Home > Analyses > Technology > Apple Inc.

Apple Inc. transforms everyday life with its seamless blend of innovative technology and elegant design, making its products an integral part of millions worldwide. As a dominant force in consumer electronics, Apple’s flagship devices—iPhone, Mac, iPad—and its expanding ecosystem of services set industry standards for quality and user experience. With a reputation for cutting-edge innovation and a vast market influence, the key question now is whether Apple’s robust fundamentals justify its lofty market valuation and growth prospects moving forward.

Table of contents

Business Model & Company Overview

Apple Inc., founded in 1976 and headquartered in Cupertino, California, stands as a dominant force in the consumer electronics industry. Its core business weaves together smartphones, personal computers, tablets, wearables, and accessories into a seamless ecosystem. This integration extends to platforms like the App Store and a suite of subscription services, creating a user experience that spans devices and digital content worldwide.

The company’s revenue engine balances robust hardware sales with rapidly growing software and recurring services, including cloud offerings, digital content subscriptions, and payment solutions. Apple maintains a strategic presence across the Americas, Europe, and Asia, leveraging global distribution channels. Its competitive advantage lies in this tightly integrated ecosystem, which not only drives customer loyalty but also shapes the future trajectory of technology and consumer engagement.

Financial Performance & Fundamental Metrics

In this section, I analyze Apple Inc.’s income statement, key financial ratios, and dividend payout policy to assess its overall financial health and shareholder returns.

Income Statement

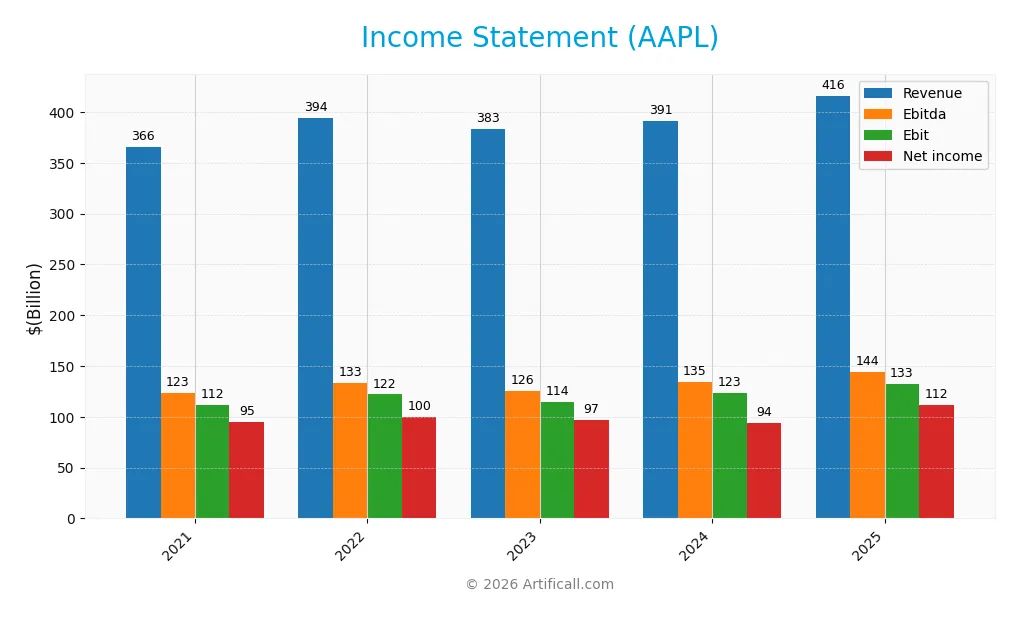

Below is Apple Inc.’s Income Statement overview for the fiscal years 2021 through 2025, detailing key financial metrics in USD.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 366B | 394B | 383B | 391B | 416B |

| Cost of Revenue | 213B | 224B | 214B | 210B | 221B |

| Operating Expenses | 44B | 51B | 55B | 57B | 62B |

| Gross Profit | 153B | 171B | 169B | 181B | 195B |

| EBITDA | 123B | 133B | 126B | 135B | 144B |

| EBIT | 112B | 122B | 114B | 123B | 133B |

| Interest Expense | 2.6B | 2.9B | 3.9B | 0 | 0 |

| Net Income | 95B | 100B | 97B | 94B | 112B |

| EPS | 5.67 | 6.15 | 6.16 | 6.11 | 7.49 |

| Filing Date | 2021-10-29 | 2022-10-28 | 2023-11-03 | 2024-11-01 | 2025-10-31 |

Income Statement Evolution

From 2021 to 2025, Apple Inc. demonstrated a favorable overall growth trajectory, with revenue increasing by 13.76% and net income rising 18.3%. The gross margin showed a positive trend, reaching 46.91%, while the net margin remained relatively stable at 26.92%. Operating expenses grew in line with revenue, slightly weighing on margin expansion but not significantly affecting profitability.

Is the Income Statement Favorable?

In fiscal 2025, Apple reported revenue of $416B and net income of $112B, reflecting a 6.43% revenue growth and a 12.28% improvement in net margin year-on-year. EBITDA and EBIT margins were robust at 34.7% and 31.89%, respectively, supported by zero interest expense. The EPS rose sharply by 22.7%, confirming strong earnings quality. Overall, the fundamentals for 2025 appear favorable, with solid profitability and efficient cost management.

Financial Ratios

The following table presents key financial ratios for Apple Inc. over the fiscal years 2021 to 2025, reflecting profitability, valuation, liquidity, leverage, efficiency, and dividend metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 26% | 25% | 25% | 24% | 27% |

| ROE | 150% | 197% | 156% | 165% | 152% |

| ROIC | 39% | 45% | 43% | 44% | 52% |

| P/E | 26 | 24 | 28 | 37 | 34 |

| P/B | 39 | 48 | 43 | 61 | 52 |

| Current Ratio | 1.07 | 0.88 | 0.99 | 0.87 | 0.89 |

| Quick Ratio | 1.02 | 0.85 | 0.94 | 0.83 | 0.86 |

| D/E | 2.16 | 2.61 | 1.99 | 2.09 | 1.52 |

| Debt-to-Assets | 39% | 38% | 35% | 33% | 31% |

| Interest Coverage | 41.2 | 40.7 | 29.1 | 0 | 0 |

| Asset Turnover | 1.04 | 1.12 | 1.09 | 1.07 | 1.16 |

| Fixed Asset Turnover | 7.39 | 7.51 | 7.05 | 8.56 | 6.82 |

| Dividend Yield | 0.59% | 0.61% | 0.56% | 0.44% | 0.40% |

Evolution of Financial Ratios

Over the period from 2021 to 2025, Apple Inc.’s Return on Equity (ROE) showed variability with a peak around 197% in 2022 before settling at approximately 152% in 2025, indicating strong but fluctuating profitability. The Current Ratio steadily declined from above 1.07 in 2021 to 0.89 in 2025, signaling reduced short-term liquidity. The Debt-to-Equity Ratio also decreased from about 2.16 in 2021 to 1.52 in 2025, reflecting some deleveraging efforts while maintaining significant leverage.

Are the Financial Ratios Fovorable?

In 2025, profitability ratios such as net margin (27%) and ROE (152%) are considered favorable, alongside solid returns on invested capital (52%) and positive asset and fixed asset turnovers. However, liquidity ratios like the current ratio (0.89) and quick ratio (0.86) are neutral to unfavorable, indicating tight liquidity. Leverage remains elevated with a debt-to-equity ratio of 1.52 marked as unfavorable, while the interest coverage ratio is favorable. Market valuation metrics like price-to-earnings (34.09) and price-to-book (51.79) ratios are unfavorable, contributing to an overall slightly favorable assessment of the financial ratios.

Shareholder Return Policy

Apple Inc. maintains a consistent dividend policy with a payout ratio around 14%, a gradually increasing dividend per share reaching $1.03 in 2025, and a modest annual yield near 0.4%. The company also engages in share buybacks, supported by strong free cash flow coverage, balancing returns with financial health.

This approach indicates a sustainable distribution strategy, combining steady dividends and buybacks without overextending cash resources. The policy aligns with long-term shareholder value creation by preserving capital for growth while rewarding investors through both income and capital return.

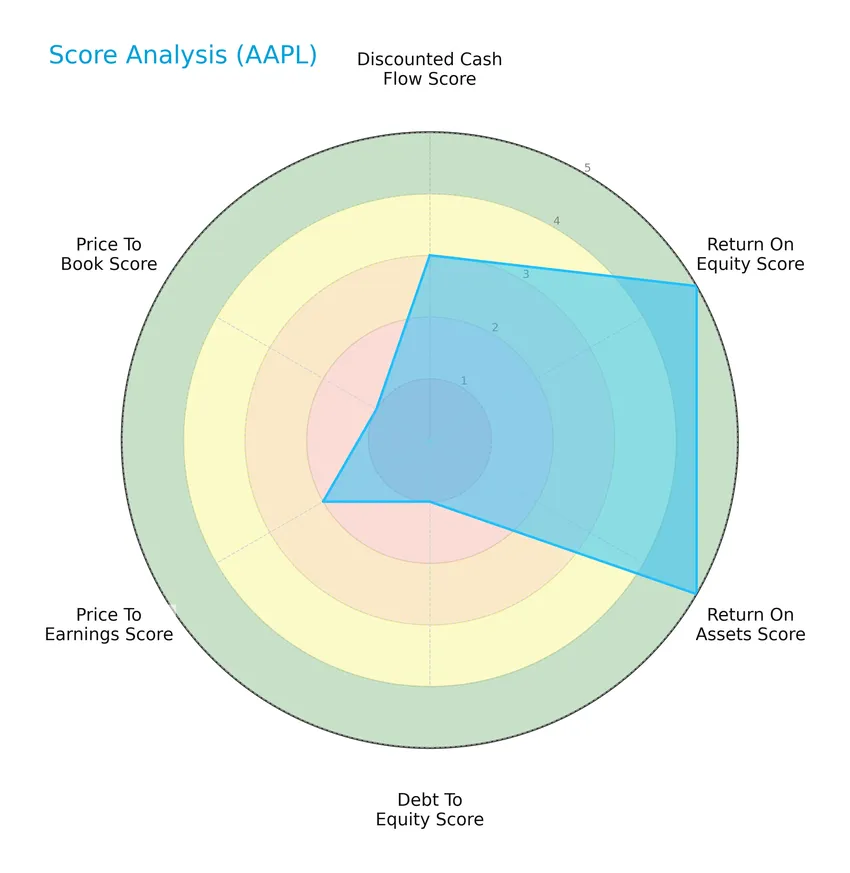

Score analysis

The following radar chart illustrates the company’s performance across key financial ratios and valuation metrics:

Apple Inc. shows very favorable scores in return on equity and return on assets, indicating strong profitability. However, debt-to-equity and price-to-book scores are very unfavorable, reflecting high leverage and potentially overvalued book value. Other scores remain moderate, suggesting mixed signals on valuation and cash flow.

Analysis of the company’s bankruptcy risk

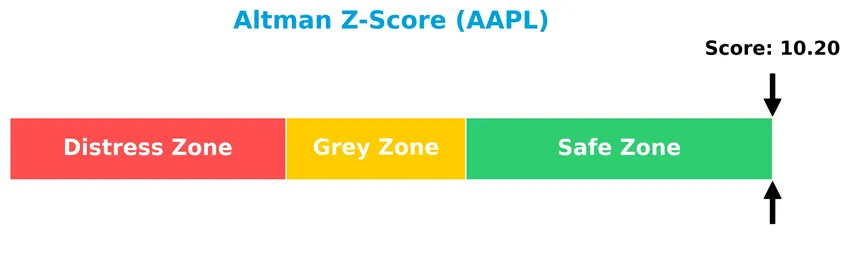

Apple Inc.’s Altman Z-Score places it firmly in the safe zone, indicating a low risk of bankruptcy and solid financial stability:

Is the company in good financial health?

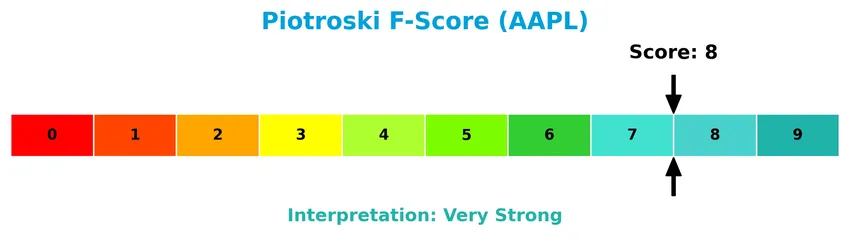

The Piotroski Score diagram below presents the company’s financial strength assessment based on nine accounting criteria:

With a very strong Piotroski Score of 8, Apple Inc. demonstrates robust financial health, reflecting good profitability, liquidity, and operational efficiency.

Competitive Landscape & Sector Positioning

This sector analysis will explore Apple Inc.’s strategic positioning, revenue segmentation, key products, and main competitors in the technology industry. I will assess whether Apple holds a competitive advantage over its rivals based on these factors.

Strategic Positioning

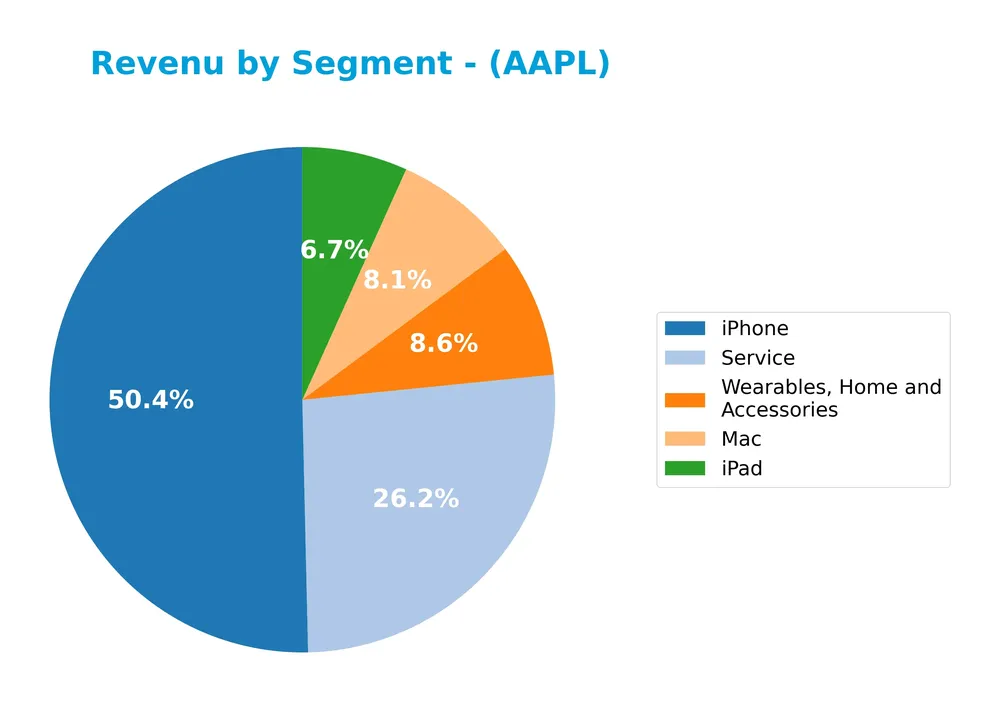

Apple Inc. maintains a diversified product portfolio spanning smartphones, PCs, tablets, wearables, and digital services, with iPhone generating the largest revenue at $210B in 2025. Geographically, its revenue is well distributed, led by the Americas at $178B, followed by Europe, Greater China, Japan, and Asia Pacific segments.

Revenue by Segment

The pie chart illustrates Apple Inc.’s revenue distribution by product segment for the fiscal year 2025, highlighting how each category contributes to the company’s total sales.

In 2025, iPhone remains the dominant revenue driver with $210B, followed by Services at $109B, showing strong and consistent growth. Wearables, Home and Accessories generated $35.7B, slightly down from the previous year, while Mac and iPad contributed $33.7B and $28B respectively. The trend highlights a growing reliance on Services alongside steady hardware sales, indicating a balanced yet increasingly service-focused portfolio.

Key Products & Brands

The table below presents Apple Inc.’s main products and brands along with their descriptions:

| Product | Description |

|---|---|

| iPhone | A line of smartphones representing the largest revenue segment, with $210B in FY 2025. |

| Mac | Personal computers generating $33.7B in revenue in FY 2025, including desktops and portables. |

| iPad | Multi-purpose tablets with $28B in revenue in FY 2025. |

| Wearables, Home and Accessories | Includes AirPods, Apple TV, Apple Watch, Beats products, and HomePod, with $35.7B revenue in FY 2025. |

| Service | Subscription-based and platform services including App Store, Apple Music, Apple TV+, AppleCare, and Apple Pay, $109B in FY 2025. |

Apple’s portfolio spans hardware like iPhone and Mac, complemented by a growing services segment and wearables, contributing to a diversified revenue base.

Main Competitors

There are 165 competitors in the Technology Consumer Electronics sector; below are the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| NVIDIA Corporation | 4.60T |

| Apple Inc. | 4.00T |

| Alphabet Inc. | 3.80T |

| Microsoft Corporation | 3.52T |

| Meta Platforms, Inc. | 1.64T |

| Broadcom Inc. | 1.64T |

| Taiwan Semiconductor Manufacturing Company Limited | 1.58T |

| Oracle Corporation | 553B |

| ASML Holding N.V. | 415B |

| Palantir Technologies Inc. | 383B |

Apple Inc. ranks 2nd among 165 competitors, with a market cap approximately 80% the size of the leader, NVIDIA Corporation. Apple is positioned above both the average market cap of the top 10 competitors (2.21T) and the sector median (22.3B). It maintains a +25.45% market cap advantage over its closest rival above.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does AAPL have a competitive advantage?

Apple Inc. presents a very favorable competitive advantage, demonstrating a durable economic moat with a ROIC exceeding its WACC by over 43%, and a growing ROIC trend of 33.5% from 2021 to 2025. This indicates efficient capital use and consistent value creation, supported by strong profitability metrics including a net margin near 27%.

Looking ahead, Apple’s diverse product portfolio spans smartphones, personal computers, tablets, wearables, and services such as cloud, subscriptions, and digital content platforms. Continued expansion across global markets, particularly in the Americas and Europe, alongside innovation in hardware and services, underpins its potential to sustain growth opportunities.

SWOT Analysis

This analysis highlights Apple Inc.’s internal strengths and weaknesses alongside external opportunities and threats to inform strategic investment decisions.

Strengths

- strong global brand

- robust profitability with 26.92% net margin

- durable competitive advantage with growing ROIC

- favorable income statement and financial ratios

- very strong Altman Z-Score and Piotroski Score

Weaknesses

- high price-to-earnings and price-to-book ratios indicate valuation risk

- moderate revenue growth rate

- debt-to-equity ratio unfavorable at 1.52

- current ratio below 1 suggests liquidity concerns

- low dividend yield at 0.4%

Opportunities

- expansion in emerging markets like Greater China and Asia Pacific

- growth in subscription services and digital platforms

- innovation in wearables and health tech

- increasing ecosystem integration to boost customer retention

Threats

- intense competition in consumer electronics and services

- geopolitical tensions affecting supply chain and sales in key regions

- regulatory scrutiny on privacy, app store policies, and antitrust risks

- technological disruption and rapid market changes

Apple’s strong profitability, financial health, and competitive moat position it well for sustained growth. However, valuation concerns and external risks require cautious monitoring. Strategic focus on innovation and market expansion will be key to maintaining its leadership.

Stock Price Action Analysis

The following weekly stock chart illustrates Apple Inc.’s price movements and volatility over the past 12 months:

Trend Analysis

Over the past 12 months, Apple’s stock price increased by 38.06%, indicating a bullish trend despite deceleration in momentum. The price fluctuated between a low of 165.0 and a high of 278.85, with a high volatility level reflected in a standard deviation of 28.38. Recent weeks show a short-term decline of 7.61%.

Volume Analysis

In the last three months, trading volumes have been decreasing overall, with sellers dominating by a 15.74% margin. Buyer participation has weakened, suggesting cautious sentiment and lower market engagement among investors during this period.

Target Prices

The consensus target prices for Apple Inc. indicate a generally optimistic outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 350 | 220 | 299.08 |

Analysts expect Apple’s stock price to range between 220 and 350, with a consensus around 299, reflecting confidence in its growth potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback related to Apple Inc.’s market performance and products.

Stock Grades

Here is the latest summary of Apple Inc.’s stock grades from recognized financial institutions as of early 2026:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Evercore ISI Group | Maintain | Outperform | 2026-01-20 |

| Citigroup | Maintain | Buy | 2026-01-20 |

| Wedbush | Maintain | Outperform | 2026-01-13 |

| Wedbush | Maintain | Outperform | 2026-01-12 |

| Evercore ISI Group | Maintain | Outperform | 2026-01-09 |

| Morgan Stanley | Maintain | Overweight | 2025-12-17 |

| Citigroup | Maintain | Buy | 2025-12-09 |

| Evercore ISI Group | Maintain | Outperform | 2025-12-08 |

| Wedbush | Maintain | Outperform | 2025-12-08 |

| CLSA | Maintain | Outperform | 2025-12-05 |

The consensus among these well-established analysts is predominantly positive, with most maintaining Outperform or Buy ratings and no recent downgrades. This indicates stable confidence in the stock’s prospects as of early 2026.

Consumer Opinions

Apple Inc. continues to evoke strong feelings from its user base, reflecting a blend of admiration and critique that shapes its market presence.

| Positive Reviews | Negative Reviews |

|---|---|

| Exceptional build quality and design | Premium pricing can be prohibitive |

| Seamless ecosystem integration | Limited customization options |

| Reliable software updates and security | Battery life could be improved |

| Innovative features like Face ID and M1 chip | Customer service wait times sometimes lengthy |

Overall, consumers praise Apple for its innovation and product reliability, though concerns about pricing and battery longevity are frequently noted. This feedback underscores the brand’s appeal to quality-driven users but signals areas for enhancement.

Risk Analysis

Below is a table summarizing the primary risks associated with investing in Apple Inc., highlighting their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Valuation | High price-to-book (51.79) and price-to-earnings (34.09) ratios may limit upside. | Medium | High |

| Liquidity | Current ratio below 1 (0.89) indicates potential short-term liquidity constraints. | Medium | Medium |

| Debt Levels | Elevated debt-to-equity ratio (1.52) poses financial leverage risk. | Medium | Medium |

| Competitive | Intense competition in consumer electronics and services markets. | High | High |

| Regulatory | Increasing scrutiny on tech companies could affect operations and profits. | Medium | Medium |

| Dividend Yield | Low dividend yield (0.4%) may deter income-focused investors. | Low | Low |

The most significant risks for Apple are its high valuation metrics that could limit capital gains and the fierce competition in technology sectors. Despite strong financial health indicated by a safe Altman Z-Score (10.2) and a very strong Piotroski score (8), investors should remain cautious about market volatility and leverage risks.

Should You Buy Apple Inc.?

Apple Inc. appears to be a robust value creator with a durable competitive moat supported by a growing ROIC, suggesting operational efficiency. Despite a challenging leverage profile, indicated by substantial debt concerns, the overall rating of B could be seen as reflecting a very favorable financial health.

Strength & Efficiency Pillars

Apple Inc. presents a robust financial profile underpinned by exceptional profitability and value creation. The company boasts a net margin of 26.92%, an outstanding return on equity of 151.91%, and a return on invested capital (ROIC) of 51.97%. Significantly, its ROIC far exceeds the weighted average cost of capital (WACC) at 8.83%, confirming Apple as a clear value creator. Financial health indicators reinforce this strength, with an Altman Z-Score of 10.20 placing the firm firmly in the safe zone, complemented by a very strong Piotroski score of 8, signaling resilient operational and balance sheet quality.

Weaknesses and Drawbacks

Despite its strengths, Apple faces notable concerns on valuation and liquidity fronts. The stock trades at a premium with a high price-to-earnings ratio of 34.09 and an extraordinary price-to-book ratio of 51.79, suggesting market expectations are lofty and may limit upside. Leverage metrics are unfavorable, with a debt-to-equity ratio of 1.52 indicating significant reliance on debt, while a current ratio of 0.89 flags potential short-term liquidity constraints. Furthermore, recent market behavior reveals seller dominance with only 15.74% buyer volume, creating near-term headwinds despite a bullish longer-term trend.

Our Verdict about Apple Inc.

Apple’s long-term fundamental profile appears favorable, demonstrated by its strong profitability, value creation, and financial stability. However, despite an overall bullish stock trend, the recent seller-dominant market behavior suggests caution. This combination might indicate that, while Apple may appear attractive for long-term exposure, investors could consider a wait-and-see approach to identify a more opportune entry point amid current short-term selling pressure.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Apple (AAPL) Continued to Rebound in Q4 – Yahoo Finance (Jan 20, 2026)

- Apple added to Evercore’s tactical outperform list as firm expects near-term upside – Seeking Alpha (Jan 20, 2026)

- Is Most-Watched Stock Apple Inc. (AAPL) Worth Betting on Now? – Yahoo Finance (Jan 23, 2026)

- Apple Inc. $AAPL Shares Sold by WestEnd Advisors LLC – MarketBeat (Jan 23, 2026)

- Apple plans to complete rollout of ad expansion in App Store search by late March – Seeking Alpha (Jan 23, 2026)

For more information about Apple Inc., please visit the official website: apple.com