Home > Analyses > Technology > AudioCodes Ltd.

AudioCodes Ltd. transforms how businesses communicate by delivering cutting-edge software and hardware solutions that power digital workplaces worldwide. As a recognized leader in communication equipment, AudioCodes excels with flagship offerings like VoIP network routing, session border controllers, and innovative voice applications integrated with Microsoft Teams. Renowned for its blend of quality and innovation, the company shapes unified communications and contact center technologies. Yet, as the market evolves, it’s crucial to assess whether AudioCodes’ fundamentals still support its valuation and future growth prospects.

Table of contents

Business Model & Company Overview

AudioCodes Ltd., founded in 1992 and headquartered in Lod, Israel, is a leading player in the communication equipment industry. The company delivers an integrated ecosystem of advanced communications software, hardware, and productivity solutions designed for the digital workplace. Its portfolio spans unified communications, contact centers, and VoiceAI, uniting session border controllers, VoIP routing, IP phones, and value-added applications into a cohesive offering that addresses modern enterprise needs.

The company’s revenue engine is powered by a balanced mix of hardware products, software solutions, and recurring managed services, including its Cloud-based Microsoft Teams offerings. AudioCodes serves a global footprint across the Americas, Europe, and Asia through direct and partner sales channels. Its strong foothold in multiple markets and diverse product suite create a durable economic moat, positioning it as a pivotal force shaping the future of voice networking and unified communications.

Financial Performance & Fundamental Metrics

I will analyze AudioCodes Ltd.’s income statement, key financial ratios, and dividend payout policy to provide a clear view of its fundamental strength.

Income Statement

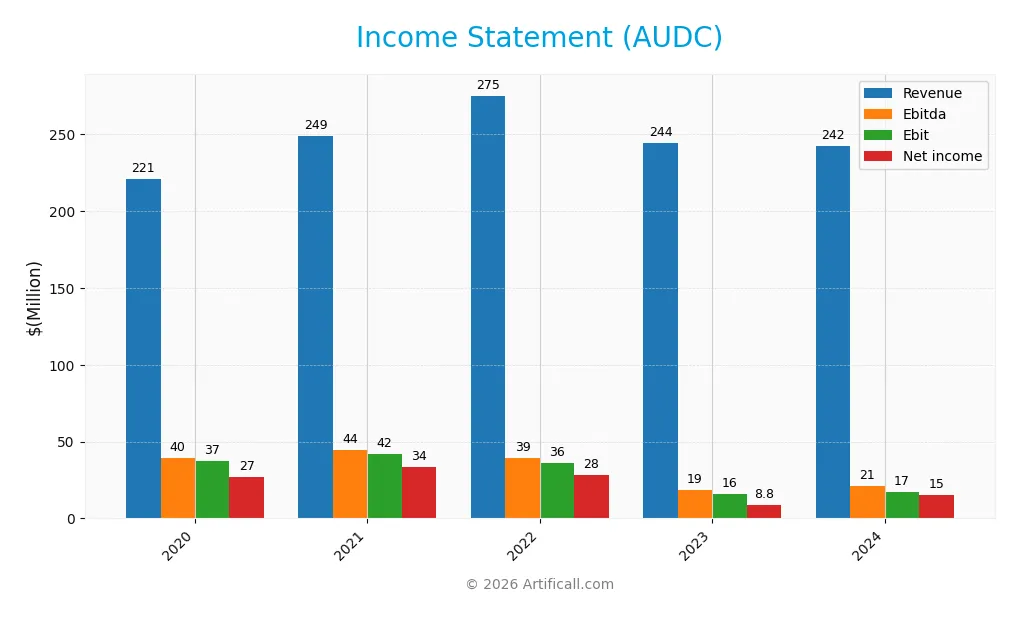

The table below summarizes AudioCodes Ltd.’s key income statement figures over the past five fiscal years, showing trends in revenue, profitability, and earnings per share.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 221M | 249M | 275M | 244M | 242M |

| Cost of Revenue | 71M | 78M | 96M | 86M | 84M |

| Operating Expenses | 111M | 131M | 147M | 144M | 141M |

| Gross Profit | 150M | 171M | 179M | 158M | 158M |

| EBITDA | 40M | 44M | 39M | 19M | 21M |

| EBIT | 37M | 42M | 36M | 16M | 17M |

| Interest Expense | 1M | 2.3M | 0.36M | 3.2M | 0.3M |

| Net Income | 27M | 34M | 28M | 8.8M | 15M |

| EPS | 0.87 | 1.03 | 0.89 | 0.28 | 0.51 |

| Filing Date | 2021-04-27 | 2022-04-28 | 2023-04-24 | 2024-03-27 | 2025-03-26 |

Income Statement Evolution

AudioCodes Ltd. showed a modest revenue decline of 0.9% from 2023 to 2024, despite a 9.7% overall growth since 2020. Gross profit slightly decreased by 0.12% in the last year, but the gross margin remained favorable at 65.31%. EBIT margin was stable at 7.1%, reflecting neutral operating efficiency, while net margin improved significantly to 6.32%, indicating better bottom-line profitability.

Is the Income Statement Favorable?

In 2024, AudioCodes reported net income of $15.3M, up 76% year-over-year, with EPS growing 79%, signaling strong earnings momentum. Operating expenses decreased proportionally with revenue, supporting margin expansion. Interest expense remained low at 0.12% of revenue, a favorable factor. Overall, 57% of income statement metrics were favorable, 36% unfavorable, and 7% neutral, leading to a generally favorable fundamental profile for the fiscal year.

Financial Ratios

The following table summarizes key financial ratios for AudioCodes Ltd. (AUDC) over the fiscal years 2020 to 2024, offering insight into profitability, liquidity, leverage, and market valuation:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 12.3% | 13.6% | 10.3% | 3.6% | 6.3% |

| ROE | 13.0% | 16.4% | 15.0% | 4.7% | 8.0% |

| ROIC | 10.4% | 12.9% | 11.0% | 3.4% | 6.5% |

| P/E | 31.8 | 33.7 | 20.0 | 42.3 | 19.2 |

| P/B | 4.13 | 5.53 | 3.00 | 1.97 | 1.53 |

| Current Ratio | 2.15 | 1.75 | 1.59 | 1.69 | 2.09 |

| Quick Ratio | 1.84 | 1.50 | 1.20 | 1.17 | 1.69 |

| D/E | 0.14 | 0.10 | 0.07 | 0.21 | 0.19 |

| Debt-to-Assets | 8.3% | 5.6% | 4.2% | 11.6% | 10.9% |

| Interest Coverage | 38.4 | 17.5 | 87.5 | 4.5 | 58.1 |

| Asset Turnover | 0.62 | 0.71 | 0.85 | 0.72 | 0.72 |

| Fixed Asset Turnover | 7.35 | 11.9 | 15.7 | 5.13 | 4.05 |

| Dividend Yield | 0.97% | 0.96% | 2.03% | 3.07% | 3.70% |

Evolution of Financial Ratios

From 2020 to 2024, AudioCodes Ltd. saw a general decline in Return on Equity (ROE), dropping from 13%+ in 2020 to 7.98% in 2024, signaling reduced profitability. The Current Ratio improved from around 1.75 to 2.09, indicating stronger liquidity. The Debt-to-Equity Ratio remained low and stable near 0.19, reflecting cautious leverage use. Profit margins showed a downward trend, with net margin falling to 6.32% in 2024.

Are the Financial Ratios Favorable?

In 2024, the company’s liquidity ratios are favorable, with a Current Ratio of 2.09 and Quick Ratio of 1.69, supporting solid short-term financial health. Leverage is conservative, with Debt-to-Equity at 0.19 and Debt-to-Assets at 10.85%. Profitability ratios, including ROE at 7.98% and net margin at 6.32%, are neutral to unfavorable, suggesting modest returns. Market valuation ratios such as P/E at 19.21 and P/B at 1.53 are neutral, while efficiency and coverage ratios mostly indicate favorable performance. Overall, half of the evaluated ratios are favorable, with a slight bias toward positivity.

Shareholder Return Policy

AudioCodes Ltd. maintains a consistent dividend policy with a payout ratio around 70% in 2024 and a dividend yield of 3.7%, supported by free cash flow coverage near 31%. The company also engages in share buybacks, balancing distributions with investments.

While dividends and buybacks provide returns, the relatively high payout ratio compared to free cash flow coverage suggests potential risk if cash generation weakens. This policy appears aimed at sustainable long-term shareholder value, though monitoring payout sustainability remains important.

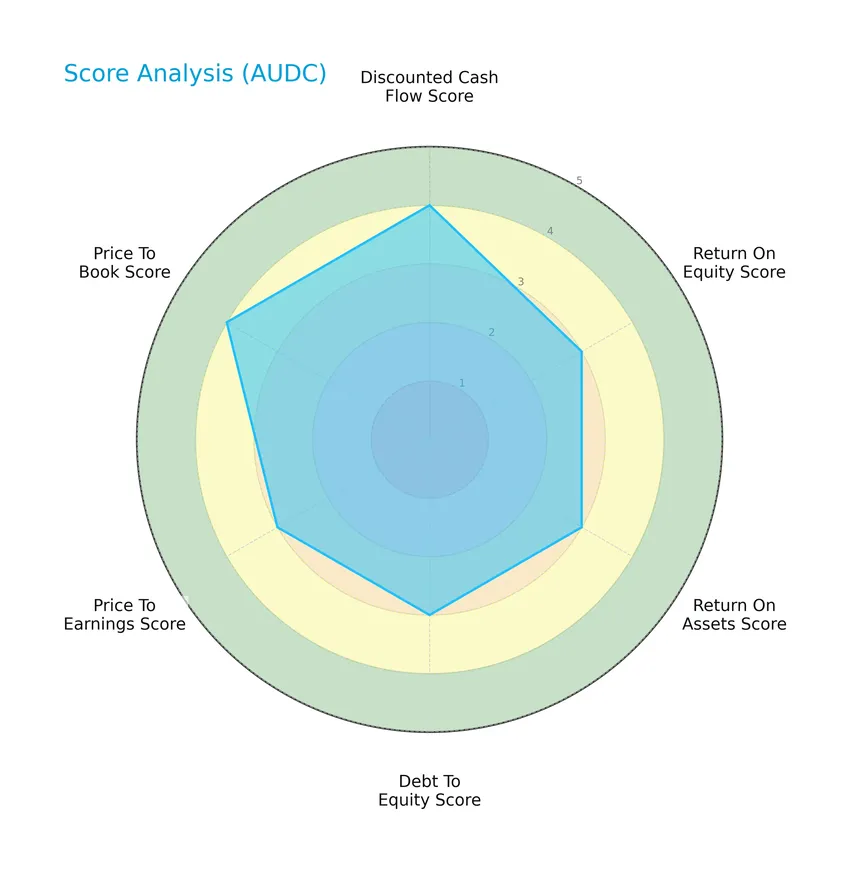

Score analysis

The following radar chart displays key financial scores for a comprehensive overview of the company’s valuation and performance metrics:

AudioCodes Ltd. shows favorable discounted cash flow and price-to-book scores at 4 each, while return on equity, return on assets, debt to equity, and price to earnings scores stand at a moderate level of 3, indicating balanced financial metrics.

Analysis of the company’s bankruptcy risk

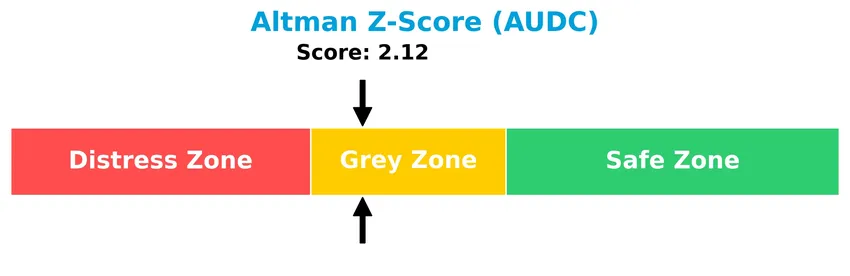

The Altman Z-Score places AudioCodes Ltd. in the grey zone, indicating a moderate risk of bankruptcy and suggesting caution in financial stability assessment:

Is the company in good financial health?

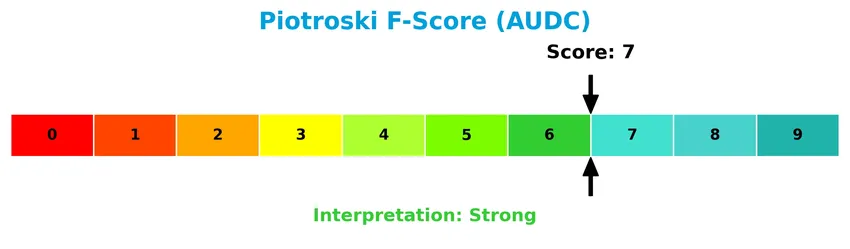

The Piotroski Score diagram provides insight into the company’s financial strength and operational efficiency:

With a Piotroski Score of 7, AudioCodes Ltd. demonstrates strong financial health, reflecting solid profitability, liquidity, and leverage metrics, which supports a positive view of its overall financial condition.

Competitive Landscape & Sector Positioning

This sector analysis will explore AudioCodes Ltd.’s strategic positioning, revenue by segment, key products, main competitors, competitive advantages, and SWOT analysis. I will assess whether AudioCodes holds a competitive advantage over its peers in the communication equipment industry.

Strategic Positioning

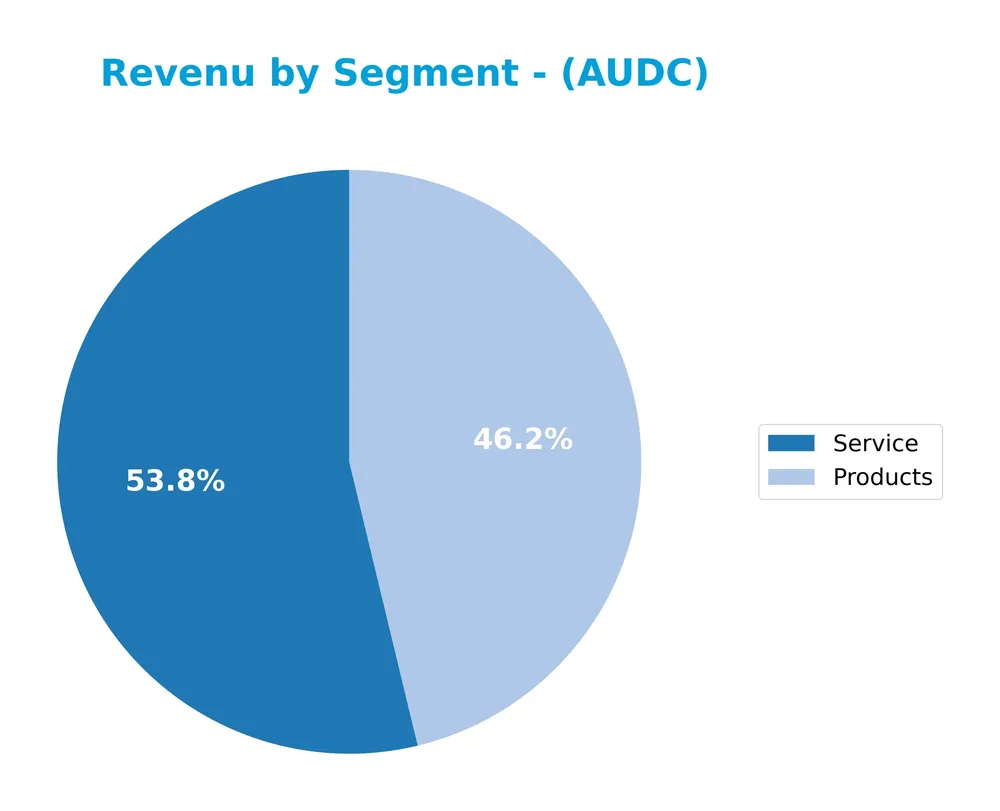

AudioCodes Ltd. operates with a diversified product portfolio encompassing advanced communications software, hardware, and managed services, split roughly evenly between products and services in 2024. Geographically, it maintains broad exposure across the Americas (125M), Europe (77M), Eastern Asia (33M), and Israel (7.6M), reflecting a balanced global footprint in communication equipment.

Revenue by Segment

The pie chart illustrates AudioCodes Ltd.’s revenue distribution by segment for the fiscal year 2024, detailing contributions from Products and Service categories.

In 2024, AudioCodes’ revenue is primarily driven by Service at $130M and Products at $112M, showing a shift from previous years where product revenue was higher. The Service segment’s growth indicates a strategic emphasis on recurring or support revenues, while Products saw a modest decline. This diversification reduces concentration risk, although the overall revenue balance suggests potential volatility if one segment underperforms.

Key Products & Brands

The table below outlines AudioCodes Ltd.’s main products and brand offerings in communications technology:

| Product | Description |

|---|---|

| Session Border Controllers | Devices that secure and control VoIP network borders for unified communications and service providers. |

| Lifecycle Management Solutions | Tools for managing the deployment, maintenance, and support of communication devices and services. |

| VoIP Network Routing Solutions | Technologies enabling efficient call routing and connectivity across IP networks. |

| Media Gateways and Servers | Hardware and software that facilitate voice and multimedia communication across different network types. |

| Multi-Service Business Routers | Network routers designed to support multiple services within business communication environments. |

| IP Phones Solutions | Telephone hardware and software designed for voice over IP communications. |

| Value-Added Applications | Includes SmartTAP, Voca, VoiceAI Connect, and Meeting Insights, enhancing voice and meeting productivity. |

| One Voice Operations Center | Voice network management solution for operational monitoring and control of voice services. |

| Device Manager | Administration tool for managing business phones and meeting room communication systems. |

| AudioCodes Routing Manager | Software for handling call routing in VoIP networks. |

| User Management Pack 365 | Simplifies user lifecycle and identity management across Microsoft Teams and Skype for Business. |

| AudioCodes Live for Microsoft Teams | Managed service portfolio facilitating Teams adoption and integration. |

| Survivable Branch Appliances, CCE, CloudBond 365 | Appliances supporting Microsoft Skype/Teams for Business environments for resilience and connectivity. |

| Managed Services | Professional services including AudioCodes Live Cloud SaaS for Microsoft Teams migration and operational support. |

AudioCodes Ltd. offers a comprehensive suite of communications products and services, focusing on unified communications, VoIP infrastructure, and Microsoft Teams integration, serving diverse global markets.

Main Competitors

In the Communication Equipment industry, there are 7 competitors, with the table below listing the top 7 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Cisco Systems, Inc. | 300.4B |

| Motorola Solutions, Inc. | 63.5B |

| Nokia Oyj | 34.9B |

| Hewlett Packard Enterprise Company | 32.0B |

| Credo Technology Group Holding Ltd | 24.7B |

| Zebra Technologies Corporation | 12.6B |

| AudioCodes Ltd. | 255M |

AudioCodes Ltd. ranks 7th among its competitors, with a market cap just 0.08% of the leader, Cisco Systems. The company’s market cap is significantly below both the average of 66.9B for the top 10 and the sector median of 32.0B. It also maintains a wide gap of +5165.77% to the next competitor above, indicating a much smaller scale relative to its peers.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does AUDC have a competitive advantage?

AudioCodes Ltd. does not currently present a competitive advantage, as it is shedding value with a negative spread between ROIC and WACC and a declining ROIC trend, signaling decreasing profitability. Despite a favorable gross margin of 65.31% and improving net margin growth of 75.97% in the last year, the overall economic moat status is very unfavorable.

Looking ahead, AudioCodes continues to expand its product portfolio with advanced communication software, VoiceAI business lines, and managed services for Microsoft Teams adoption. Its geographic diversification across the Americas, Europe, and Asia offers opportunities for growth, although the company must address profitability challenges to leverage these prospects effectively.

SWOT Analysis

This SWOT analysis highlights AudioCodes Ltd.’s key strategic factors to aid investors in evaluating its potential.

Strengths

- Strong product portfolio in unified communications

- Favorable gross and net margins

- Solid liquidity ratios and low debt

Weaknesses

- Declining ROIC indicating value destruction

- Negative long-term net income and EPS growth

- Moderate profitability ratios (ROE and ROIC)

Opportunities

- Growth potential in Microsoft Teams managed services

- Expansion opportunities in Americas and Europe

- Increasing demand for digital workplace communication solutions

Threats

- Intense competition in communication equipment sector

- Market volatility affecting revenue growth

- Technological disruptions and rapid innovation cycles

Overall, AudioCodes shows solid operational strengths and opportunities in a growing niche but faces risks from declining profitability trends and competitive pressures. Strategic focus on innovation and market expansion is essential for sustainable value creation.

Stock Price Action Analysis

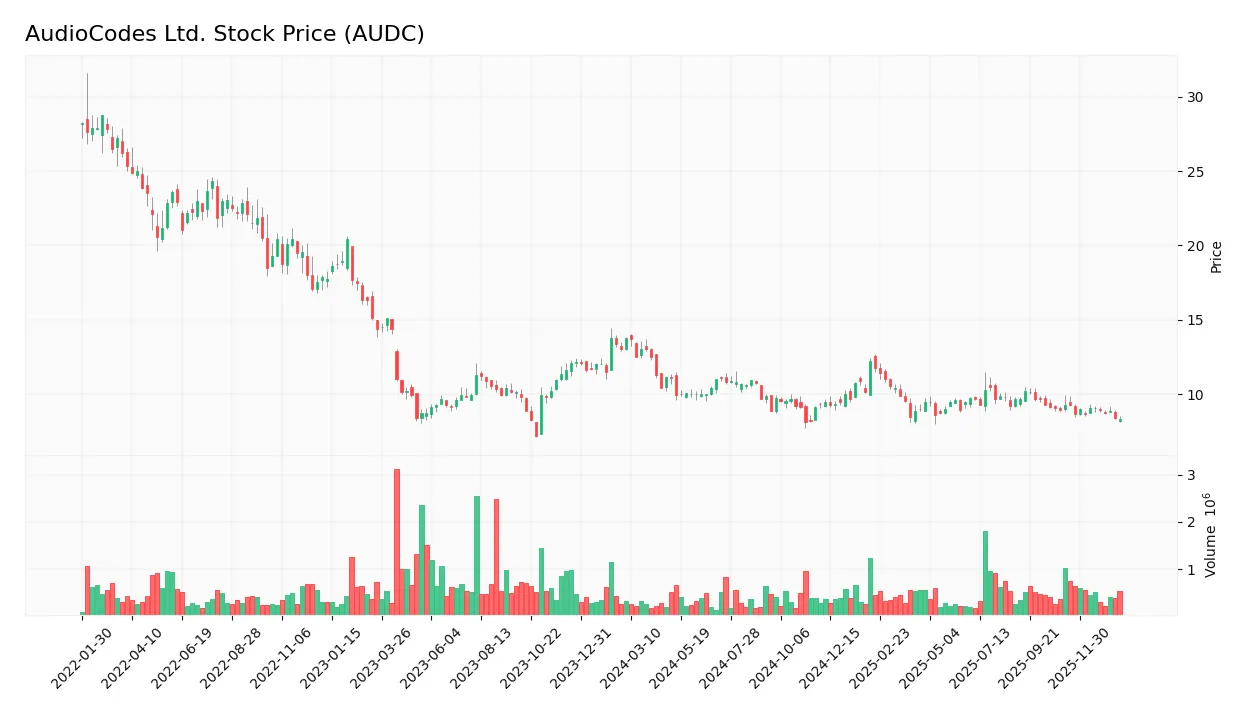

The weekly stock chart for AudioCodes Ltd. (AUDC) illustrates price movements and volume trends over the past 12 months:

Trend Analysis

Over the past year, AUDC’s stock price declined by 39.59%, indicating a bearish trend with deceleration. The price fluctuated between a high of 13.79 and a low of 8.12, with a standard deviation of 1.14. Recent months showed a continued decline of 10.24%, with reduced volatility (std deviation 0.3) and a gentle downward slope of -0.06.

Volume Analysis

Trading volume has been increasing, with a total of 55.18M shares exchanged recently. Buyer volume slightly exceeds seller volume at 53.16%, reflecting a slightly buyer-dominant market from November 2025 to January 2026. This suggests moderate investor interest with cautious optimism despite the ongoing price decline.

Target Prices

Analysts present a clear consensus on AudioCodes Ltd. target prices, reflecting moderate optimism.

| Target High | Target Low | Consensus |

|---|---|---|

| 24 | 14 | 19 |

The target prices suggest that analysts expect the stock to trade within a range of 14 to 24, with a consensus around 19, indicating balanced growth potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews the latest analyst ratings and consumer feedback regarding AudioCodes Ltd. (AUDC) performance and reputation.

Stock Grades

Here is a summary of recent verified stock grades from reputable analysts for AudioCodes Ltd.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Buy | 2025-05-07 |

| Needham | Maintain | Buy | 2025-02-05 |

| Barclays | Maintain | Underweight | 2025-02-05 |

| Needham | Maintain | Buy | 2025-01-21 |

| Barclays | Maintain | Underweight | 2024-11-07 |

| Needham | Maintain | Buy | 2024-11-07 |

| Needham | Maintain | Buy | 2024-07-31 |

| Needham | Maintain | Buy | 2024-05-09 |

| Barclays | Maintain | Underweight | 2024-05-08 |

| Barclays | Maintain | Underweight | 2024-02-07 |

The overall trend shows consistent buy ratings from Needham, while Barclays maintains an underweight stance, reflecting a divergence in analyst perspectives. The consensus across the market leans towards a buy rating with moderate mixed sentiment.

Consumer Opinions

AudioCodes Ltd. has garnered a mix of praise and criticism from its user base, reflecting both its technological strengths and areas needing improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| Reliable voice communication solutions with clear audio. | Customer support response times can be slow. |

| Innovative VoIP technology that integrates well with systems. | Some users report occasional software bugs during updates. |

| Strong security features ensuring data protection. | Pricing can be high for small businesses. |

Overall, consumers appreciate AudioCodes’ robust and innovative communication technology, though some express concerns about customer service efficiency and pricing for smaller clients.

Risk Analysis

Below is a summary table outlining the key risk factors relevant to AudioCodes Ltd. (AUDC) based on recent financial and market data:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Price fluctuations with a beta of 1.05 indicate moderate sensitivity to market swings. | Medium | Medium |

| Profitability Risk | Low net margin (6.3%) and unfavorable ROE (8.0%) suggest limited profitability growth. | Medium | High |

| Financial Distress | Altman Z-Score in the grey zone (2.12) signals moderate bankruptcy risk under stress. | Low | High |

| Competitive Pressure | Operating in a competitive tech sector with evolving communication solutions. | Medium | Medium |

| Liquidity Risk | Strong current (2.09) and quick ratios (1.69) reduce near-term liquidity concerns. | Low | Low |

| Debt Risk | Low debt-to-equity (0.19) and high interest coverage (58.1) mitigate solvency risks. | Low | Low |

| Dividend Yield Risk | Dividend yield of 3.7% could be at risk if earnings weaken or cash flow declines. | Medium | Medium |

The most significant risks for AudioCodes are tied to its moderate profitability and the Altman Z-Score placing it in a grey zone, indicating a cautious stance is prudent. Despite strong liquidity and low leverage, investors should monitor industry competition and earnings stability closely.

Should You Buy AudioCodes Ltd.?

AudioCodes Ltd. appears to be a company with moderate profitability and a deteriorating competitive moat, suggesting operational challenges and value erosion. Despite a manageable leverage profile and favorable overall rating of A-, its financial health could be seen as balanced but warrants cautious interpretation.

Strength & Efficiency Pillars

AudioCodes Ltd. presents a mixed yet cautiously optimistic efficiency profile. With a net margin of 6.32% and an interest coverage ratio of 58.08, the company maintains operational stability and manageable debt costs. Its Piotroski score of 7 indicates strong financial health, supported by a current ratio of 2.09 and a low debt-to-equity ratio of 0.19, which demonstrate solid liquidity and conservative leverage. However, the return on invested capital (6.51%) remains below the weighted average cost of capital (8.09%), signaling that AudioCodes is currently not a value creator.

Weaknesses and Drawbacks

The company faces challenges that warrant caution. Its price-to-earnings ratio of 19.21 and price-to-book ratio of 1.53 suggest a neutral valuation, neither deeply discounted nor richly valued, potentially limiting upside from multiple expansion. The bearish overall stock trend, marked by a -39.59% price decline and deceleration, underscores significant market pressure. While recent buyer dominance at 53.16% is a mild positive, the grey zone Altman Z-score of 2.12 flags moderate bankruptcy risk. Declining ROIC, down 37.5%, further highlights deteriorating profitability, reflecting value destruction.

Our Verdict about AudioCodes Ltd.

AudioCodes Ltd. exhibits a fundamentally mixed profile with some strengths in financial health and liquidity but clear signs of profitability challenges and market pressure. Despite its strong Piotroski score and favorable liquidity metrics, the company’s inability to generate returns above its cost of capital and ongoing stock weakness may appear concerning. Given the bearish technical trend yet slight recent buyer dominance, the profile might suggest a wait-and-see approach for a more attractive entry point rather than immediate exposure.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- AudioCodes Ltd. (NASDAQ:AUDC) Short Interest Update – MarketBeat (Jan 19, 2026)

- Institutional investors own a significant stake of 32% in AudioCodes Ltd. (NASDAQ:AUDC) – Yahoo Finance (Dec 27, 2025)

- AudioCodes Announces Fourth Quarter and Full Year 2025 Reporting Date – PR Newswire (Jan 06, 2026)

- AudioCodes (NASDAQ:AUDC) Is Posting Promising Earnings But The Good News Doesn’t Stop There – simplywall.st (Nov 11, 2025)

- Is AudioCodes Ltd.’s (NASDAQ:AUDC) Stock On A Downtrend As A Result Of Its Poor Financials? – Yahoo Finance (Nov 22, 2025)

For more information about AudioCodes Ltd., please visit the official website: audiocodes.com