Home > Analyses > Technology > Arqit Quantum Inc.

Arqit Quantum Inc. is transforming digital security by leveraging quantum technology to safeguard communications across the globe. As a pioneer in quantum encryption, Arqit’s flagship QuantumCloud software enables devices to generate unbreakable encryption keys, setting new standards in cybersecurity infrastructure. With its innovative approach and strong industry presence, Arqit challenges traditional security paradigms. The key question for investors today is whether its cutting-edge technology and growth prospects justify its current market valuation and risk profile.

Table of contents

Business Model & Company Overview

Arqit Quantum Inc., founded in 2021 and headquartered in London, stands at the forefront of the cybersecurity sector within the software infrastructure industry. Its innovative ecosystem centers on QuantumCloud, a platform that empowers devices to generate encryption keys via lightweight software agents, leveraging satellite and terrestrial networks. This integration underpins Arqit’s mission to deliver cutting-edge security solutions tailored for a digital age.

The company’s revenue engine is driven primarily by its software-based cybersecurity services, creating value through scalable, recurring adoption across global markets including the Americas, Europe, and Asia. With a market cap of $379M and a focused team of 82 employees, Arqit leverages its competitive advantage in quantum encryption technology. This positions it as a key architect in shaping the future landscape of secure communications worldwide.

Financial Performance & Fundamental Metrics

I will analyze Arqit Quantum Inc.’s income statement, key financial ratios, and dividend payout policy to provide a clear view of its fundamental health.

Income Statement

The table below presents Arqit Quantum Inc.’s key income statement figures for fiscal years 2021 through 2025, reported in USD.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 48K | 7.2M | 640K | 293K | 530K |

| Cost of Revenue | 187K | 1.3M | 2.3M | 1.9M | 760K |

| Operating Expenses | 173M | 71M | 82.8M | 23.1M | 38.7M |

| Gross Profit | -139K | 5.9M | -1.6M | -1.6M | -230K |

| EBITDA | -271M | 55M | -41.2M | -20.2M | -36.8M |

| EBIT | -271M | 54M | -43.8M | -23.8M | -37.6M |

| Interest Expense | 1.1M | 221K | 284K | 223K | 48K |

| Net Income | -272M | 65M | -70.4M | -54.6M | -35.3M |

| EPS | -99.42 | 13.43 | -13.39 | -10.79 | -2.56 |

| Filing Date | 2021-12-16 | 2022-12-14 | 2023-11-21 | 2024-12-05 | 2025-12-09 |

Income Statement Evolution

From 2021 to 2025, Arqit Quantum Inc. exhibited strong revenue growth of over 1000%, recovering from minimal sales to $530K in 2025. Net income also improved significantly, rising by nearly 87%, though it remained negative at -$35.3M in 2025. Gross margins stayed unfavorable, reflecting persistent cost pressures, while operating margins worsened, indicating continued high expenses relative to revenue.

Is the Income Statement Favorable?

In 2025, despite a net loss of $35.3M, key metrics show improvement compared to prior years, with revenue up 81% year-over-year and net margin growth of 64%. EBITDA and EBIT margins remain deeply negative, signaling ongoing operational challenges. Interest expenses are neutral relative to revenue. Overall, the fundamentals present a generally favorable trajectory but reflect continued financial strain and negative profitability.

Financial Ratios

The table below presents key financial ratios for Arqit Quantum Inc. over fiscal years 2021 to 2025, illustrating profitability, liquidity, leverage, efficiency, and dividend metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | -5671.66% | 9.02% | -109.99% | -186.28% | -66.68% |

| ROE | 8.03% | 0.83% | -1.06% | -4.62% | -1.30% |

| ROIC | -1.79% | -0.51% | -0.72% | -1.67% | -1.27% |

| P/E | -5.05 | 10.55 | -1.11 | -0.53 | -15.12 |

| P/B | -40.52 | 8.74 | 1.17 | 2.44 | 19.62 |

| Current Ratio | 5.29 | 2.38 | 3.22 | 1.94 | 2.69 |

| Quick Ratio | 5.16 | 2.38 | 3.22 | 1.94 | 2.69 |

| D/E | 0.00 | 0.10 | 0.13 | 0.08 | 0.03 |

| Debt-to-Assets | 0.00 | 0.06 | 0.08 | 0.04 | 0.02 |

| Interest Coverage | -160.08 | -235.74 | -191.93 | -110.72 | -802.90 |

| Asset Turnover | 0.00 | 0.06 | 0.01 | 0.01 | 0.01 |

| Fixed Asset Turnover | 0.24 | 0.86 | 0.08 | 0.27 | 0.74 |

| Dividend Yield | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

Evolution of Financial Ratios

From 2021 to 2025, Arqit Quantum Inc. saw a marked decline in profitability metrics, with Return on Equity (ROE) deteriorating significantly to -130% in 2025. The Current Ratio showed some fluctuation but generally remained above 1.9, improving to 2.69 in 2025, indicating better short-term liquidity. The Debt-to-Equity Ratio dropped steadily, reaching a low 0.03 in 2025, reflecting reduced leverage.

Are the Financial Ratios Favorable?

In 2025, the liquidity ratios such as Current and Quick Ratios at 2.69 are favorable, showing solid short-term financial health. The low Debt-to-Equity Ratio of 0.03 and Debt-to-Assets at 1.68% also indicate low financial risk. However, profitability ratios like ROE at -130%, net margin at -6668%, and interest coverage ratio at -783 are unfavorable, signaling operational and earnings challenges. Asset turnover remains low, and market valuation ratios such as Price-to-Book at 19.62 suggest an overvalued stock. Overall, 64% of key ratios are unfavorable.

Shareholder Return Policy

Arqit Quantum Inc. does not pay dividends, reflecting its sustained negative net income and ongoing reinvestment in growth and development. No share buyback programs are reported, consistent with its focus on preserving cash amid continued operating losses. This policy aligns with a high-growth phase prioritizing long-term value creation over immediate returns.

Score analysis

Here is a radar chart presenting the evaluation of key financial scores for Arqit Quantum Inc.:

The scores reveal a mixed financial profile: discounted cash flow is moderate at 2, but profitability indicators like return on equity and assets score very low at 1. The company’s debt to equity ratio is favorable with a score of 4, while valuation metrics price to earnings and price to book are also very unfavorable at 1 each.

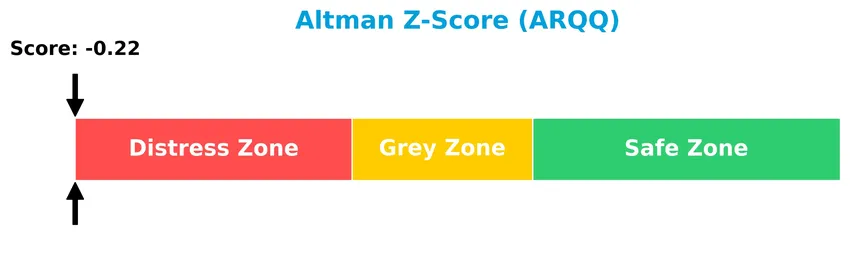

Analysis of the company’s bankruptcy risk

The Altman Z-Score places Arqit Quantum Inc. in the distress zone, indicating a high risk of bankruptcy based on its financial ratios:

Is the company in good financial health?

The Piotroski Score diagram summarizes the company’s financial health assessment based on nine criteria:

With a Piotroski Score of 2, Arqit Quantum Inc. is considered very weak financially, suggesting limited strength in profitability, leverage, liquidity, and operational efficiency.

Competitive Landscape & Sector Positioning

This sector analysis will explore Arqit Quantum Inc.’s strategic positioning, revenue segments, key products, main competitors, and competitive advantages. I will also assess the company’s SWOT profile to understand its market stance. The goal is to determine whether Arqit Quantum holds a competitive advantage over its peers in the cybersecurity infrastructure sector.

Strategic Positioning

Arqit Quantum Inc. focuses on cybersecurity software infrastructure, primarily operating in the United Kingdom with a revenue of $6.85M from other countries in 2022, indicating a concentrated geographic exposure and a specialized product portfolio centered on quantum encryption technology.

Key Products & Brands

The table below outlines the primary products and brands offered by Arqit Quantum Inc.:

| Product | Description |

|---|---|

| QuantumCloud | A platform enabling devices to download a lightweight software agent that creates encryption keys with partners. |

Arqit Quantum Inc. focuses on cybersecurity solutions delivered via satellite and terrestrial platforms. Its flagship product, QuantumCloud, facilitates secure encryption key generation across devices, supporting its infrastructure software industry positioning.

Main Competitors

Arqit Quantum Inc. faces competition from 32 companies, with the table below showing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Microsoft Corporation | 3.52T |

| Oracle Corporation | 553B |

| Palantir Technologies Inc. | 383B |

| Adobe Inc. | 140B |

| Palo Alto Networks, Inc. | 120B |

| CrowdStrike Holdings, Inc. | 113B |

| Synopsys, Inc. | 92B |

| Cloudflare, Inc. | 69B |

| Fortinet, Inc. | 59B |

| Block, Inc. | 40B |

Arqit Quantum Inc. ranks 31st among 32 competitors in the Technology sector’s Software – Infrastructure industry. Its market cap is just 0.01% of the leader Microsoft’s scale. The company is positioned below both the average market cap of the top 10 competitors (508B) and the sector median (18.8B). There is a large 501% market cap gap between Arqit and its closest competitor above, highlighting significant scale challenges.

Does Arqit Quantum Inc. have a competitive advantage?

Arqit Quantum Inc. currently does not present a strong competitive advantage as it is shedding value, with a ROIC significantly below its WACC, indicating inefficiency in capital use despite growing profitability. Its global moat status is slightly unfavorable, reflecting value destruction even as ROIC trends upward.

Looking ahead, Arqit’s focus on cybersecurity services via satellite and terrestrial platforms, along with its QuantumCloud software enabling secure encryption key exchanges, suggests potential growth opportunities in technology infrastructure. Expansion in new markets and the development of innovative products may improve its competitive positioning over time.

Comparisons with competitors

Check out how we compare the company to its competitors:

SWOT Analysis

This SWOT analysis highlights the key internal and external factors influencing Arqit Quantum Inc.’s strategic positioning and investment potential.

Strengths

- Strong revenue growth (80.9% YoY)

- Favorable net margin and EPS growth trends

- Robust liquidity ratios (current and quick ratio at 2.69)

Weaknesses

- Negative profitability metrics (net margin -6668.5%, ROE -129.8%)

- High beta indicating significant volatility (2.41)

- Weak Altman Z-Score indicating financial distress

Opportunities

- Expansion in cybersecurity demand via satellite and quantum encryption

- Growth potential in underserved global markets

- Increasing adoption of QuantumCloud technology

Threats

- Intense competition in cybersecurity and quantum tech

- High operational losses affecting sustainability

- Regulatory and technological risks in quantum encryption

Overall, Arqit Quantum shows promising growth and liquidity but faces severe profitability challenges and financial distress signals. Strategic focus should prioritize improving operational efficiency and leveraging its technological opportunities while managing volatility and market risks cautiously.

Stock Price Action Analysis

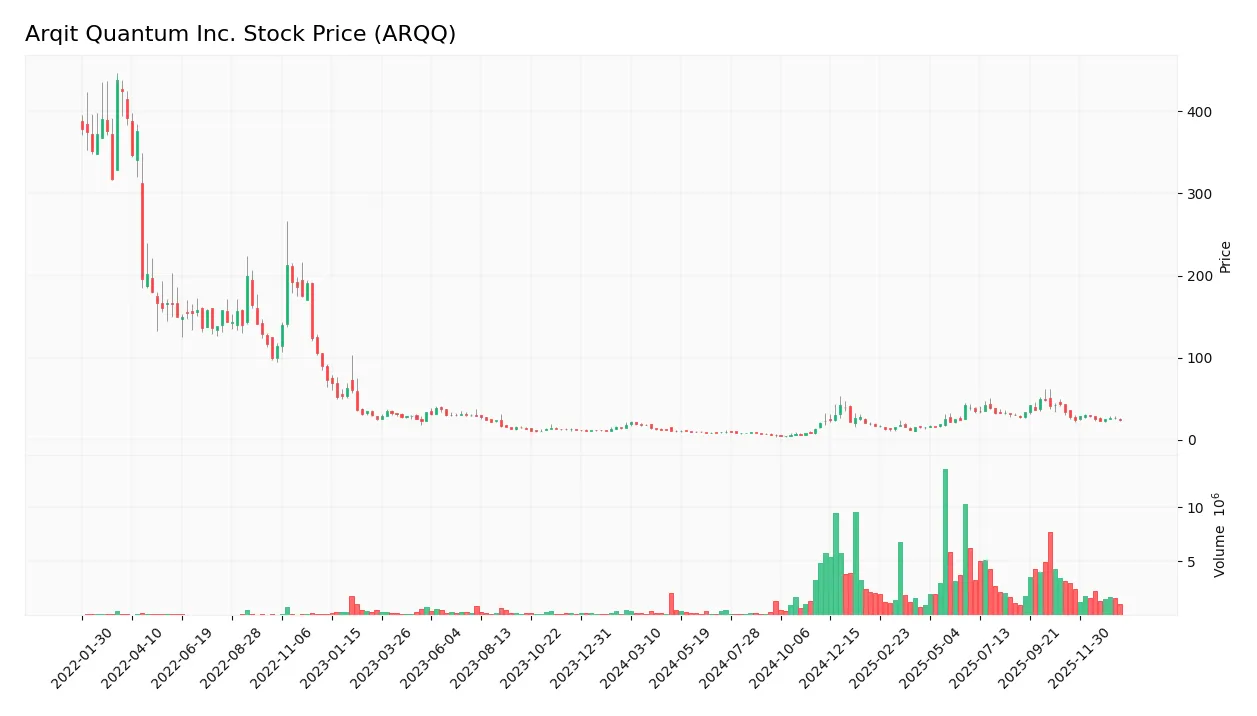

The weekly stock chart of Arqit Quantum Inc. (ARQQ) over the past 12 months shows significant price fluctuations and key support and resistance levels:

Trend Analysis

Over the past 12 months, ARQQ’s stock price increased by 32.24%, indicating a bullish trend with a deceleration in momentum. The price ranged from a low of 4.19 to a high of 49.92, with an overall volatility measured by an 11.73 standard deviation.

Volume Analysis

In the last three months, trading volume has been increasing but is seller-driven, with buyers accounting for only 27.15% of activity. This seller dominance suggests cautious investor sentiment and higher selling pressure during this recent period.

Target Prices

The consensus target price for Arqit Quantum Inc. (ARQQ) is firmly established by available analyst data.

| Target High | Target Low | Consensus |

|---|---|---|

| 60 | 60 | 60 |

Analysts uniformly project a target price of $60, indicating a strong, consistent expectation for the stock’s future valuation.

Analyst & Consumer Opinions

This section examines the recent grades and consumer feedback regarding Arqit Quantum Inc. (ARQQ) to assess market sentiment.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Stock Grades

The following table presents the latest verified grades for Arqit Quantum Inc. from a recognized grading company:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| HC Wainwright & Co. | Maintain | Buy | 2025-10-13 |

HC Wainwright & Co. has consistently maintained a Buy rating on Arqit Quantum Inc. over multiple assessments, reflecting stable positive analyst sentiment. The consensus rating also supports a Buy position, indicating moderate investor confidence.

Consumer Opinions

Consumer sentiment around Arqit Quantum Inc. (ARQQ) reflects a mix of optimism for its cutting-edge technology and concerns about its current market execution.

| Positive Reviews | Negative Reviews |

|---|---|

| Innovative approach to quantum encryption technology. | Product adoption is slower than expected. |

| Strong potential to revolutionize cybersecurity. | Limited practical applications available today. |

| Impressive leadership with clear vision for the future. | Stock volatility causes investor uncertainty. |

Overall, consumers appreciate Arqit’s pioneering role in quantum security, but recurring concerns focus on the slow pace of commercialization and market instability. This balance suggests cautious optimism for long-term growth.

Risk Analysis

Below is a summary table of the key risks affecting Arqit Quantum Inc., highlighting their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Stability | Negative net margin and poor profitability metrics indicate ongoing losses. | High | High |

| Bankruptcy Risk | Altman Z-Score in distress zone signals elevated bankruptcy risk. | High | High |

| Market Volatility | High beta (2.4) suggests stock price is highly sensitive to market swings. | High | Medium |

| Valuation | Unfavorable price-to-book and price-to-earnings ratios imply overvaluation. | Medium | Medium |

| Liquidity | Current and quick ratios are favorable, reducing short-term liquidity risk. | Low | Low |

| Debt Levels | Low debt-to-equity ratio reduces financial leverage risks. | Low | Low |

| Operational Efficiency | Extremely low asset turnover and negative return on invested capital. | High | High |

| Dividend Policy | No dividend yield may deter income-focused investors. | Medium | Low |

The most pressing risks for Arqit Quantum Inc. are its poor profitability and financial distress signals, including a negative net margin (-6668%) and a distressed Altman Z-Score (-0.22). These factors point to a high likelihood of financial instability. Additionally, the stock’s high beta (2.4) increases exposure to market volatility, which may amplify downside risk. Investors should exercise caution and prioritize risk management when considering this stock.

Should You Buy Arqit Quantum Inc.?

Arqit Quantum Inc. appears to be navigating significant financial distress with weak profitability and a slightly unfavorable competitive moat despite improving ROIC trends. Its leverage profile seems manageable, though the overall rating of C suggests considerable caution for investors.

Strength & Efficiency Pillars

Arqit Quantum Inc. shows solid financial health with a low debt-to-equity ratio of 0.03 and a current ratio of 2.69, indicating strong liquidity and conservative leverage management. Despite unfavorable profitability metrics, the firm’s revenue growth remains robust at 80.89% over the past year and an impressive 1006.24% over the 2021-2025 period, signaling operational scaling. While ROIC is negative at -127.45%, well below the WACC of 15.18%, Arqit’s improving ROIC trend suggests gradual progress in operational efficiency, although it is currently a value destroyer.

Weaknesses and Drawbacks

Profitability is a critical concern with a net margin of -6668.49% and ROE at -129.77%, reflecting persistent losses and inefficiency in capital use. Valuation metrics highlight elevated risk: a high price-to-book ratio of 19.62 points to potential overvaluation, while seller dominance at 72.85% in the recent period reinforces short-term market pressure. Furthermore, the Altman Z-score of -0.22 places the company in the distress zone, suggesting significant bankruptcy risk. Interest coverage is deeply negative at -782.67, indicating challenges in servicing debt despite low leverage.

Our Verdict about Arqit Quantum Inc.

Arqit Quantum’s long-term fundamental profile appears unfavorable due to sustained losses and financial distress indicators. Despite a bullish overall stock trend with a 32.24% price increase, recent seller dominance and a 28.49% price decline suggest cautious market sentiment. Therefore, despite some growth promise, the current profile might appear suitable only for investors with high risk tolerance and a long-term horizon, while others could consider a wait-and-see approach for a more favorable entry point.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Arqit Quantum Vs. Open Standards. My Bet Is On The Latter (NASDAQ:ARQQ) – Seeking Alpha (Jan 22, 2026)

- Arqit Launches Encryption Intelligence: Automated Cryptographic Discovery for Post-Quantum Migration and Compliance – Arqit Quantum Inc. (ARQQ) (Jan 22, 2026)

- Is ARQIT QUANTUM (ARQQ) Outperforming Other Computer and Technology Stocks This Year? – Yahoo Finance (Jan 06, 2026)

- QUBT’s Key 2025 Milestones Continue to Gain Industry Attention – The Globe and Mail (Jan 23, 2026)

- Precision Trading with Arqit Quantum Inc. (ARQQ) Risk Zones – Stock Traders Daily (Jan 17, 2026)

For more information about Arqit Quantum Inc., please visit the official website: arqit.uk