Home > Analyses > Healthcare > Align Technology, Inc.

Align Technology, Inc. revolutionizes orthodontics by transforming smiles with its cutting-edge Invisalign clear aligners and iTero intraoral scanners. As a pioneer in medical devices for dental care, the company stands out for its innovative digital solutions that enhance treatment precision and patient experience worldwide. With a strong presence in the healthcare sector and a reputation for quality, Align Technology’s future growth potential invites a closer look into whether its current valuation reflects its fundamentals and market opportunities.

Table of contents

Business Model & Company Overview

Align Technology, Inc., founded in 1997 and based in Tempe, Arizona, stands as a leader in the medical devices sector. The company has built a cohesive ecosystem centered on its Invisalign clear aligners and iTero intraoral scanners, serving orthodontists and dental professionals worldwide. This integrated approach addresses a range of orthodontic needs, from children to adults, blending hardware, software, and services into a unified dental care solution.

The company’s revenue engine balances sales of innovative hardware like scanners with recurring software services and treatment packages, fostering steady cash flow. Align operates across the Americas, Europe, and Asia, leveraging its global footprint to drive growth. Its stronghold in digital orthodontics and comprehensive product suite create a durable economic moat, positioning it to shape the future of dental care technology.

Financial Performance & Fundamental Metrics

I will analyze Align Technology, Inc.’s income statement, key financial ratios, and dividend payout policy to provide a clear view of its financial health and investment potential.

Income Statement

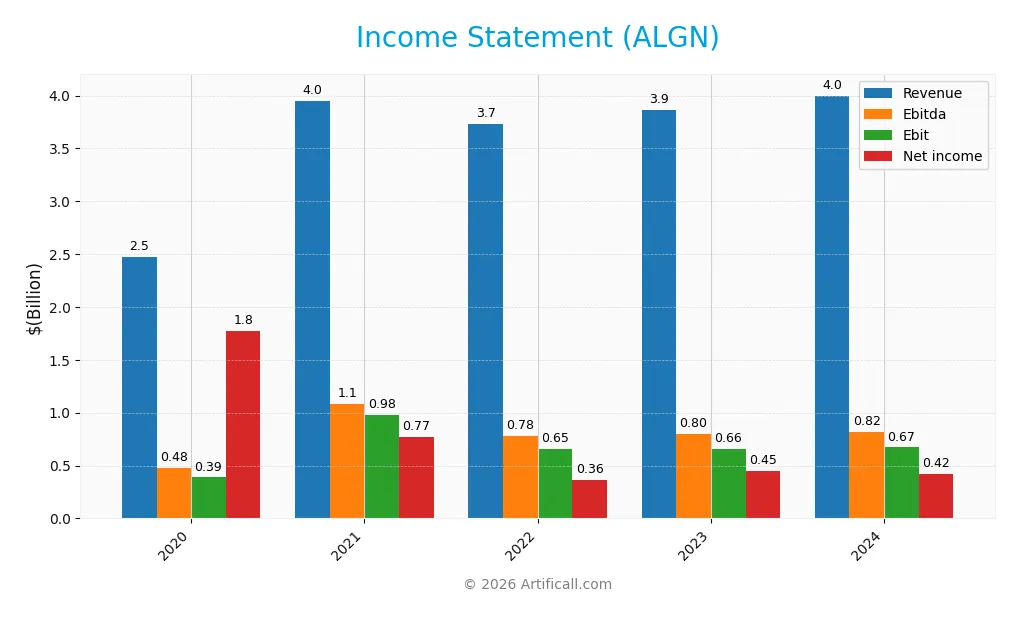

The table below summarizes Align Technology, Inc.’s key income statement figures for fiscal years 2020 through 2024, reported in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 2.47B | 3.95B | 3.73B | 3.86B | 4.00B |

| Cost of Revenue | 709M | 1.02B | 1.10B | 1.16B | 1.20B |

| Operating Expenses | 1.38B | 1.96B | 1.99B | 2.06B | 2.19B |

| Gross Profit | 1.76B | 2.94B | 2.63B | 2.71B | 2.80B |

| EBITDA | 481M | 1.09B | 780M | 799M | 817M |

| EBIT | 387M | 976M | 654M | 657M | 672M |

| Interest Expense | 0 | 0 | 0 | 0 | 0 |

| Net Income | 1.78B | 772M | 362M | 445M | 421M |

| EPS | 22.55 | 9.78 | 4.62 | 5.82 | 5.63 |

| Filing Date | 2021-02-26 | 2022-02-25 | 2023-02-27 | 2024-02-28 | 2025-02-28 |

Income Statement Evolution

From 2020 to 2024, Align Technology’s revenue increased by 61.78%, indicating solid top-line growth, while net income declined sharply by 76.27%. Gross margin remained consistently favorable at 70.0%, reflecting stable cost control on revenue. However, net margin decreased by 85.33% over the period, suggesting pressure on profitability despite a 16.8% EBIT margin staying favorable.

Is the Income Statement Favorable?

In 2024, the income statement reveals moderate revenue growth of 3.54% but a decline in net income and EPS by 8.56% and 3.27%, respectively. Operating expenses grew in line with revenue, which is unfavorable for margin expansion. While gross and EBIT margins remain favorable, the overall income statement evaluation rates the fundamentals as unfavorable due to declining net margins and earnings performance.

Financial Ratios

The table below presents key financial ratios for Align Technology, Inc. over the fiscal years 2020 to 2024, reflecting the company’s profitability, valuation, liquidity, leverage, efficiency, and dividend metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 72% | 20% | 10% | 12% | 11% |

| ROE | 55% | 21% | 10% | 12% | 11% |

| ROIC | 11% | 18% | 10% | 11% | 10% |

| P/E | 24 | 67 | 46 | 47 | 37 |

| P/B | 13 | 14 | 5 | 6 | 4 |

| Current Ratio | 1.40 | 1.30 | 1.26 | 1.18 | 1.22 |

| Quick Ratio | 1.29 | 1.18 | 1.08 | 1.04 | 1.10 |

| D/E | 0.027 | 0.035 | 0.035 | 0.035 | 0.031 |

| Debt-to-Assets | 2.0% | 2.1% | 2.1% | 2.1% | 1.9% |

| Interest Coverage | 0 | 0 | 0 | 0 | 0 |

| Asset Turnover | 0.51 | 0.67 | 0.63 | 0.63 | 0.64 |

| Fixed Asset Turnover | 3.0 | 3.3 | 2.8 | 2.7 | 2.9 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

*Net Margin, ROE, and ROIC are approximated from available net profit and return metrics. *Interest Coverage is reported as zero for all years. *Debt-to-Equity (D/E) and Debt-to-Assets ratios are expressed as decimals and percentages respectively. *Dividend Yield is zero reflecting no dividend payments during the period.

Evolution of Financial Ratios

From 2021 to 2024, Align Technology’s Return on Equity (ROE) declined significantly from 21.31% to 10.94%, indicating a slowdown in profitability. The Current Ratio showed minor fluctuations but remained stable around 1.2, reflecting consistent liquidity. The Debt-to-Equity Ratio stayed low and stable near 0.03, signaling minimal leverage and a conservative capital structure.

Are the Financial Ratios Favorable?

In 2024, profitability ratios show mixed signals: net margin is favorable at 10.54%, but ROE and return on invested capital are neutral around 10%, while WACC is unfavorable at 12.4%. Liquidity is generally favorable with a quick ratio of 1.1 and a neutral current ratio of 1.22. Leverage ratios including debt-to-equity (0.03) and debt-to-assets (1.92%) are favorable, with interest coverage effectively infinite. Market valuation ratios such as P/E (37.05) and P/B (4.05) are unfavorable. Overall, the financial ratios are slightly favorable.

Shareholder Return Policy

Align Technology, Inc. (ALGN) does not pay dividends, reflecting a reinvestment strategy likely aimed at supporting growth or innovation. The company maintains no dividend payout ratio or yield, with free cash flow coverage ratios indicating sufficient operational cash generation.

There is no indication of share buyback programs in the data. This absence of direct shareholder returns through dividends or buybacks suggests a focus on long-term value creation via reinvestment, although the lack of distributions requires careful monitoring of growth and capital allocation efficiency.

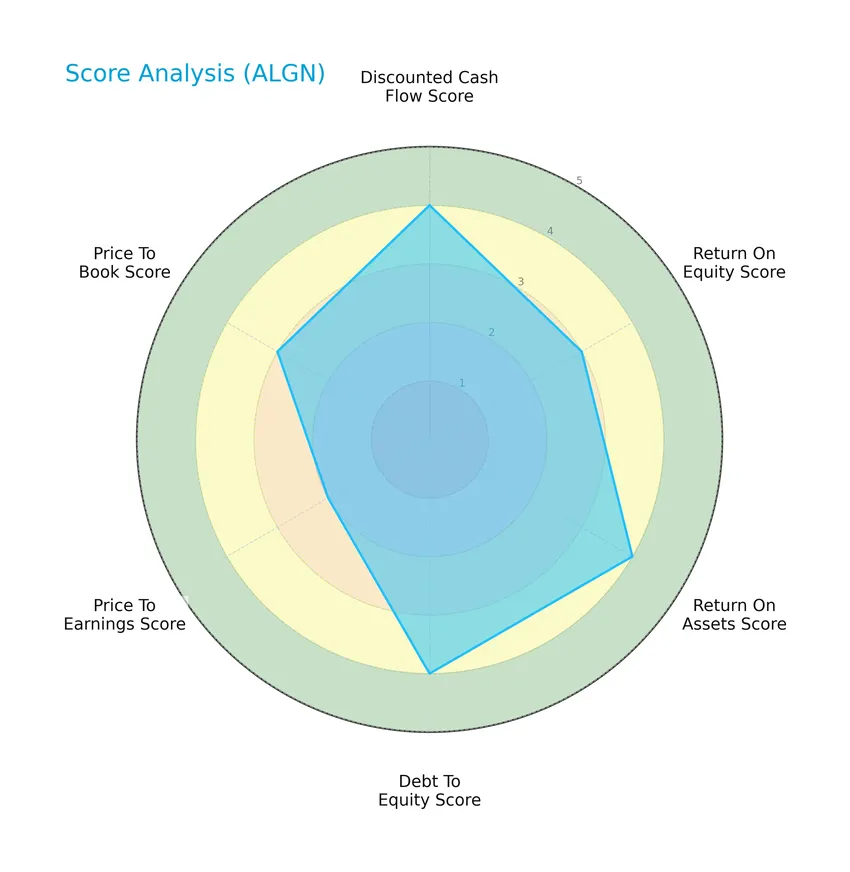

Score analysis

Here is an overview of Align Technology’s key financial scores, illustrating its valuation and financial performance indicators:

The company demonstrates favorable scores in discounted cash flow (4), return on assets (4), and debt-to-equity (4), indicating solid financial management. Return on equity (3), price-to-earnings (2), and price-to-book (3) scores are moderate, reflecting balanced profitability and valuation metrics.

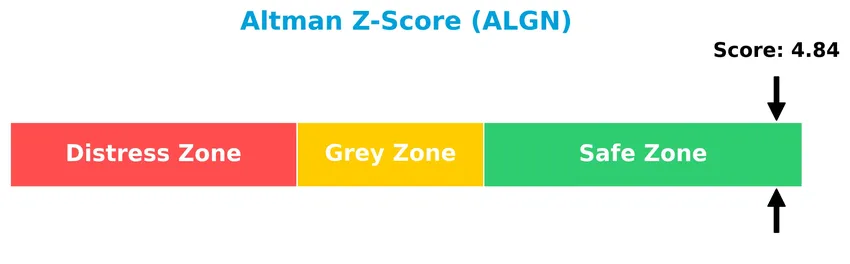

Analysis of the company’s bankruptcy risk

Align Technology’s Altman Z-Score indicates a strong financial position with a very low risk of bankruptcy:

Is the company in good financial health?

The Piotroski Score diagram summarizes Align Technology’s financial strength and operational efficiency:

With a Piotroski Score of 7, Align Technology is considered to have strong financial health, suggesting effective management of profitability, leverage, and liquidity factors.

Competitive Landscape & Sector Positioning

This sector analysis will explore Align Technology, Inc.’s strategic positioning, revenue by segment, key products, and main competitors within the medical devices industry. I will assess whether Align Technology holds a competitive advantage over its peers based on its product offerings and market presence.

Strategic Positioning

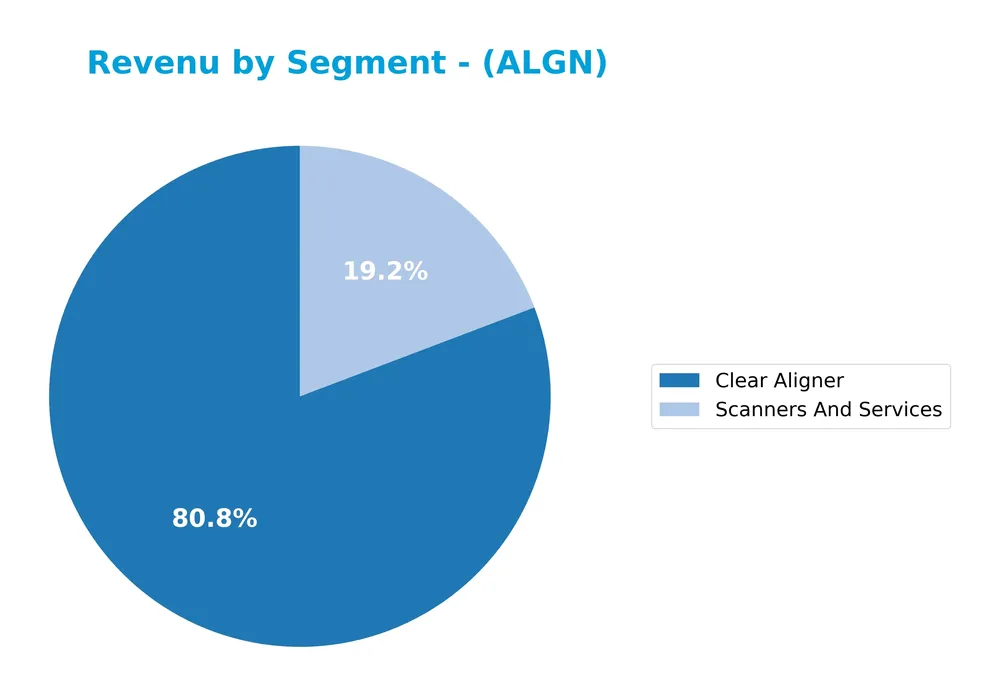

Align Technology, Inc. focuses on a concentrated product portfolio centered on clear aligners and intraoral scanners, with FY2024 revenues of $3.23B and $769M respectively. Geographically, it diversifies sales across the U.S. ($1.70B), Switzerland ($984M), and other international markets ($1.32B).

Revenue by Segment

The pie chart illustrates Align Technology, Inc.’s revenue distribution by product segment for the fiscal year 2024, highlighting the contribution of Clear Aligner and Scanners And Services.

In 2024, Clear Aligner remains the dominant revenue driver with $3.23B, reflecting steady growth and strong market demand. Scanners And Services contribute a smaller but significant $769M, showing consistent expansion. The business’s focus clearly centers on Clear Aligner solutions, with no major shifts in segment proportions recently, indicating concentration risk but also a clear specialization strategy.

Key Products & Brands

The table below presents Align Technology’s main products and brands along with their descriptions:

| Product | Description |

|---|---|

| Invisalign Clear Aligners | Comprehensive orthodontic treatment products, including packages for teenagers and children aged 7-10, addressing various dental needs with multiple treatment options. |

| Invisalign Non-Comprehensive Products | Moderate, lite, express packages, Invisalign Go, retention products, training fees, and ancillary treatment materials for dental professionals. |

| iTero Intraoral Scanners | A hardware platform with software options for restorative and orthodontic procedures, including digital records, CAD/CAM services, and various diagnostic and simulation tools. |

| Scanners and Services | Ancillary scanner products, disposable sleeves, third-party scanner integrations, and cloud-based applications for treatment progress and outcomes assessment. |

Align Technology’s key offerings focus on clear aligner orthodontics and advanced intraoral scanners with supporting software and services, serving a diverse range of dental practitioners globally.

Main Competitors

There are 10 competitors in the Healthcare – Medical Devices sector; below are the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Abbott Laboratories | 216.2B |

| Boston Scientific Corporation | 140.4B |

| Stryker Corporation | 133.1B |

| Medtronic plc | 123.2B |

| Edwards Lifesciences Corporation | 50.1B |

| DexCom, Inc. | 26.0B |

| STERIS plc | 24.6B |

| Insulet Corporation | 19.9B |

| Zimmer Biomet Holdings, Inc. | 17.8B |

| Align Technology, Inc. | 11.2B |

Align Technology ranks 10th among its main competitors with a market cap representing only 5.6% of the sector leader, Abbott Laboratories. The company is below both the average market cap of the top 10 competitors (76.3B) and the median market cap of the sector (38.1B). It also shows a significant 47.36% gap to the next competitor above, Zimmer Biomet Holdings.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does ALGN have a competitive advantage?

Align Technology, Inc. currently does not present a competitive advantage, as its return on invested capital (ROIC) is below its weighted average cost of capital (WACC), indicating value destruction and declining profitability. The company’s profitability metrics show a favorable gross margin of 70%, but net margin and earnings per share have declined significantly over recent years.

Looking ahead, Align Technology continues to develop new products like Invisalign comprehensive treatments for various age groups and advanced iTero scanners with software enhancements, offering growth opportunities in established and international markets including the US, Switzerland, and China.

SWOT Analysis

This SWOT analysis highlights Align Technology, Inc.’s key strengths, weaknesses, opportunities, and threats to aid investors in understanding its strategic position.

Strengths

- Strong brand recognition with Invisalign

- High gross margin at 70%

- Favorable net margin of 10.54%

Weaknesses

- Declining net income and EPS over 5 years

- High valuation multiples (PE 37.05, PB 4.05)

- Unfavorable operating expense growth

Opportunities

- Expansion in international markets, especially China and other international regions

- Innovation in scanner and digital orthodontic technology

- Growing demand for aesthetic dental solutions globally

Threats

- Intense competition in clear aligner market

- Regulatory risks in healthcare industry

- Economic downturns impacting elective dental procedures

Overall, Align Technology benefits from its market-leading product and strong profitability metrics but faces challenges from declining earnings growth and high valuation. Strategic focus on innovation and international expansion will be crucial to mitigate competitive and regulatory threats.

Stock Price Action Analysis

The weekly stock chart below illustrates Align Technology, Inc. (ALGN) price movements over the past 12 months, highlighting key fluctuations and trends:

Trend Analysis

Over the past 12 months, ALGN’s stock price declined by 43.76%, indicating a bearish trend with accelerating downward momentum. The highest price reached 327.92, while the lowest dropped to 125.79. Recent weeks show a short-term rebound of 25.13% since November 2025, suggesting a potential recovery phase but not altering the overall bearish stance.

Volume Analysis

In the last three months, trading volume for ALGN has been increasing, with buyer-driven activity dominating at 65.85%. This buyer dominance amid rising volume indicates growing investor interest and market participation, possibly reflecting optimism or accumulation following prior declines.

Target Prices

The consensus target prices for Align Technology, Inc. reflect a cautiously optimistic outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 200 | 140 | 173.63 |

Analysts expect Align Technology’s stock to trade between $140 and $200, with a consensus target price around $174, indicating moderate upside potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews recent analyst ratings and consumer feedback regarding Align Technology, Inc. (ALGN) to assess market sentiment.

Stock Grades

Here is a summary of the latest verified stock grades for Align Technology, Inc. from recognized financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Mizuho | Maintain | Outperform | 2026-01-20 |

| Piper Sandler | Maintain | Overweight | 2025-10-30 |

| Wells Fargo | Maintain | Overweight | 2025-10-30 |

| Morgan Stanley | Maintain | Equal Weight | 2025-10-30 |

| Evercore ISI Group | Maintain | Outperform | 2025-10-30 |

| Morgan Stanley | Maintain | Equal Weight | 2025-10-21 |

| UBS | Maintain | Neutral | 2025-10-16 |

| Mizuho | Maintain | Outperform | 2025-10-13 |

| Jefferies | Downgrade | Hold | 2025-10-10 |

| Evercore ISI Group | Maintain | Outperform | 2025-10-08 |

The consensus among these reputable firms leans toward a positive outlook, with multiple “Outperform” and “Overweight” ratings sustained over recent months, though a few hold and neutral positions suggest a cautious approach remains among some analysts.

Consumer Opinions

Consumers generally express a mix of admiration for Align Technology’s innovation and concerns about pricing and accessibility.

| Positive Reviews | Negative Reviews |

|---|---|

| “The Invisalign system has transformed my smile with minimal discomfort.” | “The treatment cost is quite high compared to traditional braces.” |

| “User-friendly app and excellent customer support throughout my treatment.” | “Waiting times for appointments can be lengthy in some locations.” |

| “Clear aligners are discreet and effective, perfect for adults.” | “Some users experienced slower progress than initially promised.” |

Overall, consumers appreciate Align Technology for its innovative, effective orthodontic solutions and strong customer service, while pricing and appointment availability remain common concerns.

Risk Analysis

Below is a summary table highlighting key risks associated with investing in Align Technology, Inc., focusing on their nature, likelihood, and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Valuation | Elevated P/E ratio of 37.05 suggests potential overvaluation, increasing downside risk. | Medium | High |

| Competitive Pressure | Intense competition in medical devices could affect market share and revenue growth. | Medium | Medium |

| Regulatory Risks | Healthcare regulations and approvals may delay product launches or add compliance costs. | Low | High |

| Operational Risks | Dependence on innovation and supply chain efficiency is critical for continuous product delivery. | Medium | Medium |

| Financial Leverage | Very low debt-to-equity ratio (0.03) reduces financial risk but may limit aggressive growth. | Low | Low |

| Market Volatility | Beta of 1.833 indicates high sensitivity to market fluctuations, increasing price volatility. | High | Medium |

The most significant risks for Align Technology are its high valuation multiples and market volatility, which could lead to sharp price corrections. Despite a strong financial position and solid Altman Z-Score placing the company in a safe zone, investors should remain cautious of sector competition and regulatory challenges.

Should You Buy Align Technology, Inc.?

Align Technology, Inc. appears to exhibit improving profitability with robust operational efficiency but shows a deteriorating competitive moat characterized by declining ROIC and value destruction. Despite a manageable leverage profile, the overall rating of A- suggests a favorable yet cautious investment profile.

Strength & Efficiency Pillars

Align Technology, Inc. exhibits solid financial health, underscored by an Altman Z-Score of 4.84, placing it firmly in the safe zone against bankruptcy risks. The company’s Piotroski Score of 7 reflects strong financial fundamentals, signaling operational strength. Profitability metrics are respectable with a net margin of 10.54% and a return on equity of 10.94%. However, the return on invested capital (ROIC) at 9.99% falls below the weighted average cost of capital (WACC) of 12.4%, indicating that Align is currently not a value creator and is shedding value despite operational efficiency.

Weaknesses and Drawbacks

Align’s valuation appears stretched, with a price-to-earnings ratio of 37.05 and a price-to-book ratio of 4.05, both flagged as unfavorable, suggesting investors are paying a premium that may not be fully justified by current earnings. Although leverage remains low with a debt-to-equity ratio of just 0.03 and favorable liquidity ratios (quick ratio of 1.1), the company faces pressure from its declining net margin (-85.33% over the overall period) and EPS (-74.92%), highlighting profitability erosion. The bearish overall stock trend with a -43.76% price change since the past year adds to market uncertainty, despite a recent buyer-dominant phase.

Our Verdict about Align Technology, Inc.

The long-term fundamental profile for Align Technology is mixed: financial stability and operational strength are evident, but value destruction due to ROIC below WACC and negative earnings trends present cautionary signals. Given the recent buyer dominance and positive short-term price acceleration, the profile may appear attractive for selective exposure; however, the stretched valuation and ongoing profitability challenges suggest investors might consider a wait-and-see approach for a more favorable entry point.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Align Technology Q4 Preview: Even After A Big Drop In Price, It’s Too Expensive (ALGN) – Seeking Alpha (Jan 19, 2026)

- Zacks Industry Outlook Highlights McKesson, Cardinal Health, West Pharmaceutical and Align Technology – Yahoo Finance (Jan 23, 2026)

- Align Tech (ALGN) Receives a Hold from UBS – The Globe and Mail (Jan 21, 2026)

- Demystifying Align Technology: Insights From 6 Analyst Reviews – Benzinga (Jan 20, 2026)

- Align Technology Announces Third Quarter 2025 Financial Results – Business Wire (Oct 29, 2025)

For more information about Align Technology, Inc., please visit the official website: aligntech.com