Home > Analyses > Industrials > Advanced Drainage Systems, Inc.

Advanced Drainage Systems, Inc. revolutionizes water management by engineering innovative thermoplastic pipe solutions that underpin critical infrastructure across North America and beyond. As a dominant force in the construction sector, it leads with a broad portfolio of drainage products that combine durability and efficiency, serving residential, agricultural, and commercial markets. Renowned for its quality and market influence, the company continuously adapts to evolving infrastructure demands. The key question now is whether Advanced Drainage Systems’ solid fundamentals and growth prospects still justify its current market valuation.

Table of contents

Business Model & Company Overview

Advanced Drainage Systems, Inc., founded in 1966 and headquartered in Hilliard, Ohio, commands a dominant position in the construction industry through its comprehensive ecosystem of thermoplastic corrugated pipes and water management products. Serving underground construction and infrastructure markets, the company integrates diverse solutions—from corrugated polypropylene pipes to geosynthetic materials—across residential, non-residential, agricultural, and infrastructure applications. This cohesive portfolio supports a robust network of about 38 distribution centers in North America and beyond.

The company’s revenue engine balances manufacturing and distribution of hardware with complementary allied products and geosynthetics, enabling recurring value creation. Its strategic footprint spans the United States, Canada, Mexico, and international markets, reinforcing its global reach. Advanced Drainage Systems leverages this scale and diversified product mix to maintain a resilient economic moat, shaping the future of water management infrastructure worldwide.

Financial Performance & Fundamental Metrics

In this section, I analyze Advanced Drainage Systems, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its core financial health.

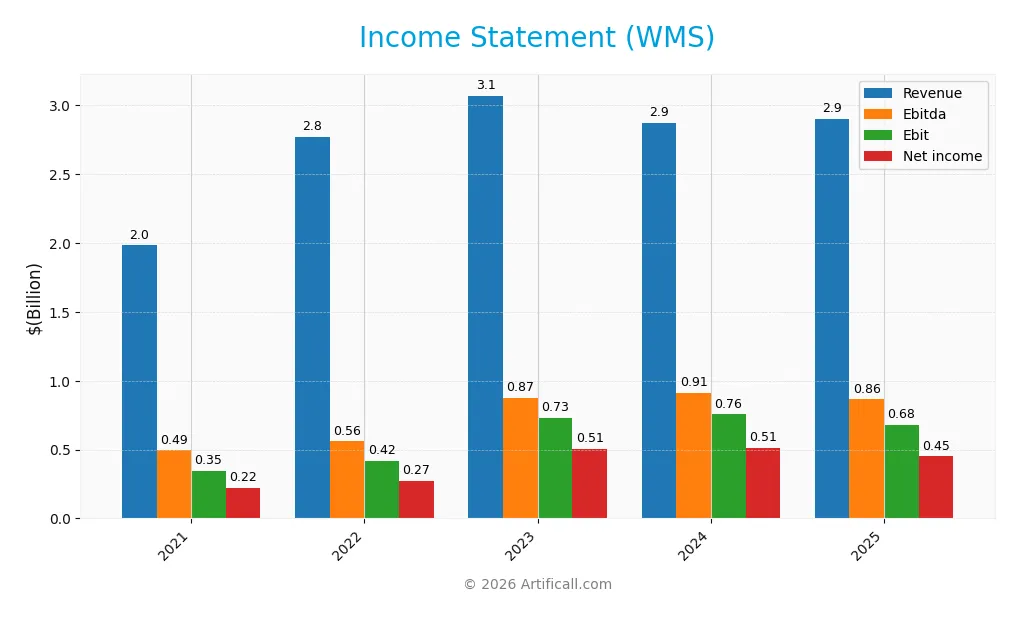

Income Statement

The table below presents Advanced Drainage Systems, Inc.’s key income statement figures for the fiscal years 2021 through 2025, reported in USD.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 1.98B | 2.77B | 3.07B | 2.87B | 2.90B |

| Cost of Revenue | 1.29B | 1.97B | 1.95B | 1.73B | 1.81B |

| Operating Expenses | 346M | 388M | 399M | 414M | 437M |

| Gross Profit | 690M | 800M | 1.12B | 1.15B | 1.09B |

| EBITDA | 494M | 559M | 872M | 911M | 865M |

| EBIT | 348M | 417M | 727M | 756M | 681M |

| Interest Expense | 36M | 34M | 70M | 89M | 92M |

| Net Income | 224M | 271M | 507M | 510M | 450M |

| EPS | 2.64 | 3.22 | 6.16 | 6.52 | 5.81 |

| Filing Date | 2021-05-27 | 2022-05-19 | 2023-05-18 | 2024-05-16 | 2025-05-15 |

Income Statement Evolution

Advanced Drainage Systems, Inc. (WMS) experienced a 46.47% revenue growth from 2021 to 2025, with net income more than doubling, increasing by 100.76%. However, the latest 1-year period saw a slight revenue growth of 1.04% alongside declines in gross profit (-4.51%) and EBIT (-9.84%). Margins remain robust, with a favorable gross margin of 37.68% and net margin of 15.5%, although recent margin growth slowed.

Is the Income Statement Favorable?

For fiscal 2025, WMS reported $2.9B revenue and $450M net income, yielding a 15.5% net margin, which is classified as favorable. Interest expense remains low at 3.16% of revenue, supporting profitability. Despite a 10.7% decline in EPS over one year, the company’s overall income statement reflects solid fundamentals, with positive long-term growth trends and healthy operating margins.

Financial Ratios

The following table presents key financial ratios for Advanced Drainage Systems, Inc. (WMS) from fiscal years 2021 to 2025, offering a snapshot of profitability, liquidity, leverage, and efficiency metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 11.3% | 9.8% | 16.5% | 17.7% | 15.5% |

| ROE | 21.4% | 24.9% | 51.9% | 40.4% | 27.8% |

| ROIC | 11.7% | 12.8% | 21.7% | 19.4% | 14.9% |

| P/E | 32.3 | 31.2 | 13.7 | 26.1 | 18.7 |

| P/B | 6.9 | 7.8 | 7.1 | 10.6 | 5.2 |

| Current Ratio | 2.33 | 2.23 | 2.69 | 2.96 | 3.33 |

| Quick Ratio | 1.39 | 0.97 | 1.46 | 1.90 | 2.10 |

| D/E | 0.81 | 0.88 | 1.37 | 1.08 | 0.89 |

| Debt-to-Assets | 35.2% | 36.2% | 46.2% | 41.8% | 39.2% |

| Interest Coverage | 9.7 | 12.3 | 10.2 | 8.2 | 7.2 |

| Asset Turnover | 0.82 | 1.05 | 1.06 | 0.88 | 0.79 |

| Fixed Asset Turnover | 3.93 | 4.47 | 4.19 | 3.28 | 2.76 |

| Dividend Yield | 0.42% | 0.44% | 0.57% | 0.33% | 0.59% |

Evolution of Financial Ratios

Over the period from 2021 to 2025, Advanced Drainage Systems, Inc. (WMS) experienced fluctuations in key financial ratios. Return on Equity (ROE) showed a general improvement, peaking in 2023 and moderating somewhat by 2025 at 27.82%. The Current Ratio increased steadily, reaching 3.33 in 2025, indicating stronger liquidity but potentially inefficient asset use. Debt-to-Equity ratio remained relatively stable around 0.89 in 2025, reflecting consistent leverage management. Profitability margins saw some variability, with net margin improving to 15.5% in 2025 after prior fluctuations.

Are the Financial Ratios Favorable?

In 2025, the company’s profitability ratios, including net margin, ROE, and return on invested capital, are evaluated as favorable, demonstrating solid earnings performance. Liquidity shows mixed signals: a strong quick ratio (2.1) is favorable, but the high current ratio (3.33) is considered unfavorable, suggesting possible overcapitalization in current assets. Leverage ratios such as debt-to-equity and debt-to-assets are neutral, indicating balanced debt levels. Market valuations reveal a neutral price-earnings ratio (18.72) but an unfavorable price-to-book ratio (5.21), while dividend yield remains low and unfavorable. Overall, the ratio profile is slightly favorable with a blend of strengths and areas for caution.

Shareholder Return Policy

Advanced Drainage Systems, Inc. maintains a consistent dividend payout ratio around 8-14%, with dividend per share steadily increasing from $0.44 in 2021 to $0.64 in 2025. Dividend yield remains modest near 0.4-0.6%, supported by free cash flow coverage, while no share buyback programs are reported.

This disciplined dividend policy reflects a balanced approach to returning capital without jeopardizing growth or liquidity. The low payout ratio and solid cash flow coverage indicate sustainable distributions, suggesting alignment with long-term shareholder value creation and prudent financial management.

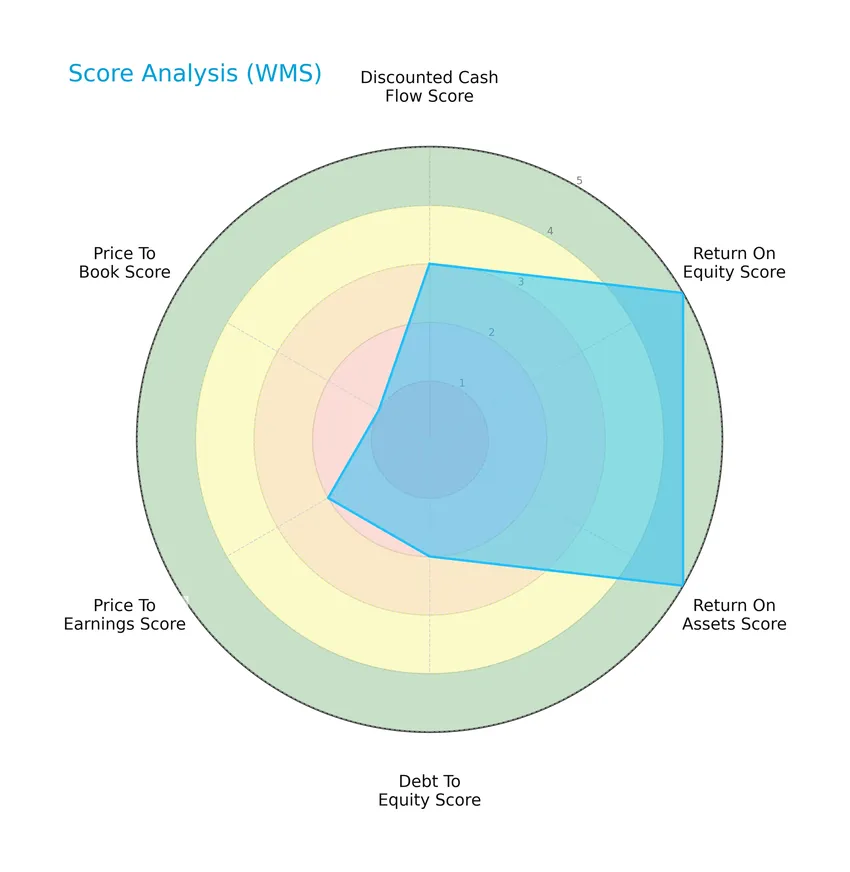

Score analysis

The following radar chart presents an overview of key valuation and financial performance scores for the company:

Advanced Drainage Systems, Inc. shows very favorable scores in return on equity and return on assets with top marks of 5. Discounted cash flow is moderate at 3, while debt to equity and price to earnings are also moderate at 2. The price to book ratio is notably unfavorable with a score of 1.

Analysis of the company’s bankruptcy risk

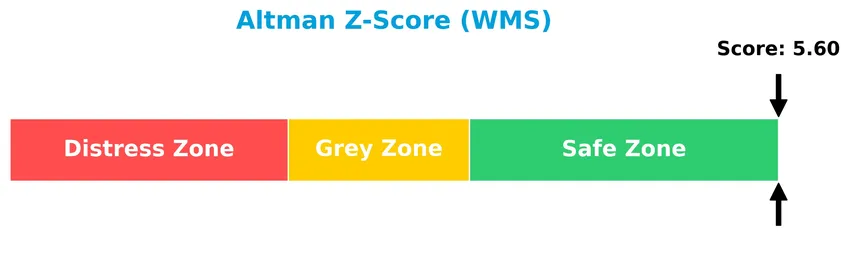

The Altman Z-Score indicates that the company is firmly within the safe zone, suggesting a low risk of bankruptcy and strong financial stability:

Is the company in good financial health?

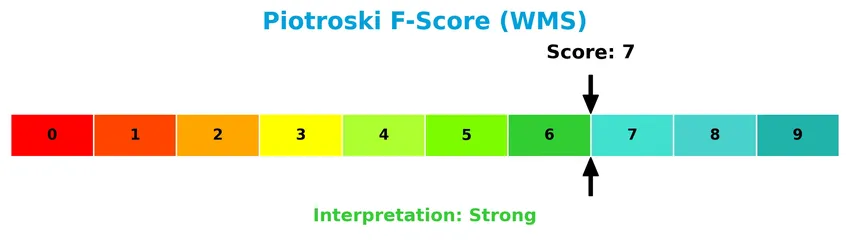

The Piotroski Score diagram illustrates the company’s financial strength based on nine accounting criteria:

With a Piotroski Score of 7, Advanced Drainage Systems, Inc. is considered to have strong financial health, reflecting solid profitability, leverage, and operational efficiency metrics.

Competitive Landscape & Sector Positioning

This sector analysis will examine Advanced Drainage Systems, Inc.’s strategic positioning, revenue segmentation, key products, main competitors, and competitive advantages. I will assess whether the company holds a competitive advantage over its industry peers.

Strategic Positioning

Advanced Drainage Systems, Inc. maintains a diversified product portfolio across pipe, water technologies, and allied products segments, with dominant revenue from the Pipe segment (~$1.56B in 2025). Geographically, it is heavily concentrated in North America, primarily the US ($2.7B in 2025), with limited international exposure.

Revenue by Segment

The pie chart illustrates Advanced Drainage Systems, Inc.’s revenue distribution by segment for the fiscal year 2025, highlighting the company’s diversified business streams.

In 2025, the Pipe Segment remains the primary revenue driver with 1.56B, showing slight contraction from 1.59B in 2024. Allied Products and Other Business Segments grew modestly to 707M, while Infiltrator Water Technologies increased to 596M, reflecting steady expansion. Intersegment Eliminations at -163M indicate internal adjustments. The overall trend suggests a balanced portfolio with some revenue concentration risk in the Pipe Segment despite gradual diversification.

Key Products & Brands

The table below highlights Advanced Drainage Systems, Inc.’s main products and brands along with their descriptions:

| Product | Description |

|---|---|

| Pipe Segment | Single, double, and triple wall corrugated polypropylene and polyethylene pipes for underground construction and infrastructure. |

| Infiltrator Water Technologies | Plastic leachfield chambers and systems, EZflow synthetic aggregate bundles, mechanical aeration wastewater solutions, septic tanks. |

| Allied Products & Other | Storm retention/detention and septic chambers, PVC drainage structures, fittings, water quality filters, separators, and geosynthetics. |

Advanced Drainage Systems, Inc. specializes in thermoplastic corrugated pipes and related water management solutions, serving diverse applications in infrastructure, residential, agricultural, and non-residential markets.

Main Competitors

There are 6 competitors in the Industrials Construction sector; below is a table of the top 6 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Trane Technologies plc | 88.3B |

| Johnson Controls International plc | 80.0B |

| Carrier Global Corporation | 45.1B |

| Lennox International Inc. | 17.5B |

| Masco Corporation | 13.4B |

| Builders FirstSource, Inc. | 11.6B |

Advanced Drainage Systems, Inc. is not ranked among these top competitors. The company’s market cap is below both the average market cap of 42.6B and the median market cap of 31.3B for the top 10 sector players. The absence of its ranking and relative market cap to the leader indicates a smaller scale compared to the industry leaders.

Comparisons with competitors

Check out how we compare the company to its competitors:

Aucun article trouvé pour ces critères.

Does WMS have a competitive advantage?

Advanced Drainage Systems, Inc. (WMS) demonstrates a durable competitive advantage, supported by a ROIC exceeding its WACC by over 5%, indicating consistent value creation and efficient capital use. The company’s profitability trend is positive, reflecting growing returns and a very favorable moat status.

Looking ahead, WMS maintains opportunities through its diverse product offerings in thermoplastic pipes, water management, and drainage solutions across North America and international markets. Expansion in infrastructure and underground construction sectors offers potential for sustained growth and market penetration.

SWOT Analysis

This SWOT analysis highlights the key internal and external factors influencing Advanced Drainage Systems, Inc. (WMS), aiding investors in identifying strategic advantages and risks.

Strengths

- strong profitability with 15.5% net margin

- durable competitive advantage with growing ROIC

- diverse product portfolio and extensive distribution network

Weaknesses

- recent 1-year revenue growth weak at 1.04%

- unfavorable gross profit and net margin declines in last year

- high price-to-book ratio indicating potential overvaluation

Opportunities

- expansion in international markets beyond North America

- increasing infrastructure spending boosting demand

- innovation in water management solutions

Threats

- economic slowdown impacting construction sector

- raw material cost volatility

- competitive pressure from alternative materials and suppliers

Overall, Advanced Drainage Systems demonstrates solid financial health and a durable moat, but recent short-term profit pressures and valuation concerns warrant careful monitoring. The company should leverage its strong operational base to expand internationally and innovate, while managing cost risks and market competition prudently.

Stock Price Action Analysis

The upcoming weekly stock chart for Advanced Drainage Systems, Inc. (WMS) illustrates price movements and trading activity over the past 12 months:

Trend Analysis

Over the past 12 months, WMS stock price declined by 5.99%, indicating a bearish trend with accelerating downward momentum. The stock ranged between a high of 174.48 and a low of 101.1, with significant volatility reflected by a standard deviation of 20.93. Recent weeks show a 3.43% price increase, suggesting a short-term bullish correction.

Volume Analysis

Trading volume over the last three months has been increasing, with buyer volume at 23.5M versus seller volume at 11.3M, reflecting buyer dominance at 67.51%. This elevated buying activity signals growing investor interest and a potential shift in market participation toward accumulation.

Target Prices

The current analyst consensus for Advanced Drainage Systems, Inc. (WMS) reflects a moderately optimistic outlook.

| Target High | Target Low | Consensus |

|---|---|---|

| 197 | 166 | 179.33 |

Analysts expect the stock to trade between 166 and 197, with a consensus target near 179, indicating a positive growth potential in the near to mid-term.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines recent analyst ratings and consumer feedback related to Advanced Drainage Systems, Inc. (WMS).

Stock Grades

Here is the latest summary of Advanced Drainage Systems, Inc. stock grades from recognized financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Oppenheimer | Maintain | Outperform | 2026-01-15 |

| Barclays | Maintain | Overweight | 2026-01-15 |

| UBS | Maintain | Buy | 2026-01-06 |

| Barclays | Maintain | Overweight | 2025-12-08 |

| RBC Capital | Maintain | Outperform | 2025-11-07 |

| Barclays | Maintain | Overweight | 2025-11-07 |

| Keybanc | Maintain | Overweight | 2025-11-07 |

| Barclays | Maintain | Overweight | 2025-08-08 |

| Baird | Maintain | Outperform | 2025-08-08 |

| Keybanc | Maintain | Overweight | 2025-08-08 |

The consensus across top-tier analysts reflects a consistent positive stance, primarily ranging from “Overweight” to “Outperform,” with no recent downgrades or sales recommendations. This steady grade trend indicates stable confidence in the company’s prospects.

Consumer Opinions

Consumers of Advanced Drainage Systems, Inc. (WMS) generally appreciate the company’s product quality and innovation but express concerns about pricing and customer service responsiveness.

| Positive Reviews | Negative Reviews |

|---|---|

| Durable and reliable drainage solutions. | Some customers find prices higher than competitors. |

| Innovative product designs that simplify installation. | Occasional delays in delivery times reported. |

| Strong technical support and knowledgeable staff. | Customer service can be slow to respond. |

Overall, customers praise the durability and innovation of Advanced Drainage Systems’ products, though pricing and customer service responsiveness remain areas for improvement.

Risk Analysis

Below is a concise overview of key risks associated with Advanced Drainage Systems, Inc. to consider before investing:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Exposure to cyclical construction industry trends affecting demand for drainage solutions. | Medium | High |

| Valuation Concerns | Elevated price-to-book ratio (5.21) may indicate overvaluation risk. | High | Medium |

| Liquidity Risk | Unfavorable current ratio (3.33) points to potential short-term liquidity constraints. | Medium | Medium |

| Debt Management | Moderate debt-to-equity ratio (0.89) with neutral debt metrics could affect financial flexibility. | Medium | Medium |

| Dividend Yield | Low dividend yield (0.59%) might limit income appeal for yield-focused investors. | Low | Low |

The most significant risks stem from valuation and market cyclicality. Despite a strong Altman Z-Score (5.6, safe zone) and favorable profitability metrics, the high price-to-book ratio suggests caution. Investors should monitor construction sector trends and company liquidity closely.

Should You Buy Advanced Drainage Systems, Inc.?

Advanced Drainage Systems, Inc. appears to be delivering improving profitability with a durable competitive moat supported by growing ROIC that suggests strong value creation. Despite moderate leverage concerns, the overall B+ rating reflects a very favorable financial profile, indicating measured operational efficiency.

Strength & Efficiency Pillars

Advanced Drainage Systems, Inc. demonstrates a robust profitability profile with a net margin of 15.5%, an impressive return on equity (ROE) of 27.82%, and a return on invested capital (ROIC) of 14.94%. The company is a clear value creator as its ROIC significantly exceeds its weighted average cost of capital (WACC) of 9.56%. Financial health indicators reinforce this strength: an Altman Z-score of 5.60 places it firmly in the safe zone, and a Piotroski score of 7 signals strong operational fundamentals. These metrics collectively underscore the company’s durable competitive advantage and efficient capital allocation.

Weaknesses and Drawbacks

Despite solid fundamentals, Advanced Drainage Systems faces valuation challenges, marked by an unfavorable price-to-book (P/B) ratio of 5.21, which suggests that the stock may be priced at a premium relative to its book value. The current ratio stands at 3.33, flagged as unfavorable, potentially indicating excess short-term assets that may not be optimally deployed. Additionally, the dividend yield is low at 0.59%, which might disappoint income-focused investors. These factors introduce risks related to valuation discipline and capital efficiency that investors should weigh carefully.

Our Verdict about Advanced Drainage Systems, Inc.

The company exhibits a favorable long-term fundamental profile supported by strong profitability and financial stability. Coupled with buyer dominance in the recent period—67.51% buyer volume—the technical outlook also appears constructive. Therefore, the overall profile may appear attractive for long-term exposure, suggesting potential value for investors willing to navigate near-term valuation and liquidity nuances.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Is Advanced Drainage Systems (WMS) Pricing In Too Much Optimism After Its Recent Rally – simplywall.st (Jan 24, 2026)

- Advanced Drainage Systems (NYSE:WMS) Hits New 12-Month High – Here’s Why – MarketBeat (Jan 22, 2026)

- Are Robust Financials Driving The Recent Rally In Advanced Drainage Systems, Inc.’s (NYSE:WMS) Stock? – Yahoo Finance (Jan 15, 2026)

- Is Advanced Drainage Systems, Inc.’s (NYSE:WMS) Stock’s Recent Performance A Reflection Of Its Financial Health? – 富途资讯 (Jan 24, 2026)

- Advanced Drainage Systems, Inc. $WMS Stock Position Lifted by Vest Financial LLC – MarketBeat (Jan 22, 2026)

For more information about Advanced Drainage Systems, Inc., please visit the official website: adspipe.com