Home > Analyses > Communication Services > Baidu, Inc.

Baidu, Inc. revolutionizes how millions in China access information and entertainment, seamlessly integrating AI-driven search and cloud services into daily life. As a dominant force in internet content and digital marketing, Baidu leads with innovative platforms like Haokan and iQIYI, blending user-generated and original content to shape consumer engagement. With its strong foothold and cutting-edge initiatives, the key question for investors is whether Baidu’s current fundamentals support its valuation and long-term growth prospects in a rapidly evolving digital landscape.

Table of contents

Business Model & Company Overview

Baidu, Inc., founded in 2000 and headquartered in Beijing, stands as a dominant player in the Internet Content & Information sector in China. Its ecosystem integrates search-based and feed-based online marketing services, cloud computing, and AI-driven products, complemented by a rich portfolio including Haokan’s short video platform and the iQIYI entertainment video service. This cohesive digital network targets diverse consumer needs across content and technology.

The company’s revenue engine balances advertising-driven income from Baidu Core with subscription and content monetization through iQIYI, supported by expanding cloud services. Baidu’s strategic positioning in major global markets—primarily Asia with growing influence in the Americas and Europe—strengthens its competitive edge. Its robust AI capabilities and integrated platform form a powerful economic moat, shaping the future of online marketing and digital entertainment.

Financial Performance & Fundamental Metrics

This section provides a clear overview of Baidu, Inc.’s income statement, key financial ratios, and dividend payout policy to support informed investment decisions.

Income Statement

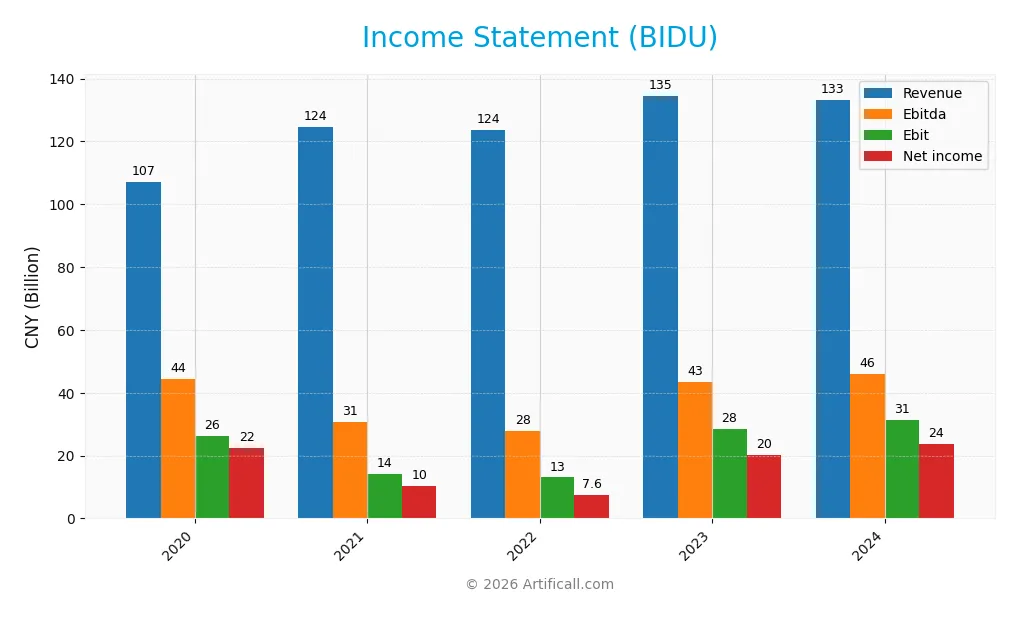

The table below presents Baidu, Inc.’s key income statement figures for the fiscal years 2020 to 2024, reported in CNY.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 107.1B | 124.5B | 123.7B | 134.6B | 133.1B |

| Cost of Revenue | 55.2B | 64.3B | 63.9B | 65.0B | 66.1B |

| Operating Expenses | 37.6B | 49.7B | 43.8B | 47.7B | 45.8B |

| Gross Profit | 51.9B | 60.2B | 59.7B | 69.6B | 67.0B |

| EBITDA | 44.4B | 30.6B | 27.8B | 43.4B | 46.1B |

| EBIT | 26.2B | 14.2B | 13.0B | 28.4B | 31.4B |

| Interest Expense | 3.1B | 3.4B | 2.9B | 3.2B | 2.8B |

| Net Income | 22.5B | 10.2B | 7.6B | 20.3B | 23.8B |

| EPS | 65.8 | 28.6 | 20.0 | 55.8 | 66.5 |

| Filing Date | 2021-03-09 | 2022-03-28 | 2023-03-22 | 2024-03-15 | 2025-03-28 |

Income Statement Evolution

From 2020 to 2024, Baidu, Inc.’s revenue grew by 24.33% overall but declined slightly by 1.09% in the last year. Gross profit followed a similar pattern, decreasing 3.66% in 2024. Despite this, operating expenses relative to revenue improved, supporting a 10.55% increase in EBIT and an 18.25% rise in net margin growth over the past year. Margins remain generally favorable with a gross margin of 50.35% and net margin at 17.85%.

Is the Income Statement Favorable?

In 2024, Baidu reported revenue of CNY 133.1B and net income of CNY 23.76B, reflecting solid profitability with a net margin of 17.85%. EBIT margin stood at 23.62%, and interest expenses were well-controlled at 2.12% of revenue. The earnings per share rose nearly 20% over the prior year, indicating improving earnings quality. Overall, the fundamentals for 2024 are assessed as favorable, supported by margin expansion and earnings growth despite a slight revenue dip.

Financial Ratios

The table below presents key financial ratios for Baidu, Inc. over the fiscal years 2020 to 2024, providing a concise overview of profitability, liquidity, leverage, and market valuation metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 21% | 8.2% | 6.1% | 15.1% | 17.8% |

| ROE | 12.3% | 4.8% | 3.4% | 8.3% | 9.0% |

| ROIC | 4.2% | 2.3% | 3.5% | 5.3% | 4.9% |

| P/E | 21.4 | 31.9 | 36.3 | 14.6 | 9.0 |

| P/B | 2.64 | 1.54 | 1.23 | 1.22 | 0.81 |

| Current Ratio | 2.68 | 2.86 | 2.67 | 3.01 | 2.09 |

| Quick Ratio | 2.67 | 2.84 | 2.66 | 2.99 | 2.01 |

| D/E | 0.45 | 0.43 | 0.41 | 0.35 | 0.30 |

| Debt-to-Assets | 25% | 24% | 23% | 21% | 19% |

| Interest Coverage | 4.6 | 3.1 | 5.5 | 6.7 | 7.5 |

| Asset Turnover | 0.32 | 0.33 | 0.32 | 0.33 | 0.31 |

| Fixed Asset Turnover | 3.92 | 3.55 | 3.60 | 3.47 | 3.25 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

From 2020 to 2024, Baidu’s Return on Equity (ROE) showed a declining trend, dropping from 12.3% in 2020 to 9.0% in 2024, indicating reduced profitability efficiency. The Current Ratio remained relatively stable but decreased from around 2.86 in 2021 to 2.09 in 2024, suggesting a slight contraction in liquidity. The Debt-to-Equity Ratio improved steadily from 0.45 in 2020 down to 0.30 in 2024, reflecting a more conservative leverage position.

Are the Financial Ratios Favorable?

In 2024, Baidu’s profitability ratios present a mixed picture: a favorable net profit margin at 17.85% contrasts with an unfavorable ROE of 9.01% and return on invested capital (ROIC) of 4.87%. Liquidity ratios such as the current ratio (2.09) and quick ratio (2.01) are favorable, indicating solid short-term financial health. The leverage is well controlled with a debt-to-equity ratio of 0.30 and an interest coverage ratio of 11.14, both favorable. Market valuation ratios, including a price-to-earnings ratio of 9.03 and price-to-book ratio of 0.81, are positive, while asset turnover at 0.31 remains unfavorable. Overall, 71.43% of evaluated ratios are favorable, supporting a generally favorable financial profile.

Shareholder Return Policy

Baidu, Inc. does not pay dividends, reflecting a strategy focused on reinvestment and growth rather than immediate shareholder payouts. Despite zero dividend yield and payout ratio, the company maintains healthy free cash flow coverage, supporting operational and capital expenditures efficiently.

Additionally, Baidu does not currently engage in share buybacks, emphasizing reinvestment over capital returns. This approach suggests a prioritization of long-term value creation, relying on sustained profitability and cash flow to support future shareholder wealth rather than short-term distributions.

Score analysis

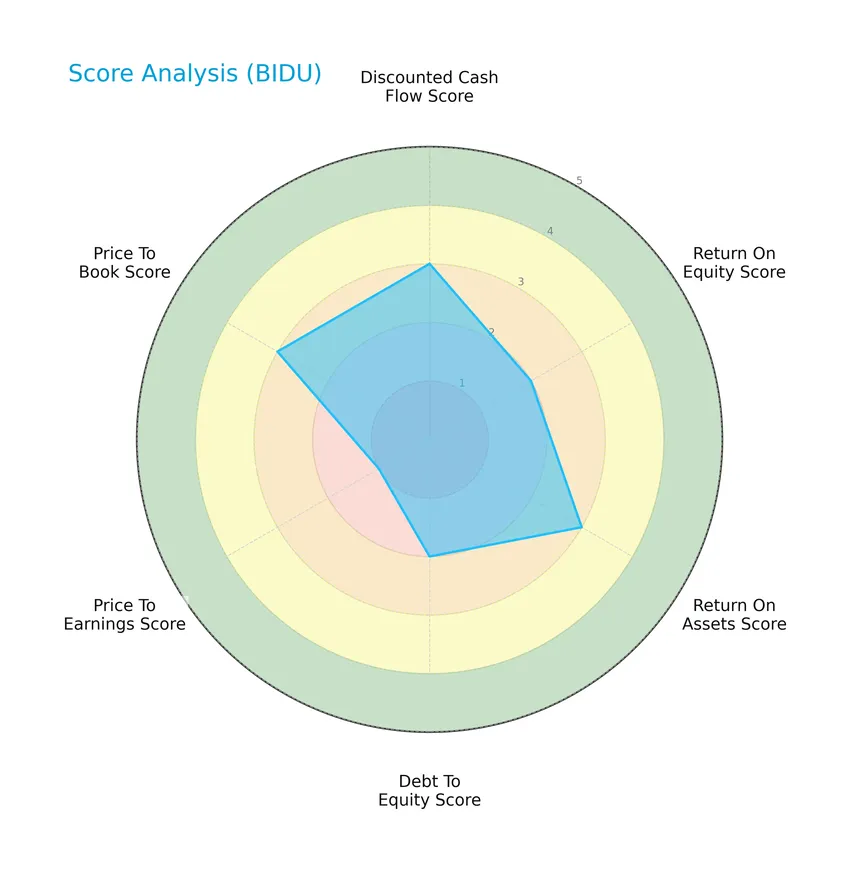

The following radar chart presents a comprehensive view of Baidu, Inc.’s key financial scores, highlighting strengths and weaknesses:

Baidu shows moderate scores in discounted cash flow (3), return on equity (2), return on assets (3), debt to equity (2), and price to book (3). The price to earnings score is notably low at 1, indicating valuation concerns compared to earnings.

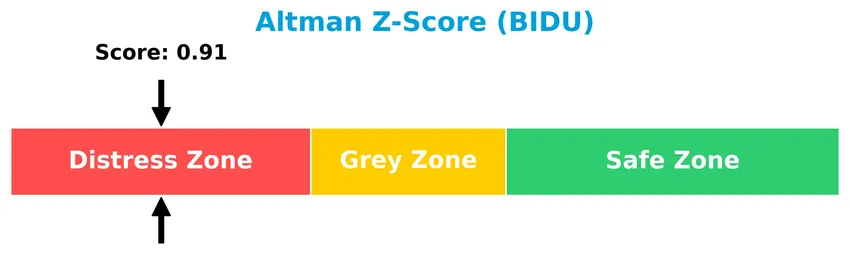

Analysis of the company’s bankruptcy risk

The Altman Z-Score places Baidu in the distress zone, signaling a high risk of financial distress and potential bankruptcy:

Is the company in good financial health?

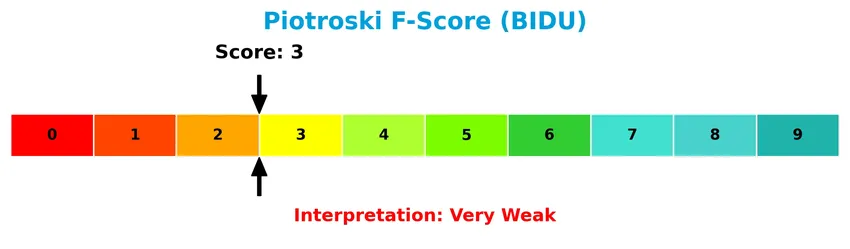

The Piotroski Score diagram illustrates Baidu’s financial health based on nine accounting criteria:

With a Piotroski Score of 3, Baidu’s financial health is considered very weak, indicating underlying operational or financial challenges that may impact its investment quality.

Competitive Landscape & Sector Positioning

This sector analysis will explore Baidu, Inc.’s strategic positioning, revenue by segment, key products, main competitors, and competitive advantages. I will also examine the company’s SWOT analysis to assess its overall market stance. The goal is to determine whether Baidu holds a competitive advantage over its industry peers.

Strategic Positioning

Baidu, Inc. maintains a concentrated geographic focus primarily on the People’s Republic of China, with minimal revenue from outside markets. Its product portfolio centers on two main segments: Online Marketing Services and diverse AI-driven products and cloud services, reflecting a focused approach within the internet content and information industry.

Revenue by Segment

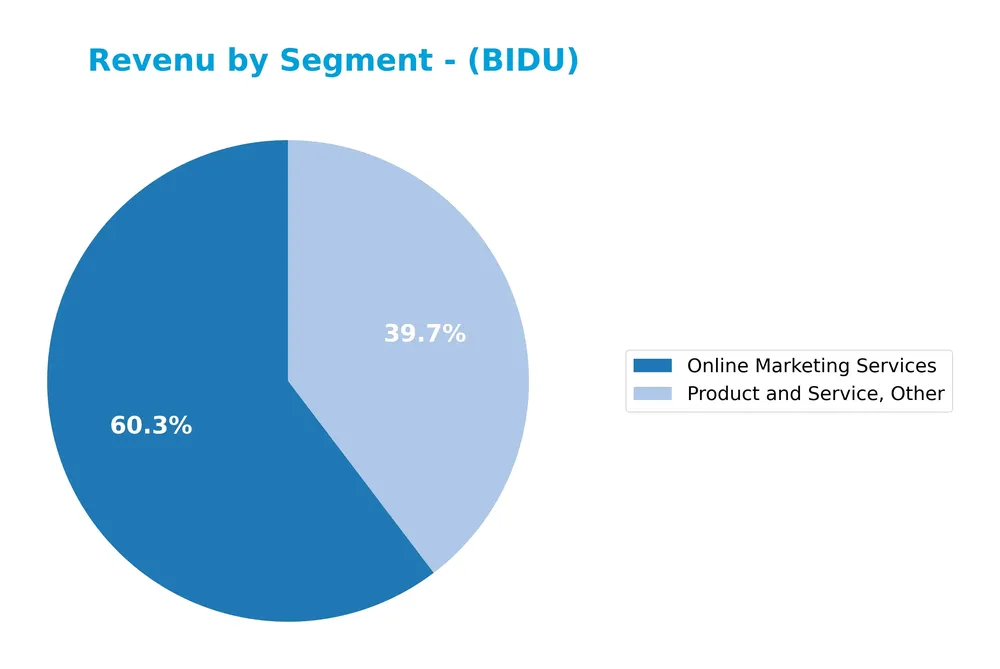

This pie chart illustrates Baidu, Inc.’s revenue distribution by segment for the fiscal year 2023, highlighting the company’s primary business sources.

In 2023, Online Marketing Services remained Baidu’s dominant revenue driver with 81.2B CNY, showing steady growth from 74.7B CNY in 2022. The Product and Service, Other segment also increased to 53.4B CNY, reflecting diversification beyond advertising. The overall trend points to a solid reliance on marketing services while expanding other offerings, with 2023 indicating moderate acceleration in the secondary segment and a balanced revenue mix.

Key Products & Brands

The table below outlines Baidu, Inc.’s main products and brands along with their descriptions:

| Product | Description |

|---|---|

| Baidu Core | Provides search-based, feed-based, and other online marketing services, cloud services, AI products, and operates Haokan short video platform. |

| iQIYI | An online entertainment video platform offering original, professionally produced, and partner-generated content. |

| Online Marketing Services | Services focused on search and feed-based digital advertising, a significant revenue contributor. |

| Product and Service, Other | Includes cloud services and other AI initiatives products beyond online marketing. |

Baidu’s key offerings center on online marketing and entertainment, supported by its core search and AI-driven services, alongside video content through iQIYI. These segments drive its revenue in the Chinese internet content and information industry.

Main Competitors

There are 6 main competitors in the Communication Services sector; below is a table of the top 6 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Alphabet Inc. | 3.8T |

| Meta Platforms, Inc. | 1.6T |

| DoorDash, Inc. | 95B |

| Baidu, Inc. | 44B |

| Twilio Inc. | 22B |

| Snap Inc. | 14B |

Baidu, Inc. ranks 4th among its 6 competitors with a market cap at just 1.44% of the sector leader Alphabet Inc. Its valuation is below both the average market cap of the top 10 competitors (936B) and the sector median (69B). Baidu maintains a significant 73% gap above its closest rival, DoorDash, underscoring a distinct market positioning.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does Baidu have a competitive advantage?

Baidu currently does not present a clear competitive advantage, as its return on invested capital (ROIC) is below its weighted average cost of capital (WACC), indicating value destruction despite a growing ROIC trend. The company’s income statement shows a favorable overall evaluation with strong margins and improving net margin growth, yet revenue growth has recently been slightly negative.

Looking ahead, Baidu’s future opportunities include expanding its AI initiatives within the Baidu Core segment and leveraging its online entertainment platform, iQIYI, to tap into new content markets. These developments could support profitability improvements and potentially enhance its competitive positioning over time.

SWOT Analysis

This SWOT analysis highlights Baidu, Inc.’s key strategic factors to guide investors in assessing its market position and risks.

Strengths

- Strong market presence in China

- Robust AI and cloud service offerings

- Favorable profitability margins

Weaknesses

- Declining recent revenue growth

- Low ROE and ROIC indicate efficiency issues

- Weak financial distress scores

Opportunities

- Expansion of AI-driven products

- Growth in cloud computing demand

- Diversification into entertainment platforms

Threats

- Intense competition in internet services

- Regulatory risks in China

- Economic slowdown impacting advertising spend

Overall, Baidu maintains solid profitability and a strong foothold in China’s digital economy, but recent revenue softness and financial distress signals require caution. Strategic focus on innovation and geographic diversification could mitigate risks and drive growth.

Stock Price Action Analysis

The following weekly stock chart of Baidu, Inc. (BIDU) highlights price movements and key levels over the past 100 weeks:

Trend Analysis

Over the past 100 weeks, BIDU’s stock price increased by 55.2%, indicating a bullish trend with clear acceleration. The price ranged between a low of 77.43 and a high of 161.44, supported by a volatility measure of 17.7 standard deviation. The recent 12-week trend remains bullish with a 28.17% rise and a slope of 3.79, confirming continued upward momentum.

Volume Analysis

In the last three months, trading volume has been increasing with a total buyer volume of 103M versus seller volume of 91M, reflecting a slightly buyer-dominant market at 53.13%. This growing volume trend suggests steady investor interest and market participation favoring accumulation.

Target Prices

The consensus target prices for Baidu, Inc. indicate a positive outlook from analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 215 | 110 | 160.78 |

Analysts expect Baidu’s stock to trade between $110 and $215, with a consensus target around $160.78, reflecting moderate confidence in upside potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section provides an overview of analyst ratings and consumer feedback regarding Baidu, Inc. (BIDU) performance.

Stock Grades

Here is the latest overview of Baidu, Inc.’s stock ratings from leading financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Freedom Capital Markets | Maintain | Buy | 2026-01-07 |

| Jefferies | Maintain | Buy | 2026-01-02 |

| JP Morgan | Upgrade | Overweight | 2025-11-24 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-19 |

| Benchmark | Maintain | Buy | 2025-11-19 |

| Goldman Sachs | Maintain | Buy | 2025-11-19 |

| B of A Securities | Maintain | Buy | 2025-11-19 |

| Barclays | Maintain | Equal Weight | 2025-11-19 |

| Macquarie | Upgrade | Outperform | 2025-10-10 |

| DBS Bank | Upgrade | Buy | 2025-09-25 |

The consensus leans strongly toward a Buy rating, with several recent upgrades reflecting growing confidence among analysts. Most firms maintain Buy or equivalent ratings, though a few hold neutral stances, indicating a cautiously optimistic outlook.

Consumer Opinions

Baidu, Inc. continues to evoke strong reactions from its user base, reflecting a blend of admiration and concerns.

| Positive Reviews | Negative Reviews |

|---|---|

| “Baidu’s search engine delivers fast and relevant results, making information retrieval seamless.” | “The platform occasionally struggles with outdated content and ads cluttering search results.” |

| “Innovative AI features and voice recognition have significantly improved my daily tasks.” | “Customer service response times can be slow, which is frustrating during urgent issues.” |

| “The integration of various services under one ecosystem is very convenient for users.” | “Privacy concerns remain due to data handling practices that are not fully transparent.” |

Overall, consumers appreciate Baidu’s technological innovation and convenience but often cite issues with content quality, ad intrusion, and privacy transparency as areas needing improvement.

Risk Analysis

Below is a summary table of key risks associated with Baidu, Inc., highlighting their probability and potential impact on investment:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Altman Z-Score indicates distress zone, signaling high bankruptcy risk despite favorable margins. | High | High |

| Profitability | Weak Piotroski Score (3) suggests poor financial strength and operational challenges. | High | Medium |

| Market Valuation | Low P/E ratio with very unfavorable score may reflect undervaluation or market doubts. | Medium | Medium |

| Debt Management | Low debt-to-equity ratio and good interest coverage reduce risk but require ongoing monitoring. | Low | Low |

| Regulatory Risks | Operating mainly in China, Baidu faces geopolitical and regulatory uncertainties. | Medium | High |

| Competitive Pressure | Intense competition in AI and online services may impact revenue growth and margins. | Medium | Medium |

The most critical risks are Baidu’s financial distress signals and regulatory challenges in China, which may affect its stability and growth prospects despite solid market positioning and favorable liquidity ratios. Caution and close monitoring of financial health are advisable.

Should You Buy Baidu, Inc.?

Baidu, Inc. appears to be in a distress zone with a very weak financial strength profile, suggesting cautious risk management. While its profitability shows an improving trend, the company seems to be shedding value with a slightly unfavorable moat. Supported by a moderate leverage profile and a very favorable overall rating of B-, the investment case could be seen as balanced but warrants close monitoring.

Strength & Efficiency Pillars

Baidu, Inc. exhibits solid profitability with a net margin of 17.85% and an EBIT margin of 23.62%, underscoring effective cost management and operational efficiency. The company maintains a favorable weighted average cost of capital (WACC) at 4.9%, although its return on invested capital (ROIC) stands slightly lower at 4.87%, indicating marginal value destruction rather than creation. Financial health indicators reveal a concerning Altman Z-Score of 0.91, placing Baidu in the distress zone, and a weak Piotroski score of 3, reflecting financial fragility. Nonetheless, liquidity ratios remain strong, with a current ratio of 2.09 and a debt-to-equity ratio of 0.3, signaling prudent leverage management.

Weaknesses and Drawbacks

Baidu’s valuation metrics show mixed signals but lean toward attractiveness, with a price-to-earnings ratio of 9.03 and a price-to-book ratio of 0.81, both favorable. However, the company suffers from a low return on equity (ROE) of 9.01%, which is considered unfavorable for generating shareholder value. Operational challenges persist as asset turnover is weak at 0.31, implying inefficient asset utilization. Market dynamics appear stable, with buyer dominance at 53.13% during the recent period, mitigating short-term selling pressure, but the distress zone Altman Z-Score and weak Piotroski score elevate bankruptcy risk concerns, tempering enthusiasm.

Our Verdict about Baidu, Inc.

The long-term fundamental profile for Baidu, Inc. is moderately favorable, supported by robust margins and liquidity despite concerns around value creation and financial distress signals. The bullish overall stock trend combined with recent slight buyer dominance suggests cautious optimism. However, given the financial fragility highlighted by the Altman Z and Piotroski scores, Baidu’s profile may appear attractive for long-term exposure but could warrant a measured entry with vigilant risk management.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Baidu Stock (BIDU) Rallies to 3-Year High on Ernie 5.0 Launch – Outperforms Google, OpenAI – TipRanks (Jan 22, 2026)

- What Is Going On With Baidu Stock On Tuesday? – Baidu (NASDAQ:BIDU) – Benzinga (Jan 20, 2026)

- Wall Street Analysts See Baidu Inc. (BIDU) as a Buy: Should You Invest? – Finviz (Jan 23, 2026)

- Baidu, Inc. (NASDAQ:BIDU) most popular amongst individual investors who own 41% of the shares, institutions hold 40% – Yahoo Finance (Jan 20, 2026)

- Bull of the day: Baidu (BIDU) – MSN (Jan 23, 2026)

For more information about Baidu, Inc., please visit the official website: ir.baidu.com