Home > Analyses > Consumer Defensive > Acme United Corporation

Acme United Corporation quietly shapes everyday life by providing essential cutting, measuring, and first aid products that millions rely on at home, school, and work. Renowned for its trusted Westcott, Clauss, and First Aid Only brands, the company stands as a leader in the household and personal products industry, blending innovation with quality. As market dynamics evolve, we must ask: does Acme United’s solid foundation still support its current valuation and future growth prospects?

Table of contents

Business Model & Company Overview

Acme United Corporation, founded in 1867 and headquartered in Shelton, Connecticut, holds a dominant position in the Household & Personal Products industry. Its comprehensive ecosystem spans first aid, safety, cutting, sharpening, and measuring products, serving diverse markets including school, office, hardware, and industrial sectors across the US, Canada, and Europe. The company integrates well-known brands like Westcott, Clauss, and Camillus, delivering a broad range of tools and safety solutions that cater to both consumers and professionals.

The company’s revenue engine balances hardware—such as scissors, knives, and first aid kits—with recurring sales of consumables like wipes and safety refills. Its strategic presence across the Americas, Europe, and beyond supports steady demand and market penetration. With a workforce of 633 employees and a market cap of 160M USD, Acme United leverages its competitive advantage through a diversified product portfolio and a reliable distribution network, securing its role as a shaping force in personal and workplace safety.

Financial Performance & Fundamental Metrics

In this section, I analyze Acme United Corporation’s income statement, key financial ratios, and dividend payout policy to evaluate its fundamental strength.

Income Statement

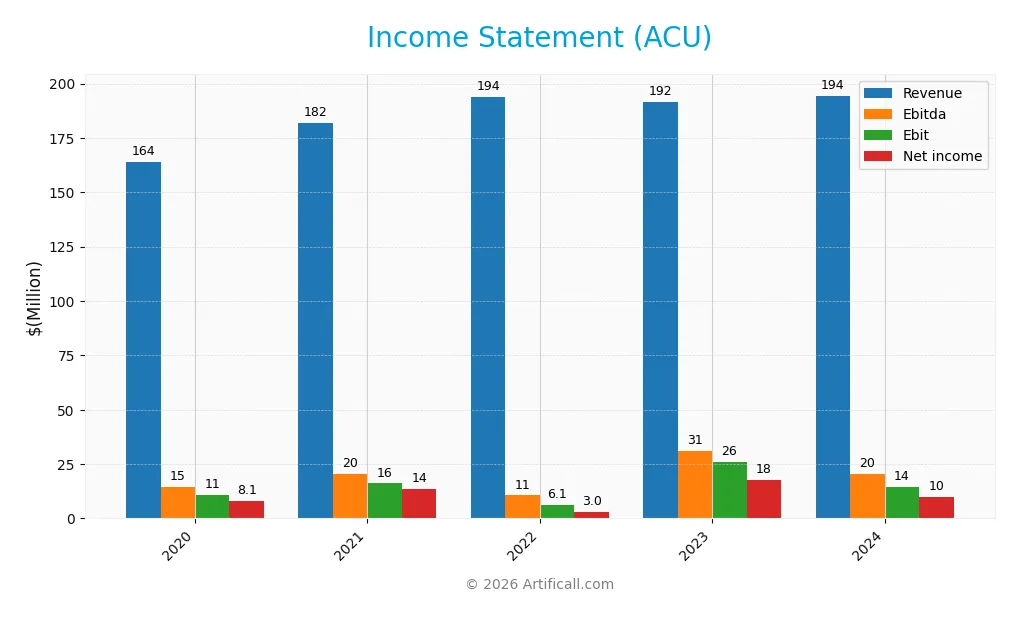

Below is the income statement of Acme United Corporation (ticker: ACU) for fiscal years 2020 through 2024, showing key financial metrics in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 164M | 182M | 194M | 192M | 194M |

| Cost of Revenue | 104M | 117M | 130M | 119M | 118M |

| Operating Expenses | 48M | 52M | 57M | 59M | 62M |

| Gross Profit | 60M | 65M | 64M | 72M | 76M |

| EBITDA | 14.6M | 20.3M | 10.6M | 30.9M | 20.4M |

| EBIT | 10.8M | 16.1M | 6.1M | 25.8M | 14.4M |

| Interest Expense | 0.94M | 0.92M | 2.4M | 3.1M | 2.1M |

| Net Income | 8.1M | 13.7M | 3.0M | 17.8M | 10.0M |

| EPS | 2.42 | 3.93 | 0.86 | 4.98 | 2.71 |

| Filing Date | 2021-03-31 | 2022-03-30 | 2023-03-10 | 2024-03-07 | 2025-03-06 |

Income Statement Evolution

From 2020 to 2024, Acme United Corporation’s revenue grew by 18.6%, reaching $194.5M in 2024, though the one-year growth was only 1.56%, indicating a recent slowdown. Net income rose 23.7% over the period but declined 44.5% in the last year to $10M. Gross margin remained stable and favorable at 39.3%, while EBIT and net margins showed neutral to favorable stability overall.

Is the Income Statement Favorable?

In 2024, Acme United reported a net margin of 5.15%, considered favorable, despite a sharp year-on-year decline in EBIT by 44.4% to $14.4M and EPS falling nearly 50% to $2.71. Interest expense remained low at 1.07% of revenue, supporting financial health. The mixed recent performance contrasts with longer-term improvements, leading to an overall favorable income statement assessment.

Financial Ratios

The following table summarizes key financial ratios for Acme United Corporation (ACU) over the last five fiscal years, providing a snapshot of profitability, liquidity, leverage, and efficiency metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 4.9% | 7.5% | 1.6% | 9.3% | 5.2% |

| ROE | 12.9% | 17.7% | 3.8% | 18.2% | 9.4% |

| ROIC | 8.5% | 9.2% | 3.6% | 8.3% | 8.2% |

| P/E | 12.4 | 8.6 | 25.5 | 8.8 | 13.8 |

| P/B | 1.6 | 1.5 | 1.0 | 1.6 | 1.3 |

| Current Ratio | 4.1 | 4.7 | 4.8 | 3.5 | 4.2 |

| Quick Ratio | 1.6 | 2.1 | 1.9 | 1.4 | 1.7 |

| D/E | 0.76 | 0.62 | 0.80 | 0.26 | 0.31 |

| Debt-to-Assets | 37% | 33% | 39% | 17% | 20% |

| Interest Coverage | 12.1 | 13.9 | 2.6 | 4.3 | 6.8 |

| Asset Turnover | 1.26 | 1.26 | 1.18 | 1.28 | 1.20 |

| Fixed Asset Turnover | 7.2 | 6.7 | 6.7 | 6.4 | 5.3 |

| Dividend Yield | 1.6% | 1.5% | 2.5% | 1.3% | 1.6% |

Evolution of Financial Ratios

From 2020 to 2024, Acme United Corporation’s Return on Equity (ROE) exhibited volatility, peaking around 18% in 2023 before declining to 9.37% in 2024, signaling a slowdown in profitability growth. The Current Ratio remained consistently high above 3.5, indicating strong liquidity but with a slight decrease to 4.17 in 2024. The Debt-to-Equity Ratio notably improved, dropping from above 0.6 in earlier years to a favorable 0.31 in 2024, reflecting reduced leverage.

Are the Financial Ratios Favorable?

In 2024, profitability ratios such as net margin (5.15%) and return on invested capital (8.16%) are classified as neutral, while ROE at 9.37% is unfavorable. Liquidity shows mixed signals: the Current Ratio at 4.17 is unfavorable, but the Quick Ratio of 1.71 is favorable. Leverage ratios including Debt-to-Equity (0.31) and Debt-to-Assets (20.25%) are favorable, supported by a strong interest coverage of 6.9. Efficiency metrics like asset turnover (1.2) and fixed asset turnover (5.33) are favorable. Overall, 64% of ratios are favorable, suggesting a generally positive financial profile.

Shareholder Return Policy

Acme United Corporation maintains a consistent dividend payment with a payout ratio around 22% in 2024 and a dividend yield near 1.6%. The dividend per share has steadily increased, supported by free cash flow coverage and moderate buyback activity, reflecting a balanced approach to shareholder returns.

This policy appears sustainable given the company’s positive free cash flow and solid operating cash flow, suggesting the distribution and repurchases are managed prudently to support long-term value creation without overextending financial resources.

Score analysis

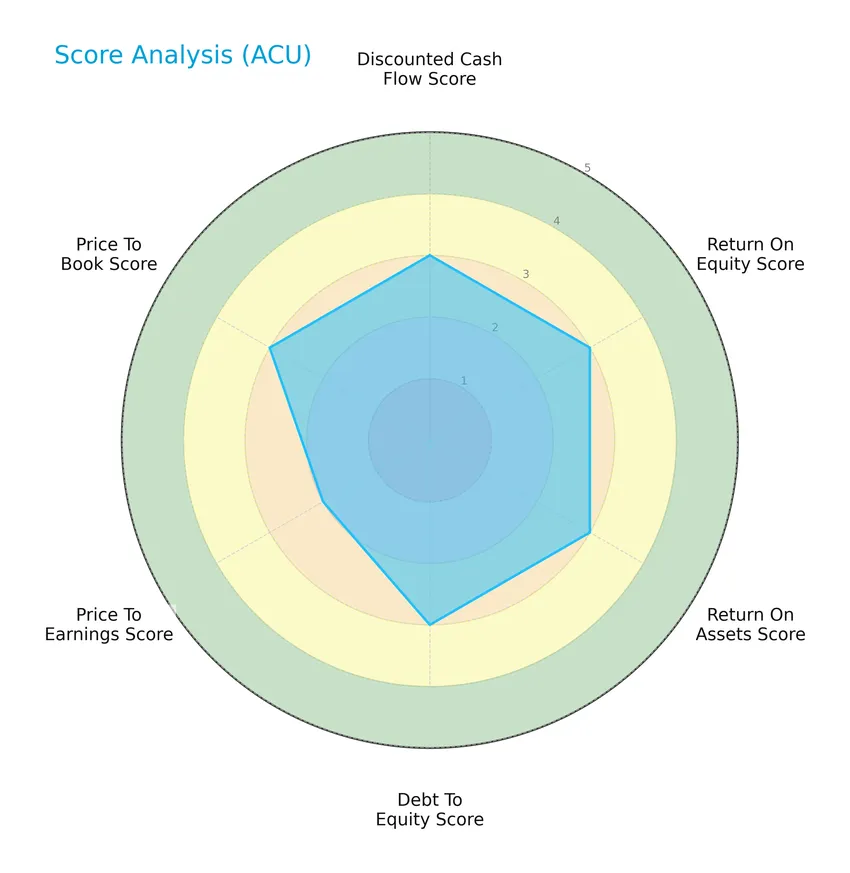

The following radar chart presents an overview of Acme United Corporation’s key financial scores across multiple valuation and performance metrics:

Acme United shows moderate scores in discounted cash flow, return on equity, return on assets, debt to equity, and price to book ratios, all rated at 3. The price to earnings score is slightly lower at 2, indicating a relatively moderate valuation from earnings perspectives.

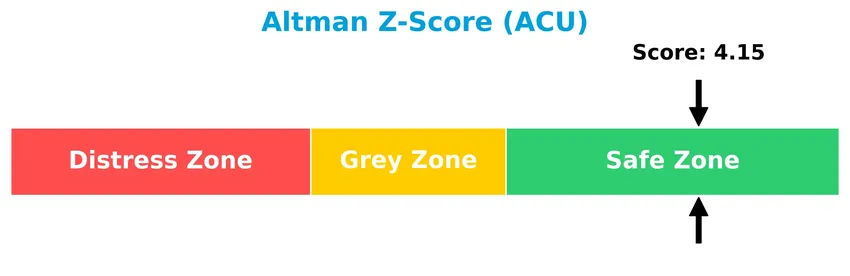

Analysis of the company’s bankruptcy risk

Acme United’s Altman Z-Score places the company confidently in the safe zone, indicating a low risk of bankruptcy and stable financial health:

Is the company in good financial health?

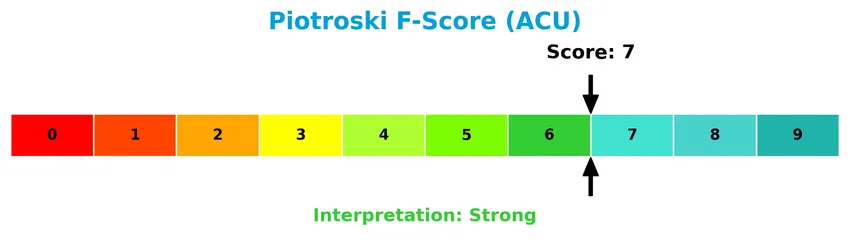

The Piotroski Score diagram illustrates the company’s financial strength and operational efficiency based on nine fundamental criteria:

With a Piotroski Score of 7, Acme United is classified as strong, reflecting solid profitability, liquidity, and operational efficiency that suggest good financial health and resilience.

Competitive Landscape & Sector Positioning

This sector analysis will examine Acme United Corporation’s strategic positioning, revenue by segment, key products, and main competitors. I will also evaluate whether Acme United holds a competitive advantage within its Household & Personal Products industry.

Strategic Positioning

Acme United Corporation maintains a diversified product portfolio spanning first aid, cutting, sharpening, measuring, and safety products under multiple brands. Geographically, it primarily operates in the United States with significant exposure in Canada and Europe, reflecting a balanced but U.S.-centric market presence.

Revenue by Segment

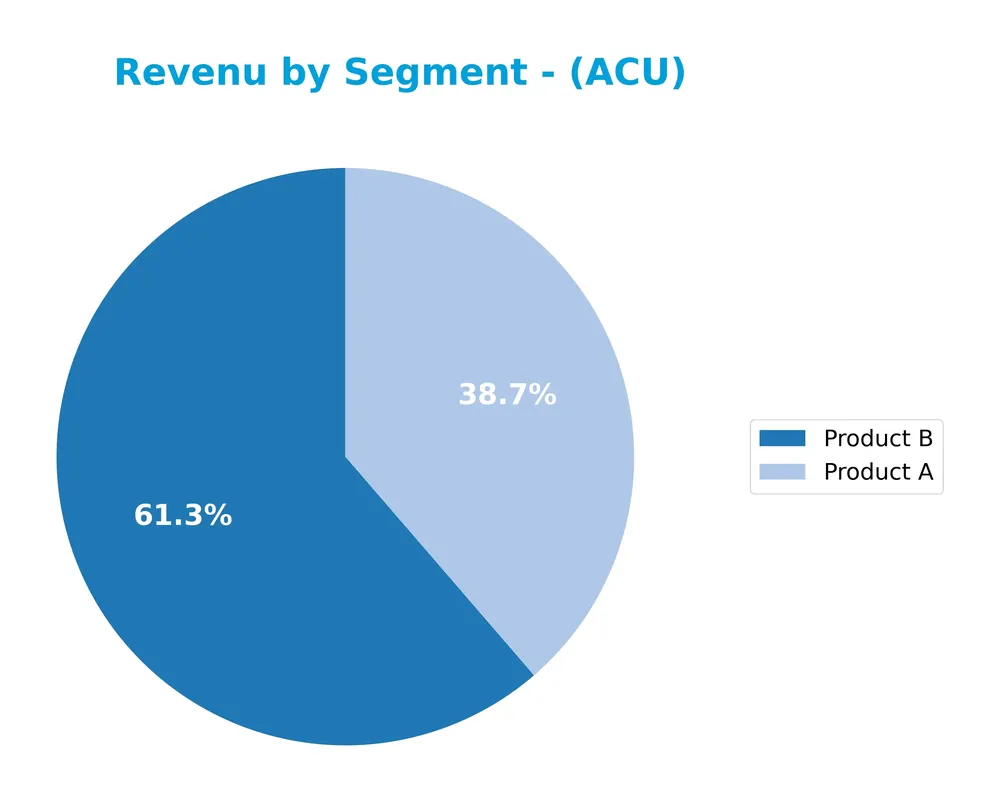

The pie chart illustrates Acme United Corporation’s revenue distribution by product segments for the fiscal year 2024, highlighting the contributions of Product A and Product B.

In 2024, Product B led revenue generation with $119M, slightly increasing from $114M in 2023, while Product A saw a modest decline to $75M from $77M. The business remains heavily driven by these two product lines, with Product B showing stronger growth momentum. This concentration suggests a reliance on Product B’s performance, warranting attention to diversification and risk management moving forward.

Key Products & Brands

The following table summarizes Acme United Corporation’s principal products and brand offerings:

| Product | Description |

|---|---|

| Westcott | Scissors, shears, knives, rulers, pencil sharpeners, paper trimmers, safety cutters, lettering products, glue guns, and other craft products. |

| Clauss | Cutting tools including scissors and shears. |

| Camillus | Fixed blades, folding knives, sight cutting tools, and tactical tools. |

| Cuda | Fishing tools and knives, cut and puncture resistant gloves, telescopic landing nets, net containment systems, and fishing gaffs. |

| DMT | Sharpening tools. |

| First Aid Only | First aid kits and safety solutions. |

| PhysiciansCare | Portable eyewash solutions and over-the-counter medication containing aspirin, acetaminophen, and ibuprofen. |

| Spill Magic | Bodily fluid and spill clean-up solutions. |

| First Aid Central | Various first aid kits, refills, and safety supplies including CPR kits, burn kits, automotive and emergency first aid kits. |

| Med-Nap | Alcohol prep pads, alcohol wipes, benzalkonium chloride wipes, antiseptic wipes, castile soaps, and lens cleaning wipes. |

Acme United Corporation offers a diverse product range under multiple established brands, covering cutting, measuring, safety, first aid, and fishing tool markets across various regions.

Main Competitors

There are 17 competitors in the Consumer Defensive sector for Acme United Corporation, with the table below listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| The Procter & Gamble Company | 331.3B |

| Unilever PLC | 143.2B |

| Colgate-Palmolive Company | 62.6B |

| The Estée Lauder Companies Inc. | 38.5B |

| Kimberly-Clark Corporation | 33.7B |

| Kenvue Inc. | 33.2B |

| Church & Dwight Co., Inc. | 20.2B |

| The Clorox Company | 12.3B |

| e.l.f. Beauty, Inc. | 4.3B |

| Inter Parfums, Inc. | 2.7B |

Acme United Corporation ranks 17th among 17 competitors, with a market capitalization only 0.05% of the sector leader, The Procter & Gamble Company. It is positioned well below both the average market cap of the top 10 competitors (68.2B) and the sector median (4.3B). The distance to its nearest competitor above is +196.41%, indicating a significant gap between Acme United and the rest of the market.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does ACU have a competitive advantage?

Acme United Corporation currently does not demonstrate a competitive advantage as its return on invested capital (ROIC) is below its weighted average cost of capital (WACC), indicating value is being shed. The company’s ROIC trend is declining, signaling decreasing profitability over the 2020-2024 period.

Looking ahead, Acme United serves diversified markets across the US, Canada, and Europe with a broad product portfolio in household and personal products. Opportunities may arise from expanding its product lines and geographic reach, although current financial trends suggest caution regarding sustained value creation.

SWOT Analysis

This SWOT analysis highlights Acme United Corporation’s key internal and external factors to guide investment decisions.

Strengths

- diversified product portfolio

- strong brand recognition

- favorable gross margin (39.26%)

Weaknesses

- recent decline in EBIT and net margin growth

- declining ROIC trend

- relatively low revenue growth (1.56% last year)

Opportunities

- expanding international markets

- growing demand for safety and first aid products

- e-commerce sales growth potential

Threats

- intense competition in household products

- supply chain disruptions risk

- economic downturn impact on discretionary spending

Acme United’s solid product diversity and margin strength position it well, but recent profitability declines and a shrinking ROIC signal caution. Strategic focus on international expansion and e-commerce could offset competitive and economic risks.

Stock Price Action Analysis

The weekly stock chart of Acme United Corporation (ACU) illustrates price movements and trading patterns over the last 12 months:

Trend Analysis

Over the past 12 months, ACU’s stock price declined by 4.28%, indicating a bearish trend with acceleration. The price fluctuated between a high of 46.99 and a low of 33.7, with a volatility measured by a standard deviation of 2.79.

Volume Analysis

Trading volumes over the last three months show a strongly buyer-dominant pattern, with buyers accounting for 76.29% of volume. Although overall volume is decreasing, buyer participation remains high, suggesting sustained investor interest despite reduced market activity.

Target Prices

No verified target price data is available from recognized analysts for Acme United Corporation (ACU). Investors should rely on fundamental analysis and market conditions when considering this stock.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines Acme United Corporation’s analyst ratings and consumer feedback to provide balanced insights.

Stock Grades

The following table presents the latest verified stock grades for Acme United Corporation from reputable sources:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| DA Davidson | Maintain | Buy | 2016-07-01 |

The overall consensus indicates a Buy rating with no changes from DA Davidson, suggesting stable analyst confidence in the stock as of the last available update.

Consumer Opinions

Consumers have mixed but insightful views on Acme United Corporation, reflecting both satisfaction and areas for improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| “High-quality products with reliable durability.” | “Customer service response times can be slow.” |

| “Innovative designs that meet everyday needs.” | “Some items are priced higher than competitors.” |

| “Consistent product availability in stores.” | “Packaging could be more environmentally friendly.” |

Overall, Acme United is praised for product quality and innovation, though customers frequently note concerns about service speed and pricing. Environmental packaging also emerges as a potential growth area.

Risk Analysis

The following table summarizes key risks related to Acme United Corporation’s business and financial profile:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Share price fluctuation with recent 4.56% drop indicates sensitivity to market conditions. | Medium | Medium |

| Profitability Risk | Moderate net margin (5.15%) and unfavorable ROE (9.37%) may limit earnings growth. | Medium | Medium |

| Liquidity Risk | Unfavorable current ratio (4.17) suggests potential short-term financial management concerns. | Low | Medium |

| Competitive Risk | Operating in a crowded Consumer Defensive sector with established brands requires innovation. | Medium | High |

| Supply Chain Risk | Global supply chain disruptions could affect product availability internationally. | Medium | High |

The most likely and impactful risks are competitive pressure and supply chain disruptions due to Acme United’s global footprint and diverse product lines. Despite a safe Altman Z-Score (4.15) and strong Piotroski score (7), investors should monitor sector competition and operational efficiency to manage downside risks effectively.

Should You Buy Acme United Corporation?

Acme United Corporation appears to be characterized by moderate profitability and a slightly unfavorable competitive moat, suggesting challenges in value creation amid declining returns. Despite a manageable leverage profile and a solid safety rating, its overall rating of B could be seen as reflecting cautious optimism.

Strength & Efficiency Pillars

Acme United Corporation presents a solid financial foundation with a net margin of 5.15% and a strong Altman Z-Score of 4.15, positioning the company safely away from bankruptcy risk. The Piotroski Score of 7 further attests to its robust operational health. While the return on equity (ROE) is modest at 9.37%, the company maintains favorable leverage with a debt-to-equity ratio of 0.31 and exhibits healthy liquidity supported by a quick ratio of 1.71. Despite a neutral ROIC of 8.16% slightly exceeding the WACC of 7%, Acme United does not yet stand out as a strong value creator, but its financial health and operational efficiency remain commendable.

Weaknesses and Drawbacks

Notwithstanding these strengths, Acme United faces some challenges. The current ratio is high at 4.17, which could indicate inefficient asset utilization or excess inventory, potentially tying up capital unnecessarily. The stock’s overall trend remains bearish with a price decline of 4.28%, despite recent positive momentum. Moreover, revenue growth over the last year was only 1.56%, and key profitability metrics like EBIT and net margin showed significant declines of over 44%, signaling short-term operational pressures. These factors suggest caution, as the company’s short-term performance and market sentiment may pose risks to investors.

Our Verdict about Acme United Corporation

Acme United’s long-term fundamental profile may appear favorable given its strong financial health and moderate valuation metrics such as a P/E of 13.78 and P/B of 1.29. The recent period shows strong buyer dominance at 76.29%, reflecting renewed market interest. Despite the overall bearish trend, this combination suggests the stock could present an attractive opportunity for long-term exposure, though investors might consider a cautious, measured approach given the recent volatility and operational headwinds.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Acme United Completes My Medic and Rapid Medical Acquisition – TipRanks (Jan 22, 2026)

- Emergency trauma gear brand My Medic bought for $18.7M by Acme United – Stock Titan (Jan 15, 2026)

- Acme United Corp. Acquires the Assets of My Medic – citybiz (Jan 16, 2026)

- Acme United: Sometimes The Market Disagrees, And That’s The Opportunity (NYSE:ACU) – Seeking Alpha (Nov 24, 2025)

- Technical Reactions to ACU Trends in Macro Strategies – Stock Traders Daily (Jan 20, 2026)

For more information about Acme United Corporation, please visit the official website: acmeunited.com