Home > Analyses > Technology > ASML Holding N.V.

ASML Holding N.V. powers the semiconductor industry with its cutting-edge lithography technology, enabling the production of the most advanced microchips that drive today’s digital world. As the undisputed leader in semiconductor manufacturing equipment, ASML’s flagship EUV systems and innovative metrology solutions set the standard for precision and efficiency. Renowned for its technological prowess and market influence, the company stands at a pivotal moment—do its fundamentals still support its premium valuation and ambitious growth outlook?

Table of contents

Business Model & Company Overview

ASML Holding N.V., founded in 1984 and headquartered in Veldhoven, the Netherlands, stands as a dominant player in the semiconductor equipment industry. It develops and markets an integrated ecosystem of advanced lithography, metrology, and inspection systems, enabling chipmakers to produce a wide range of semiconductor nodes and technologies. This core mission centers on pushing the boundaries of precision and innovation in chip manufacturing.

The company’s revenue engine balances sales of cutting-edge hardware like extreme ultraviolet lithography systems with software and recurring services including system upgrades and customer support. ASML’s strategic footprint spans key global markets across the Americas, Europe, and Asia, reinforcing its vital role in the semiconductor supply chain. Its strong economic moat is built on technological leadership and high barriers to entry, shaping the future of the industry.

Financial Performance & Fundamental Metrics

This section provides a fundamental analysis of ASML Holding N.V., covering its income statement, key financial ratios, and dividend payout policy.

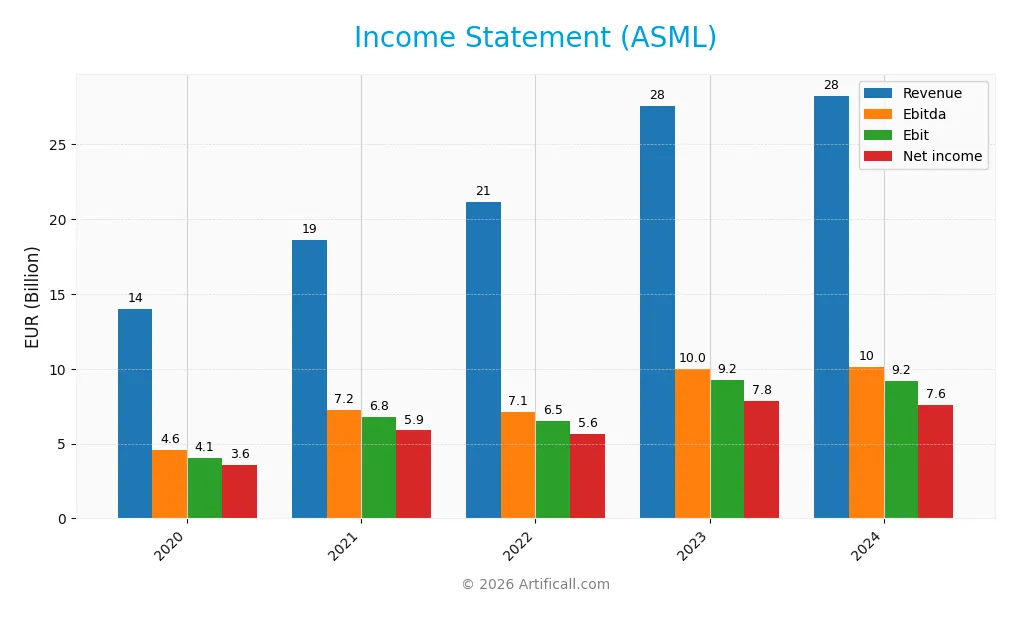

Income Statement

The table below presents ASML Holding N.V.’s key income statement figures for the fiscal years 2020 through 2024, expressed in euros.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 14B | 18.6B | 21.2B | 27.6B | 28.3B |

| Cost of Revenue | 7.2B | 8.8B | 10.5B | 13.4B | 13.8B |

| Operating Expenses | 2.7B | 3.1B | 4.2B | 5.1B | 5.5B |

| Gross Profit | 6.8B | 9.8B | 10.7B | 14.1B | 14.5B |

| EBITDA | 4.6B | 7.2B | 7.1B | 10B | 10.1B |

| EBIT | 4.1B | 6.8B | 6.5B | 9.2B | 9.2B |

| Interest Expense | 40M | 57M | 59M | 149M | 161M |

| Net Income | 3.6B | 5.9B | 5.6B | 7.8B | 7.6B |

| EPS | 7.91 | 14.97 | 13.81 | 19.56 | 19.25 |

| Filing Date | 2020-12-31 | 2021-12-31 | 2022-12-31 | 2023-12-31 | 2025-03-05 |

Income Statement Evolution

From 2020 to 2024, ASML Holding N.V. achieved a favorable overall growth in revenue and net income, with respective increases of 102.19% and 113.06%. However, in the last year, revenue rose modestly by 2.56%, while net income and EBIT declined slightly, reflecting some margin pressures. Gross and net margins improved marginally over the period, signaling enhanced profitability.

Is the Income Statement Favorable?

The 2024 income statement reveals a generally favorable financial condition with a strong gross margin of 51.28% and an EBIT margin of 32.57%. Despite a 5.82% contraction in net margin and a 1.54% drop in EPS compared to 2023, interest expenses remain low at 0.57% of revenue. Overall, 57.14% of income statement metrics are favorable, supporting a positive fundamental assessment.

Financial Ratios

The following table presents key financial ratios for ASML Holding N.V. over the fiscal years 2020 to 2024, providing a clear view of its profitability, liquidity, leverage, and market valuation metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 25% | 32% | 27% | 28% | 27% |

| ROE | 26% | 58% | 64% | 58% | 41% |

| ROIC | 17% | 31% | 29% | 32% | 25% |

| P/E | 47 | 49 | 36 | 34 | 35 |

| P/B | 12 | 28 | 23 | 20 | 14 |

| Current Ratio | 2.41 | 1.48 | 1.28 | 1.50 | 1.53 |

| Quick Ratio | 1.68 | 1.03 | 0.86 | 0.91 | 0.95 |

| D/E | 0.35 | 0.47 | 0.51 | 0.36 | 0.27 |

| Debt-to-Assets | 18% | 16% | 12% | 12% | 10% |

| Interest Coverage | 101 | 119 | 109 | 61 | 56 |

| Asset Turnover | 0.51 | 0.61 | 0.59 | 0.69 | 0.58 |

| Fixed Asset Turnover | 5.0 | 5.9 | 5.2 | 4.7 | 3.9 |

| Dividend Yield | 0.6% | 0.5% | 1.2% | 0.9% | 1.0% |

Evolution of Financial Ratios

From 2020 to 2024, ASML Holding N.V.’s Return on Equity (ROE) showed strong fluctuations, peaking above 64% in 2022 before settling at around 41% in 2024, indicating a slight decline but maintaining high profitability. The Current Ratio improved from 1.28 in 2022 to 1.53 in 2024, reflecting enhanced short-term liquidity. The Debt-to-Equity Ratio decreased notably to 0.27 in 2024, signaling a reduction in financial leverage and stronger balance sheet stability.

Are the Financial Ratios Favorable?

In 2024, ASML’s profitability metrics such as net margin (26.79%) and ROE (40.98%) were favorable, demonstrating effective profit generation. Liquidity ratios were mixed, with a favorable current ratio (1.53) but a neutral quick ratio (0.95). Leverage indicators like debt-to-equity (0.27) and debt-to-assets (10.28%) were favorable, supporting financial resilience. Market valuation ratios, including a high P/E of 34.77 and P/B of 14.25, were unfavorable, while operational efficiency showed a favorable fixed asset turnover (3.91) but neutral asset turnover (0.58). Overall, the global ratio evaluation was favorable.

Shareholder Return Policy

ASML Holding N.V. maintains a consistent dividend payout ratio around 30-44%, with a dividend per share steadily increasing from €2.37 in 2020 to €6.51 in 2024, yielding just under 1% annually. The company supports dividends with strong free cash flow coverage and also engages in share buybacks, balancing shareholder returns with capital expenditure.

This disciplined approach, combining moderate dividends and buybacks funded by robust cash flows, suggests a sustainable policy aimed at long-term value creation. The payout levels appear prudent relative to earnings and cash generation, mitigating risks of over-distribution or excessive repurchases.

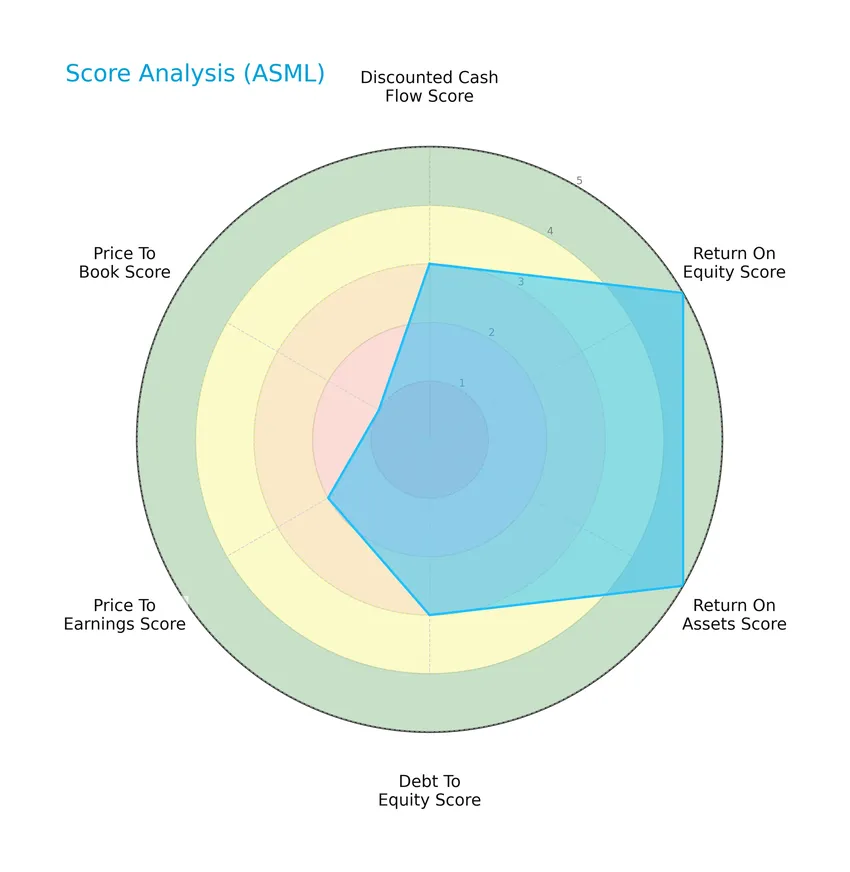

Score analysis

The following radar chart illustrates ASML Holding N.V.’s key financial scores, providing a snapshot of its valuation and performance metrics:

ASML scores very favorably on return on equity and return on assets with top marks of 5, while its discounted cash flow and debt to equity scores sit at a moderate 3. Valuation metrics show weaker scores, particularly price to book at 1, indicating potential market pricing concerns.

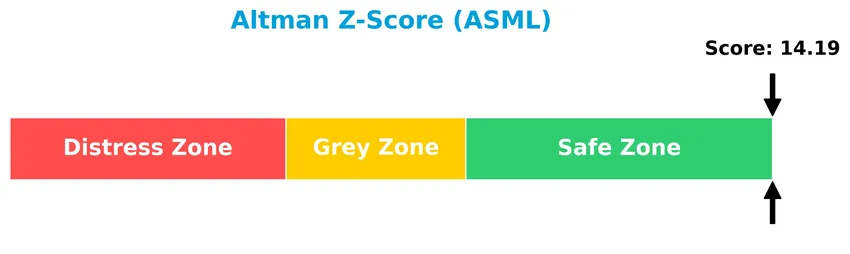

Analysis of the company’s bankruptcy risk

The Altman Z-Score places ASML Holding N.V. firmly in the safe zone, indicating a very low risk of bankruptcy based on its financial ratios:

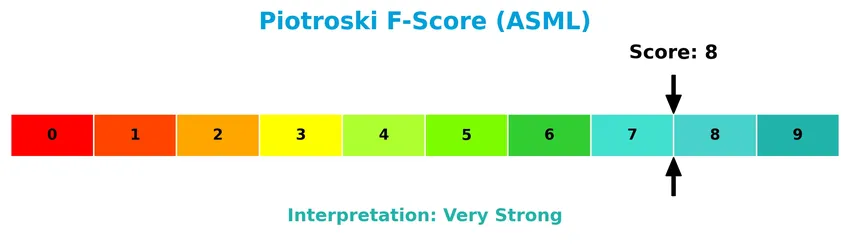

Is the company in good financial health?

The Piotroski Score chart below offers insight into ASML Holding N.V.’s overall financial strength and operational efficiency:

With a very strong Piotroski Score of 8, ASML demonstrates robust financial health, reflecting solid profitability, liquidity, and leverage metrics that underline its sound investment fundamentals.

Competitive Landscape & Sector Positioning

This sector analysis will explore ASML Holding N.V.’s strategic positioning, revenue segments, key products, main competitors, and competitive strengths. I will examine whether ASML holds a competitive advantage over its industry peers.

Strategic Positioning

ASML Holding N.V. maintains a concentrated product portfolio focused on advanced semiconductor lithography, metrology, and inspection systems, with significant revenue from immersion and extreme ultraviolet lithography. Geographically, it operates globally, with strong exposure to China (10.2B), South Korea (6.4B), Taiwan (4.4B), and the United States (4.5B), reflecting diversified international market penetration.

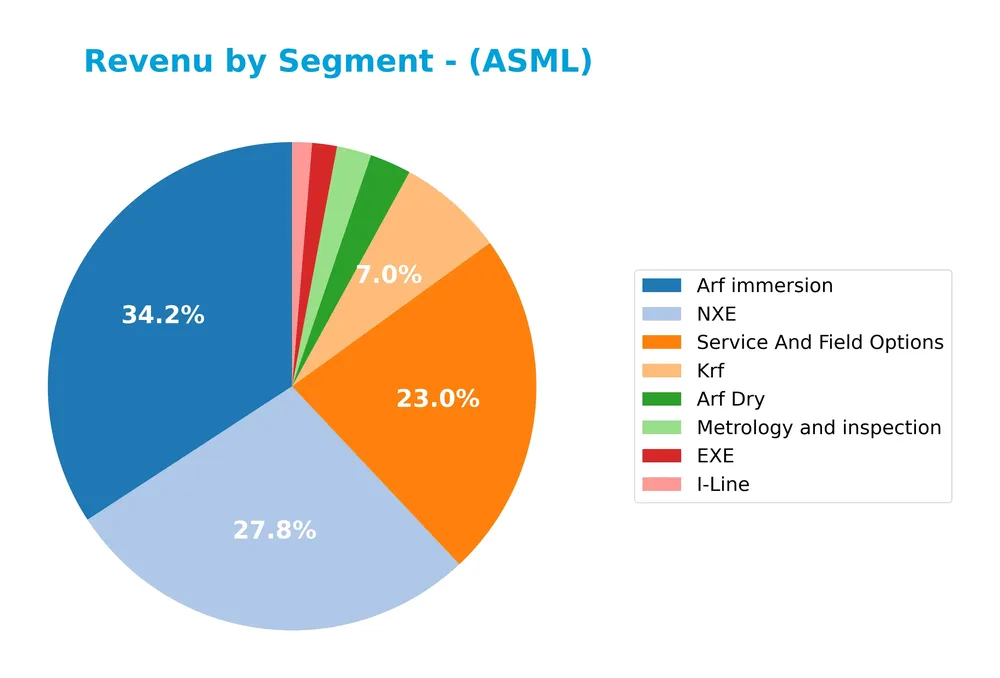

Revenue by Segment

This pie chart illustrates ASML Holding N.V.’s revenue distribution by product segment for the fiscal year 2024, highlighting key contributors to the company’s business.

In 2024, the dominant revenue driver was the “Arf immersion” segment with 9.7B, closely followed by “NXE” at 7.9B and “Service And Field Options” at 6.5B. Other notable segments include “Krf” with 2B and smaller contributions from “Arf Dry,” “EXE,” “I-Line,” and “Metrology and inspection.” The data indicates a strong concentration in advanced lithography systems, with “Arf immersion” and “NXE” fueling recent growth while service revenues continue to expand steadily, reflecting a balanced mix of product and service offerings.

Key Products & Brands

The table below presents ASML Holding N.V.’s key products and brands with their descriptions:

| Product | Description |

|---|---|

| Arf Dry | Dry lithography systems used in semiconductor manufacturing. |

| Arf Immersion | Immersion lithography systems for advanced semiconductor nodes and technologies. |

| EXE | Extreme ultraviolet (EUV) lithography systems for cutting-edge chip production. |

| I-Line | Lithography systems using I-line wavelength technology. |

| Krf | Deep ultraviolet lithography systems using KrF lasers. |

| Metrology and Inspection | Systems including YieldStar optical metrology and HMI electron beam solutions for wafer quality assessment. |

| NXE | Next-generation EUV lithography systems for high-volume chip manufacturing. |

| Service And Field Options | Customer support, refurbishing, upgrades, and related service offerings for lithography systems. |

ASML’s product portfolio focuses on advanced lithography technologies, metrology and inspection systems, and comprehensive service options, supporting semiconductor manufacturers worldwide.

Main Competitors

There are 38 competitors in the Semiconductors industry; below are the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| NVIDIA Corporation | 4.6T |

| Broadcom Inc. | 1.6T |

| Taiwan Semiconductor Manufacturing Company Limited | 1.6T |

| ASML Holding N.V. | 415B |

| Advanced Micro Devices, Inc. | 363B |

| Micron Technology, Inc. | 353B |

| Lam Research Corporation | 232B |

| Applied Materials, Inc. | 214B |

| QUALCOMM Incorporated | 185B |

| Intel Corporation | 173B |

ASML Holding N.V. ranks 4th among its 38 competitors, with a market cap roughly 11.7% of the leader NVIDIA Corporation. The company sits below the average market cap of the top 10 (974.8B) but remains well above the sector median (30.7B). It holds a significant gap of +192.75% to Broadcom Inc., the next competitor above it.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does ASML have a competitive advantage?

ASML Holding N.V. presents a clear competitive advantage, demonstrated by a very favorable moat status supported by a ROIC exceeding its WACC by 14.83% and a growing ROIC trend of 47.15% over 2020-2024, indicating efficient capital use and value creation. The company maintains strong profitability metrics with a 51.28% gross margin and a 26.79% net margin, reinforcing its position in advanced semiconductor equipment systems.

Looking ahead, ASML’s future outlook includes opportunities to expand its presence in key semiconductor markets such as China, Korea, Taiwan, and the United States, where revenues have shown significant growth. Continued innovation in extreme ultraviolet lithography and computational lithography solutions supports potential revenue expansion and market penetration in advanced semiconductor manufacturing technologies.

SWOT Analysis

This SWOT analysis highlights ASML Holding N.V.’s key strategic factors to guide investors in evaluating its potential and risks.

Strengths

- Market leader in advanced semiconductor lithography

- Strong profitability with net margin of 26.79%

- Durable competitive advantage with growing ROIC

Weaknesses

- High valuation with PE of 34.77 and PB of 14.25

- Dependence on cyclical semiconductor industry

- Moderate revenue growth slowdown recently

Opportunities

- Expansion in growing Asian semiconductor markets, especially China

- Innovation in EUV technology and computational lithography

- Increasing demand for advanced chips in AI and 5G

Threats

- Geopolitical tensions affecting key markets like China

- Supply chain disruptions and raw material costs

- Intense competition and rapid technological changes

Overall, ASML demonstrates strong competitive positioning and profitability but faces valuation pressures and external risks. Its strategy should focus on leveraging technological leadership while managing geopolitical and market cyclicality risks prudently.

Stock Price Action Analysis

The weekly stock chart for ASML Holding N.V. highlights its price movements and volatility over the recent 12-week period:

Trend Analysis

Over the past 12 weeks, ASML’s stock price increased by 36.59%, indicating a bullish trend. The trend shows clear acceleration, supported by a notable slope of 34.34. Price volatility remains elevated with a standard deviation of 133.16. The overall 100-week period also reflects a strong bullish trend with a 40.17% gain.

Volume Analysis

Trading volume over the last three months is increasing, with buyers slightly dominating at 57.53%. This buyer-driven activity suggests positive investor sentiment and growing market participation in ASML shares during this period.

Target Prices

Analysts present a confident target consensus for ASML Holding N.V.

| Target High | Target Low | Consensus |

|---|---|---|

| 1642 | 1150 | 1401.17 |

The target prices indicate a positive outlook, with analysts expecting ASML’s stock to trade between 1150 and 1642, centering around 1401. This suggests moderate growth potential in the medium term.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines recent analyst ratings and consumer feedback related to ASML Holding N.V.’s market performance and products.

Stock Grades

The following table presents recent verified grades for ASML Holding N.V. from established financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Bernstein | Maintain | Outperform | 2026-01-22 |

| KGI Securities | Upgrade | Outperform | 2026-01-15 |

| Wells Fargo | Maintain | Overweight | 2026-01-15 |

| JP Morgan | Maintain | Overweight | 2026-01-14 |

| Bernstein | Upgrade | Outperform | 2026-01-05 |

| B of A Securities | Maintain | Buy | 2025-12-03 |

| JP Morgan | Maintain | Overweight | 2025-12-01 |

| Wells Fargo | Maintain | Overweight | 2025-10-16 |

| Susquehanna | Maintain | Positive | 2025-10-10 |

| JP Morgan | Maintain | Overweight | 2025-10-06 |

Overall, the consensus among analysts is positive, with multiple upgrades to outperform and consistent maintenance of overweight and buy ratings, indicating a generally favorable outlook from recognized grading firms.

Consumer Opinions

Consumer sentiment about ASML Holding N.V. reflects a mix of admiration for its technological leadership and concerns about product accessibility and cost.

| Positive Reviews | Negative Reviews |

|---|---|

| “ASML’s innovation in semiconductor lithography is unmatched.” | “High prices make their products less accessible for smaller manufacturers.” |

| “Reliable and cutting-edge technology that drives the industry forward.” | “Long lead times cause delays in production schedules.” |

| “Strong customer support and continuous software updates.” | “Complex machinery requires extensive training to operate effectively.” |

Overall, consumers appreciate ASML’s technological excellence and support, while common criticisms focus on pricing and operational complexity. These insights suggest a strong market position but highlight areas for customer experience improvement.

Risk Analysis

Below is a table summarizing the key risks associated with ASML Holding N.V., highlighting their likelihood and potential impact on the company’s performance and stock value:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Valuation | High P/E (34.77) and P/B (14.25) ratios suggest the stock may be overvalued. | Medium | High |

| Industry Cyclicality | Semiconductor industry is highly cyclical, sensitive to global demand shifts. | High | High |

| Geopolitical Risk | Exposure to Asia and US markets creates vulnerability to trade tensions. | Medium | Medium |

| Technology Risk | Rapid innovation required; failure to keep pace may reduce competitiveness. | Medium | High |

| Supply Chain | Disruptions in advanced component supply could delay production and sales. | Medium | Medium |

| Currency Fluctuations | Operating globally exposes ASML to currency exchange risks. | Medium | Low |

| Regulatory Risk | Changes in export controls or technology regulations could limit sales. | Low | High |

The most significant risks for ASML today stem from its relatively elevated valuation coupled with the semiconductor sector’s inherent cyclicality. Recent global chip demand fluctuations and geopolitical tensions notably in Asia emphasize the need for cautious risk management despite ASML’s strong financial health and safe Altman Z-score.

Should You Buy ASML Holding N.V.?

ASML appears to be a highly profitable company with robust value creation and a durable competitive moat supported by growing ROIC. Despite some moderate leverage profile indicators, its debt situation seems manageable, reflecting a strong overall rating of B+ in this analytical interpretation.

Strength & Efficiency Pillars

ASML Holding N.V. stands out with robust profitability metrics, including a net margin of 26.79% and a return on equity (ROE) of 40.98%, underscoring efficient capital use. The company’s return on invested capital (ROIC) at 24.93% significantly exceeds its weighted average cost of capital (WACC) of 10.1%, confirming ASML as a clear value creator. Financial health is reinforced by a strong Altman Z-score of 14.19, well within the safe zone, and a Piotroski score of 8, indicating very strong financial strength. These pillars reflect ASML’s durable competitive advantage and growing profitability.

Weaknesses and Drawbacks

Despite solid fundamentals, ASML faces valuation pressures with a high price-to-earnings ratio (P/E) of 34.77 and an elevated price-to-book ratio (P/B) of 14.25, signaling a premium market valuation that may not appeal to value-focused investors. While leverage remains moderate with a debt-to-equity ratio of 0.27, the dividend yield is relatively low at 0.97%, potentially limiting income appeal. These factors, combined with a slight slowdown in recent revenue and net margin growth, introduce risks related to market expectations and near-term performance sustainability.

Our Verdict about ASML Holding N.V.

The long-term fundamental profile of ASML appears very favorable, supported by strong profitability, value creation, and financial stability. Coupled with a bullish overall price trend and slightly buyer-dominant recent market activity, the profile may appear attractive for investors seeking exposure to a high-quality semiconductor equipment leader. However, the premium valuation and modest near-term growth caution that a measured approach could be prudent to optimize entry timing.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Why neither Asia nor the US has produced a rival to ASML – Financial Times (Jan 21, 2026)

- Ahead of Earnings, Is ASML Stock a Buy, a Sell, or Fairly Valued? – Morningstar (Jan 23, 2026)

- ASML (ASML) Outperforms Broader Market: What You Need to Know – Yahoo Finance (Jan 22, 2026)

- ASML Q4 Preview: AI Momentum Beats Rich Valuation (Rating Downgrade) – Seeking Alpha (Jan 23, 2026)

- How Is The Market Feeling About ASML Holding NV? – Benzinga (Jan 20, 2026)

For more information about ASML Holding N.V., please visit the official website: asml.com