Home > Analyses > Consumer Defensive > Anheuser-Busch InBev SA/NV

Anheuser-Busch InBev SA/NV (BUD) shapes the social fabric by delivering some of the world’s most iconic beers, influencing celebrations and daily moments across the globe. As a dominant force in the alcoholic beverages industry, it commands a vast portfolio including Budweiser, Corona, and Stella Artois, renowned for quality and innovation. With a legacy spanning centuries and a global footprint, the key question is whether its current fundamentals justify continued investor confidence and growth potential in today’s evolving market landscape.

Table of contents

Business Model & Company Overview

Anheuser-Busch InBev SA/NV, founded in 1366 and headquartered in Leuven, Belgium, stands as a global leader in the alcoholic beverages industry. Its extensive portfolio of around 500 beer brands—featuring names like Budweiser, Corona, and Stella Artois—forms a cohesive ecosystem that spans diverse markets and consumer tastes. This breadth solidifies its dominant position and underpins its mission to connect consumers worldwide through iconic beverages.

The company’s revenue engine is driven by a balanced mix of production, distribution, and sales across the Americas, Europe, and Asia. With a workforce of 144K employees, it leverages both scale and brand equity to generate consistent cash flow from core beer brands and soft drinks. This strategic global footprint and diversified product base create a formidable economic moat, positioning the firm to shape the future of the beverage sector.

Financial Performance & Fundamental Metrics

This section analyzes Anheuser-Busch InBev SA/NV’s income statement, key financial ratios, and dividend payout policy to assess its investment potential.

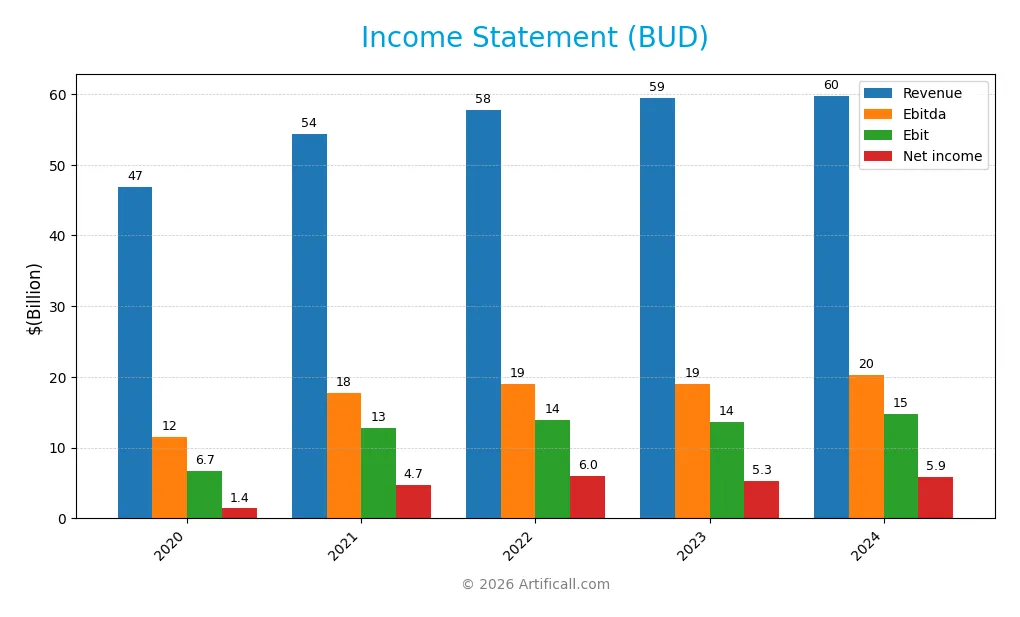

Income Statement

The table below presents Anheuser-Busch InBev SA/NV’s key income statement figures for fiscal years 2020 through 2024, expressed in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 46.9B | 54.3B | 57.8B | 59.4B | 59.8B |

| Cost of Revenue | 19.6B | 23.1B | 26.3B | 27.4B | 26.7B |

| Operating Expenses | 17.6B | 17.4B | 17.0B | 18.0B | 17.5B |

| Gross Profit | 27.2B | 31.2B | 31.5B | 32.0B | 33.0B |

| EBITDA | 11.6B | 17.8B | 19.0B | 19.1B | 20.3B |

| EBIT | 6.7B | 12.7B | 13.9B | 13.7B | 14.8B |

| Interest Expense | 4.7B | 4.4B | 4.6B | 4.8B | 4.5B |

| Net Income | 1.4B | 4.7B | 6.0B | 5.3B | 5.9B |

| EPS | 0.7 | 2.33 | 2.97 | 2.65 | 2.92 |

| Filing Date | 2021-03-19 | 2022-03-18 | 2023-03-17 | 2024-03-11 | 2025-03-12 |

Income Statement Evolution

Between 2020 and 2024, Anheuser-Busch InBev’s revenue grew 27.5%, though the 0.65% rise from 2023 to 2024 was unfavorable. Net income surged 317% over the period, supported by an 8.9% net margin improvement in the last year. Gross and EBIT margins remained favorable, with gross margin steady at 55.25% and EBIT margin at 24.68%, indicating operational stability.

Is the Income Statement Favorable?

In 2024, the company reported revenue of $59.8B and net income of $5.9B, reflecting modest revenue growth but solid earnings improvement. EBIT rose 8%, supported by controlled operating expenses and favorable margin expansion. Interest expense remained neutral at 7.47% of revenue. Overall, 79% of income statement metrics are favorable, indicating fundamentally positive financial health for the year.

Financial Ratios

The following table presents key financial ratios for Anheuser-Busch InBev SA/NV (BUD) over the fiscal years 2020 to 2024, providing insight into profitability, valuation, liquidity, leverage, and efficiency:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 3.0% | 8.6% | 10.3% | 9.0% | 9.8% |

| ROE | 2.1% | 6.8% | 8.1% | 6.5% | 7.5% |

| ROIC | 0.3% | 5.4% | 6.4% | 5.7% | 6.2% |

| P/E | 99.4 | 26.0 | 20.2 | 24.4 | 17.1 |

| P/B | 2.05 | 1.77 | 1.65 | 1.59 | 1.28 |

| Current Ratio | 0.82 | 0.70 | 0.67 | 0.63 | 0.70 |

| Quick Ratio | 0.68 | 0.54 | 0.48 | 0.48 | 0.54 |

| D/E | 1.45 | 1.29 | 1.09 | 0.96 | 0.92 |

| Debt-to-Assets | 44% | 41% | 38% | 36% | 35% |

| Interest Coverage | 2.0 | 3.1 | 3.1 | 2.9 | 3.5 |

| Asset Turnover | 0.21 | 0.25 | 0.27 | 0.27 | 0.29 |

| Fixed Asset Turnover | 1.77 | 2.04 | 2.17 | 2.21 | 2.54 |

| Dividend Yield | 1.3% | 1.9% | 2.0% | 2.3% | 2.7% |

Evolution of Financial Ratios

Between 2020 and 2024, Anheuser-Busch InBev’s Return on Equity (ROE) showed variability, peaking near 8.13% in 2022 before declining to 7.48% in 2024. The Current Ratio steadily decreased, ending at 0.70 in 2024, indicating tighter short-term liquidity. The Debt-to-Equity ratio also declined from around 1.29 in 2021 to 0.92 by 2024, suggesting reduced leverage. Profitability margins showed moderate stability with net profit margin near 9.8% in 2024.

Are the Financial Ratios Fovorable?

In 2024, the company’s profitability is generally neutral, with a net margin at 9.8% and ROE rated unfavorable at 7.48%. Liquidity ratios like Current Ratio (0.7) and Quick Ratio (0.54) are unfavorable, reflecting limited short-term asset coverage. Leverage metrics, including Debt-to-Equity (0.92) and Debt-to-Assets (34.93%), are neutral. Market valuation ratios show mixed signals, with Price-to-Book favorable at 1.28 and Price-to-Earnings neutral at 17.13. Overall, the ratio profile appears slightly unfavorable.

Shareholder Return Policy

Anheuser-Busch InBev SA/NV maintains a dividend payout ratio around 41% to 56%, with a stable dividend per share rising from $0.91 in 2020 to $1.33 in 2024. The annual dividend yield is approximately 2.7%, supported by free cash flow coverage near 74%, indicating a balanced distribution approach.

The company also conducts share buybacks, complementing dividends in returning capital to shareholders. This policy appears designed to sustain shareholder value without overextending cash flow, reflecting a prudent balance between rewarding investors and retaining resources for operational needs.

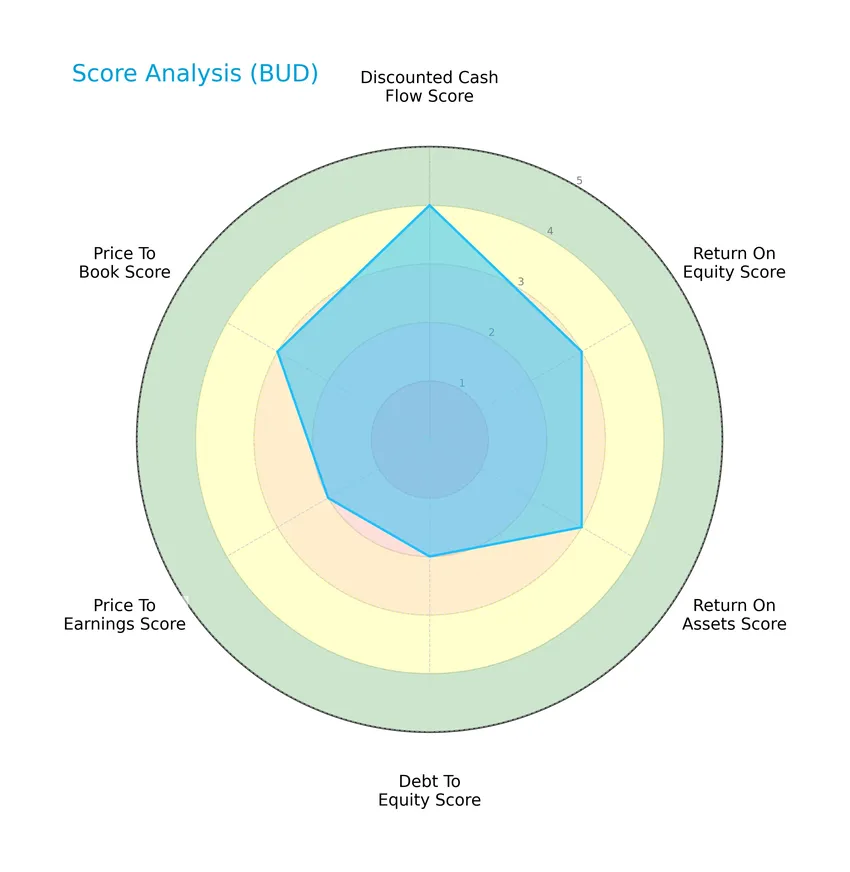

Score analysis

The radar chart below presents a summary of key financial scores for Anheuser-Busch InBev SA/NV:

The company shows a favorable discounted cash flow score of 4, indicating good valuation prospects. Return on equity and assets scores are moderate at 3 each, reflecting average profitability. Debt-to-equity and price-to-earnings scores sit at 2, suggesting moderate leverage and valuation. The price-to-book ratio is also moderate at 3.

Analysis of the company’s bankruptcy risk

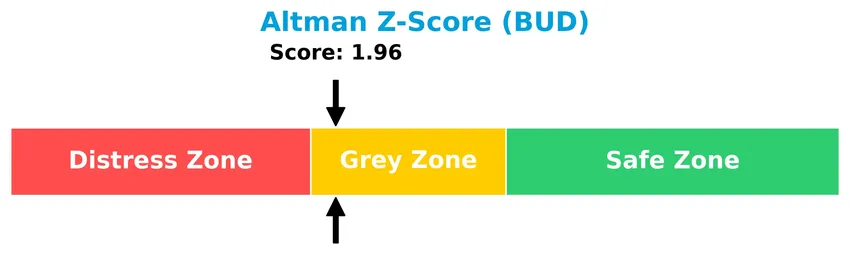

The Altman Z-Score places Anheuser-Busch InBev in the grey zone, indicating a moderate risk of bankruptcy and some financial uncertainty:

Is the company in good financial health?

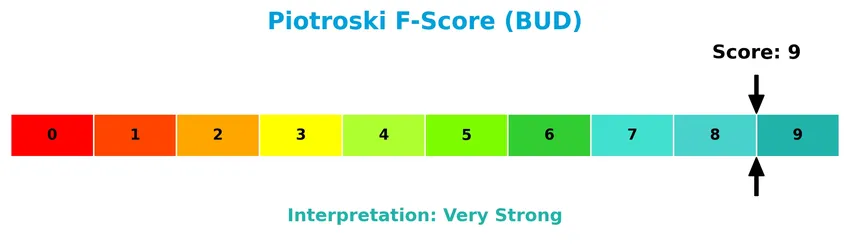

The Piotroski diagram below illustrates the company’s financial strength based on nine criteria:

With a Piotroski Score of 9, Anheuser-Busch InBev demonstrates very strong financial health, signaling excellent profitability, efficiency, and low financial risk.

Competitive Landscape & Sector Positioning

This sector analysis will explore Anheuser-Busch InBev SA/NV’s strategic positioning, revenue segments, key products, main competitors, and competitive advantages. I will also assess whether the company holds a competitive edge over its rivals in the alcoholic beverages industry.

Strategic Positioning

Anheuser-Busch InBev SA/NV operates a highly diversified product portfolio with around 500 beer brands and additional alcoholic and soft drink offerings. Geographically, it generates substantial revenues across North America (approx. $15B), Middle America ($17B), South America ($12B), EMEA ($9B), and Asia Pacific ($6B), reflecting broad global exposure.

Revenue by Segment

This pie chart illustrates the revenue distribution by segment for Anheuser-Busch InBev SA/NV, focusing on transportation services, lease agreements, and advertising services during fiscal years 2018 to 2020.

Revenue from transportation services, lease agreements, and advertising services showed a steady increase from 8.1M in 2018 to 13M in 2020. Although this segment’s revenue remains relatively small, the consistent growth indicates a gradual expansion in ancillary services. The 2020 figure suggests a moderate acceleration compared to prior years, but the business is still highly concentrated outside this segment.

Key Products & Brands

The following table outlines the key products and brands of Anheuser-Busch InBev SA/NV:

| Product | Description |

|---|---|

| Budweiser | One of the flagship beer brands in the company’s portfolio, known worldwide. |

| Corona | A leading international beer brand, popular in multiple markets. |

| Stella Artois | Premium beer brand with a strong global presence. |

| Beck’s, Hoegaarden, Leffe, Michelob Ultra | Additional well-known beer brands covering various segments and tastes. |

| Aguila, Antarctica, Bud Light, Brahma, Cass, Castle, Castle Lite, Cristal, Harbin, Jupiler, Modelo Especial, Quilmes, Victoria, Sedrin, Skol | Diverse portfolio of regional and international beer brands catering to different markets worldwide. |

| Transportation services, lease agreements and advertising services | Ancillary business activities generating supplementary revenue, reported at $13M in 2020. |

Anheuser-Busch InBev maintains a broad portfolio of approximately 500 beer brands, supplemented by related services. Its flagship brands like Budweiser, Corona, and Stella Artois anchor its global market presence, while numerous regional brands support diversified consumer preferences.

Main Competitors

There are 2 competitors in total, with the table below listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Anheuser-Busch InBev SA/NV | 125B |

| Molson Coors Beverage Company | 9.6B |

Anheuser-Busch InBev SA/NV holds the 1st position among its competitors, with a market cap 1.09 times larger than the top player (itself). The company is above both the average market cap of the top 10 and the median market cap in the sector. It is substantially ahead of its closest competitor, Molson Coors Beverage Company, by over 1300%.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does BUD have a competitive advantage?

Anheuser-Busch InBev SA/NV does not yet demonstrate a clear competitive advantage, as its ROIC is below WACC indicating value shedding, despite a favorable income statement and growing profitability. The overall moat status is slightly favorable, reflecting improving returns but no definitive economic moat.

Looking ahead, the company’s extensive portfolio of approximately 500 beer brands and its presence across diverse global markets may provide growth opportunities. Continued expansion in emerging markets and innovation in product offerings could further impact its competitive positioning in the alcoholic beverages sector.

SWOT Analysis

This SWOT analysis highlights the key internal and external factors affecting Anheuser-Busch InBev SA/NV to guide strategic investment decisions.

Strengths

- Strong global brand portfolio

- Favorable gross and EBIT margins

- Consistent net income and EPS growth

Weaknesses

- Declining revenue growth in recent year

- Unfavorable liquidity ratios

- Moderate ROE indicating efficiency concerns

Opportunities

- Expansion in emerging markets

- Innovation in low-alcohol and health-conscious beverages

- Growth through strategic acquisitions

Threats

- Intense competition in alcoholic beverages

- Regulatory and taxation pressures

- Currency fluctuations impacting international sales

Overall, Anheuser-Busch InBev demonstrates solid profitability and brand strength but faces challenges in revenue momentum and liquidity. Strategic focus on market expansion and product innovation can mitigate risks and enhance shareholder value.

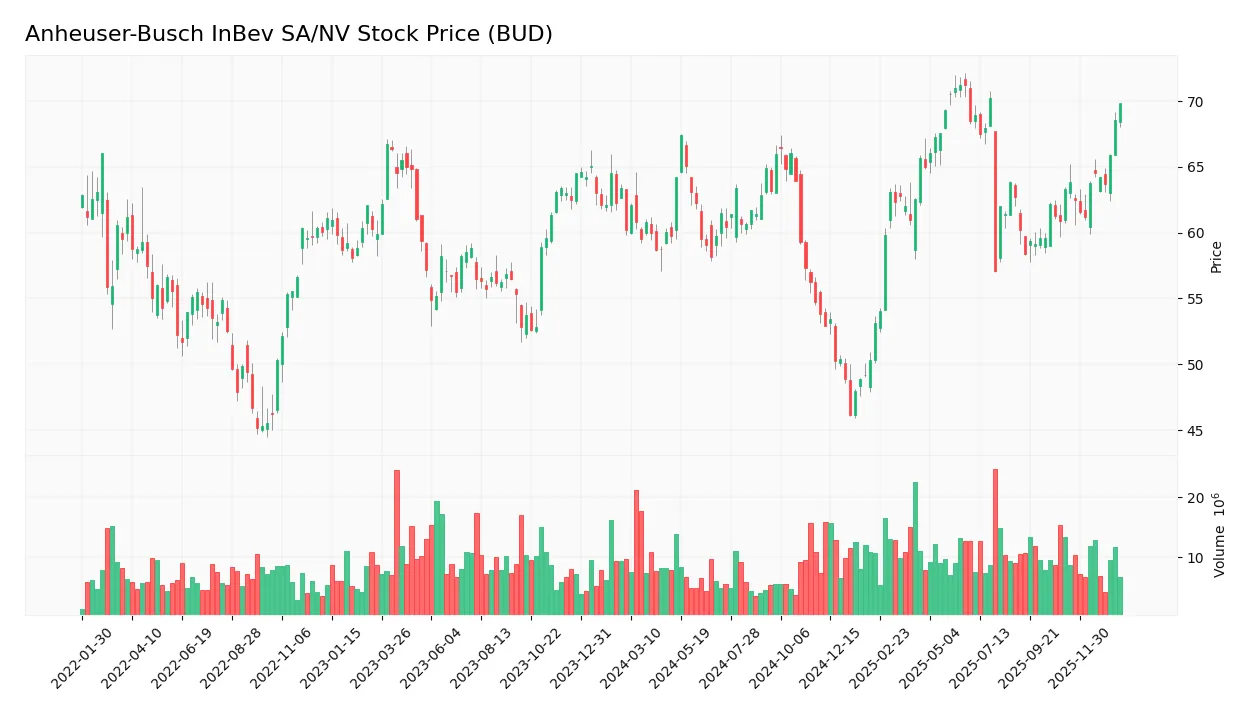

Stock Price Action Analysis

The weekly stock chart for Anheuser-Busch InBev SA/NV (BUD) over the past 100 weeks shows price movements and volume dynamics through the last 12 months:

Trend Analysis

Over the past 12 months, BUD’s stock price increased by 16.14%, indicating a bullish trend with acceleration. The price fluctuated between a low of 46.15 and a high of 71.22. The standard deviation of 5.42 points reflects moderate volatility, supporting a strong upward momentum.

Volume Analysis

Trading volumes over the last three months are increasing with buyer dominance at 67.84%. Buyer volume of 74.6M exceeds seller volume of 35.4M, suggesting bullish investor sentiment and stronger market participation favoring demand over supply.

Target Prices

The consensus target price for Anheuser-Busch InBev SA/NV (BUD) reflects a stable outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 75 | 74 | 74.5 |

Analysts expect the stock to trade around 74.5, indicating a narrow range and moderate confidence in its near-term valuation.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback regarding Anheuser-Busch InBev SA/NV (BUD).

Stock Grades

Here is a summary of recent reliable analyst grades for Anheuser-Busch InBev SA/NV (BUD) from leading financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Goldman Sachs | Upgrade | Buy | 2025-05-12 |

| TD Cowen | Maintain | Hold | 2025-01-08 |

| TD Cowen | Downgrade | Hold | 2024-10-08 |

| Citigroup | Upgrade | Buy | 2024-10-01 |

| Morgan Stanley | Maintain | Overweight | 2024-09-10 |

| Morgan Stanley | Maintain | Overweight | 2024-07-02 |

| TD Cowen | Maintain | Outperform | 2024-03-05 |

| Exane BNP Paribas | Downgrade | Neutral | 2024-01-12 |

| Jefferies | Upgrade | Buy | 2024-01-10 |

| JP Morgan | Maintain | Overweight | 2023-11-29 |

Analyst sentiment on BUD shows a generally positive bias with multiple upgrades to Buy and sustained Overweight ratings, although some downgrades to Hold and Neutral indicate cautious views among a few firms. The consensus rating remains Buy with a notable majority of analysts favoring the stock.

Consumer Opinions

Consumers have mixed but insightful views on Anheuser-Busch InBev SA/NV, reflecting its market presence and product quality.

| Positive Reviews | Negative Reviews |

|---|---|

| “Great variety of beers with consistent quality.” | “Prices have increased noticeably in recent years.” |

| “Strong global brand recognition and availability.” | “Customer service can be slow and unresponsive.” |

| “Innovative flavors and seasonal releases are exciting.” | “Some products lack the craft feel compared to smaller breweries.” |

Overall, consumer feedback praises Anheuser-Busch InBev for its extensive product range and brand strength, while common criticisms focus on rising prices and occasional service issues.

Risk Analysis

Below is a summary table outlining the key risks facing Anheuser-Busch InBev SA/NV, including their likelihood and potential impact on investors:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Altman Z-Score in grey zone (1.96) indicates moderate bankruptcy risk. | Medium | High |

| Liquidity | Unfavorable current (0.7) and quick ratios (0.54) suggest liquidity risks. | Medium | Medium |

| Profitability | ROE (7.48%) is unfavorable, indicating lower profitability than peers. | Medium | Medium |

| Market Volatility | Beta of 0.679 indicates lower sensitivity to market swings but still exists. | Low | Medium |

| Operational Efficiency | Unfavorable asset turnover (0.29) points to potential inefficiencies. | Medium | Medium |

| Debt Management | Debt-to-equity moderate but interest coverage ratio (3.3) is sufficient. | Medium | Medium |

The most pressing risks are the moderate bankruptcy risk indicated by the Altman Z-Score and liquidity constraints evidenced by low current and quick ratios. Despite these, the company’s very strong Piotroski score (9) and favorable dividend yield (2.66%) demonstrate financial resilience. Investors should monitor liquidity closely while appreciating AB InBev’s strong brand portfolio and market position.

Should You Buy Anheuser-Busch InBev SA/NV?

Anheuser-Busch InBev appears to be demonstrating improving profitability and operational efficiency, supported by a slightly favorable competitive moat with growing ROIC. Despite a moderate leverage profile and grey-zone Altman Z-Score, its overall rating suggests a cautiously optimistic financial health.

Strength & Efficiency Pillars

Anheuser-Busch InBev SA/NV presents a solid profitability profile, with a net margin of 9.8% and a consistently strong Piotroski score of 9, signaling robust financial health. The company exhibits moderate efficiency with a ROIC of 6.21%, slightly above its WACC of 5.92%, confirming it as a value creator. Although its Altman Z-Score of 1.96 places it in the grey zone, the favorable discounted cash flow score and moderate return on equity underscore a resilient operational foundation.

Weaknesses and Drawbacks

The firm faces challenges in liquidity, evidenced by an unfavorable current ratio of 0.7 and quick ratio of 0.54, indicating potential short-term solvency risks. While the price-to-earnings ratio of 17.13 is neutral, valuation pressure remains moderate with a P/B ratio of 1.28 considered favorable. However, asset turnover is low at 0.29, reflecting suboptimal asset utilization. These factors, combined with a moderate debt-to-equity ratio of 0.92, suggest cautious attention to leverage and operational efficiency is warranted.

Our Verdict about Anheuser-Busch InBev SA/NV

The company’s long-term fundamental profile appears favorable, supported by strong financial health scores and value creation capacity. Coupled with a bullish overall trend and recent buyer dominance signaling positive market sentiment, the profile may appear attractive for long-term exposure. Nonetheless, liquidity concerns and moderate efficiency metrics suggest investors could benefit from a measured approach, monitoring for improvements in operational leverage before committing fully.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Anheuser-Busch InBev SA/NV (NYSE:BUD) Given Consensus Recommendation of “Moderate Buy” by Brokerages – MarketBeat (Jan 23, 2026)

- March 6th Options Now Available For Anheuser-Busch InBev (BUD) – Nasdaq (Jan 22, 2026)

- Top Stock Reports for Microsoft, Anheuser-Busch & CVS Health – Zacks Investment Research (Jan 23, 2026)

- Anheuser-Busch InBev: Strong Cash Flow And Growing Profitability (NYSE:BUD) – Seeking Alpha (Jan 14, 2026)

- Anheuser-Busch InBev SA/NV $BUD Shares Sold by Pinnacle Financial Partners Inc – MarketBeat (Jan 20, 2026)

For more information about Anheuser-Busch InBev SA/NV, please visit the official website: ab-inbev.com