AudioCodes Ltd. is revolutionizing how businesses communicate, seamlessly integrating advanced voice and video solutions into the digital workplace. As a prominent player in the Communication Equipment industry, AudioCodes offers an impressive array of products, including session border controllers and VoIP solutions, that enhance productivity and connectivity. With a reputation for innovation and quality, I now question whether the company’s solid fundamentals and market position can sustain its current valuation and growth trajectory in a competitive landscape.

Table of contents

Company Description

AudioCodes Ltd. is a leading provider of advanced communications software and products tailored for the digital workplace. Founded in 1992 and headquartered in Lod, Israel, the company specializes in unified communications, contact centers, and VoiceAI solutions. With a robust portfolio that includes session border controllers, VoIP network routing solutions, and managed services, AudioCodes operates primarily in the Americas, Europe, the Far East, and Israel. The company leverages a direct sales force and partnerships with original equipment manufacturers and systems integrators to deliver its offerings. As a key player in the communication equipment industry, AudioCodes is well-positioned to drive innovation and enhance connectivity in an increasingly digital world.

Fundamental Analysis

In this section, I will conduct a fundamental analysis of AudioCodes Ltd., focusing on the income statement, financial ratios, and dividend payout policy.

Income Statement

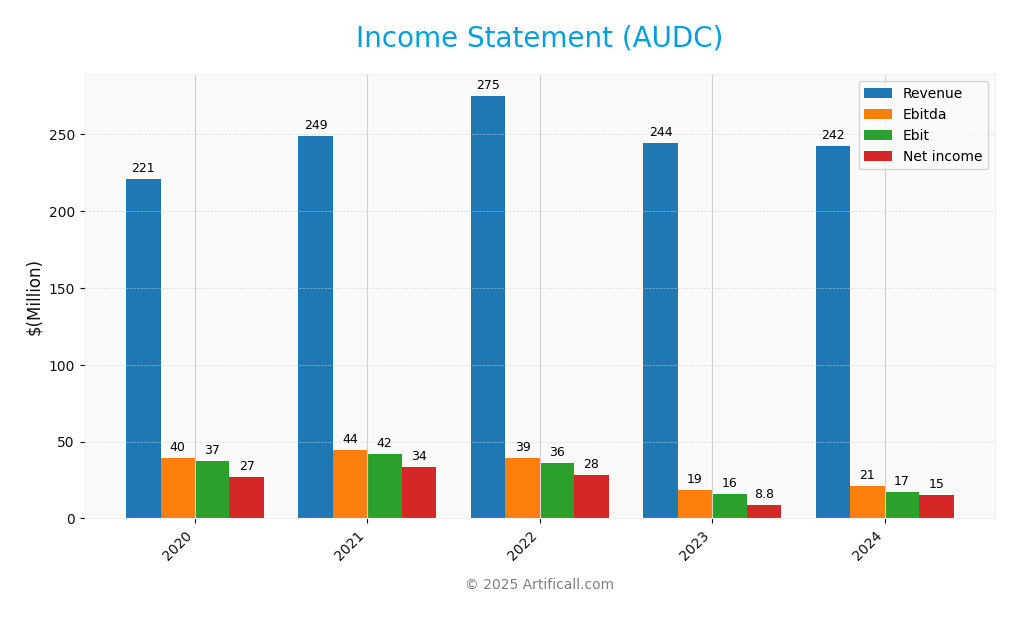

The following table presents the Income Statement for AudioCodes Ltd. (AUDC) over the last few fiscal years, highlighting key financial metrics essential for evaluating its performance.

| Metric | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 220.77M | 248.92M | 275.09M | 244.38M | 242.18M |

| Cost of Revenue | 70.96M | 78.03M | 96.32M | 86.03M | 84.02M |

| Operating Expenses | 111.47M | 131.37M | 147.46M | 143.93M | 140.97M |

| Gross Profit | 149.82M | 170.89M | 178.78M | 158.35M | 158.16M |

| EBITDA | 39.57M | 44.34M | 39.36M | 18.53M | 21.07M |

| EBIT | 37.30M | 41.91M | 36.38M | 15.94M | 17.19M |

| Interest Expense | 1.00M | 2.26M | 0.36M | 3.24M | 0.30M |

| Net Income | 27.25M | 33.75M | 28.47M | 8.78M | 15.31M |

| EPS | 0.87 | 1.03 | 0.89 | 0.28 | 0.51 |

| Filing Date | 2021-04-27 | 2022-04-28 | 2023-04-24 | 2024-03-27 | 2025-03-26 |

Interpretation of Income Statement

Over the past five years, AudioCodes Ltd. has experienced fluctuations in revenue, peaking in 2022 at 275.09M before declining to 242.18M in 2024. Net income followed a similar trend, witnessing a significant drop in 2023 to 8.78M, before rebounding to 15.31M in 2024. The gross profit margins have remained relatively stable, though the margins have compressed slightly in the most recent year, indicating increased cost pressures. Overall, while the company showed signs of recovery in net income in 2024, the decline in revenue suggests caution in future growth prospects.

Financial Ratios

The following table summarizes the financial ratios for AudioCodes Ltd. (AUDC) over the past five fiscal years.

| Metrics | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 12.34% | 13.56% | 10.35% | 3.59% | 6.32% |

| ROE | 12.98% | 16.42% | 15.00% | 4.67% | 7.98% |

| ROIC | 10.42% | 12.48% | 10.65% | 3.37% | 6.60% |

| P/E | 31.79 | 33.66 | 20.02 | 42.27 | 19.21 |

| P/B | 4.13 | 5.53 | 3.00 | 1.97 | 1.53 |

| Current Ratio | 2.15 | 1.75 | 1.59 | 1.69 | 2.09 |

| Quick Ratio | 1.84 | 1.50 | 1.20 | 1.17 | 1.69 |

| D/E | 0.14 | 0.10 | 0.07 | 0.21 | 0.19 |

| Debt-to-Assets | 8.33% | 5.59% | 4.24% | 11.64% | 10.85% |

| Interest Coverage | 38.35 | 17.49 | 87.48 | 4.45 | 58.08 |

| Asset Turnover | 0.62 | 0.71 | 0.85 | 0.72 | 0.72 |

| Fixed Asset Turnover | 7.35 | 11.94 | 15.74 | 5.13 | 4.05 |

| Dividend Yield | 0.97% | 0.96% | 2.03% | 3.07% | 3.70% |

Interpretation of Financial Ratios

AudioCodes Ltd. (AUDC) exhibits a strong liquidity position with a current ratio of 2.09 and a quick ratio of 1.69, indicating a solid ability to meet short-term obligations. However, its solvency ratio of 0.13 raises some concerns about long-term financial stability, as it suggests a higher reliance on debt. Profitability ratios show a net profit margin of 6.32%, which is moderate but could be improved, especially when compared to the gross profit margin of 65.31%. Efficiency metrics like asset turnover (0.72) and inventory turnover (2.67) indicate that there is room for improvement in asset utilization. Overall, while liquidity is strong, the solvency and profitability ratios warrant caution for potential investors.

Evolution of Financial Ratios

Over the past five years, AudioCodes’ financial ratios have shown a mixed performance. Liquidity ratios improved, evidenced by an increase in the current ratio from 1.59 in 2022 to 2.09 in 2024, while profitability ratios have declined, with net profit margin dropping from 10.35% in 2022 to 6.32% in 2024. This trend suggests a need for strategic adjustments to enhance profitability while maintaining liquidity.

Distribution Policy

AudioCodes Ltd. (AUDC) currently pays a dividend of $0.36 per share, translating to an annual yield of approximately 3.7%. The dividend payout ratio stands at 71.16%, indicating a sustainable approach, supported by a free cash flow coverage ratio of 1.00. However, I remain cautious about potential risks related to the payout, as excessive distributions could hinder reinvestment opportunities. Overall, the current distribution strategy appears to support long-term value creation for shareholders.

Sector Analysis

AudioCodes Ltd. operates in the Communication Equipment industry, offering a range of advanced solutions for unified communications and contact centers, competing with major players through its innovative products and services.

Strategic Positioning

AudioCodes Ltd. (AUDC) operates in the competitive communication equipment industry, focusing on advanced software and productivity solutions for unified communications and contact centers. With a market cap of $253M, the company holds a moderate market share in its key product lines, particularly in VoIP network solutions. Competitive pressure is significant from both established players and emerging tech firms, especially with the rise of VoiceAI technologies. Additionally, ongoing technological disruption necessitates constant innovation and agility to maintain its market position. As I analyze, it’s crucial for investors to weigh these factors when considering AUDC for their portfolios.

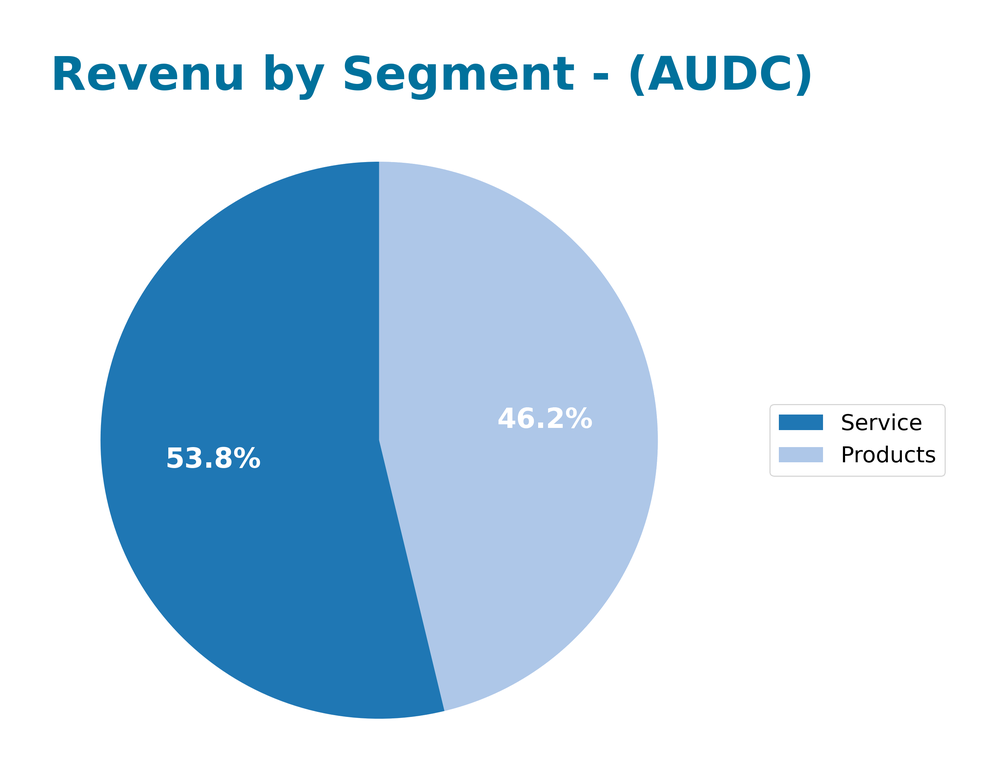

Revenue by Segment

The chart illustrates the revenue generated by AudioCodes Ltd. across different product segments for the fiscal year ending December 31, 2024.

In FY 2024, AudioCodes reported revenues of 112M from Products and 130M from Services. The Services segment continues to drive the majority of revenue, showing a solid performance compared to the previous year, where it generated 120M. However, the Products segment has seen a decline, dropping from 124M in FY 2023. This decline raises some concerns about potential concentration risks, particularly as the company relies more heavily on its Service revenues. Overall, while the revenue from Services demonstrates resilience, the slowdown in Product sales warrants close monitoring moving forward.

Key Products

AudioCodes Ltd. offers a diverse range of products designed to enhance communication and productivity in the digital workplace. Below is a table summarizing their key products:

| Product | Description |

|---|---|

| Session Border Controllers (SBCs) | Securely manage and control voice traffic across IP networks, ensuring quality and security. |

| Media Gateways | Facilitate the connection between traditional telephony and VoIP networks, enabling seamless communication. |

| VoIP Network Routing Solutions | Optimize the routing of voice calls over IP networks, enhancing efficiency and reducing costs. |

| One Voice Operations Center | A comprehensive voice network management solution for monitoring and maintaining voice services. |

| Device Manager | Tool for administering business phones and managing meeting room solutions effectively. |

| AudioCodes Live for Microsoft Teams | A managed service portfolio designed to simplify the adoption of Microsoft Teams in organizations. |

| SmartTAP | A value-added application that enhances call recording and compliance capabilities. |

| VoiceAI Connect | Integrates AI capabilities into voice communication for improved customer interactions. |

| Meeting Insights | Provides analytics and insights on meeting effectiveness and user engagement. |

| AudioCodes Live Cloud | A SaaS solution enabling service providers to facilitate seamless migration to Microsoft Teams. |

These products reflect AudioCodes’ commitment to delivering advanced communication solutions tailored to the needs of modern enterprises.

Main Competitors

The competitive landscape for AudioCodes Ltd. (AUDC) includes various companies operating within the communication equipment sector. Below is a summary of the main competitors, sorted by market capitalization:

| Company | Market Cap |

|---|---|

| SmartRent, Inc. | 372M |

| Frequency Electronics, Inc. | 305M |

| 8×8, Inc. | 281M |

| Aviat Networks, Inc. | 267M |

| BK Technologies Corporation | 246M |

| AudioCodes Ltd. | 253M |

| A2Z Cust2Mate Solutions Corp. | 213M |

| Vuzix Corporation | 210M |

| Inseego Corp. | 180M |

| Ceragon Networks Ltd. | 177M |

The main competitors of AudioCodes operate primarily in the North American and global markets, providing various communication solutions and services. Each of these companies plays a significant role in the evolving technology landscape, offering products that cater to both enterprise and service provider needs.

Competitive Advantages

AudioCodes Ltd. (AUDC) holds a strong position in the communication equipment industry with its comprehensive product portfolio and advanced software solutions tailored for unified communications and contact centers. The company’s focus on VoiceAI and managed services positions it well for future growth, especially as businesses increasingly adopt digital communication tools. Additionally, as remote work continues to be a norm, opportunities in expanding markets and developing new products will likely enhance its competitive edge. The integration of solutions for Microsoft Teams also opens new avenues for customer acquisition and retention.

SWOT Analysis

This SWOT analysis aims to evaluate the key factors influencing AudioCodes Ltd.’s strategic position.

Strengths

- Strong market presence in unified communications

- Diverse product portfolio

- Experienced management team

Weaknesses

- Dependence on specific markets

- Limited brand recognition compared to larger competitors

- High operational costs

Opportunities

- Growth in VoIP and communication solutions market

- Partnerships with cloud service providers

- Expansion into emerging markets

Threats

- Intense competition

- Rapid technological changes

- Economic downturns impacting customer budgets

The overall SWOT assessment indicates that while AudioCodes has a solid foundation and potential for growth, it must navigate significant market challenges and competition. The company should leverage its strengths while addressing weaknesses to capitalize on emerging opportunities effectively.

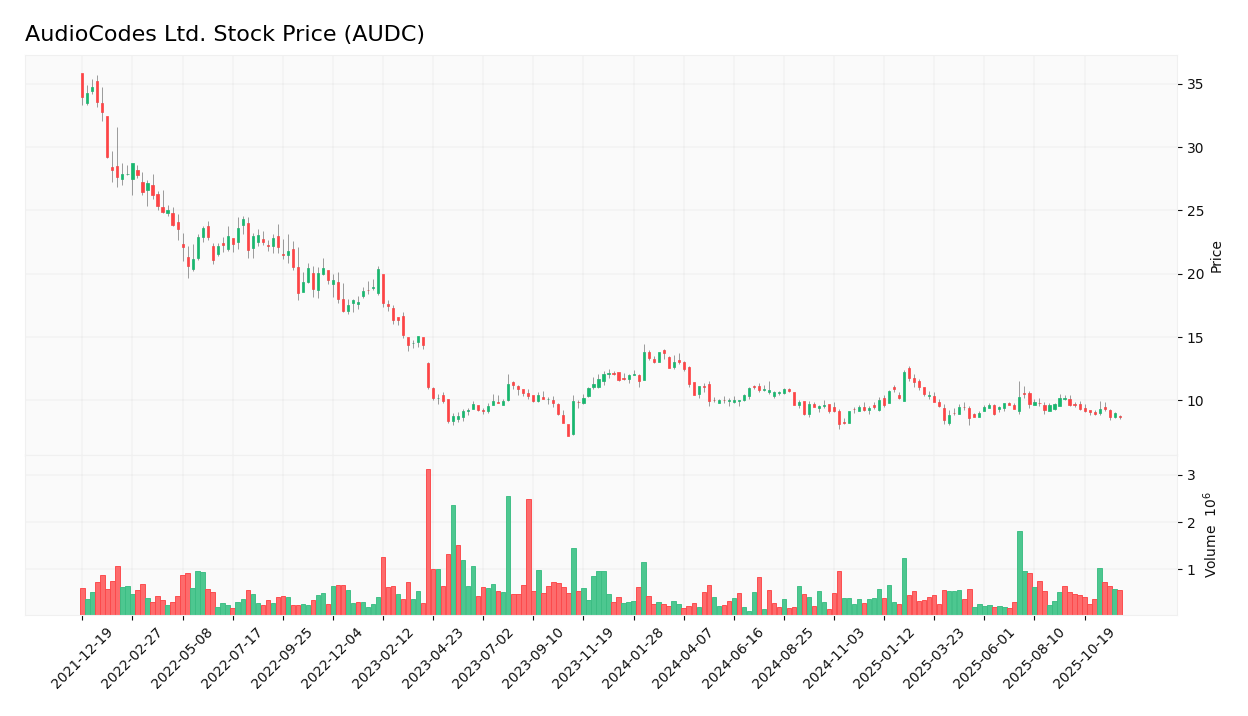

Stock Analysis

Over the past year, AudioCodes Ltd. (AUDC) has experienced significant price movements, characterized by a notable decline in its stock price, reflecting underlying trading dynamics in a challenging market environment.

Trend Analysis

Analyzing the stock’s performance over the past year, we observe a price change of -25.62%. This indicates a bearish trend, as the percentage change is well below the -2% threshold. The stock has shown deceleration in its downtrend, with notable highs at $13.79 and lows at $8.12. Additionally, with a standard deviation of 1.28, the stock has exhibited moderate volatility during this period.

Volume Analysis

Examining trading volumes over the last three months reveals a total trading volume of approximately 58.9M shares, with buyer-driven activity accounting for about 47.46%. However, the recent period has seen a decrease in overall volume, as recent buyer volume stands at 1.61M compared to seller volume of 4.30M, indicating a seller-dominant market sentiment. This decreasing volume trend suggests a cautious investor participation, possibly reflecting uncertainty about the stock’s future performance.

Analyst Opinions

Recent recommendations for AudioCodes Ltd. (AUDC) indicate a strong consensus towards a “buy” rating. Analysts have highlighted the company’s robust fundamentals, particularly its discounted cash flow score of 5, suggesting significant intrinsic value. Key analysts have emphasized the favorable return on assets and equity, scoring 4 and 3 respectively, as indicators of efficient management. With an overall score of 4, the sentiment remains positive for AUDC in 2025. Given these insights, I believe this stock presents a compelling opportunity for investors looking to expand their portfolios.

Stock Grades

AudioCodes Ltd. (AUDC) has received consistent evaluations from reputable grading companies. Here are the latest grades:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Buy | 2025-05-07 |

| Needham | Maintain | Buy | 2025-02-05 |

| Barclays | Maintain | Underweight | 2025-02-05 |

| Needham | Maintain | Buy | 2025-01-21 |

| Barclays | Maintain | Underweight | 2024-11-07 |

| Needham | Maintain | Buy | 2024-11-07 |

| Needham | Maintain | Buy | 2024-07-31 |

| Needham | Maintain | Buy | 2024-05-09 |

| Barclays | Maintain | Underweight | 2024-05-08 |

| Barclays | Maintain | Underweight | 2024-02-07 |

Overall, the trend indicates a strong preference from Needham for a “Buy” rating, while Barclays maintains a more cautious “Underweight” stance. This divergence suggests a mixed sentiment towards AudioCodes Ltd., with potential opportunities for investors who align with the bullish outlook.

Target Prices

The consensus target price for AudioCodes Ltd. (AUDC) reflects a balanced outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 24 | 14 | 19 |

Overall, analysts expect the stock to reach a consensus of 19, indicating a moderate growth opportunity within the projected range.

Consumer Opinions

Consumer sentiment regarding AudioCodes Ltd. (AUDC) reflects a mix of appreciation for its innovative solutions and concerns about service support.

| Positive Reviews | Negative Reviews |

|---|---|

| “AudioCodes offers exceptional voice quality.” | “Customer support response times are slow.” |

| “Their products are user-friendly and reliable.” | “Pricing can be higher than competitors.” |

| “Great integration capabilities with existing systems.” | “Some features require extensive training.” |

Overall, consumer feedback highlights AudioCodes’ strong product reliability and integration, while concerns about customer support and pricing remain prevalent.

Risk Analysis

In evaluating the investment potential of AudioCodes Ltd. (AUDC), it’s essential to consider various risks that could impact performance. Below is a summary of key risks.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in demand for VoIP solutions. | High | High |

| Competitive Risk | Intense competition from larger tech firms. | High | Medium |

| Regulatory Risk | Changes in telecom regulations impacting operations. | Medium | High |

| Currency Risk | Exposure to currency fluctuations affecting earnings. | Medium | Medium |

| Operational Risk | Supply chain disruptions affecting product delivery. | Low | High |

Market and competitive risks are particularly significant for AUDC, given the rapid evolution of technology and shifting consumer preferences. Recent trends indicate a growing reliance on VoIP solutions, but competition remains fierce.

Should You Buy AudioCodes Ltd.?

AudioCodes Ltd. (AUDC) has demonstrated a positive profitability trend, with a net profit margin of 6.32% and an EBITDA margin of 13.27% in 2025. The company appears to create value as its return on invested capital (ROIC) of 6.60% exceeds the weighted average cost of capital (WACC) of 7.97%, although its revenue has shown a slight decline of 2.8%. AudioCodes maintains a modest debt profile, with a total debt of 36.46M against total equity of 265.97M, suggesting a debt-to-equity ratio of 0.137. The overall rating of A indicates strong fundamentals, though investors might want to monitor the evolving financial landscape.

Favorable signals

From the data provided, several favorable elements can be identified. The company showcases a positive gross margin of 65.31%, indicating efficient cost management in relation to revenue. Additionally, the operating expenses compared to revenue growth are favorable, and the interest expense percentage stands at a low 0.12%. The net margin is also positive at 6.32%, with a remarkable net margin growth of 75.97%. Furthermore, the company has a favorable current ratio of 2.09, a quick ratio of 1.69, and a low debt-to-equity ratio of 0.19.

Unfavorable signals

However, there are some unfavorable aspects to consider. The revenue growth is negative at -0.9%, which might indicate challenges in generating additional income. The gross profit growth is also unfavorable at -0.12%, and the return on equity is unsatisfactory at 7.98%. Furthermore, the overall stock trend is bearish, with a price change of -25.62%, reflecting a significant decline in value.

Conclusion

Considering the favorable income statement evaluation and the overall favorable ratios, it may appear favorable for long-term investors. However, given the negative long-term trend, it could be prudent to wait for a bullish reversal before making any investment decisions.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Is AudioCodes Ltd.’s (NASDAQ:AUDC) Stock On A Downtrend As A Result Of Its Poor Financials? – Yahoo Finance (Nov 22, 2025)

- AudioCodes Reports Third Quarter 2025 Results – PR Newswire (Nov 04, 2025)

- AudioCodes (NASDAQ:AUDC) Is Posting Promising Earnings But The Good News Doesn’t Stop There – Sahm (Nov 11, 2025)

- Nov. 4 results release — AudioCodes to report Third-Quarter 2025 results; webcast conference call at 8:30 AM ET – Stock Titan (Oct 13, 2025)

- AudioCodes Ltd. (NASDAQ:AUDC) Q3 2025 Earnings Call Transcript – Insider Monkey (Nov 05, 2025)

For more information about AudioCodes Ltd., please visit the official website: audiocodes.com