Home > Analyses > Consumer Cyclical > Alibaba Group Holding Limited

Alibaba Group Holding Limited transforms how millions shop, sell, and interact digitally, shaping the future of commerce and technology in China and beyond. Renowned for its dominant e-commerce platforms like Taobao and Tmall, alongside cutting-edge cloud and logistics services, Alibaba stands as a beacon of innovation and market influence. As it navigates evolving regulatory and competitive landscapes, the critical question remains: do Alibaba’s fundamentals still support its lofty market valuation and growth ambitions?

Table of contents

Business Model & Company Overview

Alibaba Group Holding Limited, founded in 1999 and headquartered in Hangzhou, China, stands as a dominant force in specialty retail and technology infrastructure. Its ecosystem seamlessly connects merchants, brands, and consumers through platforms like Taobao, Tmall, and Lazada, driving a comprehensive digital commerce experience across China and beyond.

The company’s revenue engine balances diverse streams including e-commerce marketplaces, cloud computing, logistics, and digital media services. By integrating hardware, software, and marketing solutions, Alibaba leverages its global presence in the Americas, Europe, and Asia to sustain growth. Its extensive platform network and innovative capabilities constitute a formidable economic moat, shaping the future of global retail and technology.

Financial Performance & Fundamental Metrics

This section provides a comprehensive fundamental analysis of Alibaba Group Holding Limited, focusing on its income statement, key financial ratios, and dividend payout policy.

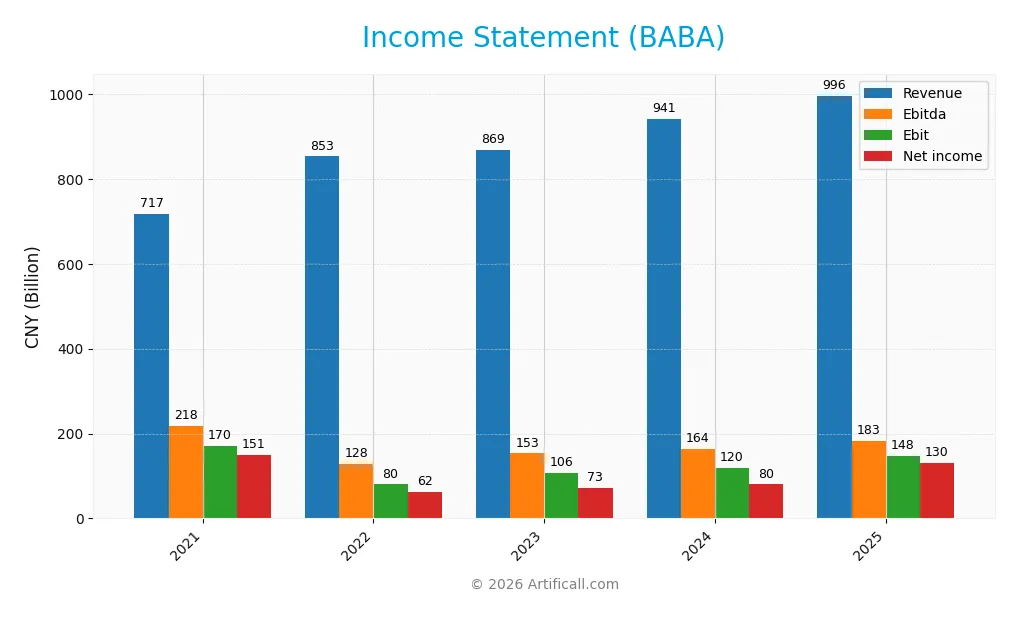

Income Statement

The following table presents Alibaba Group Holding Limited’s key income statement figures for the fiscal years 2021 through 2025, reported in CNY.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 717.3B | 853.1B | 868.7B | 941.2B | 996.3B |

| Cost of Revenue | 421.2B | 539.5B | 549.7B | 586.3B | 598.3B |

| Operating Expenses | 206.4B | 244.0B | 218.6B | 241.5B | 257.2B |

| Gross Profit | 296.1B | 313.6B | 319.0B | 354.8B | 398.1B |

| EBITDA | 218.0B | 128.2B | 153.1B | 164.0B | 182.7B |

| EBIT | 170.1B | 80.2B | 106.2B | 119.5B | 147.7B |

| Interest Expense | 20.6B | 20.6B | 17.0B | 17.9B | 9.6B |

| Net Income | 150.3B | 61.9B | 72.5B | 79.5B | 129.5B |

| EPS | 55.6 | 22.96 | 27.68 | 31.6 | 55.12 |

| Filing Date | 2021-07-27 | 2022-07-26 | 2023-07-21 | 2024-05-23 | 2025-06-26 |

Income Statement Evolution

Between 2021 and 2025, Alibaba’s revenue grew by 38.9%, showing a favorable expansion, though net income declined by 13.59%, indicating some profitability challenges. Gross margin improved to 39.95%, reflecting better cost control, while net margin fell by 37.79% overall, signaling margin pressures despite a recent one-year net margin growth of 53.61%.

Is the Income Statement Favorable?

In 2025, Alibaba reported revenue of 996B CNY, up 5.86% year-on-year, with gross profit rising 12.18%, indicating strong operational efficiency. Operating expenses grew at the same rate as revenue, which was unfavorable, yet EBIT increased by 23.6%. Net margin and EPS growth were notably favorable, supporting a generally positive assessment of the company’s recent income statement fundamentals.

Financial Ratios

Below is a summary of key financial ratios for Alibaba Group Holding Limited over the last five fiscal years:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 21% | 7% | 8% | 9% | 13% |

| ROE | 16% | 7% | 7% | 8% | 13% |

| ROIC | 6% | 3% | 6% | 6% | 8% |

| P/E | 27 | 30 | 25 | 17 | 17 |

| P/B | 4.3 | 2.0 | 1.9 | 1.4 | 2.2 |

| Current Ratio | 1.7 | 1.7 | 1.8 | 1.8 | 1.5 |

| Quick Ratio | 1.6 | 1.6 | 1.7 | 1.7 | 1.5 |

| D/E (Debt-to-Equity) | 0.19 | 0.19 | 0.20 | 0.21 | 0.25 |

| Debt-to-Assets | 11% | 10% | 11% | 12% | 14% |

| Interest Coverage | 4.4x | 3.4x | 5.9x | 6.3x | 14.7x |

| Asset Turnover | 0.42 | 0.50 | 0.50 | 0.53 | 0.55 |

| Fixed Asset Turnover | 3.2 | 3.4 | 3.4 | 3.4 | 4.0 |

| Dividend Yield | 0% | 0% | 0% | 1.3% | 1.3% |

Evolution of Financial Ratios

Over the 2021-2025 period, Alibaba’s Return on Equity (ROE) showed a decline from 16.04% in 2021 to 12.86% in 2025, indicating a moderate reduction in profitability. The Current Ratio decreased from about 1.70 to 1.54, reflecting a slight tightening in liquidity. The Debt-to-Equity Ratio increased marginally to 0.25 in 2025, suggesting stable but slightly higher leverage. Profit margins improved notably in 2025 with net margin reaching 13.06%.

Are the Financial Ratios Favorable?

In 2025, Alibaba’s profitability ratios show a neutral to favorable picture, with net margin favorable at 13.06% and ROE neutral at 12.86%. Liquidity ratios, including the current ratio of 1.54 and quick ratio of 1.49, are favorable, ensuring adequate short-term asset coverage. Leverage remains low and favorable with a debt-to-equity ratio of 0.25 and interest coverage ratio of 15.39. Efficiency measures such as asset turnover are neutral, while market valuation ratios like P/E of 17.32 and P/B of 2.23 are neutral, reflecting balanced investor expectations. Overall, 57.14% of key ratios are favorable, indicating a generally positive financial health.

Shareholder Return Policy

Alibaba Group Holding Limited has paid dividends since fiscal year 2024, with a dividend payout ratio around 22%, a dividend per share rising from 7.11 CNY in 2024 to 12.38 CNY in 2025, and an annual yield near 1.3%. The dividend is moderately covered by free cash flow, indicating a balanced distribution approach.

The company also engages in share buybacks, complementing dividends as a shareholder return mechanism. This combined policy appears to support sustainable long-term value creation, given Alibaba’s positive net income and solid cash flow coverage, though careful monitoring of payout and repurchase levels remains prudent.

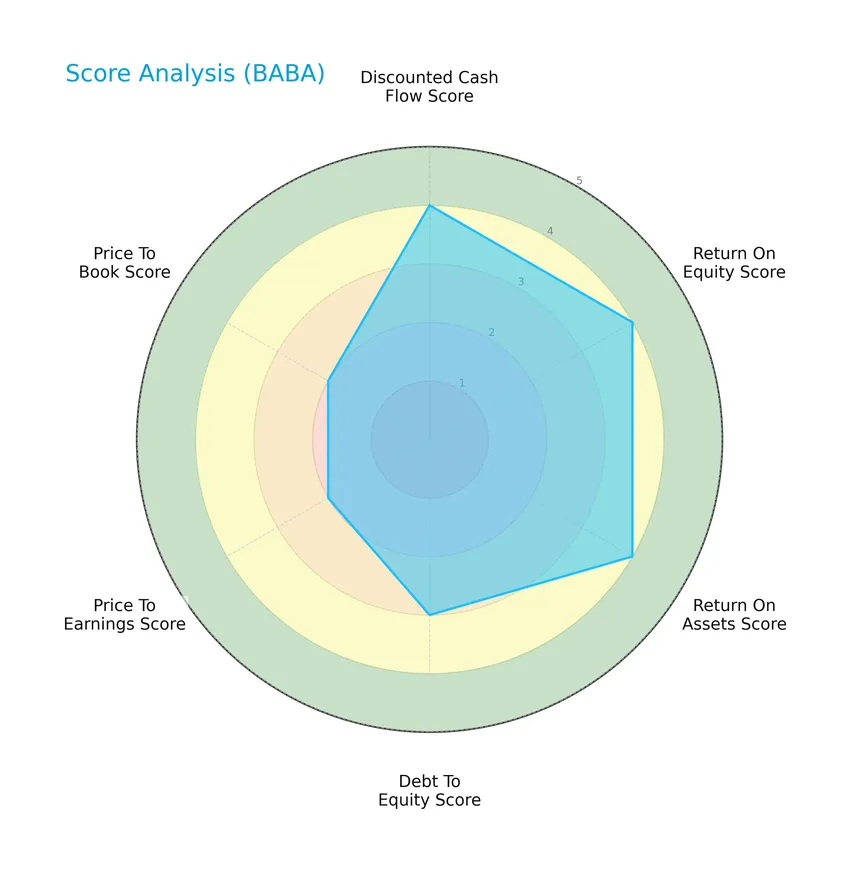

Score analysis

The following radar chart presents a comprehensive view of Alibaba Group Holding Limited’s key financial scores:

Alibaba demonstrates favorable scores in discounted cash flow, return on equity, and return on assets, each rated 4. Debt-to-equity holds a moderate score of 3, while valuation metrics price-to-earnings and price-to-book show moderate scores of 2, reflecting mixed market valuation perspectives.

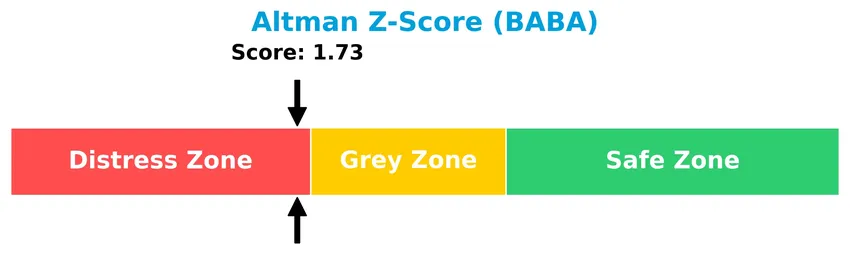

Analysis of the company’s bankruptcy risk

Alibaba’s Altman Z-Score places it in the distress zone, indicating a higher risk of financial distress and potential bankruptcy:

Is the company in good financial health?

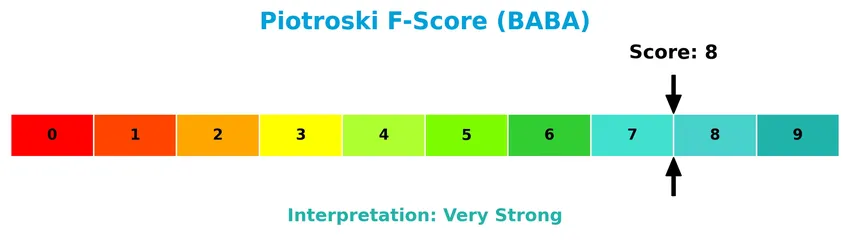

The Piotroski Score diagram provides insight into Alibaba’s financial health based on nine fundamental criteria:

With a strong Piotroski Score of 8, Alibaba exhibits very strong financial health, suggesting robust profitability, liquidity, and operational efficiency.

Competitive Landscape & Sector Positioning

This sector analysis will explore Alibaba Group Holding Limited’s strategic positioning, revenue by segment, key products, main competitors, and competitive advantages. I will assess whether Alibaba possesses a competitive edge relative to its industry peers.

Strategic Positioning

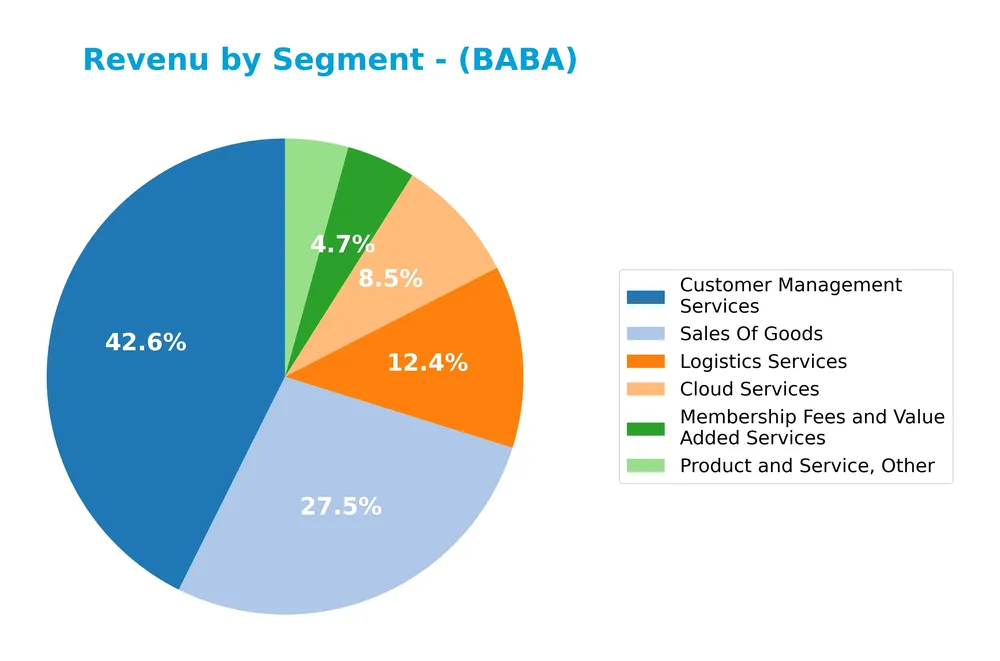

Alibaba Group Holding Limited maintains a diversified portfolio across multiple segments, including significant revenues from Customer Management Services (over 420B CNY in 2025), Sales of Goods (around 274B CNY), Logistics Services (123B CNY), and Cloud Services (85B CNY), reflecting broad geographic and business exposure beyond China.

Revenue by Segment

The pie chart illustrates Alibaba Group Holding Limited’s revenue distribution by segment for the fiscal year 2025, highlighting key business areas and their contribution to total revenue.

In 2025, Customer Management Services led revenue generation with 425B, followed by Sales of Goods at 274B and Logistics Services at 123B. Cloud Services and Membership Fees segments showed steady growth to 85B and 47B respectively, while Sales of Goods slightly declined from 2024. The data indicates a diversification in revenue sources, with customer management as the dominant driver, though some slowdown in goods sales suggests a need for cautious portfolio balance.

Key Products & Brands

The table below outlines Alibaba Group Holding Limited’s key products and brands along with their descriptions:

| Product | Description |

|---|---|

| Taobao and Tmall | Digital retail platforms serving consumers and merchants primarily in China. |

| Alimama | Proprietary monetization platform offering marketing services such as pay-for-performance, in-feed, and display advertising. |

| 1688.com and Alibaba.com | Online wholesale marketplaces connecting suppliers and buyers globally. |

| AliExpress, Lazada, Trendyol, Daraz | International e-commerce platforms catering to retail consumers across various regions. |

| Freshippo | Retail platform specializing in groceries and fresh goods. |

| Tmall Global | Import e-commerce platform facilitating cross-border sales. |

| Cainiao Network | Logistics services platform supporting efficient delivery and supply chain management. |

| Ele.me and Koubei | On-demand delivery and local services platforms, including restaurant guides. |

| Fliggy | Online travel platform offering travel-related booking and services. |

| Youku, Alibaba Pictures, Quark | Digital media platforms delivering online videos, films, live events, news, literature, and music content. |

| Amap | Mobile digital map, navigation, and real-time traffic information application. |

| DingTalk | Business efficiency mobile application for communication and collaboration. |

| Tmall Genie | Smart speaker device integrating AI and voice interaction capabilities. |

| Qwen | Artificial intelligence chatbot supporting various interactive functions. |

Alibaba’s diverse portfolio spans e-commerce, logistics, cloud computing, digital media, and innovative AI-driven products, reflecting a broad engagement across consumer and enterprise services.

Main Competitors

Alibaba Group Holding Limited faces competition from 10 major companies in the Specialty Retail sector, ranked here by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Amazon.com, Inc. | 2.42T |

| Alibaba Group Holding Limited | 340B |

| PDD Holdings Inc. | 159B |

| MercadoLibre, Inc. | 102B |

| eBay Inc. | 39.4B |

| Ulta Beauty, Inc. | 27.8B |

| Tractor Supply Company | 26.9B |

| Williams-Sonoma, Inc. | 23.0B |

| Genuine Parts Company | 17.2B |

| Best Buy Co., Inc. | 14.5B |

Alibaba ranks 2nd among its competitors, with a market cap about 16.6% that of the leader, Amazon. The company stands above both the average market cap of the top 10 (317B) and the median market cap in the sector (33.6B). Notably, Alibaba’s market cap is 502.7% higher than the next closest competitor, highlighting a significant gap.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does Alibaba have a competitive advantage?

Alibaba Group Holding Limited presents a competitive advantage, as it consistently generates a return on invested capital (ROIC) that exceeds its weighted average cost of capital (WACC) by over 2.5%, indicating value creation. The company’s ROIC has shown a strong upward trend of 40.8% over the 2021-2025 period, reflecting growing profitability and efficient capital use.

Looking ahead, Alibaba’s diverse segments—including e-commerce platforms like Taobao and Tmall, logistics with Cainiao, cloud computing, and digital media—position it well for future growth. Innovation initiatives such as AI chatbot Qwen and smart devices like Tmall Genie suggest potential expansion opportunities in technology-driven markets.

SWOT Analysis

This SWOT analysis highlights Alibaba Group Holding Limited’s key internal and external factors to inform strategic investment decisions.

Strengths

- strong technology infrastructure

- diverse business segments

- favorable profitability margins

Weaknesses

- moderate revenue growth rate

- net income decline over period

- Altman Z-Score in distress zone

Opportunities

- expanding international commerce

- growth in cloud and AI services

- rising demand for digital and local consumer services

Threats

- regulatory pressure in China

- fierce e-commerce competition

- economic slowdown impacting consumer spending

Alibaba’s durable competitive advantage and solid profitability support a favorable outlook. However, cautious monitoring of regulatory risks and improving financial distress signals is critical to managing investment risks.

Stock Price Action Analysis

The weekly stock chart for Alibaba Group Holding Limited displays price movements and trends over the past 12 months, highlighting key fluctuations and momentum shifts:

Trend Analysis

Over the past 12 months, Alibaba’s stock price increased by 132.15%, indicating a strong bullish trend. The price ranged between a low of 69.07 and a high of 188.03, with volatility reflected by a 32.17 standard deviation. However, the trend shows deceleration despite continued upward movement.

Volume Analysis

In the last three months, trading volume has been decreasing overall, with buyer volume at 351M and seller volume slightly higher at 361M, reflecting neutral buyer behavior at 49.29% dominance. This suggests balanced investor sentiment with reduced market participation.

Target Prices

The consensus target prices for Alibaba Group Holding Limited reflect moderate optimism among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 225 | 140 | 188.62 |

Analysts expect Alibaba’s stock to trade within a range of 140 to 225, with a consensus target near 189, suggesting potential upside while acknowledging some downside risk.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews the latest analyst ratings and consumer feedback concerning Alibaba Group Holding Limited’s market performance and reputation.

Stock Grades

The latest verified grades from reputable financial institutions for Alibaba Group Holding Limited are presented in the table below:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Jefferies | Maintain | Buy | 2026-01-08 |

| Freedom Capital Markets | Downgrade | Hold | 2026-01-06 |

| JP Morgan | Maintain | Overweight | 2025-11-26 |

| Barclays | Maintain | Overweight | 2025-11-26 |

| Citigroup | Maintain | Buy | 2025-11-26 |

| Benchmark | Maintain | Buy | 2025-11-26 |

| Bernstein | Maintain | Outperform | 2025-11-26 |

| Bernstein | Maintain | Outperform | 2025-10-10 |

| JP Morgan | Maintain | Overweight | 2025-10-09 |

| JP Morgan | Maintain | Overweight | 2025-10-01 |

Overall, the grades for Alibaba remain predominantly positive with multiple institutions maintaining Buy, Overweight, and Outperform ratings. The only recent downgrade was by Freedom Capital Markets, shifting from Buy to Hold, indicating a cautious but generally favorable outlook.

Consumer Opinions

Consumer sentiment around Alibaba Group Holding Limited (BABA) remains mixed but insightful, reflecting both strong brand loyalty and areas for improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| “Fast delivery and wide product range make shopping easy and convenient.” | “Customer service response times can be slow during peak periods.” |

| “Competitive prices and regular promotions offer great value.” | “Some sellers on the platform have inconsistent product quality.” |

| “User-friendly interface with helpful product reviews and ratings.” | “International shipping delays affect overall satisfaction.” |

Overall, consumers appreciate Alibaba’s vast selection and competitive pricing but often cite concerns related to customer service responsiveness and occasional product quality issues from third-party sellers.

Risk Analysis

Below is a table summarizing the key risks facing Alibaba Group Holding Limited, with their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Regulatory Risk | Heightened regulatory scrutiny by Chinese authorities could limit growth or impose fines. | High | High |

| Market Volatility | Stock price has shown a wide trading range (86.48-192.67 USD), reflecting sensitivity to market conditions. | Medium | Medium |

| Financial Distress | Altman Z-score of 1.73 places Alibaba in the distress zone, signaling potential bankruptcy risk. | Medium | High |

| Competition | Intense competition in e-commerce and cloud sectors from both domestic and global players. | Medium | Medium |

| Geopolitical Risk | US-China tensions and trade policies can disrupt international commerce and investor sentiment. | High | High |

The most pressing risks are regulatory and geopolitical, both carrying high probability and impact due to ongoing government interventions and global tensions. Alibaba’s distress-zone Altman Z-score also warrants caution despite strong operational metrics and a very strong Piotroski score. Investors should weigh these risks carefully against Alibaba’s favorable financial ratios before investing.

Should You Buy Alibaba Group Holding Limited?

Alibaba appears to be a company with improving profitability and a durable competitive moat supported by growing ROIC, suggesting strong value creation. Despite a moderate leverage profile and an Altman Z-score in the distress zone, its overall rating of B+ could be seen as very favorable.

Strength & Efficiency Pillars

Alibaba Group Holding Limited exhibits solid profitability with a net margin of 13.06% and a return on equity (ROE) of 12.86%, reflecting stable earnings generation. The company’s return on invested capital (ROIC) stands at 7.87%, notably exceeding its weighted average cost of capital (WACC) of 5.35%, confirming Alibaba as a value creator. Financial health indicators reinforce this strength: a Piotroski score of 8 suggests very strong fundamentals, although the Altman Z-Score of 1.73 places it in the distress zone, signaling caution. Overall, Alibaba maintains favorable operational efficiency and value creation metrics.

Weaknesses and Drawbacks

Risks stem primarily from valuation and liquidity perspectives. The price-to-earnings (P/E) ratio of 17.32 and price-to-book (P/B) ratio of 2.23 indicate a moderate premium, which may limit upside if growth slows. While leverage is conservatively managed with a debt-to-equity ratio of 0.25 and favorable current and quick ratios above 1.5, the Altman Z-Score’s distress zone status flags potential financial vulnerability. Additionally, recent buyer dominance stands neutral at 49.29%, suggesting a lack of strong market conviction and possible short-term indecision.

Our Verdict about Alibaba Group Holding Limited

Alibaba’s long-term fundamental profile might appear favorable given its consistent value creation and strong profitability. However, the recent period shows neutral buyer behavior and slight deceleration in price momentum, which suggests that despite its underlying strength, investors could consider a cautious stance. This profile could attract those seeking long-term exposure but might also warrant waiting for more decisive market signals to confirm a sustainable uptrend.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Alibaba Group Holding Limited $BABA Shares Sold by Root Financial Partners LLC – MarketBeat (Jan 21, 2026)

- Alibaba Group Holding Limited (BABA) Launching its AI Services for Restaurants – Yahoo Finance (Jan 12, 2026)

- Alibaba: Brace For Dip After Exceptional Price Performance YTD (Rating Downgrade) – Seeking Alpha (Jan 23, 2026)

- Strong Analyst Confidence in Alibaba Group Holding (BABA) Amid AI and Cloud Momentum – Insider Monkey (Jan 18, 2026)

- Where Will Alibaba Stock Be in 5 Years? – Finviz (Jan 20, 2026)

For more information about Alibaba Group Holding Limited, please visit the official website: alibabagroup.com