Home > Analyses > Financial Services > Assurant, Inc.

Assurant, Inc. safeguards the everyday purchases that consumers rely on, from mobile devices to homes. As a specialty insurer, it leads with innovative protection solutions across Global Lifestyle and Housing segments. Its reputation for quality and adaptability spans North America, Latin America, Europe, and Asia Pacific. I’m keen to explore whether Assurant’s strong market position and diversified offerings still justify its valuation and promise sustainable growth ahead.

Table of contents

Business Model & Company Overview

Assurant, Inc., founded in 1892 and headquartered in New York, operates as a leader in the specialty insurance sector. It delivers an integrated ecosystem of lifestyle and housing solutions across North America, Latin America, Europe, and Asia Pacific. Its two segments—Global Lifestyle and Global Housing—work cohesively to protect and connect consumer purchases, from mobile devices to homeowners insurance, reinforcing its dominant market position.

The company’s revenue engine balances hardware-related protection with recurring insurance services. Global Lifestyle drives value through mobile device solutions and vehicle protection, while Global Housing focuses on lender-placed and voluntary insurance products. Assurant’s strategic footprint across major global markets fortifies its competitive advantage and secures a robust economic moat, positioning it as a key architect of future industry standards.

Financial Performance & Fundamental Metrics

I analyze Assurant, Inc.’s income statement, key financial ratios, and dividend payout policy to uncover its operational strength and shareholder value creation.

Income Statement

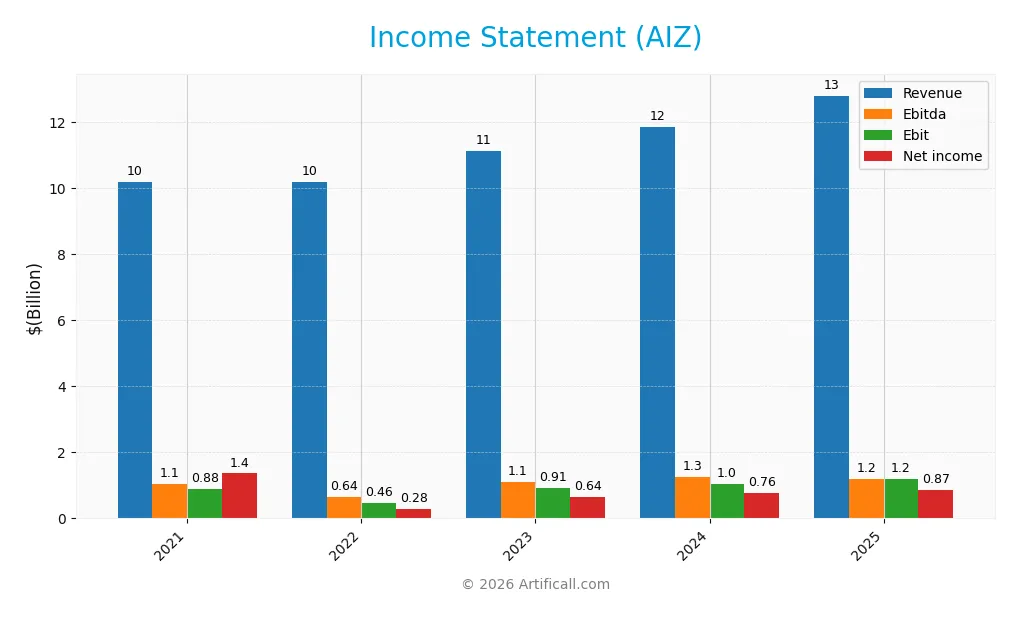

The table below presents Assurant, Inc.’s key income statement items for the fiscal years 2021 through 2025, reflecting revenue trends and profitability metrics.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 10.2B | 10.2B | 11.1B | 11.9B | 12.8B |

| Cost of Revenue | 6.0B | 2.4B | 2.5B | 2.8B | 2.9B |

| Operating Expenses | 3.4B | 7.5B | 7.8B | 8.2B | 8.8B |

| Gross Profit | 4.1B | 7.8B | 8.6B | 9.1B | 9.9B |

| EBITDA | 1.1B | 640M | 1.1B | 1.3B | 1.2B |

| EBIT | 883M | 458M | 915M | 1.0B | 1.2B |

| Interest Expense | 112M | 108M | 108M | 107M | 110M |

| Net Income | 1.4B | 277M | 643M | 760M | 873M |

| EPS | 10.4 | 5.1 | 12.0 | 14.6 | 17.3 |

| Filing Date | 2022-02-22 | 2023-02-17 | 2024-02-15 | 2025-02-20 | 2026-02-10 |

Income Statement Evolution

Assurant, Inc. reported steady revenue growth, rising 7.9% in 2025 and 25.8% over five years. Gross margins improved favorably to 77.15%, reflecting efficient cost control. Operating expenses grew in line with revenue, supporting a 15.7% EBIT increase in 2025. However, net income declined by 36% over the period, with margins contracting by nearly half.

Is the Income Statement Favorable?

In 2025, Assurant’s fundamentals appear generally favorable. The company achieved a solid 6.8% net margin, supported by low interest expenses at 0.86% of revenue. EPS surged 20.3%, signaling improved profitability per share. Neutral EBIT margins at 9.3% suggest room for operational efficiency gains. Overall, the income statement reflects disciplined growth amid margin pressures.

Financial Ratios

The table below presents key financial ratios for Assurant, Inc. over the last five fiscal years, illustrating profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 13% | 3% | 6% | 6% | 7% |

| ROE | 25% | 7% | 13% | 15% | 15% |

| ROIC | – | 1.2% | – | – | 51% |

| P/E | 6.8 | 24.6 | 14.0 | 14.6 | 13.9 |

| P/B | 1.7 | 1.6 | 1.9 | 2.2 | 2.1 |

| Current Ratio | 0 | 0 | 0 | 0 | 0 |

| Quick Ratio | 0 | 0 | 0 | 0 | 0 |

| D/E | 0.40 | 0.50 | 0.43 | 0.41 | 0.38 |

| Debt-to-Assets | 6.5% | 6.4% | 6.2% | 6.0% | 6.1% |

| Interest Coverage | 6.9 | 3.2 | 7.5 | 8.7 | 85.0 |

| Asset Turnover | 0.30 | 0.31 | 0.33 | 0.34 | 0.35 |

| Fixed Asset Turnover | 18.1 | 15.8 | 16.2 | 15.5 | 0 |

| Dividend Yield | 1.8% | 2.2% | 1.7% | 1.4% | 1.4% |

Evolution of Financial Ratios

From 2021 to 2025, Assurant, Inc.’s Return on Equity (ROE) showed moderate stability, fluctuating around 13% to 25% before settling near 14.9% in 2025. The Current Ratio remained at zero, signaling no available liquidity data or possible reporting gaps. The Debt-to-Equity Ratio improved slightly, decreasing from 0.50 in 2022 to 0.38 in 2025, indicating modest deleveraging. Profitability metrics experienced gradual improvement, with net margins rising from 2.7% in 2022 to 6.8% in 2025.

Are the Financial Ratios Favorable?

Evaluating 2025 ratios, profitability appears neutral with a 6.81% net margin and 14.86% ROE. The company’s high Return on Invested Capital (51.41%) exceeds its Weighted Average Cost of Capital (5.96%), a favorable sign. Leverage ratios, including a 0.38 debt-to-equity and 6.08% debt-to-assets, indicate prudent financial structure. However, liquidity ratios remain unfavorable at zero, and asset turnover is low at 0.35, suggesting inefficiency. Overall, 43% of ratios are favorable, with a slightly favorable global assessment.

Shareholder Return Policy

Assurant, Inc. maintains a consistent dividend payout ratio near 20%, with dividend per share gradually rising to $3.28 in 2025. The annual dividend yield hovers around 1.3-1.7%, supported by moderate free cash flow coverage and occasional share buybacks.

This balanced approach aligns with sustainable shareholder value creation, avoiding excessive distributions or repurchases. The company’s disciplined capital allocation suggests a prudent strategy that supports long-term financial health and steady income for investors.

Score analysis

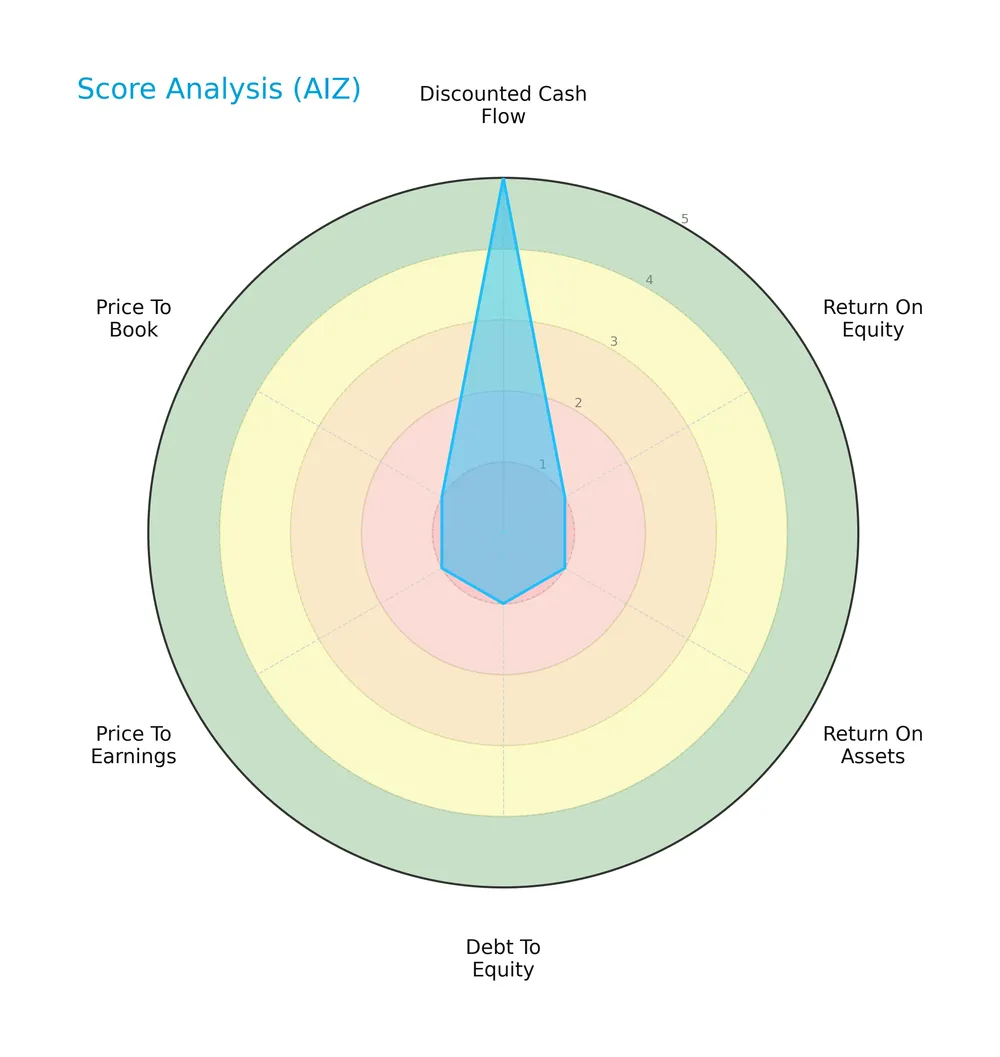

Here is a radar chart summarizing key valuation and financial performance scores for Assurant, Inc.:

The discounted cash flow score rates very favorably at 5, indicating strong intrinsic value. However, the company scores very unfavorably, with values of 1 across return on equity, return on assets, debt to equity, price to earnings, and price to book ratios, reflecting underlying operational and valuation challenges.

Analysis of the company’s bankruptcy risk

The Altman Z-Score places Assurant, Inc. in the distress zone, signaling a high risk of financial distress and potential bankruptcy:

Is the company in good financial health?

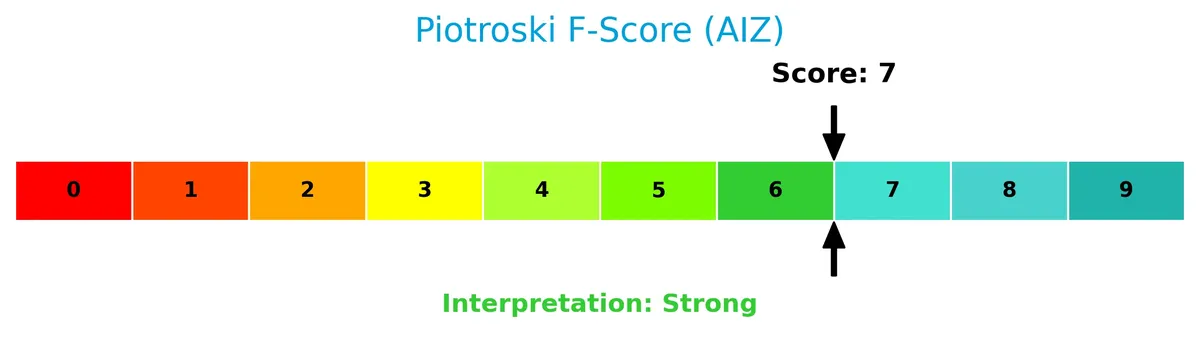

This Piotroski diagram highlights the company’s financial strength based on nine criteria:

With a strong Piotroski score of 7, Assurant, Inc. shows solid financial health despite some valuation and leverage concerns, suggesting effective operational and profitability metrics relative to peers.

Competitive Landscape & Sector Positioning

This section analyzes Assurant, Inc.’s strategic positioning within the specialty insurance sector. It examines revenue by segment, key products, and main competitors. I will assess whether Assurant holds a competitive advantage over its industry peers.

Strategic Positioning

Assurant, Inc. focuses on two main segments: Global Lifestyle and Global Housing, with 2024 revenues of $9.3B and $2.6B, respectively. Its geographic exposure is heavily concentrated in the U.S., generating $9.8B, with smaller foreign tax authority revenues, reflecting a mostly domestic footprint.

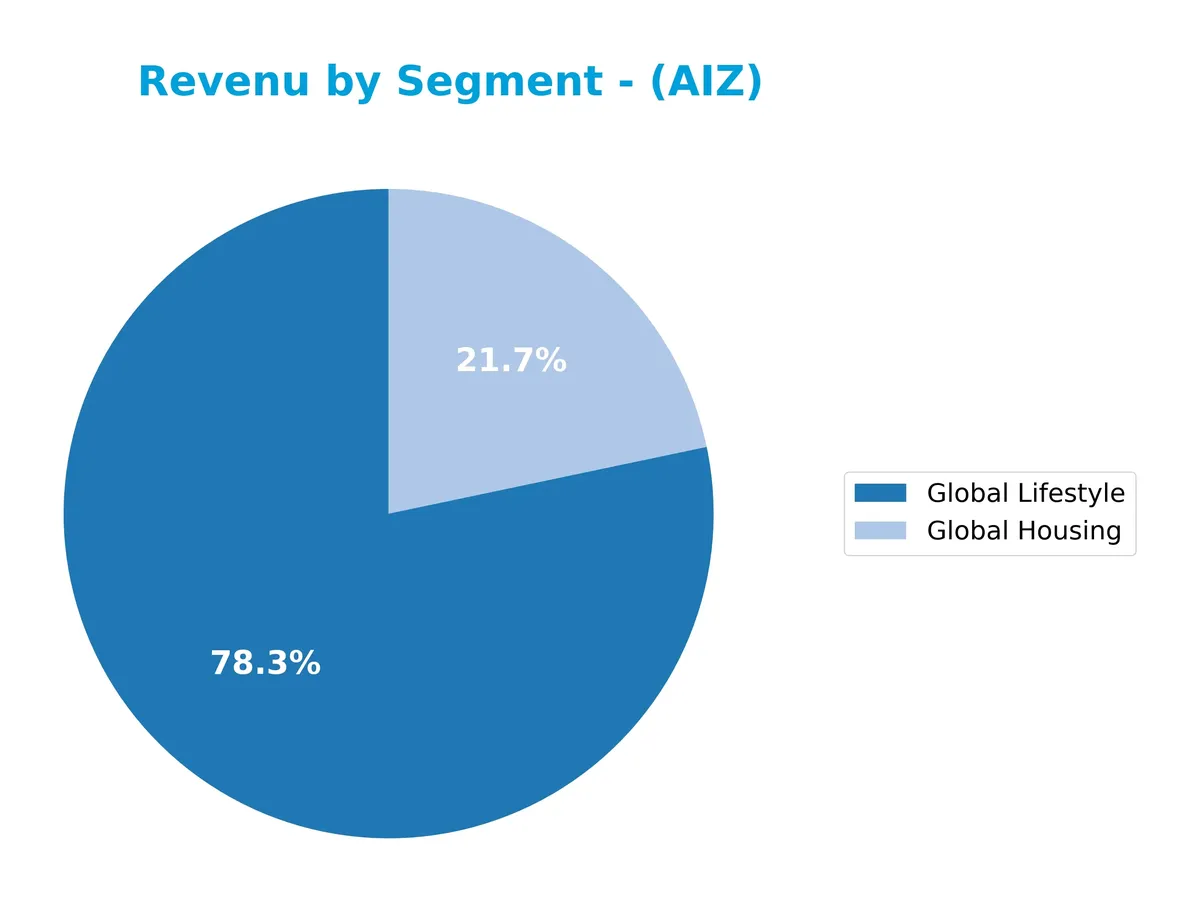

Revenue by Segment

This pie chart illustrates Assurant, Inc.’s revenue breakdown by segment for fiscal year 2024, highlighting the relative size of each business unit’s contribution.

In 2024, Global Lifestyle dominates with $9.3B, driving most of the company’s growth. Global Housing also shows strong momentum, increasing to $2.6B. Historically, these two segments have been the core revenue engines, reflecting strategic focus and market demand. The recent acceleration in Global Lifestyle signals strengthened consumer engagement, but reliance on two segments poses concentration risk investors should monitor closely.

Key Products & Brands

The table below outlines Assurant, Inc.’s key products and brands across its main business segments:

| Product | Description |

|---|---|

| Global Lifestyle | Mobile device solutions, extended service products, vehicle protection, credit protection. |

| Global Housing | Lender-placed homeowners insurance, manufactured housing, flood insurance, renters insurance. |

Assurant operates primarily through two segments. Global Lifestyle dominates with mobile and vehicle protection services. Global Housing focuses on specialty insurance products for housing-related risks across multiple regions.

Main Competitors

Assurant, Inc. faces 71 competitors in its sector; below is a table of the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Berkshire Hathaway Inc. | 1.07T |

| JPMorgan Chase & Co. | 886B |

| Visa Inc. | 672B |

| Mastercard Incorporated | 506B |

| Bank of America Corporation | 409B |

| Wells Fargo & Company | 310B |

| Morgan Stanley | 289B |

| The Goldman Sachs Group, Inc. | 287B |

| American Express Company | 260B |

| Citigroup Inc. | 221B |

Assurant ranks 68th out of 71 competitors by market cap. Its scale is just 1.02% of Berkshire Hathaway, the sector leader. The company sits below both the average market cap of the top 10 (491B) and the sector median (55B). It maintains a 10.11% market cap gap from its nearest larger competitor, indicating a modest distance to climb.

Comparisons with competitors

Check out how we compare the company to its competitors:

Aucun article trouvé pour ces critères.

Does AIZ have a competitive advantage?

Assurant, Inc. demonstrates a clear competitive advantage, consistently generating returns on invested capital well above its cost of capital. This favorable moat status reflects stable profitability and efficient capital use in specialty insurance.

Looking ahead, Assurant’s diverse global segments in lifestyle and housing solutions position it to capitalize on expanding markets. Continued innovation in mobile device and housing insurance products offers promising growth opportunities.

SWOT Analysis

This SWOT analysis highlights Assurant, Inc.’s strategic position by examining internal strengths and weaknesses alongside external opportunities and threats.

Strengths

- strong ROIC well above WACC

- favorable income growth metrics

- diversified global insurance segments

Weaknesses

- current and quick ratios reported as zero, indicating liquidity concerns

- declining net income over 5 years

- unfavorable asset turnover ratios

Opportunities

- expanding mobile device and housing insurance markets

- leveraging technology for enhanced service delivery

- growing demand in emerging markets

Threats

- intense competition in specialty insurance

- regulatory risks in multiple jurisdictions

- economic downturns impacting consumer spending

Assurant shows robust value creation with a competitive moat and solid income growth. However, liquidity weaknesses and net income decline warrant caution. The company must focus on operational efficiency and market expansion to sustain its favorable position.

Stock Price Action Analysis

The weekly chart below illustrates Assurant, Inc.’s stock price performance over the past 12 months, capturing key highs and lows:

Trend Analysis

Over the past 12 months, AIZ’s stock rose 21.04%, indicating a bullish trend with decelerating momentum. The price ranged from a low of 161.28 to a high of 243.31. Despite a high volatility level (20.08 std deviation), the uptrend shows signs of slowing down.

Volume Analysis

Trading volume has increased overall, with buyers accounting for 51.54% of activity in the last year. In the recent three-month period, buyer dominance slightly strengthened to 53.04%, suggesting cautious optimism and moderate market participation.

Target Prices

Analysts set a clear target consensus for Assurant, Inc. based on current market insights.

| Target Low | Target High | Consensus |

|---|---|---|

| 246 | 264 | 253.6 |

The target range of $246 to $264 reflects moderate upside potential. The consensus at $253.6 signals steady confidence in Assurant’s near-term performance.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback surrounding Assurant, Inc., ticker AIZ.

Stock Grades

Here are the latest verified grades from established analysts covering Assurant, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Truist Securities | Maintain | Buy | 2026-02-12 |

| BMO Capital | Maintain | Outperform | 2026-02-12 |

| Piper Sandler | Maintain | Overweight | 2025-12-19 |

| Keefe, Bruyette & Woods | Maintain | Outperform | 2025-11-20 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-17 |

| UBS | Maintain | Buy | 2025-11-10 |

| Piper Sandler | Maintain | Overweight | 2025-10-10 |

| UBS | Maintain | Buy | 2025-10-08 |

| Morgan Stanley | Maintain | Equal Weight | 2025-10-07 |

| Morgan Stanley | Maintain | Equal Weight | 2025-08-18 |

The consensus leans toward a Buy rating, with most firms maintaining positive views ranging from Buy to Outperform. Morgan Stanley consistently holds an Equal Weight stance, indicating balanced risk-reward expectations.

Consumer Opinions

Assurant, Inc. draws mixed reactions from its customers, reflecting diverse experiences across its service offerings.

| Positive Reviews | Negative Reviews |

|---|---|

| Efficient claims processing speeds up resolutions. | Customer service wait times can be excessively long. |

| Clear communication enhances trust and transparency. | Policy terms sometimes lack clarity, causing confusion. |

| Comprehensive coverage options meet diverse needs. | Premiums have increased noticeably over recent years. |

Overall, customers praise Assurant’s efficient claims handling and clear communication. However, recurring complaints about customer service delays and rising premiums signal areas needing urgent improvement.

Risk Analysis

Below is a summary table of key risks Assurant, Inc. faces, highlighting their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Altman Z-Score at 1.07 signals distress zone risk of bankruptcy. | High | High |

| Liquidity | Current and quick ratios at 0 indicate severe liquidity issues. | High | High |

| Operational | Low asset turnover (0.35) suggests inefficiency in asset use. | Medium | Medium |

| Valuation | PE ratio (13.93) is favorable but price-to-book and ROE weak. | Medium | Medium |

| Debt Management | Favorable debt metrics (D/E 0.38, interest coverage 10.9x). | Low | Low |

| Market Volatility | Beta of 0.575 implies lower volatility than market average. | Low | Low |

I observe that Assurant’s most pressing risks are liquidity constraints and financial distress signals. The Altman Z-Score below 1.8 raises a red flag for bankruptcy risk despite strong Piotroski fundamentals. Zero current and quick ratios sharply contrast the favorable debt profile, suggesting potential working capital challenges. Asset turnover under 0.4 further hints at operational inefficiencies. Investors must weigh these risks carefully against the company’s solid ROIC (51.4%) and moderate valuation. Prudence demands close monitoring of liquidity before committing.

Should You Buy Assurant, Inc.?

Assurant, Inc. appears to be delivering mixed signals, with a favorable competitive moat driven by consistent value creation but a weak leverage profile flagged by a distress-zone Altman Z-score. While profitability shows operational efficiency, the overall C rating suggests cautious analytical interpretation.

Strength & Efficiency Pillars

Assurant, Inc. delivers solid operational margins with a gross margin of 77.15% and a net margin of 6.81%. Its return on invested capital (ROIC) of 51.41% significantly exceeds the weighted average cost of capital (WACC) at 5.96%, marking the company as a clear value creator. While return on equity stands at a moderate 14.86%, Assurant maintains favorable interest coverage at 10.91x, supporting efficient capital management despite mixed asset turnover metrics.

Weaknesses and Drawbacks

The company is in financial distress, with an Altman Z-Score of 1.07 signaling a high bankruptcy risk. This solvency red flag overshadows other metrics. Additionally, valuation indicators show vulnerability: a P/E of 13.93 and a price-to-book of 2.07 offer limited margin for error. Liquidity ratios are critically weak, with both current and quick ratios at zero, heightening short-term risk. Asset turnover figures also remain unfavorable, suggesting operational inefficiencies.

Our Final Verdict about Assurant, Inc.

Despite operational strengths and clear value creation, Assurant’s distress-zone Altman Z-Score of 1.07 makes its investment profile highly speculative. The solvency risk dominates, implying caution for conservative capital. Investors might consider this a risky proposition until financial stability improves, regardless of its favorable profitability and moderate bullish price trend.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Versor Investments LP Has $342,000 Stake in Assurant, Inc. $AIZ – MarketBeat (Feb 14, 2026)

- Is Assurant (AIZ) Using Buybacks and Home Warranties to Quietly Redefine Its Growth Playbook? – Yahoo Finance (Feb 14, 2026)

- Assurant Inc (AIZ) Q4 2025 Earnings Call Highlights: Strong Grow – GuruFocus (Feb 14, 2026)

- Assurant, Inc. (NYSE:AIZ) Q4 2025 Earnings Call Transcript – Insider Monkey (Feb 12, 2026)

- Assurant (NYSE:AIZ) Could Be A Buy For Its Upcoming Dividend – simplywall.st (Feb 12, 2026)

For more information about Assurant, Inc., please visit the official website: assurant.com