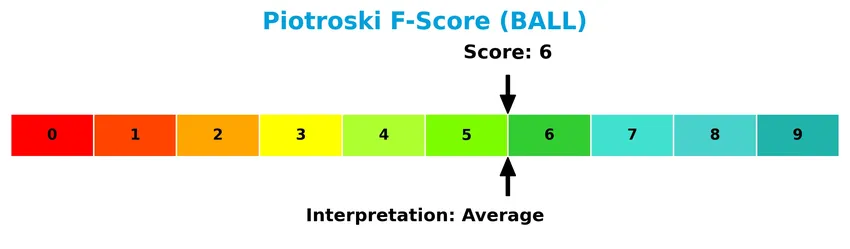

The Piotroski Score chart provides insight into Ball Corporation’s overall financial condition:

With a Piotroski Score of 6, Ball Corporation demonstrates average financial health, suggesting moderate strength but room for improvement in profitability, leverage, and efficiency metrics.

Competitive Landscape & Sector Positioning

This sector analysis will examine Ball Corporation’s strategic positioning, revenue by segment, key products, main competitors, competitive advantages, and SWOT analysis. I will also assess whether Ball Corporation holds a competitive advantage relative to its industry peers.

Strategic Positioning

Ball Corporation maintains a diversified product portfolio focused on aluminum packaging across beverage, food, and household segments, with significant geographic exposure spanning the United States, Brazil, Europe, and other international markets. It also operates an aerospace segment, reflecting a multi-industry strategy.

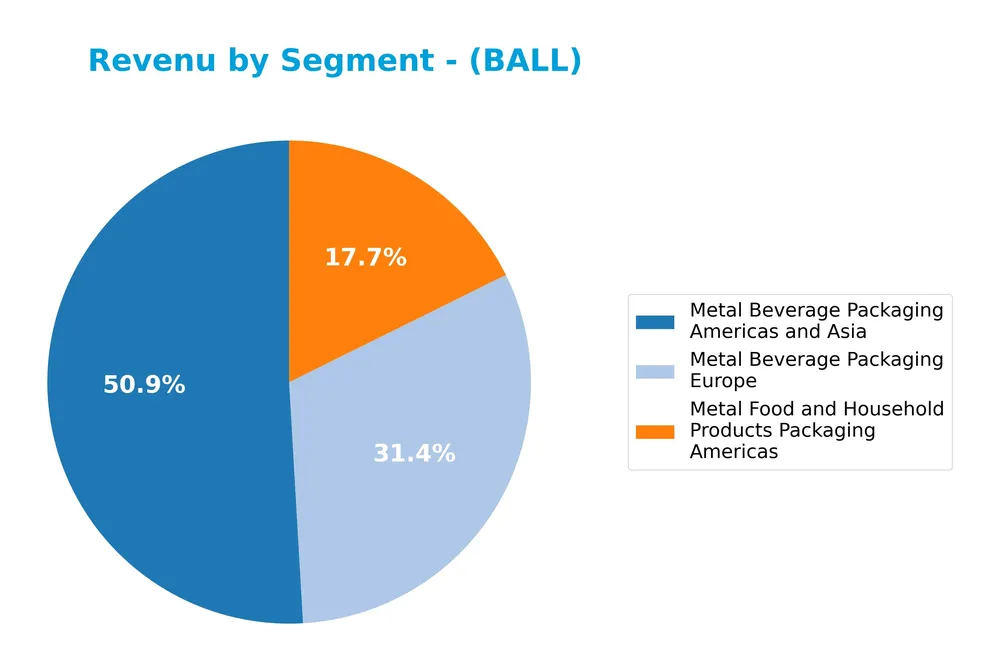

Revenue by Segment

The pie chart illustrates Ball Corporation’s revenue distribution by segment for the fiscal year 2024, highlighting the contributions of different metal packaging categories.

In 2024, Metal Beverage Packaging Americas and Asia remained the dominant segment with $5.62B in revenue, followed by Metal Beverage Packaging Europe at $3.47B. Metal Food and Household Products Packaging Americas contributed a smaller $1.95B. The trend shows a slight slowdown in the Americas and Asia segment compared to previous years while Europe stabilized. The business remains heavily driven by beverage packaging, presenting a concentration risk if market dynamics shift.

Key Products & Brands

The following table summarizes Ball Corporation’s key products and brands by segment and description:

| Product | Description |

|---|---|

| Metal Beverage Packaging Americas and Asia | Aluminum beverage containers for carbonated soft drinks, beer, energy drinks, and other beverages in the Americas and Asia. |

| Metal Beverage Packaging Europe | Aluminum beverage containers serving the European market. |

| Metal Food and Household Products Packaging Americas | Extruded aluminum aerosol containers, recloseable aluminum bottles, aluminum cups, and aluminum slugs for food and household products in the Americas. |

| Aerospace | Development of spacecraft, sensors, radio frequency systems, defense hardware, antennas, tactical video solutions, satellites, and related aerospace technologies and services. |

Ball Corporation primarily focuses on aluminum beverage packaging across global regions and provides aerospace technologies, including satellite and defense systems, diversifying its product portfolio across packaging and aerospace industries.

Main Competitors

There are 5 competitors in the Packaging & Containers industry, with the table listing the top 5 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| International Paper Company | 21.3B |

| Smurfit Westrock Plc | 20.7B |

| Amcor plc | 19.4B |

| Packaging Corporation of America | 19.0B |

| Ball Corporation | 14.3B |

Ball Corporation ranks 5th among its competitors, holding approximately 72% of the market cap of the leader, International Paper Company. The company is positioned below both the average market cap of the top 10 competitors (18.9B) and the median market cap in the sector (19.4B). It maintains a 23.6% market cap gap from the next closest competitor above.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does BALL have a competitive advantage?

Ball Corporation currently does not present a competitive advantage, as its return on invested capital (ROIC) is below its weighted average cost of capital (WACC) by 2.26%, with a declining ROIC trend of -28.64% over 2020-2024. This indicates the company is shedding value and experiencing decreasing profitability.

Looking forward, Ball Corporation’s operations span beverage packaging and aerospace technologies, providing opportunities for growth across multiple geographic markets including the U.S., Brazil, and Europe. The company’s diverse product offerings and international presence could support future developments, though current profitability challenges remain.

SWOT Analysis

This SWOT analysis highlights Ball Corporation’s strategic position by examining its internal strengths and weaknesses alongside external opportunities and threats.

Strengths

- Strong market presence in aluminum beverage packaging

- Diverse aerospace and defense technology segments

- Favorable net margin of 34% and high ROE at 68%

Weaknesses

- Declining revenue growth and EBIT margin

- Low liquidity ratios and unfavorable debt-to-equity ratio

- Negative ROIC trend indicating value destruction

Opportunities

- Expansion in emerging markets outside the US

- Growth potential in sustainable packaging solutions

- Increasing demand in aerospace and defense sectors

Threats

- Raw material price volatility impacting margins

- Intense competition in packaging industry

- Regulatory pressures on aluminum production and aerospace exports

Overall, Ball Corporation leverages its diversified product lines and strong profitability but faces challenges from declining growth and financial leverage. Strategic focus on innovation and market expansion, while managing debt and operational efficiency, will be crucial for sustainable value creation.

Stock Price Action Analysis

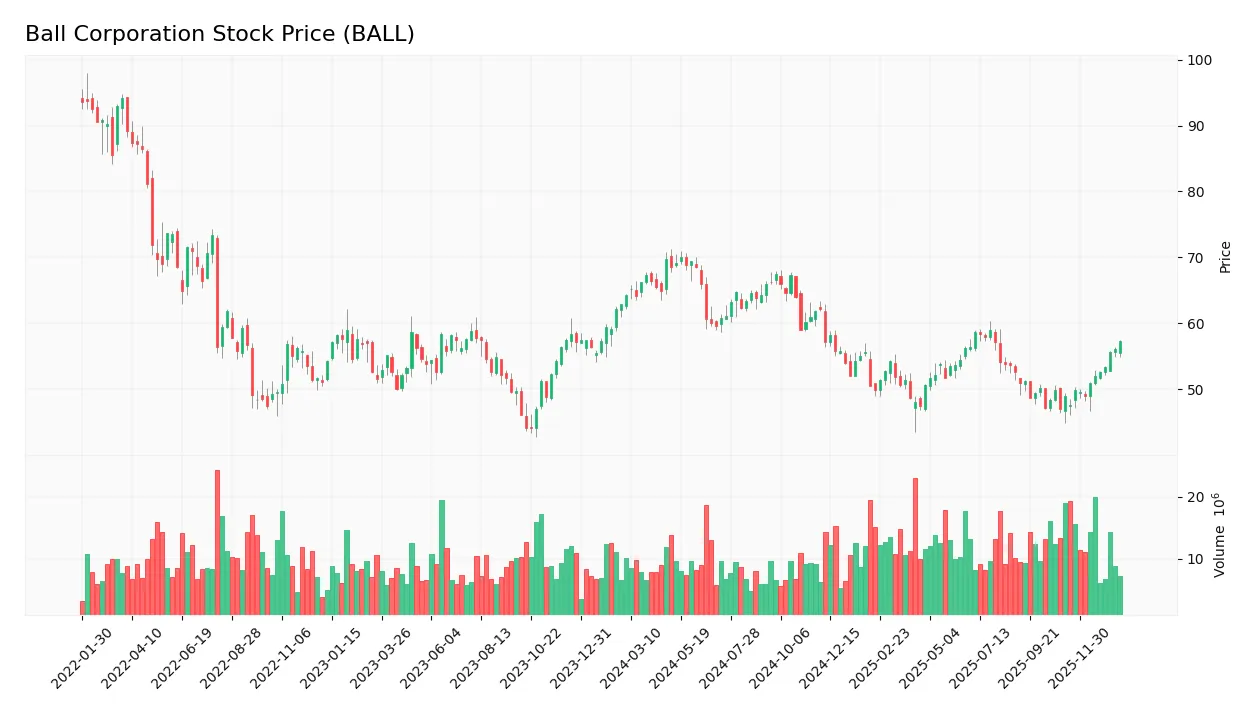

The following weekly stock chart illustrates Ball Corporation’s price movements over the past 100 weeks, highlighting recent volatility and trend shifts:

Trend Analysis

Over the past 100 weeks, Ball Corporation’s stock price declined by 10.77%, indicating a bearish trend with accelerating downward momentum. The price ranged between a high of 70.11 and a low of 47.0, exhibiting notable volatility with a standard deviation of 6.69. However, from November 2025 to January 2026, the price rose 17.11%, suggesting a short-term recovery.

Volume Analysis

Trading volume for Ball Corporation has been increasing, driven by a buyer-dominant market with 56.14% of total volume attributed to buyers over the full period. In the recent 11-week span, buyer dominance strengthened to 72.81%, reflecting strong investor participation and positive sentiment toward the stock.

Target Prices

The consensus target prices for Ball Corporation indicate moderate upside potential.

| Target High | Target Low | Consensus |

|---|---|---|

| 69 | 55 | 62.5 |

Analysts expect the stock to trade around 62.5, with a high target of 69 and a low of 55, reflecting cautious optimism about the company’s prospects.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines recent analyst ratings and consumer feedback related to Ball Corporation’s market performance and reputation.

Stock Grades

Here is the latest overview of Ball Corporation’s stock grades from recognized financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Neutral | 2026-01-12 |

| Wells Fargo | Upgrade | Overweight | 2026-01-06 |

| Citigroup | Upgrade | Buy | 2026-01-06 |

| Truist Securities | Maintain | Buy | 2026-01-06 |

| B of A Securities | Upgrade | Buy | 2025-11-17 |

| JP Morgan | Maintain | Neutral | 2025-11-05 |

| Wells Fargo | Maintain | Underweight | 2025-10-15 |

| Truist Securities | Maintain | Buy | 2025-10-13 |

| UBS | Maintain | Neutral | 2025-10-06 |

| Mizuho | Maintain | Outperform | 2025-10-03 |

The trend shows a predominance of buy ratings with several upgrades in early 2026, while a few firms maintain neutral or underweight stances. Overall consensus remains a buy, reflecting moderate positive sentiment among analysts.

Consumer Opinions

Consumers have expressed a mixed yet insightful range of opinions about Ball Corporation, reflecting both satisfaction and areas for improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| “Ball Corporation offers durable and eco-friendly packaging solutions.” | “Some customers find the pricing slightly higher than competitors.” |

| “Excellent customer service with timely delivery.” | “Occasional delays reported in bulk orders.” |

| “Innovative product designs that meet modern sustainability standards.” | “Limited customization options for specific packaging needs.” |

Overall, consumers appreciate Ball Corporation’s commitment to sustainability and quality, though pricing and delivery consistency remain common concerns.

Risk Analysis

Below is a summary table highlighting key risk categories for Ball Corporation, including their likelihood and potential impact on the company:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Moderate risk due to Altman Z-Score in grey zone and weak liquidity ratios (current ratio 1.0). | Medium | Medium |

| Debt Management | Elevated risk from unfavorable debt-to-equity ratio (1.03) impacting financial flexibility. | Medium | High |

| Market Volatility | Beta of 1.137 indicates moderate sensitivity to market swings, affecting stock price stability. | Medium | Medium |

| Operational Risks | Exposure to global supply chain disruptions in packaging and aerospace sectors. | Medium | Medium |

| Regulatory Risks | Potential impact from evolving environmental regulations on aluminum packaging production. | Medium | Medium |

The most significant concerns are Ball’s moderate financial distress indicated by the grey-zone Altman Z-Score and its relatively high debt levels, which could constrain growth and increase vulnerability during economic downturns. Investors should weigh these risks carefully against the company’s favorable profitability and return metrics.

Should You Buy Ball Corporation?

Ball Corporation appears to be facing challenges with a declining and value-eroding profitability profile, coupled with a substantial leverage position that could pressure operational flexibility. While its overall rating suggests a moderate investment appeal, caution might be warranted given the very unfavorable moat status and mixed financial health indicators.

Strength & Efficiency Pillars

Ball Corporation exhibits solid profitability metrics with a net margin of 33.97% and a robust return on equity (ROE) of 68.37%, underscoring efficient capital use. While its return on invested capital (ROIC) at 5.73% trails its weighted average cost of capital (WACC) of 7.99%, indicating the company is currently not a value creator, its Altman Z-Score of 2.51 places it in the grey zone, reflecting moderate financial stability. The Piotroski score of 6 suggests average financial strength, supporting a foundation of operational efficiency despite some concerns.

Weaknesses and Drawbacks

There are notable risks embedded in Ball’s financial structure. A debt-to-equity ratio of 1.03 and a current ratio of 1.0 highlight elevated leverage and potential liquidity constraints, which could pressure the company if market conditions deteriorate. The moderate price-to-earnings ratio of 4.2 and price-to-book ratio of 2.87 reflect a valuation that is not excessive but could attract cautious scrutiny given the company’s bearish overall stock trend (-10.77%) and accelerating price decline. These factors underline ongoing market pressure and financial vulnerabilities.

Our Verdict about Ball Corporation

Ball Corporation’s long-term fundamental profile might appear mixed due to its strong profitability but lower ROIC relative to WACC and leverage concerns. Despite a bearish overall stock trend, the recent period shows strongly buyer-dominant behavior with 72.81% buyer volume dominance and positive price momentum (+17.11%), suggesting potential market interest. This profile could suggest a cautious approach, where investors might consider waiting for further confirmation before committing to long-term exposure.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Inside Ball’s People-First Strategy – Ball (Sep 02, 2025)

- Ball Corporation Announces Board and Leadership Transitions – PR Newswire (Nov 10, 2025)

- Here’s What to Expect From Ball Corporation’s Next Earnings Report – Yahoo Finance (Jan 06, 2026)

- Ball Corporation $BALL Shares Sold by QRG Capital Management Inc. – MarketBeat (Jan 22, 2026)

- Ball announces sudden CEO transition – Packaging Dive (Nov 10, 2025)

For more information about Ball Corporation, please visit the official website: ball.com