Home > Analyses > Healthcare > AbbVie Inc.

AbbVie transforms patients’ lives by pioneering therapies for autoimmune diseases, cancers, and neurological disorders. Its flagship drugs—HUMIRA, SKYRIZI, and IMBRUVICA—set industry standards in efficacy and innovation. With a robust pipeline and a reputation for scientific rigor, AbbVie leads the pharmaceutical sector in both scale and impact. As the healthcare landscape evolves, I question whether AbbVie’s current fundamentals still justify its lofty valuation and growth ambitions.

Table of contents

Business Model & Company Overview

AbbVie Inc., founded in 2012 and headquartered in North Chicago, Illinois, commands a leading role in the Drug Manufacturers – General industry. With 55K employees, it delivers a comprehensive pharmaceutical ecosystem targeting autoimmune, oncology, and chronic conditions. Its portfolio includes industry staples like HUMIRA and innovative therapies such as SKYRIZI and RINVOQ, reflecting a core mission to improve patient outcomes across multiple disease areas.

AbbVie’s revenue engine balances patented biologics with specialty pharmaceuticals and recurring revenue from chronic treatments. Its footprint spans the Americas, Europe, and Asia, securing diversified global market access. This strategic blend drives steady cash flow and underpins its formidable economic moat, positioning AbbVie as a pivotal innovator shaping healthcare’s future.

Financial Performance & Fundamental Metrics

I will analyze AbbVie Inc.’s income statement, key financial ratios, and dividend payout policy to assess its core financial health and shareholder value.

Income Statement

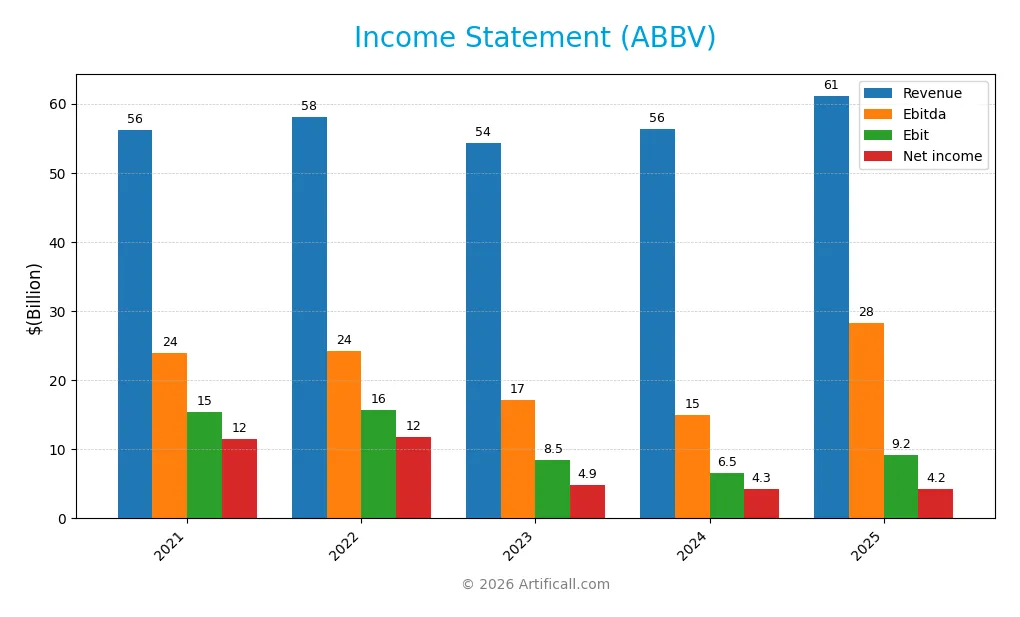

The following table summarizes AbbVie Inc.’s annual income statement figures from 2021 through 2025, reflecting revenues, expenses, profits, and earnings per share.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 56.2B | 58.1B | 54.3B | 56.3B | 61.2B |

| Cost of Revenue | 17.4B | 17.4B | 20.4B | 16.9B | 10.0B |

| Operating Expenses | 20.8B | 22.5B | 21.1B | 30.3B | 29.9B |

| Gross Profit | 38.8B | 40.6B | 33.9B | 39.4B | 51.2B |

| EBITDA | 23.9B | 24.2B | 17.2B | 14.9B | 28.3B |

| EBIT | 15.4B | 15.7B | 8.5B | 6.5B | 9.2B |

| Interest Expense | 2.4B | 2.2B | 2.2B | 2.8B | 2.6B |

| Net Income | 11.5B | 11.8B | 4.9B | 4.3B | 4.2B |

| EPS | 6.48 | 6.65 | 2.73 | 2.40 | 2.38 |

| Filing Date | 2022-02-18 | 2023-02-17 | 2024-02-20 | 2025-02-14 | 2026-02-16 |

Income Statement Evolution

AbbVie’s revenue grew steadily, rising 8.83% overall and 8.57% in the latest year. Gross profit surged 29.84% in the last year, boosting margins despite a 66.36% decline in net margin over the period. Operating expenses tracked revenue growth, keeping operational leverage stable. Net income, however, fell sharply by 63.39%, reflecting margin compression.

Is the Income Statement Favorable?

In 2025, AbbVie reported a solid gross margin of 83.7% and an EBIT margin of 15.1%, both favorable. Interest expense remained controlled at 4.3% of revenue. Despite an 8.6% revenue rise and 41.4% EBIT growth, net income and EPS declined slightly, signaling margin pressures. Overall, 64% of income statement metrics are favorable, supporting a generally positive view.

Financial Ratios

The following table summarizes AbbVie Inc.’s key financial ratios for the fiscal years 2022 through 2025, offering insight into profitability, valuation, liquidity, leverage, and operational efficiency:

| Ratios | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|

| Net Margin | 20% | 9% | 8% | 7% |

| ROE | 69% | 47% | 129% | 0% |

| ROIC | 14% | 10% | 9% | 0% |

| P/E | 24.2x | 56.3x | 73.5x | 96.8x |

| P/B | 16.6x | 26.4x | 94.5x | 0 |

| Current Ratio | 0.96 | 0.87 | 0.66 | 0 |

| Quick Ratio | 0.84 | 0.76 | 0.55 | 0 |

| D/E | 3.7x | 5.8x | 20.4x | 0 |

| Debt-to-Assets | 46% | 45% | 50% | 0% |

| Interest Coverage | 8.1x | 5.7x | 3.3x | 8.1x |

| Asset Turnover | 0.42 | 0.40 | 0.42 | 0 |

| Fixed Asset Turnover | 11.8x | 10.9x | 11.0x | 0 |

| Dividend Yield | 3.5% | 3.8% | 3.5% | 2.9% |

Evolution of Financial Ratios

AbbVie’s ROE and ROIC both registered at zero for 2025, marking a sharp decline from prior years. The current ratio fell to zero in 2025, indicating worsening liquidity. Debt-to-equity ratio data is missing but previously showed a high level, suggesting leverage remained significant. Profitability margins narrowed, with net margin at 6.91%, a neutral sign after previous fluctuations.

Are the Financial Ratios Favorable?

In 2025, AbbVie’s profitability appears neutral with a 6.91% net margin but unfavorable ROE and ROIC. Liquidity ratios (current and quick) are critically low, flagged unfavorable. Debt metrics show a favorable status despite missing values, possibly reflecting improved debt structure. The high PE ratio (96.82) is unfavorable, while dividend yield at 2.87% is favorable. Overall, the ratios signal a slightly unfavorable financial profile.

Shareholder Return Policy

AbbVie maintains a consistent dividend policy with a payout ratio around 2.7 and a dividend yield near 2.9%. Dividends per share have steadily increased from $5.23 in 2021 to $6.56 in 2025, supported by free cash flow coverage and modest share buyback activities.

This approach aligns with sustainable shareholder value creation, balancing income distribution and reinvestment. The relatively stable dividend payout ratio and yield indicate disciplined capital allocation, though investors should monitor potential risks from leverage and cash flow variability.

Score analysis

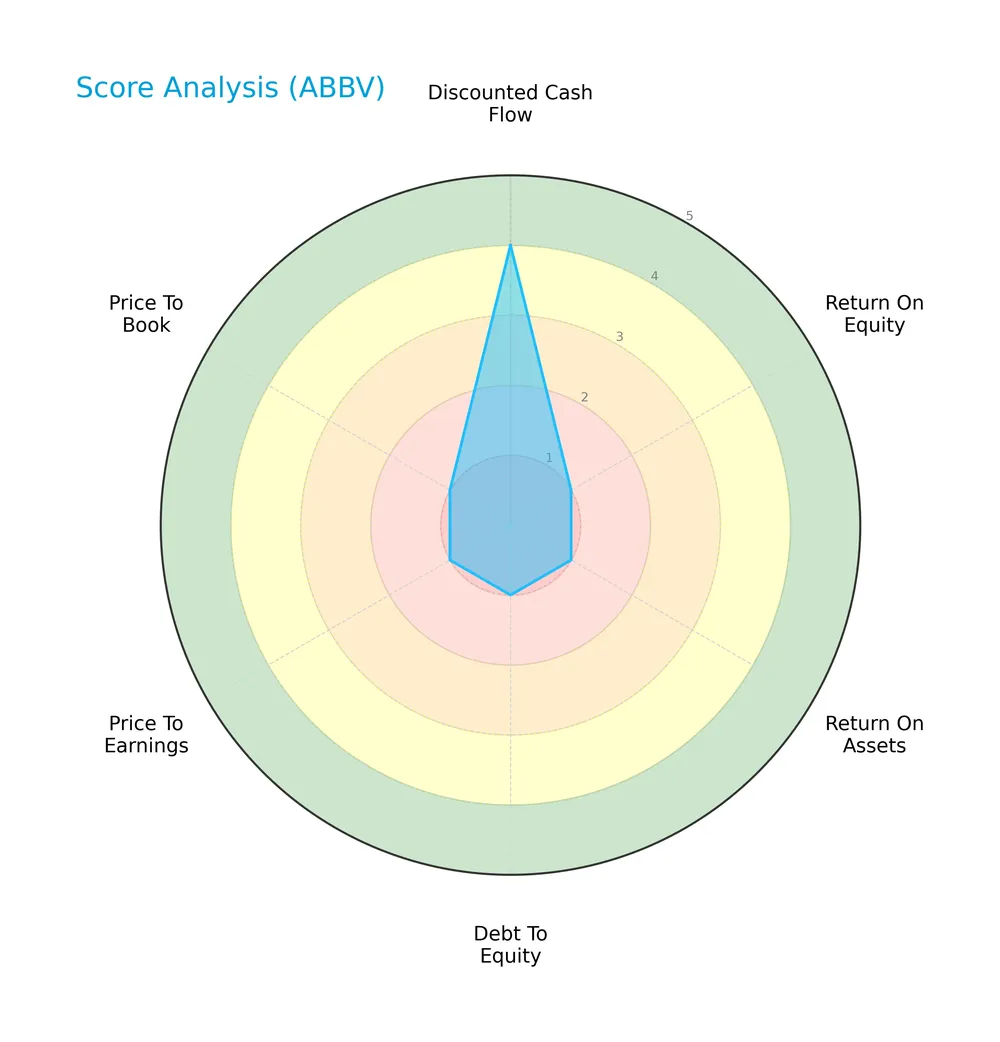

The following radar chart highlights AbbVie Inc.’s key financial scores across valuation and profitability metrics:

AbbVie’s discounted cash flow score stands out as favorable at 4. However, all other scores—including return on equity, return on assets, debt to equity, price to earnings, and price to book—register very unfavorable values of 1, indicating broad weaknesses in profitability and valuation metrics.

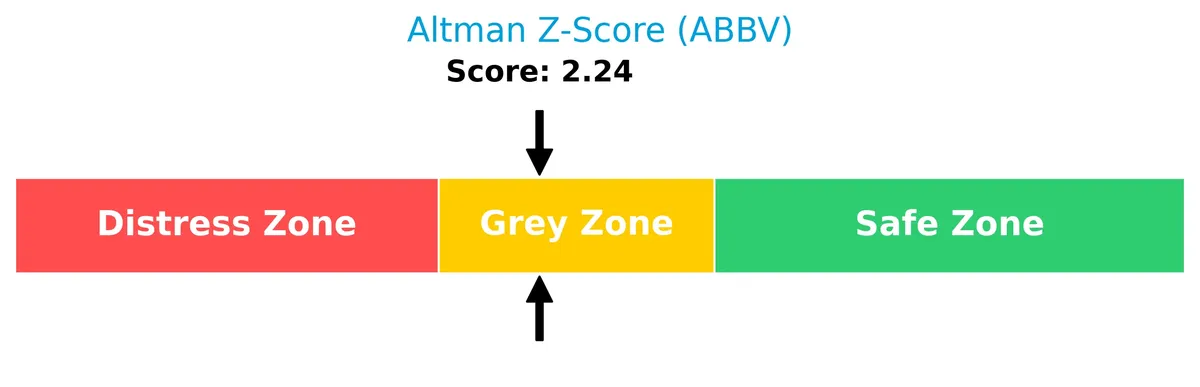

Analysis of the company’s bankruptcy risk

AbbVie’s Altman Z-Score places it in the grey zone, signaling a moderate risk of financial distress and potential bankruptcy:

Is the company in good financial health?

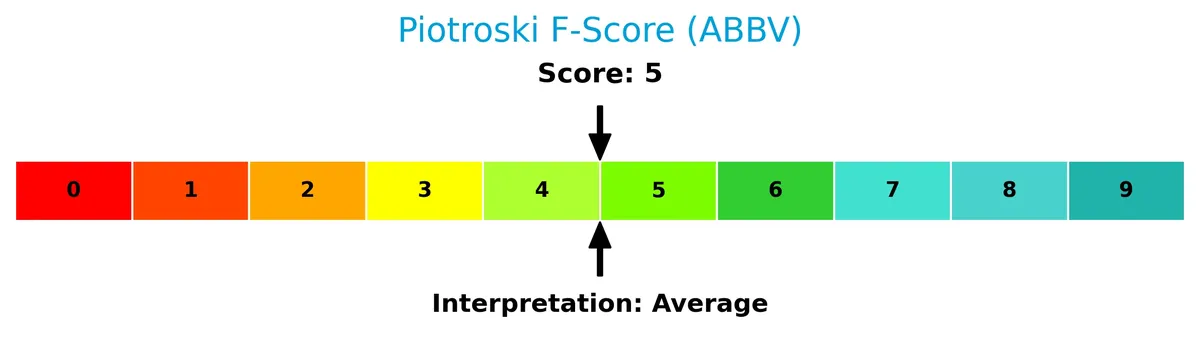

The Piotroski Score chart offers insight into AbbVie’s financial health based on nine fundamental criteria:

With a Piotroski Score of 5, AbbVie is categorized as average. This score reflects mixed financial strength, underscoring neither strong resilience nor significant weakness in its fundamentals.

Competitive Landscape & Sector Positioning

This sector analysis examines AbbVie Inc.’s strategic positioning, revenue segments, key products, and main competitors. I will assess whether AbbVie holds a competitive advantage over its industry peers.

Strategic Positioning

AbbVie maintains a diversified pharmaceutical portfolio with significant revenue from immunology, aesthetics, neuroscience, and eye care. The U.S. dominates geographically, generating over 75% of 2024 sales, reflecting concentrated market exposure despite broad product offerings.

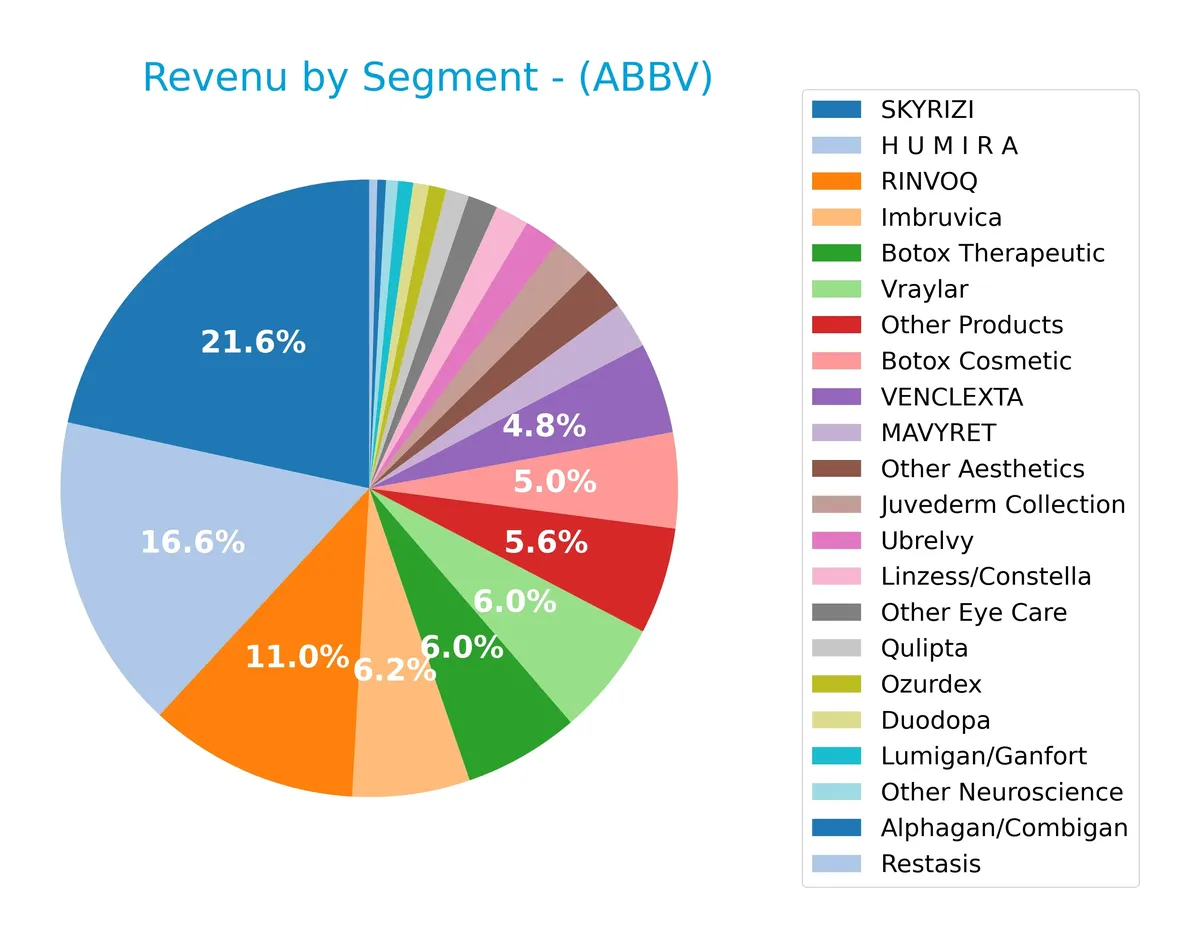

Revenue by Segment

This pie chart displays AbbVie Inc.’s revenue distribution by product segment for fiscal year 2024, highlighting the varied contributions across its pharmaceutical portfolio.

In 2024, SKYRIZI leads with $11.7B, followed by HUMIRA at $9B and RINVOQ at $6B, showing AbbVie’s stronghold in immunology and inflammation. Neuroscience and aesthetics segments, including Botox Therapeutic ($3.3B) and Imbruvica ($3.3B), remain significant. Notably, HUMIRA revenue sharply declined from prior years, indicating patent expirations and competitive pressure, while SKYRIZI and RINVOQ revenues accelerated, signaling a strategic shift and concentration risk toward newer immunology drugs.

Key Products & Brands

The following table summarizes AbbVie Inc.’s principal products and brands by therapeutic area and application:

| Product | Description |

|---|---|

| HUMIRA | Injection therapy for autoimmune and intestinal Behçet’s diseases. |

| SKYRIZI | Treatment for moderate to severe plaque psoriasis in adults. |

| RINVOQ | JAK inhibitor for moderate to severe active rheumatoid arthritis in adults. |

| IMBRUVICA | Therapy for chronic lymphocytic leukemia (CLL) and small lymphocytic lymphoma (SLL). |

| VENCLEXTA | BCL-2 inhibitor for adults with CLL or SLL. |

| MAVYRET | Treatment for chronic HCV genotype 1-6 infection. |

| CREON | Pancreatic enzyme therapy for exocrine pancreatic insufficiency. |

| Synthroid | Treatment for hypothyroidism. |

| Linzess/Constella | Therapies for irritable bowel syndrome with constipation and chronic idiopathic constipation. |

| Lupron | Palliative treatment for advanced prostate cancer, endometriosis, and related conditions. |

| Botox Therapeutic | Therapeutic applications of Botox beyond cosmetics. |

| Botox Cosmetic | Cosmetic use of Botox for aesthetic enhancements. |

| Juvederm Collection | Dermal fillers for aesthetic treatments. |

| Alphagan/Combigan | Alpha-adrenergic receptor agonists for reducing intraocular pressure in glaucoma or ocular hypertension. |

| Lumigan/Ganfort | Ophthalmic solutions for elevated intraocular pressure in glaucoma or ocular hypertension. |

| Restasis | Immunosuppressant to increase tear production in dry eye disease. |

| Ozurdex | Implant for ocular inflammation and macular edema. |

| Duopa/Duodopa | Levodopa-carbidopa intestinal gel for Parkinson’s disease. |

| Ubrelvy | Treatment for migraine with or without aura in adults. |

| Qulipta | Medication for migraine prevention. |

| Vraylar | Treatment for schizophrenia and bipolar disorder. |

| Other Aesthetics | Additional aesthetic products beyond Botox and Juvederm. |

| Other Eye Care | Various ophthalmic products not specifically named. |

| Other Neuroscience | Neuroscience-related therapies excluding major named products. |

| Other Products | Diverse pharmaceutical products outside core brands listed above. |

AbbVie’s portfolio spans immunology, oncology, virology, neuroscience, aesthetics, and eye care. Its flagship drugs, HUMIRA and SKYRIZI, dominate immunology sales. The company balances established blockbuster therapies with growing newer treatments, reflecting a broad therapeutic reach.

Main Competitors

AbbVie Inc. faces competition from 10 major companies in its sector, with the table below showing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Eli Lilly and Company | 970B |

| Johnson & Johnson | 500B |

| AbbVie Inc. | 405B |

| AstraZeneca PLC | 285B |

| Merck & Co., Inc. | 268B |

| Amgen Inc. | 176B |

| Gilead Sciences, Inc. | 151B |

| Pfizer Inc. | 143B |

| Bristol-Myers Squibb Company | 109B |

| Biogen Inc. | 26B |

AbbVie ranks third among these competitors, with a market cap at 42.16% of the leader, Eli Lilly. It stands above both the average market cap of the top 10 (303B) and the sector median (222B). Notably, AbbVie maintains a 22.1% market cap premium over its closest rival above, Johnson & Johnson, underscoring its strong positioning within the healthcare industry.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does AbbVie have a competitive advantage?

AbbVie presents competitive strengths through its diverse pharmaceutical portfolio and strong revenue base, supported by favorable gross and EBIT margins. However, its declining ROIC trend signals caution on capital efficiency and long-term moat sustainability.

Looking ahead, AbbVie’s pipeline includes therapies for autoimmune diseases, oncology, and eye care, with growth opportunities in expanding non-US markets and research collaborations. These factors may enhance future competitive positioning despite current challenges.

SWOT Analysis

This analysis highlights AbbVie Inc.’s key internal and external factors shaping its strategic outlook.

Strengths

- strong global pharmaceutical portfolio

- high gross margin (83.7%)

- solid US market presence with $43B revenue

Weaknesses

- declining ROIC trend

- unfavorable net income growth (-63%)

- weak liquidity ratios (current, quick ratio at 0)

Opportunities

- expanding non-US markets

- pipeline innovation in autoimmune and oncology

- strategic research collaborations

Threats

- patent expirations on key drugs

- intense industry competition

- pricing pressure from regulators

AbbVie’s strengths in product diversity and margin resilience underpin its market leadership. However, deteriorating profitability metrics and liquidity signals caution. Strategic focus should target pipeline innovation and geographic expansion to offset patent cliffs and competitive risks.

Stock Price Action Analysis

The weekly stock chart below illustrates AbbVie Inc.’s price movement over the past 12 months, highlighting key highs and lows with overall trend direction:

Trend Analysis

Over the past 12 months, AbbVie’s stock price increased by 29.73%, indicating a bullish trend. The trend shows deceleration despite the strong gain. Price volatility is high, with a standard deviation of 21.28. The highest price reached 236.28, and the lowest was 157.06.

Volume Analysis

Trading volume is increasing, with buyers accounting for 55.54% of total trades. Recent three-month data shows slight buyer dominance at 54.17%. This suggests sustained investor interest and moderate bullish sentiment supporting price gains.

Target Prices

Analysts show a confident target consensus for AbbVie Inc., reflecting solid growth expectations.

| Target Low | Target High | Consensus |

|---|---|---|

| 223 | 289 | 253.18 |

The target prices indicate a bullish outlook, with a consensus around $253, suggesting upside potential from current levels.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines AbbVie Inc.’s recent analyst ratings and consumer feedback to assess market sentiment and brand perception.

Stock Grades

Here is the latest overview of AbbVie Inc. grades from leading financial institutions, reflecting diverse analyst opinions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Evercore ISI Group | Maintain | Outperform | 2026-02-05 |

| Morgan Stanley | Maintain | Overweight | 2026-02-05 |

| UBS | Maintain | Neutral | 2026-02-05 |

| Citigroup | Maintain | Neutral | 2026-01-27 |

| Wolfe Research | Downgrade | Peer Perform | 2026-01-08 |

| Morgan Stanley | Maintain | Overweight | 2025-12-12 |

| HSBC | Upgrade | Buy | 2025-12-10 |

| UBS | Maintain | Neutral | 2025-11-07 |

| Piper Sandler | Maintain | Overweight | 2025-11-05 |

| JP Morgan | Maintain | Overweight | 2025-11-03 |

Grades show a general tilt toward positive sentiment, with most firms maintaining overweight or outperform stances. A minor downgrade from Wolfe Research contrasts with HSBC’s recent upgrade, indicating some analyst caution amid broadly stable views.

Consumer Opinions

Consumer sentiment around AbbVie Inc. reflects a mix of strong product satisfaction and concern over pricing strategies.

| Positive Reviews | Negative Reviews |

|---|---|

| Effective treatments with noticeable health benefits. | High drug prices limit accessibility for many patients. |

| Reliable customer support and clear communication. | Side effects reported in some medications cause worry. |

| Innovative therapies leading the pharmaceutical sector. | Delays in prescription fulfillment frustrate some consumers. |

Overall, consumers praise AbbVie’s innovation and efficacy but frequently cite pricing and occasional service delays as key concerns. The balance between breakthrough treatments and affordability remains a critical challenge.

Risk Analysis

Below is an overview of AbbVie Inc.’s key risks, categorized by likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| High Valuation Risk | P/E ratio at 96.8 signals stretched valuation, raising downside risk on multiple market shifts | High | High |

| Profitability Concerns | Zero ROE and ROIC indicate weak capital returns, threatening long-term value creation | Medium | High |

| Liquidity Weakness | Current and quick ratios at zero point to potential liquidity constraints | Medium | Medium |

| Debt and Leverage | Favorable debt-to-equity but Altman Z-score in grey zone highlights moderate financial stress | Medium | Medium |

| Dividend Sustainability | 2.87% yield is attractive, but weak earnings may pressure future payouts | Medium | Medium |

AbbVie’s most pressing risks stem from its sky-high P/E and poor returns on capital, which historically in pharma suggest vulnerability to patent cliffs or competitive pressures. The grey-zone Altman Z-score underlines moderate financial distress, warranting caution despite solid dividend yield.

Should You Buy AbbVie Inc.?

AbbVie appears to be a company with moderate profitability and an average financial strength profile. While its leverage profile raises caution and its competitive moat seems unclear due to declining ROIC trends, the overall rating could be seen as a cautious C-.

Strength & Efficiency Pillars

AbbVie Inc. posts solid operational margins, with a gross margin of 83.71% and an EBIT margin of 15.08%. These figures highlight efficient core operations and cost control. Despite this, key profitability metrics like ROE and ROIC are unavailable or unfavorable, limiting the visibility on capital efficiency. The company’s net margin at 6.91% remains stable but modest. With an Altman Z-Score in the grey zone (2.24), AbbVie shows moderate solvency but lacks definitive evidence as a strong value creator given missing ROIC versus WACC data.

Weaknesses and Drawbacks

AbbVie faces significant financial challenges. The Altman Z-Score of 2.24 places it in the grey zone, indicating moderate bankruptcy risk and financial uncertainty. Valuation metrics are stretched, with a P/E ratio of 96.82 signaling a premium market price that may not be justified by earnings. Critical liquidity ratios such as current and quick ratios are unavailable or unfavorable, raising concerns about short-term solvency. Additionally, the company’s return on equity is at 0%, reflecting poor capital returns. These factors collectively heighten investment risk.

Our Final Verdict about AbbVie Inc.

Despite operational strength and a bullish long-term stock trend, AbbVie’s moderate solvency risk and rich valuation make its profile cautious. The Altman Z-Score in the grey zone suggests financial vulnerability, while the recent market shows slight buyer dominance. This combination might warrant a wait-and-see approach for a clearer entry point. AbbVie’s profile could appeal to investors with higher risk tolerance but may appear too speculative for conservative capital.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Glenview Trust Co Has $95.89 Million Stake in AbbVie Inc. $ABBV – MarketBeat (Feb 17, 2026)

- AbbVie: Dominating Immunology While Building Oncology Upside (NYSE:ABBV) – Seeking Alpha (Feb 17, 2026)

- Where is AbbVie Inc. (ABBV) Headed According to the Street? – Yahoo Finance (Feb 13, 2026)

- Arvest Bank Trust Division Cuts Stock Position in AbbVie Inc. $ABBV – MarketBeat (Feb 17, 2026)

- AbbVie Inc. (ABBV) Achieves Record Net Sales on Diversified Growth Platform – Yahoo Finance (Feb 12, 2026)

For more information about AbbVie Inc., please visit the official website: abbvie.com