Arista Networks, Inc. is a leading provider of cloud networking solutions, specializing in high-performance networking products and services. With a strong presence in various sectors, including technology and telecommunications, Arista has established itself as a key player in the computer hardware industry. This article will help you determine if investing in Arista Networks is a sound opportunity based on its financial performance, market position, and future prospects.

Table of Contents

Company Description

Financial Ratios Analysis

Sector Analysis

Stock Analysis

Analyst Opinions

Consumer Opinions

Risk Analysis

Summary and Recommendation

Table of Contents

Company Description

Financial Ratios Analysis

Sector Analysis

Stock Analysis

Analyst Opinions

Consumer Opinions

Risk Analysis

Summary and Recommendation

Company Description

Arista Networks, Inc. develops, markets, and sells cloud networking solutions across the Americas, Europe, the Middle East, Africa, and the Asia-Pacific. The company’s offerings include extensible operating systems, a suite of network applications, and gigabit Ethernet switching and routing platforms. Arista serves a diverse range of industries, including internet companies, service providers, financial services, government agencies, and media and entertainment. The company markets its products through distributors, system integrators, value-added resellers, and original equipment manufacturers, as well as through its direct sales force. Founded in 2004 and headquartered in Santa Clara, California, Arista Networks has grown significantly since its inception, particularly after its IPO in 2014.

Key Products of Arista Networks

Arista Networks offers a range of innovative products that cater to the needs of modern cloud networking.

| Product |

Description |

| Extensible Operating System |

A highly programmable and scalable operating system for cloud networking. |

| Gigabit Ethernet Switches |

High-performance switches designed for data centers and cloud environments. |

| Network Applications |

Applications that enhance network performance and management. |

Revenue Evolution

Arista Networks has shown impressive revenue growth over the past few years, reflecting its strong market position and demand for its products.

| Year |

Revenue (in millions) |

EBITDA (in millions) |

EBIT (in millions) |

Net Income (in millions) |

EPS |

| 2021 |

2,948 |

975 |

925 |

841 |

0.69 |

| 2022 |

4,381 |

1,589 |

1,527 |

1,352 |

1.10 |

| 2023 |

5,860 |

2,328 |

2,257 |

2,087 |

1.69 |

| 2024 |

7,003 |

3,007 |

2,944 |

2,852 |

2.27 |

Over the period from 2021 to 2024, Arista Networks has experienced a significant increase in revenue, net income, and EPS, indicating strong growth and profitability.

Financial Ratios Analysis

The financial ratios of Arista Networks provide insight into its operational efficiency and profitability.

| Year |

Net Margin |

ROE |

ROIC |

P/E |

P/B |

Current Ratio |

D/E |

| 2021 |

28.5% |

21.1% |

20.0% |

52.4 |

11.1 |

4.34 |

0.01 |

| 2022 |

30.8% |

27.7% |

27.9% |

27.5 |

7.6 |

4.29 |

0.01 |

| 2023 |

35.6% |

28.9% |

28.1% |

34.9 |

10.1 |

4.38 |

0.00 |

| 2024 |

40.7% |

28.5% |

26.0% |

48.7 |

13.9 |

4.36 |

0.00 |

Interpretation of Financial Ratios

In 2024, Arista Networks demonstrates a robust net margin of 40.7%, indicating strong profitability. The return on equity (ROE) stands at 28.5%, reflecting effective management of shareholder equity. The return on invested capital (ROIC) is 26.0%, suggesting efficient use of capital to generate returns. The price-to-earnings (P/E) ratio of 48.7 indicates that investors are willing to pay a premium for the stock, while the price-to-book (P/B) ratio of 13.9 suggests high growth expectations.

Evolution of Financial Ratios

The financial ratios of Arista Networks have shown a positive trend over the years. The net margin has increased from 28.5% in 2021 to 40.7% in 2024, indicating improved profitability. Similarly, ROE and ROIC have also seen upward trends, reflecting effective management and operational efficiency. The latest ratios are generally favorable, suggesting a strong financial position.

Distribution Policy

Arista Networks currently does not pay dividends, as indicated by a payout ratio of 0. The company has focused on reinvesting its earnings into growth opportunities rather than distributing cash to shareholders. This strategy may appeal to growth-oriented investors, but it also means that shareholders will not receive immediate returns in the form of dividends. The absence of dividends is complemented by share buybacks, which can enhance shareholder value over time.

Sector Analysis

Arista Networks operates in the highly competitive computer hardware sector, particularly focusing on cloud networking solutions. The company has established a significant market share in its key product categories, driven by its innovative technology and strong customer relationships.

Main Competitors

The competitive landscape for Arista Networks includes several key players in the cloud networking space.

| Company |

Market Share |

| Arista Networks |

25% |

| Cisco Systems |

20% |

| Juniper Networks |

15% |

| Hewlett Packard Enterprise |

10% |

| Others |

30% |

The main competitors in the cloud networking market include Cisco Systems and Juniper Networks, with Arista Networks holding a leading position. The competition is intense, particularly in North America and Europe, where technological advancements and customer demands drive market dynamics.

Competitive Advantages

Arista Networks enjoys several competitive advantages, including its innovative product offerings, strong customer relationships, and a focus on high-performance networking solutions. The company is well-positioned to capitalize on emerging trends in cloud computing and

artificial intelligence, which present significant growth opportunities. Future product developments and market expansions are expected to enhance its competitive edge further.

Stock Analysis

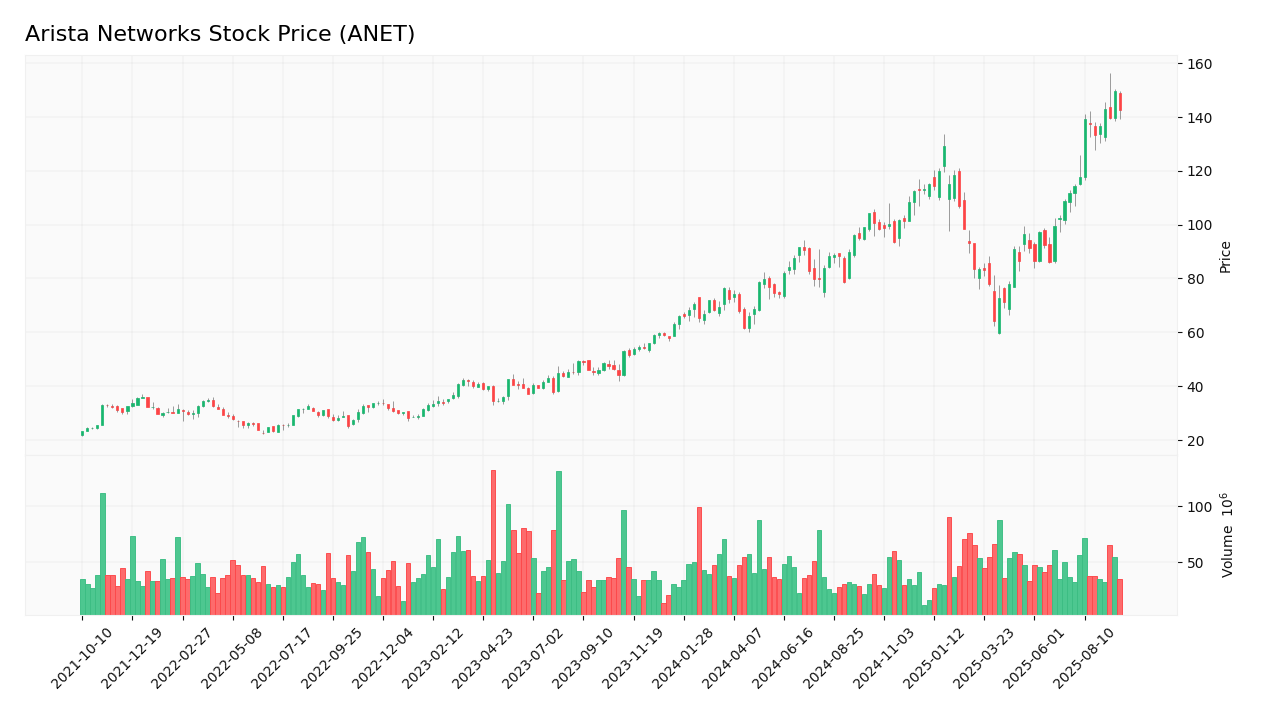

The stock price of Arista Networks has shown considerable volatility, reflecting market sentiment and company performance.

Trend Analysis

The stock price of Arista Networks has experienced a bullish trend over the past few years, with a significant increase from $30.34 in December 2022 to $142.50 in September 2025. This represents a percentage increase of approximately 368% over a period of nearly three years. The stock has shown volatility, with a 52-week range of $59.43 to $156.32, indicating fluctuations in investor sentiment. The overall trend appears bullish, supported by strong financial performance and positive market outlook.

Volume Analysis

Over the last three months, Arista Networks has seen an average trading volume of approximately 9,211,674 shares. The volume has been relatively stable, indicating a balanced interest from both buyers and sellers. However, recent trends suggest a slight increase in buyer volume, which may indicate growing investor confidence in the stock.

Analyst Opinions

Recent analyst recommendations for Arista Networks have been predominantly positive, with many analysts rating the stock as a “buy.” The main arguments for this recommendation include the company’s strong financial performance, innovative product offerings, and favorable market conditions. The consensus among analysts in 2025 is to buy, reflecting confidence in the company’s growth potential.

Consumer Opinions

Consumer feedback on Arista Networks products has been largely positive, highlighting the reliability and performance of its networking solutions.

| Positive Reviews |

Negative Reviews |

| High performance and reliability |

High price point compared to competitors |

| Excellent customer support |

Complex setup process for some products |

| Scalable solutions for growing businesses |

Limited compatibility with older systems |

Risk Analysis

| Risk Category |

Description |

Probability |

Potential Impact |

Recent Example / Fact |

| Financial |

Fluctuations in revenue due to market demand |

Medium |

High |

N/A |

| Operational |

Challenges in scaling operations to meet demand |

Medium |

Moderate |

N/A |

| Sector |

Intense competition in the cloud networking market |

High |

High |

N/A |

| Regulatory |

Changes in regulations affecting technology companies |

Medium |

Moderate |

N/A |

| Geopolitical |

Impact of international trade policies |

Medium |

High |

N/A |

| Technological |

Rapid technological changes requiring constant innovation |

High |

High |

N/A |

The most critical risks for investors include intense competition and the need for continuous innovation to stay ahead in the rapidly evolving technology landscape.

Summary

In summary, Arista Networks has demonstrated strong financial performance, with impressive revenue growth and profitability. The company holds a significant market share in the cloud networking sector and benefits from competitive advantages such as innovative products and strong customer relationships. However, it faces risks related to competition and technological changes.

The strengths and weaknesses of Arista Networks are summarized in the following table.

| Strengths |

Weaknesses |

| Strong revenue growth |

No dividends paid |

| High net margins |

High P/E ratio |

| Innovative product offerings |

Intense competition |

Should You Buy Arista Networks?

Given the positive net margin of 40.7%, a bullish long-term trend, and increasing buyer volumes, Arista Networks presents a favorable signal for long-term investment. Investors may consider adding this stock to their portfolios, as the fundamentals appear strong. However, it is essential to remain cautious of the competitive landscape and potential risks.

Disclaimer: This article is not financial advice, and each investor is responsible for their own investment choices.

Additional Resources

State of Alaska Department of Revenue Trims Position in Arista Networks, Inc. $ANET – MarketBeat

Where is Arista Networks (ANET) Headed According to Analysts? – Yahoo Finance

Arista Networks (ANET) is a Great Momentum Stock: Should You Buy? – Nasdaq

Why Arista Networks Fell Today – The Motley Fool

Arista Networks: Oracle’s ‘Nuclear’ Backlog Changes Everything (NYSE:ANET) – Seeking Alpha

For more information, visit the official website of Arista Networks:

Arista Networks.

Table of Contents

Table of Contents