Home > Analyses > Financial Services > Aflac Incorporated

Aflac Incorporated profoundly influences how millions manage health and life risks daily through its innovative supplemental insurance solutions. As a prominent player in the life insurance industry, Aflac leads with a diverse portfolio spanning cancer, accident, disability, and life insurance products across the U.S. and Japan. Renowned for its customer-centric approach and strong market presence, the company continually adapts to evolving healthcare needs. Yet, as market dynamics shift, it’s essential to evaluate whether Aflac’s solid fundamentals still support its current valuation and future growth potential.

Table of contents

Business Model & Company Overview

Aflac Incorporated, founded in 1955 and headquartered in Columbus, Georgia, stands as a dominant player in the life insurance sector. Its business centers on a complementary ecosystem of supplemental health and life insurance products, spanning from cancer and medical coverage to whole and term life policies. Operating through its two main segments—Aflac Japan and Aflac U.S.—the company leverages a diverse product suite tailored to distinct markets, reinforcing its core mission of financial protection.

The company’s revenue engine blends recurring premium income from a broad portfolio of insurance products sold via an extensive network of sales associates, brokers, and agencies. Its strategic footprint spans key global markets, notably the Americas, Europe, and Asia, with Aflac Japan and U.S. segments driving growth. This global reach, combined with a robust product mix, creates a strong economic moat, positioning Aflac as an influential force shaping the future of supplemental insurance.

Financial Performance & Fundamental Metrics

In this section, I analyze Aflac Incorporated’s income statement, key financial ratios, and dividend payout policy to assess its financial health and investment potential.

Income Statement

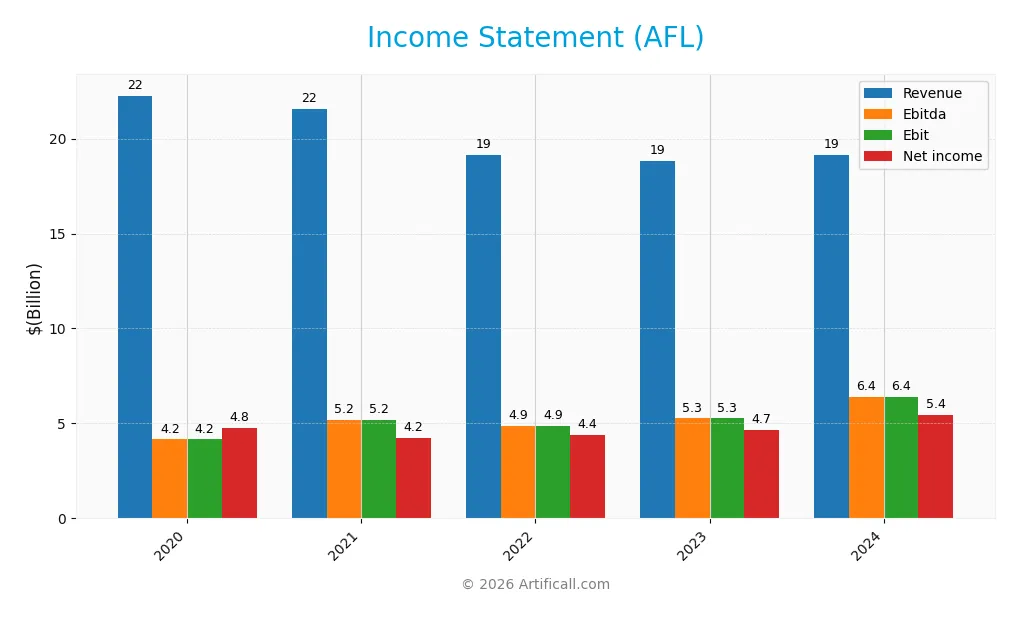

The table below summarizes Aflac Incorporated’s key income statement figures for the fiscal years 2020 through 2024, providing a clear view of its financial performance over this period.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 22.26B | 21.55B | 19.15B | 18.84B | 19.13B |

| Cost of Revenue | 0 | 0 | 0 | 0 | 12.31B |

| Operating Expenses | 18.10B | 16.34B | 14.28B | 13.58B | 398M |

| Gross Profit | 22.26B | 21.55B | 19.15B | 18.84B | 6.82B |

| EBITDA | 4.16B | 5.21B | 4.87B | 5.26B | 6.42B |

| EBIT | 4.16B | 5.21B | 4.87B | 5.26B | 6.42B |

| Interest Expense | 242M | 238M | 226M | 195M | 197M |

| Net Income | 4.78B | 4.23B | 4.42B | 4.66B | 5.44B |

| EPS | 6.69 | 6.42 | 6.96 | 7.81 | 9.68 |

| Filing Date | 2021-02-23 | 2022-02-23 | 2023-02-24 | 2024-02-22 | 2025-02-26 |

Income Statement Evolution

From 2020 to 2024, Aflac Incorporated’s revenue declined by 14.07%, indicating an overall unfavorable top-line trend. However, net income grew by 13.92% over the same period, reflecting improved profitability. Margins strengthened notably, with net margin increasing by 32.58%, supported by a 23.78% rise in EPS in the latest year, signaling better earnings efficiency despite slower revenue growth.

Is the Income Statement Favorable?

The 2024 income statement shows a revenue of $19.13B with a gross margin of 35.63%, an EBIT margin of 33.55%, and a net margin of 28.46%, all rated favorable. Operating expenses grew in line with revenue, while EBIT increased by 21.95% year-on-year, driving a 15.07% net margin improvement. Overall, 78.57% of income statement metrics are favorable, indicating solid fundamentals in 2024.

Financial Ratios

The following table summarizes key financial ratios for Aflac Incorporated (AFL) over the fiscal years 2020 to 2024, providing insight into profitability, valuation, liquidity, leverage, efficiency, and dividend performance:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 21% | 20% | 23% | 25% | 28% |

| ROE | 14% | 13% | 22% | 21% | 21% |

| ROIC | 2.5% | – | – | – | – |

| P/E | 6.6 | 9.3 | 10.3 | 10.6 | 10.6 |

| P/B | 0.95 | 1.18 | 2.27 | 2.24 | 2.21 |

| Current Ratio | 0 | 0 | 0 | 0 | 0 |

| Quick Ratio | 0 | 0 | 0 | 0 | 0 |

| D/E | 0.24 | 0.24 | 0.37 | 0.33 | 0.29 |

| Debt-to-Assets | 4.8% | 5.1% | 5.6% | 5.8% | 6.4% |

| Interest Coverage | 17.2 | 21.9 | 21.5 | 27.0 | 32.6 |

| Asset Turnover | 0.13 | 0.14 | 0.15 | 0.15 | 0.16 |

| Fixed Asset Turnover | 37.0 | 40.0 | 36.1 | 42.3 | 49.4 |

| Dividend Yield | 2.4% | 2.2% | 2.1% | 2.0% | 1.9% |

Evolution of Financial Ratios

From 2020 to 2024, Aflac Incorporated’s Return on Equity (ROE) improved steadily, rising from 14.2% in 2020 to 20.9% in 2024, indicating enhanced profitability. The Debt-to-Equity Ratio showed some variation but remained moderate, ending at 0.29 in 2024, which suggests stable leverage management. The Current Ratio remained at zero throughout, reflecting no reported liquidity improvement.

Are the Financial Ratios Favorable?

In 2024, Aflac’s profitability ratios such as net margin (28.46%) and ROE (20.86%) are favorable, supported by a strong interest coverage ratio of 32.57, indicating comfortable debt servicing. However, liquidity ratios like current and quick ratios are unfavorable at zero. Efficiency, reflected by asset turnover at 0.16, is also unfavorable, while fixed asset turnover is favorable at 49.43. Market valuation ratios are mixed, with a favorable P/E of 10.6 but a neutral price-to-book ratio of 2.21. Overall, the financial ratios lean toward a favorable opinion.

Shareholder Return Policy

Aflac Incorporated maintains a consistent dividend payout ratio near 20%, with dividends per share rising steadily from $1.08 in 2020 to $1.95 in 2024, supporting an annual yield around 1.9%. The dividend payments are well covered by free cash flow, indicating financial sustainability without excessive leverage.

The company does not report share buyback programs, focusing on dividend distributions. This stable dividend policy, backed by solid profitability and cash flow metrics, suggests a balanced approach aimed at supporting long-term shareholder value creation while managing payout risks prudently.

Score analysis

The following radar chart illustrates the company’s key financial scores, reflecting various valuation and profitability metrics:

Aflac Incorporated shows favorable scores in discounted cash flow, return on equity, and return on assets, each rated 4. Debt to equity is moderate at 3, while price to earnings and price to book ratios are lower, both scoring 2, indicating some valuation caution.

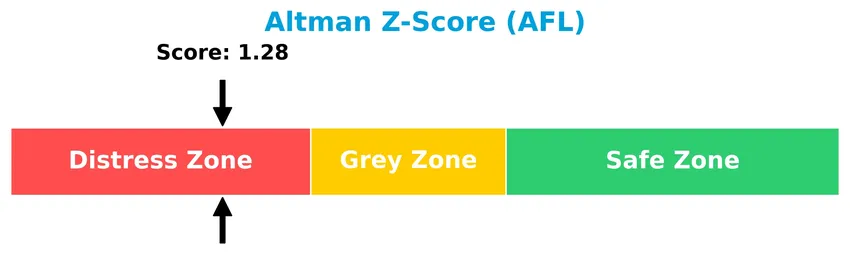

Analysis of the company’s bankruptcy risk

The Altman Z-Score places the company in the distress zone, signaling a higher risk of financial distress and potential bankruptcy:

Is the company in good financial health?

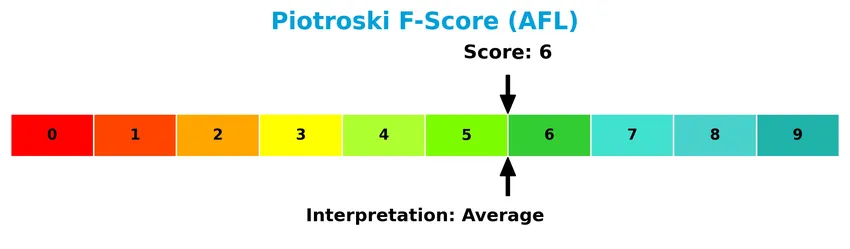

The Piotroski Score diagram below provides insight into the company’s overall financial health:

With a Piotroski Score of 6, Aflac Incorporated exhibits average financial strength, suggesting moderate financial stability but not reaching the threshold for strong or very strong health.

Competitive Landscape & Sector Positioning

This sector analysis will explore Aflac Incorporated’s strategic positioning, revenue by segment, key products, main competitors, competitive advantages, and SWOT analysis. I will assess whether Aflac holds a competitive advantage over its industry peers in the insurance – life sector.

Strategic Positioning

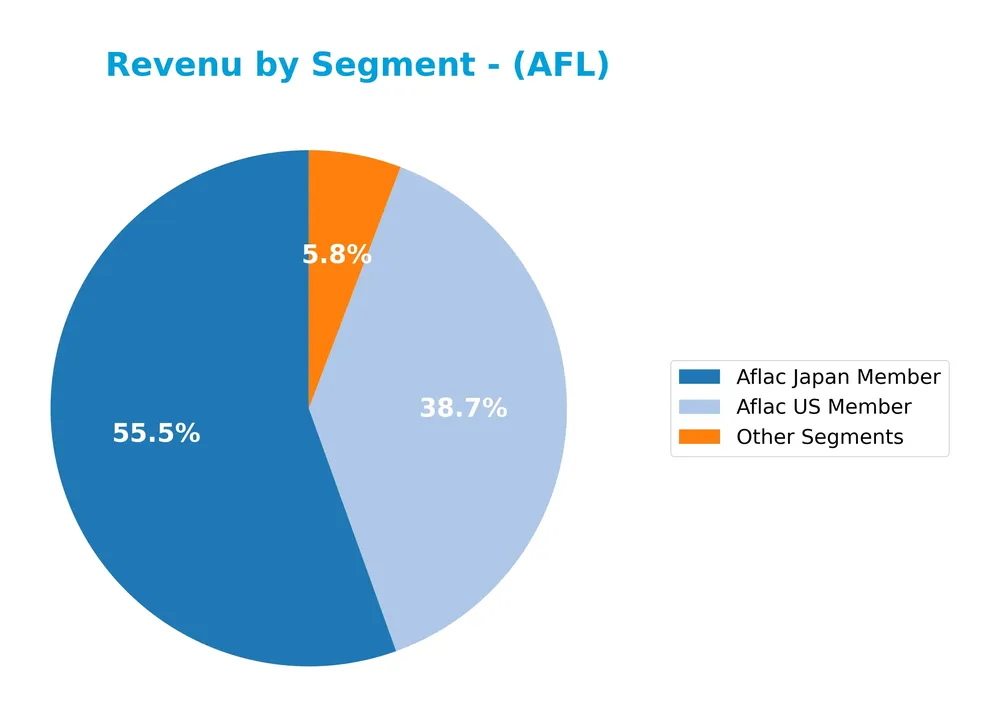

Aflac Incorporated maintains a geographically diversified insurance portfolio, primarily split between Aflac Japan and Aflac U.S., with Japan consistently generating over $9.6B in revenue and the U.S. segment contributing around $6.7B in 2024, alongside smaller other segments.

Revenue by Segment

This pie chart illustrates Aflac Incorporated’s revenue distribution by segment for the fiscal year 2024, highlighting the relative contributions of its main business units.

Aflac Japan Member remains the dominant revenue driver with $9.7B in 2024, although it has declined from previous years, indicating a slowdown. The Aflac US Member segment showed moderate growth to $6.7B, signaling steady performance. Other Segments, while smaller at $1.0B, have nearly doubled since 2023, suggesting some diversification. Overall, the business shows concentration risk in Japan but signs of stabilization and growth in the US.

Key Products & Brands

The table below outlines Aflac Incorporated’s main insurance products and brand segments with their descriptions:

| Product | Description |

|---|---|

| Aflac Japan Segment | Offers cancer, medical, nursing care income support, GIFT, whole and term life insurance, WAYS, and child endowment plans in Japan. |

| Aflac U.S. Segment | Provides cancer, accident, short-term disability, critical illness, hospital indemnity, dental, vision, long-term care, disability, and term and whole life insurance products in the U.S. |

| Other Segments | Includes additional business lines and smaller insurance offerings outside the main Japan and U.S. segments. |

Aflac’s core business is divided into two geographic segments—Japan and the U.S.—each offering a broad range of supplemental health and life insurance products. Other segments contribute modestly to overall revenue.

Main Competitors

There are 4 competitors in the Financial Services sector, with the table below listing the top 4 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Aflac Incorporated | 59.6B |

| MetLife, Inc. | 52.9B |

| Prudential Financial, Inc. | 40.2B |

| Globe Life Inc. | 11.0B |

Aflac Incorporated ranks 1st among its 4 competitors, holding 96.03% of the market cap of the top player. It is positioned above both the average market cap of the top 10 competitors (41B) and the median market cap in the sector (47B). The company has an 8.22% market cap lead over its closest competitor below.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does AFL have a competitive advantage?

Aflac Incorporated currently does not present a competitive advantage, as its return on invested capital (ROIC) is significantly below its weighted average cost of capital (WACC), with a declining ROIC trend indicating value destruction. Despite favorable profitability margins—gross margin at 35.63%, EBIT margin at 33.55%, and net margin at 28.46%—the company’s overall economic moat is rated very unfavorable due to inefficient capital use.

Looking ahead, Aflac operates in both the Japanese and U.S. supplemental insurance markets, offering diverse products like cancer, medical, and life insurance, which may present opportunities. However, recent revenue growth has been weak or negative, and the company faces challenges in sustaining growth, suggesting caution when evaluating future market expansion or product development potential.

SWOT Analysis

This SWOT analysis highlights Aflac Incorporated’s key internal strengths and weaknesses alongside external opportunities and threats to guide strategic investment decisions.

Strengths

- strong net margin at 28.46%

- favorable EBIT margin of 33.55%

- diversified product portfolio in US and Japan

Weaknesses

- declining revenue trend over 5 years (-14.07%)

- low ROIC indicating value destruction

- Altman Z-Score in distress zone (1.28)

Opportunities

- growing demand for supplemental health insurance

- potential market expansion in aging Japan

- technological innovation in insurance distribution

Threats

- intense competition in life insurance sector

- regulatory changes impacting insurance products

- macroeconomic volatility affecting investment returns

Overall, Aflac shows robust profitability and operational efficiency but faces challenges in revenue growth and capital returns. The company must leverage its strong margins and product diversification while addressing declining ROIC and financial distress signals to sustain long-term value creation.

Stock Price Action Analysis

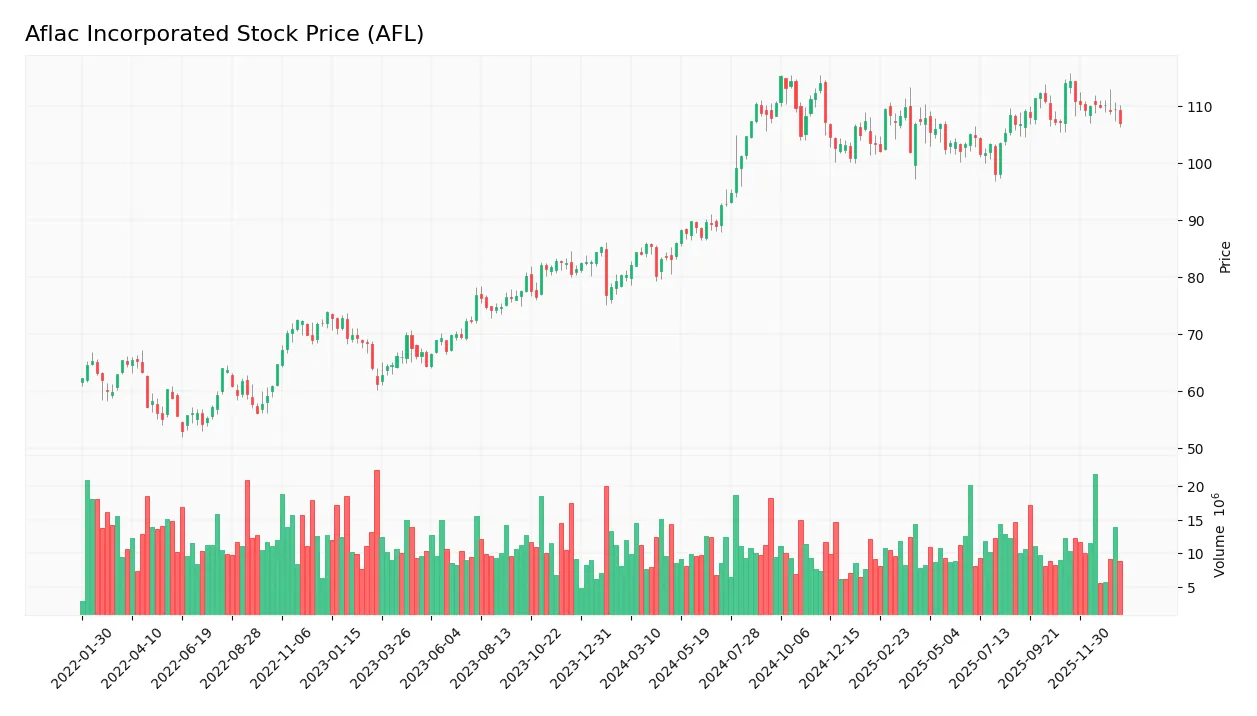

The weekly stock chart for Aflac Incorporated (AFL) highlights price movements and key levels over the last 100 weeks:

Trend Analysis

Over the past 12 months, AFL’s stock price increased by 33.15%, indicating a bullish trend. However, this trend shows deceleration despite a high price volatility with a standard deviation of 9.25. The stock reached a high of 115.26 and a low of 80.28 during this period.

Volume Analysis

Trading volume over the last three months is decreasing overall, with buyer volume slightly dominating at 56.75%. This buyer-driven activity suggests steady investor interest but a cautious market participation trend amid declining volumes.

Target Prices

The consensus target prices for Aflac Incorporated reflect a positive outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 125 | 101 | 115.2 |

Analysts expect Aflac’s stock to trade between 101 and 125, with an average target near 115, indicating moderate confidence in its growth potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback regarding Aflac Incorporated’s market performance and services.

Stock Grades

Here is a summary of the latest verified stock grades for Aflac Incorporated from recognized financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Underweight | 2026-01-08 |

| JP Morgan | Maintain | Neutral | 2026-01-05 |

| Raymond James | Maintain | Outperform | 2025-12-30 |

| TD Cowen | Maintain | Hold | 2025-12-22 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-17 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-07 |

| Evercore ISI Group | Maintain | Underperform | 2025-11-07 |

| Barclays | Maintain | Underweight | 2025-11-05 |

| JP Morgan | Maintain | Neutral | 2025-11-05 |

| Evercore ISI Group | Maintain | Underperform | 2025-10-09 |

The overall trend in grades for Aflac shows a predominance of hold or neutral stances with a few underweight and outperform ratings, indicating a balanced but cautious outlook among analysts. The consensus remains steady at “Hold” with a majority of 18 hold ratings versus 9 buys and 4 sells.

Consumer Opinions

Consumers express a mix of appreciation and concern regarding Aflac Incorporated’s services, reflecting a balanced view of the company’s performance.

| Positive Reviews | Negative Reviews |

|---|---|

| “Aflac provides reliable supplemental insurance with quick claim processing.” | “Customer service can be slow during peak times.” |

| “Affordable premiums and clear policy options make it easy to understand.” | “Some policy terms are confusing without thorough explanation.” |

| “Helpful and responsive agents who assist promptly with inquiries.” | “Occasional delays in claim reimbursements reported by some users.” |

Overall, consumers praise Aflac for its affordability and efficient claim handling, while some point to customer service delays and policy clarity as areas needing improvement.

Risk Analysis

Below is a summary table highlighting key risk categories, their descriptions, and estimated probabilities and impacts for Aflac Incorporated:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Distress | Altman Z-Score of 1.28 places AFL in the distress zone, signaling risk of bankruptcy. | Medium | High |

| Market Volatility | Beta of 0.664 indicates moderate sensitivity to market swings, possibly affecting stock price. | Medium | Medium |

| Regulatory Changes | Insurance industry is sensitive to evolving regulations in US and Japan markets. | Medium | Medium |

| Operational Risks | Dependence on Japan and US segments exposes AFL to regional economic fluctuations. | Medium | Medium |

| Liquidity Concerns | Unfavorable current and quick ratios suggest potential short-term liquidity issues. | Low | Medium |

| Competitive Pressure | Intense competition in supplemental insurance could reduce market share and margins. | Medium | Medium |

The most critical risks for Aflac are its financial distress signal from the Altman Z-Score and liquidity concerns due to weak current ratios. Although profitability and returns on equity are favorable, these financial health indicators warrant caution. Investors should also monitor regulatory environments and market conditions in Japan and the US, as they directly impact AFL’s core business segments.

Should You Buy Aflac Incorporated?

Aflac Incorporated appears to be characterized by moderate profitability and a manageable leverage profile, yet it faces a very unfavorable competitive moat with declining returns on invested capital. While its overall rating is a favorable B+, financial distress signals suggest caution in value creation assessment.

Strength & Efficiency Pillars

Aflac Incorporated exhibits robust profitability with a net margin of 28.46% and a return on equity of 20.86%, signaling efficient capital deployment. The company maintains a conservative debt-to-equity ratio of 0.29 and strong interest coverage at 32.57, underscoring sound financial health. Although the Altman Z-Score at 1.28 places it in the distress zone, the Piotroski Score of 6 reflects average financial strength. Despite these mixed signals, Aflac’s weighted average cost of capital (6.58%) is favorable; however, its return on invested capital is at 0%, indicating it currently does not generate value above its capital costs.

Weaknesses and Drawbacks

Aflac’s investment case is tempered by significant weaknesses. Its Altman Z-Score of 1.28 suggests elevated bankruptcy risk, placing the company in a distress zone. The net margin growth has been favorable, but revenue growth remains sluggish and declined by 14.07% over the 2020–2024 period. The current and quick ratios are unavailable or unfavorable, raising concerns about short-term liquidity. With a price-to-book ratio of 2.21, valuation appears moderate but not compellingly cheap. Additionally, asset turnover at 0.16 signals inefficient asset utilization, which may constrain growth prospects.

Our Verdict about Aflac Incorporated

Aflac presents a fundamentally mixed profile that might appear favorable given its strong profitability and moderate valuation metrics. The long-term fundamental outlook is cautiously favorable, supported by a bullish overall stock trend. Recent market behavior shows slight buyer dominance with a 56.75% buyer share, suggesting some resilience despite a recent modest price decline of -6.14%. Despite these positives, investors could consider a wait-and-see approach to confirm sustained momentum and mitigate liquidity and operational risks.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- QV Investors Inc. Has $1.12 Million Stock Holdings in Aflac Incorporated $AFL – MarketBeat (Jan 23, 2026)

- Aflac: Priced For A Perfect Scenario – Seeking Alpha (Jan 23, 2026)

- Aflac Incorporated Announces Third Quarter Results, Reports Third Quarter Net Earnings of $1.6 Billion, Declares Fourth Quarter Dividend – Aflac (Nov 04, 2025)

- Mizuho initiates coverage on Aflac (AFL) with cautious outlook citing stagnant sales growth – MSN (Jan 22, 2026)

- Are Aflac Incorporated’s (NYSE:AFL) Fundamentals Good Enough to Warrant Buying Given The Stock’s Recent Weakness? – Yahoo Finance (Jan 13, 2026)

For more information about Aflac Incorporated, please visit the official website: aflac.com