Home > Analyses > Technology > AppLovin Corporation

AppLovin Corporation revolutionizes mobile app marketing and monetization, directly shaping how millions engage with their favorite apps daily. As a dominant force in software applications, AppLovin offers cutting-edge platforms like AppDiscovery, Adjust, and MAX, blending marketing precision with real-time ad optimization. Renowned for innovation and a vast developer ecosystem, the company sets industry standards. Yet, with recent volatility, I question whether its fundamentals still support its lofty market valuation and future growth.

Table of contents

Business Model & Company Overview

AppLovin Corporation, founded in 2011 and headquartered in Palo Alto, CA, commands a leading position in the mobile app software sector. It operates a cohesive platform that empowers developers to market and monetize their apps effectively. Its ecosystem integrates marketing, analytics, and in-app bidding tools, creating a seamless environment that drives app growth and revenue worldwide.

The company’s revenue engine balances software solutions across marketing and monetization, including AppDiscovery, Adjust, and MAX. These platforms serve advertisers and publishers through real-time auctions and analytics, capturing demand across the Americas, Europe, and Asia. AppLovin’s competitive advantage lies in its ability to optimize app revenue globally, reinforcing its role as a pivotal force shaping the future of mobile app monetization.

Financial Performance & Fundamental Metrics

I analyze AppLovin Corporation’s income statement, key financial ratios, and dividend payout policy to assess its core profitability and capital allocation efficiency.

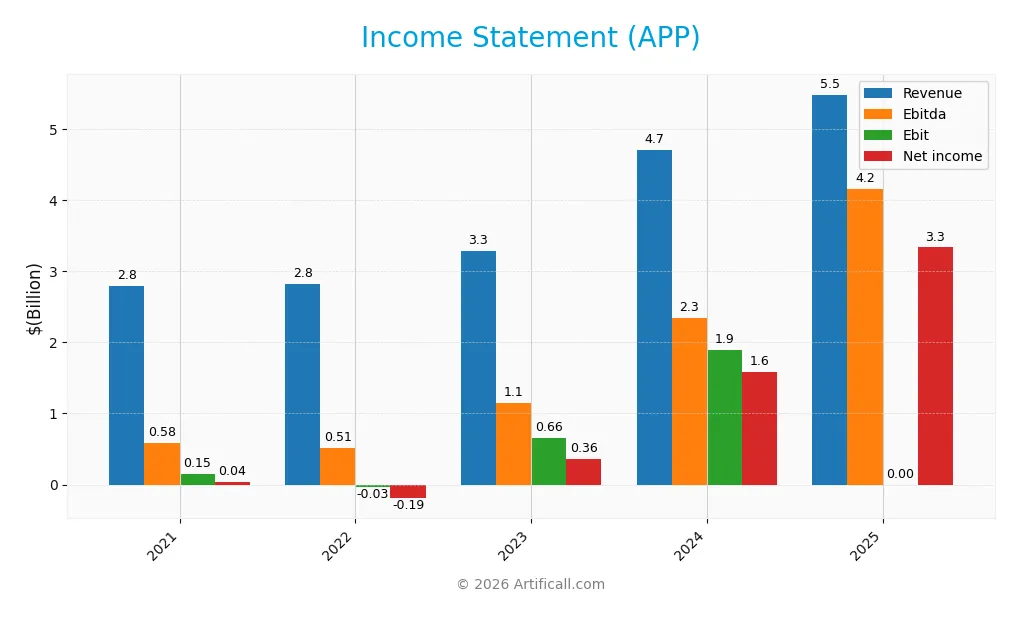

Income Statement

Below is AppLovin Corporation’s Income Statement for fiscal years 2021 through 2025, showing key profitability and earnings metrics.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 2.79B | 2.82B | 3.28B | 4.71B | 5.48B |

| Cost of Revenue | 988M | 1.26B | 1.06B | 1.17B | 665M |

| Operating Expenses | 1.65B | 1.61B | 1.58B | 1.67B | 664M |

| Gross Profit | 1.81B | 1.56B | 2.22B | 3.54B | 4.82B |

| EBITDA | 581M | 514M | 1.15B | 2.34B | 4.15B |

| EBIT | 149M | -33M | 656M | 1.89B | 0* |

| Interest Expense | 103M | 172M | 276M | 318M | 207M |

| Net Income | 35M | -193M | 357M | 1.58B | 3.33B |

| EPS | 0.10 | -0.52 | 1.01 | 4.68 | 9.84 |

| Filing Date | 2022-03-11 | 2023-02-28 | 2024-02-26 | 2025-02-27 | 2026-02-11 |

*Note: EBIT for 2025 is reported as zero in the source data.

Income Statement Evolution

AppLovin’s revenue nearly doubled from 2.79B in 2021 to 5.48B in 2025, reflecting robust growth. Net income surged even more, soaring from 31.9M in 2021 to 3.33B in 2025. Gross margin improved significantly, stabilizing at 87.9%, while net margin rose sharply to 60.8%, indicating enhanced profitability and operational efficiency.

Is the Income Statement Favorable?

In 2025, AppLovin posted strong fundamentals with a 16.4% revenue growth and a 35.9% increase in gross profit year-over-year. Despite a zero EBIT margin, the company maintained a high EBITDA of 4.15B and a favorable interest expense ratio of -3.78%. Net income margin expanded substantially to 60.8%, supporting a favorable income statement evaluation overall.

Financial Ratios

The following table summarizes key financial ratios for AppLovin Corporation (APP) over the last five fiscal years, illustrating profitability, liquidity, leverage, and market valuation metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 1.3% | -6.8% | 10.9% | 33.5% | 60.8% |

| ROE | 1.7% | -10.1% | 28.4% | 145% | 0 |

| ROIC | 2.0% | -0.8% | 13.1% | 38.7% | 0 |

| P/E | 864 | -20.3 | 39.3 | 69.1 | 68.5 |

| P/B | 14.3 | 2.1 | 11.2 | 100.1 | 0 |

| Current Ratio | 5.05 | 3.35 | 1.71 | 2.19 | 0 |

| Quick Ratio | 5.05 | 3.35 | 1.71 | 2.19 | 0 |

| D/E | 1.56 | 1.72 | 2.53 | 3.26 | 0 |

| Debt-to-Assets | 54.0% | 56.1% | 59.3% | 60.6% | 0 |

| Interest Coverage | 1.45 | -0.28 | 2.35 | 5.89 | -20.1 |

| Asset Turnover | 0.45 | 0.48 | 0.61 | 0.80 | 0 |

| Fixed Asset Turnover | 20.8 | 20.3 | 14.8 | 23.7 | 0 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

From 2021 to 2025, AppLovin’s Return on Equity (ROE) remained weak, showing no improvement by 2025. The current ratio declined significantly, reaching zero in 2025, indicating deteriorated liquidity. Debt-to-equity ratios showed volatility, peaking in 2024 before dropping to zero in 2025. Profitability margins, especially net margin, improved sharply by 2025.

Are the Financial Ratios Favorable?

In 2025, profitability metrics like net margin appear favorable at 60.83%, yet ROE and ROIC are absent, marking them unfavorable. Liquidity ratios, including current and quick ratios, are zero, signaling weak liquidity. Leverage ratios such as debt-to-equity are favorable, but negative interest coverage raises risk concerns. Market valuation ratios like P/E are elevated and unfavorable, reflecting stretched investor expectations. Overall, the financial ratios lean toward an unfavorable assessment.

Shareholder Return Policy

AppLovin Corporation does not pay dividends, reflecting a reinvestment strategy aligned with its high-growth profile. The company focuses on expanding operations and innovation rather than distributing cash, which supports long-term value creation.

Despite no dividend payouts, AppLovin engages in share buybacks. This approach can enhance shareholder value by reducing share count and signaling confidence. The policy appears consistent with sustainable capital allocation for growth-oriented firms.

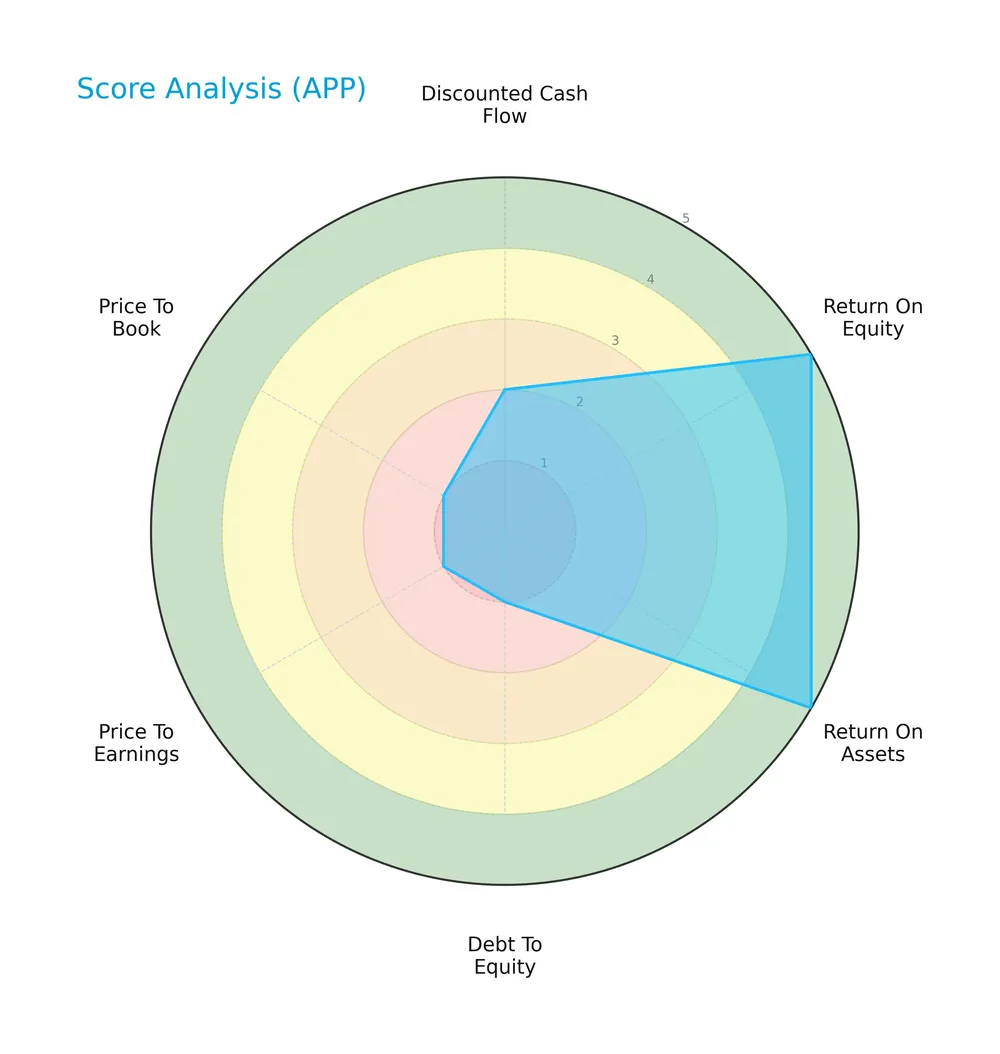

Score analysis

The following radar chart illustrates AppLovin Corporation’s key financial scores across multiple valuation and performance metrics:

AppLovin scores very favorably on return on equity and assets, highlighting operational efficiency. However, it shows very unfavorable marks on debt-to-equity, price-to-earnings, and price-to-book, indicating valuation and leverage concerns. The discounted cash flow score is also unfavorable, contributing to a moderate overall score.

Analysis of the company’s bankruptcy risk

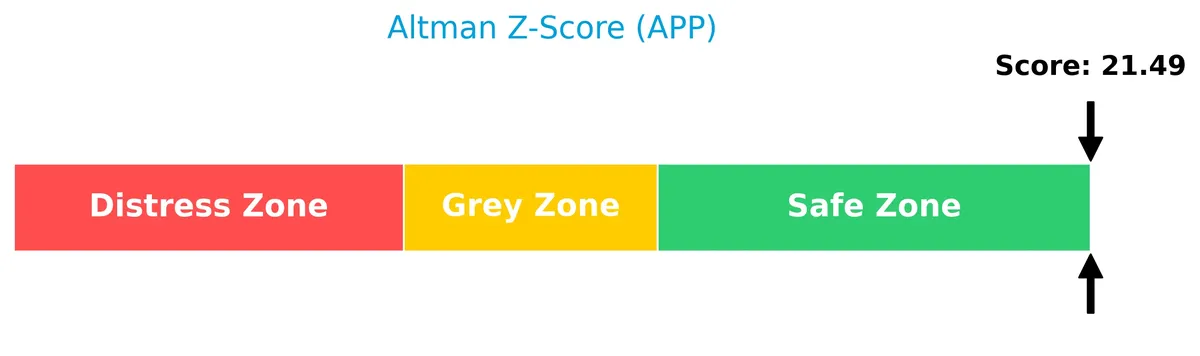

AppLovin’s Altman Z-Score places it well within the safe zone, indicating a low risk of bankruptcy and strong financial stability:

Is the company in good financial health?

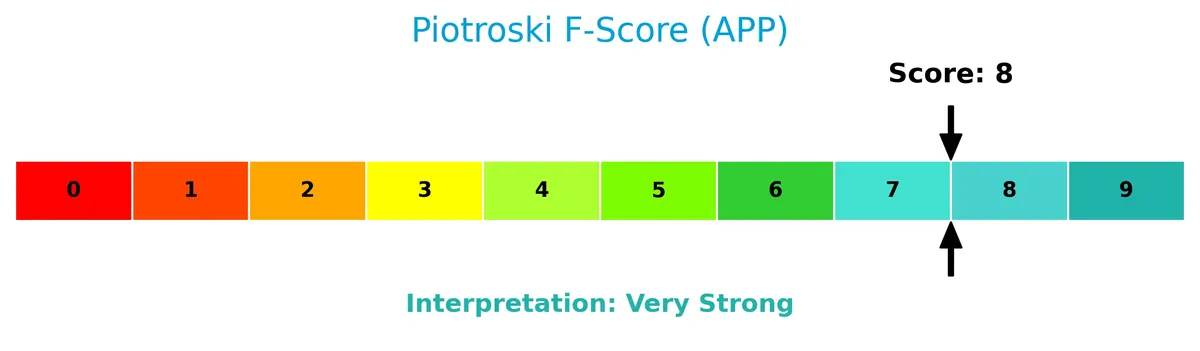

The Piotroski Score diagram below reflects the company’s strong financial health and robust fundamentals:

With a very strong Piotroski Score of 8, AppLovin demonstrates solid profitability, liquidity, and operational efficiency, signaling a financially healthy company.

Competitive Landscape & Sector Positioning

This section analyzes AppLovin Corporation’s strategic position within the software application sector. It covers revenue by segment, key products, main competitors, and competitive advantages. I will assess whether AppLovin holds a sustainable competitive edge over its rivals.

Strategic Positioning

AppLovin concentrates on software for mobile app marketing and monetization, with a product mix shifting from Apps toward Advertising and Software Platforms. Geographically, it maintains significant exposure to the US while steadily expanding international revenue, balancing domestic dominance with global growth.

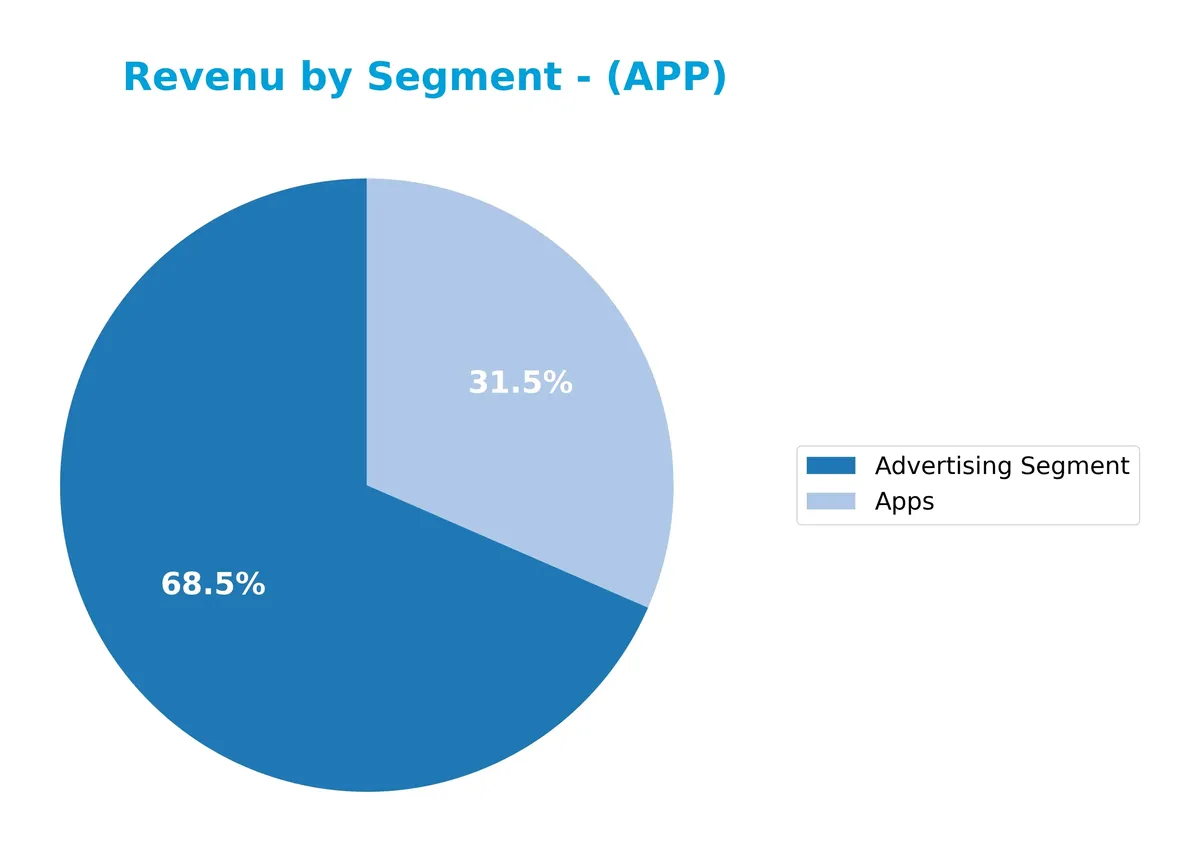

Revenue by Segment

This pie chart illustrates AppLovin Corporation’s revenue distribution by segment for the fiscal year 2024, showing how each business area contributes to total sales.

AppLovin’s revenue mix in 2024 is dominated by the Advertising Segment with $3.2B, signaling a strong shift from prior years where Apps and Software Platform segments were more balanced. The Apps segment generated $1.5B, reflecting a slowdown compared to previous years’ declines. This concentration in advertising suggests the company leans heavily on ad monetization, raising concentration risk while capitalizing on digital marketing growth.

Key Products & Brands

AppLovin Corporation’s key products and brands drive its software-based platform for mobile app marketing and monetization:

| Product | Description |

|---|---|

| AppDiscovery | Marketing software that matches advertiser demand with publisher supply through auctions. |

| Adjust | Analytics platform helping marketers measure, optimize campaigns, and protect user data. |

| MAX | In-app bidding software that runs real-time competitive auctions to maximize advertising inventory value. |

| Advertising Segment | Revenue stream from marketing solutions connecting advertisers and publishers via digital ads. |

| Apps | Revenue generated from mobile applications developed or monetized through the platform. |

| Software Platform | Suite of integrated tools supporting app developers in marketing, analytics, and monetization. |

AppLovin’s portfolio centers on software solutions enhancing mobile app growth and monetization. Its revenues come primarily from advertising and app-related services, reflecting a scalable platform addressing developers’ marketing and monetization needs.

Main Competitors

AppLovin Corporation faces 33 competitors in the Technology sector. Below is the top 10 list by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Salesforce, Inc. | 242B |

| Shopify Inc. | 210B |

| AppLovin Corporation | 209B |

| Intuit Inc. | 175B |

| Uber Technologies, Inc. | 172B |

| ServiceNow, Inc. | 153B |

| Cadence Design Systems, Inc. | 84B |

| Snowflake Inc. | 73B |

| Autodesk, Inc. | 61B |

| Workday, Inc. | 55B |

AppLovin ranks 3rd among 33 competitors, with a market cap at 51.2% of the leader Salesforce. It sits below the average market cap of the top 10 (143.6B) but above the sector median (18.8B). The company maintains a 68.85% gap from the next bigger rival Shopify, highlighting a strong but challenged position.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does APP have a competitive advantage?

AppLovin Corporation presents some competitive strength with a high gross margin of 88% and a robust net margin near 61%, signaling efficient cost control and profitability. The company’s software solutions connect advertisers and publishers via real-time auctions, creating a specialized platform in mobile app marketing.

Looking ahead, AppLovin’s growth in international markets, with revenues outside the U.S. rising to $2B in 2024, suggests expanding global reach. Continued innovation in in-app bidding and analytics software offers opportunities to deepen client integration and capture additional advertising spend.

SWOT Analysis

This analysis highlights AppLovin Corporation’s internal capabilities and external environment to guide strategic decisions.

Strengths

- Strong revenue growth of 96% over five years

- High net margin at 60.8%

- Very strong Piotroski score of 8

- Safe Altman Z-Score indicating financial stability

Weaknesses

- Negative EBIT margin at 0%

- Unfavorable ROIC trend declining sharply

- Weak liquidity ratios (current and quick ratios at 0)

- High beta of 2.49 implies elevated volatility

Opportunities

- Expanding international market with Rest of World revenue doubling since 2021

- Increasing demand for mobile app marketing solutions

- Potential to improve operational efficiency and EBIT profitability

Threats

- Intense competition in software application sector

- High valuation with PE at 68.5 raises risk of correction

- Exposure to macroeconomic cycles impacting ad spend

- Rapid technological change requiring ongoing innovation

AppLovin shows robust growth and profitability strengths but faces operational inefficiencies and valuation risks. The company must leverage its market expansion and strong financial health to improve margins and mitigate volatility.

Stock Price Action Analysis

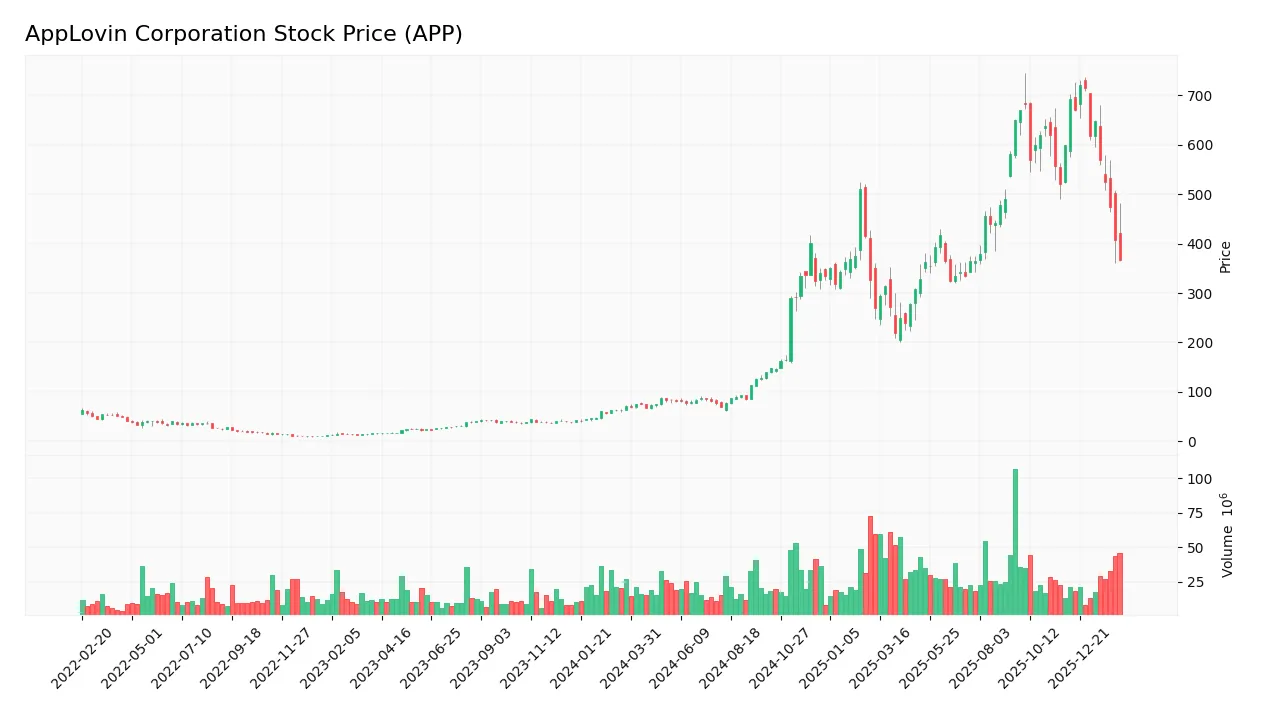

The weekly stock chart below illustrates AppLovin Corporation’s price movements over the last 12 months, capturing key highs, lows, and overall momentum:

Trend Analysis

Over the past 12 months, AppLovin’s stock surged 415.11%, signaling a strong bullish trend. The price peaked at 721.37 and bottomed at 66.8, but the pace of gains has decelerated recently. Volatility remains elevated with a standard deviation of 196.61.

Volume Analysis

Trading volume has been increasing, with buyers accounting for 62.74% of total activity historically. However, over the last three months, sellers dominated with only 25.27% buyer volume. This shift suggests weakening bullish momentum and cautious investor sentiment.

Target Prices

Analysts set a clear target consensus for AppLovin Corporation, reflecting cautious optimism.

| Target Low | Target High | Consensus |

|---|---|---|

| 543 | 835 | 690.93 |

The target range from 543 to 835 suggests varied expectations, with a consensus near 691 indicating moderate upside potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines AppLovin Corporation’s recent analyst ratings alongside consumer sentiment and feedback trends.

Stock Grades

Here are the latest verified analyst grades for AppLovin Corporation as of February 12, 2026:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-02-12 |

| Piper Sandler | Maintain | Overweight | 2026-02-12 |

| Wedbush | Maintain | Outperform | 2026-02-12 |

| Needham | Maintain | Buy | 2026-02-12 |

| BTIG | Maintain | Buy | 2026-02-12 |

| Scotiabank | Maintain | Sector Outperform | 2026-02-12 |

| Goldman Sachs | Maintain | Neutral | 2026-02-12 |

| RBC Capital | Maintain | Outperform | 2026-02-12 |

| UBS | Maintain | Buy | 2026-02-12 |

| Wells Fargo | Maintain | Overweight | 2026-02-12 |

Grades consistently maintain a positive bias toward AppLovin, with multiple firms issuing Buy and Outperform ratings. Only Goldman Sachs holds a Neutral stance, indicating cautious optimism among analysts.

Consumer Opinions

AppLovin Corporation enjoys a lively mix of consumer sentiment, reflecting both enthusiasm for its innovation and concern over customer service.

| Positive Reviews | Negative Reviews |

|---|---|

| “AppLovin’s platform drives excellent user engagement.” | “Customer support response times are slow.” |

| “Their ad targeting significantly boosts ROI.” | “Pricing plans feel confusing and costly.” |

| “Intuitive interface simplifies campaign management.” | “Occasional glitches disrupt app performance.” |

Overall, users praise AppLovin’s cutting-edge ad technology and effectiveness. However, recurring complaints about customer service delays and pricing complexity suggest areas for operational improvement.

Risk Analysis

Below is a summary of key risks facing AppLovin Corporation, ranked by likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Valuation Risk | Elevated P/E ratio (68.47) signals potential overvaluation, increasing downside risk. | High | High |

| Liquidity Risk | Zero current and quick ratios indicate weak short-term liquidity, posing solvency concerns. | Medium | High |

| Profitability Risk | ROE and ROIC are at zero, reflecting operational inefficiency despite strong net margin. | Medium | Medium |

| Market Volatility | Beta of 2.49 suggests high sensitivity to market swings, raising share price volatility. | High | Medium |

| Debt Risk | Although debt-to-equity and debt-to-assets ratios are zero, negative interest coverage is red flag. | Low | Medium |

AppLovin’s most pressing risks stem from its high valuation and severely impaired liquidity ratios. The stock’s 20% recent drop reflects investor concerns. Despite a strong Altman Z-Score and Piotroski Score, these liquidity and profitability metrics warrant caution.

Should You Buy AppLovin Corporation?

AppLovin appears to be a company with improving profitability and very strong operational efficiency. Despite an unclear moat and significant leverage concerns, its overall rating of B- suggests a moderately favorable profile supported by strong financial health signals.

Strength & Efficiency Pillars

AppLovin Corporation exhibits robust operational efficiency, evidenced by an exceptional gross margin of 87.86% and a remarkable net margin of 60.83%. The company’s Piotroski score of 8 signals very strong financial health. Despite the absence of available ROIC and WACC data, high profitability margins underscore effective cost management and value generation. Historically in tech-driven sectors, such margins support competitive positioning and reinvestment capacity.

Weaknesses and Drawbacks

The company faces notable valuation and leverage concerns. A steep price-to-earnings ratio of 68.47 signals an elevated premium, increasing downside risk if growth slows. Liquidity metrics such as the current and quick ratios are unavailable or unfavorable, posing potential short-term solvency issues. While debt-to-equity is favorable, negative interest coverage suggests stress servicing debt. Recent market activity shows seller dominance at 74.73%, indicating short-term selling pressure and volatility.

Our Final Verdict about AppLovin Corporation

The company’s strong profitability and financial health, supported by a safe Altman Z-Score of 21.49, suggest a fundamentally sound profile. However, recent seller dominance and high valuation ratios suggest caution. Despite long-term strength, recent market pressure may warrant a wait-and-see approach for a better entry point. AppLovin might appear attractive for investors with a tolerance for short-term volatility and premium pricing.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Why AppLovin (APP) Stock Is Down Today – Yahoo Finance (Feb 11, 2026)

- A Big AppLovin Critic Walked Back Some Of Its Claims. The Stock Jumped. – Investopedia (Feb 09, 2026)

- AppLovin Corporation $APP Shares Sold by Mitchell Capital Management Co. – MarketBeat (Feb 12, 2026)

- APP Stock Quote Price and Forecast – CNN (Feb 09, 2026)

- Oversold Conditions For Applovin (APP) – Nasdaq (Feb 12, 2026)

For more information about AppLovin Corporation, please visit the official website: applovin.com