Home > Analyses > Industrials > Axon Enterprise, Inc.

Axon Enterprise, Inc. revolutionizes public safety by equipping law enforcement with advanced conducted energy devices and cutting-edge digital evidence management systems. As a pioneer in aerospace and defense technology, Axon’s flagship TASER products and integrated software solutions have set industry standards for innovation and reliability. With a strong foothold in both hardware and cloud-based services, the company’s ability to adapt and expand raises a critical question: does Axon’s current valuation fully reflect its growth potential in a rapidly evolving security landscape?

Table of contents

Business Model & Company Overview

Axon Enterprise, Inc., founded in 1993 and headquartered in Scottsdale, Arizona, stands as a leader in the aerospace & defense sector. The company delivers a cohesive ecosystem centered around conducted energy devices under the TASER brand, complemented by advanced hardware and cloud-based software solutions. This integration empowers law enforcement agencies globally to capture, store, and analyze digital evidence efficiently, reinforcing Axon’s dominant market position.

Axon’s revenue engine balances sales of TASER devices and body cameras with recurring income from software and cloud services, including digital evidence management and real-time crime center solutions. Its strategic presence spans the Americas, Europe, and Asia, supported by a direct sales force and distribution partners. This diversified model underpins a strong economic moat, securing Axon’s pivotal role in shaping the future of public safety technology.

Financial Performance & Fundamental Metrics

This section provides a focused analysis of Axon Enterprise, Inc.’s income statement, key financial ratios, and dividend payout policy to guide investment decisions.

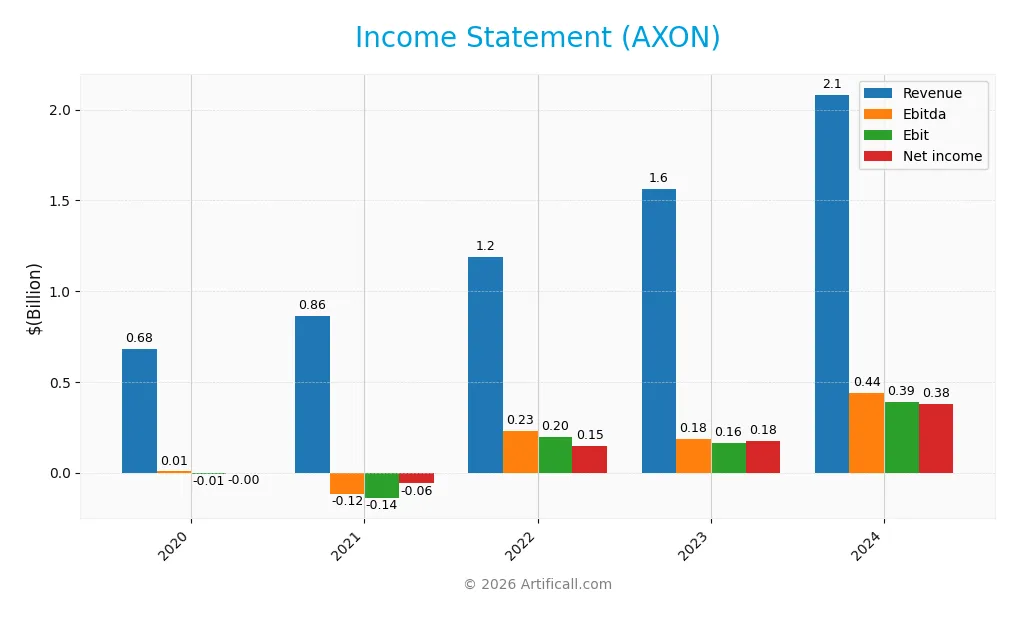

Income Statement

The table below presents Axon Enterprise, Inc.’s key income statement figures over the last five fiscal years, showing revenue, expenses, profitability, and earnings per share.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 681M | 863M | 1.19B | 1.56B | 2.08B |

| Cost of Revenue | 265M | 332M | 461M | 605M | 841M |

| Operating Expenses | 430M | 698M | 635M | 796M | 1.18B |

| Gross Profit | 416M | 531M | 729M | 955M | 1.24B |

| EBITDA | 6.3M | -117M | 228M | 183M | 437M |

| EBIT | -6.2M | -141M | 197M | 164M | 389M |

| Interest Expense | 0.1M | 0 | 0 | 7.0M | 7.1M |

| Net Income | -1.7M | -60M | 147M | 176M | 377M |

| EPS | -0.028 | -0.91 | 2.07 | 2.37 | 4.98 |

| Filing Date | 2021-02-26 | 2022-02-25 | 2023-02-28 | 2024-02-27 | 2025-02-28 |

Income Statement Evolution

Between 2020 and 2024, Axon Enterprise, Inc. demonstrated strong revenue growth, rising from 681M to 2.08B, a 206% increase. Net income exhibited an even more significant surge, from a slight loss of 1.7M in 2020 to 377M in 2024. Margins improved notably, with gross margin reaching 59.6% and net margin expanding to 18.1%, reflecting enhanced profitability and operational efficiency.

Is the Income Statement Favorable?

The 2024 income statement reveals solid fundamentals, with revenue growing 33.4% year-over-year and net income up by 61%. Earnings per share more than doubled, reflecting strong shareholder value creation. While operating expenses grew in line with revenue, the company maintained a favorable EBIT margin of 18.7% and a low interest expense ratio of 0.34%. Overall, the income statement is assessed as favorable, driven by robust margin expansion and significant profit growth.

Financial Ratios

The table below summarizes key financial ratios for Axon Enterprise, Inc. over the fiscal years 2020 to 2024:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | -0.25% | -6.95% | 12.37% | 11.26% | 18.10% |

| ROE | -0.18% | -5.73% | 11.60% | 10.90% | 16.20% |

| ROIC | -0.34% | -5.58% | 3.10% | 6.02% | 1.66% |

| P/E | -4391 | -173.15 | 80.17 | 109.04 | 119.40 |

| P/B | 7.75 | 9.92 | 9.30 | 11.89 | 19.34 |

| Current Ratio | 3.83 | 2.65 | 3.00 | 3.14 | 1.37 |

| Quick Ratio | 3.48 | 2.39 | 2.66 | 2.79 | 1.21 |

| D/E | 0 | 0.02 | 0.56 | 0.44 | 0.60 |

| Debt-to-Assets | 0 | 1.21% | 24.93% | 20.85% | 31.33% |

| Interest Coverage | -141.5 | 0 | 0 | 22.79 | 8.25 |

| Asset Turnover | 0.49 | 0.51 | 0.42 | 0.46 | 0.47 |

| Fixed Asset Turnover | 5.33 | 6.24 | 7.01 | 6.59 | 8.42 |

| Dividend Yield | 0 | 0 | 0 | 0 | 0 |

Evolution of Financial Ratios

Axon Enterprise’s Return on Equity (ROE) showed improvement, reaching 16.2% in 2024, indicating enhanced profitability. The Current Ratio declined from above 3 in prior years to 1.37 in 2024, reflecting reduced liquidity but still within a neutral range. The Debt-to-Equity Ratio rose to 0.6, signaling a moderate increase in leverage over the period with stable profitability margins.

Are the Financial Ratios Favorable?

In 2024, profitability metrics such as net margin (18.1%) and ROE (16.2%) are favorable, supported by a strong interest coverage ratio of 54.75. Liquidity is mixed: the quick ratio is favorable at 1.21, while the current ratio is neutral at 1.37. Leverage ratios, including debt-to-equity at 0.6 and debt-to-assets at 31.33%, are neutral. However, valuation ratios like P/E (119.4) and Price-to-Book (19.34) are unfavorable. Overall, the financial ratios present a slightly unfavorable picture.

Shareholder Return Policy

Axon Enterprise, Inc. does not pay dividends, reflecting a focus on reinvestment and growth rather than immediate shareholder payouts. The company’s dividend payout ratio and yield remain at zero, with no indication of dividend distributions in recent years. Despite the absence of dividends, Axon engages in share buybacks, supporting capital return to shareholders through repurchases.

This approach aligns with a strategy prioritizing long-term value creation, leveraging strong free cash flow coverage and reinvestment in operations. The lack of dividend payments combined with share buybacks suggests a balanced capital allocation aimed at sustaining growth while rewarding shareholders, though investors should monitor buyback levels for sustainability.

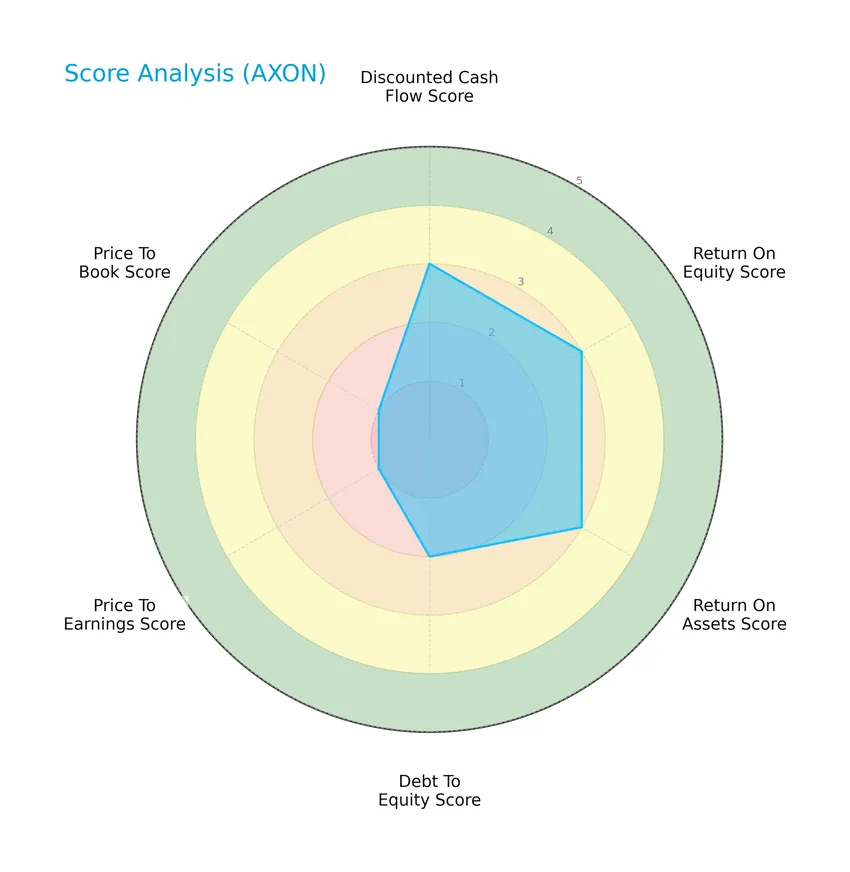

Score analysis

The following radar chart presents a comprehensive view of Axon Enterprise, Inc.’s key financial scores:

Axon Enterprise, Inc. shows moderate scores for discounted cash flow, return on equity, and return on assets, reflecting stable profitability metrics. Its debt-to-equity ratio is also moderate, but valuation scores such as price-to-earnings and price-to-book are very unfavorable, indicating potential market valuation concerns.

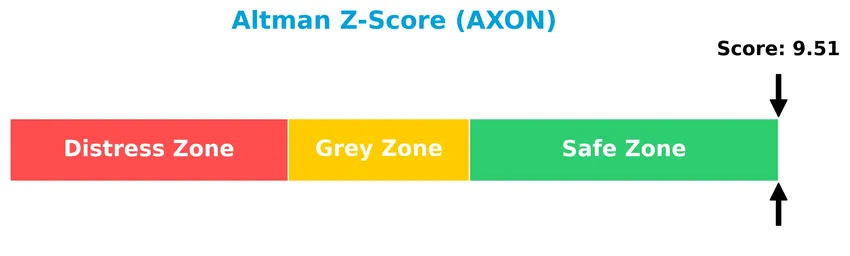

Analysis of the company’s bankruptcy risk

Axon Enterprise, Inc. is positioned well within the safe zone according to its Altman Z-Score, indicating a low risk of bankruptcy:

Is the company in good financial health?

The Piotroski Score diagram below assesses the overall financial health of Axon Enterprise, Inc.:

With a Piotroski Score of 4, the company is considered to have average financial health, suggesting moderate strength but room for improvement in its financial fundamentals.

Competitive Landscape & Sector Positioning

This sector analysis will examine Axon Enterprise, Inc.’s strategic positioning, revenue by segment, key products, main competitors, and competitive advantages. I will assess whether Axon holds a competitive edge over its industry rivals based on these factors.

Strategic Positioning

Axon Enterprise, Inc. maintains a concentrated product portfolio focused on conducted energy devices and law enforcement software, with Software and Sensors revenue surpassing TASER products at $951M versus $613M in 2023. Geographically, it is heavily US-centric, generating over $1.3B domestically in 2023, with international sales around $225M.

Revenue by Segment

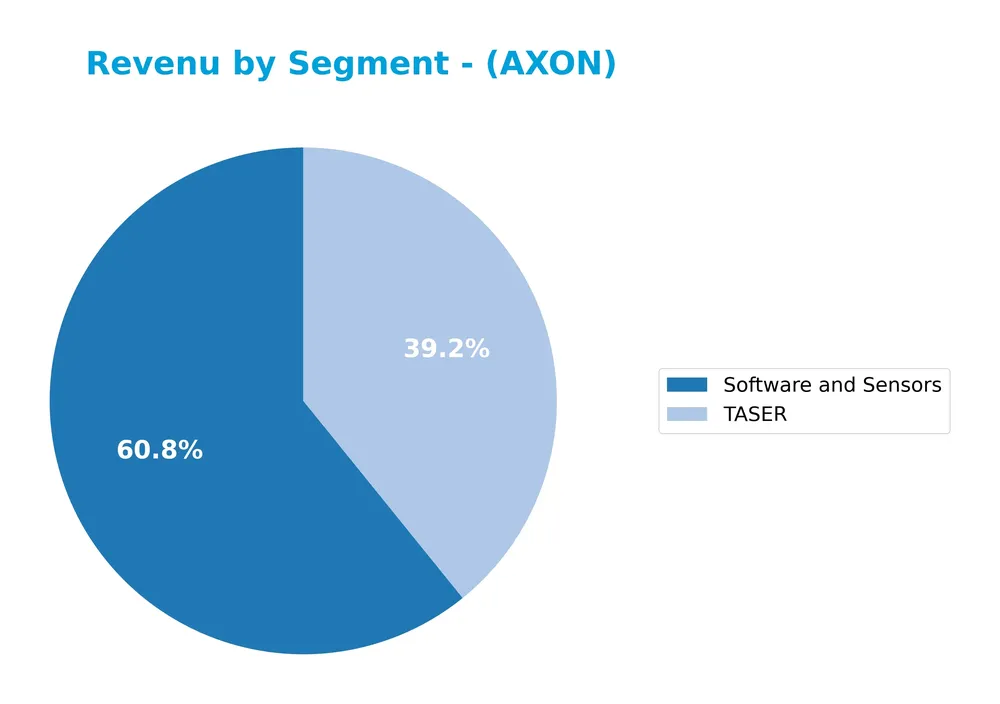

This pie chart illustrates Axon Enterprise, Inc.’s revenue distribution by segment for the fiscal year 2023.

In 2023, Axon’s revenue was mainly driven by two segments: Software and Sensors at $951M and TASER at $613M. The Software and Sensors segment has shown strong growth from $426M in 2021 to $951M in 2023, indicating acceleration in recurring revenue streams. TASER revenue also grew but at a slower pace, reflecting a shift toward software-based solutions. This trend highlights a gradual concentration risk on the Software and Sensors segment as it increasingly dominates the business.

Key Products & Brands

The table below summarizes Axon Enterprise, Inc.’s key products and brands across its main business segments:

| Product | Description |

|---|---|

| TASER Devices | Conducted energy devices including TASER 7, TASER X26P, TASER X2, and TASER Consumer devices with related cartridges. |

| Body Cameras | On-officer body cameras and Axon Fleet in-car systems for law enforcement video capture. |

| Axon Evidence Software | Cloud-based digital evidence management software for storing, managing, sharing, and analyzing video and digital evidence. |

| Axon Signal Enabled Devices | Devices integrated with Axon Signal technology to enhance connectivity and functionality. |

| Hardware Extended Warranties | Service contracts covering hardware maintenance and repairs. |

| Axon Accessories | Docks, cartridges, and batteries supporting Axon hardware products. |

Axon’s product portfolio combines physical security devices under the TASER brand with advanced software and sensor solutions, reflecting its integrated approach to law enforcement technology.

Main Competitors

There are 12 competitors in the Aerospace & Defense industry; the table below lists the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| GE Aerospace | 338.3B |

| RTX Corporation | 250.7B |

| The Boeing Company | 171.4B |

| Lockheed Martin Corporation | 116.3B |

| General Dynamics Corporation | 92.6B |

| Northrop Grumman Corporation | 83.6B |

| TransDigm Group Incorporated | 76.5B |

| L3Harris Technologies, Inc. | 56.9B |

| Axon Enterprise, Inc. | 44.5B |

| BWX Technologies, Inc. | 17.3B |

Axon Enterprise, Inc. ranks 9th among its top 10 competitors in the Aerospace & Defense sector, with a market cap about 14.3% the size of the leading GE Aerospace. The company is positioned below both the average market cap of 124.8B and the sector median of 80.0B. It maintains a notable 17.74% gap above its closest competitor, L3Harris Technologies.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does AXON have a competitive advantage?

Axon Enterprise, Inc. currently shows a slightly unfavorable competitive advantage as its return on invested capital (ROIC) remains below its weighted average cost of capital (WACC), indicating value destruction despite improving profitability. The company’s gross margin of 59.61% and net margin of 18.1% reflect favorable profitability metrics, supported by strong revenue and net income growth over recent years.

Looking ahead, Axon is positioned to expand through innovative hardware and cloud-based software solutions, including TASER devices, body cameras, and digital evidence management systems. Its strategic partnership with Fusus, Inc. aims to enhance real-time situational awareness and investigative workflows, potentially opening new markets and opportunities in law enforcement technology.

SWOT Analysis

The following SWOT analysis highlights Axon Enterprise, Inc.’s key internal and external factors to guide investors in understanding its strategic position.

Strengths

- Strong revenue growth of 33.4% in 2024

- High net margin of 18.1% indicating profitability

- Leading market position in conducted energy devices and law enforcement software

Weaknesses

- High valuation multiples (PE 119.4, PB 19.34) indicating expensive stock

- ROIC below WACC, suggesting value destruction

- Operating expense growth matching revenue growth, pressuring margins

Opportunities

- Expansion in digital evidence management and cloud-based solutions

- Increasing law enforcement and security spending globally

- Strategic partnerships enhancing real-time crime monitoring capabilities

Threats

- Intense competition in aerospace & defense technology

- Regulatory risks related to law enforcement products

- Dependence on US market with limited international revenue diversification

Axon’s solid profitability and rapid growth offer attractive investment potential, yet its high valuation and value destruction risk caution investors. The company should focus on improving capital efficiency and expanding international presence to capitalize on growing security technology demands while mitigating competitive and regulatory risks.

Stock Price Action Analysis

The weekly stock chart illustrates Axon Enterprise, Inc.’s price movements over the past 12 months, highlighting key highs and lows and recent trend behavior:

Trend Analysis

Over the past 12 months, AXON’s stock price increased by 95.11%, indicating a strong bullish trend with acceleration. The price moved from a low of 280.5 to a high of 842.5, with high volatility reflected in a standard deviation of 171.8. Recent weeks show a neutral trend with a modest 1.76% gain and a reduced volatility of 34.89.

Volume Analysis

Trading volume for AXON has been increasing, with a total of 369M shares traded and buyer volume at 54.46% overall. However, in the recent period, seller volume slightly exceeds buyer volume (52% vs. 48%), suggesting a neutral buyer sentiment and balanced market participation from November 2025 to January 2026.

Target Prices

Analysts present a confident target consensus for Axon Enterprise, Inc. (AXON).

| Target High | Target Low | Consensus |

|---|---|---|

| 900 | 713 | 814.78 |

The target prices indicate a generally bullish outlook, with analysts expecting the stock to trade between 713 and 900, averaging near 815.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews recent analyst grades and consumer feedback regarding Axon Enterprise, Inc. to gauge market sentiment.

Stock Grades

The following table presents the latest verified grades for Axon Enterprise, Inc. from leading financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Overweight | 2025-12-17 |

| Barclays | Maintain | Overweight | 2025-11-06 |

| UBS | Maintain | Neutral | 2025-11-05 |

| Goldman Sachs | Maintain | Buy | 2025-11-05 |

| Piper Sandler | Maintain | Overweight | 2025-11-05 |

| JMP Securities | Maintain | Market Outperform | 2025-09-29 |

| Needham | Maintain | Buy | 2025-09-24 |

| B of A Securities | Maintain | Buy | 2025-08-06 |

| Northland Capital Markets | Maintain | Outperform | 2025-08-05 |

| Needham | Maintain | Buy | 2025-08-05 |

Overall, the grades show a consistent pattern of positive sentiment, predominantly in the “Buy” to “Overweight” range, with no recent downgrades or negative revisions. This reflects steady confidence from multiple reputable analysts.

Consumer Opinions

Consumer sentiment around Axon Enterprise, Inc. reveals a mix of appreciation for innovation and concerns about pricing and product complexity.

| Positive Reviews | Negative Reviews |

|---|---|

| “Axon’s body cameras have improved police transparency significantly.” | “The devices are quite expensive for smaller departments.” |

| “Their software integrations are seamless and user-friendly.” | “Customer support response times can be slow during peak periods.” |

| “Regular updates keep the technology ahead of the curve.” | “Some features have a steep learning curve for new users.” |

Overall, consumers praise Axon for its cutting-edge technology and positive impact on law enforcement transparency. However, pricing and usability challenges remain common concerns among users.

Risk Analysis

Below is a summary table presenting key risk factors for Axon Enterprise, Inc., highlighting their probability and potential impact on the company:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Valuation | High P/E (119.4) and P/B (19.34) ratios suggest overvaluation risk. | Medium | High |

| Competitive Pressure | Intense competition in aerospace & defense technology could affect market share. | Medium | Medium |

| Product Dependence | Heavy reliance on TASER and law enforcement tech limits diversification. | High | Medium |

| Regulatory Risks | Changes in law enforcement policies or device regulations could reduce demand. | Medium | High |

| Financial Efficiency | Low ROIC (1.66%) and unfavorable WACC (10.29%) may constrain capital returns and growth. | Medium | Medium |

| Liquidity & Debt | Neutral current ratio (1.37) and moderate debt levels (D/E 0.6) maintain financial stability. | Low | Low |

| Innovation Pace | Need to continuously innovate in software/hardware to maintain competitive edge. | High | High |

The most significant risks for Axon are its high valuation multiples, which could lead to price corrections, and the critical need for sustained innovation to stay ahead in defense technology. Regulatory changes remain a wildcard due to evolving law enforcement standards impacting product demand.

Should You Buy Axon Enterprise, Inc.?

Axon Enterprise, Inc. appears to be showing improving profitability with growing operational efficiency, while its competitive moat might be slightly unfavorable due to value shedding. Despite moderate leverage, the company’s overall rating could be seen as a cautious C+.

Strength & Efficiency Pillars

Axon Enterprise, Inc. showcases robust profitability with a net margin of 18.1% and a return on equity (ROE) of 16.2%, underscoring efficient capital use. Its Altman Z-Score of 9.51 places it securely in the safe zone, signaling strong financial health and low bankruptcy risk. The company’s quick ratio of 1.21 and interest coverage of 54.75 reflect solid liquidity and low financial stress. However, its return on invested capital (ROIC) at 1.66% trails its weighted average cost of capital (WACC) of 10.29%, indicating that Axon is currently not a value creator despite improving profitability trends.

Weaknesses and Drawbacks

Valuation metrics present notable concerns: Axon’s price-to-earnings (P/E) ratio stands at an elevated 119.4, while its price-to-book (P/B) ratio is 19.34, both flagged as very unfavorable, suggesting a premium valuation that may expose investors to downside risk. The debt-to-equity ratio of 0.6 and a current ratio of 1.37 are neutral but warrant monitoring for leverage and liquidity balance. Recent trading volumes show seller dominance with buyers at 48.43%, potentially indicating short-term market pressure and a cautious investor sentiment.

Our Verdict about Axon Enterprise, Inc.

Axon’s long-term fundamental profile appears favorable due to strong profitability and financial stability, albeit challenged by overvaluation and suboptimal capital returns relative to cost. The stock’s bullish overall trend contrasts with recent neutral buyer behavior and slight seller dominance, which suggests that despite underlying strengths, a wait-and-see approach for a more attractive entry point might be prudent. This profile may appear suitable for investors with a moderate risk tolerance and long-term horizon.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Here is What to Know Beyond Why Axon Enterprise, Inc (AXON) is a Trending Stock – Yahoo Finance (Jan 22, 2026)

- Is Analyst Optimism on Axon’s Software Pivot Amid Q4 Earnings Pressure Altering The Investment Case For Axon Enterprise (AXON)? – simplywall.st (Jan 24, 2026)

- What’s Driving the Market Sentiment Around Axon Enterprise Inc? – Benzinga (Jan 23, 2026)

- Axon Enterprise (AXON) Stock Sinks As Market Gains: What You Should Know – Nasdaq (Jan 21, 2026)

- Axon Enterprise Earnings Preview: What to Expect – Barchart.com (Jan 20, 2026)

For more information about Axon Enterprise, Inc., please visit the official website: axon.com