Home > Analyses > Financial Services > Ameriprise Financial, Inc.

Ameriprise Financial, Inc. shapes the financial futures of millions by delivering expert wealth management and retirement solutions that influence everyday financial decisions. As a prominent player in asset management, Ameriprise combines innovative advisory services with a comprehensive suite of investment and insurance products, earning a reputation for quality and market influence. As we dive into its 2026 performance, the key question remains: does Ameriprise’s strong foundation still support robust growth and justify its current market valuation?

Table of contents

Business Model & Company Overview

Ameriprise Financial, Inc., founded in 1894 and headquartered in Minneapolis, Minnesota, stands as a prominent player in the Asset Management industry. The company orchestrates a comprehensive ecosystem of financial services, spanning Advice & Wealth Management, Asset Management, Retirement & Protection Solutions, and Corporate segments. This integrated approach empowers individual and institutional clients with tailored financial planning, investment management, and insurance solutions, reinforcing its dominant market position.

The company’s Revenue Engine thrives on a balanced mix of advisory fees, asset management products, and recurring insurance premiums. Its diversified portfolio includes mutual funds, ETFs, annuities, and life insurance, serving clients across the Americas, Europe, and Asia. This global footprint, combined with a strong advisory network, secures Ameriprise’s competitive advantage and cements its role as a key architect shaping the future of financial services.

Financial Performance & Fundamental Metrics

I will analyze Ameriprise Financial, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its overall financial health and investment potential.

Income Statement

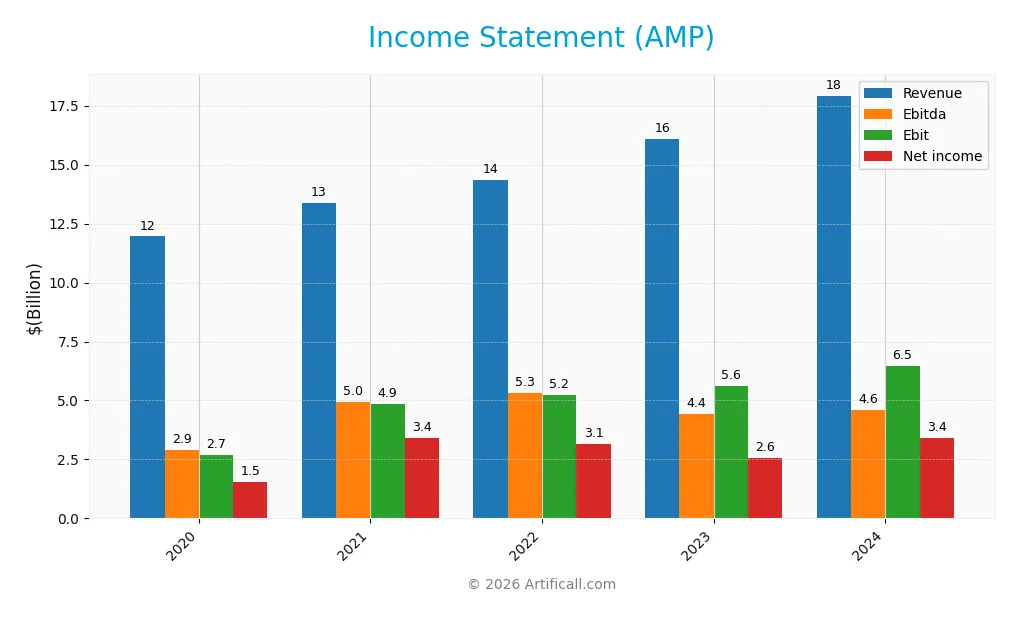

The following table summarizes Ameriprise Financial, Inc.’s key income statement figures for fiscal years 2020 through 2024, showing trends in revenue, expenses, and profitability.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 11.96B | 13.39B | 14.33B | 16.10B | 17.93B |

| Cost of Revenue | 6.14B | 5.13B | 5.43B | 6.67B | 7.57B |

| Operating Expenses | 3.12B | 3.40B | 3.67B | 3.81B | 3.90B |

| Gross Profit | 5.82B | 8.26B | 8.91B | 9.42B | 10.36B |

| EBITDA | 2.91B | 4.95B | 5.33B | 4.41B | 4.60B |

| EBIT | 2.70B | 4.86B | 5.23B | 5.61B | 6.46B |

| Interest Expense | 0.16B | 0.19B | 0.20B | 0.32B | 0.33B |

| Net Income | 1.53B | 3.42B | 3.15B | 2.56B | 3.40B |

| EPS | 12.39 | 29.13 | 28.29 | 24.18 | 33.67 |

| Filing Date | 2021-02-24 | 2022-02-25 | 2023-02-23 | 2024-02-22 | 2025-02-20 |

Income Statement Evolution

From 2020 to 2024, Ameriprise Financial’s revenue grew by nearly 50%, reaching $17.9B in 2024. Net income more than doubled, increasing by 122% over the period to $3.4B. Margins improved notably, with the net margin rising by 48% to 19%, supported by a favorable gross margin of 57.8% and an EBIT margin of 36.0%, indicating enhanced operational efficiency and cost control.

Is the Income Statement Favorable?

The 2024 income statement displays solid fundamentals with revenue growth of 11.4% year-over-year and a net income increase of 19.5%. Operating expenses scaled in line with revenue, reflecting disciplined cost management. Interest expense remains low at 1.8% of revenue, contributing to a strong EBIT margin. Overall, the income statement is deemed favorable, with all key profitability and growth metrics showing positive trends.

Financial Ratios

The table below presents key financial ratios for Ameriprise Financial, Inc. (AMP) over the fiscal years 2020 to 2024, offering insight into profitability, valuation, liquidity, leverage, efficiency, and dividend metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 13% | 26% | 22% | 16% | 19% |

| ROE | 26% | 58% | 83% | 54% | 65% |

| ROIC | 1.4% | 2.3% | 2.6% | 2.5% | 2.8% |

| P/E | 15.7 | 10.6 | 11.0 | 15.7 | 15.8 |

| P/B | 4.1 | 6.1 | 9.1 | 8.5 | 10.3 |

| Current Ratio | 255 | 278 | 42 | 99 | 107 |

| Quick Ratio | 255 | 278 | 42 | 99 | 107 |

| D/E | 0.84 | 0.87 | 1.42 | 1.22 | 1.05 |

| Debt-to-Assets | 3.0% | 3.0% | 3.4% | 3.3% | 3.0% |

| Interest Coverage | 17 | 25 | 26 | 17 | 20 |

| Asset Turnover | 0.07 | 0.08 | 0.09 | 0.09 | 0.10 |

| Fixed Asset Turnover | 0 | 0 | 0 | 0 | 0 |

| Dividend Yield | 2.1% | 1.4% | 1.5% | 1.4% | 1.1% |

Evolution of Financial Ratios

From 2020 to 2024, Ameriprise Financial, Inc. showed a notable increase in Return on Equity (ROE), rising from approximately 26.1% to 65.1%, reflecting improved profitability. The Current Ratio fluctuated significantly, peaking at 277.6 in 2021 before dropping to 107.2 in 2024, indicating variability in liquidity management. The Debt-to-Equity Ratio increased from 0.84 in 2020 to 1.05 in 2024, suggesting a modest rise in leverage over the period.

Are the Financial Ratios Favorable?

In 2024, profitability ratios such as net margin (19.0%) and ROE (65.1%) are favorable, while return on invested capital (2.8%) is unfavorable. Liquidity shows mixed signals, with a high current ratio (107.2) deemed unfavorable but a quick ratio equally high and favorable. Leverage is somewhat concerning, with a debt-to-equity ratio of 1.05 marked unfavorable, though a low debt-to-assets ratio (3.0%) and strong interest coverage (19.6) are favorable. Market valuation ratios like P/E (15.8) are neutral, while price-to-book (10.3) is unfavorable. Overall, the financial ratios are slightly unfavorable.

Shareholder Return Policy

Ameriprise Financial, Inc. maintains a consistent dividend policy with a payout ratio around 17-21% and a dividend yield near 1.1-1.5%. The dividend per share has steadily increased from $4.01 in 2020 to $5.68 in 2024, supported by strong free cash flow coverage close to 97%. Share buybacks are not explicitly mentioned in the data.

The moderate payout ratio combined with reliable free cash flow coverage suggests a balanced approach to shareholder returns, aiming to sustain dividends without compromising financial flexibility. This policy appears aligned with sustainable long-term value creation, avoiding excessive distributions or buybacks that might strain resources.

Score analysis

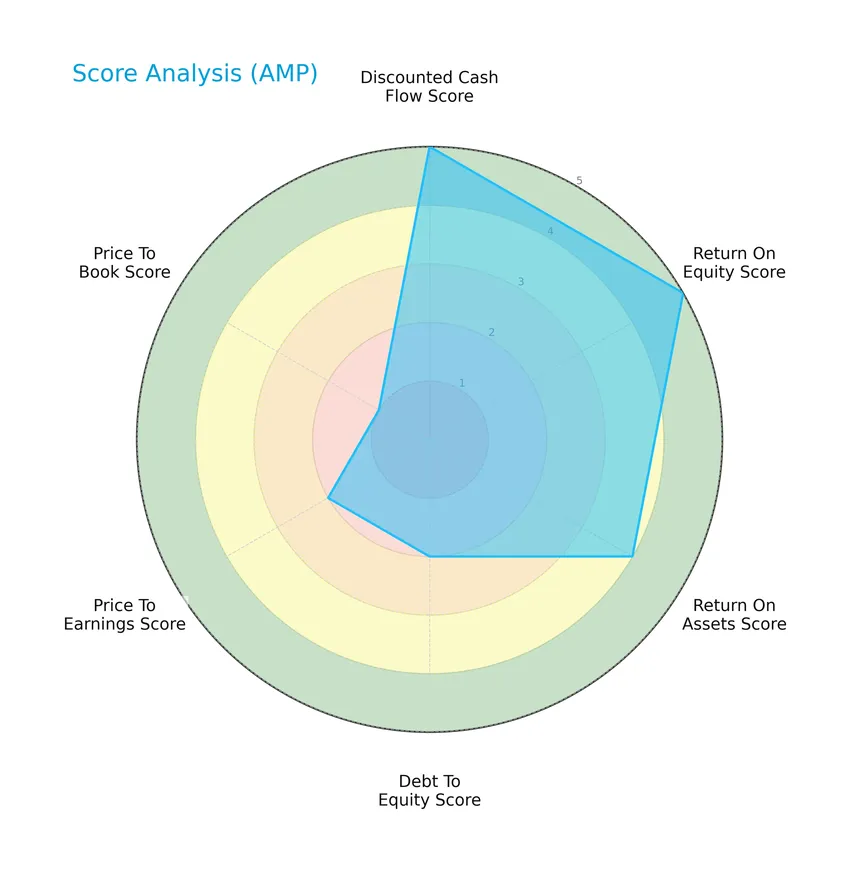

The following radar chart presents a comprehensive view of Ameriprise Financial, Inc.’s key financial scores for investor consideration:

Ameriprise Financial scores very favorably on discounted cash flow and return on equity, and favorably on return on assets. However, it shows moderate scores in debt to equity and price to earnings, with a very unfavorable price to book score.

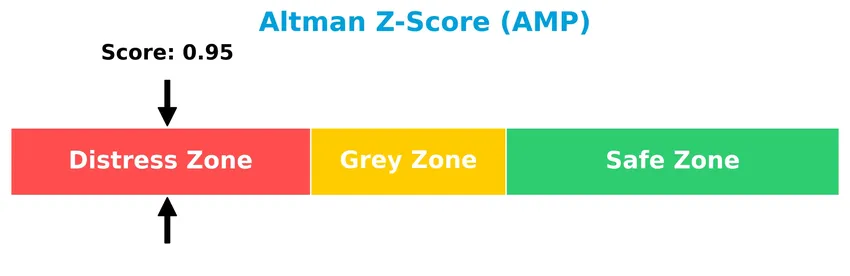

Analysis of the company’s bankruptcy risk

Ameriprise Financial’s Altman Z-Score indicates a position in the distress zone, suggesting a higher risk of financial distress and potential bankruptcy:

Is the company in good financial health?

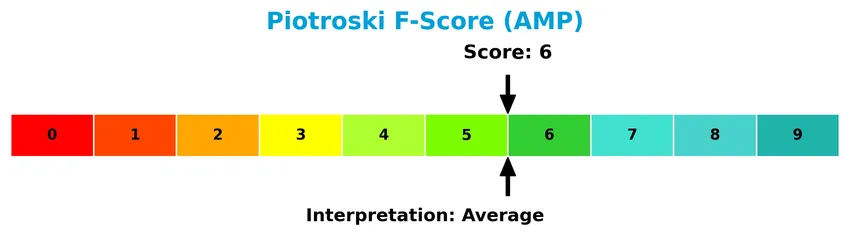

The Piotroski Score diagram illustrates Ameriprise Financial’s financial health status based on nine fundamental criteria:

With a Piotroski Score of 6, the company is assessed to have average financial health, showing some strengths but also areas that require closer monitoring.

Competitive Landscape & Sector Positioning

This section presents a detailed sector analysis of Ameriprise Financial, Inc., focusing on its strategic positioning, revenue segments, key products, and main competitors. I will assess whether Ameriprise Financial holds a competitive advantage within the asset management industry.

Strategic Positioning

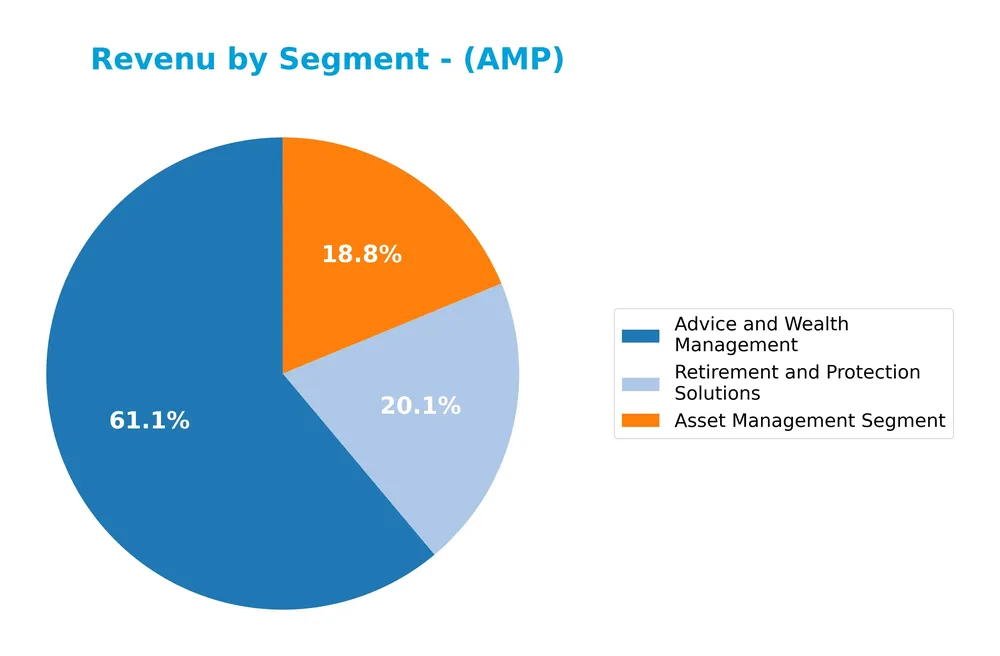

Ameriprise Financial, Inc. maintains a diversified product portfolio across Advice & Wealth Management, Asset Management, and Retirement & Protection Solutions, with 2024 revenues of $11.4B, $3.5B, and $3.8B respectively. Its geographic exposure is primarily U.S.-centric, with limited non-U.S. revenue reported.

Revenue by Segment

This pie chart illustrates the revenue distribution of Ameriprise Financial, Inc. by business segment for the fiscal year 2024.

In 2024, the Advice and Wealth Management segment led revenues with $11.4B, showing consistent growth over recent years and reinforcing its role as the primary business driver. Retirement and Protection Solutions followed with $3.8B, also growing steadily. The Asset Management segment posted $3.5B, remaining relatively stable. The trend highlights strong concentration in Advice and Wealth Management, suggesting careful attention to diversification and risk management is warranted.

Key Products & Brands

The following table outlines Ameriprise Financial’s key products and brands by segment and their descriptions:

| Product | Description |

|---|---|

| Advice & Wealth Management | Financial planning and advice; brokerage products and services; discretionary and non-discretionary investment advisory accounts; mutual funds; insurance and annuities products; cash management and banking products; face-amount certificates. |

| Asset Management | Investment management and advice; U.S. and non-U.S. mutual funds; exchange-traded funds; variable product funds; institutional asset management products including separately managed accounts, hedge funds, collateralized loan obligations, and infrastructure funds. |

| Retirement & Protection Solutions | Variable annuity products; life and disability insurance products for retail clients. |

| Corporate & Other | Corporate activities not classified under main business segments (limited information disclosed). |

Ameriprise Financial operates primarily through its Advice & Wealth Management, Asset Management, and Retirement & Protection Solutions segments, offering a broad range of financial products and services to individual and institutional clients.

Main Competitors

There are 11 competitors in the Asset Management industry; below are the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Blackstone Inc. | 191B |

| BlackRock, Inc. | 168B |

| KKR & Co. Inc. | 115B |

| The Bank of New York Mellon Corporation | 82B |

| Ares Management Corporation | 55B |

| Ameriprise Financial, Inc. | 46B |

| State Street Corporation | 36B |

| Northern Trust Corporation | 26B |

| T. Rowe Price Group, Inc. | 23B |

| Franklin Resources, Inc. | 12B |

Ameriprise Financial, Inc. ranks 6th among its peers with a market cap at 24.21% of the leader Blackstone Inc. It is positioned below the average market cap of the top 10 competitors (75B) but above the median market cap of the sector (46B). The company maintains a +18.4% market cap gap over its closest competitor above.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does AMP have a competitive advantage?

Ameriprise Financial, Inc. currently shows a slightly unfavorable competitive advantage, as its return on invested capital (ROIC) is below its weighted average cost of capital (WACC), indicating value destruction despite a growing ROIC trend. The company maintains favorable income statement metrics, including a net margin of 19% and positive revenue and earnings growth, reflecting operational efficiency and profitability improvements.

Looking ahead, Ameriprise’s diversified segments in Advice & Wealth Management, Asset Management, and Retirement & Protection Solutions position it well to capitalize on expanding market opportunities. Continued growth in financial planning, investment products, and insurance services may support future profitability, but the overall value creation remains cautious given the current ROIC versus WACC dynamics.

SWOT Analysis

This SWOT analysis highlights Ameriprise Financial, Inc.’s key internal and external factors to inform strategic investment decisions.

Strengths

- Strong revenue and net income growth

- High return on equity at 65%

- Diverse financial service segments

Weaknesses

- Low ROIC of 2.84% below WACC

- High price-to-book ratio at 10.29

- Altman Z-Score in distress zone

Opportunities

- Growing demand for wealth management services

- Expansion in retirement and protection solutions

- Increasing profitability trend

Threats

- Competitive pressure in asset management

- Regulatory changes in financial services

- Economic downturn affecting client investments

Ameriprise demonstrates robust profitability and growth but faces challenges with value destruction and financial stability risks. Strategic focus on improving capital efficiency and mitigating regulatory risks will be critical for sustainable success.

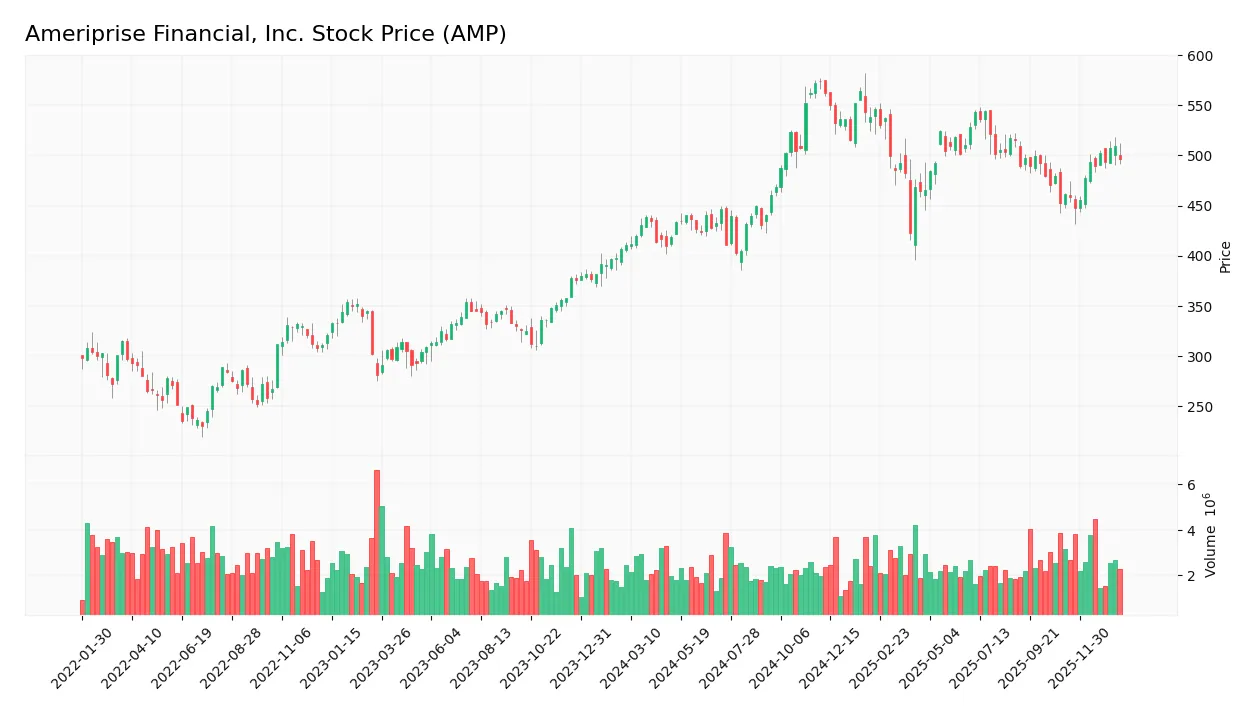

Stock Price Action Analysis

The weekly stock chart of Ameriprise Financial, Inc. (AMP) over the past 100 weeks illustrates its price movement and volatility trends clearly:

Trend Analysis

Over the past 100 weeks, AMP’s stock price increased by 20.95%, indicating a bullish trend with acceleration. The price ranged from a low of 402.61 to a high of 573.97, with a high volatility level shown by a standard deviation of 45.43. Recent weeks show a 7.62% gain, confirming continued upward momentum.

Volume Analysis

In the last three months, trading volume for AMP has been increasing and is slightly buyer-driven, with buyers accounting for 55.48% of volume. This suggests moderate investor confidence and growing market participation, reflecting a cautiously optimistic sentiment among traders.

Target Prices

Analysts present a solid target consensus for Ameriprise Financial, Inc., reflecting confidence in its potential.

| Target High | Target Low | Consensus |

|---|---|---|

| 570 | 485 | 527.5 |

The target prices indicate a bullish outlook, with expectations that the stock could reach as high as 570, supporting a favorable investment perspective.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback related to Ameriprise Financial, Inc. (AMP).

Stock Grades

The following table presents the latest verified grades for Ameriprise Financial, Inc. from reputable financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Underweight | 2025-12-22 |

| Argus Research | Maintain | Buy | 2025-11-13 |

| RBC Capital | Maintain | Outperform | 2025-11-03 |

| Keefe, Bruyette & Woods | Maintain | Market Perform | 2025-11-03 |

| Evercore ISI Group | Maintain | In Line | 2025-10-09 |

| Morgan Stanley | Maintain | Underweight | 2025-10-01 |

| RBC Capital | Maintain | Outperform | 2025-07-30 |

| Raymond James | Maintain | Strong Buy | 2025-07-25 |

| William Blair | Downgrade | Market Perform | 2025-07-25 |

| Morgan Stanley | Downgrade | Underweight | 2025-07-15 |

Overall, the grades for Ameriprise Financial reveal a mixed outlook with notable downgrades from Morgan Stanley and William Blair, while others maintain positive stances such as Outperform and Strong Buy. The consensus remains a Buy based on the distribution of analyst opinions.

Consumer Opinions

Consumers of Ameriprise Financial, Inc. (AMP) express a mix of satisfaction and concerns, reflecting diverse experiences with the company’s services.

| Positive Reviews | Negative Reviews |

|---|---|

| “Strong personalized financial advice and attentive advisors.” | “High fees compared to competitors.” |

| “User-friendly digital platform for managing investments.” | “Occasional delays in customer service response.” |

| “Comprehensive retirement planning options.” | “Limited transparency on some product charges.” |

| “Reliable performance and consistent portfolio growth.” | “Some frustration with complex account setup.” |

Overall, customers appreciate Ameriprise’s personalized approach and robust financial planning tools but often cite concerns about fees and customer service responsiveness, indicating areas for potential improvement.

Risk Analysis

Below is a summary table of key risks for Ameriprise Financial, Inc. (AMP), detailing their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Distress | Altman Z-Score of 0.95 places AMP in the distress zone, indicating elevated bankruptcy risk. | High | High |

| Valuation Concerns | Unfavorable Price-to-Book ratio (10.29) signals overvaluation risk amid market fluctuations. | Medium | Medium |

| Leverage | Debt-to-Equity ratio of 1.05 is unfavorable, raising concerns about financial leverage. | Medium | Medium |

| Operational Efficiency | Low asset turnover (0.1) and fixed asset turnover (0) indicate inefficiencies in asset use. | Medium | Medium |

| Dividend Yield | Dividend yield is neutral at 1.07%, which could affect income-focused investors in downturns. | Low | Low |

The most critical risk for Ameriprise is its financial distress indicated by the Altman Z-Score below 1.8, suggesting a high probability of bankruptcy if adverse conditions persist. Additionally, the company’s unfavorable valuation metrics and leverage ratios warrant caution, especially in volatile markets. Investors should carefully monitor these factors and consider risk management strategies when evaluating AMP for their portfolio.

Should You Buy Ameriprise Financial, Inc.?

Ameriprise Financial, Inc. appears to be delivering improving profitability and operational efficiency, though its competitive moat could be seen as slightly unfavorable due to value destruction despite rising ROIC. Supported by a manageable leverage profile, its overall rating suggests a B+ profile with moderate financial strength.

Strength & Efficiency Pillars

Ameriprise Financial, Inc. exhibits robust profitability with a net margin of 18.97% and an impressive return on equity (ROE) of 65.05%, underscoring effective capital deployment. The company maintains a strong interest coverage ratio of 19.63, reflecting solid financial health. Despite an unfavorable return on invested capital (ROIC) of 2.84% below its WACC of 9.29%, Ameriprise’s Piotroski score of 6 indicates average financial strength, while revenue and net income growth over the 2020-2024 period remain favorable, supporting operational efficiency.

Weaknesses and Drawbacks

Key risks include a high price-to-book ratio of 10.29, signaling a potentially stretched valuation that may deter value-seeking investors. The debt-to-equity ratio stands at 1.05, indicating moderate leverage that could pressure financial flexibility. The current ratio registers an unusually high 107.24, potentially reflecting liquidity management issues or accounting anomalies. Furthermore, asset turnover is low at 0.1, suggesting inefficiencies in asset utilization. These factors contribute to a slightly unfavorable ratio profile and warrant cautious assessment.

Our Verdict about Ameriprise Financial, Inc.

The company’s long-term fundamental profile is moderately favorable given its strong profitability and growth metrics, despite value destruction indicated by ROIC below WACC. The bullish overall stock trend combined with a slightly buyer-dominant recent period suggests investor confidence, and the profile may appear attractive for long-term exposure. However, valuation concerns and leverage risks imply that investors might consider a measured approach before committing.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Here’s Why Ameriprise Financial Services (AMP) is a Strong Growth Stock – Nasdaq (Jan 22, 2026)

- Universal Beteiligungs und Servicegesellschaft mbH Reduces Stock Holdings in Ameriprise Financial, Inc. $AMP – MarketBeat (Jan 21, 2026)

- Ameriprise Financial, Inc. (AMP): A Bull Case Theory – Yahoo Finance (Jan 15, 2026)

- Ameriprise Financial Services (AMP) Earnings Expected to Grow: What to Know Ahead of Next Week’s Release – Finviz (Jan 22, 2026)

- Ameriprise Financial: Highest Ranked Diversified Financial Services Firm on TIME’s “America’s Most Iconic Companies” List for 2026 – Business Wire (Jan 14, 2026)

For more information about Ameriprise Financial, Inc., please visit the official website: ameriprise.com