Home > Analyses > Financial Services > Arch Capital Group Ltd.

Arch Capital Group Ltd. underpins risk management across global markets, shaping how businesses and individuals secure their futures. It commands a leading position in diversified insurance, reinsurance, and mortgage insurance, boasting a broad portfolio from casualty coverages to specialty financial protections. Renowned for innovation and disciplined underwriting, Arch delivers stability in a volatile sector. The key question now is whether its robust fundamentals and strategic positioning justify continued growth and valuation in today’s evolving market landscape.

Table of contents

Business Model & Company Overview

Arch Capital Group Ltd., founded in 1995 and headquartered in Pembroke, Bermuda, stands as a formidable force in the diversified insurance sector. With a workforce of 7,200, it delivers a comprehensive ecosystem of insurance, reinsurance, and mortgage insurance products. Its portfolio spans casualty, property, marine, aviation, and specialty coverages, unified by a mission to provide tailored risk solutions across industries and geographies.

The company’s revenue engine balances primary insurance, reinsurance, and mortgage insurance streams, each distributed through independent brokers worldwide. Arch maintains a strategic foothold in the Americas, Europe, and Asia, leveraging its diverse product mix to optimize risk and revenue. Its durable economic moat stems from deep underwriting expertise and global broker networks that shape the evolving insurance landscape.

Financial Performance & Fundamental Metrics

I analyze Arch Capital Group Ltd.’s income statement, key financial ratios, and dividend payout policy to assess its core financial health and shareholder value.

Income Statement

The table below presents Arch Capital Group Ltd.’s income statement highlights for fiscal years 2021 through 2025 in USD.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 8.92B | 9.66B | 13.29B | 16.93B | 14.54B |

| Cost of Revenue | 5.89B | 6.77B | 8.56B | 10.99B | 9.51B |

| Operating Expenses | 1.30B | 1.52B | 1.63B | 1.46B | 1.38B |

| Gross Profit | 3.04B | 2.89B | 4.74B | 5.94B | 5.03B |

| EBITDA | 2.32B | 1.72B | 3.61B | 4.85B | 3.91B |

| EBIT | 2.24B | 1.62B | 3.52B | 4.62B | 3.70B |

| Interest Expense | 139M | 131M | 133M | 141M | 72M |

| Net Income | 2.16B | 1.48B | 4.44B | 4.31B | 4.40B |

| EPS | 5.34 | 3.90 | 11.94 | 11.47 | 11.84 |

| Filing Date | 2022-02-25 | 2023-02-24 | 2024-02-23 | 2025-02-27 | 2026-02-09 |

Income Statement Evolution

Arch Capital Group Ltd. revenue rose 63% from 2021 to 2025 but declined 14% in the latest year. Net income more than doubled over the period, with a 19% drop last year offset by margin improvements. Gross and EBIT margins remain strong at 34.6% and 25.5%, respectively, signaling consistent operational efficiency despite recent top-line pressure.

Is the Income Statement Favorable?

The 2025 income statement shows solid fundamentals with a 30.3% net margin and interest expense below 1% of revenue, indicating cost control. Despite a revenue and EBIT decline, net margin and EPS grew 19% and 4%, respectively, reflecting improved profitability. Overall, the income statement presents a favorable profile with strong margins and income growth tempered by recent revenue weakness.

Financial Ratios

The following table presents key financial ratios for Arch Capital Group Ltd. (ACGL) from 2021 to 2025, illustrating profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 24% | 15% | 33% | 25% | 30% |

| ROE | 16% | 11% | 24% | 21% | 0% |

| ROIC | 3.3% | 0% | 0% | 0% | 0% |

| P/E | 8.1 | 15.7 | 6.2 | 8.0 | 0 |

| P/B | 1.29 | 1.79 | 1.49 | 1.65 | 0 |

| Current Ratio | 2.36 | 0 | 0 | 0 | 0 |

| Quick Ratio | 2.36 | 0 | 0 | 0 | 0 |

| D/E | 0.20 | 0.21 | 0.15 | 0.13 | 0 |

| Debt-to-Assets | 6.0% | 5.7% | 4.6% | 3.8% | 0% |

| Interest Coverage | 12.5 | 10.5 | 23.4 | 31.7 | 50.7 |

| Asset Turnover | 0.20 | 0.20 | 0.23 | 0.24 | 0 |

| Fixed Asset Turnover | 0 | 0 | 0 | 0 | 0 |

| Dividend Yield | 0.27% | 0.17% | 0.15% | 5.54% | 0% |

Evolution of Financial Ratios

Arch Capital Group’s Return on Equity shows no reported data for 2025, indicating a gap in profitability metrics. The Current Ratio remains at zero across recent years, signaling either missing data or potential liquidity concerns. Debt-to-Equity Ratio trends to zero in 2025, suggesting reduced leverage or unavailable information. Profitability margins remain strong, with net margin at 30.25% in 2025, reflecting stable profitability despite ratio reporting gaps.

Are the Financial Ratios Fovorable?

In 2025, Arch Capital Group posts a favorable net profit margin of 30.25% and a robust interest coverage ratio above 50, demonstrating strong earnings and debt-servicing ability. However, the absence of current and quick ratios, along with an unfavorable Return on Equity and asset turnover, highlight liquidity and efficiency weaknesses. Debt-related ratios appear favorable, but the overall ratio evaluation is slightly unfavorable, reflecting mixed financial health signals.

Shareholder Return Policy

Arch Capital Group Ltd. (ACGL) does not pay dividends as of 2025, maintaining a zero dividend payout ratio and yield. The company’s focus appears to be on reinvestment or other capital allocation strategies, with no disclosed share buyback programs in the recent data.

This absence of shareholder distributions suggests ACGL prioritizes long-term value creation through growth or operational investments. Without dividends or buybacks, sustainability depends on continued profitable reinvestment, aligning shareholder returns with the company’s strategic capital use.

Score analysis

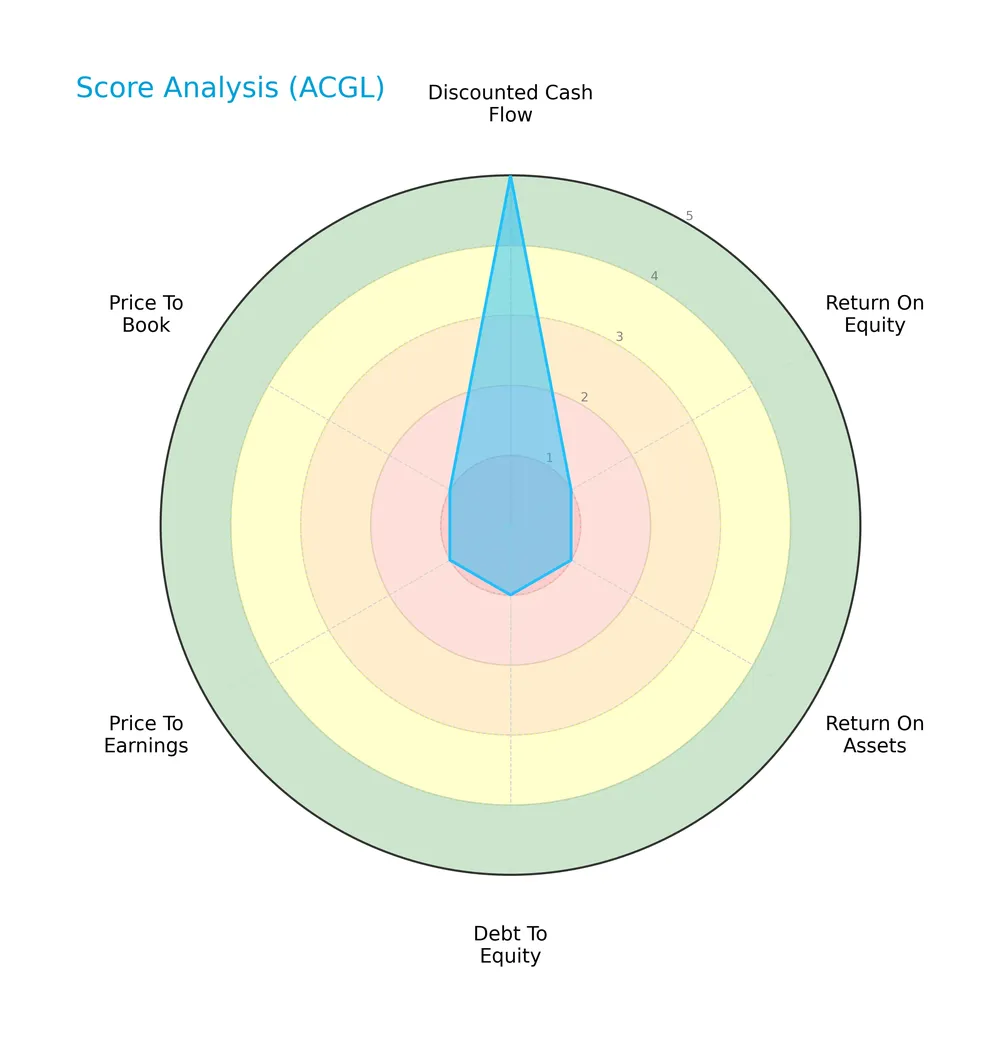

The radar chart below illustrates Arch Capital Group Ltd.’s key valuation and financial performance scores:

The discounted cash flow score stands at a very favorable 5, contrasting sharply with poor returns and valuation metrics. Return on equity, assets, debt to equity, price-to-earnings, and price-to-book scores all sit at a low 1, signaling significant financial and market challenges.

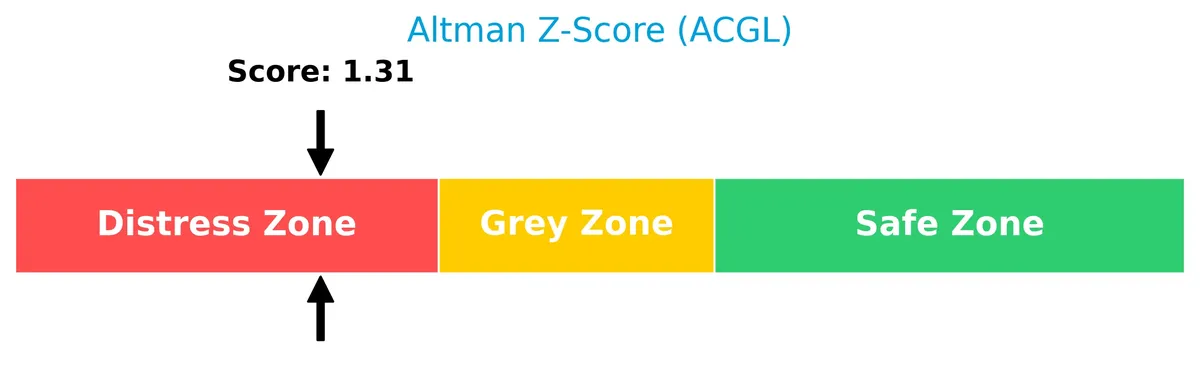

Analysis of the company’s bankruptcy risk

Arch Capital Group’s Altman Z-Score of 1.31 places it in the distress zone, indicating a high risk of bankruptcy and financial instability:

Is the company in good financial health?

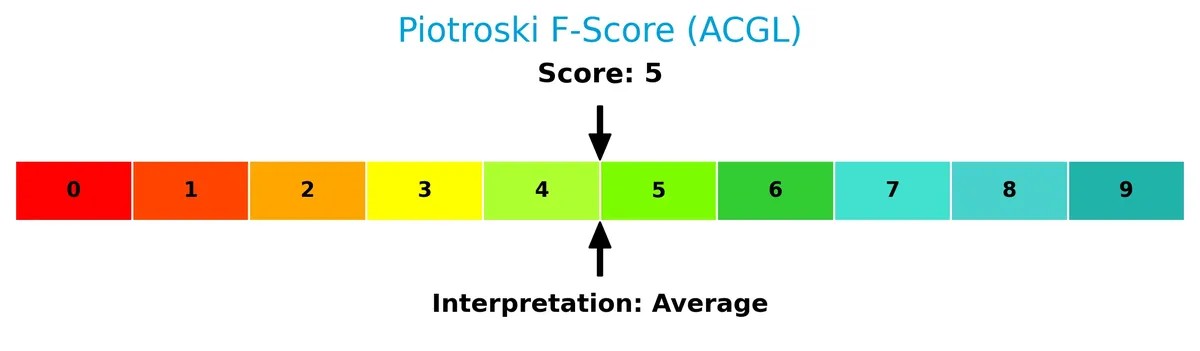

The Piotroski Score diagram presents an average financial health rating for Arch Capital Group Ltd.:

A Piotroski Score of 5 suggests the company exhibits moderate financial strength. It neither signals robust health nor severe weakness, indicating a mixed picture of profitability, leverage, and operational efficiency.

Competitive Landscape & Sector Positioning

This sector analysis examines Arch Capital Group Ltd.’s strategic positioning, revenue segments, key products, and main competitors. I will assess whether Arch Capital holds a competitive advantage over its industry peers.

Strategic Positioning

Arch Capital Group Ltd. maintains a diversified portfolio across insurance, reinsurance, and mortgage segments, with revenues growing steadily to 14.1B in 2024. Its geographic reach spans global markets, emphasizing balanced exposure and risk distribution within the financial services sector.

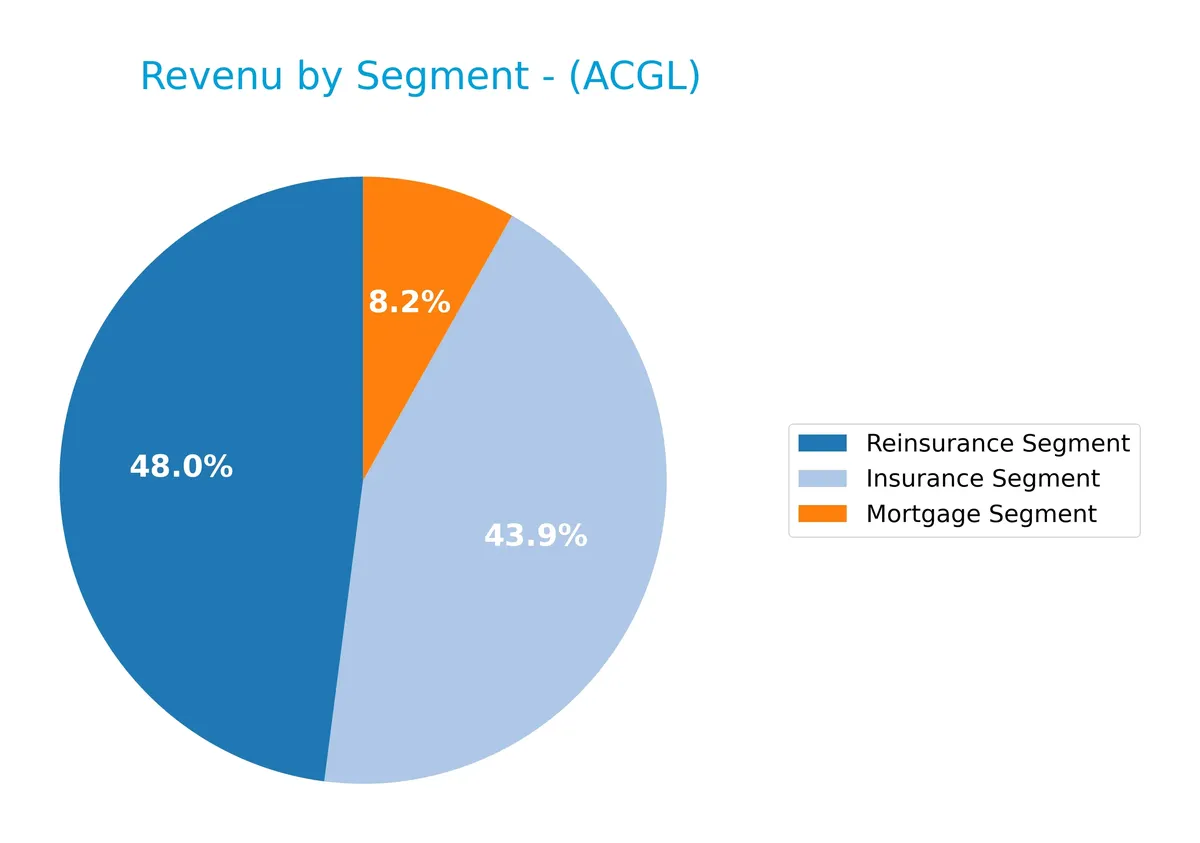

Revenue by Segment

This pie chart displays Arch Capital Group Ltd.’s revenue distribution by segment for the fiscal year 2024, highlighting key sources of income.

In 2024, the Reinsurance Segment leads with $7.2B, followed closely by the Insurance Segment at $6.6B. The Mortgage Segment contributes a smaller $1.2B. Over recent years, both Reinsurance and Insurance have accelerated steadily, underscoring their critical roles. However, Mortgage revenue shows relative stagnation, signaling potential concentration risk if reliance on the top two segments intensifies.

Key Products & Brands

Arch Capital Group Ltd. offers diverse insurance, reinsurance, and mortgage insurance products globally:

| Product | Description |

|---|---|

| Insurance Segment | Provides casualty coverages, liability insurance, workers’ compensation, commercial automobile, property, energy, marine, and aviation. |

| Reinsurance Segment | Offers casualty, marine, aviation, surety, accident, health, catastrophe, agriculture, trade credit, political risk, and life reinsurance. |

| Mortgage Segment | Provides direct mortgage insurance and mortgage reinsurance products. |

Arch Capital’s product mix spans primary insurance to complex reinsurance solutions and mortgage insurance. Its diversified portfolio supports risk management across multiple industries worldwide.

Main Competitors

Arch Capital Group Ltd. faces competition from 5 key players; here are the top 5 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Berkshire Hathaway Inc. | 1.07T |

| American International Group, Inc. | 45.5B |

| The Hartford Financial Services Group, Inc. | 38.2B |

| Arch Capital Group Ltd. | 34.9B |

| Principal Financial Group, Inc. | 20.1B |

Arch Capital Group Ltd. ranks 4th among its peers, with just 3.34% of the market cap of Berkshire Hathaway, the sector leader. It remains below both the average market cap of top competitors (242B) and the sector median (38.2B). The company holds a 6.84% market cap gap from the next competitor above.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does ACGL have a competitive advantage?

Arch Capital Group Ltd. presents a diverse insurance and reinsurance portfolio with favorable margins and strong net income growth over the 2021-2025 period. However, its return on invested capital (ROIC) trend is declining, and ROIC vs. WACC data is unavailable, limiting a full competitive advantage assessment.

Looking ahead, ACGL’s expansion across insurance, mortgage, and reinsurance segments offers growth opportunities. Continued innovation and market diversification remain key to sustaining its financial performance amid evolving industry risks.

SWOT Analysis

This SWOT analysis highlights Arch Capital Group Ltd.’s key strategic factors shaping its competitive position and growth potential.

Strengths

- diversified insurance and reinsurance portfolio

- strong net margin at 30.25%

- low interest expense of 0.5%

Weaknesses

- recent 14% revenue decline

- unfavorable ROE and ROIC metrics

- Altman Z-score in distress zone

Opportunities

- expanding reinsurance market

- growth in mortgage insurance segment

- leveraging broker network globally

Threats

- intense industry competition

- exposure to catastrophic losses

- regulatory and economic uncertainty

Arch Capital’s strong profitability and diversified offerings provide a solid base, yet recent revenue declines and weak returns on capital signal caution. The firm must capitalize on market growth while managing financial and operational risks to sustain competitive advantage.

Stock Price Action Analysis

The weekly stock chart below illustrates Arch Capital Group Ltd.’s price movements and volatility over the past 12 months:

Trend Analysis

Over the past 12 months, ACGL’s stock price rose 8.75%, indicating a bullish trend with accelerating momentum. The price ranged from a low of 86.31 to a high of 114.86. The volatility measured by a 6.7% standard deviation underscores notable price swings during this period.

Volume Analysis

Trading volumes have increased, with buyer volume at 762M outpacing seller volume at 448M over the recent 2.5 months. The 63% buyer dominance signals strong buyer-driven activity, suggesting rising investor confidence and heightened market participation.

Target Prices

Analysts set a clear target consensus for Arch Capital Group Ltd. based on current market conditions.

| Target Low | Target High | Consensus |

|---|---|---|

| 93 | 125 | 104 |

The target range reflects a moderately bullish outlook, with consensus suggesting a potential upside from current levels.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews analyst ratings and consumer feedback to provide a balanced view of Arch Capital Group Ltd.’s market perception.

Stock Grades

Below is a summary of the latest stock grades provided by leading financial institutions for Arch Capital Group Ltd.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Overweight | 2026-02-11 |

| RBC Capital | Maintain | Outperform | 2026-02-11 |

| Cantor Fitzgerald | Maintain | Neutral | 2026-01-14 |

| Goldman Sachs | Maintain | Sell | 2026-01-08 |

| Barclays | Maintain | Equal Weight | 2026-01-08 |

| Evercore ISI Group | Maintain | In Line | 2026-01-07 |

| JP Morgan | Maintain | Neutral | 2026-01-07 |

| Keefe, Bruyette & Woods | Maintain | Market Perform | 2026-01-06 |

| Roth Capital | Maintain | Buy | 2025-12-02 |

| Morgan Stanley | Maintain | Overweight | 2025-11-17 |

The overall trend shows a balanced mix of buy and hold ratings, with no recent upgrades or downgrades. Notably, Goldman Sachs stands alone with a sell rating, contrasting with generally positive or neutral views from other firms.

Consumer Opinions

Investor sentiment around Arch Capital Group Ltd. (ACGL) reveals a mix of appreciation for its stability and concerns over premium pricing.

| Positive Reviews | Negative Reviews |

|---|---|

| Strong underwriting discipline maintains solid risk management. | Some clients find premiums higher than competitors. |

| Consistent dividend payouts attract income-focused investors. | Occasional delays in claims processing noted. |

| Transparent communication builds trust during market volatility. | Limited product variety in certain insurance segments. |

Overall, consumers praise Arch Capital’s risk control and steady dividends. However, pricing and service speed occasionally dampen satisfaction. These patterns underscore the company’s reputable but not flawless market positioning.

Risk Analysis

Below is a summary table highlighting key risks Arch Capital Group Ltd. (ACGL) faces, including their probability and impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Distress | Altman Z-Score at 1.31 signals high bankruptcy risk, placing the company in the distress zone. | High | Severe |

| Profitability Risk | Zero ROE and ROIC indicate poor capital returns, raising concerns about value creation. | Medium | High |

| Liquidity Risk | Unfavorable current and quick ratios suggest potential difficulties meeting short-term obligations. | Medium | Medium |

| Valuation Risk | Zero or very low P/E and P/B ratios conflict with market price, indicating valuation inconsistencies. | Medium | Medium |

| Dividend Risk | No dividend yield undermines income-focused investors and may signal cash flow constraints. | Low | Low |

| Debt Management | Favorable debt to equity and interest coverage ratios reduce bankruptcy risk from leverage. | Low | Low |

The most pressing concern is ACGL’s Altman Z-Score of 1.31, firmly in the distress zone, indicating significant financial instability. While the company maintains strong interest coverage, its zero returns on equity and invested capital reveal weak operational efficiency. Investors should monitor liquidity ratios closely, as poor short-term coverage may exacerbate stress during market volatility.

Should You Buy Arch Capital Group Ltd.?

Arch Capital Group Ltd. appears to be in financial distress with a weak leverage profile and declining operational returns. While it suggests manageable debt, the deteriorating profitability and average financial strength contribute to a cautious C rating overall.

Strength & Efficiency Pillars

Arch Capital Group Ltd. delivers strong operational margins, with a gross margin of 34.6% and an EBIT margin of 25.46%. The company maintains a robust net margin of 30.25%, signaling efficient cost management and profitability. Interest expenses remain exceptionally low at 0.5%, highlighting effective capital cost control. However, key return metrics like ROE and ROIC register at 0%, limiting insights into value creation. The absence of a WACC figure prevents confirming if Arch Capital is a value creator.

Weaknesses and Drawbacks

Arch Capital is in financial distress, as indicated by an Altman Z-Score of 1.31, well below the 1.8 threshold. This suggests a high bankruptcy risk despite favorable margins. The company’s liquidity ratios and leverage metrics show unfavorable trends, raising solvency concerns. Valuation metrics such as P/E and P/B are unavailable or weak, complicating market pricing assessment. Despite bullish overall and recent buyer-dominant trends, the distress signal overshadows short-term market optimism and creates a significant risk profile.

Our Final Verdict about Arch Capital Group Ltd.

Despite excellent operational profitability, Arch Capital’s low Altman Z-Score of 1.31 places it in the distress zone. This solvency risk makes the investment profile highly speculative and too risky for conservative capital. Investors might consider waiting for clearer financial stabilization before committing, as current fundamentals suggest vulnerability despite positive price momentum.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Management’s Confidence Boosted Arch Capital Group Ltd. (ACGL) – Yahoo Finance (Feb 10, 2026)

- Arch Capital Group (ACGL) Receives Enhanced Price Target from We – GuruFocus (Feb 11, 2026)

- Madison Asset Management LLC Has $427.15 Million Position in Arch Capital Group Ltd. $ACGL – MarketBeat (Feb 11, 2026)

- Forecasting The Future: 12 Analyst Projections For Arch Capital Group – Benzinga (Feb 11, 2026)

- Arch Capital Group Ltd. Reports 2025 Fourth Quarter Results – Business Wire (Feb 09, 2026)

For more information about Arch Capital Group Ltd., please visit the official website: archgroup.com