Home > Analyses > Technology > Akamai Technologies, Inc.

Akamai Technologies, Inc. powers the digital experiences that shape our connected world, ensuring websites, applications, and media streams run smoothly and securely. As a pioneer in cloud infrastructure and cybersecurity, Akamai leads with innovative solutions that protect and optimize internet content delivery on a global scale. Renowned for its cutting-edge edge computing and threat mitigation services, the company plays a critical role in today’s digital economy. But does Akamai’s solid market position and technology edge still translate into attractive growth and value for investors in 2026?

Table of contents

Business Model & Company Overview

Akamai Technologies, Inc., founded in 1998 and headquartered in Cambridge, Massachusetts, stands as a leader in the Software – Infrastructure industry. The company’s core mission centers on a cohesive ecosystem of cloud services that secure, deliver, and optimize internet content and business applications globally. Its offerings span cybersecurity, web and mobile performance, media delivery, and edge computing, creating a comprehensive platform that supports dynamic digital experiences.

Akamai’s revenue engine balances software-driven cloud solutions with recurring service contracts, underpinning its global reach across the Americas, Europe, and Asia. The company’s integration of security, performance, and edge compute solutions fuels its value creation, serving a diverse client base through direct sales and channel partners. This stronghold establishes a durable economic moat, positioning Akamai as a pivotal force shaping the future of internet infrastructure.

Financial Performance & Fundamental Metrics

I will analyze Akamai Technologies, Inc.’s income statement, key financial ratios, and dividend payout policy to provide a comprehensive view of its fundamental strength.

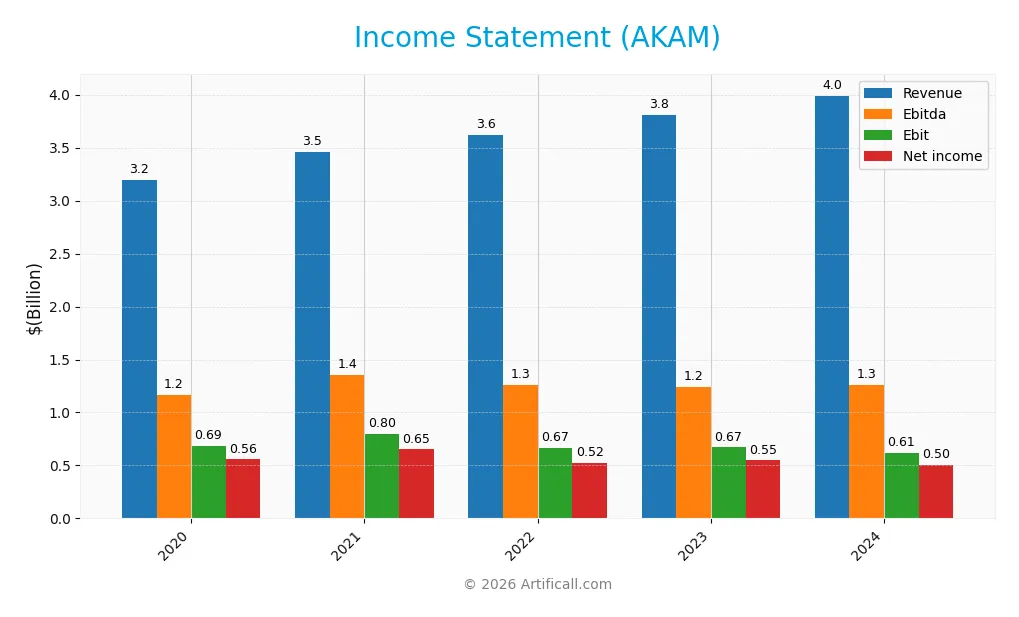

Income Statement

The table below presents Akamai Technologies, Inc.’s key income statement figures for the fiscal years 2020 through 2024, reported in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 3.20B | 3.46B | 3.62B | 3.81B | 3.99B |

| Cost of Revenue | 1.13B | 1.27B | 1.38B | 1.51B | 1.62B |

| Operating Expenses | 1.41B | 1.41B | 1.56B | 1.66B | 1.84B |

| Gross Profit | 2.07B | 2.19B | 2.23B | 2.30B | 2.37B |

| EBITDA | 1.16B | 1.35B | 1.26B | 1.24B | 1.26B |

| EBIT | 685M | 801M | 669M | 670M | 614M |

| Interest Expense | 69M | 72M | 11M | 18M | 27M |

| Net Income | 557M | 652M | 524M | 548M | 505M |

| EPS | 3.43 | 4.01 | 3.29 | 3.59 | 3.34 |

| Filing Date | 2021-02-26 | 2022-02-28 | 2023-02-28 | 2023-12-31 | 2025-02-24 |

Income Statement Evolution

Akamai Technologies saw a 24.8% revenue growth over 2020-2024, with a more modest 4.7% increase from 2023 to 2024, indicating a slowdown. Gross profit followed a similar trend with neutral growth recently. However, net income declined by 9.36% over the period, with margins reflecting this: net margin dropped by 27.37%, while gross margin remained favorable at 59.39%.

Is the Income Statement Favorable?

In 2024, Akamai reported a revenue of 3.99B USD and net income of 505M USD, translating to a net margin of 12.65%, which is still favorable. Yet, key profitability indicators such as EBIT and net margin declined year-over-year by 8.37% and 11.94%, respectively. Operating expenses grew on par with revenue, limiting margin expansion. Overall, the fundamentals appear mixed, leaning towards an unfavorable income statement assessment.

Financial Ratios

The following table presents key financial ratios for Akamai Technologies, Inc. over the fiscal years 2020 to 2024, illustrating its profitability, liquidity, leverage, and market valuation metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 17% | 19% | 14% | 14% | 13% |

| ROE | 13% | 14% | 12% | 12% | 10% |

| ROIC | 8% | 9% | 7% | 6% | 5% |

| P/E | 31 | 29 | 26 | 33 | 29 |

| P/B | 4.01 | 4.20 | 3.08 | 3.93 | 2.97 |

| Current Ratio | 2.54 | 2.43 | 2.41 | 2.16 | 1.23 |

| Quick Ratio | 2.54 | 2.43 | 2.41 | 2.16 | 1.23 |

| D/E | 0.65 | 0.63 | 0.73 | 0.99 | 0.95 |

| Debt-to-Assets | 36% | 35% | 38% | 46% | 45% |

| Interest Coverage | 9.5x | 11x | 61x | 36x | 20x |

| Asset Turnover | 0.41 | 0.43 | 0.44 | 0.39 | 0.38 |

| Fixed Asset Turnover | 1.41 | 1.39 | 1.54 | 1.39 | 1.33 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

Over the recent period, Akamai Technologies’ Return on Equity (ROE) declined from 14.38% in 2021 to 10.35% in 2024, indicating a slowing in profitability growth. The Current Ratio also decreased significantly from about 2.43 in 2021 to 1.23 in 2024, reflecting reduced liquidity. Meanwhile, the Debt-to-Equity Ratio rose from 0.63 to 0.95, showing increased leverage over time.

Are the Financial Ratios Favorable?

In 2024, Akamai’s profitability is moderate with a net margin of 12.65%, considered favorable, but ROE and return on invested capital are neutral to unfavorable. Liquidity ratios present a mixed picture: a neutral Current Ratio of 1.23 contrasts with a favorable Quick Ratio of the same value. Leverage levels are neutral with a Debt-to-Equity Ratio of 0.95 and debt to assets at 44.7%. Market valuation ratios such as P/E at 28.68 are unfavorable, while P/B at 2.97 is neutral. Overall, the financial ratios convey a neutral stance.

Shareholder Return Policy

Akamai Technologies, Inc. does not pay dividends, reflecting a strategy focused on reinvestment rather than direct shareholder distributions. The company’s free cash flow supports potential share buybacks; however, no explicit buyback activity is reported. This approach aligns with prioritizing growth and long-term value creation.

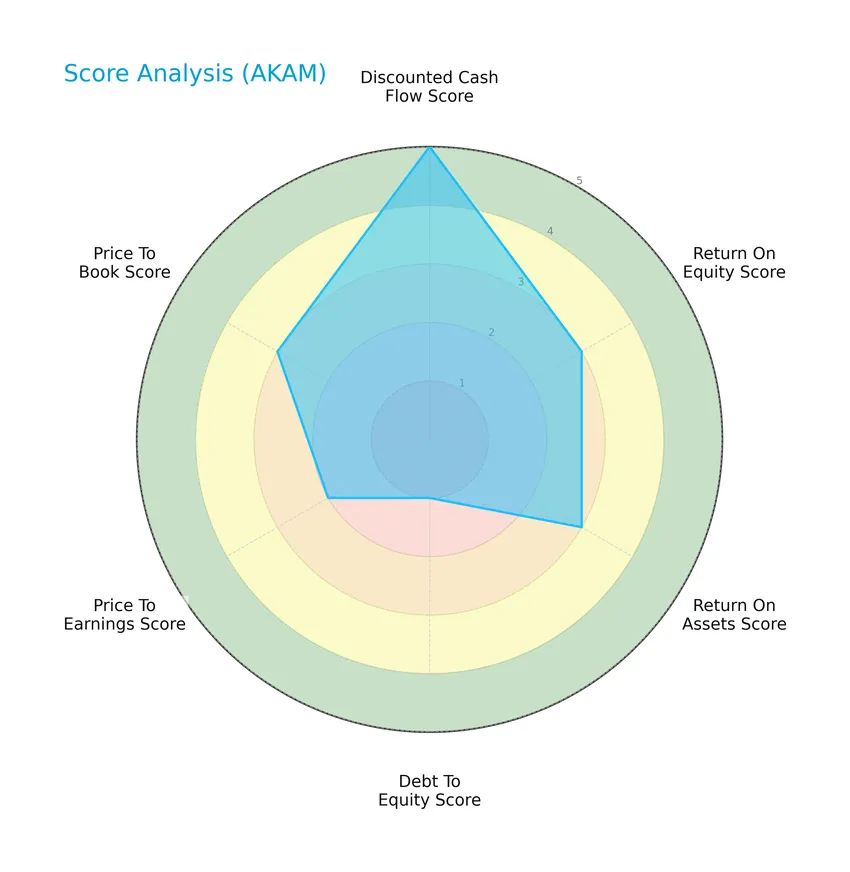

Score analysis

The following radar chart presents a comprehensive view of Akamai Technologies, Inc.’s key financial scores across multiple valuation and performance metrics:

Akamai shows a very favorable discounted cash flow score of 5, signaling strong intrinsic value. Return on equity and assets scores are moderate at 3, reflecting average profitability. However, the debt to equity score is very unfavorable at 1, indicating higher leverage risks. Price-to-earnings and price-to-book scores are moderate, suggesting a balanced market valuation.

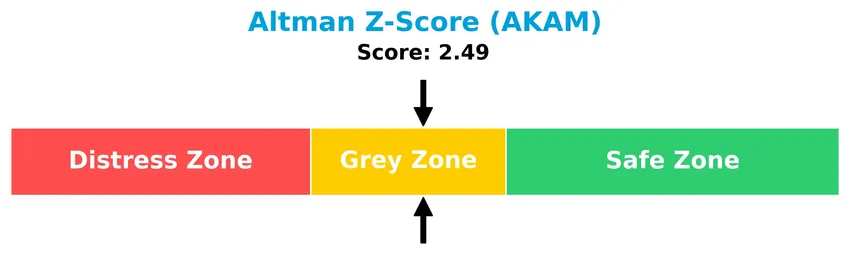

Analysis of the company’s bankruptcy risk

The Altman Z-Score places Akamai Technologies in the grey zone, indicating a moderate risk of bankruptcy that warrants cautious monitoring:

Is the company in good financial health?

The Piotroski Score diagram illustrates Akamai’s solid financial health based on key profitability, liquidity, and efficiency metrics:

With a Piotroski Score of 7 classified as strong, Akamai demonstrates robust financial strength, reflecting good fundamentals though not at the very highest level of financial health.

Competitive Landscape & Sector Positioning

This sector analysis will explore Akamai Technologies, Inc.’s strategic positioning, revenue by segment, key products, main competitors, competitive advantages, and SWOT analysis. I will examine whether Akamai holds a competitive advantage over its industry peers.

Strategic Positioning

Akamai Technologies, Inc. maintains a concentrated product portfolio focused on cloud services for security, content delivery, and edge computing within the software infrastructure industry. Geographically, it balances exposure between the U.S. (2.08B in 2024) and international markets (1.92B in 2024), showing steady global revenue growth.

Revenue by Segment

The pie chart illustrates the revenue distribution by segment for Akamai Technologies, Inc. during the fiscal year 2024.

In 2024, Akamai reported total segment revenue of approximately 3.99B USD. The data indicates a consolidated reporting under a single segment, which suggests a focused business model without further detailed subdivision. This concentration highlights a potential risk if the company does not diversify its revenue streams, although it may also reflect a streamlined operational structure. Monitoring future disclosures for segmentation changes will be important.

Key Products & Brands

The following table outlines Akamai Technologies’ principal products and services:

| Product | Description |

|---|---|

| Cloud Security Solutions | Services designed to protect infrastructure, websites, applications, APIs, and users from cyberattacks and online threats. |

| Web & Mobile Performance | Solutions that enhance the speed and reliability of dynamic websites and mobile applications. |

| Media Delivery | Technologies supporting video streaming, video player services, game and software delivery, and broadcast operations. |

| Edge Compute Solutions | Platforms enabling developers to deploy and distribute code at the edge of the network for improved performance and scalability. |

| Carrier Offerings | Cybersecurity protection, parental controls, DNS infrastructure, and content delivery services tailored for carrier networks. |

| Service & Support | Assistance with integration, configuration, optimization, and management of Akamai’s products and services. |

Akamai Technologies offers a comprehensive suite of cloud services focused on security, performance, media delivery, and edge computing, supporting diverse customer needs across global internet infrastructure.

Main Competitors

There are 32 competitors in the sector, with the table below showing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Microsoft Corporation | 3.52T |

| Oracle Corporation | 553B |

| Palantir Technologies Inc. | 383B |

| Adobe Inc. | 140B |

| Palo Alto Networks, Inc. | 120B |

| CrowdStrike Holdings, Inc. | 113B |

| Synopsys, Inc. | 92B |

| Cloudflare, Inc. | 69B |

| Fortinet, Inc. | 59B |

| Block, Inc. | 40B |

Akamai Technologies, Inc. ranks 23rd among 32 competitors, with a market cap just 0.39% of Microsoft Corporation, the sector leader. The company is positioned below both the average market cap of the top 10 competitors (508B) and the sector median (18.8B). Akamai maintains a narrow 1.39% gap above its closest competitor, indicating a tight cluster around its market size.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does AKAM have a competitive advantage?

Akamai Technologies, Inc. currently does not present a competitive advantage, as it is shedding value with a declining ROIC trend and an overall very unfavorable moat status. The company’s profitability metrics, including net margin and EBIT margin, remain favorable but its ROIC is below WACC, indicating value destruction.

Looking ahead, Akamai focuses on expanding its cloud services portfolio, including cybersecurity, edge computing, and media delivery solutions for global markets, which may present growth opportunities in evolving internet infrastructure and security demands.

SWOT Analysis

This SWOT analysis highlights Akamai Technologies, Inc.’s key internal and external factors to aid investors in strategic decision-making.

Strengths

- Strong market position in cloud security and content delivery

- Favorable gross margin at 59.39%

- Diverse global revenue with growing international sales

Weaknesses

- Declining net margin and EPS growth over recent years

- Moderate debt level with debt-to-equity concerns

- Unfavorable asset turnover and value destruction indicated by ROIC below WACC

Opportunities

- Expansion in edge computing and cybersecurity demand

- Increasing cloud adoption worldwide

- Potential to improve operational efficiency and margin recovery

Threats

- Intense competition in cloud infrastructure and security

- Rapid technological changes

- Economic uncertainties impacting IT budgets

Overall, Akamai shows robust strengths in its core offerings and market reach but faces profitability and efficiency challenges. Strategic focus should be on margin improvement, innovation in emerging cloud segments, and prudent risk management to sustain growth and shareholder value.

Stock Price Action Analysis

The following weekly stock chart illustrates Akamai Technologies, Inc.’s price movements over the past 12 months, highlighting volatility and key price levels:

Trend Analysis

Over the past 12 months, AKAM’s stock price declined by 13.75%, indicating a bearish trend with accelerating downward momentum. The price fluctuated between a high of 111.0 and a low of 70.53, with a standard deviation of 10.77 reflecting notable volatility during this period.

Volume Analysis

In the last three months, trading volume has been increasing and strongly buyer-driven, with buyers accounting for 86.48% of activity. This rising volume and buyer dominance suggest heightened market participation and positive investor sentiment during this recent period.

Target Prices

The consensus target prices for Akamai Technologies, Inc. reflect a cautiously optimistic outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 115 | 89 | 104.8 |

Analysts expect the stock price to move within a range of 89 to 115, with an average consensus target near 105, indicating moderate confidence in future growth potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback related to Akamai Technologies, Inc. (AKAM).

Stock Grades

Here is the latest summary of Akamai Technologies, Inc. grades from well-known financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Neutral | 2026-01-16 |

| Morgan Stanley | Upgrade | Overweight | 2026-01-12 |

| Scotiabank | Maintain | Sector Outperform | 2026-01-09 |

| Piper Sandler | Maintain | Neutral | 2026-01-05 |

| RBC Capital | Maintain | Sector Perform | 2026-01-05 |

| Keybanc | Upgrade | Overweight | 2025-12-15 |

| TD Cowen | Maintain | Hold | 2025-11-13 |

| Citigroup | Maintain | Neutral | 2025-11-11 |

| Piper Sandler | Maintain | Neutral | 2025-11-07 |

| Scotiabank | Maintain | Sector Outperform | 2025-11-07 |

The overall trend shows a predominance of neutral and hold ratings, with notable upgrades to overweight by Morgan Stanley and Keybanc, indicating some growing confidence in the stock’s potential in late 2025 and early 2026.

Consumer Opinions

Consumers have mixed but generally favorable impressions of Akamai Technologies, reflecting both appreciation for its strengths and concerns about certain areas.

| Positive Reviews | Negative Reviews |

|---|---|

| Reliable and fast content delivery network (CDN) | Customer support can be slow to respond |

| Strong security features protecting against attacks | Pricing structure is complex and sometimes high |

| Consistent uptime and excellent network performance | Interface and tools have a steep learning curve |

Overall, Akamai is praised for its robust performance and security, essential for enterprise clients. However, customers often note challenges with pricing and customer service responsiveness.

Risk Analysis

Below is a table summarizing the main risks associated with investing in Akamai Technologies, Inc., focusing on their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | AKAM’s beta of 0.685 indicates moderate sensitivity to market fluctuations. | Medium | Medium |

| Valuation Risk | Price-to-earnings ratio at 28.68 is high, suggesting possible overvaluation. | High | High |

| Financial Leverage | Debt-to-equity ratio is high and rated very unfavorable, increasing risk. | Medium | High |

| Profitability | ROIC is low at 4.74%, signaling less efficient capital use. | Medium | Medium |

| Dividend Policy | No dividend yield, limiting income appeal for investors. | High | Low |

| Cybersecurity | As a cloud security provider, vulnerability to cyber threats could impact. | Medium | High |

| Competitive Pressure | Intense competition in cloud infrastructure and content delivery markets. | High | Medium |

The most significant risks are valuation concerns due to a high P/E ratio and financial leverage, as the company’s debt load could strain resources in adverse conditions. Despite a strong Piotroski score of 7, Akamai remains in the Altman Z-score grey zone (2.49), indicating moderate bankruptcy risk. Caution is advised, especially considering market shifts in technology infrastructure sectors.

Should You Buy Akamai Technologies, Inc.?

Akamai Technologies appears to be navigating a challenging profitability landscape with declining ROIC, suggesting a deteriorating competitive moat and value destruction. Despite a substantial leverage profile reflected in debt metrics, the overall rating of B indicates a moderately favorable investment case with balanced operational efficiency and risk considerations.

Strength & Efficiency Pillars

Akamai Technologies, Inc. exhibits solid profitability with a net margin of 12.65% and a moderate return on equity of 10.35%. The company maintains a favorable weighted average cost of capital (WACC) at 6.18%, which is above its return on invested capital (ROIC) of 4.74%, indicating it is currently not a value creator. Financial health metrics are mixed: the Altman Z-score of 2.49 places Akamai in the grey zone, suggesting moderate bankruptcy risk, while a strong Piotroski score of 7 underscores robust financial strength and operational efficiency.

Weaknesses and Drawbacks

Akamai faces valuation and leverage concerns that warrant caution. Its price-to-earnings ratio stands at 28.68, reflecting a relatively high premium that could pressure future returns. The debt-to-equity ratio at 0.95 signals moderate leverage, potentially constraining financial flexibility. Although the current ratio is a neutral 1.23, the absence of dividend yield limits income appeal. Additionally, the company’s asset turnover is low at 0.38, indicating inefficiency in asset utilization. Market dynamics show a bearish overall trend with a -13.75% price decline, despite recent strong buyer dominance.

Our Verdict about Akamai Technologies, Inc.

The long-term fundamental profile of Akamai may appear mixed but leans toward unfavorable due to value destruction and moderate financial distress signals. However, recent market behavior shows strong buyer dominance and a positive short-term trend, suggesting some optimism. Despite this, the bearish overall trend and valuation risks imply that investors could consider a cautious, wait-and-see stance before committing, seeking a more attractive entry point aligned with improved fundamentals.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Akamai Technologies (NASDAQ:AKAM) CTO Robert Blumofe Sells 3,500 Shares – MarketBeat (Jan 23, 2026)

- Implied Volatility Surging for Akamai Technologies Stock Options – Yahoo Finance (Jan 22, 2026)

- Akamai Technologies: Growing Edge Opportunities In The Agentic AI Era (NASDAQ:AKAM) – Seeking Alpha (Jan 20, 2026)

- Akamai Technologies, Appian, and The Trade Desk Shares Skyrocket, What You Need To Know – Finviz (Jan 22, 2026)

- Rakuten Investment Management Inc. Takes $5.32 Million Position in Akamai Technologies, Inc. $AKAM – MarketBeat (Jan 23, 2026)

For more information about Akamai Technologies, Inc., please visit the official website: akamai.com