Home > Analyses > Industrials > Automatic Data Processing, Inc.

Automatic Data Processing, Inc. (ADP) revolutionizes how businesses manage their workforce by delivering cutting-edge cloud-based human capital management solutions. As a dominant force in staffing and employment services, ADP’s platforms streamline payroll, benefits, talent acquisition, and compliance for millions worldwide. Renowned for innovation and reliability, the company continues to shape HR outsourcing with its comprehensive services. The key question now is whether ADP’s solid fundamentals justify its current market valuation and future growth prospects.

Table of contents

Business Model & Company Overview

Automatic Data Processing, Inc., founded in 1949 and headquartered in Roseland, New Jersey, stands as a dominant player in the Staffing & Employment Services industry. Its comprehensive ecosystem integrates cloud-based human capital management solutions, including payroll, benefits administration, talent and workforce management, and compliance services. This robust platform serves a wide range of clients by combining strategic Employer Services with Professional Employer Organization (PEO) offerings, addressing the needs of both large enterprises and small to mid-sized businesses.

The company’s revenue engine balances recurring software subscriptions with outsourcing services delivered globally across the Americas, Europe, and Asia. This dual-segment approach—Employer Services and PEO—creates a steady, diversified income stream from cloud platforms and co-employment models. Automatic Data Processing’s competitive advantage lies in its integrated HCM solutions and extensive global footprint, forming a strong economic moat that shapes the future of workforce management worldwide.

Financial Performance & Fundamental Metrics

I will analyze Automatic Data Processing, Inc.’s income statement, key financial ratios, and dividend payout policy to provide a clear view of its fundamental health.

Income Statement

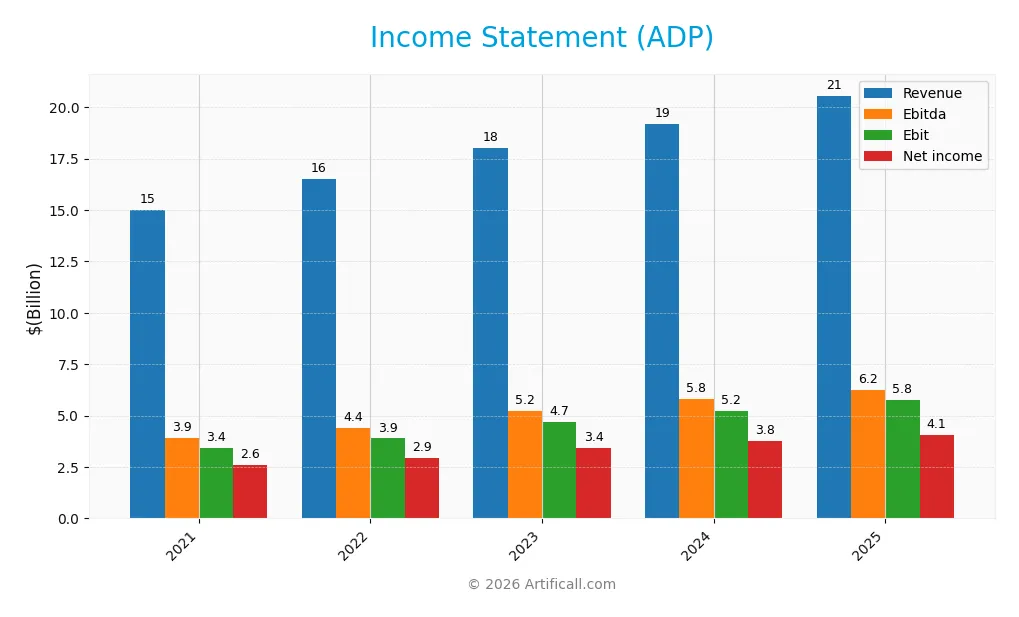

The table below presents Automatic Data Processing, Inc. (ADP)’s key income statement figures over the past five fiscal years, reflecting its financial performance in USD.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 15.01B | 16.50B | 18.01B | 19.20B | 20.56B |

| Cost of Revenue | 8.03B | 8.77B | 9.21B | 9.61B | 10.11B |

| Operating Expenses | 3.65B | 3.93B | 4.30B | 4.65B | 5.04B |

| Gross Profit | 6.97B | 7.73B | 8.81B | 9.59B | 10.45B |

| EBITDA | 3.93B | 4.41B | 5.24B | 5.80B | 6.24B |

| EBIT | 3.42B | 3.89B | 4.70B | 5.24B | 5.76B |

| Interest Expense | 59.7M | 86.3M | 257.7M | 365.8M | 455.9M |

| Net Income | 2.60B | 2.95B | 3.41B | 3.75B | 4.08B |

| EPS | 6.10 | 7.04 | 8.25 | 9.14 | 10.02 |

| Filing Date | 2021-08-04 | 2022-08-03 | 2023-08-03 | 2024-08-07 | 2025-08-06 |

Income Statement Evolution

From 2021 to 2025, ADP’s revenue rose steadily by 37.02%, with net income growing even more robustly at 57.0%. Gross margin improved to 50.84%, reflecting better cost control, while the EBIT margin reached 27.99%, indicating efficient operating performance. Net margin also expanded by 14.58%, showing overall margin improvement and profitability growth during this period.

Is the Income Statement Favorable?

The fiscal year 2025 shows generally favorable fundamentals for ADP, with revenue increasing 7.07% year-over-year and gross profit up 8.98%. EBIT grew nearly 10%, supported by a strong 19.84% net margin and controlled interest expense at 2.22%. Operating expenses grew at the same pace as revenue, slightly unfavorable but outweighed by earnings per share growth of 9.64%, resulting in a broadly positive income statement evaluation.

Financial Ratios

The table below presents key financial ratios for Automatic Data Processing, Inc. (ADP) over recent fiscal years, providing insight into profitability, efficiency, liquidity, leverage, and shareholder returns:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 17% | 18% | 19% | 20% | 20% |

| ROE | 46% | 91% | 97% | 83% | 66% |

| ROIC | 24% | 37% | 42% | 39% | 25% |

| P/E | 33 | 30 | 27 | 26 | 31 |

| P/B | 15 | 27 | 26 | 21 | 20 |

| Current Ratio | 1.07 | 0.99 | 0.99 | 1.01 | 1.05 |

| Quick Ratio | 1.07 | 0.99 | 0.99 | 1.01 | 1.05 |

| D/E | 0.59 | 1.08 | 0.98 | 0.81 | 1.46 |

| Debt-to-Assets | 7% | 6% | 7% | 7% | 17% |

| Interest Coverage | 56 | 44 | 17 | 14 | 12 |

| Asset Turnover | 0.31 | 0.26 | 0.35 | 0.35 | 0.39 |

| Fixed Asset Turnover | 13 | 15 | 17 | 18 | 20 |

| Dividend Yield | 1.9% | 1.9% | 2.1% | 2.3% | 1.9% |

Evolution of Financial Ratios

From 2021 to 2025, ADP’s Return on Equity (ROE) showed notable fluctuations, reaching a peak of 97.2% in 2023 before settling at 65.9% in 2025, indicating some volatility but generally strong profitability. The Current Ratio remained close to 1.0 throughout the period, reflecting stable short-term liquidity. Meanwhile, the Debt-to-Equity Ratio increased sharply from 0.59 in 2021 to 1.46 in 2025, suggesting a growing reliance on debt financing.

Are the Financial Ratios Favorable?

In 2025, ADP demonstrated favorable profitability metrics, with a high net margin of 19.8% and a strong ROE of 65.9%. Liquidity appeared adequate with a neutral Current Ratio of 1.05 and a favorable Quick Ratio at the same level. Debt metrics were mixed: the Debt-to-Equity Ratio at 1.46 was unfavorable, but debt-to-assets at 17% and interest coverage of 12.6 were favorable. Market valuation ratios like P/E (30.8) and P/B (20.3) were unfavorable, while asset turnover was also unfavorable, balanced by a favorable fixed asset turnover and a neutral dividend yield of 1.9%. Overall, the global ratio opinion was favorable.

Shareholder Return Policy

Automatic Data Processing, Inc. maintains a dividend payout ratio near 58-60%, with a steady increase in dividend per share from $3.70 in 2021 to $5.89 in 2025 and a current yield around 1.9-2.3%. The dividend is well-covered by free cash flow, indicating disciplined capital allocation.

The company also supports shareholder returns through share buybacks, complementing its dividend policy. This balanced distribution approach appears aligned with sustainable long-term value creation, avoiding excessive payouts or repurchases that could impair financial stability.

Score analysis

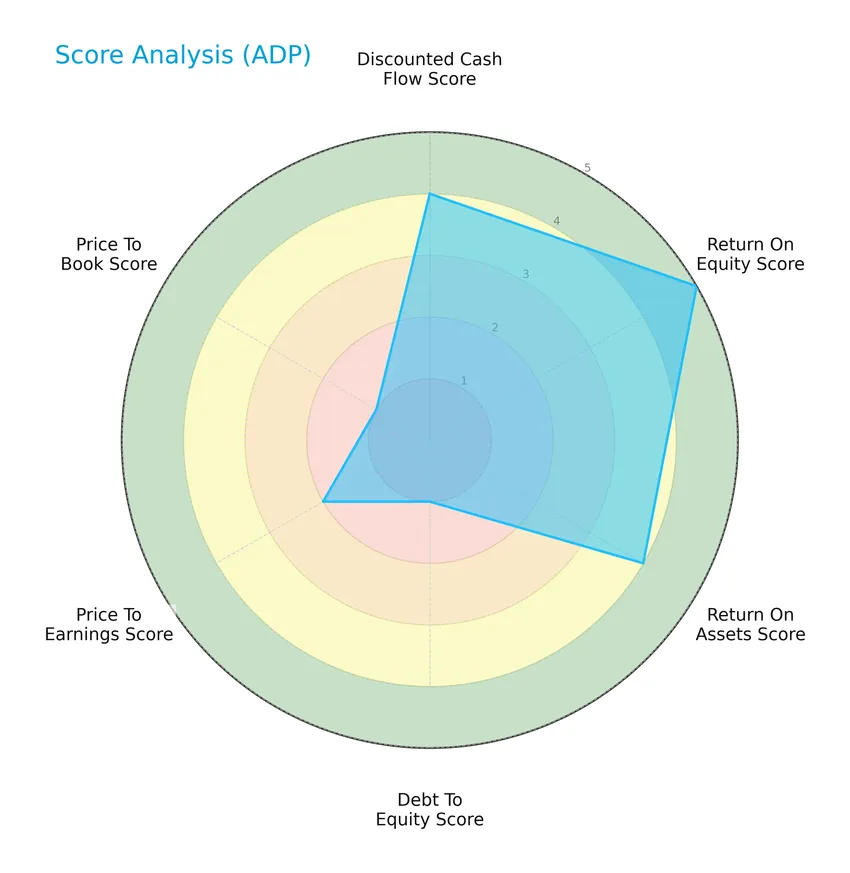

The following radar chart presents an overview of key financial scores to evaluate the company’s performance and valuation metrics:

Automatic Data Processing, Inc. shows strong returns with favorable discounted cash flow (4), return on equity (5), and return on assets (4) scores. However, the company has very unfavorable debt-to-equity (1) and price-to-book (1) metrics, with moderate price-to-earnings (2) valuation indicators.

Analysis of the company’s bankruptcy risk

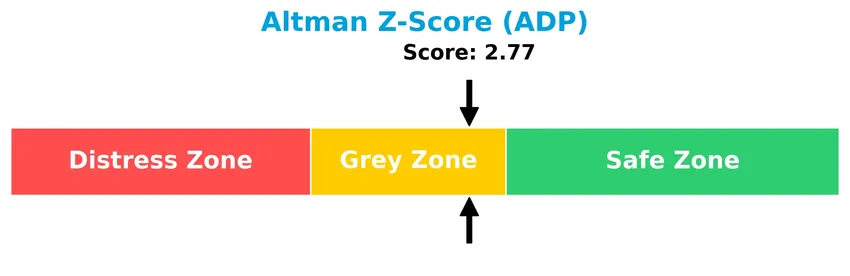

The Altman Z-Score places the company in the grey zone, indicating a moderate risk of bankruptcy that warrants careful monitoring:

Is the company in good financial health?

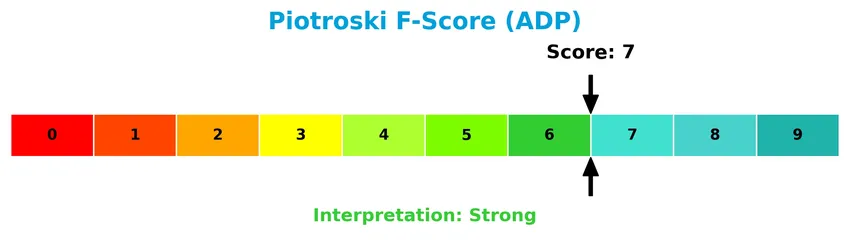

The Piotroski Score diagram illustrates the company’s overall financial strength based on profitability, leverage, and efficiency metrics:

With a Piotroski Score of 7, Automatic Data Processing, Inc. demonstrates strong financial health, suggesting solid fundamentals and operational efficiency.

Competitive Landscape & Sector Positioning

This section provides an overview of Automatic Data Processing, Inc.’s sector dynamics, including strategic positioning, revenue by segment, key products, and main competitors. I will assess whether ADP holds a competitive advantage over its peers in the staffing and employment services industry.

Strategic Positioning

Automatic Data Processing, Inc. (ADP) maintains a diversified product portfolio centered on cloud-based human capital management and professional employer organization services. Geographically, it has a strong concentration in the United States with growing contributions from Europe and Canada, reflecting a primarily North American focus with expanding global reach.

Revenue by Segment

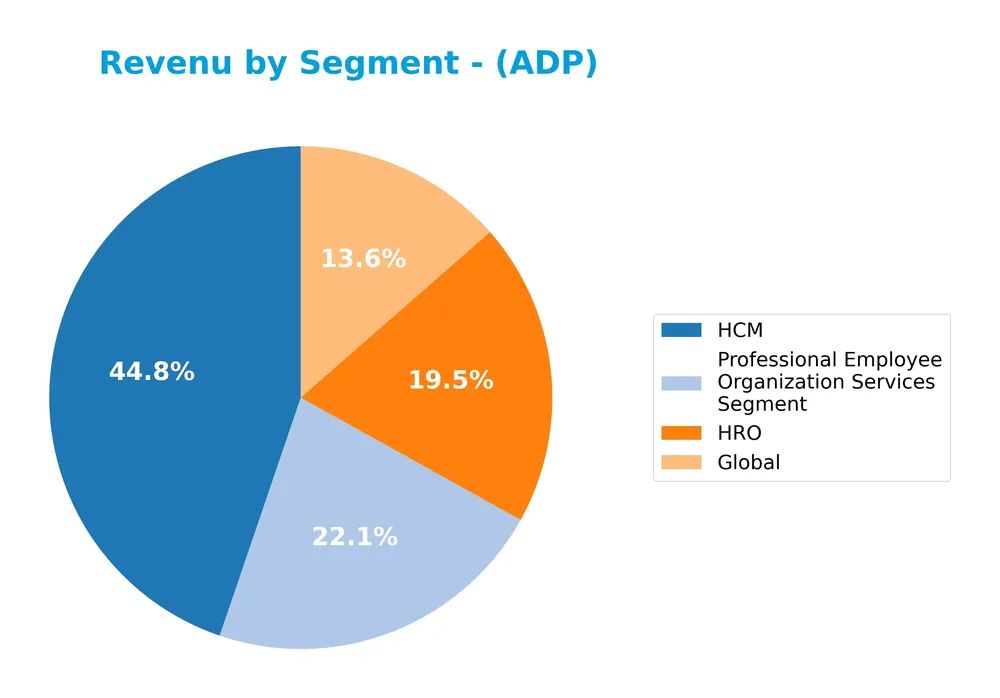

The pie chart illustrates Automatic Data Processing, Inc.’s revenue distribution by segment for the fiscal year 2025, highlighting key business areas and their relative contributions.

In 2025, the Human Capital Management (HCM) segment led revenues at 8.67B, followed by Professional Employee Organization Services at 4.29B, and Human Resource Outsourcing (HRO) at 3.78B. The Global segment contributed 2.63B. The steady growth in HCM and Professional Employee Organization Services underpins ADP’s core strength, while the Global segment shows moderate expansion. This diversification reduces concentration risk, though HCM remains the primary revenue driver.

Key Products & Brands

The key products and brands of Automatic Data Processing, Inc. reflect its comprehensive human capital management and outsourcing services:

| Product | Description |

|---|---|

| Human Capital Management (HCM) | Cloud-based platforms offering payroll, benefits administration, talent management, HR and workforce management. |

| Professional Employer Organization (PEO) | HR outsourcing services for small and mid-sized businesses, including benefits, compliance, and recruitment. |

| Employer Services Segment | Strategic cloud-based HR outsourcing solutions encompassing payroll, benefits, talent, insurance, and compliance. |

| Global | International HR and workforce management services. |

| Human Resources Outsourcing (HRO) | Outsourcing services focused on HR functions. |

| Interest on Funds Held for Clients | Income generated from managing client funds. |

Automatic Data Processing’s product portfolio centers on cloud-based human capital management and outsourcing solutions, serving a broad range of clients globally with specialized services for small to mid-sized businesses.

Main Competitors

There are 2 competitors in the Staffing & Employment Services industry; below are the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Automatic Data Processing, Inc. | 102.3B |

| Paychex, Inc. | 39.1B |

Automatic Data Processing, Inc. holds the 1st position among its competitors with a market cap 1.02 times larger than the top player (itself). The company is significantly Above both the average market cap of the top 10 (70.7B) and the median market cap of the sector. There is a substantial gap of -166.77% to the next competitor below, Paychex, Inc.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does ADP have a competitive advantage?

Automatic Data Processing, Inc. shows a durable competitive advantage supported by a very favorable moat status. Its return on invested capital (ROIC) exceeds the weighted average cost of capital (WACC) by over 17%, with a positive ROIC trend, indicating efficient capital use and value creation.

Looking ahead, ADP’s cloud-based human capital management solutions and expanding international presence, especially in Europe and Canada, position it to capitalize on growing demand for HR outsourcing. These opportunities could support ongoing revenue and profitability growth in new markets.

SWOT Analysis

This analysis highlights Automatic Data Processing, Inc.’s core strengths, weaknesses, opportunities, and threats to guide investment decisions.

Strengths

- strong market position in HR cloud solutions

- consistent revenue and profit growth

- durable competitive advantage with growing ROIC

Weaknesses

- high price-to-book and price-to-earnings ratios

- moderate debt-to-equity ratio

- relatively low asset turnover

Opportunities

- expanding demand for integrated HR platforms

- growth potential in international markets

- increasing adoption of PEO services

Threats

- intense competition in staffing and HR tech

- regulatory changes impacting HR outsourcing

- economic downturns affecting client budgets

Overall, ADP demonstrates robust financial health and a solid competitive moat, making it a favorable long-term investment. However, investors should watch valuation levels and external market risks closely.

Stock Price Action Analysis

The weekly stock price chart of Automatic Data Processing, Inc. (ADP) over the past 12 months reveals recent price movements and key levels:

Trend Analysis

Over the past 12 months, ADP’s stock price increased by 3.28%, indicating a bullish trend supported by acceleration. The price ranged between a low of 235.56 and a high of 326.81, with notable volatility reflected in a standard deviation of 25.08, confirming strong momentum.

Volume Analysis

Trading volume for ADP has been increasing overall, with a total volume exceeding 1B shares. However, the recent three-month period shows a slightly seller-dominant environment, as sellers account for 53.49% of volume, suggesting cautious investor sentiment and moderate market participation.

Target Prices

The consensus target prices for Automatic Data Processing, Inc. (ADP) reflect a generally optimistic outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 290 | 230 | 277.2 |

Analysts expect ADP’s stock price to range between $230 and $290, with an average consensus target around $277, indicating moderate upside potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews the latest analyst ratings and consumer feedback regarding Automatic Data Processing, Inc. (ADP).

Stock Grades

Here is a summary of the latest verified stock grades for Automatic Data Processing, Inc. from recognized financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Jefferies | Downgrade | Underperform | 2025-12-16 |

| JP Morgan | Maintain | Underweight | 2025-10-30 |

| Wells Fargo | Maintain | Underweight | 2025-10-30 |

| UBS | Maintain | Neutral | 2025-09-17 |

| Morgan Stanley | Maintain | Equal Weight | 2025-07-31 |

| Stifel | Maintain | Hold | 2025-07-31 |

| Morgan Stanley | Maintain | Equal Weight | 2025-06-17 |

| UBS | Maintain | Neutral | 2025-06-13 |

| Mizuho | Maintain | Outperform | 2025-06-13 |

| RBC Capital | Maintain | Sector Perform | 2025-06-05 |

The majority of grades for ADP remain neutral to underweight, with a recent downgrade to underperform by Jefferies. This indicates cautious sentiment among analysts, with limited upward revisions and a tendency toward holding or reducing exposure.

Consumer Opinions

Consumer sentiment around Automatic Data Processing, Inc. (ADP) reveals a mixed but generally favorable perception, reflecting its strong market presence and areas needing improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| Reliable payroll processing with minimal errors | Customer service can be slow to respond |

| User-friendly platform interface | Pricing is considered high by some customers |

| Comprehensive HR solutions that streamline operations | Occasional software glitches reported |

Overall, consumers appreciate ADP’s dependable and efficient payroll services and comprehensive HR tools. However, concerns about customer support responsiveness and pricing recur frequently in feedback.

Risk Analysis

The table below summarizes key risks associated with Automatic Data Processing, Inc. (ADP), focusing on their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Valuation Risk | Elevated Price-to-Earnings (30.77) and Price-to-Book (20.29) ratios may limit upside potential. | High | Moderate |

| Leverage Risk | Debt-to-Equity ratio of 1.46 indicates relatively high leverage, increasing financial risk. | Moderate | High |

| Market Volatility | Beta of 0.864 suggests moderate sensitivity to market swings, affecting stock price stability. | Moderate | Moderate |

| Bankruptcy Risk | Altman Z-Score of 2.77 places ADP in the grey zone, indicating moderate bankruptcy risk. | Moderate | High |

| Competitive Risk | Rapid changes in cloud-based HR technology could erode market share if ADP does not innovate. | Moderate | Moderate |

| Dividend Yield Risk | Dividend yield at 1.91% is neutral but may be pressured in economic downturns. | Low | Low |

The most critical risks for ADP currently stem from its relatively high leverage and valuation metrics, along with a moderate bankruptcy risk indicated by the Altman Z-Score in the grey zone. Investors should watch these factors closely, especially since high debt levels can amplify impacts during economic slowdowns or market volatility.

Should You Buy Automatic Data Processing, Inc.?

Automatic Data Processing, Inc. appears to be exhibiting robust profitability with a growing return on invested capital, suggesting a durable competitive moat. Despite a challenging leverage profile indicated by unfavorable debt metrics, the overall rating is a solid B, reflecting a balanced yet cautious investment profile.

Strength & Efficiency Pillars

Automatic Data Processing, Inc. (ADP) exhibits strong profitability with a net margin of 19.84% and a robust return on equity (ROE) of 65.93%. The company’s return on invested capital (ROIC) stands at 24.66%, well above its weighted average cost of capital (WACC) of 7.6%, confirming ADP as a clear value creator. Financial health indicators are generally solid, with a Piotroski score of 7 reflecting strong fundamentals, while the Altman Z-score at 2.77 places the company in the grey zone, suggesting moderate bankruptcy risk but overall stability.

Weaknesses and Drawbacks

ADP faces valuation challenges, with a price-to-earnings (P/E) ratio of 30.77 and an elevated price-to-book (P/B) ratio of 20.29, signaling a premium valuation that may constrain upside potential. Leverage metrics are concerning; the debt-to-equity ratio of 1.46 is high, which could increase financial risk during adverse conditions. Market pressure appears in the recent period, where sellers slightly dominate with 53.49% of volume, indicating short-term headwinds despite a longer-term bullish trend.

Our Verdict about Automatic Data Processing, Inc.

The long-term fundamental profile of ADP is favorable, supported by strong profitability and value creation. However, despite a bullish overall stock trend, recent market behavior is slightly seller dominant, which suggests a cautious wait-and-see approach may be prudent to identify a better entry point. The company’s premium valuation and leverage risks should be carefully weighed against its durable competitive advantage.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Rakuten Investment Management Inc. Invests $5.54 Million in Automatic Data Processing, Inc. $ADP – MarketBeat (Jan 23, 2026)

- ADP to Report Q2 Earnings: Here’s What Investors Should Know – Yahoo Finance (Jan 23, 2026)

- Automatic Data Processing authorizes $6B share repurchase program – MSN (Jan 23, 2026)

- Automatic Data Processing, Inc. (ADP) Stock Analysis: Evaluating the 12.28% Potential Upside for Investors – DirectorsTalk Interviews (Jan 22, 2026)

- A Look At Automatic Data Processing (ADP) Valuation After Fortune Recognition And New NER Pulse Hiring Data – simplywall.st (Jan 22, 2026)

For more information about Automatic Data Processing, Inc., please visit the official website: adp.com