Home > Analyses > Technology > Badger Meter, Inc.

Badger Meter, Inc. powers essential infrastructure by accurately measuring and controlling the flow of water and other fluids worldwide. Its cutting-edge meters and smart communication systems set industry standards for precision and reliability. Renowned for innovation and quality, Badger Meter serves municipal utilities and industrial clients with advanced solutions that drive efficiency and sustainability. As market dynamics evolve, I’m keen to assess whether Badger Meter’s robust fundamentals justify its premium valuation and growth prospects.

Table of contents

Business Model & Company Overview

Badger Meter, Inc., founded in 1905 and headquartered in Milwaukee, Wisconsin, stands as a leader in flow measurement and control solutions. Its ecosystem integrates mechanical and static water meters with advanced radio and software technologies, serving municipal utilities and industrial clients worldwide. This broad product suite reflects a core mission to enhance water management and sustainability across sectors.

The company’s revenue engine balances hardware sales of meters and valves with recurring software and service offerings, including cloud-based analytics and automatic meter reading systems. Its strategic footprint spans the Americas, Europe, and Asia, providing critical infrastructure to utilities and OEMs. Badger Meter’s competitive advantage lies in its integrated technology platform, which fortifies its economic moat and positions it to shape the future of fluid measurement.

Financial Performance & Fundamental Metrics

I analyze Badger Meter, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its operational efficiency and shareholder value creation.

Income Statement

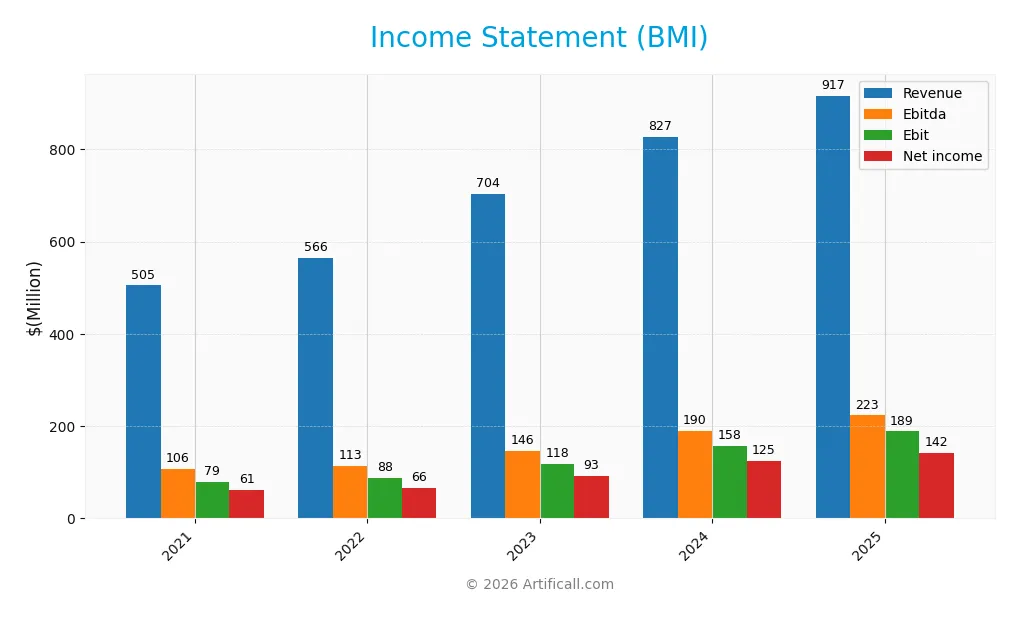

Below is Badger Meter, Inc.’s income statement overview for the fiscal years 2021 through 2025, showing key profitability and expense metrics in USD.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 505.2M | 565.6M | 703.6M | 826.6M | 916.7M |

| Cost of Revenue | 299.7M | 345.6M | 427.2M | 497.4M | 534.6M |

| Operating Expenses | 126.9M | 132.8M | 158.4M | 171.2M | 198.6M |

| Gross Profit | 205.5M | 220.0M | 276.4M | 329.2M | 382.1M |

| EBITDA | 106.5M | 113.4M | 146.0M | 190.1M | 223.2M |

| EBIT | 78.6M | 87.7M | 117.9M | 157.9M | 188.7M |

| Interest Expense | 0 | 0 | 0 | 0 | 0 |

| Net Income | 60.9M | 66.5M | 92.6M | 124.9M | 141.6M |

| EPS | 2.09 | 2.28 | 3.16 | 4.26 | 4.82 |

| Filing Date | 2022-02-23 | 2023-02-22 | 2024-02-16 | 2025-02-14 | 2026-02-17 |

Income Statement Evolution

Badger Meter, Inc. (BMI) recorded steady revenue growth from $505M in 2021 to $917M in 2025, an 81% increase. Net income surged 133% over the same period, reflecting improved profitability. Gross margin expanded to 41.7%, while EBIT margin rose to 20.6%, signaling enhanced operational efficiency and disciplined cost control.

Is the Income Statement Favorable?

In 2025, BMI delivered $917M revenue with a 15.5% net margin, consistent with industry-leading peers. EBIT grew nearly 20% year-over-year, driven by a 16% gross profit increase despite unfavorable operating expense growth matching revenue gains. Zero interest expense strengthens fundamentals, supporting a favorable overall income statement profile with sound margin expansion and EPS growth.

Financial Ratios

The table below presents key financial ratios for Badger Meter, Inc. over the last five fiscal years, illustrating profitability, liquidity, leverage, and valuation trends:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 12.1% | 11.8% | 13.2% | 15.1% | 15.5% |

| ROE | 15.1% | 15.0% | 17.9% | 20.6% | 19.9% |

| ROIC | 13.6% | 13.4% | 15.3% | 17.0% | 16.7% |

| P/E | 51.0 | 47.9 | 48.8 | 49.8 | 36.2 |

| P/B | 7.70 | 7.20 | 8.75 | 10.3 | 7.19 |

| Current Ratio | 3.18 | 3.15 | 3.35 | 4.57 | 3.36 |

| Quick Ratio | 1.97 | 2.07 | 2.19 | 3.36 | 2.36 |

| D/E | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Debt-to-Assets | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Coverage | 0 | 0 | 0 | 0 | 0 |

| Asset Turnover | 0.95 | 0.94 | 0.98 | 1.01 | 0.94 |

| Fixed Asset Turnover | 6.47 | 7.69 | 9.52 | 11.1 | 11.5 |

| Dividend Yield | 0.71% | 0.78% | 0.64% | 0.58% | 0.85% |

Evolution of Financial Ratios

Return on Equity (ROE) improved steadily from 15.1% in 2021 to 19.9% in 2025, reflecting enhanced profitability. The Current Ratio fluctuated, peaking at 4.57 in 2024 before settling at 3.36 in 2025, indicating stable liquidity. Debt-to-Equity remained at zero throughout, signaling a consistent absence of financial leverage.

Are the Financial Ratios Favorable?

Profitability ratios including ROE (19.9%) and Net Margin (15.5%) are favorable, supported by ROIC (16.7%) exceeding WACC (7.8%). Liquidity is mixed: Quick Ratio (2.36) is favorable, but Current Ratio (3.36) is considered unfavorable due to potential capital inefficiency. Leverage is favorable with no debt, while efficiency ratios like Asset Turnover (0.94) are neutral. Valuation multiples such as P/E (36.2) and P/B (7.19) are unfavorable, suggesting premium pricing. Overall, 64% of ratios are favorable, supporting a positive financial stance.

Shareholder Return Policy

Badger Meter, Inc. maintains a consistent dividend payout ratio around 30%, with dividend per share rising steadily to $1.48 in 2025. The annual yield hovers near 0.85%, supported by ample free cash flow coverage and moderate share repurchases.

This distribution policy balances shareholder returns with reinvestment capacity, indicating sustainable long-term value creation. The dividend payout appears prudent relative to earnings, minimizing risks of over-distribution or excessive buybacks despite the company’s low leverage and solid liquidity.

Score analysis

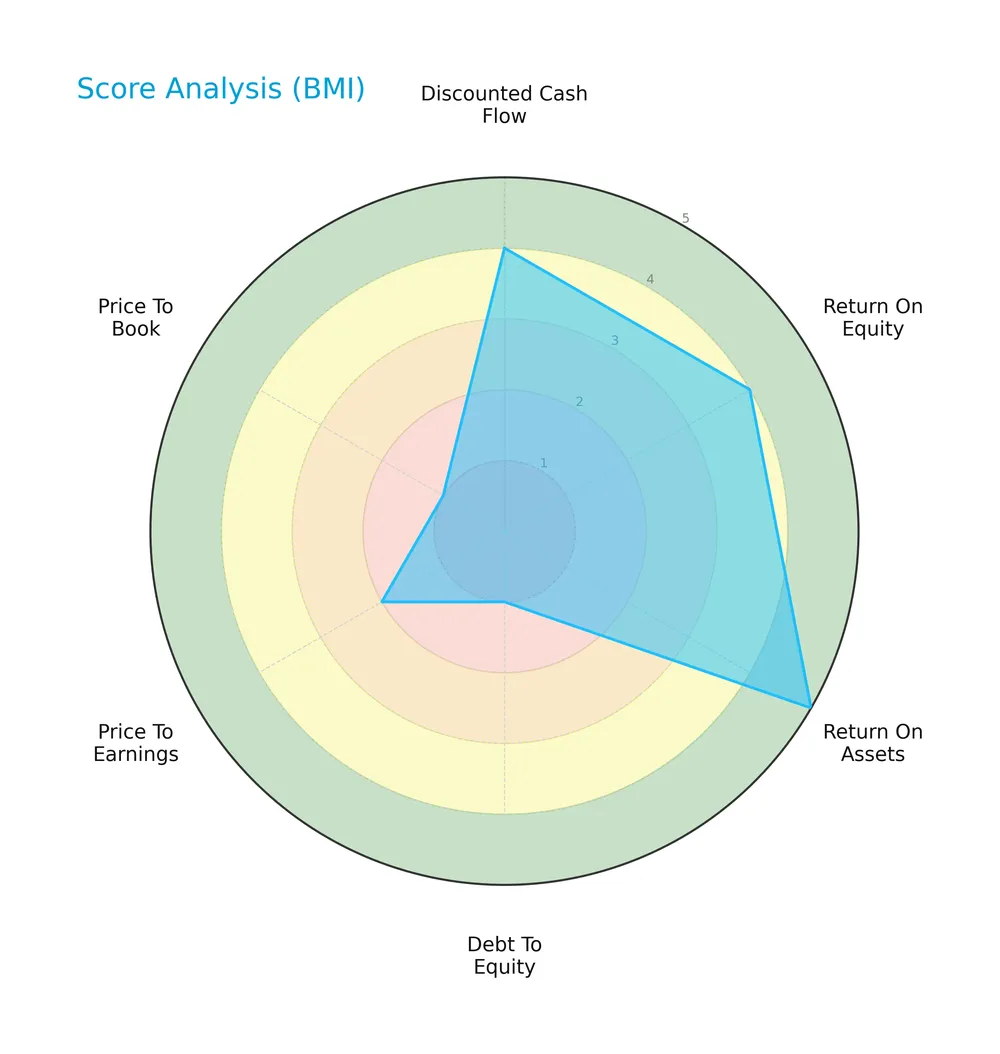

The following radar chart illustrates Badger Meter, Inc.’s key financial metric scores and valuation measures:

The company scores favorably on discounted cash flow (4), return on equity (4), and return on assets (5), indicating operational strength. However, debt to equity (1), price to earnings (2), and price to book (1) scores reflect weak leverage and valuation metrics.

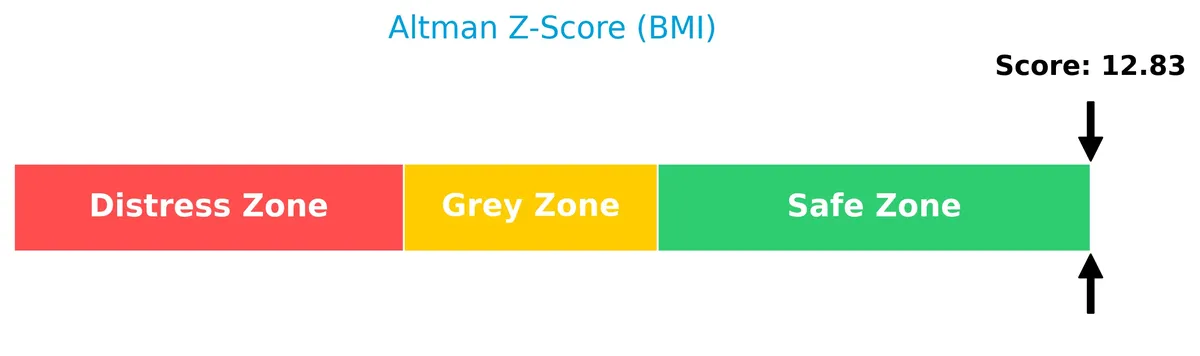

Analysis of the company’s bankruptcy risk

Badger Meter, Inc. is firmly positioned in the safe zone according to its Altman Z-Score, signaling very low bankruptcy risk:

Is the company in good financial health?

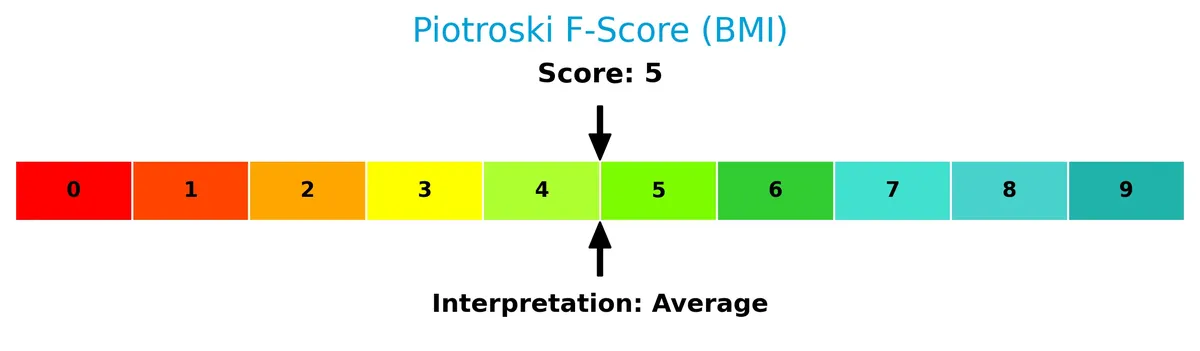

The Piotroski Score diagram highlights the company’s financial condition based on nine key criteria:

With a Piotroski Score of 5, Badger Meter, Inc. shows average financial health, indicating moderate operational efficiency and financial strength without clear signs of distress or exceptional robustness.

Competitive Landscape & Sector Positioning

This sector analysis examines Badger Meter, Inc.’s strategic positioning, revenue segments, key products, and main competitors. I will assess whether the company holds a competitive advantage over its industry peers.

Strategic Positioning

Badger Meter concentrates its product portfolio on flow measurement and control solutions, including software services generating $74M in 2025. It maintains a diversified geographic presence, with 83% revenue from the U.S. and incremental exposure across Asia, Europe, Canada, and the Middle East.

Revenue by Segment

This pie chart illustrates Badger Meter, Inc.’s revenue distribution by segment for fiscal year 2025, highlighting the company’s focus areas within its business model.

Badger Meter’s revenue is concentrated entirely in the Software as a Service segment, generating $73.6M in 2025. This singular focus suggests a strategic pivot or specialization in SaaS, which can offer recurring revenue benefits but also signals concentration risk if diversification is limited. Observing this in context, I’d watch for expansion into other segments or deeper SaaS growth to mitigate dependence on one revenue stream.

Key Products & Brands

Badger Meter, Inc. offers a range of flow measurement and control products alongside software solutions:

| Product | Description |

|---|---|

| Mechanical & Static Water Meters | Devices designed for municipal water utilities to measure water flow accurately. |

| Flow Instrumentation Products | Includes meters, valves, and sensors to control and measure fluids like water, air, steam, oil, and gases in pipelines. |

| ORION Migratable | Automatic meter reading system enabling efficient flow data collection. |

| ORION (SE) | Traditional fixed network meter reading application for infrastructure setups. |

| ORION Cellular | Infrastructure-free fixed network meter reading solution using cellular technology. |

| BEACON Advanced Metering Analytics | Cloud-hosted software suite providing alerts and consumer engagement tools for water usage management. |

| Software as a Service (SaaS) | Subscription-based software solutions supporting meter reading and analytics, contributing $73.6M in revenue in 2025. |

Badger Meter combines hardware flow measurement devices with advanced software analytics. This integration supports municipal utilities and industrial clients with precise fluid control and data-driven water management.

Main Competitors

The sector includes 20 competitors, with the table below listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Amphenol Corporation | 171B |

| Corning Incorporated | 77.7B |

| TE Connectivity Ltd. | 68.6B |

| Sandisk Corporation | 40B |

| Garmin Ltd. | 39B |

| Keysight Technologies, Inc. | 35.5B |

| Celestica Inc. | 34B |

| Coherent, Inc. | 28.7B |

| Jabil Inc. | 25.7B |

| Teledyne Technologies Incorporated | 24.4B |

Badger Meter, Inc. does not rank within the top 10 competitors by market cap, showing a relative size of zero compared to the leader, Amphenol Corporation. The company stands below both the average market cap of the top 10 competitors (54.4B) and the sector median (21.6B). Its market position is distant from the next closest competitor above, indicating a small scale relative to industry leaders.

Comparisons with competitors

Check out how we compare the company to its competitors:

Aucun article trouvé pour ces critères.

Does BMI have a competitive advantage?

Badger Meter, Inc. exhibits a clear competitive advantage, with a ROIC exceeding WACC by nearly 9%, indicating efficient capital use and consistent value creation. Its growing ROIC trend over 2021-2025 underscores increasing profitability, confirming a very favorable economic moat.

Looking ahead, BMI’s diverse product suite—mechanical/static water meters, advanced metering analytics, and communication solutions—positions it well for expansion. Continued innovation in automatic meter reading and cloud-hosted software opens opportunities across municipal utilities and industrial markets globally.

SWOT Analysis

This SWOT analysis highlights key internal and external factors shaping Badger Meter, Inc.’s strategic position.

Strengths

- strong profitability with 15.45% net margin

- growing ROIC at 16.73%, well above 7.76% WACC

- zero debt and excellent interest coverage

Weaknesses

- high valuation multiples with PE at 36.2 and PB at 7.19

- relatively low dividend yield at 0.85%

- unfavorable operating expense growth matching revenue growth

Opportunities

- expanding water metering and sustainability markets globally

- increasing demand for advanced metering analytics and IoT integration

- geographic revenue growth outside U.S. especially Europe and Asia

Threats

- pricing pressure in hardware and equipment sector

- economic sensitivity in municipal spending cycles

- technological disruption risk from emerging smart metering competitors

Badger Meter’s strong profitability and financial health underpin a durable competitive advantage. However, stretched valuation and cost controls require vigilance. Growth opportunities in smart metering and international markets support an expansion strategy, while the company must actively manage sector-specific threats and innovation risks.

Stock Price Action Analysis

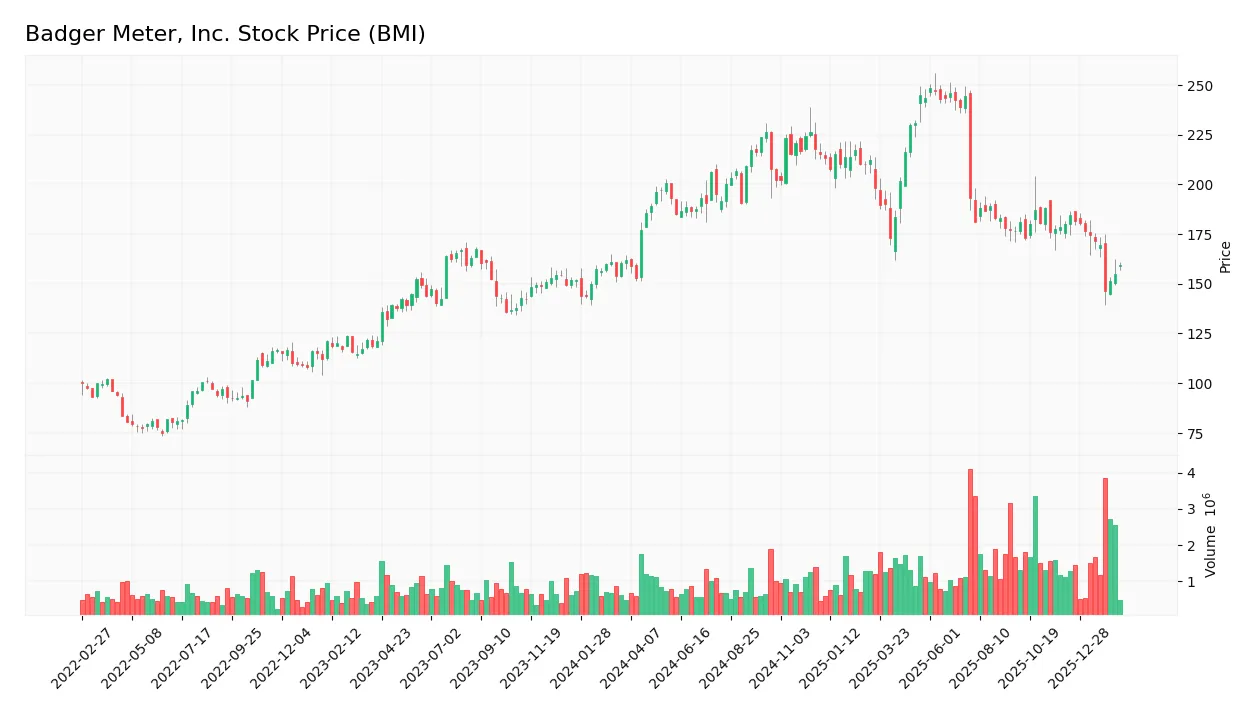

The weekly stock chart below illustrates Badger Meter, Inc.’s price movements and volatility over the last 100 weeks:

Trend Analysis

Over the past year, BMI’s stock price declined by 1.62%, indicating a neutral trend by the defined threshold. The trend shows deceleration with notable price swings between a high of 248.22 and a low of 146.58. Volatility remains elevated, with a standard deviation of 23.9.

Volume Analysis

Trading volume has increased overall, with buyers slightly surpassing sellers at 50.63%. However, the recent three-month period reveals seller dominance at 56.85%, reflecting cautious investor sentiment and higher selling pressure despite rising market participation.

Target Prices

Analysts present a target price consensus that reflects measured optimism for Badger Meter, Inc. (BMI).

| Target Low | Target High | Consensus |

|---|---|---|

| 136 | 220 | 180.71 |

The target range from 136 to 220 signals a broad valuation spectrum, with a consensus near 181, indicating moderate upside potential grounded in current fundamentals.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews recent analyst ratings and consumer feedback to provide balanced insights on Badger Meter, Inc. (BMI).

Stock Grades

Here is a summary of recent verified analyst grades for Badger Meter, Inc. from recognized financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Argus Research | Downgrade | Hold | 2026-02-02 |

| JP Morgan | Maintain | Overweight | 2026-01-29 |

| Barclays | Maintain | Underweight | 2026-01-29 |

| RBC Capital | Maintain | Outperform | 2026-01-29 |

| Stifel | Maintain | Buy | 2026-01-29 |

| Jefferies | Maintain | Buy | 2026-01-29 |

Most analysts maintain a positive stance with a bias toward holding or buying. Argus Research’s recent downgrade to Hold signals some caution despite the overall stable or optimistic ratings.

Consumer Opinions

Consumers express a mixed but generally favorable view of Badger Meter, Inc., reflecting its commitment to quality amid some operational concerns.

| Positive Reviews | Negative Reviews |

|---|---|

| Reliable and accurate metering devices. | Customer service response times lag. |

| Durable products withstand harsh conditions. | Software updates occasionally glitch. |

| Strong focus on innovation in water management. | Pricing feels high compared to competitors. |

Overall, customers praise Badger Meter’s product reliability and innovation. However, recurring complaints about support delays and pricing suggest areas needing improvement to enhance user satisfaction.

Risk Analysis

Below is a summary of key risks facing Badger Meter, Inc., highlighting their likelihood and potential impact on the business:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Valuation Risk | High P/E (36.2) and P/B (7.19) ratios suggest overvaluation risk. | Medium | High |

| Dividend Yield | Low yield (0.85%) may disappoint income-focused investors. | Medium | Medium |

| Liquidity Risk | Current ratio (3.36) flagged unfavorable, possibly indicating excess current assets or working capital inefficiency. | Low | Low |

| Leverage Risk | Zero debt minimizes financial risk but limits capital structure flexibility. | Low | Low |

| Market Volatility | Beta below 1 (0.876) suggests lower sensitivity to market swings. | Medium | Medium |

| Operational Risk | Dependence on municipal water utilities and industrial sectors. | Medium | Medium |

The most pressing risk is valuation. The stock trades at a premium compared to S&P 500 averages, which could compress returns if growth slows. Meanwhile, Badger Meter’s strong balance sheet and low leverage provide a solid cushion. Investors should monitor valuation closely, given the average Piotroski score of 5 and a strong Altman Z-Score of 12.8 indicating financial safety but moderate operational efficiency.

Should You Buy Badger Meter, Inc.?

Badger Meter, Inc. appears to be a profitable company with a durable competitive moat, supported by growing ROIC above WACC and strong value creation. Despite a manageable leverage profile, valuation metrics suggest caution. The overall rating could be seen as B.

Strength & Efficiency Pillars

Badger Meter, Inc. exhibits robust operational efficiency with a net margin of 15.45% and a return on equity (ROE) of 19.86%. Its return on invested capital (ROIC) stands at 16.73%, comfortably exceeding the weighted average cost of capital (WACC) at 7.76%, confirming the company as a clear value creator. I note the growing ROIC trend of 23.17%, signaling improving profitability and a sustainable competitive advantage. These metrics collectively highlight strong profitability and disciplined capital allocation.

Weaknesses and Drawbacks

Despite solid fundamentals, Badger Meter faces valuation concerns with a high price-to-earnings ratio of 36.2 and a price-to-book ratio of 7.19, indicating a premium market valuation that may limit upside. The current ratio of 3.36, though seemingly strong, is flagged as unfavorable here, suggesting potential inefficiencies in working capital management. Additionally, recent stock trends are bearish with a 11.63% price decline and slightly seller-dominant volume at 43.15%, creating short-term market pressure and caution for new investors.

Our Final Verdict about Badger Meter, Inc.

Badger Meter presents a fundamentally strong profile supported by its value-creating ROIC and solid profitability. However, the recent bearish price action and stretched valuation might suggest a wait-and-see approach for a more favorable entry point. While the company’s operational metrics appear attractive for long-term exposure, market dynamics could temper near-term enthusiasm and require prudence.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Decoding Badger Meter Inc (BMI): A Strategic SWOT Insight – GuruFocus (Feb 18, 2026)

- Reassessing Badger Meter (BMI) After A 28% One Year Share Price Decline – Yahoo Finance (Feb 15, 2026)

- Badger Meter, Inc. $BMI Shares Sold by Rhumbline Advisers – MarketBeat (Feb 17, 2026)

- Badger Meter Declares Regular Quarterly Dividend and Expands Share Repurchase Authorization – Business Wire (Feb 13, 2026)

- Badger Meter declares $0.40 dividend – MSN (Feb 13, 2026)

For more information about Badger Meter, Inc., please visit the official website: badgermeter.com