Home > Analyses > Healthcare > Abbott Laboratories

Abbott Laboratories fundamentally transforms healthcare with innovative medical devices, diagnostics, pharmaceuticals, and nutrition products that touch millions of lives daily. As a pioneer in cardiovascular devices, molecular diagnostics, and nutritional solutions, Abbott combines cutting-edge technology with a reputation for quality and reliability. With a diverse product portfolio and strong global presence, the company holds a leading position in the healthcare sector. The critical question for investors today is whether Abbott’s strong fundamentals and innovation pipeline continue to support its current market valuation and future growth prospects.

Table of contents

Business Model & Company Overview

Abbott Laboratories, founded in 1888 and headquartered in North Chicago, Illinois, stands as a global leader in healthcare innovation. With a workforce of 114K, it operates through a cohesive ecosystem spanning pharmaceuticals, diagnostics, nutrition, and medical devices. This integrated approach targets a broad spectrum of health needs, reinforcing its position in the medical devices industry and beyond.

The company’s revenue engine is diversified across four segments, balancing established pharmaceuticals with advanced diagnostics and medical devices, including cardiovascular and diabetes care technologies. Abbott’s strategic presence across the Americas, Europe, and Asia supports robust global demand. Its enduring competitive advantage lies in combining cutting-edge innovation with a vast portfolio, securing its role in shaping healthcare’s future.

Financial Performance & Fundamental Metrics

I will analyze Abbott Laboratories’ income statement, key financial ratios, and dividend payout policy to provide a clear view of its fundamental strength.

Income Statement

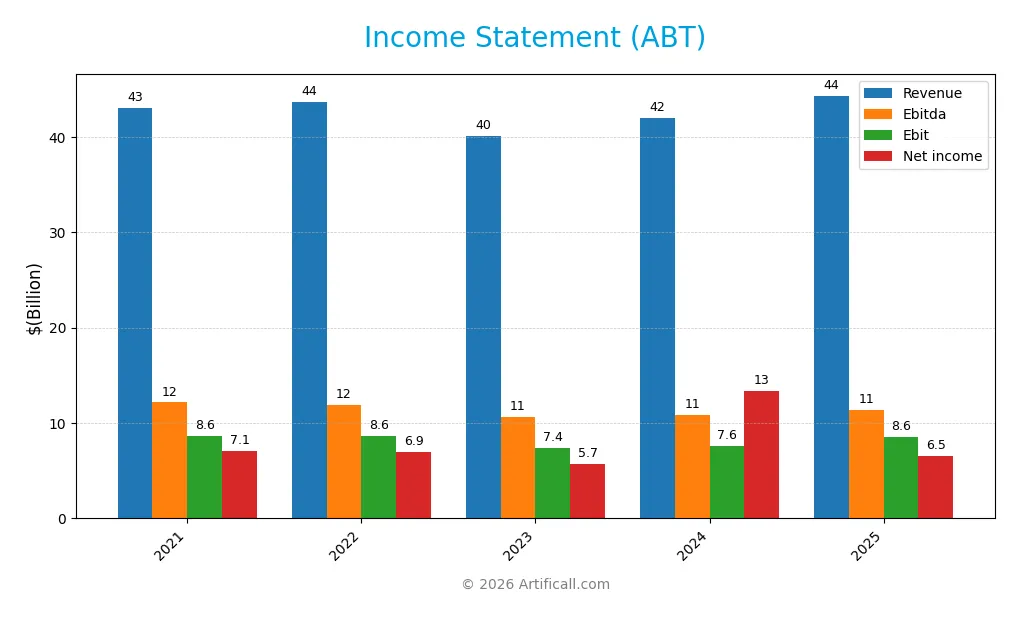

The table below presents Abbott Laboratories’ key income statement figures for fiscal years 2021 through 2025, detailing revenue, expenses, profits, and earnings per share.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 43.1B | 43.7B | 40.1B | 41.9B | 44.3B |

| Cost of Revenue | 19.9B | 21.3B | 20.1B | 20.6B | 19.7B |

| Operating Expenses | 14.0B | 13.9B | 13.6B | 14.5B | 16.6B |

| Gross Profit | 23.2B | 22.3B | 20.0B | 21.3B | 24.6B |

| EBITDA | 12.2B | 11.9B | 10.6B | 10.8B | 11.3B |

| EBIT | 8.6B | 8.6B | 7.4B | 7.6B | 8.6B |

| Interest Expense | 410M | 315M | 698M | 603M | 341M |

| Net Income | 7.1B | 6.9B | 5.7B | 13.4B | 6.5B |

| EPS | 3.97 | 3.94 | 3.30 | 7.67 | 3.74 |

| Filing Date | 2022-02-18 | 2023-02-17 | 2024-02-16 | 2025-02-21 | 2026-01-22 |

Income Statement Evolution

Between 2021 and 2025, Abbott Laboratories’ revenue showed a modest overall increase of 2.91%, with a neutral one-year revenue growth of 5.67%. Gross profit improved notably by 15.39% in the last year, supporting favorable gross margins near 55.5%. However, net income declined by 7.74% over the period, with net margin and EPS also decreasing, reflecting some margin pressures despite stable operating income growth.

Is the Income Statement Favorable?

The 2025 income statement reveals favorable gross and EBIT margins of 55.5% and 19.4%, respectively, alongside a low interest expense burden at 0.77% of revenue. Yet, net margin contracted sharply by 53.9% year-over-year, causing net income and EPS to fall by over 50%. Operating expenses grew alongside revenue, which is an unfavorable trend. Overall, the fundamental income metrics for 2025 present a mixed to unfavorable picture.

Financial Ratios

The following table presents key financial ratios for Abbott Laboratories (ABT) over recent fiscal years, providing insight into profitability, valuation, liquidity, leverage, and efficiency:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 16% | 16% | 14% | 32% | 15% |

| ROE | 20% | 19% | 15% | 28% | 0% |

| ROIC | 13% | 11% | 9% | 10% | 0% |

| P/E | 35.3 | 27.8 | 33.4 | 14.6 | 33.6 |

| P/B | 7.0 | 5.2 | 4.9 | 4.1 | 0.0 |

| Current Ratio | 1.85 | 1.63 | 1.64 | 1.67 | 0.0 |

| Quick Ratio | 1.46 | 1.23 | 1.16 | 1.23 | 0.0 |

| D/E | 0.54 | 0.49 | 0.41 | 0.32 | 0.0 |

| Debt-to-Assets | 26% | 24% | 22% | 19% | 0% |

| Interest Coverage | 22.4 | 26.5 | 9.2 | 11.3 | 23.6 |

| Asset Turnover | 0.57 | 0.59 | 0.55 | 0.52 | 0.0 |

| Fixed Asset Turnover | 4.26 | 4.25 | 3.56 | 3.58 | 0.0 |

| Dividend Yield | 1.3% | 1.7% | 1.9% | 2.0% | 1.9% |

Note: Zero values indicate data not available for the year 2025.

Evolution of Financial Ratios

Over the period, Abbott Laboratories’ Return on Equity (ROE) shows a decline, reaching zero in 2025, indicating a loss of profitability on shareholder equity. The Current Ratio also fell to zero in 2025, reflecting deteriorated liquidity. Meanwhile, the Debt-to-Equity Ratio improved to zero, suggesting reduced leverage or debt burden. Profitability margins showed mixed trends, with net profit margin stabilizing around 14.7% in 2025.

Are the Financial Ratios Favorable?

In 2025, Abbott’s net margin of 14.72% and interest coverage ratio of 25.18 indicate strong profitability and debt service capacity, respectively, both favorable metrics. However, ROE and return on invested capital are unfavorable, reflecting challenges in generating returns. Liquidity ratios like current and quick ratios are unfavorable due to zero values. Debt ratios are favorable, and dividend yield is neutral. Overall, about 36% of ratios are favorable, 50% unfavorable, indicating a slightly unfavorable financial position.

Shareholder Return Policy

Abbott Laboratories maintains a consistent dividend payout with a payout ratio near 63% in 2025 and an annual yield of about 1.88%. Dividends per share have steadily increased from $1.80 in 2021 to $2.36 in 2025, reflecting stable shareholder distributions. No data on share buybacks is provided.

The dividend payments appear well-supported by earnings, suggesting a sustainable approach to shareholder returns. The steady yield and payout ratio indicate a balanced policy, aligning distributions with profitability to support long-term value creation without signs of overextension.

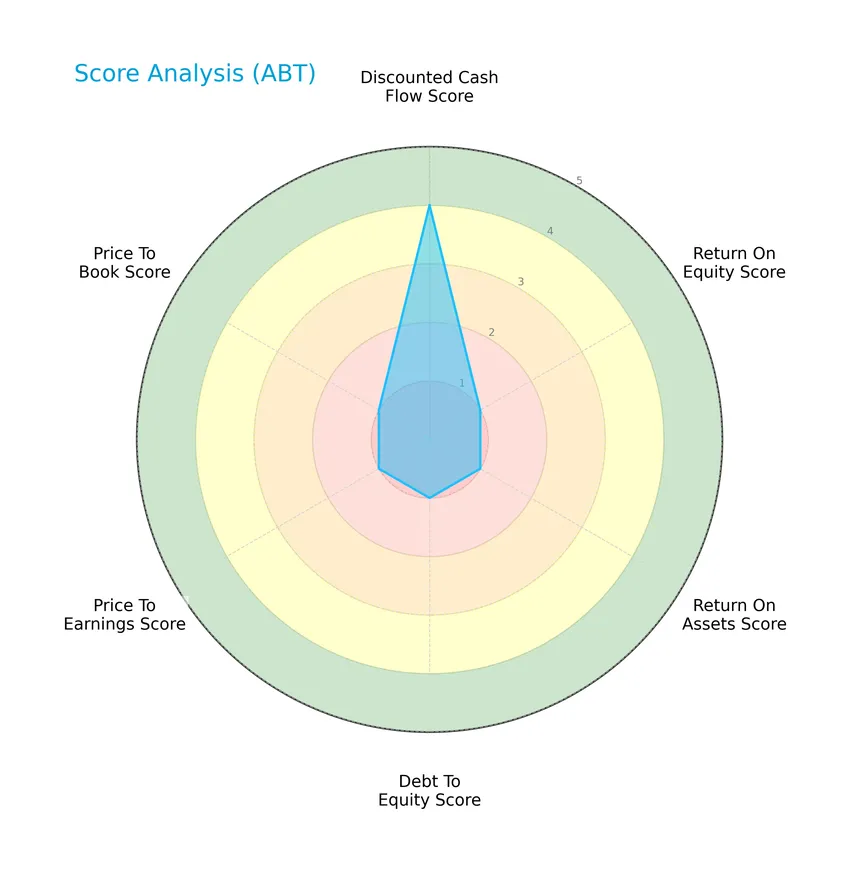

Score analysis

The radar chart below illustrates Abbott Laboratories’ key financial scores for a comprehensive overview:

Abbott Laboratories shows a mixed performance with a favorable discounted cash flow score of 4, while all other metrics including return on equity, return on assets, debt to equity, price to earnings, and price to book scores are very unfavorable at 1 each.

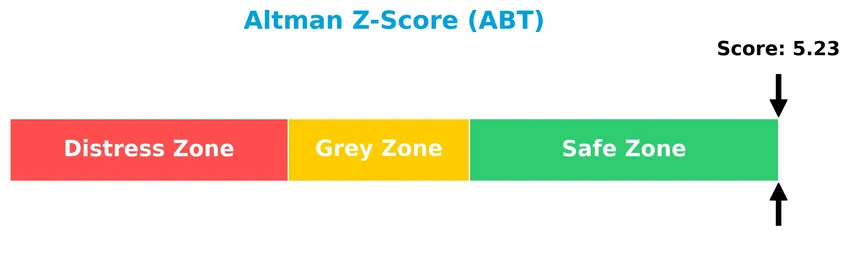

Analysis of the company’s bankruptcy risk

Abbott Laboratories’ Altman Z-Score of 5.23 places it firmly in the safe zone, indicating a low risk of bankruptcy and strong financial stability:

Is the company in good financial health?

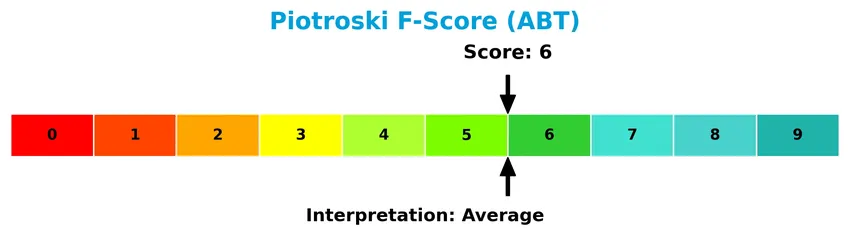

The Piotroski Score diagram below highlights the company’s financial health assessment:

With a Piotroski Score of 6, Abbott Laboratories falls into the average category, reflecting moderate financial strength but not indicating exceptional robustness.

Competitive Landscape & Sector Positioning

This sector analysis will examine Abbott Laboratories’ strategic positioning, revenue by segment, key products, main competitors, and competitive advantages. I will assess whether Abbott holds a competitive advantage relative to its peers in the medical devices and healthcare industry.

Strategic Positioning

Abbott Laboratories maintains a diversified product portfolio across four segments: Medical Devices, Diagnostic Products, Nutritional Products, and Established Pharmaceutical Products, with 2024 revenues of $19B, $9.3B, $8.4B, and $5.2B respectively. Geographically, its exposure splits between the US ($16.3B) and Non-US markets ($14.8B), reflecting a broad global footprint.

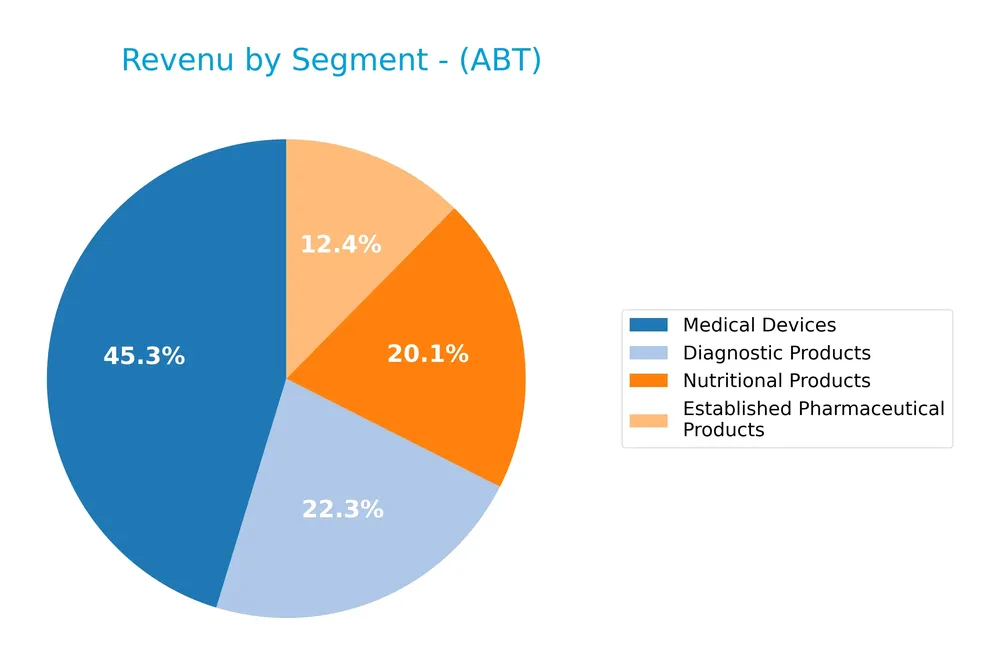

Revenue by Segment

The pie chart displays Abbott Laboratories’ revenue distribution by segment for the fiscal year 2024, highlighting the company’s diversified product portfolio.

In 2024, Medical Devices remained the dominant revenue driver at 19B, followed by Diagnostic Products at 9.3B. Nutritional Products and Established Pharmaceutical Products contributed 8.4B and 5.2B respectively. Notably, Medical Devices saw a steady increase from 14.7B in 2022 to 19B in 2024, indicating strong growth, while Diagnostic Products experienced a decline since 2022. This suggests a concentration risk towards Medical Devices, though the portfolio remains well-diversified.

Key Products & Brands

The table below summarizes Abbott Laboratories’ main products and brands across its business segments:

| Product | Description |

|---|---|

| Established Pharmaceutical Products | Generic pharmaceuticals treating conditions such as pancreatic insufficiency, irritable bowel syndrome, hypertension, depression, and infections. |

| Diagnostic Products | Laboratory and molecular diagnostics systems, point of care testing, rapid diagnostics for infectious diseases, cardiometabolic tests, and lab automation. |

| Nutritional Products | Pediatric and adult nutritional products designed to support health and wellness. |

| Medical Devices | Devices for cardiovascular diseases, diabetes care, neuromodulation for chronic pain, and movement disorder management. |

Abbott Laboratories operates through four primary segments offering pharmaceuticals, diagnostics, nutrition, and medical devices, reflecting a diversified healthcare product portfolio.

Main Competitors

There are 10 competitors in the Healthcare Medical – Devices sector; below are the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Abbott Laboratories | 216B |

| Boston Scientific Corporation | 140B |

| Stryker Corporation | 133B |

| Medtronic plc | 123B |

| Edwards Lifesciences Corporation | 50B |

| DexCom, Inc. | 26B |

| STERIS plc | 25B |

| Insulet Corporation | 20B |

| Zimmer Biomet Holdings, Inc. | 18B |

| Align Technology, Inc. | 11B |

Abbott Laboratories ranks 1st among its competitors with a market cap of 216B. It is positioned well above the average market cap of the top 10 (76B) and the sector median (38B). Abbott holds a significant lead over its closest competitor, Boston Scientific Corporation, with a distance of -33.16% to the next rival below.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does ABT have a competitive advantage?

Abbott Laboratories presents some competitive advantages through its diversified portfolio across pharmaceuticals, diagnostics, nutrition, and medical devices with favorable margins. However, the company shows a declining return on invested capital (ROIC) trend from 2021 to 2025, limiting clear evidence of a durable economic moat.

Looking forward, Abbott has opportunities to expand in diagnostic systems, molecular point-of-care testing, and cardiovascular and diabetes care devices. These markets could support future growth, although the overall income statement trend remains mixed with some unfavorable earnings growth indicators.

SWOT Analysis

This SWOT analysis highlights Abbott Laboratories’ key strategic factors to guide informed investment decisions.

Strengths

- Strong global brand with 186B market cap

- Diversified portfolio across pharmaceuticals, diagnostics, nutrition, and devices

- Favorable gross and EBIT margins above 19%

Weaknesses

- Declining net income and EPS over recent years

- Unfavorable overall income statement and ratio trends

- Moderate Piotroski score indicating average financial strength

Opportunities

- Growing demand for advanced diagnostics and remote monitoring

- Expansion potential in emerging markets

- Innovation in chronic disease management devices

Threats

- Intense competition in healthcare and medical devices

- Regulatory and reimbursement risks globally

- Economic uncertainty impacting healthcare spending

Overall, Abbott benefits from a solid market position and diversified offerings but faces challenges in profitability growth and financial efficiency. Strategic focus on innovation and geographic expansion is critical to counter competitive and regulatory threats.

Stock Price Action Analysis

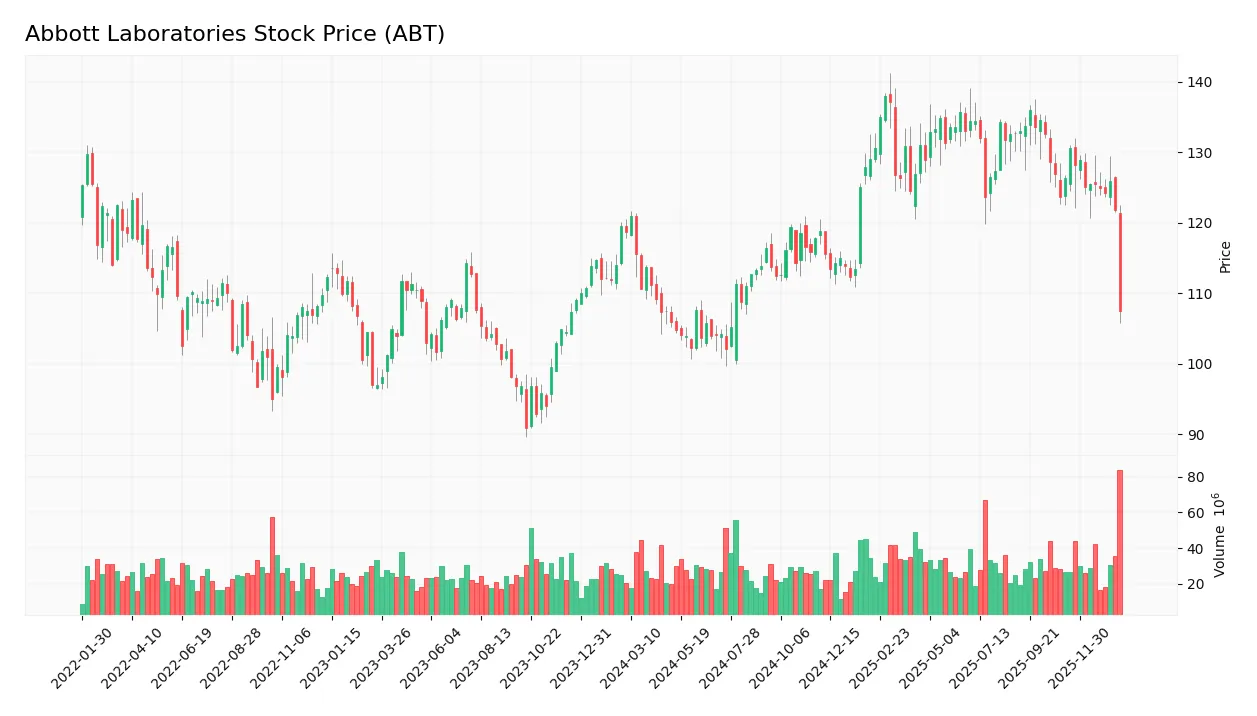

The weekly stock chart of Abbott Laboratories (ABT) over the past 12 months illustrates price fluctuations and trend dynamics in detail:

Trend Analysis

Over the past 12 months, Abbott Laboratories’ stock price declined by 9.44%, indicating a bearish trend. The stock showed deceleration in this downward movement, with a high of 138.01 and a low of 102.03. Volatility is notable, with a standard deviation of 10.48. Recent weeks saw an accelerated decline of 14.99%.

Volume Analysis

In the last three months, trading volumes have been increasing, with total volume exceeding 3.5B shares. However, seller volume dominates at 65.2%, indicating selling pressure. This seller-driven activity suggests cautious or negative investor sentiment and heightened market participation during this period.

Target Prices

The target price consensus for Abbott Laboratories (ABT) reflects moderate upside potential.

| Target High | Target Low | Consensus |

|---|---|---|

| 169 | 122 | 138.8 |

Analysts generally expect the stock to trade within a range of $122 to $169, with an average consensus around $139, indicating cautious optimism.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section presents a detailed analysis of Abbott Laboratories’ ratings and consumer feedback to inform investors.

Stock Grades

Here is the latest overview of Abbott Laboratories’ stock grades from leading financial institutions as of early 2026:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Evercore ISI Group | Maintain | Outperform | 2026-01-23 |

| Piper Sandler | Maintain | Overweight | 2026-01-23 |

| BTIG | Maintain | Buy | 2026-01-23 |

| Citigroup | Maintain | Buy | 2026-01-23 |

| RBC Capital | Maintain | Outperform | 2026-01-23 |

| Oppenheimer | Maintain | Outperform | 2026-01-23 |

| Bernstein | Maintain | Outperform | 2026-01-23 |

| Bernstein | Maintain | Outperform | 2026-01-09 |

| Barclays | Maintain | Overweight | 2026-01-05 |

| BTIG | Maintain | Buy | 2025-11-20 |

The consensus reflects a stable positive outlook, with the majority of firms maintaining Buy or Outperform ratings. No downgrades were recorded, indicating steady confidence in the stock’s prospects.

Consumer Opinions

Abbott Laboratories continues to generate mixed but generally favorable consumer sentiment, reflecting both satisfaction with its product innovation and concerns over pricing.

| Positive Reviews | Negative Reviews |

|---|---|

| “Abbott’s medical devices are reliable and user-friendly, making health monitoring easier.” | “Some Abbott products are priced higher than competitors, which can be a barrier.” |

| “Their nutritional products have greatly improved my family’s health and wellness.” | “Customer service response times could be faster, especially for technical support.” |

| “I trust Abbott for consistent quality in their diagnostics and healthcare solutions.” | “Occasionally, product availability is an issue in certain regions.” |

Overall, consumers appreciate Abbott’s innovation and product quality, though pricing and customer service responsiveness are areas needing attention.

Risk Analysis

Below is a summary table outlining the key risks associated with Abbott Laboratories (ABT) for your investment consideration:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Valuation | High P/E ratio (33.55) suggests possible overvaluation, increasing downside risk on price falls. | Medium | High |

| Financial Health | Mixed financial ratios with unfavorable ROE and ROIC; liquidity ratios unavailable, signaling caution. | Medium | Medium |

| Industry Risks | Exposure to regulatory changes and competition in medical devices and pharmaceuticals. | Medium | High |

| Dividend Yield | Moderate dividend yield (1.88%) may limit income appeal in volatile markets. | Low | Low |

| Operational Risks | Dependence on innovation and supply chains in healthcare products segments. | Medium | Medium |

Abbott’s most significant risks lie in its valuation and sector-specific challenges, despite a strong Altman Z-Score indicating low bankruptcy risk. Investors should monitor valuation shifts and regulatory developments closely.

Should You Buy Abbott Laboratories?

Abbott Laboratories appears to be characterized by improving profitability and a manageable debt profile, supported by a strong Altman Z-Score indicating financial stability. Despite a declining ROIC trend suggesting an eroding competitive moat, the overall rating could be seen as cautious at C-.

Strength & Efficiency Pillars

Abbott Laboratories exhibits solid profitability with a gross margin of 55.51%, an EBIT margin of 19.37%, and a net margin of 14.72%, all flagged as favorable. Its Altman Z-Score of 5.23 places the company securely in the safe zone, indicating strong financial health and low bankruptcy risk. The Piotroski score of 6 suggests average financial strength. While ROE and ROIC data are unavailable or unfavorable, the low interest expense ratio of 0.77% and robust interest coverage ratio of 25.18 further signal operational efficiency and manageable debt costs.

Weaknesses and Drawbacks

The valuation metrics present notable risks: a high P/E ratio of 33.55 points to a premium market valuation, which may limit upside potential. Both current and quick ratios are reported as unfavorable, raising concerns about short-term liquidity. Moreover, recent market activity is dominated by sellers, with buyer dominance at only 34.8%, signaling short-term selling pressure. The overall stock trend is bearish with a 9.44% price decline, accelerating to a 14.99% drop in the recent period, which may reflect investor caution amidst earnings growth challenges.

Our Verdict about Abbott Laboratories

Abbott Laboratories’ long-term fundamental profile might appear mixed to slightly unfavorable due to uneven profitability growth and valuation concerns. Despite the company’s stable financial health indicated by the Altman Z-Score and moderate Piotroski score, the bearish technical trend and recent seller dominance suggest a wait-and-see approach could be prudent. Investors may find better entry points as market pressure persists despite underlying operational strengths.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Abbott Dives 7% On Quarterly Upset As Exact Close Looms – Investor’s Business Daily (Jan 22, 2026)

- Abbott Laboratories: Buy This Dividend King On Sale Now (NYSE:ABT) – Seeking Alpha (Jan 23, 2026)

- Why Abbott Laboratories (ABT) Shares Are Sliding Today – Yahoo Finance (Jan 22, 2026)

- Abbott Stock Suffers Worst Drop in More Than 20 Years – The Wall Street Journal (Jan 22, 2026)

- Is The Fall In Abbott Stock Justified? – Forbes (Jan 23, 2026)

For more information about Abbott Laboratories, please visit the official website: abbott.com