Home > Analyses > Real Estate > American Tower Corporation

American Tower Corporation powers the backbone of global wireless communication, enabling millions to stay connected every day. As a dominant player in the specialty REIT sector, it owns and operates a vast network of approximately 219,000 communication sites worldwide, driving innovation in infrastructure that supports the digital age. Renowned for its quality assets and strategic growth, American Tower remains a compelling subject for investors questioning if its fundamentals continue to justify its robust market valuation and future expansion potential.

Table of contents

Business Model & Company Overview

American Tower Corporation, founded in 1998 and headquartered in Boston, MA, stands as one of the largest global REITs specializing in multitenant communications real estate. With a portfolio of approximately 219K communications sites, it operates a cohesive ecosystem that supports wireless infrastructure and connectivity worldwide. This core mission positions it as a dominant player in the specialty real estate sector, delivering critical infrastructure for the digital economy.

The company’s revenue engine balances ownership and operation of physical tower assets with the recurring leasing of space to wireless service providers. Its strategic footprint spans the Americas, Europe, and Asia, reflecting a globally diversified presence. American Tower’s economic moat is rooted in its scale and infrastructure, shaping the future of wireless communications and enabling sustained competitive advantages in a capital-intensive industry.

Financial Performance & Fundamental Metrics

I will analyze American Tower Corporation’s income statement, key financial ratios, and dividend payout policy to provide a clear view of its financial health and investment potential.

Income Statement

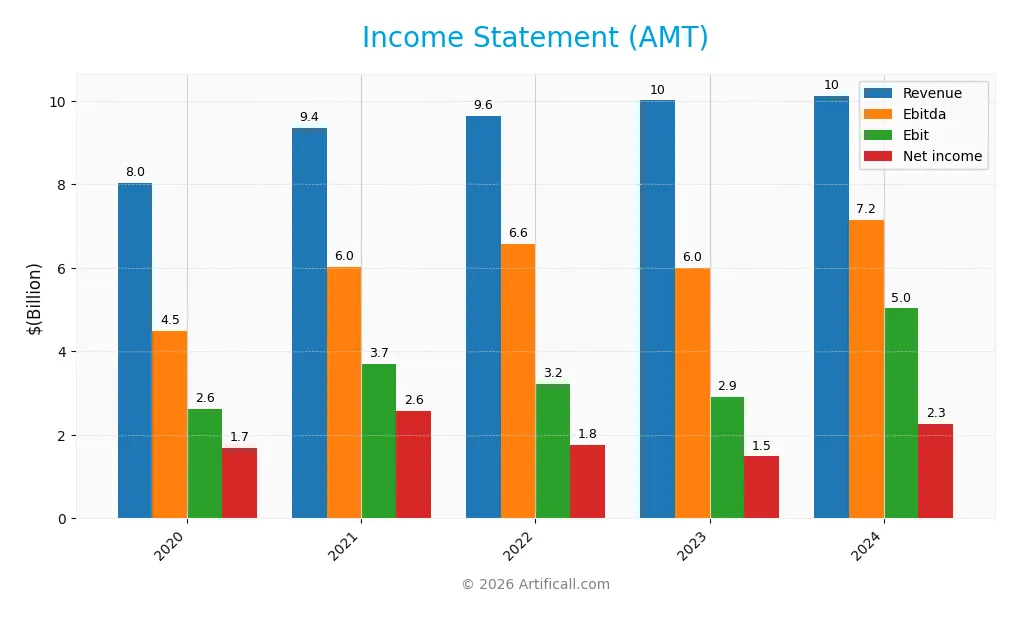

Below is the Income Statement for American Tower Corporation (AMT) covering fiscal years 2020 to 2024, presented in USD and rounded to the nearest million for clarity.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 8.04B | 9.36B | 9.65B | 10.01B | 10.13B |

| Cost of Revenue | 2.23B | 2.68B | 2.57B | 2.56B | 2.57B |

| Operating Expenses | 2.93B | 3.54B | 4.34B | 4.33B | 3.04B |

| Gross Profit | 5.81B | 6.67B | 7.08B | 7.45B | 7.55B |

| EBITDA | 4.50B | 6.03B | 6.58B | 6.00B | 7.15B |

| EBIT | 2.61B | 3.70B | 3.22B | 2.92B | 5.03B |

| Interest Expense | 794M | 871M | 1.14B | 1.39B | 1.40B |

| Net Income | 1.69B | 2.57B | 1.77B | 1.48B | 2.26B |

| EPS | 3.81 | 5.69 | 3.83 | 3.18 | 4.83 |

| Filing Date | 2021-02-25 | 2022-02-25 | 2023-02-23 | 2024-02-27 | 2025-02-25 |

Income Statement Evolution

From 2020 to 2024, American Tower Corporation’s revenue increased by 25.94% to reach $10.1B, showing steady top-line growth despite a recent 1.15% slowdown. Gross profit grew moderately, maintaining a stable gross margin near 74.6%. Operating expenses grew proportionally slower than revenue in the last year, supporting an improved EBIT margin of 49.7%, while net margin expanded by 5.9% overall, reflecting enhanced profitability.

Is the Income Statement Favorable?

The 2024 income statement shows generally favorable fundamentals with revenue at $10.1B and net income rising to $2.25B, marking a 50.3% increase in net margin and a 51.6% jump in EPS. Despite a relatively high interest expense ratio of 13.9%, the company’s strong gross and EBIT margins suggest effective cost control and operational efficiency. Overall, 78.6% of key income statement metrics are favorable, supporting a positive financial performance assessment.

Financial Ratios

The following table summarizes key financial ratios for American Tower Corporation (AMT) over recent fiscal years, providing insights into profitability, valuation, liquidity, leverage, and operational efficiency:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 21.0% | 27.4% | 18.3% | 14.8% | 22.3% |

| ROE | 41.3% | 50.5% | 31.7% | 35.3% | 66.7% |

| ROIC | 6.0% | 4.3% | 4.0% | 4.7% | 7.0% |

| P/E | 58.9 | 51.4 | 55.4 | 67.8 | 38.0 |

| P/B | 24.3 | 26.0 | 17.5 | 24.0 | 25.3 |

| Current Ratio | 0.79 | 0.41 | 0.44 | 0.51 | 0.45 |

| Quick Ratio | 0.79 | 0.41 | 0.44 | 0.51 | 0.45 |

| D/E | 9.0 | 10.2 | 8.4 | 11.0 | 13.0 |

| Debt-to-Assets | 77.7% | 74.4% | 70.0% | 70.1% | 71.9% |

| Interest Coverage | 3.6 | 3.6 | 2.4 | 2.3 | 3.2 |

| Asset Turnover | 0.17 | 0.13 | 0.14 | 0.15 | 0.17 |

| Fixed Asset Turnover | 0.39 | 0.32 | 0.33 | 0.51 | 0.37 |

| Dividend Yield | 1.9% | 1.7% | 2.7% | 2.9% | 3.6% |

Evolution of Financial Ratios

Over the analyzed period, American Tower Corporation’s Return on Equity (ROE) showed significant improvement, reaching 66.67% in 2024, indicating a strong increase in profitability. The Current Ratio declined, registering 0.45 in 2024, reflecting reduced short-term liquidity. Meanwhile, the Debt-to-Equity Ratio rose to 13.0, signaling higher financial leverage and increased reliance on debt financing.

Are the Financial Ratios Favorable?

In 2024, profitability ratios such as net margin (22.27%) and ROE (66.67%) were favorable, showing robust earnings generation. However, liquidity ratios like the current and quick ratios (both 0.45) were unfavorable, suggesting potential liquidity constraints. Leverage ratios, including a high debt-to-equity of 13.0 and debt-to-assets at 71.96%, were also unfavorable, highlighting elevated financial risk. Market valuation ratios, price-to-earnings at 37.98 and price-to-book at 25.33, were unfavorable, indicating expensive stock pricing relative to earnings and book value. Overall, the global opinion on the financial ratios was unfavorable.

Shareholder Return Policy

American Tower Corporation maintains a consistent dividend policy, with a payout ratio exceeding 100% in recent years, supported by free cash flow coverage above 70%. The dividend per share has steadily increased to 6.58 in 2024, yielding approximately 3.6%, alongside ongoing share buybacks.

While the high payout ratio suggests aggressive distribution, it is cushioned by robust free cash flow and a dividend-plus-capex coverage ratio above 1.1, indicating a balanced approach. This policy appears to support sustainable long-term value creation, though close monitoring of debt levels and cash flow is advisable.

Score analysis

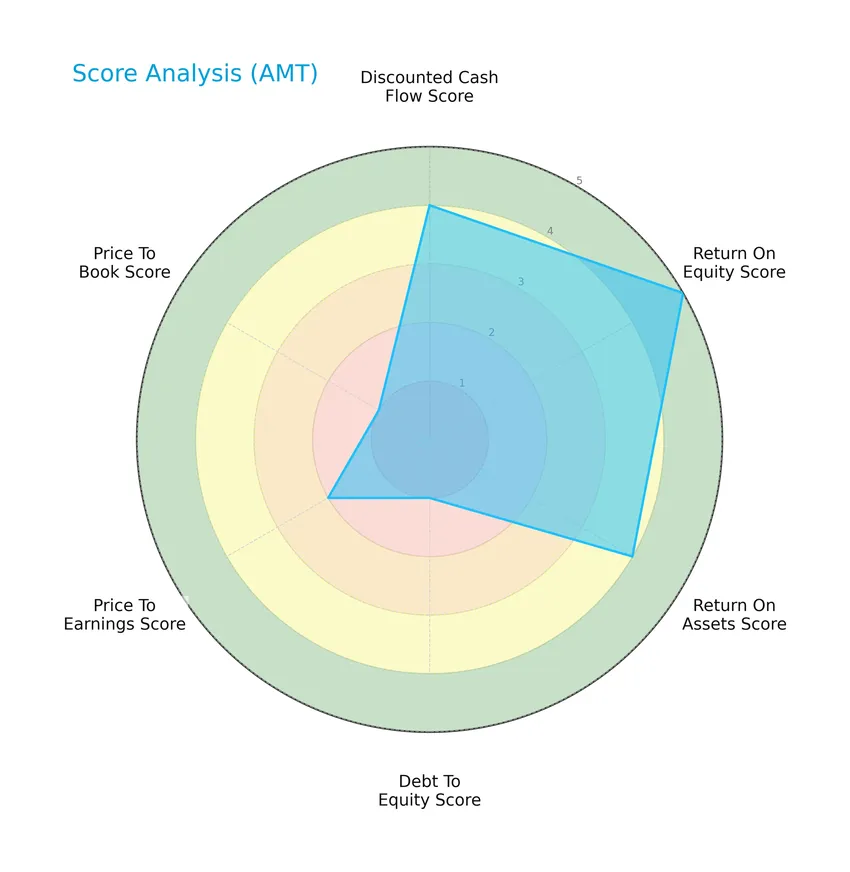

The radar chart below summarizes the key financial scores of American Tower Corporation for a comprehensive overview:

American Tower shows strong profitability scores with a return on equity score of 5 and return on assets score of 4, alongside a favorable discounted cash flow score of 4. However, leverage and valuation metrics such as debt to equity and price to book scores are very unfavorable, indicating caution on financial structure and market pricing.

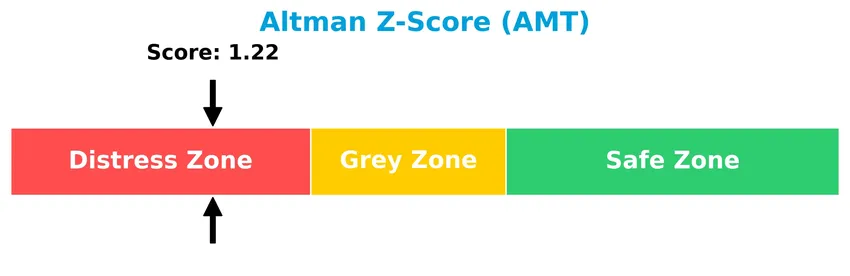

Analysis of the company’s bankruptcy risk

The Altman Z-Score places American Tower Corporation in the distress zone, signaling a higher risk of financial distress and potential bankruptcy:

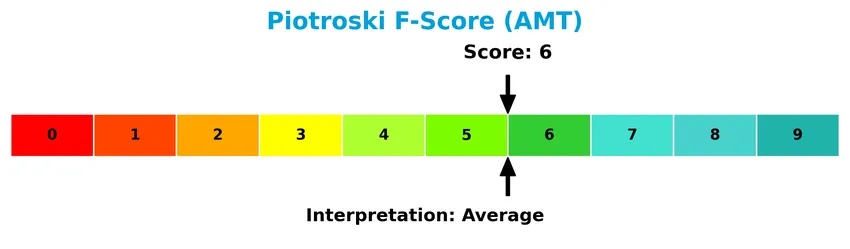

Is the company in good financial health?

The Piotroski Score diagram provides insight into the company’s financial health based on nine key criteria:

With a Piotroski Score of 6, American Tower demonstrates average financial strength, reflecting moderate profitability, leverage, and operational efficiency, but not reaching the threshold of strong financial health.

Competitive Landscape & Sector Positioning

This sector analysis will examine American Tower Corporation’s strategic positioning, revenue by segment, key products, main competitors, and competitive advantages. I will also assess whether the company holds a competitive advantage over its industry peers.

Strategic Positioning

American Tower Corporation concentrates primarily on its core product, communications real estate, with property revenues of nearly 9.9B USD in 2024, supplemented by a smaller services segment. Geographically, it maintains a diversified presence across the United States (5.4B USD) and multiple international regions including Latin America, Asia-Pacific, Europe, and Africa.

Revenue by Segment

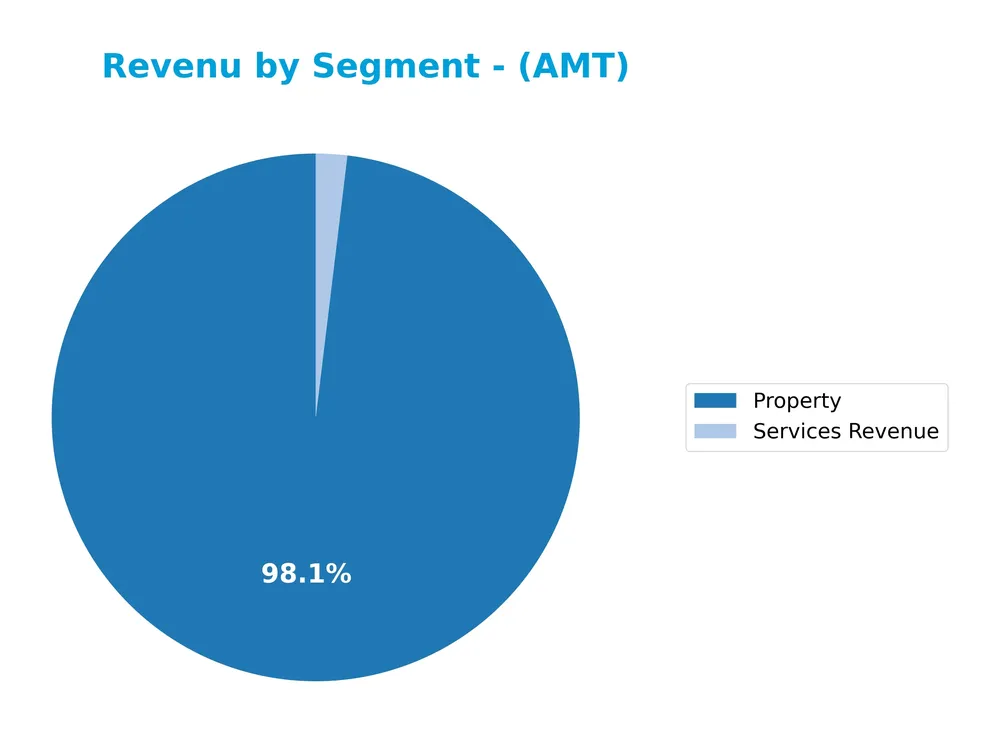

This pie chart illustrates American Tower Corporation’s revenue distribution by segment for the full fiscal year 2024, highlighting the relative contribution of Property and Services Revenue.

In 2024, the Property segment generated $9.93B, remaining the dominant revenue driver despite a decline from $11B in 2023, indicating some contraction. Services Revenue, at $194M, increased compared to $143M in 2023, showing modest growth but still representing a small portion of total revenue. The business remains heavily concentrated in Property, with Services Revenue providing limited diversification, which may pose concentration risk if the Property segment slows further.

Key Products & Brands

The table below outlines the key products and services generating revenue for American Tower Corporation:

| Product | Description |

|---|---|

| Property | Ownership, operation, and leasing of approximately 219,000 multitenant communications sites. |

| Services Revenue | Revenue from various services related to network development and management. |

| Network Development Services | Services focused on the development of communications networks (reported in earlier years). |

| Rental And Management | Rental and management services of communication real estate (reported in earlier years). |

American Tower Corporation primarily generates revenue through its property portfolio of communication sites, complemented by service revenues from network development and management activities.

Main Competitors

There are 6 competitors in total, with the table below listing the top 6 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| American Tower Corporation | 81.8B |

| Equinix, Inc. | 74.5B |

| Crown Castle Inc. | 38.6B |

| Iron Mountain Incorporated | 24.6B |

| SBA Communications Corporation | 20.7B |

| Weyerhaeuser Company | 17.2B |

American Tower Corporation ranks 1st among its 6 competitors, with a market cap 2.26% larger than the next largest player. Its market capitalization is above both the average market cap of the top 10 in the sector (42.9B) and the median market cap (31.6B). The company maintains a 12.27% lead over its closest competitor below, Equinix, Inc., highlighting its strong positioning in the REIT – Specialty industry within the Real Estate sector.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does AMT have a competitive advantage?

American Tower Corporation currently does not demonstrate a clear competitive advantage as its return on invested capital (ROIC) remains below its weighted average cost of capital (WACC), indicating value is being shed. However, its ROIC trend is growing, reflecting improving profitability and a slightly favorable moat status.

Looking ahead, AMT’s extensive portfolio of approximately 219,000 communication sites across diverse regions including the United States, Latin America, and Asia-Pacific, alongside its expansion in data centers, suggests potential growth opportunities. Continued profitability improvements could enhance its competitive position in the real estate investment trust (REIT) specialty sector.

SWOT Analysis

This SWOT analysis highlights American Tower Corporation’s key internal strengths and weaknesses alongside external opportunities and threats to guide strategic investment decisions.

Strengths

- Leading global REIT with 219K communication sites

- Strong profitability with 49.66% EBIT margin

- Growing net income and EPS over 5 years

Weaknesses

- High debt levels with 72% debt-to-assets

- Low liquidity ratios (current 0.45)

- Overvalued with high P/E and P/B ratios

Opportunities

- Expansion in emerging markets like Latin America and Asia-Pacific

- Increasing demand for data centers and 5G infrastructure

- Rising dividend yield attracts income investors

Threats

- Rising interest expenses impacting profitability

- Intense competition in telecom real estate

- Economic downturn risks affecting tenant demand

American Tower shows robust profitability and growth potential but carries financial leverage and valuation risks. Its strategy should focus on managing debt prudently while capitalizing on expanding telecom infrastructure globally.

Stock Price Action Analysis

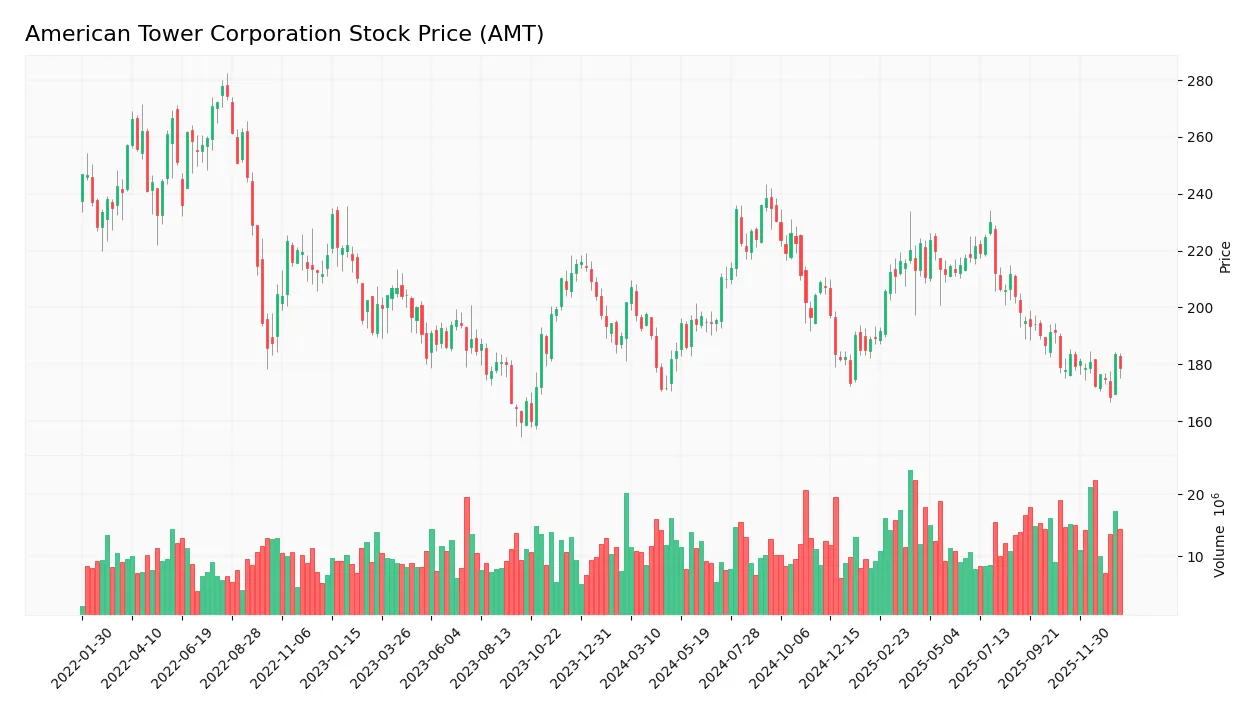

The following weekly stock chart illustrates American Tower Corporation’s price movements over the past 100 weeks, highlighting key fluctuations and trend shifts:

Trend Analysis

Over the past 12 months, AMT’s stock price declined by 11.4%, indicating a bearish trend with deceleration. The price ranged between a high of 238.5 and a low of 168.51, showing significant volatility with a standard deviation of 17.55. Recent weeks present a neutral trend with a 0.45% increase but a slight negative slope.

Volume Analysis

Trading volume for AMT has been increasing overall, with sellers dominating 54.75% of activity. In the recent period from November 2025 to January 2026, seller dominance remains at 57.68%, reflecting slightly seller-driven volume. This suggests cautious investor sentiment and moderate market participation.

Target Prices

The current analyst consensus for American Tower Corporation (AMT) indicates a positive outlook with a well-defined target range.

| Target High | Target Low | Consensus |

|---|---|---|

| 255 | 185 | 217.82 |

Analysts expect AMT’s stock price to trade between 185 and 255, with a consensus target near 218, reflecting moderate optimism about its growth potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines recent analyst ratings and consumer feedback to provide an overview of American Tower Corporation’s market perception.

Stock Grades

Here is a summary of recent stock grades for American Tower Corporation (AMT) from recognized financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Buy | 2026-01-20 |

| Scotiabank | Maintain | Sector Outperform | 2026-01-14 |

| Mizuho | Maintain | Neutral | 2026-01-12 |

| JP Morgan | Maintain | Overweight | 2026-01-12 |

| BMO Capital | Downgrade | Market Perform | 2026-01-09 |

| RBC Capital | Maintain | Sector Perform | 2025-12-19 |

| Morgan Stanley | Maintain | Overweight | 2025-12-05 |

| Barclays | Downgrade | Equal Weight | 2025-12-01 |

| Barclays | Maintain | Overweight | 2025-11-17 |

| Raymond James | Maintain | Strong Buy | 2025-10-29 |

The overall trend shows a majority of buy and outperform ratings with a few recent downgrades to market perform and equal weight, indicating mixed but generally positive sentiment among analysts.

Consumer Opinions

American Tower Corporation (AMT) continues to earn mixed reactions from its consumer base, reflecting varied experiences with its services and infrastructure.

| Positive Reviews | Negative Reviews |

|---|---|

| Reliable network coverage enhancing connectivity. | Occasional delays in customer service response. |

| Strong infrastructure supporting seamless data flow. | Pricing perceived as high by some customers. |

| Professional and helpful technical support team. | Limited transparency in billing details. |

Overall, consumers praise American Tower’s robust network and technical support but express concerns about pricing and customer service responsiveness. Addressing these issues could improve overall satisfaction.

Risk Analysis

Below is a summary table highlighting key risks associated with American Tower Corporation (AMT) for investors to consider:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Leverage | High debt-to-assets ratio at 71.96%, increasing financial risk. | High | High |

| Bankruptcy Risk | Altman Z-Score of 1.22 places AMT in distress zone, signaling bankruptcy risk. | Moderate | High |

| Valuation Concerns | Elevated P/E (37.98) and P/B (25.33) ratios may indicate overvaluation. | Moderate | Medium |

| Liquidity Issues | Low current and quick ratios (0.45) suggest liquidity constraints. | High | Medium |

| Operational Efficiency | Low asset turnovers (0.17 and 0.37) may limit growth and profitability. | Moderate | Medium |

| Dividend Stability | Dividend yield at 3.59% is favorable but depends on cash flow sustainability. | Low | Medium |

The most critical risks for AMT include its high leverage with debt-to-assets near 72% and a low Altman Z-Score signaling potential financial distress. These factors demand caution, despite favorable profitability and dividend yield metrics. Monitoring debt management and liquidity is essential to mitigate downside risk.

Should You Buy American Tower Corporation?

American Tower Corporation appears to exhibit improving profitability and operational efficiency, supported by a slightly favorable moat with growing returns despite shedding value. However, its leverage profile could be seen as substantial, reflecting heightened financial risk, while the overall rating suggests a moderate investment profile.

Strength & Efficiency Pillars

American Tower Corporation exhibits strong profitability with a net margin of 22.27% and an impressive return on equity of 66.67%, underscoring efficient capital use. Although its return on invested capital (ROIC) stands at 6.97%, slightly above the weighted average cost of capital (WACC) at 6.52%, it suggests marginal value creation. The firm’s Altman Z-Score of 1.22 places it in the distress zone, cautioning on financial stability, while its Piotroski score of 6 indicates average financial health. Overall, profitability and capital returns remain solid pillars despite some financial risk signals.

Weaknesses and Drawbacks

Valuation metrics pose significant concerns with a high price-to-earnings ratio of 37.98 and a price-to-book ratio of 25.33, reflecting a premium market valuation that may limit upside potential. Leverage is notably elevated, with a debt-to-equity ratio of 13.0 and a debt-to-assets ratio near 72%, exposing the company to financial risk amid tight liquidity, as evidenced by a current ratio of 0.45. Market pressure is also apparent; recent buyer dominance is only 42.32%, indicating seller dominance that, combined with an 11.4% overall price decline, suggests short-term headwinds.

Our Verdict about American Tower Corporation

American Tower Corporation’s long-term fundamental profile might appear favorable given its robust profitability and moderate value creation, but the elevated leverage and stretched valuation introduce material risks. Despite these strengths, the recent slightly seller-dominant market trend and bearish price momentum suggest a cautious stance. Therefore, while the company could be attractive for long-term exposure, a wait-and-see approach might be prudent to identify a more advantageous entry point.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Reasons Why American Tower Corporation (AMT) is Strongly Favored by Hedge Funds – Yahoo Finance (Jan 21, 2026)

- Cantillon Capital Management LLC Sells 20,035 Shares of American Tower Corporation $AMT – MarketBeat (Jan 23, 2026)

- American Tower Is Boring, But The Upside Potential Isn’t (NYSE:AMT) – Seeking Alpha (Jan 08, 2026)

- American Tower Corporation Announces Tax Reporting Information for 2025 Distributions – Yahoo Finance (Jan 20, 2026)

- American Tower Corporation $AMT Shares Sold by Fisher Funds Management LTD – MarketBeat (Jan 20, 2026)

For more information about American Tower Corporation, please visit the official website: americantower.com