Home > Analyses > Technology > Autodesk, Inc.

Autodesk, Inc. transforms the way architects, engineers, and creators bring ideas to life through cutting-edge 3D design and engineering software. As a pioneer in application software, its flagship products like AutoCAD and Fusion 360 have become indispensable tools across construction, manufacturing, and entertainment industries. Renowned for innovation and quality, Autodesk continues to shape digital workflows worldwide. But in 2026, do its strong fundamentals still support its lofty market valuation and growth prospects?

Table of contents

Business Model & Company Overview

Autodesk, Inc., founded in 1982 and headquartered in San Rafael, California, stands as a leader in the software application industry. It delivers a comprehensive ecosystem of 3D design, engineering, and entertainment software, including flagship products like AutoCAD, Fusion 360, and BIM 360, which serve professionals in architecture, manufacturing, and media. This integrated platform streamlines workflows across diverse sectors, reinforcing Autodesk’s dominant market position.

The company’s revenue engine balances recurring software subscriptions with specialized cloud services and perpetual licenses, driving sustained growth. Autodesk’s strategic footprint spans the Americas, Europe, and Asia, enabling wide market penetration and customer reach. Its strong network of direct sales and channel partners further supports global expansion. This robust model creates a durable economic moat, positioning Autodesk as a pivotal force shaping the future of design and engineering software.

Financial Performance & Fundamental Metrics

This section presents a fundamental analysis of Autodesk, Inc., focusing on its income statement, key financial ratios, and dividend payout policy.

Income Statement

The table below presents Autodesk, Inc.’s key income statement figures over the last five fiscal years, highlighting revenue performance, expenses, profitability, and earnings per share.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 3.79B | 4.40B | 4.95B | 5.44B | 6.13B |

| Cost of Revenue | 375M | 458M | 517M | 553M | 578M |

| Operating Expenses | 2.78B | 3.28B | 3.44B | 3.77B | 4.20B |

| Gross Profit | 3.42B | 3.94B | 4.43B | 4.89B | 5.55B |

| EBITDA | 721M | 789M | 1.17B | 1.27B | 1.55B |

| EBIT | 597M | 641M | 1.02B | 1.14B | 1.37B |

| Interest Expense | 50M | 76M | 71M | 0 | 0 |

| Net Income | 1.21B | 497M | 823M | 906M | 1.11B |

| EPS | 5.51 | 2.26 | 3.81 | 4.19 | 5.17 |

| Filing Date | 2021-03-19 | 2022-03-14 | 2023-03-14 | 2024-06-10 | 2025-03-06 |

Income Statement Evolution

Between 2021 and 2025, Autodesk, Inc. showed a consistent upward trend in revenue, growing 61.7% overall and 12.7% in the last year alone. Gross profit growth of 13.6% in the latest year outpaced revenue growth, contributing to a strong gross margin of 90.6%. Operating expenses rose in line with revenue, supporting an improved EBIT margin of 22.3%, while net margin also increased to 18.1%, reflecting better profitability.

Is the Income Statement Favorable?

In fiscal 2025, Autodesk’s fundamentals appear favorable. The company reported $6.13B in revenue with a net income of $1.11B, translating to an EPS of $5.17. Operating efficiency is highlighted by zero interest expense and a solid EBIT of $1.37B. Income tax expense was proportionate, and net margin growth of 8.9% year-over-year indicates improving profitability. Overall, 78.6% of evaluated income statement metrics are favorable, supporting a positive view on the income statement’s quality.

Financial Ratios

The table below presents key financial ratios for Autodesk, Inc. (ADSK) over the fiscal years 2021 to 2025, providing insights into profitability, valuation, liquidity, leverage, and operational efficiency:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 32% | 11% | 17% | 17% | 18% |

| ROE | 125% | 59% | 72% | 49% | 42% |

| ROIC | 16% | 12% | 16% | 16% | 18% |

| P/E | 52 | 110 | 56 | 61 | 60 |

| P/B | 65 | 65 | 41 | 30 | 26 |

| Current Ratio | 0.83 | 0.69 | 0.84 | 0.82 | 0.68 |

| Quick Ratio | 0.83 | 0.69 | 0.84 | 0.82 | 0.68 |

| D/E | 2.18 | 3.60 | 2.33 | 1.42 | 0.98 |

| Debt-to-Assets | 29% | 36% | 28% | 26% | 24% |

| Interest Coverage | 13 | 9 | 14 | 0 | 0 |

| Asset Turnover | 0.52 | 0.51 | 0.52 | 0.55 | 0.57 |

| Fixed Asset Turnover | 6.2 | 9.4 | 12.7 | 15.8 | 21.4 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

From 2021 to 2025, Autodesk, Inc. showed fluctuating but generally strong profitability, with Return on Equity (ROE) varying significantly, peaking at 125% in 2021 and settling at 42.4% in 2025. The Current Ratio trended downward from around 0.83 in 2021 to 0.68 in 2025, indicating reduced short-term liquidity. The Debt-to-Equity ratio improved, decreasing from over 3.6 in 2022 to about 0.98 in 2025, reflecting better leverage control.

Are the Financial Ratios Favorable?

In 2025, Autodesk’s profitability ratios, including net margin (18.14%) and ROE (42.43%), are favorable, supported by strong returns on invested capital. Liquidity ratios such as the current and quick ratios remain below 1.0, marking an unfavorable liquidity position. Leverage ratios like debt-to-assets (23.62%) are favorable, while debt-to-equity is neutral. Market valuation metrics, including a high price-to-earnings ratio (60.2) and price-to-book (25.54), are seen as unfavorable. Overall, the ratio assessment is neutral, balancing favorable profitability and leverage against weaker liquidity and valuation metrics.

Shareholder Return Policy

Autodesk, Inc. does not pay dividends, reflecting a reinvestment strategy likely prioritizing growth and innovation over immediate shareholder payouts. The absence of dividends aligns with its consistent positive net income and strong free cash flow, supporting operational and capital expenditures.

The company engages in share buybacks, which can offer shareholder value through capital return while maintaining flexibility. This approach appears consistent with sustainable long-term value creation, balancing reinvestment with selective capital distribution.

Score analysis

The following radar chart summarizes key financial scores for Autodesk, Inc., highlighting its valuation and profitability metrics:

Autodesk shows a strong return on equity (5) and a favorable return on assets (4), indicating efficient use of capital and assets. However, the company scores low on debt-to-equity (1), price-to-earnings (1), and price-to-book (1), reflecting unfavorable leverage and valuation metrics. The discounted cash flow score is moderate at 3.

Analysis of the company’s bankruptcy risk

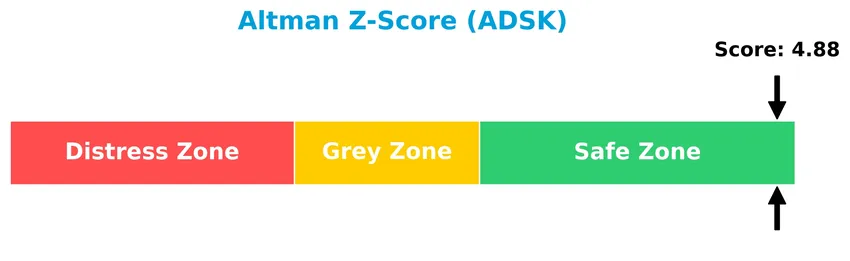

Autodesk’s Altman Z-Score places it firmly in the safe zone, indicating a low probability of bankruptcy and strong financial stability:

Is the company in good financial health?

The Piotroski Score diagram below illustrates the company’s strong financial health based on profitability, leverage, liquidity, and efficiency criteria:

With a Piotroski Score of 8, Autodesk demonstrates very strong financial health, suggesting robust fundamentals and a solid financial position.

Competitive Landscape & Sector Positioning

This sector analysis will examine Autodesk, Inc.’s strategic positioning, revenue by segment, key products, main competitors, and competitive advantages. I will assess whether Autodesk holds a competitive advantage over its industry peers based on these factors.

Strategic Positioning

Autodesk, Inc. maintains a diversified product portfolio spanning architecture, engineering, construction, manufacturing, and media software, with revenues of $7.4B in 2025. Geographically, it operates globally, generating $2.7B in the Americas, $2.3B in EMEA, and $1.1B in Asia Pacific, reflecting broad market exposure.

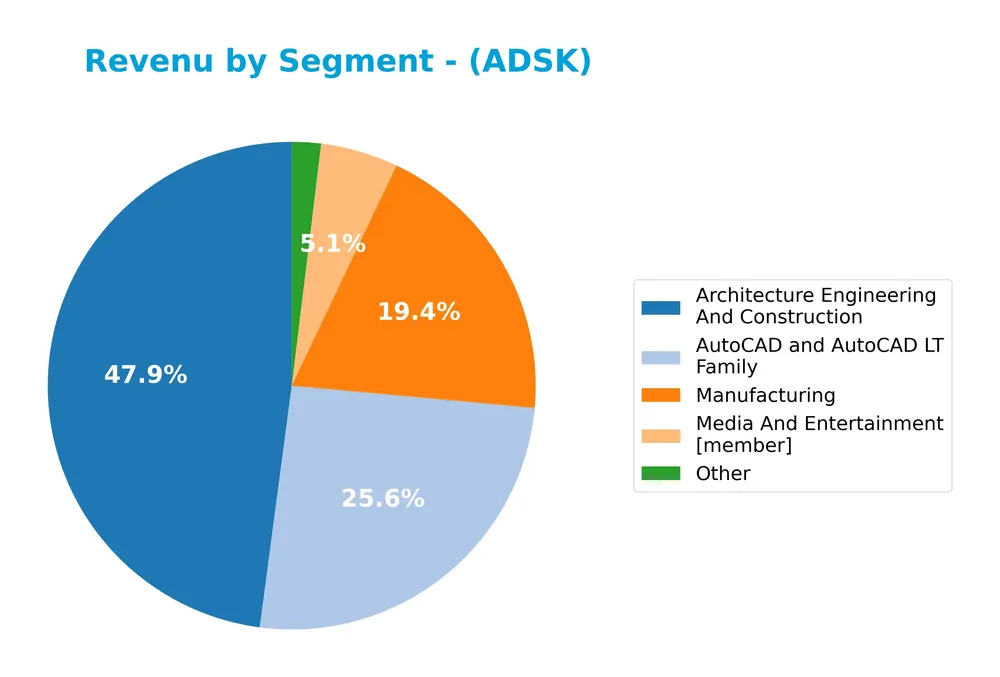

Revenue by Segment

This pie chart illustrates Autodesk, Inc.’s revenue breakdown by product segment for the fiscal year 2025, highlighting the distribution across its main business areas.

In 2025, Architecture Engineering and Construction remains the dominant segment, generating 2.94B USD, followed by the AutoCAD family at 1.57B USD and Manufacturing at 1.19B USD. Media and Entertainment, while smaller at 315M USD, shows steady contribution. The overall trend points to consistent growth across major segments, with Architecture Engineering and Construction showing notable acceleration, reflecting its critical role in Autodesk’s portfolio and potential concentration risk.

Key Products & Brands

The table below summarizes Autodesk, Inc.’s key products and brands with their respective descriptions:

| Product | Description |

|---|---|

| AutoCAD and AutoCAD LT Family | Software for professional design, drafting, detailing, and visualization, including AutoCAD Civil 3D. |

| BIM 360 | Construction management cloud-based software. |

| Fusion 360 | 3D CAD, CAM, and computer-aided engineering tool. |

| Inventor | Tools for 3D mechanical design, simulation, analysis, tooling, visualization, and documentation. |

| Vault | Data management software to centralize data, accelerate design processes, and streamline collaboration. |

| Maya and 3ds Max | 3D modeling, animation, effects, rendering, and compositing solutions. |

| ShotGrid | Cloud-based software for review and production tracking in media and entertainment. |

| Industry Collections | Tools for architecture, engineering and construction, product design and manufacturing, media industries. |

| Computer-Aided Manufacturing (CAM) | Software for CNC machining, inspection, and manufacturing modeling. |

Autodesk’s portfolio spans software solutions focused on 3D design, engineering, construction management, manufacturing, and media production, serving diverse professional industries worldwide.

Main Competitors

There are 33 competitors in the Technology – Software Application sector; below are the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Salesforce, Inc. | 242.5B |

| Shopify Inc. | 209.6B |

| AppLovin Corporation | 209.0B |

| Intuit Inc. | 175.2B |

| Uber Technologies, Inc. | 172.2B |

| ServiceNow, Inc. | 153.0B |

| Cadence Design Systems, Inc. | 84.5B |

| Snowflake Inc. | 73.4B |

| Autodesk, Inc. | 61.2B |

| Workday, Inc. | 54.9B |

Autodesk ranks 9th among its 33 competitors, holding about 24% of the market cap of the sector leader, Salesforce. It is positioned below the average market cap of the top 10 competitors (143.6B) but above the sector median of 18.8B. The company maintains a 27.7% market cap gap with its nearest competitor above, Snowflake.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does ADSK have a competitive advantage?

Autodesk, Inc. presents a very favorable competitive advantage, demonstrated by a ROIC exceeding its WACC by 7.56% and a positive ROIC growth trend of 15.41%, indicating efficient capital use and value creation. The company maintains high profitability with a gross margin above 90% and an EBIT margin of 22.33%, supporting its strong market position in the software application industry.

Looking ahead, Autodesk’s outlook is supported by its diverse portfolio of 3D design, engineering, and cloud-based construction management software, targeting architecture, manufacturing, and entertainment sectors. Continued expansion in global markets, including Americas, EMEA, and Asia Pacific, alongside innovation in CAD, CAM, and data management tools, offers significant growth opportunities.

SWOT Analysis

This SWOT analysis highlights Autodesk, Inc.’s key strategic factors to support informed investment decisions.

Strengths

- Strong market position in 3D design and engineering software

- High gross margin of 90.57%

- Durable competitive advantage with growing ROIC

Weaknesses

- High valuation multiples (PE 60.2, PB 25.54)

- Low liquidity ratios (current and quick ratio 0.68)

- No dividend yield to attract income investors

Opportunities

- Expanding cloud-based construction management solutions

- Growth in emerging markets like Asia Pacific

- Increasing demand for integrated CAD/CAM tools

Threats

- Intense competition from other software providers

- Rapid technological change requiring continuous innovation

- Macroeconomic uncertainty impacting capital spending in construction and manufacturing

Autodesk’s robust profitability and competitive moat position it well for continued growth, but its elevated valuation and liquidity constraints warrant caution. Investors should balance the growth potential from cloud expansion and global market penetration against competitive and economic risks.

Stock Price Action Analysis

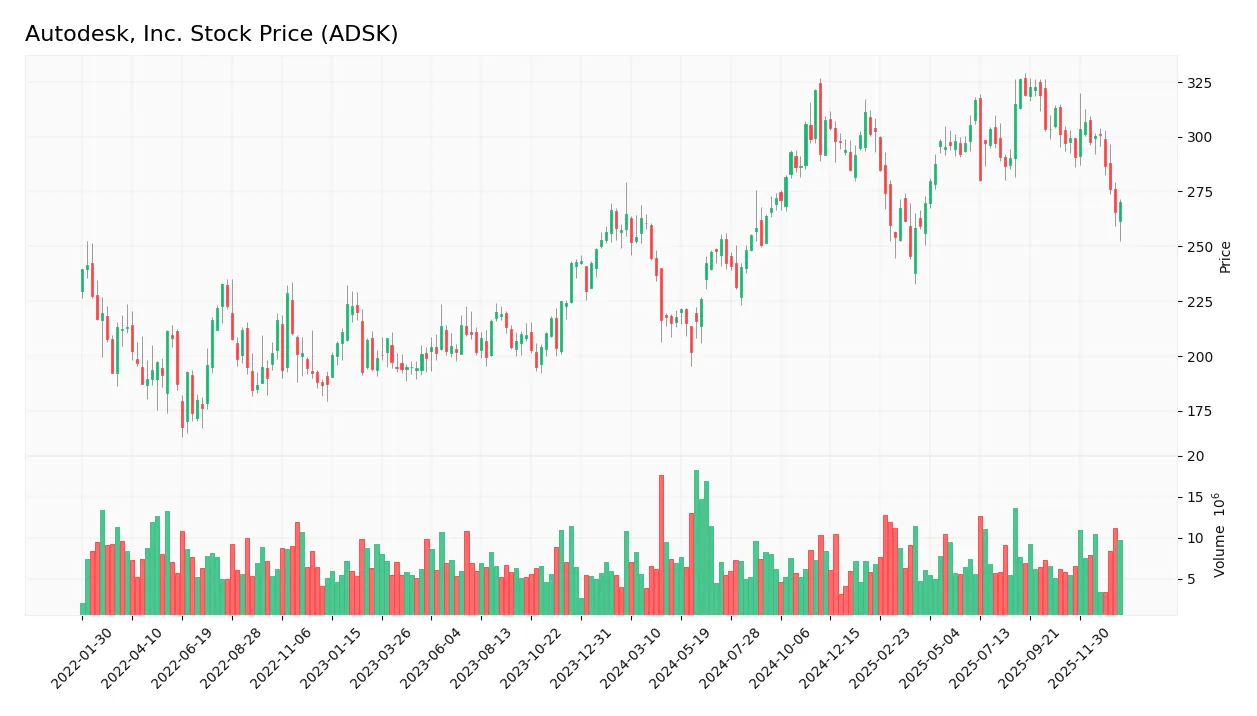

The following weekly stock chart illustrates Autodesk, Inc.’s price movements over the past 12 months with key highs and lows highlighted:

Trend Analysis

Over the past 12 months, Autodesk’s stock price increased by 1.99%, indicating a neutral trend just below the 2% bullish threshold. The trend shows deceleration despite a high volatility level with a standard deviation of 29.81. The price ranged between a low of 201.6 and a high of 326.37.

Volume Analysis

In the last three months, trading volume has been increasing, with buyers accounting for 52.35% of activity, reflecting a neutral buyer behavior. This suggests steady market participation without strong directional conviction between buyers and sellers.

Target Prices

The current target price consensus for Autodesk, Inc. (ADSK) reflects a positive outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 400 | 343 | 373 |

Analysts expect Autodesk’s stock to trade between 343 and 400, with a consensus target price of 373, indicating moderate growth potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews recent analyst ratings and consumer feedback to provide insight into Autodesk, Inc.’s market perception.

Stock Grades

Here are the latest verified stock grades from reputable financial institutions for Autodesk, Inc. (ADSK):

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| BMO Capital | Maintain | Market Perform | 2025-11-26 |

| Barclays | Maintain | Overweight | 2025-11-26 |

| B of A Securities | Maintain | Neutral | 2025-11-26 |

| Wells Fargo | Maintain | Overweight | 2025-11-26 |

| Deutsche Bank | Upgrade | Buy | 2025-11-26 |

| Baird | Maintain | Outperform | 2025-11-26 |

| Rosenblatt | Maintain | Buy | 2025-11-26 |

| Macquarie | Maintain | Outperform | 2025-11-26 |

The consensus reflects a predominantly positive outlook, with most firms maintaining or upgrading their ratings to buy or outperform. Only a few maintain neutral or market perform grades, indicating moderate confidence in Autodesk’s prospects.

Consumer Opinions

Autodesk, Inc. continues to evoke a mix of enthusiasm and constructive criticism among its user base, reflecting its complex role in design and engineering software.

| Positive Reviews | Negative Reviews |

|---|---|

| “Powerful and versatile tools that boost creativity and productivity.” | “Steep learning curve for beginners, making onboarding tough.” |

| “Regular updates improve functionality and add valuable features.” | “Subscription pricing is expensive for small businesses.” |

| “Excellent customer support and extensive online resources.” | “Occasional software bugs disrupt workflow during critical projects.” |

Overall, consumers appreciate Autodesk’s innovative and comprehensive software solutions but often cite pricing and usability challenges as areas needing improvement.

Risk Analysis

Below is a summary table outlining the key risks associated with Autodesk, Inc., considering their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Valuation Risk | High P/E (60.2) and P/B (25.54) ratios indicate potential overvaluation. | High | High |

| Liquidity Risk | Current and quick ratios at 0.68 suggest limited short-term liquidity. | Medium | Medium |

| Debt Risk | Debt-to-equity ratio near 1.0 is neutral, but debt-to-assets at 23.62% is favorable. | Low | Medium |

| Market Volatility | Beta of 1.466 implies stock price is more volatile than the market average. | High | Medium |

| Dividend Risk | No dividend payout limits income generation for income-focused investors. | Medium | Low |

| Competitive Risk | Rapid tech changes and competition in software sector may impact growth. | Medium | High |

Autodesk’s most significant risks lie in its high valuation metrics and market volatility, which may expose investors to price corrections. Despite strong profitability and a safe Altman Z-Score of 4.88, the low liquidity ratios and absence of dividends require cautious position sizing and risk management.

Should You Buy Autodesk, Inc.?

Autodesk, Inc. appears to be delivering robust profitability with a durable competitive moat supported by growing ROIC, suggesting strong value creation and operational efficiency. Despite a challenging leverage profile, the overall rating could be seen as very favorable, reflecting a cautiously positive investment profile.

Strength & Efficiency Pillars

Autodesk, Inc. exhibits robust profitability with a net margin of 18.14% and an impressive return on equity (ROE) of 42.43%. The company’s return on invested capital (ROIC) stands at 18.01%, significantly above its weighted average cost of capital (WACC) of 10.45%, confirming that Autodesk is a clear value creator. Financial stability is underscored by an Altman Z-score of 4.88, placing it well within the safe zone, and a strong Piotroski score of 8, signaling excellent financial health. These factors collectively reflect a durable competitive advantage and efficient capital use.

Weaknesses and Drawbacks

Despite solid fundamentals, Autodesk faces notable valuation and liquidity concerns. The price-to-earnings ratio is elevated at 60.2, while the price-to-book ratio is an outsized 25.54, both indicating a premium valuation that may limit near-term upside and raise valuation risk. Additionally, liquidity ratios such as the current and quick ratios are below 1.0 (0.68), signaling potential short-term liquidity constraints. These weaknesses, combined with a neutral debt-to-equity ratio near 1.0 and no dividend yield, introduce caution for investors, especially in volatile market conditions.

Our Verdict about Autodesk, Inc.

Autodesk’s long-term fundamental profile appears favorable, driven by strong profitability and value creation metrics. While the overall stock trend remains bullish, recent price weakness with a -9.15% decline and a slight deceleration in momentum suggest a wait-and-see approach might be prudent to identify a more opportune entry point. The premium valuation and liquidity challenges further support cautious exposure, although the company’s solid financial health could make it attractive for investors with a longer-term horizon.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- As Autodesk Slashes Jobs, Should You Buy, Sell, or Hold ADSK Stock? – Yahoo Finance (Jan 23, 2026)

- Autodesk announces global restructuring with 7% workforce reduction – Investing.com (Jan 22, 2026)

- Autodesk (ADSK) Seen Outgrowing Its End Markets, Rothschild Rates Buy – Yahoo Finance (Jan 20, 2026)

- Wealth Enhancement Advisory Services LLC Purchases 4,331 Shares of Autodesk, Inc. $ADSK – MarketBeat (Jan 23, 2026)

- Is There Now An Opportunity In Autodesk, Inc. (NASDAQ:ADSK)? – Yahoo Finance New Zealand (Jan 22, 2026)

For more information about Autodesk, Inc., please visit the official website: autodesk.com