Home > Analyses > Technology > Astera Labs, Inc. Common Stock

Astera Labs transforms cloud and AI infrastructure with its cutting-edge semiconductor connectivity solutions. Its Intelligent Connectivity Platform drives data, network, and memory performance for hyperscale environments. Known for innovation and seamless scalability, Astera Labs has quickly earned a reputation as a rising force in the semiconductor sector. As the market evolves, I ask: does Astera’s current valuation reflect its growth potential and fundamental strengths?

Table of contents

Business Model & Company Overview

Astera Labs, Inc. Common Stock, founded in 2017 and headquartered in Santa Clara, CA, operates as a dynamic force in the semiconductors industry. The company develops a cohesive ecosystem of semiconductor-based connectivity solutions tailored for cloud and AI infrastructure. Its Intelligent Connectivity Platform integrates data, network, and memory products under a software-defined architecture, enabling scalable high-performance deployment for tech leaders.

Astera Labs’ revenue engine balances hardware innovation with software-driven value, addressing the growing global demand across the Americas, Europe, and Asia. It leverages its portfolio to enhance cloud infrastructure efficiency, positioning itself as a key enabler in the AI era. The company’s competitive advantage lies in its unifying platform, which forms a robust economic moat amid intensifying industry complexity.

Financial Performance & Fundamental Metrics

I will analyze Astera Labs, Inc. Common Stock’s income statement, key financial ratios, and dividend payout policy to assess its overall financial health and shareholder value.

Income Statement

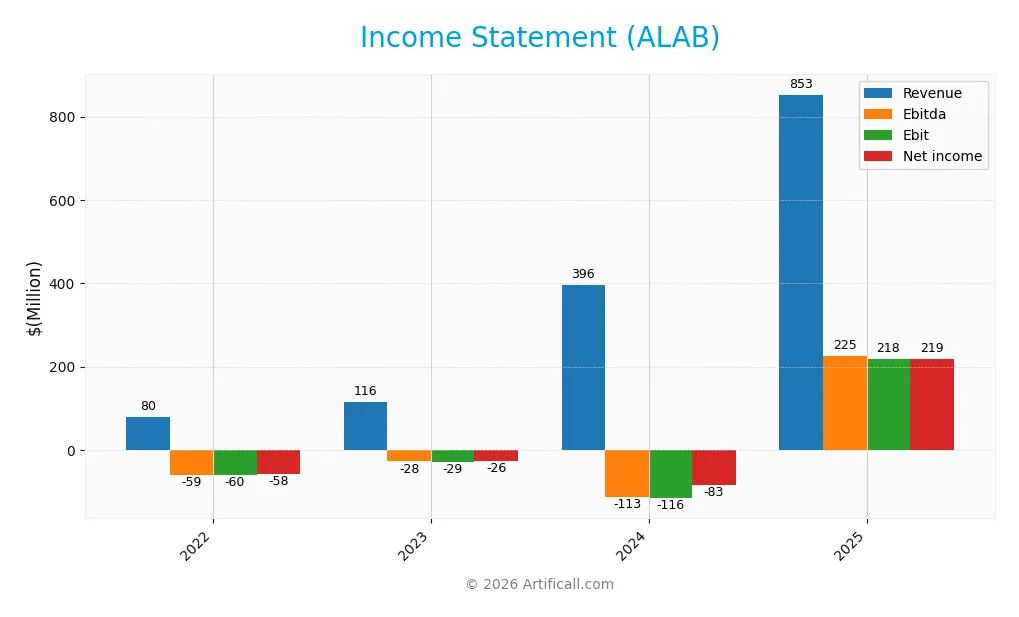

The table below summarizes Astera Labs, Inc.’s income statement figures over the past four fiscal years, highlighting revenue growth and profitability trends.

| 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|

| Revenue | 79.9M | 115.8M | 396.3M | 852.5M |

| Cost of Revenue | 21.2M | 36.0M | 93.6M | 207.3M |

| Operating Expenses | 118.9M | 109.3M | 418.8M | 471.8M |

| Gross Profit | 58.7M | 79.8M | 302.7M | 645.3M |

| EBITDA | -59.4M | -27.7M | -112.9M | 225.0M |

| EBIT | -60.2M | -29.5M | -116.1M | 218.2M |

| Interest Expense | 0 | 0 | 0 | 0 |

| Net Income | -58.3M | -26.3M | -83.4M | 219.1M |

| EPS | -0.45 | -0.17 | -0.64 | 1.32 |

| Filing Date | 2022-12-31 | 2023-12-31 | 2025-02-14 | 2026-02-10 |

Income Statement Evolution

Astera Labs recorded a robust revenue surge from $80M in 2022 to $853M in 2025, reflecting a 967% overall growth. Net income turned positive in 2025 at $219M, up from losses in prior years. Gross and net margins improved significantly, reaching favorable levels above 75% and 25%, respectively, signaling enhanced profitability and cost control.

Is the Income Statement Favorable?

The 2025 income statement shows strong fundamentals, with a gross margin of 75.7% and a net margin of 25.7%, both favorable by industry standards. Operating income rebounded sharply to $173M, supported by controlled operating expenses. Absence of interest expense and positive net interest income enhance financial stability. Overall, the income statement reflects a clear turnaround and solid profitability.

Financial Ratios

The table below presents key financial ratios for Astera Labs, Inc. over the last four fiscal years, illustrating profitability, valuation, liquidity, leverage, efficiency, and dividend metrics:

| Ratios | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|

| Net Margin | -73.0% | -22.7% | -21.1% | 25.7% |

| ROE | 68.4% | -16.7% | -8.6% | 16.1% |

| ROIC | -34.7% | -18.1% | -12.0% | 12.4% |

| P/E | -138.7 | -360.3 | -208.4 | 126.3 |

| P/B | -94.9 | 60.1 | 18.0 | 20.3 |

| Current Ratio | 5.1 | 5.3 | 11.7 | 10.2 |

| Quick Ratio | 4.4 | 4.6 | 11.2 | 9.8 |

| D/E | 0.01 | 0.02 | 0.0013 | 0 |

| Debt-to-Assets | 0.75% | 1.5% | 0.12% | 0 |

| Interest Coverage | 0 | 0 | 0 | 0 |

| Asset Turnover | 0.38 | 0.59 | 0.38 | 0.56 |

| Fixed Asset Turnover | 22.7 | 15.3 | 11.1 | 9.3 |

| Dividend Yield | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

From 2022 to 2025, Astera Labs’ Return on Equity (ROE) improved significantly, shifting from negative to a favorable 16.07% in 2025. The Current Ratio showed a fluctuating but generally high level, ending at 10.24 in 2025, indicating strong liquidity. Debt-to-Equity remained stable at zero, reflecting minimal leverage and consistent financial structure.

Are the Financial Ratios Favorable?

In 2025, profitability ratios such as net margin (25.7%) and ROE (16.07%) are favorable, supported by a strong return on invested capital (12.4%). Liquidity appears mixed; the Current Ratio is high but flagged unfavorable, while the Quick Ratio (9.79) is favorable. Leverage ratios show zero debt, favorable for financial risk. However, market multiples like P/E (126.33) and P/B (20.3) are elevated and considered unfavorable, suggesting valuation concerns despite solid operating metrics. Overall, 57% of ratios are favorable, indicating a generally healthy financial profile.

Shareholder Return Policy

Astera Labs, Inc. does not pay dividends, reflecting its negative to low net income in recent years and a focus on reinvestment. The company has no share buyback programs, indicating a strategy prioritizing growth and capital allocation toward operations and development.

This approach aligns with long-term value creation in high-growth sectors where retaining earnings supports innovation. However, the absence of cash returns to shareholders may concern those seeking immediate income, underscoring the importance of monitoring future profitability and cash flow trends.

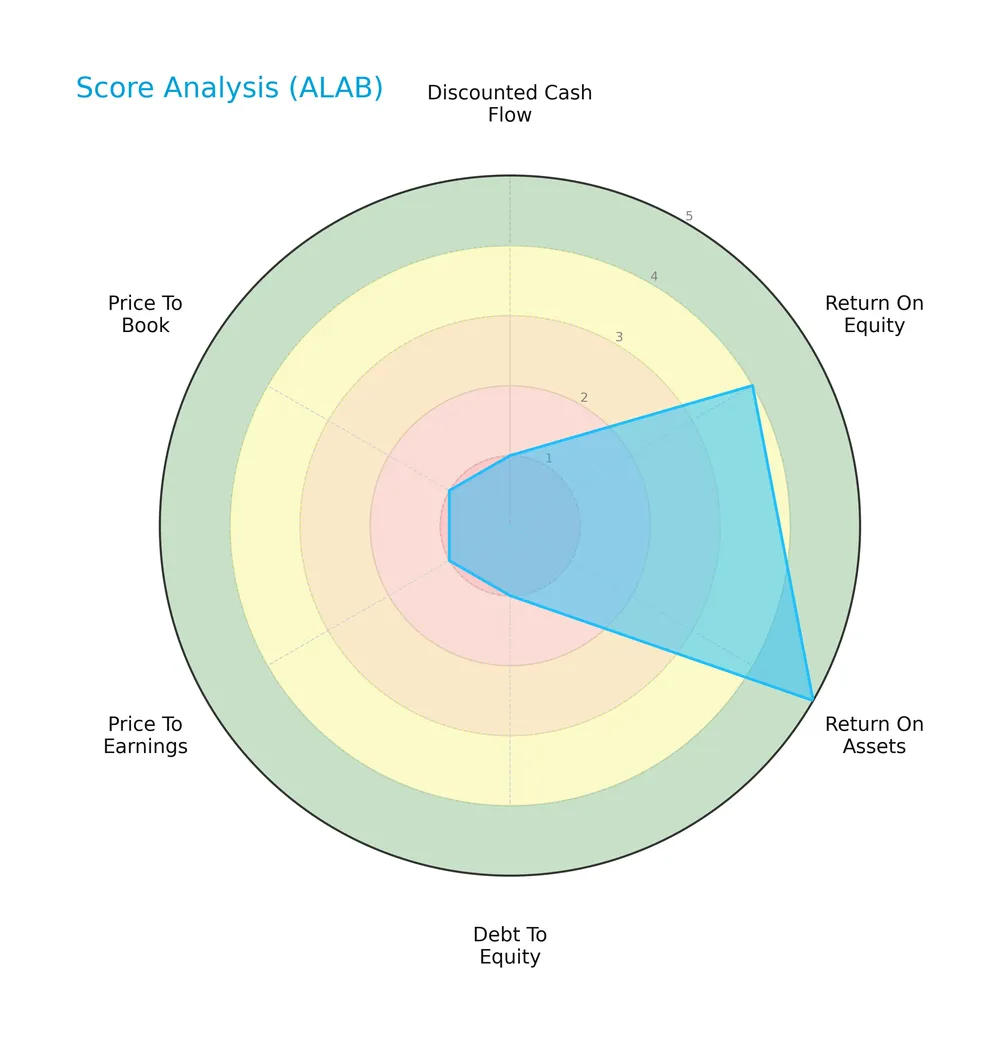

Score analysis

The radar chart below illustrates Astera Labs’ scores across key financial metrics for investor evaluation:

Astera Labs shows strong returns with a favorable ROE score of 4 and a very favorable ROA score of 5. However, its valuation and leverage metrics are weak, with very unfavorable scores of 1 in discounted cash flow, debt-to-equity, price-to-earnings, and price-to-book ratios.

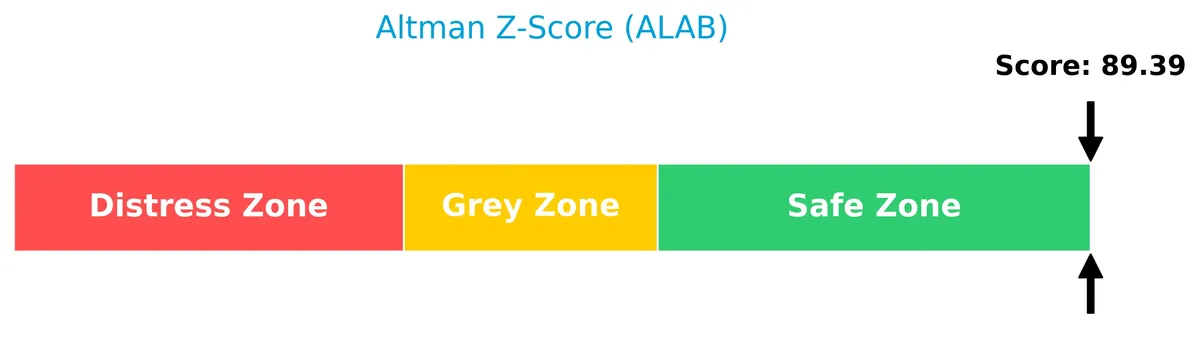

Analysis of the company’s bankruptcy risk

The Altman Z-Score indicates that Astera Labs is solidly in the safe zone, signaling low bankruptcy risk:

Is the company in good financial health?

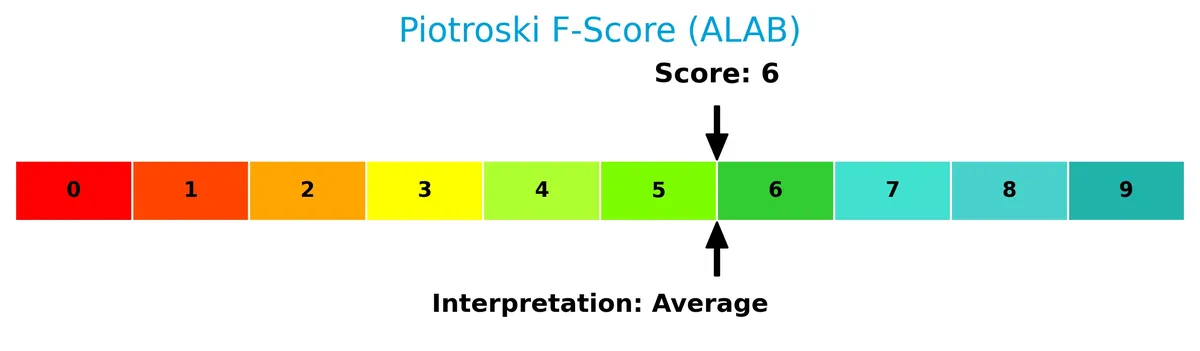

The Piotroski diagram below presents an overview of the company’s financial strength based on nine fundamental criteria:

With a Piotroski Score of 6, Astera Labs demonstrates average financial health. This suggests moderate operational efficiency and profitability, though it leaves room for improvement to reach strong financial stability.

Competitive Landscape & Sector Positioning

This analysis will explore Astera Labs’ strategic positioning, revenue segments, key products, and main competitors within the semiconductor industry. I will assess whether Astera Labs holds a competitive advantage over its peers through a detailed review of its strengths and weaknesses.

Strategic Positioning

Astera Labs concentrates its product portfolio on semiconductor-based connectivity solutions, primarily data and network products. Geographically, it focuses on key Asian markets, especially Taiwan and China, while maintaining limited U.S. exposure, reflecting a targeted approach in cloud and AI infrastructure sectors.

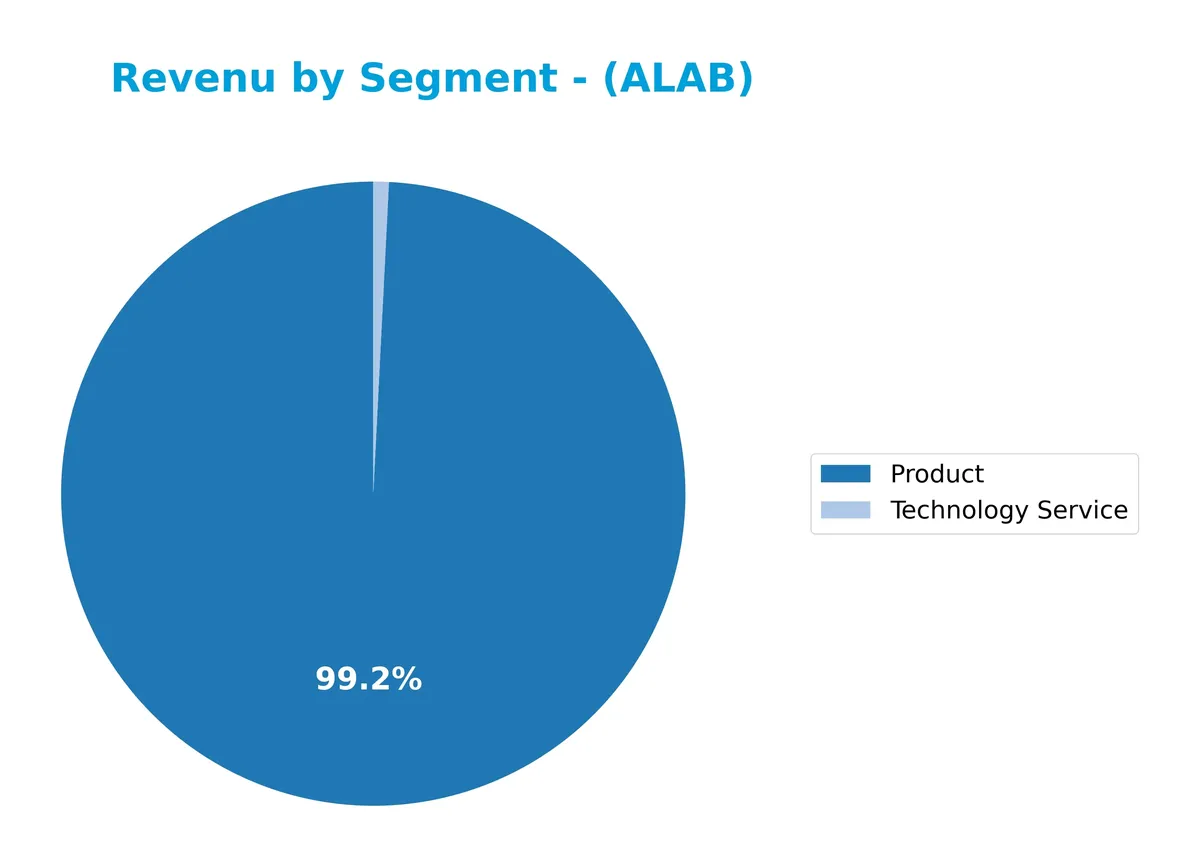

Revenue by Segment

This pie chart illustrates Astera Labs, Inc.’s revenue distribution by segment for fiscal year 2024, highlighting the contributions of core product sales and technology services.

Product sales dominate Astera Labs’ revenue, accounting for $393M, while Technology Services contribute a modest $3.2M. This concentration underscores the company’s heavy reliance on product innovation and sales. The minimal revenue from services indicates limited diversification, posing a potential concentration risk if product demand fluctuates. In 2024, product revenue remains robust, reflecting steady execution in their primary business line.

Key Products & Brands

Astera Labs offers semiconductor connectivity solutions and technology services for cloud and AI infrastructure:

| Product | Description |

|---|---|

| Intelligent Connectivity Platform | A portfolio of data, network, and memory connectivity products built on a software-defined architecture enabling scalable, high-performance cloud and AI infrastructure deployment. |

| Technology Service | Support and services related to the deployment and operation of connectivity solutions for cloud and AI systems. |

Astera Labs focuses primarily on its Intelligent Connectivity Platform, generating most revenue through semiconductor products that enhance cloud and AI infrastructure performance. Technology services complement its core hardware offerings.

Main Competitors

The sector includes 38 competitors, with the table listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| NVIDIA Corporation | 4.6T |

| Broadcom Inc. | 1.6T |

| Taiwan Semiconductor Manufacturing Company Limited | 1.6T |

| ASML Holding N.V. | 415B |

| Advanced Micro Devices, Inc. | 363B |

| Micron Technology, Inc. | 353B |

| Lam Research Corporation | 232B |

| Applied Materials, Inc. | 214B |

| QUALCOMM Incorporated | 185B |

| Intel Corporation | 173B |

Astera Labs ranks 20th among 38 competitors, with a market cap just 0.53% of NVIDIA’s. It sits below both the average top-10 market cap of 975B and the sector median of 31B. The company leads its closest rival by 37.36%, indicating a moderate gap to its next competitor above.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does ALAB have a competitive advantage?

Astera Labs does not yet demonstrate a clear competitive advantage. Its ROIC remains below the WACC, indicating value erosion despite strong revenue and profit growth.

Looking ahead, ALAB targets cloud and AI infrastructure markets with an Intelligent Connectivity Platform. Expanding product offerings and scaling in these growth areas may improve its competitive positioning.

SWOT Analysis

This SWOT analysis highlights Astera Labs’ core strategic factors to guide investment decisions.

Strengths

- High gross margin at 75.7%

- Strong 25.7% net margin

- Rapid revenue growth of 115% YoY

Weaknesses

- Very high P/E of 126x

- Elevated P/B of 20.3

- Extremely high current ratio at 10.24 indicating capital inefficiency

Opportunities

- Expanding cloud and AI infrastructure demand

- Growth in semiconductor connectivity needs

- Increasing adoption of software-defined architectures

Threats

- Intense semiconductor industry competition

- High valuation risk and volatility

- Geopolitical risks in key markets like China and Taiwan

Astera Labs boasts strong profitability and rapid growth but trades at lofty multiples. The company must leverage its technical strengths to capture AI-driven market expansion while managing valuation and geopolitical risks prudently.

Stock Price Action Analysis

The weekly stock chart of Astera Labs, Inc. reveals significant price movements and volatility patterns over the past 12 months:

Trend Analysis

Over the past 12 months, ALAB’s stock price increased by 105.3%, establishing a bullish trend despite decelerating momentum. The price ranged from a low of 40.0 to a high of 245.2. Volatility remains elevated with a standard deviation of 50.44, indicating persistent price fluctuations.

Volume Analysis

Trading volume increased notably, with total volume surpassing 2.15B shares over the last year. Buyer activity dominates at 54.95% in the recent three months, reflecting slightly buyer-driven sentiment. This rising volume suggests growing market participation and sustained investor interest in ALAB shares.

Target Prices

Analysts set a strong target consensus for Astera Labs, Inc. Common Stock, reflecting bullish expectations.

| Target Low | Target High | Consensus |

|---|---|---|

| 165 | 225 | 202.14 |

The target price range suggests confidence in upside potential, with the consensus price indicating solid growth prospects ahead.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines analyst grades and consumer feedback concerning Astera Labs, Inc. Common Stock (ALAB).

Stock Grades

Here are the recent verified analyst grades for Astera Labs, Inc. Common Stock (ALAB) from reputable financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-02-11 |

| Northland Capital Markets | Maintain | Outperform | 2025-12-09 |

| Northland Capital Markets | Upgrade | Outperform | 2025-11-17 |

| Needham | Maintain | Buy | 2025-11-05 |

| TD Cowen | Maintain | Hold | 2025-11-05 |

| Morgan Stanley | Maintain | Overweight | 2025-11-05 |

| Stifel | Maintain | Buy | 2025-11-05 |

| JP Morgan | Maintain | Overweight | 2025-11-05 |

| Roth Capital | Maintain | Buy | 2025-11-05 |

| Barclays | Downgrade | Equal Weight | 2025-10-20 |

The consensus leans decisively toward a Buy rating, supported by multiple upgrades and maintained positive outlooks. Barclays’ recent downgrade is an outlier amid generally bullish institutional sentiment.

Consumer Opinions

Astera Labs, Inc. Common Stock (ALAB) earns mixed but insightful feedback from its user base, reflecting both innovation strengths and areas needing improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| “Impressive technology integration, boosts system performance.” | “Product reliability issues caused unexpected downtime.” |

| “Strong customer support, quick and helpful responses.” | “Price point feels steep compared to competitors.” |

| “Innovative solutions that enhance data center efficiency.” | “Software updates occasionally introduce bugs.” |

Overall, consumers praise Astera Labs for cutting-edge technology and responsive support. However, recurring concerns about reliability and pricing may impact long-term brand loyalty.

Risk Analysis

Below is a summary of key risks impacting Astera Labs, Inc., focusing on likelihood and potential severity:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Valuation Risk | Elevated P/E of 126 suggests overvaluation and market correction risk | High | High |

| Market Volatility | Beta of 1.51 indicates stock is more volatile than NASDAQ average | High | Medium |

| Liquidity Risk | Exceptionally high current ratio (10.24) may signal inefficient asset use | Medium | Low |

| Debt Risk | Zero debt minimizes financial leverage risk | Low | Low |

| Profitability | Strong margins and ROIC above WACC support earnings stability | Low | Medium |

| Dividend Policy | No dividend yield could deter income-focused investors | Medium | Low |

Astera Labs faces significant valuation risk with a P/E far exceeding sector norms, reflecting high investor expectations that may not sustain. Its notable beta signals sensitivity to market swings. Despite robust profitability and a strong balance sheet, the inflated current ratio suggests capital tied up inefficiently. The company’s zero debt is a rare positive in semiconductors, reducing default risk. Overall, valuation and volatility pose the greatest threats to investors today.

Should You Buy Astera Labs, Inc. Common Stock?

Astera Labs appears to be improving profitability with growing operational efficiency but lacks a durable moat as ROIC trails WACC. Despite a manageable debt profile and strong liquidity, the overall C+ rating suggests cautious value creation amid mixed financial signals.

Strength & Efficiency Pillars

Astera Labs, Inc. Common Stock demonstrates strong operational efficiency with a net margin of 25.7% and a return on equity of 16.07%. The return on invested capital (ROIC) stands at 12.4%, exceeding its weighted average cost of capital (WACC) of 10.88%, confirming the company as a value creator. Its gross margin of 75.69% and EBIT margin of 25.59% further highlight robust profitability. The company’s ROIC growth trend of 135.7% signals improving capital allocation over the 2022-2025 period.

Weaknesses and Drawbacks

Despite favorable profitability, Astera Labs faces significant valuation risks. Its price-to-earnings ratio of 126.33 and price-to-book ratio of 20.3 indicate an expensive premium valuation relative to industry averages. The current ratio at 10.24 raises concerns about potential inefficiencies in working capital management, despite a favorable quick ratio of 9.79. While debt-to-equity is zero, suggesting low leverage risk, the absence of dividends (0% yield) may deter income-focused investors. These factors could pressure the stock amid market volatility.

Our Final Verdict about Astera Labs, Inc. Common Stock

Astera Labs presents a fundamentally strong profile with compelling profitability and value creation metrics. The company’s bullish long-term trend and slight buyer dominance in recent periods may appear attractive for strategic exposure. However, the elevated valuation multiples and short-term deceleration in price momentum suggest a cautious, wait-and-see stance for more favorable entry points.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Astera Labs (ALAB) sets CFO transition, grants $9M equity to new finance chief – Stock Titan (Feb 10, 2026)

- Astera Labs ALAB Q4 2025 Earnings Call Transcript – The Globe and Mail (Feb 11, 2026)

- Astera Labs announces CFO retirement and appoints Desmond Lynch as successor – Investing.com (Feb 10, 2026)

- New York State Common Retirement Fund Sells 66,964 Shares of Astera Labs, Inc. $ALAB – MarketBeat (Feb 02, 2026)

- Should You Buy the Dip in Astera Labs Stock? – Barchart.com (Oct 27, 2025)

For more information about Astera Labs, Inc. Common Stock, please visit the official website: asteralabs.com