Home > Analyses > Financial Services > Ares Management Corporation

Ares Management Corporation reshapes how capital flows to businesses and real estate worldwide. It leads the alternative asset management industry through diverse strategies in credit, private equity, and real estate. Known for disciplined capital allocation and innovative financing solutions, Ares impacts institutional and retail investors alike. As market dynamics evolve, I ask whether Ares’ robust fundamentals still justify its premium valuation and growth potential in 2026.

Table of contents

Business Model & Company Overview

Ares Management Corporation, founded in 1997 and headquartered in Los Angeles, commands a leading position in alternative asset management. It operates a cohesive ecosystem spanning tradable credit, direct lending, private equity, and real estate investments. The firm’s integrated approach targets under-capitalized companies and commercial real estate, reflecting a strategic focus on control or majority stakes to drive value creation.

The company’s revenue engine balances fee-based income from managing commingled and separately managed accounts with earnings from direct lending and proprietary investments. Its global footprint spans the Americas, Europe, and Asia, ensuring diversified market exposure. This multi-segment strategy underpins a durable economic moat, positioning Ares as a pivotal player shaping the alternative asset management landscape.

Financial Performance & Fundamental Metrics

I analyze Ares Management Corporation’s income statement, key financial ratios, and dividend payout policy to assess its core financial health and shareholder returns.

Income Statement

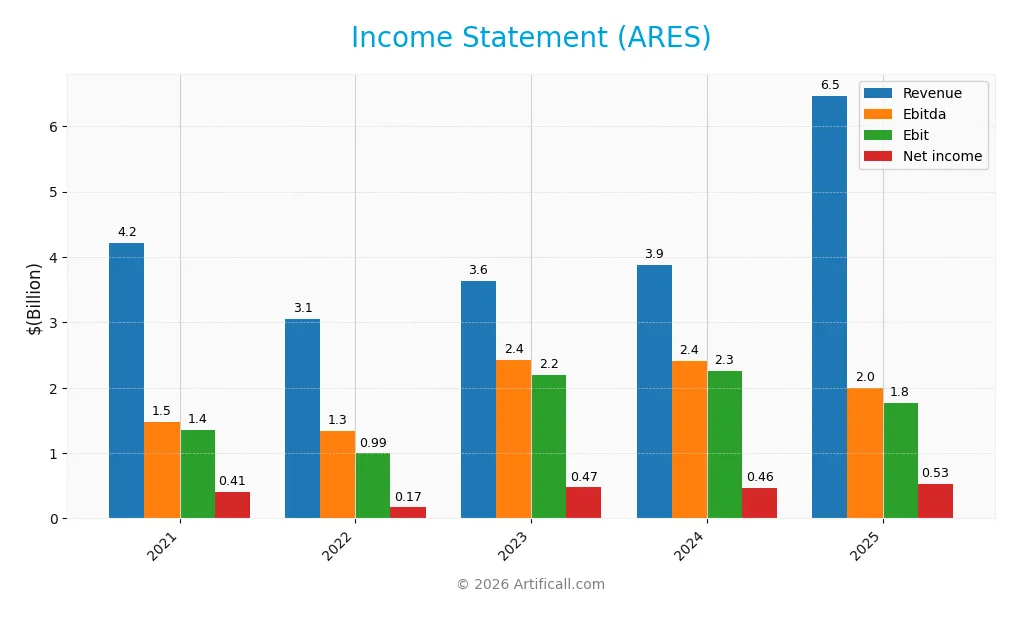

The table below presents Ares Management Corporation’s key income statement figures for fiscal years 2021 through 2025, illustrating revenue growth and profitability trends.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 4.21B | 3.06B | 3.63B | 3.88B | 6.47B |

| Cost of Revenue | 1.16B | 1.50B | 1.49B | 1.73B | 1.39B |

| Operating Expenses | 2.25B | 1.25B | 1.31B | 1.21B | 1.05B |

| Gross Profit | 3.05B | 1.56B | 2.15B | 2.15B | 1.94B |

| EBITDA | 1.47B | 1.33B | 2.43B | 2.41B | 2.00B |

| EBIT | 1.36B | 993M | 2.19B | 2.25B | 1.76B |

| Interest Expense | 295M | 483M | 861M | 978M | 0 |

| Net Income | 409M | 168M | 474M | 464M | 527M |

| EPS | 2.25 | 0.87 | 2.46 | 2.07 | 1.96 |

| Filing Date | 2022-02-28 | 2023-02-24 | 2024-02-27 | 2025-02-27 | 2026-02-05 |

Income Statement Evolution

Ares Management’s revenue rose 54% from 2021 to 2025, driven by a 67% surge in the latest year. However, gross profit declined nearly 10% in 2025, compressing margins despite revenue growth. Operating expenses scaled with revenue, keeping EBIT margin steady but net margin fell 16% over the period, reflecting margin pressure amid higher costs.

Is the Income Statement Favorable?

In 2025, revenue reached $6.47B with a gross margin of 30%, marked favorable by industry standards. EBIT margin held at 27%, indicating efficient operations. Net margin contracted to 8.2%, partly due to a sharp drop in gross profit and declines in net income growth and EPS. Overall, fundamentals show solid top-line expansion but margin deterioration.

Financial Ratios

The table below summarizes key financial ratios for Ares Management Corporation (ARES) across fiscal years 2021 to 2025, offering a clear view of its profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 9.71% | 5.48% | 13.06% | 11.94% | 8.15% |

| ROE | 22.40% | 10.54% | 25.05% | 13.09% | N/A |

| ROIC | 3.90% | 1.40% | 3.45% | 3.96% | N/A |

| P/E | 32.54 | 71.70 | 46.26 | 75.61 | 66.62 |

| P/B | 7.29 | 7.56 | 11.59 | 9.89 | 0.00 |

| Current Ratio | 0.63 | 0.64 | 0.73 | 0.98 | 0.00 |

| Quick Ratio | 0.63 | 0.64 | 0.73 | 0.98 | 0.00 |

| D/E | 6.85 | 8.39 | 8.32 | 3.71 | 0.00 |

| Debt-to-Assets | 57.83% | 60.60% | 63.71% | 52.84% | 0.00% |

| Interest Coverage | 2.72 | 0.63 | 0.97 | 0.97 | 0.00 |

| Asset Turnover | 0.19 | 0.14 | 0.15 | 0.16 | 0.00 |

| Fixed Asset Turnover | 17.63 | 12.97 | 9.77 | 5.64 | 0.00 |

| Dividend Yield | 4.54% | 6.96% | 4.70% | 3.74% | 2.77% |

Evolution of Financial Ratios

From 2021 to 2025, Ares Management Corporation’s ROE data is unavailable for 2025, but earlier years showed fluctuating profitability with a notable net margin decline to 8.15% in 2025. The current ratio worsened over time, reaching zero in 2025, indicating deteriorating liquidity. Debt-to-equity improved in 2025, suggesting reduced leverage risk despite prior volatility.

Are the Financial Ratios Fovorable?

In 2025, profitability is neutral with an 8.15% net margin, but ROE and ROIC are unfavorable or missing, signaling weak returns on equity and capital. Liquidity ratios are unfavorable due to zero current and quick ratios, raising red flags. Leverage ratios are favorable, showing controlled debt levels. Market valuations, including a high P/E of 66.62, are unfavorable, while dividend yield at 2.77% is favorable. Overall, the financial ratios appear slightly unfavorable.

Shareholder Return Policy

Ares Management Corporation maintains a dividend payout ratio exceeding 180%, with dividends per share rising to $4.48 in 2025. The annual dividend yield stands near 2.77%, supported by share buybacks, though payout levels suggest potential pressure on free cash flow coverage.

This distribution strategy may risk sustainability due to the high payout ratio relative to earnings. However, buybacks complement dividends to return capital, aligning with long-term value creation if cash flow generation stabilizes and debt levels remain manageable.

Score analysis

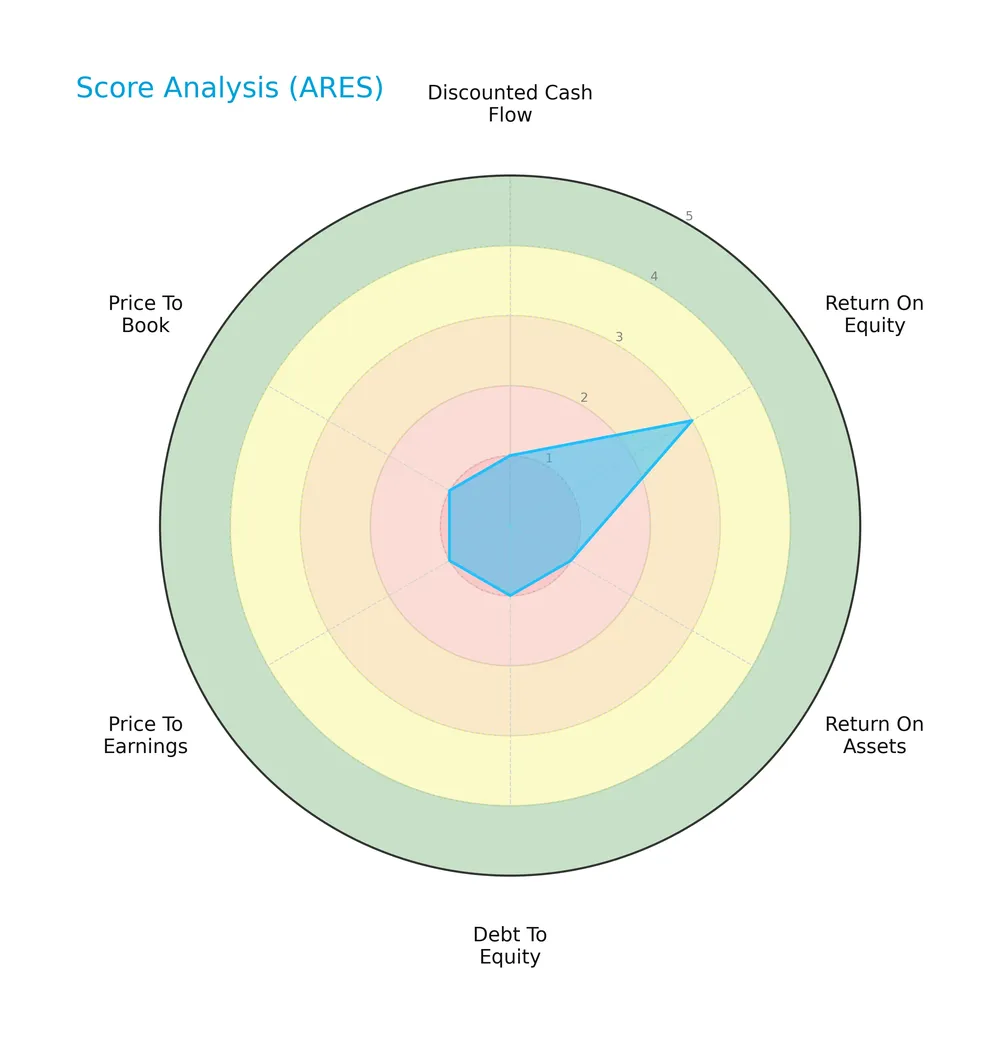

Below is a radar chart illustrating Ares Management Corporation’s key financial scores across valuation and profitability metrics:

The scores reveal very unfavorable marks in discounted cash flow, return on assets, debt to equity, price to earnings, and price to book ratios. Return on equity stands out moderately, suggesting some profitability strength amid broader weaknesses.

Is the company in good financial health?

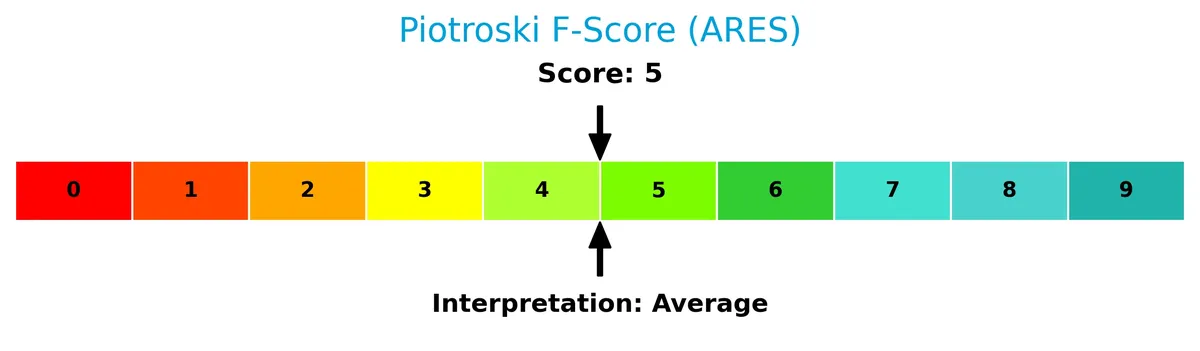

The Piotroski F-Score diagram highlights the company’s financial condition based on nine key criteria:

Ares Management’s Piotroski Score of 5 places it in an average category. This score indicates moderate financial health, reflecting a balanced mix of strengths and weaknesses in profitability, leverage, and liquidity metrics.

Competitive Landscape & Sector Positioning

This section analyzes Ares Management Corporation’s strategic positioning, revenue segments, key products, and main competitors. I will examine its competitive advantages within the asset management sector. The goal is to determine whether Ares holds a sustainable edge over its peers.

Strategic Positioning

Ares Management Corporation maintains a diversified product portfolio across asset classes, including credit, private equity, real estate, and direct lending. It operates globally in the US, Europe, and Asia, balancing institutional and retail investor segments with a mix of management fees and carried interest revenue streams.

Revenue by Segment

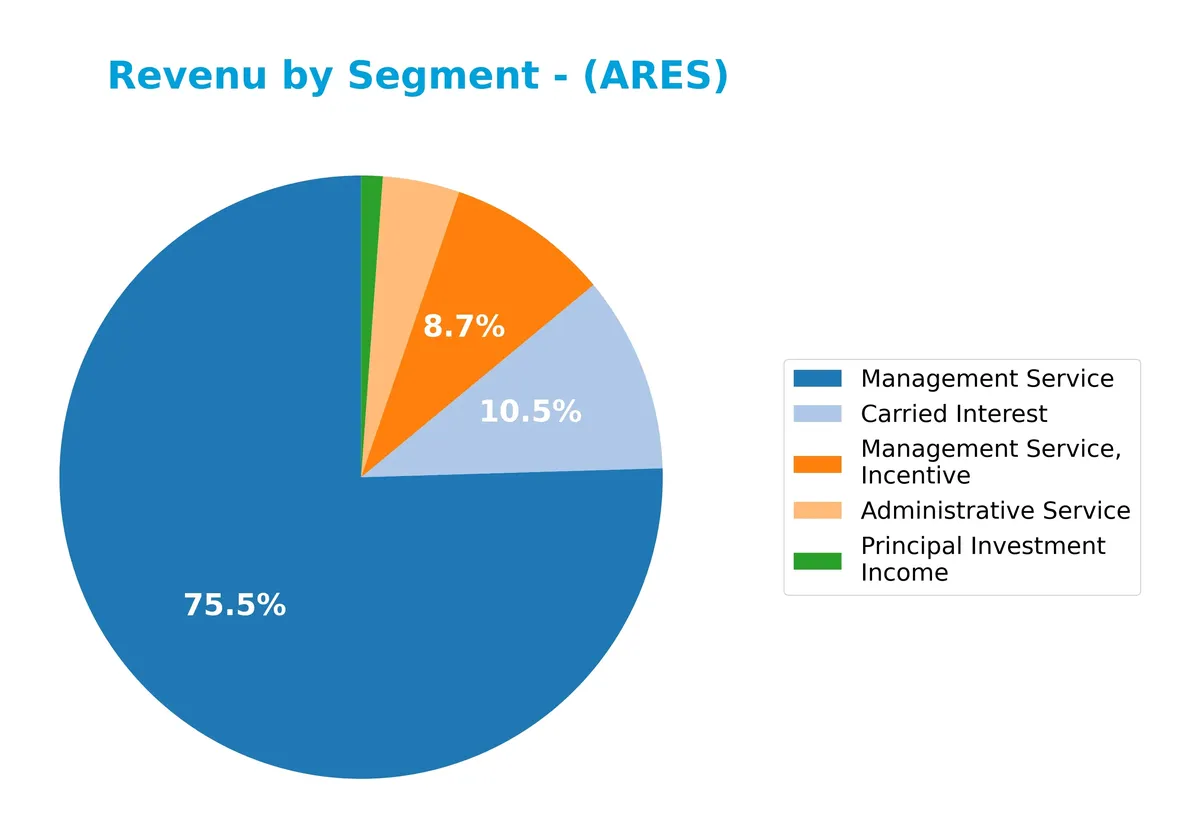

This pie chart illustrates Ares Management Corporation’s revenue distribution by segment for the fiscal year ending 2024, highlighting the company’s diversified income sources.

Management Service dominates with $2.99B, reflecting Ares’ core fee-generating business. Carried Interest at $417M shows volatility, down from $631M in 2023, signaling performance-linked income fluctuations. Administrative Service at $163M and Management Service, Incentive at $345M provide steady support. Principal Investment Income remains modest at $45M, indicating less reliance on investment gains. The 2024 profile confirms a strong fee-based model with some concentration risk in performance fees.

Key Products & Brands

The table below details Ares Management Corporation’s primary products and revenue sources:

| Product | Description |

|---|---|

| Administrative Service | Provides administrative support services to investment funds and clients. |

| Carried Interest | Performance fees earned when investment returns exceed predefined benchmarks. |

| Management Service | Fees from managing investment funds and accounts, including institutional and retail investors. |

| Management Service, Incentive | Additional incentive fees linked to fund performance beyond base management fees. |

| Principal Investment Income | Income from the company’s own investments across various asset classes. |

| Credit Group | Investment management focused on tradable and non-investment grade corporate credit markets. |

| Direct Lending Group | Provides financing solutions to small-to-medium sized companies. |

| Private Equity Group | Focuses on majority or shared-control investments in under-capitalized companies. |

| Real Estate Group | Invests in new developments, asset repositioning, and self-originated financing for commercial real estate. |

Ares Management generates revenue predominantly through management fees, performance incentives, and carried interest. Its diversified asset management spans credit, private equity, direct lending, and real estate sectors.

Main Competitors

A total of 11 competitors operate in the Asset Management industry; the following table lists the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Blackstone Inc. | 190.6B |

| BlackRock, Inc. | 168.1B |

| KKR & Co. Inc. | 114.9B |

| The Bank of New York Mellon Corporation | 81.6B |

| Ares Management Corporation | 54.6B |

| Ameriprise Financial, Inc. | 45.9B |

| State Street Corporation | 36.1B |

| Northern Trust Corporation | 26.3B |

| T. Rowe Price Group, Inc. | 23.1B |

| Franklin Resources, Inc. | 12.4B |

Ares Management ranks 5th among its peers with a market cap 22% the size of the leader, Blackstone. It sits below both the average market cap of the top 10 competitors (75.4B) and the sector median (45.9B). The company enjoys a substantial 90.5% gap above its nearest rival, indicating a clear buffer in scale within this competitive group.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does ARES have a competitive advantage?

Ares Management Corporation exhibits some competitive strengths supported by favorable margins and strong revenue growth over recent years. However, a declining return on invested capital (ROIC) trend signals caution regarding its long-term value creation capability.

Looking ahead, Ares operates across multiple asset management segments, including tradable credit, direct lending, private equity, and real estate. Its geographic presence in the US, Europe, and Asia may offer growth opportunities through new products and expanding markets.

SWOT Analysis

This SWOT analysis distills Ares Management Corporation’s core strategic factors to guide investment decisions.

Strengths

- diversified alternative asset management

- strong revenue growth (53.6% over 5 years)

- favorable gross and EBIT margins

Weaknesses

- declining ROIC trend

- unfavorable net margin and EPS growth recently

- unfavorable liquidity ratios (current and quick)

Opportunities

- expansion in Asia and Europe markets

- growing demand for direct lending

- potential in real estate financing

Threats

- high valuation (PE 66.6) limits upside

- market volatility affecting credit markets

- regulatory risks in financial services

Ares boasts robust top-line growth and solid margins but faces pressure on returns and liquidity metrics. The company must leverage global expansion and niche financing to offset valuation and market risks.

Stock Price Action Analysis

The following weekly chart displays Ares Management Corporation’s stock price behavior over the past 12 months, highlighting key price fluctuations and trend patterns:

Trend Analysis

Over the past year, ARES’s stock price declined by 1.25%, indicating a bearish trend. The price range spanned from a high of 198.22 to a low of 118.04, with trend deceleration noted. Volatility remains elevated, reflected by a standard deviation of 18.74, signaling persistent price fluctuations.

Volume Analysis

Trading volume for ARES is increasing, with buyers accounting for 53.15% overall and 53.67% in the recent three months. Buyer dominance is slight but consistent, suggesting moderate investor interest and participation skewed toward accumulation rather than distribution.

Target Prices

Analysts show a bullish consensus on Ares Management Corporation with a strong target range.

| Target Low | Target High | Consensus |

|---|---|---|

| 155 | 215 | 187.29 |

The target prices indicate expectations for solid upside potential, reflecting confidence in Ares’ strategic positioning and earnings growth.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews recent analyst ratings and consumer feedback to gauge market sentiment toward Ares Management Corporation.

Stock Grades

Here are the latest verified analyst grades for Ares Management Corporation from recognized financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2026-02-06 |

| Oppenheimer | Maintain | Outperform | 2026-02-06 |

| TD Cowen | Maintain | Buy | 2026-01-14 |

| UBS | Maintain | Neutral | 2026-01-13 |

| Barclays | Maintain | Overweight | 2026-01-09 |

| Barclays | Maintain | Overweight | 2025-12-12 |

| TD Cowen | Maintain | Buy | 2025-11-04 |

| Keefe, Bruyette & Woods | Maintain | Outperform | 2025-11-04 |

| Morgan Stanley | Maintain | Equal Weight | 2025-10-21 |

| Oppenheimer | Upgrade | Outperform | 2025-10-14 |

The consensus leans strongly positive, dominated by buy and outperform ratings. Barclays and TD Cowen consistently maintain favorable views, while UBS and Morgan Stanley hold more neutral stances, reflecting some divergence in market expectations.

Consumer Opinions

Ares Management Corporation draws mixed reactions from its clients, reflecting both strong asset management capabilities and areas needing improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| “Ares delivers consistent returns and solid client service.” | “Customer support can be slow during peak periods.” |

| “Their diverse investment options suit long-term growth.” | “Fees feel high compared to some competitors.” |

| “Transparent reporting builds trust in their management.” | “Occasional delays in communication create frustration.” |

Overall, consumers praise Ares for reliable performance and transparency. However, recurring critiques focus on customer service responsiveness and fee structures. These factors warrant attention to maintain client loyalty.

Risk Analysis

Below is a summary table outlining key risks for Ares Management Corporation, highlighting their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | High beta (1.54) exposes Ares to amplified market swings. | High | High |

| Valuation Risk | Elevated P/E of 66.6 suggests potential overvaluation. | Medium | Medium |

| Profitability | Zero ROE and ROIC indicate weak capital efficiency. | Medium | High |

| Liquidity | Unfavorable current and quick ratios signal potential cash strain. | Low | Medium |

| Debt Management | Favorable debt metrics reduce default risk but require vigilance. | Low | Low |

| Dividend Safety | Dividend yield at 2.77% appears sustainable but depends on earnings. | Medium | Medium |

Ares faces significant market risk due to its high beta, making it sensitive to economic cycles. Its lofty valuation combined with zero ROE and ROIC raises concerns about sustainable profitability. Liquidity ratios are weak or unavailable, posing a red flag for short-term financial health. Despite these challenges, debt levels remain well-managed, limiting solvency risk. Investors must weigh these factors carefully given the slightly unfavorable overall financial ratio profile.

Should You Buy Ares Management Corporation?

Analytically, Ares Management Corporation appears to have moderate profitability with improving operational efficiency but shows a declining competitive moat. Despite a challenging leverage profile, its overall rating is C-, suggesting cautious interpretation of its financial health and value creation potential.

Strength & Efficiency Pillars

Ares Management Corporation shows operational robustness with a solid gross margin of 30.01% and an EBIT margin of 27.22%. The net margin of 8.15% reflects decent profitability despite some recent margin pressure. Its interest expense at 0.0% indicates effective cost control on debt servicing. While ROE and ROIC are unfavorable or unavailable, the company maintains positive revenue growth trends over the medium term, signaling operational resilience.

Weaknesses and Drawbacks

The company faces significant challenges with an unfavorable P/E ratio of 66.62, suggesting a highly stretched valuation that may not justify current earnings. Liquidity metrics are weak, as both current and quick ratios are unavailable or unfavorable, raising concerns about short-term financial flexibility. Leverage appears manageable but lacks detailed data. The absence of an Altman Z-Score prevents a full solvency assessment, adding uncertainty to the risk profile.

Our Final Verdict about Ares Management Corporation

Given the incomplete solvency data and stretched valuation, the investment case for Ares Management Corporation remains cautious. Despite operational margins and moderate buyer dominance at 53.67%, the lack of clear financial safety signals and unfavorable profitability metrics suggest the stock might appear speculative. Investors should weigh these risks carefully before considering exposure.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Ares: The Decline Post Earnings Is A Gift (Rating Upgrade) (NYSE:ARES) – Seeking Alpha (Feb 06, 2026)

- Ares Management Corporation Reports Fourth Quarter and Full Year 2025 Results – Yahoo Finance (Feb 05, 2026)

- Ares Management upgraded at Deutsche after Q4 earnings announcement – MSN (Feb 06, 2026)

- Ares Management Corporation (NYSE:ARES) Q4 2025 Earnings Call Transcript – Insider Monkey (Feb 06, 2026)

- Shares of private capital giants sink on worries AI risks hitting growth – Financial Times (Feb 05, 2026)

For more information about Ares Management Corporation, please visit the official website: aresmgmt.com