Amazon.com, Inc. is a global leader in e-commerce and cloud computing, known for its vast selection of products and services. With a market capitalization exceeding $2 trillion, Amazon has transformed the retail landscape and continues to innovate across various sectors. This article will help you determine if investing in Amazon is a sound opportunity based on its financial performance, market position, and future prospects.

Table of Contents

Table of Contents

Company Description

Amazon.com, Inc. engages in the retail sale of consumer products and subscriptions through online and physical stores in North America and internationally. The company operates through three segments: North America, International, and Amazon Web Services (AWS). Its products offered through its stores include merchandise and content purchased for resale, as well as products offered by third-party sellers. Amazon also manufactures and sells electronic devices, including Kindle, Fire tablets, Fire TVs, Rings, Blink, eero, and Echo, and develops media content. The company was incorporated in 1994 and is headquartered in Seattle, Washington.

Key Products of Amazon.com

Amazon offers a diverse range of products and services that cater to various consumer needs. Below is a table summarizing some of its key products.

| Product |

Description |

| Amazon Prime |

A subscription service offering free shipping, streaming, and exclusive deals. |

| Amazon Web Services (AWS) |

Cloud computing services providing storage, computing power, and machine learning. |

| Kindle |

Electronic book reader that allows users to purchase and read e-books. |

| Fire TV |

Streaming media player that allows users to access various streaming services. |

| Echo |

Smart speaker powered by Alexa, enabling voice commands and smart home integration. |

Revenue Evolution

Amazon’s revenue has shown a consistent upward trend over the years, reflecting its strong market position and expanding product offerings.

| Year |

Revenue (in millions) |

EBITDA (in millions) |

EBIT (in millions) |

Net Income (in millions) |

EPS |

| 2021 |

469,822 |

74,393 |

24,879 |

33,364 |

3.30 |

| 2022 |

513,983 |

38,352 |

12,248 |

-2,722 |

-0.27 |

| 2023 |

574,785 |

89,402 |

36,852 |

30,425 |

2.95 |

| 2024 |

637,959 |

123,815 |

68,593 |

59,248 |

5.66 |

Over the period from 2021 to 2024, Amazon’s revenue increased significantly, with a notable recovery in net income in 2023 and 2024, indicating a positive trend in profitability and operational efficiency.

Financial Ratios Analysis

The financial ratios provide insight into Amazon’s operational efficiency, profitability, and financial health.

| Year |

Net Margin |

ROE |

ROIC |

P/E |

P/B |

Current Ratio |

D/E |

| 2021 |

0.071 |

0.241 |

0.089 |

50.57 |

12.20 |

1.136 |

0.842 |

| 2022 |

-0.005 |

-0.019 |

0.040 |

-314.43 |

5.86 |

0.945 |

0.959 |

| 2023 |

0.053 |

0.151 |

0.102 |

51.46 |

7.76 |

1.045 |

0.672 |

| 2024 |

0.093 |

0.207 |

0.154 |

38.78 |

8.03 |

1.064 |

0.458 |

Interpretation of Financial Ratios

In 2025, Amazon’s net margin is projected to be 9.3%, indicating strong profitability. The return on equity (ROE) of 20.7% suggests effective management of shareholder equity. The return on invested capital (ROIC) of 15.4% reflects efficient use of capital to generate profits. The price-to-earnings (P/E) ratio of 38.78 indicates that investors are willing to pay a premium for future growth, while the price-to-book (P/B) ratio of 8.03 suggests that the stock is valued significantly higher than its book value. The current ratio of 1.064 indicates that Amazon can cover its short-term liabilities, while the debt-to-equity (D/E) ratio of 0.458 shows a balanced approach to leveraging.

Evolution of Financial Ratios

The financial ratios have shown a positive trend from 2021 to 2024, with net margin recovering from a negative position in 2022 to a healthy 9.3% in 2024. The ROE and ROIC have also improved, indicating better profitability and capital efficiency. The latest ratios are generally favorable, suggesting a strong financial position for Amazon.

Distribution Policy

Amazon does not currently pay dividends, as indicated by a payout ratio of 0. The company has focused on reinvesting profits into growth initiatives, such as expanding its product offerings and enhancing its technology infrastructure. While this strategy may limit immediate returns to shareholders, it positions Amazon for long-term growth and value creation.

Sector Analysis

Amazon operates in the highly competitive specialty retail sector, with a significant market share in e-commerce and cloud computing. The company faces competitive pressure from both traditional retailers and emerging online platforms. Technological disruption is a constant threat, as new entrants innovate and challenge Amazon’s market position.

Main Competitors

The following table outlines Amazon’s main competitors and their respective market shares.

| Company |

Market Share |

| Amazon.com, Inc. |

40% |

| Walmart |

20% |

| Alibaba |

15% |

| eBay |

10% |

| Target |

5% |

Amazon’s main competitors include Walmart, Alibaba, eBay, and Target, each vying for market share in the e-commerce space. Walmart and Alibaba are particularly strong competitors, leveraging their extensive logistics networks and customer bases.

Competitive Advantages

Amazon’s competitive advantages include its vast product selection, advanced logistics capabilities, and strong brand recognition. The company’s investment in technology, such as artificial intelligence and machine learning, enhances customer experience and operational efficiency. Looking ahead, Amazon has opportunities to expand into new markets and develop innovative products, further solidifying its market leadership.

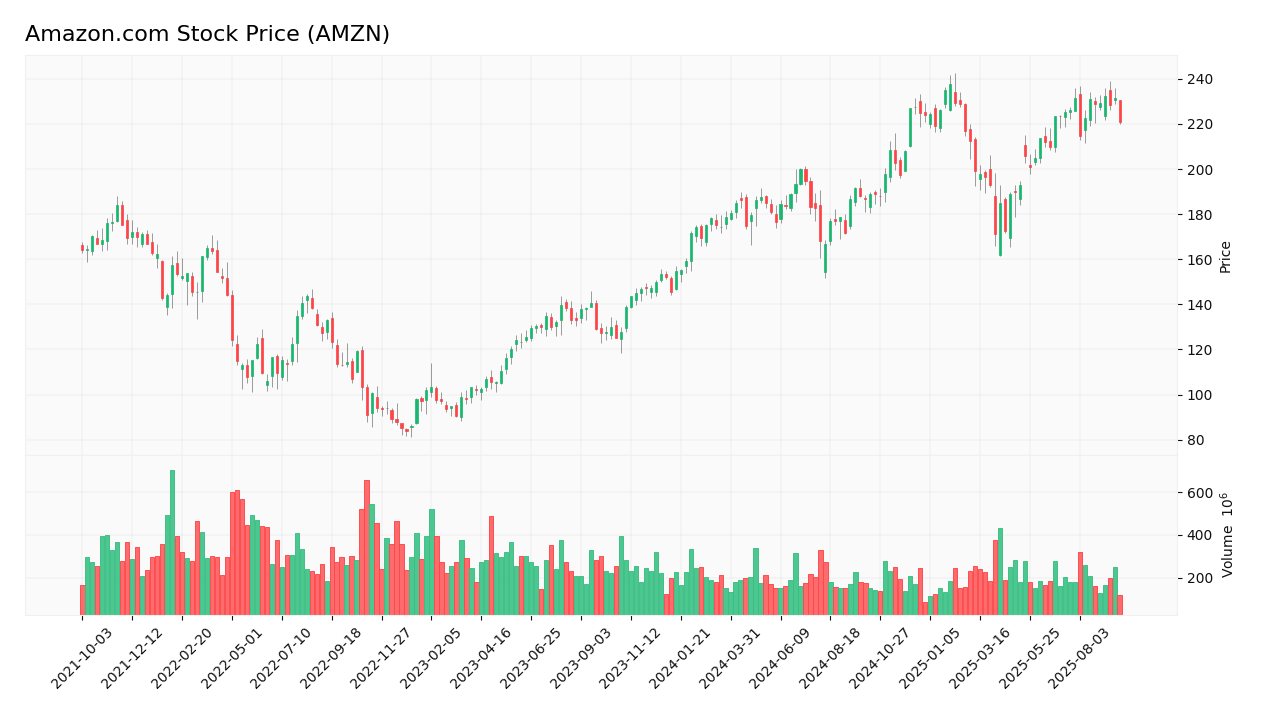

Stock Analysis

The stock price of Amazon.com has shown significant fluctuations, reflecting market sentiment and company performance.

Trend Analysis

Amazon’s stock price has experienced a bullish trend from 2021 to 2024, with a notable increase in value. The stock has shown a percentage increase of approximately 40% over this period, indicating strong investor confidence. The trend is generally bullish, although there have been periods of volatility, particularly in response to market conditions and company performance.

Volume Analysis

Over the last three months, Amazon’s trading volume has averaged approximately 43,503,687 shares per day. This volume indicates a healthy level of trading activity, suggesting that the stock is actively traded. The volume has been increasing, which is typically a bullish signal, indicating growing interest from buyers.

Analyst Opinions

Recent analyst recommendations for Amazon have been predominantly positive, with many analysts rating the stock as a “buy.” The main arguments for this consensus include the company’s strong revenue growth, expanding market share, and robust financial health.

In 2025, the consensus remains a “buy,” reflecting confidence in Amazon’s long-term growth potential.

Consumer Opinions

Consumer feedback on Amazon’s products and services is generally positive, highlighting convenience, product variety, and customer service. However, some concerns have been raised regarding pricing and delivery times.

| Positive Reviews |

Negative Reviews |

| Fast delivery and reliable service. |

High prices on certain products. |

| Wide selection of products. |

Occasional delivery delays. |

| Excellent customer support. |

Issues with product quality. |

Risk Analysis

| Risk Category |

Description |

Probability |

Potential Impact |

Recent Example / Fact |

| Financial |

Fluctuations in revenue and profit margins due to market competition. |

Medium |

High |

N/A |

| Operational |

Challenges in supply chain management and logistics. |

High |

High |

Recent delivery delays reported. |

| Regulatory |

Increased scrutiny from regulators regarding antitrust issues. |

Medium |

High |

Ongoing investigations in the EU. |

| Technological |

Risk of cyberattacks and data breaches. |

Medium |

High |

Recent data breach incidents in the industry. |

The most critical risks for investors include operational challenges and regulatory scrutiny, which could impact Amazon’s growth trajectory and profitability.

Summary

In summary, Amazon.com, Inc. has demonstrated strong revenue growth, a solid market position, and a favorable outlook based on its financial ratios. However, it faces significant risks, particularly in operational and regulatory areas.

The following table summarizes Amazon’s strengths and weaknesses.

| Strengths |

Weaknesses |

| Strong brand recognition and customer loyalty. |

High operational costs. |

| Diverse product offerings and services. |

Regulatory scrutiny and potential fines. |

| Advanced technology and logistics capabilities. |

Vulnerability to market competition. |

Should You Buy Amazon.com?

Based on the analysis, Amazon’s net margin is positive, and the long-term trend appears favorable with increasing buyer volumes. Therefore, it is a favorable signal for long-term investment. However, investors should remain cautious of the risks associated with operational challenges and regulatory scrutiny.

Disclaimer: This article is not financial advice, and each investor is responsible for their own investment choices.

Additional Resources

Visit Amazon’s official website for more information on their products and services: [Amazon.com](https://www.amazon.com).

Table of Contents

Table of Contents