How will our indicators help you?

Finding opportunities in the markets is often time-consuming and challenging. That is why I designed my indicators for demanding traders who want clarity, timing, and efficiency.

They display all the information you need to make a decision: visual analysis, signals, and exit conditions.

Whether you’re a swing trader or scalper, beginner or experienced, they will help you better approach the financial markets.

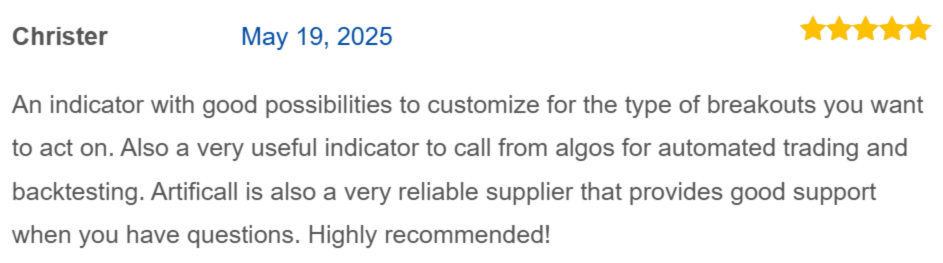

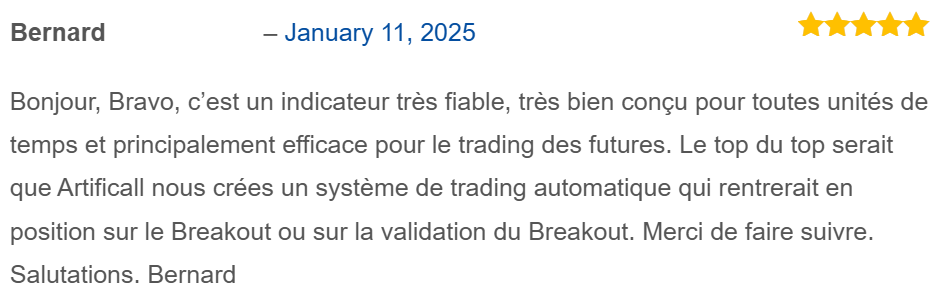

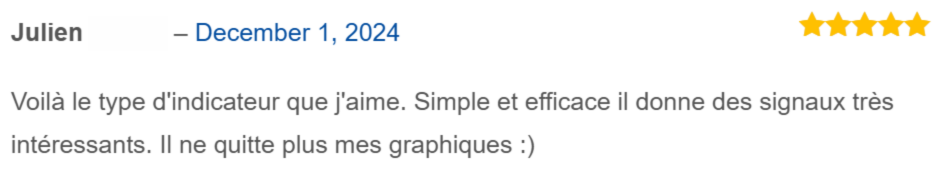

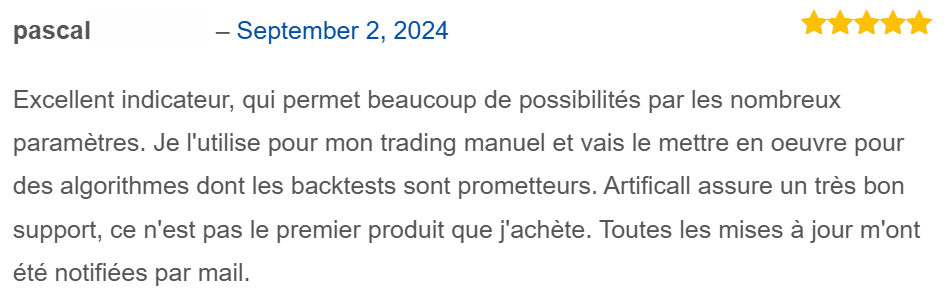

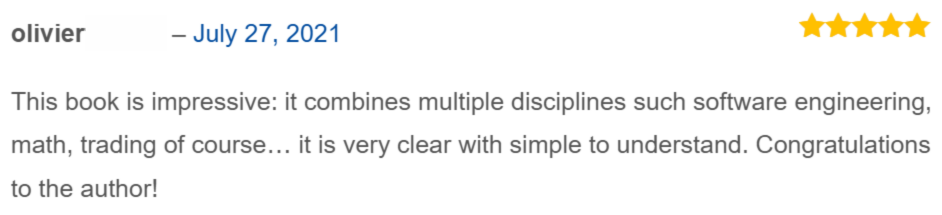

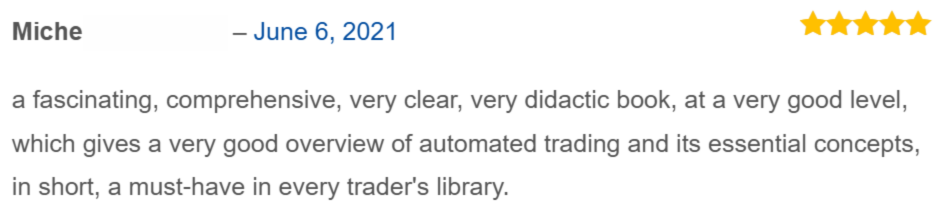

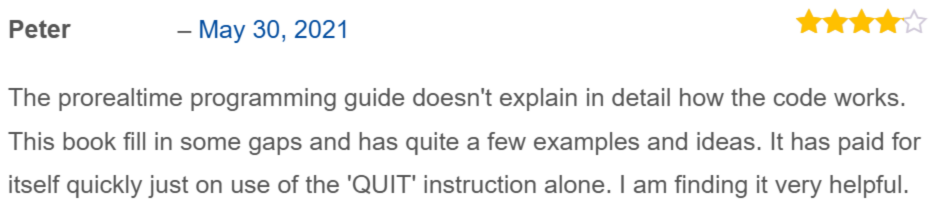

What our customers say about us

Discover our New Indicators

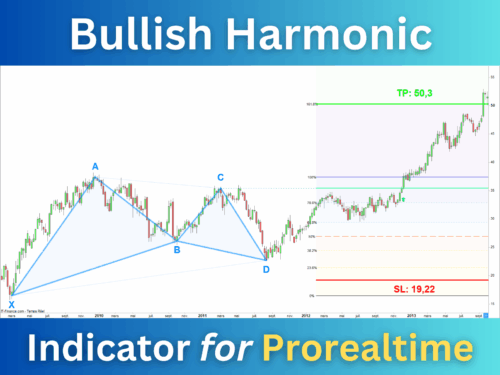

The Bullish Harmonics indicator will help you trade harmonic patterns with ease. It recognizes the twelve most favourable bullish harmonic patterns.

The indicator displays the figures with buy signals and price targets on your charts.

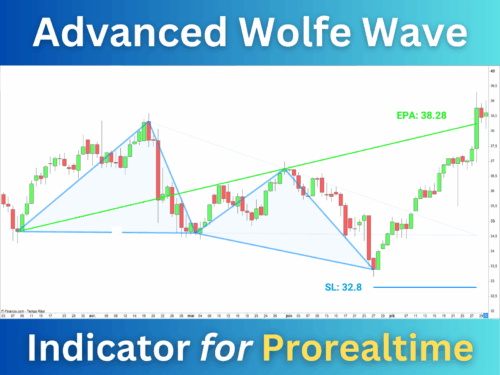

The Wolfe Wave indicator will help you trade bullish and bearish trend reversals in the markets. You will easily identify areas of temporary imbalance on your charts.

The indicator displays buy and sell signals with precise price targets and stop-loss levels.

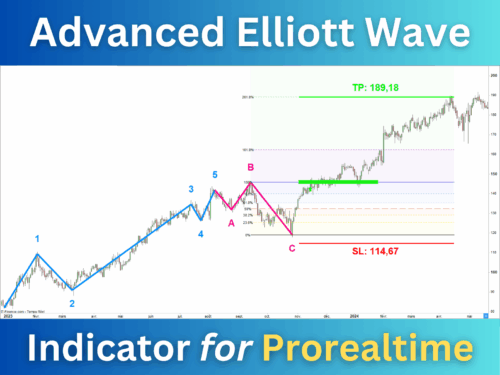

The Elliott Waves enable the identification of trend cycles in the markets. The Advanced Elliott Wave indicator will help you detect the beginning and end of uptrends as soon as they form.

It provides reliable buying signals with targets calculated from the Fibonacci levels.

Discover result-driven strategies

Finding a favorable trading strategy is challenging. It requires a lot of work. However, it is the key to your success. I regularly publish articles on strategies that I consider consistent enough. This will help you find the right one for you:

A few words about me

My name is Vivien, I’m a trader and software developer. I’ve been programming indicators and screeners for over seven years on the Prorealtime platform.

I share my knowledge in the learning section. You’ll discover effective trading strategies and valuable tips for achieving success.

I created indicators and screeners to help you seize the best opportunities. They provide buy and sell signals along with exit conditions.

➡️ You’ll have everything you need to trade all types of markets. 😉