Home > Analyses > Technology > Asana, Inc.

Asana, Inc. revolutionizes how teams coordinate and execute work, transforming everyday tasks into seamless, strategic achievements. As a leader in the application software industry, Asana’s platform empowers users across diverse sectors—from technology to healthcare—to enhance productivity and collaboration. Renowned for innovation and a user-centric design, Asana stands out in a competitive market. Yet, as the software landscape evolves rapidly, the key question remains: does Asana’s current valuation reflect its growth prospects and fundamental strength?

Table of contents

Business Model & Company Overview

Asana, Inc., founded in 2008 and headquartered in San Francisco, California, stands as a leader in the Software – Application sector. Its work management platform forms a cohesive ecosystem that empowers individuals, team leads, and executives to manage tasks and strategic initiatives seamlessly. Serving diverse industries like technology, healthcare, and financial services, Asana’s platform integrates daily operations with cross-functional goals, positioning it as a critical tool for organizational productivity worldwide.

The company’s revenue engine centers on its subscription-based software services, creating recurring value through a scalable cloud platform. Asana’s strategic presence spans the Americas, Europe, and Asia, enabling broad market penetration and customer diversification. With a market cap of approximately 2.6B USD, the company leverages its competitive advantage in workflow orchestration to maintain a durable economic moat, shaping the future of collaborative work management globally.

Financial Performance & Fundamental Metrics

In this section, I will analyze Asana, Inc.’s income statement, key financial ratios, and its dividend payout policy to assess its overall financial health.

Income Statement

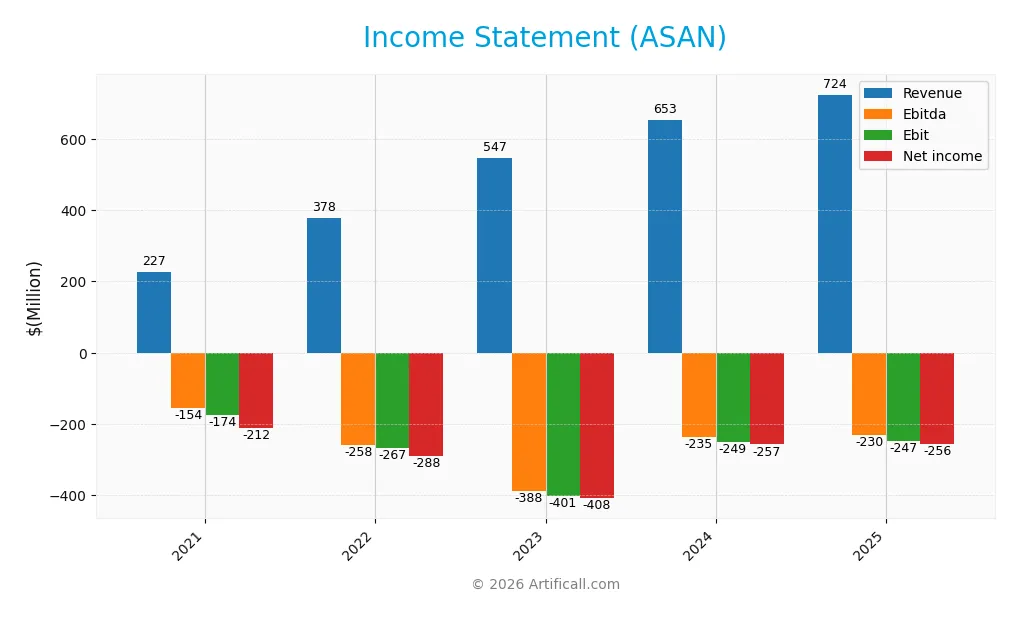

The table below summarizes Asana, Inc.’s key income statement figures for fiscal years 2021 through 2025, highlighting revenue, expenses, profitability, and earnings per share.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 227M | 378M | 547M | 653M | 724M |

| Cost of Revenue | 29M | 39M | 57M | 65M | 77M |

| Operating Expenses | 374M | 605M | 898M | 858M | 913M |

| Gross Profit | 198M | 340M | 491M | 588M | 647M |

| EBITDA | -154M | -258M | -388M | -235M | -230M |

| EBIT | -174M | -267M | -401M | -249M | -247M |

| Interest Expense | 36M | 18M | 2M | 4M | 4M |

| Net Income | -212M | -288M | -408M | -257M | -256M |

| EPS | -1.31 | -1.63 | -2.04 | -1.17 | -1.11 |

| Filing Date | 2021-03-30 | 2022-03-24 | 2023-03-24 | 2024-03-14 | 2025-03-18 |

Income Statement Evolution

From 2021 to 2025, Asana, Inc. demonstrated strong revenue growth, increasing by 218.88% overall, with a 10.94% rise in the latest year. Gross profit also grew favorably by 9.98% in the last year, maintaining a robust gross margin of 89.34%. However, net income declined overall by 20.7%, though net margin improved by 62.15%, indicating some progress in profitability despite persistent losses.

Is the Income Statement Favorable?

In 2025, Asana reported $724M in revenue and a net loss of $256M, reflecting a net margin of -35.3%, which remains unfavorable. Operating expenses grew in line with revenue, supporting stable operating margins, but EBIT stayed negative at -34.13%. Interest expense is low at 0.51% of revenue, a favorable factor. Overall, 71.43% of income statement metrics are positive, leading to a generally favorable income statement assessment despite ongoing net losses.

Financial Ratios

The table below presents key financial ratios for Asana, Inc. over the last five fiscal years, providing a snapshot of profitability, leverage, liquidity, and market valuation:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | -93% | -76% | -75% | -39% | -35% |

| ROE | 17% | -141% | -114% | -79% | -112% |

| ROIC | -31% | -56% | -64% | -44% | -53% |

| P/E | -27.0 | -32.1 | -7.6 | -14.9 | -19.2 |

| P/B | -448 | 45.4 | 8.7 | 11.8 | 21.5 |

| Current Ratio | 2.73 | 1.61 | 1.99 | 1.80 | 1.44 |

| Quick Ratio | 2.73 | 1.61 | 1.99 | 1.80 | 1.44 |

| D/E | -45.8 | 1.25 | 0.76 | 0.85 | 1.18 |

| Debt-to-Assets | 80% | 36% | 28% | 29% | 30% |

| Interest Coverage | -4.9 | -14.4 | -204 | -68.3 | -72.4 |

| Asset Turnover | 0.31 | 0.54 | 0.57 | 0.68 | 0.81 |

| Fixed Asset Turnover | 0.88 | 1.38 | 2.02 | 2.34 | 2.76 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

Between 2021 and 2025, Asana, Inc. showed a declining trend in Return on Equity (ROE), dropping from a positive 16.55% in 2021 to a negative -112.31% in 2025. The Current Ratio decreased steadily from 2.73 to 1.44, indicating reduced short-term liquidity. The Debt-to-Equity Ratio increased from a negative figure in 2021 to 1.18 in 2025, reflecting growing leverage. Profitability remained consistently negative with net margins worsening but showing slight improvement in the most recent year.

Are the Financial Ratios Favorable?

In 2025, profitability ratios such as net margin (-35.3%) and ROE (-112.31%) were unfavorable, highlighting continued losses. Liquidity indicators were mixed, with a neutral Current Ratio (1.44) but a favorable Quick Ratio (1.44). Leverage ratios, including Debt-to-Equity (1.18) and interest coverage (-67.09), were unfavorable, suggesting financial risk. Efficiency ratios like asset turnover (0.81) were neutral, while valuation metrics such as Price-to-Book (21.52) were unfavorable. Overall, approximately half of the ratios were unfavorable, leading to a slightly unfavorable financial profile.

Shareholder Return Policy

Asana, Inc. does not pay dividends, reflecting its ongoing net losses and focus on reinvestment during its high growth phase. The company has a zero dividend payout ratio and yield, indicating no current shareholder cash returns via dividends.

There is no indication of share buyback programs, consistent with Asana’s prioritization of growth and operational investments. This approach aligns with sustaining long-term shareholder value creation through reinvestment rather than immediate returns.

Score analysis

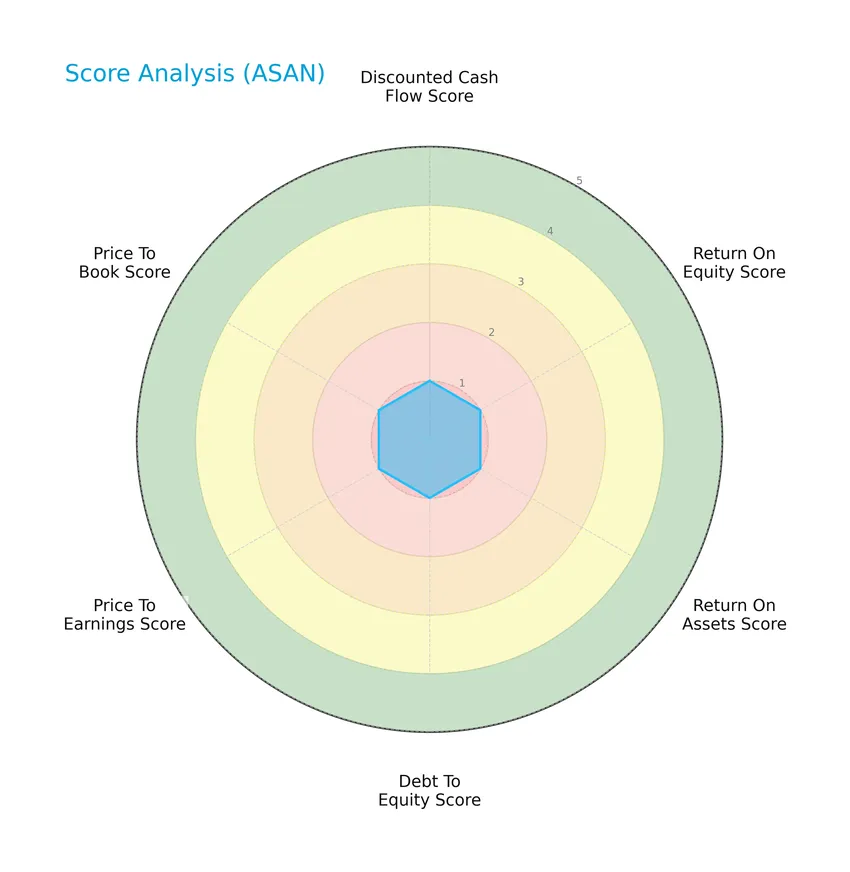

The following radar chart presents an overview of Asana, Inc.’s key financial scores to aid in evaluating its investment profile:

All evaluated metrics, including discounted cash flow, return on equity, return on assets, debt to equity, price to earnings, and price to book ratios, score very unfavorably at 1, indicating significant financial challenges across these factors.

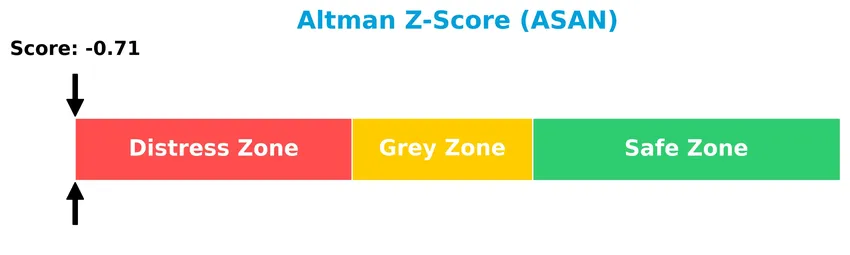

Analysis of the company’s bankruptcy risk

Asana, Inc. currently falls into the distress zone according to its Altman Z-Score, suggesting a high risk of bankruptcy:

Is the company in good financial health?

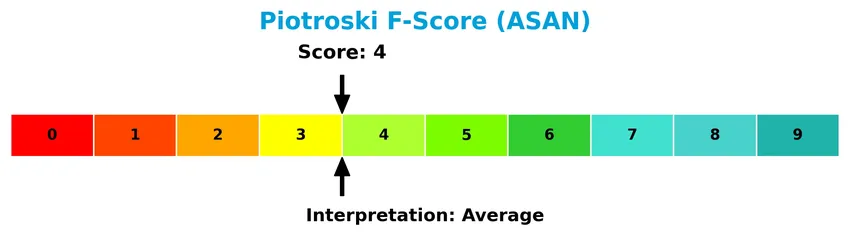

The Piotroski Score diagram below summarizes Asana, Inc.’s financial strength assessment:

With a Piotroski Score of 4, Asana is positioned in the average range, reflecting moderate financial health but not indicating strong robustness or significant financial strength.

Competitive Landscape & Sector Positioning

This sector analysis will examine Asana, Inc.’s strategic positioning, revenue by segment, key products, main competitors, and competitive advantages. I will assess whether Asana holds a competitive advantage over its peers in the software application industry.

Strategic Positioning

Asana, Inc. operates a diversified work management platform serving multiple industries, including technology, retail, education, and healthcare. Geographically, it has expanded steadily, with U.S. revenue reaching $436M and non-U.S. revenue $288M in FY 2025, reflecting balanced geographic exposure.

Key Products & Brands

The table below outlines Asana, Inc.’s key product offerings and their descriptions:

| Product | Description |

|---|---|

| Asana Work Management Platform | A platform that helps individuals, team leads, and executives manage work from daily tasks to strategic initiatives. It supports product launches, marketing campaigns, and organization-wide goal setting across multiple industries. |

Asana’s core product is its comprehensive work management platform, designed to streamline collaboration and project management for diverse sectors including technology, retail, and healthcare.

Main Competitors

There are 33 competitors in the Technology sector’s Software – Application industry; the table below lists the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Salesforce, Inc. | 242.5B |

| Shopify Inc. | 209.6B |

| AppLovin Corporation | 209.0B |

| Intuit Inc. | 175.2B |

| Uber Technologies, Inc. | 172.2B |

| ServiceNow, Inc. | 153.0B |

| Cadence Design Systems, Inc. | 84.5B |

| Snowflake Inc. | 73.4B |

| Autodesk, Inc. | 61.2B |

| Workday, Inc. | 54.9B |

Asana, Inc. ranks 30th among 33 competitors in its sector, with a market cap just 1.09% of the leader, Salesforce, Inc. The company is positioned below both the average market cap of the top 10 competitors (143.6B) and the sector median (18.8B). There is a significant 58.62% market cap gap between Asana and its closest competitor above, indicating a notable distance from higher-ranked peers.

Does ASAN have a competitive advantage?

Asana, Inc. does not currently present a competitive advantage, as its return on invested capital (ROIC) is significantly below its weighted average cost of capital (WACC), indicating value destruction and declining profitability. This unfavorable moat status is reinforced by a negative ROIC trend over the 2021-2025 period.

Looking ahead, Asana’s revenue growth, supported by expanding markets both in the U.S. and internationally, alongside ongoing product development in its work management platform, suggests potential opportunities to improve financial performance. However, the company remains challenged by negative net margins and an unfavorable EBIT margin as of fiscal 2025.

Comparisons with competitors

Check out how we compare the company to its competitors:

SWOT Analysis

This SWOT analysis highlights the key internal and external factors affecting Asana, Inc. to guide informed investment decisions.

Strengths

- Strong revenue growth of 219% over 5 years

- High gross margin at 89.3%

- Diverse customer base across industries and geographies

Weaknesses

- Negative net margin at -35.3%

- Declining ROIC and value destruction

- High price-to-book ratio indicating overvaluation

Opportunities

- Expansion in international markets

- Increasing demand for work management software

- Potential to improve profitability through operational efficiencies

Threats

- Intense competition in software sector

- Market sensitivity to economic cycles

- Financial distress risk indicated by Altman Z-score

Overall, Asana benefits from strong top-line growth and gross margins but faces significant profitability challenges and value destruction. Strategic focus should be on improving operational efficiency and leveraging international expansion while managing financial risks carefully.

Stock Price Action Analysis

The weekly stock chart for Asana, Inc. (ASAN) illustrates price movements and trading activity over the past 12 months:

Trend Analysis

Over the past 12 months, ASAN’s stock price declined by 44.49%, indicating a bearish trend. The price moved between a high of 24.15 and a low of 10.93, with volatility measured by a standard deviation of 2.88. The trend shows deceleration, suggesting a slowing pace of decline in recent months.

Volume Analysis

In the last three months, trading volume for ASAN has been increasing, with sellers accounting for 52.08% of activity, slightly outweighing buyers. Buyer behavior is neutral, reflecting balanced market participation. This suggests cautious investor sentiment amid continued downward price pressure.

Target Prices

The consensus target prices for Asana, Inc. indicate moderate upside potential based on current analyst estimates.

| Target High | Target Low | Consensus |

|---|---|---|

| 18 | 14 | 15.75 |

Analysts expect Asana’s stock price to range between $14 and $18, with a consensus target around $15.75, reflecting cautious optimism in its growth prospects.

Analyst & Consumer Opinions

This section examines recent analyst ratings and consumer feedback regarding Asana, Inc. (ASAN) to provide insight.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Stock Grades

Here is the latest overview of Asana, Inc.’s stock grades from recognized financial institutions as of early 2026:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Upgrade | Buy | 2026-01-15 |

| RBC Capital | Maintain | Underperform | 2026-01-05 |

| Keybanc | Upgrade | Overweight | 2025-12-15 |

| DA Davidson | Maintain | Neutral | 2025-12-04 |

| Citigroup | Maintain | Neutral | 2025-12-03 |

| RBC Capital | Maintain | Underperform | 2025-12-03 |

| UBS | Maintain | Neutral | 2025-12-03 |

| Baird | Maintain | Neutral | 2025-09-04 |

| Piper Sandler | Maintain | Overweight | 2025-09-04 |

| Morgan Stanley | Maintain | Underweight | 2025-09-04 |

The consensus indicates a cautious optimism with upgrades from Citigroup and Keybanc, while several firms retain neutral or underperform stances. This mix suggests a varied outlook among analysts regarding Asana’s near-term prospects.

Consumer Opinions

Consumers have mixed but insightful views on Asana, Inc., reflecting both its strong points and areas needing improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| Intuitive interface that boosts team productivity. | Occasional syncing issues reported by users. |

| Excellent integration with other tools. | Customer support response times can be slow. |

| Streamlines project management efficiently. | Learning curve for advanced features. |

Overall, users appreciate Asana’s ease of use and integration capabilities but express concerns about occasional technical glitches and customer service delays. These insights can guide cautious investors in weighing the company’s operational strengths against service challenges.

Risk Analysis

The table below summarizes the key risk factors for Asana, Inc., highlighting their likelihood and potential impact on the company’s performance:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Negative net margin (-35.3%) and deeply negative ROE (-112.31%) indicate ongoing losses. | High | High |

| Bankruptcy Risk | Altman Z-Score of -0.71 places Asana in the distress zone, signaling high bankruptcy risk. | Medium-High | Very High |

| Valuation Metrics | Extremely high price-to-book ratio (21.52) suggests overvaluation risk. | Medium | Medium |

| Debt Levels | Debt-to-equity ratio of 1.18 and interest coverage negative (-67.09) show financial leverage concerns. | Medium | High |

| Market Volatility | Stock beta of 0.916 indicates moderate sensitivity to market fluctuations. | Medium | Medium |

| Dividend Policy | No dividend yield, reflecting no income return for investors. | High | Low |

The most critical risks for Asana center on its distressed financial health and elevated bankruptcy risk, as reflected in its negative profitability ratios and Altman Z-Score. Investors should exercise caution given the company’s high leverage and overvaluation, which could exacerbate volatility and downside potential.

Should You Buy Asana, Inc.?

Asana, Inc. appears to be characterized by declining operational efficiency and negative value creation, with a very unfavorable competitive moat reflecting deteriorating profitability. Despite a manageable leverage profile, the overall investment rating could be seen as weak, suggesting caution.

Strength & Efficiency Pillars

Asana, Inc. exhibits a mixed financial profile with some favorable indicators primarily in its operational efficiency. The company maintains a strong gross margin of 89.34%, reflecting effective cost control on direct expenses. Its weighted average cost of capital (WACC) stands at a reasonable 7.75%, supporting capital efficiency. Liquidity metrics are solid, with a quick ratio of 1.44 signaling adequate short-term financial health. However, critical profitability measures such as return on equity (ROE) at -112.31% and return on invested capital (ROIC) at -53.03% reveal significant operational challenges. Importantly, ROIC is well below WACC, indicating that Asana is currently destroying value rather than creating it.

Weaknesses and Drawbacks

Asana faces pronounced headwinds in profitability and valuation metrics that present risks for investors. The company’s net margin is deeply negative at -35.3%, reflecting ongoing losses. Its price-to-book ratio of 21.52 signals an inflated market valuation relative to its book value, which could deter value-seeking investors. Leverage is elevated, with a debt-to-equity ratio of 1.18, increasing financial risk, especially given an unfavorable interest coverage ratio of -67.09, which suggests difficulty in meeting interest obligations. The stock’s bearish trend, with a price decline of 44.49% over the long term and recent seller dominance, further compounds downside pressures.

Our Verdict about Asana, Inc.

The long-term fundamental profile of Asana, Inc. is unfavorable due to sustained negative profitability and value destruction. Coupled with a bearish stock trend and recent neutral buyer behavior amid seller volume dominance, the investment case is cautious. Despite pockets of operational efficiency and strong gross margins, Asana may appear risky for long-term exposure, and the current market pressure suggests a wait-and-see approach may be prudent before considering entry.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Investors Don’t See Light At End Of Asana, Inc.’s (NYSE:ASAN) Tunnel And Push Stock Down 26% – simplywall.st (Jan 21, 2026)

- Asana, Inc. (NYSE:ASAN) Short Interest Update – MarketBeat (Jan 20, 2026)

- Asana Announces Second Quarter Fiscal 2026 Results – Asana (Sep 03, 2025)

- Asana, Inc. reports strong earnings and growth – MSN (Jan 19, 2026)

- Asana, Inc. (ASAN) Surpasses Q2 Earnings and Revenue Estimates – Yahoo Finance (Sep 03, 2025)

For more information about Asana, Inc., please visit the official website: asana.com