In a world where creativity meets technology, Adobe Inc. stands at the forefront, transforming how individuals and businesses create and manage digital content. Renowned for its innovative flagship product, Creative Cloud, Adobe has redefined the landscape of digital media, empowering millions of creators, marketers, and enterprises with cutting-edge tools and services. As we dive into the intricacies of Adobe’s financials and market positioning, one must ponder: do its strong fundamentals still support its current market valuation and growth trajectory?

Table of contents

Company Description

Adobe Inc. is a leading diversified software company, founded in 1982 and headquartered in San Jose, California. It operates primarily through three segments: Digital Media, Digital Experience, and Publishing and Advertising. The Digital Media segment is renowned for its flagship product, Creative Cloud, a subscription service that empowers content creators and businesses alike. In the Digital Experience segment, Adobe provides a comprehensive platform for managing and optimizing customer experiences, catering to a broad array of marketing and analytics professionals. The company’s Publishing and Advertising segment further enhances its offerings with solutions for e-learning, technical publishing, and web conferencing. With a market capitalization exceeding $136 billion, Adobe plays a pivotal role in shaping the software industry, driving innovation and digital transformation across various sectors.

Fundamental Analysis

In this section, I will analyze Adobe Inc.’s income statement, financial ratios, and payout policy to provide a comprehensive view of the company’s financial health and investment potential.

Income Statement

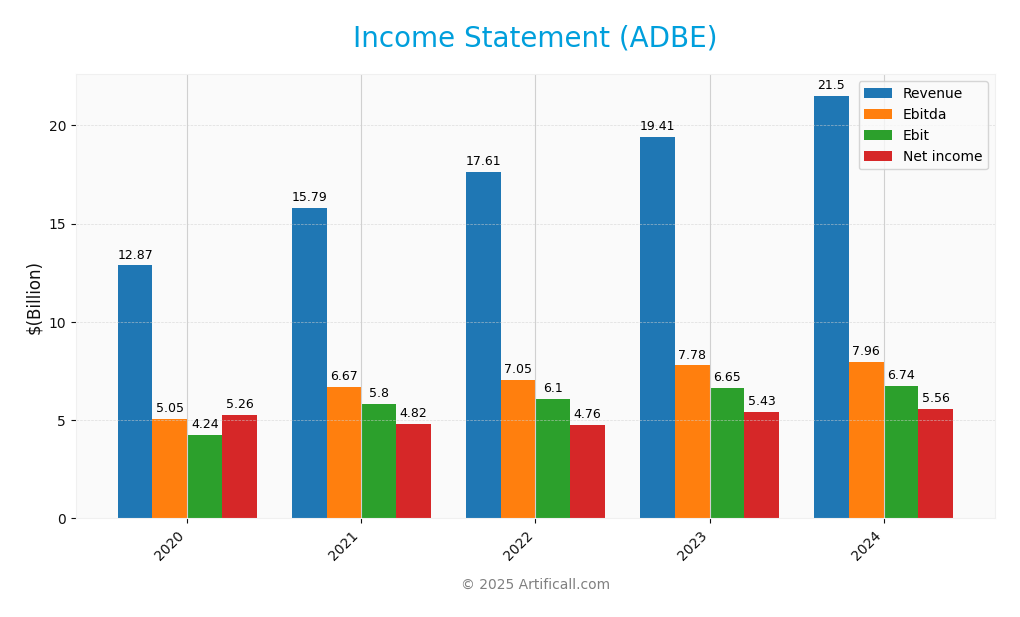

The following table provides a comprehensive overview of Adobe Inc.’s financial performance over the last five years, highlighting key metrics such as revenue, operating expenses, and net income.

| Year | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 12.87B | 15.79B | 17.61B | 19.41B | 21.51B |

| Cost of Revenue | 1.72B | 1.87B | 2.17B | 2.35B | 2.36B |

| Operating Expenses | 6.91B | 8.02B | 9.34B | 10.41B | 12.41B |

| Gross Profit | 11.15B | 13.92B | 15.44B | 17.06B | 19.15B |

| EBITDA | 5.05B | 6.68B | 7.06B | 7.78B | 7.96B |

| EBIT | 4.24B | 5.80B | 6.10B | 6.65B | 6.74B |

| Interest Expense | 0.12B | 0.11B | 0.11B | 0.11B | 0.16B |

| Net Income | 5.26B | 4.82B | 4.76B | 5.43B | 5.56B |

| EPS | 10.94 | 10.10 | 10.13 | 11.88 | 12.44 |

| Filing Date | 2021-01-15 | 2022-01-21 | 2023-01-17 | 2024-01-17 | 2025-01-13 |

Over the past five years, Adobe has demonstrated consistent growth in revenue, climbing from $12.87 billion in 2020 to $21.51 billion in 2024. The net income trend mirrors this upward trajectory, reflecting a steady increase from $5.26 billion to $5.56 billion. Although gross profit margins have remained stable, the operating expenses have risen significantly, which slightly compressed profitability ratios. In the most recent year, revenue growth has accelerated, and while net income showed improvement, the increase in operating expenses suggests that investors should monitor cost management closely as they evaluate Adobe’s ongoing performance.

Financial Ratios

Below is the summary of the financial ratios for Adobe Inc. (ADBE) over the most recent available years.

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 40.88% | 30.55% | 27.01% | 27.97% | 25.85% |

| ROE | 39.66% | 32.59% | 33.85% | 32.86% | 39.42% |

| ROIC | 22.57% | 28.57% | 32.03% | 30.89% | 34.20% |

| P/E | 43.75 | 66.26 | 34.09 | 51.44 | 41.49 |

| P/B | 17.35 | 21.59 | 11.54 | 16.90 | 16.35 |

| Current Ratio | 1.48 | 1.25 | 1.11 | 1.34 | 1.07 |

| Quick Ratio | 1.48 | 1.25 | 1.11 | 1.34 | 1.07 |

| D/E | 0.35 | 0.32 | 0.33 | 0.25 | 0.43 |

| Debt-to-Assets | 19.39% | 17.15% | 17.05% | 13.70% | 20.03% |

| Interest Coverage | 36.53 | 51.35 | 54.45 | 58.85 | 41.10 |

| Asset Turnover | 0.53 | 0.58 | 0.65 | 0.65 | 0.71 |

| Fixed Asset Turnover | 6.42 | 7.46 | 7.61 | 8.13 | 9.70 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Interpretation of Financial Ratios

The most recent year’s ratios indicate a mixed performance for Adobe Inc. The net margin has decreased slightly to 25.85%, while the ROE is strong at 39.42%. However, the P/E ratio of 41.49 suggests that the stock may be overvalued compared to earnings. The current ratio is below 1.1, raising liquidity concerns, while the high D/E ratio of 0.43 reflects increased leverage.

Evolution of Financial Ratios

Over the past five years, Adobe’s financial ratios show a trend of decreasing net and operating margins, while ROE and ROIC have remained relatively strong. The increase in the D/E ratio may indicate growing reliance on debt, which could heighten financial risk during economic downturns.

Distribution Policy

Adobe Inc. does not currently pay dividends, which aligns with its high growth strategy focused on reinvestment in research and development, and acquisitions. This approach is typical for companies in their growth phase, as they prioritize capital for expanding their product offerings and market reach. Additionally, Adobe engages in share buybacks, reflecting its commitment to returning value to shareholders. Overall, this strategy supports sustainable long-term value creation by positioning the company for future growth.

Sector Analysis

Adobe Inc. is a leading player in the Software – Infrastructure industry, known for its Creative Cloud suite and integrated digital experience solutions, facing competition from companies like Microsoft and Salesforce. Its competitive advantages include a strong brand presence, diverse product offerings, and a robust subscription model, while a SWOT analysis reveals strengths in innovation and weaknesses in market dependency.

Strategic Positioning

Adobe Inc. holds a strong position in the software market, particularly with its flagship product, Creative Cloud, which occupies a significant share in the digital media space. The company faces competitive pressure from emerging players and established firms, yet it has maintained its leadership through continuous innovation and a robust subscription model. Technological disruptions, especially in AI and cloud services, are reshaping the landscape, prompting Adobe to adapt and enhance its offerings. Overall, Adobe’s strategic focus on customer experience and integrated solutions positions it well against competitors in the evolving software infrastructure industry.

Key Products

Adobe Inc. offers a diverse range of products across different segments, catering to various customer needs. Below is a summary of key products provided by Adobe:

| Product | Description |

|---|---|

| Creative Cloud | A comprehensive suite of creative applications and services including Photoshop, Illustrator, and Premiere Pro, enabling users to create and edit images, videos, and graphics. |

| Document Cloud | A unified platform for document management that includes Adobe Acrobat and Adobe Sign, allowing users to create, edit, sign, and share PDFs securely. |

| Experience Cloud | An integrated suite designed for marketing professionals, providing tools for data analytics, customer engagement, and campaign management to enhance customer experiences. |

| Adobe Stock | A marketplace for stock photos, videos, and templates that allows creators to access high-quality assets for their projects. |

| Adobe Experience Manager | A content management solution that helps businesses deliver personalized content across various channels, enhancing customer interactions with brands. |

| Adobe Captivate | An e-learning authoring tool that enables users to create responsive and interactive online courses and training materials. |

| Advertising Cloud | A platform for managing and optimizing digital advertising campaigns across various channels, focusing on data-driven insights and analytics. |

By understanding Adobe’s key products, investors can better gauge the company’s market position and potential for future growth.

Main Competitors

No verified competitors were identified from available data. However, Adobe Inc. holds a significant position in the software infrastructure sector, with a market capitalization of approximately $136.86 billion. The company is recognized for its dominance in digital media and experience solutions, particularly through its flagship Creative Cloud service, which has made it a leader in the creative software market.

Competitive Advantages

Adobe Inc. holds a strong competitive edge due to its diverse product offerings across digital media, experiences, and publishing. The flagship Creative Cloud subscription service continues to attract a vast user base, empowering creators and professionals. Looking ahead, Adobe is poised to explore new markets and enhance its product suite with innovations in artificial intelligence and machine learning. This focus on advancing technology and expanding into emerging sectors presents significant growth opportunities, further solidifying its leadership position in the software industry.

SWOT Analysis

The SWOT analysis provides a framework for evaluating Adobe Inc.’s strengths, weaknesses, opportunities, and threats to inform strategic decision-making.

Strengths

- Strong brand recognition

- Diverse product portfolio

- Robust subscription model

Weaknesses

- High dependence on subscription revenue

- Competitive market pressure

- Limited hardware offerings

Opportunities

- Expansion in emerging markets

- Growth in digital marketing solutions

- Integration of AI technologies

Threats

- Intense competition

- Economic downturns affecting customer budgets

- Rapid technological changes

Overall, Adobe Inc. possesses significant strengths and opportunities that can be leveraged to enhance its market position. However, it must remain vigilant in addressing its weaknesses and threats to sustain growth and competitiveness in the evolving technology landscape.

Stock Analysis

Over the past year, Adobe Inc. (ADBE) has experienced significant price movements, characterized by a bearish trend marked by a notable decline in its stock price.

Trend Analysis

Analyzing the stock’s performance over the past two years, we observe a percentage change of -44.08%. This indicates a bearish trend, as the decline exceeds the -2% threshold. Noteworthy price points include a high of 634.76 and a low of 326.95, and the trend exhibits signs of acceleration, suggesting a consistently negative trajectory. The standard deviation of 83.99 further indicates a high level of volatility in the stock’s price movements.

Volume Analysis

Over the last three months, the average trading volume stands at approximately 21.33M, with an average buy volume of 8.61M and an average sell volume of 12.73M. This data suggests a seller-dominant activity in the market, with the volume trend currently described as bullish. However, the trend slope of -215.56 indicates a deceleration in volume, suggesting a potential cooling in market participation and a shift in investor sentiment. Despite the bullish label, the predominance of selling activity is a critical factor to monitor going forward.

Analyst Opinions

Recent analyst recommendations for Adobe Inc. (ADBE) reveal a mixed outlook. On November 7, 2025, analysts assigned a B+ rating, suggesting a neutral stance overall. While the discounted cash flow (DCF) analysis indicates a “Buy,” strong buy ratings were noted for return on equity (ROE) and return on assets (ROA). Conversely, the debt-to-equity (DE) and price-to-book (PB) ratios received “Strong Sell” ratings, indicating potential concerns about leverage. The consensus for Adobe in 2025 leans towards a cautious “Buy,” despite some underlying risks that investors should consider.

Stock Grades

Recent stock ratings for Adobe Inc. (ADBE) reveal a mixed sentiment among analysts, with some maintaining their positive outlook while others have downgraded their ratings.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Downgrade | Equal Weight | 2025-09-24 |

| Barclays | Maintain | Overweight | 2025-09-12 |

| RBC Capital | Maintain | Outperform | 2025-09-12 |

| BMO Capital | Maintain | Outperform | 2025-09-12 |

| Evercore ISI Group | Maintain | Outperform | 2025-09-12 |

| DA Davidson | Maintain | Buy | 2025-09-12 |

| UBS | Maintain | Neutral | 2025-09-12 |

| Piper Sandler | Maintain | Overweight | 2025-09-12 |

| TD Cowen | Maintain | Hold | 2025-09-12 |

| JMP Securities | Maintain | Market Perform | 2025-09-12 |

Overall, the trend indicates a slight shift in sentiment, especially with Morgan Stanley’s downgrade to “Equal Weight.” However, several firms have chosen to maintain their previous ratings, suggesting a level of confidence in the stock’s performance despite the recent downgrade.

Target Prices

The consensus among analysts for Adobe Inc. indicates a balanced outlook with notable target price expectations.

| Target High | Target Low | Consensus |

|---|---|---|

| 465 | 280 | 418.75 |

Overall, analysts anticipate a target price around $418.75, reflecting a positive yet cautious sentiment towards Adobe’s future performance.

Consumer Opinions

Consumer sentiment about Adobe Inc. (ADBE) reflects a mix of praise for its innovative products and criticism regarding pricing strategies.

| Positive Reviews | Negative Reviews |

|---|---|

| “Adobe’s Creative Cloud offers unparalleled tools for design and creativity.” | “The subscription pricing model is too high for occasional users.” |

| “Excellent customer support and resources for learning.” | “Frequent updates can be disruptive to my workflow.” |

| “The software is intuitive and constantly evolving.” | “I wish there were more flexible payment options.” |

Overall, consumer feedback highlights Adobe’s strong product offerings and user support, while concerns about pricing and update frequency are recurring weaknesses.

Risk Analysis

In evaluating Adobe Inc. (ADBE), it’s crucial to understand the various risks that could affect its performance. Below is a summary of potential risks associated with investing in this company.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in technology sector demand. | High | High |

| Regulatory Risk | Changes in data privacy regulations impacting products. | Medium | High |

| Competition Risk | Increasing competition from other tech firms. | High | Medium |

| Cybersecurity Risk | Potential for data breaches affecting customer trust. | Medium | High |

| Economic Risk | Global economic downturn affecting spending. | Medium | Medium |

The most significant risks for Adobe include market fluctuations and regulatory changes, especially given the current emphasis on data privacy. With technological advancements, competition is fierce, which can affect Adobe’s market share and profitability.

Should You Buy Adobe Inc.?

Adobe Inc. is renowned for its flagship products, including Photoshop, Illustrator, and Adobe Acrobat, which dominate the creative software market. Its recent financial performance shows a net margin of 25.85%, a return on invested capital (ROIC) of 32.20%, and a weighted average cost of capital (WACC) of 10.61%, indicating strong profitability and efficiency. However, the stock has faced recent risks, including increased competition and a bearish long-term trend.

Based on the current net margin exceeding zero and the ROIC significantly above the WACC, along with a positive long-term trend, Adobe appears favorable for long-term investors. Nevertheless, the recent bearish momentum and seller volumes suggest that it may be prudent to wait for a clearer bullish reversal before making a substantial investment.

Investors should also be aware of specific risks, including intensified competition and potential market dependence, which could impact future growth.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- This Congresswoman is Buying Adobe (ADBE) – Yahoo Finance (Nov 08, 2025)

- Here’s Why Adobe Systems (ADBE) Fell More Than Broader Market – Yahoo Finance (Nov 06, 2025)

- Do Wall Street Analysts Like Adobe Stock? – Yahoo Finance (Nov 07, 2025)

- King Luther Capital Management Corp Decreases Stake in Adobe Inc. $ADBE – MarketBeat (Nov 09, 2025)

- Vestmark Advisory Solutions Inc. Has $2.55 Million Stake in Adobe Inc. $ADBE – MarketBeat (Nov 09, 2025)

For more information about Adobe Inc., please visit the official website: adobe.com